HI Market View Commentary 08-29-2022

32-year-old millionaire poker champ on reading people and becoming mentally tough: This is ‘how you lose a lot of money’

Published Sun, Aug 28 20229:00 AM EDT

This story is part of the Top of the Game series, where CNBC Make It delves into the habits, routines and mindsets that top athletes use to achieve peak performance and success.

When Dan Cates first started playing poker as a teenager in Bowie, Maryland, he quickly racked up thousands of dollars in debt.

Today, the 32-year-old — known at the poker table as “Jungleman” — is a world-class player with more than $11.6 million in lifetime winnings. But 15 years ago, he was a teenager in over his head.

“I found some people in the local neighborhood, but they were much better than me and I lost $3,000 when I was 17, which was most of my money,” Cates tells CNBC Make It. “So my parents locked my account. And I had to get a day job at McDonald’s for a month to make some money.”

Cates says he made roughly $1,000 in a month in that job, which he used to bankroll his burgeoning poker habit. He tried taking it slowly, playing lower stakes games online and studying his opponents’ best tactics and strategies.

Over the next couple of years, he learned a variety of crucial skills — including how to read his opponents and not let a losing streak throw off his game.

By age 19, Cates amassed more than $1 million in poker winnings, mostly playing online, he says. He became so “obsessed” with poker that it was hindering his study of economics at the University of Maryland, so he dropped out to play poker full-time.

He promptly lost about $600,000 of that $1 million “almost immediately,” he says. Still, he stayed committed. More than a decade later, in June 2022, Cates won his second consecutive Poker Players Championship title at the 2022 World Series of Poker in Las Vegas, taking seven-figure hauls from his opponents both times.

Here, Cates discusses the mindset he needed to become a world-class poker player, the importance of being able to read people and how he stays mentally tough even when he’s losing big.

The mindset Cates used to become great at poker

The growth mindset is important: to be open to the possibility that there are other ways of doing things.

As a child, I was very arrogant. I knew I was smart by quite a young age. I had good grades and I didn’t really have to work that hard. But when I started playing video games, I remember thinking, “Well, maybe I’m not that smart, because people are crushing me.”

Then, I’d see other things that people were doing and I’d learn from them. I learned a lot. And I realized, “Wait, this mindset of being arrogant not only pisses people off, but it closes me off to possibilities that can be even better than what I know.”

Now, I beat these people who are arrogant — like, always — in poker. Many, many [of my opponents] thought I was such an idiot. And they always got crushed. The more that they thought I was an idiot, usually the harder they got crushed.

The worst situation possible is if you think that, for sure, you’re better than someone — and you’re not. This is exactly how you lose a lot of money.

How to stay mentally tough, even when you’re losing

Losing by itself isn’t really a reason to quit. It’s more about how determined you are to actually win, how willing you are to change.

It’s certainly easy to be discouraged. There were many times, even in my biggest winning years, where I just had all of these nightmare sessions of playing all night and losing. A consistent lesson of mine was that, even when it appeared like there was no hope — when I thought, “Oh, I’ll never win again, I lost 12 times in a row″ — it never was true.

It’s really tempting to fall into that mindset of despair. But I’ve essentially found ways to put my eggs in other baskets, which is a complicated process for everyone.

The simple answer would be to find meaningful friendships. Have hobbies. Basically, don’t put your whole life where all of your emotions are hinged on this one thing. If that one thing is volatile, then your emotional state will vary a lot.

You also don’t want to let winning too much affect you negatively. It’s easy to think, “Oh, I’m just always going to win.” It’s not how it works.

Why reading people is the biggest skill you need in poker (and in life)

I think it’s the ability to find the truth, to recognize what is truth and what is falsehood. You need that in combination with something else: the ability to take action on it.

In poker, you need to be able to read your opponent and respond appropriately. I find that the real-life equivalent to this would be something like: “Watch their actions, not their words.” When you’re looking at someone’s face, they’re going to try to hide their emotions really well. It’s when they don’t know you’re looking, that’s where you should be looking.

You want to look more at how they move the chips into the middle, you want to look at their overall psychology in the situation, things that they’re not really aware of. Like, they’re sweating really hard, because the money really means something to them.

If someone’s looking hard enough, similar to in real life, the truth will eventually be revealed. Because if you look hard enough at someone’s story, if they lack integrity, then it’s going to show somewhere.

This interview has been edited for length and clarity.

OK two things to help everyone understand. Let me answer the financial plan question.

Good morning Kevin (Keve) ,

Over the weekend I met with my Fidelity financial planner. I am on course to meet my financial plan but it doesn’t seem like it. Would you please go over the issues you see with financial planning one more time in the HI Market View Commentary. I am just not seeing why my plan obviously isn’t working yet my planner thinks I am right on track. Thank you in advance.

So the problem with financial plans is two fold

Averages and Compounding returns

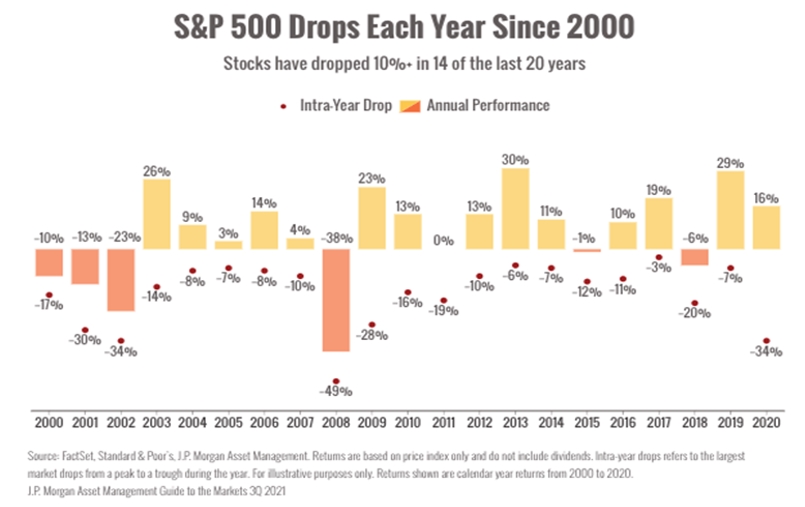

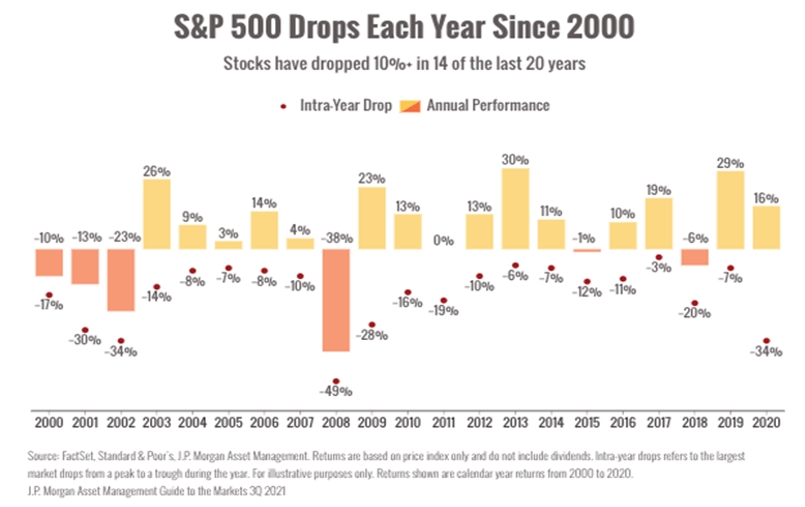

S&P 500 Averages 7.75% yearly

Yr 1 – 1.075, 2 – 1.161, 3 – 1.25, 4-1.347, 5- 1.452, 6 – 1.564, 7 – 1.685, 8 – 1.816, 9-1,957

Compound interest/growth of 7.75% on a variable return

So you are told the S&P 500 double on average every 7.75 years 1=2=4= 7.20

$1, 0.90, 0.783, 0.603, 0.760, 0.828, 0.853, 0.972, 1.011, 0.627, 0.770, 0.871, 0.871, 0.984, 1.298, 1.420, 1.406, 1.547, 1.840, 1.730, 2.232, 2.589

On Friday:

The S&P 500 fell 141.46 points, or 3.4%, to 4,057.66.

The Dow Jones Industrial Average fell 1,008.38 points, or 3%, to 32,283.40.

The Nasdaq fell 497.56 points, or 3.9%, to 12,141.71.

The Russell 2000 index of smaller companies fell 64.81 points, or 3.3%, to 1,899.83.

For the week:

The S&P 500 is down 170.82 points, or 4%.

The Dow is down 1,423.34 points, or 4.2%.

The Nasdaq is down 563.50 points, or 4.4%.

The Russell 2000 is down 57.52 points, or 2.9%.

For the year:

The S&P 500 is down 708.52 points, or 14.9%.

The Dow is down 4,054.90 points, or 11.2%.

The Nasdaq is down 3,503.26 points, or 22.4%.

The Russell 2000 is down 345.48 points, or 15.4%.

Pretty good year to be picking up shares

IF we had just followed the market we would be down -$572,900

Earnings dates:

BIDU 8/30 BMO – Pricing power

COST 9/22 AMC – ????

DG 8/25 AMC – NO

MU 9/28 – NO

https://www.briefing.com/the-big-picture

The Big Picture

Last Updated: 26-Aug-22 14:53 ET | Archive

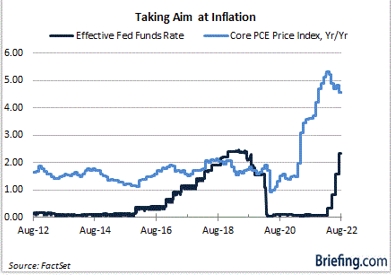

Powell and the Fed mean business in restoring price stability

We liked the speech Fed Chair Powell delivered at the Jackson Hole Economic Symposium. It was, in his own words, “shorter,” “narrower,” and “more direct” than prior speeches given there. That did not make it any less impactful, however.

If anything, the brevity of his remarks, versus the gravity of the topic, suggested he and the Fed are now properly focused on the primary task at hand: bringing inflation back down to the Federal Open Market Committee’s 2 percent goal.

That task, though, will have adverse consequences.

Pedal to the Metal

A major point of relief with the speech is that it is over. Talking heads must be walking around with a collective case of laryngitis, having talked ad nauseum leading up to the speech about what the Fed Chair might, or might not, say.

The takeaway is that he did not say anything truly surprising based on a battery of commentary heard from other Fed officials preceding his speech. What was surprising was the terse nature of his remarks.

From our vantage point, it sounded more credible this time that the Fed knows its job and that, even though it contributed to history repeating itself with inflation running amok, it is not going to let history repeat itself by cutting rates in a willy-nilly fashion because it happens to see a comforting inflation number here and there.

The Fed Chair spent a good portion of his brief speech talking about the experiences of the past, particularly the “high and volatile inflation of the 1970s and 1980s,” and how the policy approaches then have helped inform the Committee’s thinking on its policy approach today.

That is, it aims to avoid the misguided policy decisions that necessitated a lengthy period of very restrictive monetary policy under Paul Volcker to reduce inflation and to rein in inflation expectations.

This was not a speech that implied the Fed is going to be quick to take its policy foot off the gas pedal. The Fed knows it needs to keep driving beyond the neutral rate (longer run estimate of 2.5%) to a restrictive destination that is yet to be determined.

It is thought by some at the Fed that 3.75-4.00% could be the stopping point, but what the Fed Chair conceded in his Jackson Hole speech is that the Fed will keep driving until it is confident the job is done.

He also provided a reality check that there will not be a quick pivot to a rate-cut cycle, saying “Restoring price stability will likely require maintaining a restrictive policy stance for some time. The historical record cautions strongly against prematurely loosening policy.”

Showing Respect

The initial reaction in the capital markets to Mr. Powell’s speech had a respectable level of appropriateness to it that was lacking when he spoke following the July 26-27 FOMC meeting. Stock prices trended lower, the dollar increased, and the 2-yr note yield fell in price, pushing its yield higher.

The respective moves connoted a sense of respect for the Fed Chair’s message, which contained an acknowledgment that the effort to bring down inflation “will also bring some pain to households and businesses.”

The debate topic for talking heads now is just how much pain there will be. That debate will revolve around expectations for a soft landing or a hard landing.

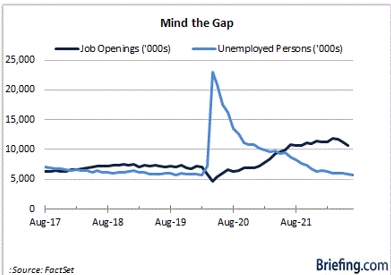

In either case, there is going to be a step down in economic activity because the stated aim of the Fed’s monetary policy is to produce a moderation in demand so that it better aligns with supply. That will inevitably lead to job losses that will help tame wage-based inflation pressures.

Those pressures have not been tamed yet, and with an unemployment rate of 3.5% and roughly 1.9 job openings for every unemployed worker, Fed officials have an unenviable, but necessary, task on their plate.

This becomes a reality check for the stock market, too, because weakening demand will translate into weakening economic activity, which should then manifest itself in weakening earnings growth.

Accordingly, multiple expansion will be, and should be, harder to come by as interest rates rise and earnings growth slows or possibly contracts.

What It All Means

It can take a while sometimes to get a point across. The stock market hasn’t necessarily been convinced that the Fed is going to be the policy disciplinarian it says it aims to be.

Fed Chair Powell, however, delivered a speech at Jackson Hole that put the market on notice that it means business in restoring price stability. We should all appreciate that.

At the same time, though, investors need to appreciate that there will be some earnings pain in that pursuit that translates into a more challenging stock market environment.

We might have seen peak inflation, but what Fed Chair Powell implied in his speech is that we are not at peak hawkishness. Moreover, when we get there, the Fed is not going to be quick to climb down until it knows the inflation ground below is stable again — and that is still a long climb given where things stand now.

—Patrick J. O’Hare, Briefing.com

(Editor’s note: the next installment of The Big Picture will be published the week of September 5)

| https://go.ycharts.com/weekly-pulse |

| Market Recap WEEK OF AUG. 22 THROUGH AUG. 26, 2022 The S&P 500 closed lower for a second straight week as Federal Reserve chairman Jerome Powell’s blunt remarks at the Jackson Hole Fed symposium spooked financial markets and left all the major US indices with heavy losses. After Powell threw cold water on the possibility for the Fed to moderate restrictive monetary policy to avert a recession, the S&P 500 continued to lose ground and closed below 4,100 for the first time in a month. As a result, the benchmark index closed the week 4% lower at 4,057.66 from last week’s close of 4,228.48 with all but one of the 11 sectors ending the week in the red. The one exception was the energy sector which closed higher for a third consecutive week with a 4.3% gain fueled by comments from members of the Organization of Petroleum Exporting Countries concerning production cuts to stabilize prices. A new oil discovery off the coast of Suriname launched APA Corp (APA) to the top spot with an 11% gain over the prior week’s close. The tech sector limped into the close down by more than 5.6%, as disappointing guidance from Salesforce (CRM) and Nvidia (NVDA) underscored the sector’s vulnerability to macroeconomic headwinds. Both saw their price targets cut by Wall Street analysts after releasing second-quarter results after Wednesday’s close. Financial stocks were weighed down by the combination of higher Treasury yields and broader market pressure, adding another 3.6% to last week’s loss. Citigroup (C), down 5.4% from last week, retreated late in the week after announcing that it would shutter its Russian consumer operations at a cost of $170 million over the next 18 months. The industrial sector closed with a loss of 3.4% as heavy selling pressure on building stocks was offset by gains in defense names like Raytheon (RTX) and Northrop Grumman (NOC). Twitter (TWTR) shares were dragged lower for a second week as whistleblower allegations concerning lax security at the social media site undermined its legal case against Elon Musk. The stock was down another 8% last week and was the worst performing stock within the communication sector (-4.8%). The consumer discretionary and consumer staples sectors were lower by 4.8% and 3.3%, respectively, while utilities were down 2.6% for the week. Real estate stocks were down a collective 4% with the poor performance of the housing market causing REIT stocks to slide by as much as 6%. Gloomy data on manufacturing and the housing market last week showed new home sales plunging 12.6% in July while pending home sales were down another 1% as higher mortgage rates continue to choke off demand. The S&P Global services PMI fell to its lowest level since May 2020 while the Richmond Fed manufacturing index sunk to a 27-month low. But the economic data was eclipsed Friday by Powell’s blunt message to Wall Street that struck a very different tone from his “inflation is transitory” speech from Jackson Hole 2021. Powell’s hawkish tone came with a warning that the Fed would do whatever is necessary to restore price stability, even if efforts to slow the economy lead to a recession. The S&P 500 suffered its biggest one-day decline since late June before bottoming out below 4,100. Next week’s calendar could give the Fed the ammunition it needs for another 75 basis point rate hike at its next FOMC meeting (Sept 20-21) with data on non-farm productivity and unit labor costs, as well as the S&P Global manufacturing and Institute for Supply Management PMIs for August. Data on the labor market next week includes job openings and labor turnover (JOLTS) Tuesday, private payrolls (ADP) on Wednesday, culminating in the pivotal August non-farm payroll report Friday with early estimates at +290,000. Provided by MT Newswires |

Where will our markets end this week?

Lower

DJIA – Bearish

SPX –technically bearish

COMP – Bearish

Where Will the SPX end September 2022?

08-29-2022 -2.0%

Earnings:

Mon:

Tues: BBY, BIG, HPQ, BIDU

Wed: FIVE

Thur: HRL, AVGO, SPWH

Fri:

Econ Reports:

Mon:

Tues: FHFA Housing Price Index, Case-Shiller Index, Consumer Confidence

Wed: MBA, ADP Employment, Chicago PMI

Thur: Initial Claims, Continuing Claims, Productivity, Unit Labor Costs, ISM Manufacturing, Consumer Spending

Fri: Average Workweek, Non-Farm Payroll, Private Payroll, Hourly Earnings, Unemployment rate, Factory Ordersd

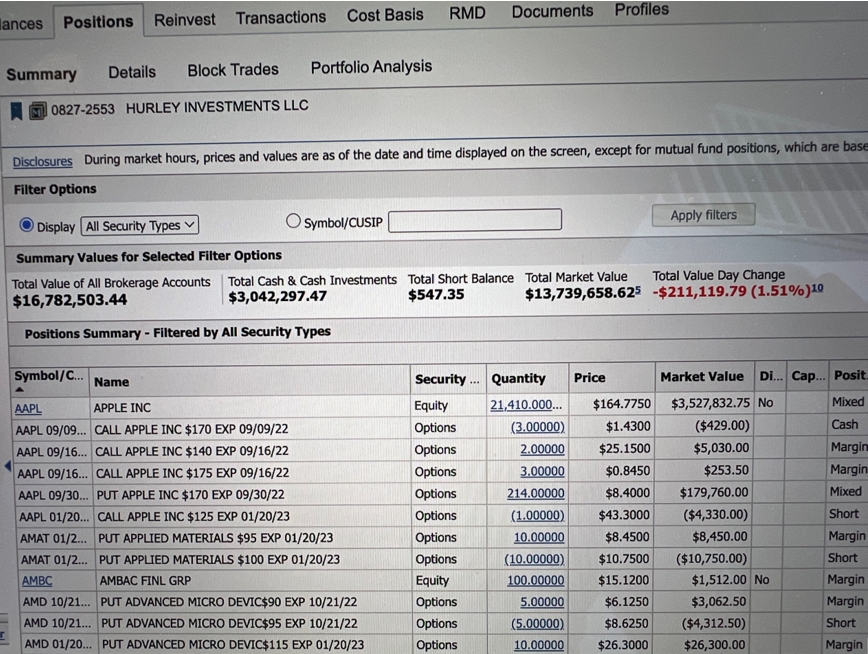

How am I looking to trade?

Currently protection on most core holdings and letting some stocks run

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

Gas prices are falling — Here’s why it’s happening and whether it can continue

PUBLISHED THU, AUG 11 202212:51 PM EDTUPDATED THU, AUG 11 20226:31 PM EDT

KEY POINTS

- The national average for a gallon of gas dropped below $4 on Thursday for the first time since March.

- The drop comes as oil falls from its highs. Crude makes up more than half of the cost at the pump.

- “The streak of daily declines in the retail price of gasoline is about to end,” said Andy Lipow, president of Lipow Oil Associates.

Gas prices are below $4 for the first time since March, but the market remains precarious and experts said it’s too early to know if the move lower will hold.

The national average for a gallon of gas has fallen for the last 58 straight sessions, according to AAA, and is now $3.99 per gallon. The fall from June, when prices topped out above $5, has been fast.

Here’s what could happen next.

Why are prices falling?

Prices at the pump have declined for a number of reasons.

In the commodity market there’s a common saying that “the cure for high prices is high prices.” And that’s proved true. In other words, high prices bring down demand, which brings down prices.

Some driving is necessary — to get to work, for example — but with prices at record levels, consumers might decide not to take a road trip, or to carpool with friends rather than driving solo. We’ve seen this show up in government consumption figures, which have shown a drop-off in demand.

Some states have also suspended their gas taxes, which artificially pushes prices lower.

But the main reason for the fall is the decline in oil prices. Crude is the single largest factor influencing gas prices, accounting for more than 50% of what we pay at the pump.

West Texas Intermediate crude, the U.S. oil benchmark, shot above $130 per barrel in March after Russia invaded Ukraine, sending global energy markets reeling. It was the first time WTI traded at that level since 2008.

But since then oil prices have retreated, with gasoline prices following suit.

WTI traded at $93.51 per barrel on Thursday, a far cry from the $130 just a few months ago. In recent weeks growing recession fears have sent prices tumbling. Oil is vulnerable to any perceived softness in global economic conditions since slowdowns typically lead to lower demand for oil and petroleum products.

Additionally, China demand has been soft as the country combats Covid cases. And the U.S. has taken unprecedented measures by releasing record amounts of oil from the Strategic Petroleum Reserve in an effort to put a lid on higher prices.

Prices at the pump have become a major issue for the White House ahead of the upcoming midterm elections, and President Joe Biden has repeatedly said his administration is doing what it can to ease the burden on consumers.

Will prices stay low?

The move below $4 begs the question of whether further declines are on the horizon. Experts said the relief may be short-lived.

For one, while WTI is far below its March peak, it has jumped more than 5% over the last week. And gasoline futures, while also well below their recent highs, are up 10% over the last week.

“The streak of daily declines in the retail price of gasoline is about to end as crude oil and refined product futures have rallied off their recent lows,” said Andy Lipow, president of Lipow Oil Associates.

The global energy market remains on edge, and there are a number of factors that could push prices higher in the coming months.

Refiners are running full out to keep pace with demand. A hurricane or other event that brings refinery outages could push up gas prices since there aren’t alternatives readily available as Europe also looks for petroleum products.

The U.S.′ historic release of barrels from the Strategic Petroleum Reserve will end this fall, taking some supply off the market. Additionally, the SPR will need to be refilled. A rebound in economic activity in China could also boost demand for petroleum products.

Additionally, the full slate of European sanctions against Russian fuel purchases has yet to go into effect. The country is a major energy producer, and so the EU scrambling to secure supplies from elsewhere could lift global prices.

This is all set against a backdrop of high demand. The International Energy Agency said Thursday that it now sees 2022 demand growth of 2.1 million barrels per day, which is 380,000 barrels per day higher than prior forecasts.

Patrick De Haan, head of petroleum analysis at GasBuddy, said in a Thursday tweet that the drop in prices may stall over the next five to 10 days. But he added that the fall could be “short term.”

Energy drives inflation

The decline for gas prices has been swift, but they’re still 81 cents per gallon more than what consumers paid last year.

The rapid ascent has been a major driver of inflation since energy prices are a driving force in many categories. If food costs more to transport because of high prices, for example, then food prices will rise.

Inflation is currently running around its hottest level in more than 40 years. The latest CPI report did show that price pressures are easing a bit in large part because of falling energy costs.

In July energy prices overall dropped 4.6% month mover month, the Bureau of Labor Statistics said Wednesday. Gasoline prices fell 7.7%.

But one month does not a trend make, and with global energy markets still tight the relief at the pump could ultimately prove temporary.

Dodge will discontinue its Challenger and Charger muscle cars next year

PUBLISHED MON, AUG 15 20227:00 PM EDTUPDATED FRI, AUG 19 20222:02 PM EDT

KEY POINTS

- Dodge will discontinue its gas-powered Challenger and Charger muscle cars at the end of next year, as the brand transitions to electric vehicles.

- Since being resurrected in the mid- to late 2000s, the Charger and Challenger have been stalwarts for Dodge and popular vehicles for a new generation of gearheads.

- But the cars have also been part of a fuel economy and emissions problem for Stellantis, formerly Fiat Chrysler.

DETROIT — Dodge will discontinue its gas-powered Challenger and Charger muscle cars at the end of next year, marking the end of an era for the brand as it starts to transition to electric vehicles.

Since being resurrected in the mid- to late 2000s, the Charger and Challenger — names made popular in the 1960s and 1970s — have been stalwarts for Dodge and popular vehicles for a new generation of gearheads.

The two-door Challenger particularly struck a chord of nostalgia with buyers thanks to its retro-inspired styling, while the four-door Charger has managed to achieve notable sales milestones despite consumers flocking from sedans to SUVs in recent years.

Dodge has also been able to juice profits from the vehicles, which have starting prices ranging from the low-$30,000s to nearly $90,000 for its infamous Hellcat models that produce more than 700 horsepower.

“Dodge, with the Challenger and Charger, they really found a way to really get to that muscle car root. These cars definitely expressed it … and were able to hold onto that essence,” said Stephanie Brinley, principal analyst at S&P Global. “Having that clear DNA and clear expression of what they’re supposed to be is helping make the transition to electric.”

Dodge CEO Tim Kuniskis has alluded to the possibility that the Charger and Challenger names could be used for future electrified vehicles, including a forthcoming electric muscle car in 2024. He’s previously said he believes electrification — whether hybrid vehicles with less powerful engines or all-electric models — will save what he has called the new “Golden Age of muscle cars.”

For several years, Kuniskis has warned that the end was coming for the gas-powered muscle cars due to emissions regulations. Dodge parent company Stellantis, formerly Fiat Chrysler, ranks the worst among major manufacturers for U.S. corporate average fuel economy and carbon emissions.

As many brands switched to smaller and more fuel-efficient engines, Dodge rolled out Hellcat models and other high-performance vehicles. Such models helped generate attention for the brand but didn’t help the automaker’s carbon footprint, forcing it to buy carbon credits from automakers such as Tesla.

“The days of an iron block supercharged 6.2-liter V-8 are numbered,” Kuniskis previously told CNBC, referring to engines like those in the Hellcat. “But the performance that those vehicles generate is not numbered.”

Dodge is launching a litany of special vehicles and products to “celebrate” the end of the cars as they are today. Dodge’s plans include seven special-edition, or “buzz,” models; a commemorative “Last Call” under-hood plaque for all 2023 model-year vehicles; and a new dealer allocation process, among other measures.

The new dealer process will see Dodge allocate 2023 Charger and Challenger models to lots all at once, instead of making orders available throughout the year. Dodge will provide customers a guide to locate specific models at each dealership.

Kuniskis said the process is meant to assist customers in getting the specific vehicle they want.

“We wanted to make sure we were celebrating these cars properly,” Kuniskis said during a media briefing for an event this week in Pontiac, Michigan.

The Charger and Challenger are produced at Stellantis’ Brampton Assembly plant in Ontario, Canada. The company says it has produced more than 3 million Dodge vehicles at the plant, including 1.5 million Chargers and more than 726,000 Challengers sold in the U.S.

Stellantis earlier this year announced plans to invest $2.8 billion in the plant and another Canadian facility, but it has not disclosed what vehicles will be produced at the facilities.

“When we shut down Brampton it will be a 20-year run of Dodge muscle cars,” Kuniskis said. “We needed to do this right.”

China needs Taiwan’s biggest chipmaker — more than the other way around

PUBLISHED TUE, AUG 16 20229:15 PM EDTUPDATED FRI, AUG 19 20221:52 PM EDT

KEY POINTS

- Taiwan is home to more than 90% of the manufacturing capacity for the world’s most advanced semiconductors, according to a 2021 Boston Consulting Group report.

- Just 10% of TSMC’s revenue comes from China, according to the company.

- “I think the real challenges for these companies are still coming from the end demand, rather than what’s going on geopolitically,” said Patrick Chen, head of research for CLSA in Taiwan.

BEIJING — When it comes to semiconductors, China needs Taiwan more than the other way around.

Beijing halted some trade with the island this month after U.S. House Speaker Nancy Pelosi’s controversial trip to Taiwan.

Notably, the bans didn’t touch electronics. Taiwan is home to more than 90% of the manufacturing capacity for the world’s most advanced semiconductors, according to a 2021 Boston Consulting Group report.

Pelosi’s itinerary included a visit with Taiwan Semiconductor Manufacturing Company, the world’s largest and most critical chip manufacturer. Its products are an integral part of everything from consumer products to military aircraft.

But just 10% of TSMC’s revenue comes from China, according to the company. More than half of its revenue comes from the United States.

“As we speak, the status quo is that these chip companies may not be as dependent on China as the other way around,” said Patrick Chen, head of research for CLSA in Taiwan.

“I think the real challenges for these companies are still coming from the end demand, rather than what’s going on geopolitically,” he said.

American chipmakers Micron and Nvidia have warned in recent weeks about falling demand for products that use their chips.

TSMC’s critical role

Pelosi’s Taiwan trip came despite warnings from Beijing, which considers the democratically self-ruled island part of its territory, with no right to conduct foreign relations independently. The U.S. recognizes Beijing as the sole legal government of China, while maintaining unofficial relations with Taiwan.

In addition to some trade bans, Beijing has stepped up military exercises around the island of Taiwan, raising concerns about the risk to global access to critical chips.

Analysts emphasized that Taiwan-made chips, especially TSMC’s, are too important to the world and to China for any major disruption on the chip front.

“If you look at the secular demand drivers, cloud infrastructure, electric vehicles, next generation of industrial facilities, they all require chips that are made at TSMC,” said Mehdi Hosseini, senior tech hardware analyst at Susquehanna.

“If, God forbid, TSMC’s fabs in Taiwan cannot operate, I think the global economy would slow down more so than what Covid did [to growth],” he said.

CLSA’s Chen described TSMC as being in “a league of its own,” Taiwanese semiconductor companies UMC and America’s GlobalFoundries as tier two chipmakers and China’s SMIC and Hua Hong Semiconductor as falling into tier three.

“In terms of competition, coming from China, it’s not a real, meaningful threat to be expected anytime soon,” he said.

China’s chipmakers are still behind

Beijing has ramped up its chip-building efforts in the last few years, with supportive policies drawing a flood of private capital. State-owned chip company Tsinghua Unigroup’s debt pileup and default show how the system has been prone to waste, despite recent growth and tech development at another Chinese chip giant, Semiconductor Manufacturing International Corporation.

Still, it took SMIC 15 years to get to where TSMC was 10 years ago, Hosseini said in a phone interview last week.

“China does not have access to leading edge equipment,” he said. “It would take a long time to have the engineering knowhow.”

Under the Trump administration, the U.S. essentially banned Chinese tech giants Huawei and SMIC from using American technology, including its chipmaking equipment.

That meant that since late 2020, TSMC could no longer manufacture semiconductors for Huawei.

TSMC’s China revenue had grown between 2018 and 2020 to nearly 20% of overall revenue, according to David Hsu, associate director at S&P Global Ratings.

But in 2021 TSMC’s exposure to China dropped back to around 10% of overall revenue, similar to levels seen in 2017, Hsu said. “After the Huawei ban, [TSMC] shifted its capacity to other companies.”

TSMC’s business has remained strong. The company, which is a major Apple supplier, reported second-quarter revenue of about $18 billion, up by more than 40% from a year ago.

That shows how much larger TSMC is than SMIC, which reported revenue for the same quarter of $1.9 billion, also up by more than 40% from a year ago.

A balancing act with the U.S.

The U.S. is also trying to fortify its access to critical semiconductor tech. U.S. President Joe Biden signed into law this month the Chips and Science Act, which offers subsidies to chipmakers for manufacturing in the U.S.

Bernstein analysts said in a report this month they expect a “lukewarm” impact for TSMC.

“Strategically TSMC is ‘everybody’s foundry’ in order to diversify customer base to reduce risk and increase scale, and will strive to stay neutral in the competition of the US and China,” the report said. “Considering these, we think TSMC likely will still keep its overseas capacity expansion in check in the next few years even with the incentive of the CHIPS Act now.”

About 10% of TSMC’s capacity is in mainland China, versus a far smaller fraction in the U.S., according to Bernstein estimates for the fourth quarter.

TSMC is spending $12 billion to build a factory in Arizona. In mainland China, the company operates in Shanghai and Nanjing.

However, CLSA’s Chen said the Arizona facility will focus on more advanced technology, while Taiwan’s restrictions on chipmakers’ investment into China means manufacturing there will remain focused on older, legacy technology — for which there’s a large market on the mainland.

Priced for a disaster’: Fund manager says inflation’s here to stay, but 2 beaten-down stocks could still do well

PUBLISHED THU, AUG 25 20228:28 PM EDTUPDATED THU, AUG 25 20228:50 PM EDT

Many investors have put their concerns about inflation on the back burner, thanks to a strong stock market rally in the second half. But those concerns are resurfacing, with a pullback in stocks this week and U.S. Federal Reserve Chair Jerome Powell’s speech at Jackson Hole.

Easing inflationary pressures in July had raised hopes that inflation had peaked, but fund manager Jordan Cvetanovski thinks “it’s here to stay.”

“The market is banking on core inflation coming down fairly quickly. We believe inflation will stay higher for longer and rates will be higher than expected. Even if energy and supply challenges ease, inflation won’t be easily tamed,” Cvetanovski, founder and chief investment officer at Pella Funds Management, told CNBC “Street Signs Asia” on Tuesday.

So where is he putting his money?

U.S. discount retailer Dollar General is one of his top picks.

“We think that in general, discount retailers across the globe will benefit from this trend in the U.S. In particular, Dollar General is one of those companies that has actually done well in past crises. In fact, it had very strong sales growth during both the [Great Financial Crisis] and the lockdown years of the Covid-19 pandemic,” Cvetanovski said.

He expects Dollar General will able to pass on any prices increases to consumers, while benefiting from consumers trading down from “more expensive retail purchases to better bargains elsewhere.”

The company sells “everything staples,” which are less price sensitive for consumers compared to discretionary items, he added.

Cvetanovski also likes sports fashion retailer JD Sports, a company he described as a “well managed business that is able to grow in a weak environment.”

“If you look this company, historically, it has grown like-for-like for 10% over the last 10 odd years, and even in this environment, it’s managing to grow like-for-like 5% per annum, which is a very good outcome. Putting valuation aside for a second. we think that’s great execution,” he said.

The company’s main customer base — 16- to 25-year-olds with a side gig — is also “still quite a resilient part” of the consumer market, he added.

Cvetanovski said JD Sports could grow significantly by adding new stores and could take advantage of weakened competitors in the U.S. and Europe to engage in mergers and acquisitions.

The stock also looks attractive from a valuation perspective, he added. “It has gone to the cleaners and is priced for a disaster. We think [the stock] is far from it.”

What’s next for retailers

Retailers are increasingly facing margin pressures, thanks to higher labor and input costs as well as shrinking consumer spending power. How, then, should investors position themselves for these conditions?

“We think one should stick to companies that are executing really well, are well managed, have strong balance sheets and have shown to do well during a crisis and they take advantage of that,” Cvetanovski said.

“To cut a long story short, some retailers will do very poorly, while others will take advantage of this to do well relative to their competitors. So, it really will require some specific stock picking, if you like, and bottom-up understanding of the company we’re investing in,” he added.

Don’t buy a new iPhone or Apple Watch right now

PUBLISHED THU, AUG 25 202210:54 AM EDTUPDATED THU, AUG 25 202212:32 PM EDT

KEY POINTS

- It’s a bad idea to plop down money for a new iPhone or Apple Watch right now.

- Apple announced Wednesday that it’s hosting a fall event on Sept. 7 that’s almost certainly for the iPhone 14.

I was in the mall two nights ago shopping for back-to-work clothes and passed an Apple Store. It looked like lots of people were shopping for new iPhones. Part of me wanted to walk in and whisper to each of them, “Don’t buy one right now!”

But I didn’t. I kept walking and decided to write this instead.

It’s a bad idea to plop down money for a new iPhone or Apple Watch right now. Apple announced Wednesday that it’s hosting a fall event on Sept. 7 that’s almost certainly for the iPhone 14. It may also announce new Apple Watches, though the company sometimes separates the events. Bloomberg said the new iPhones could ship as soon as Sept. 16, just a few weeks from now.

Sure, maybe you don’t even care about getting the latest and greatest. You just want an iPhone. That’s fair. But there’s still a reason to wait. Apple typically drops the prices of its year-old iPhones after it introduces the new ones. So, you’re also saving money by waiting a couple of weeks.

Apple is planning four new iPhone 14 models this year, according to Bloomberg. You can reportedly expect a regular version, a bigger-screened version of the regular model for the first time, and two higher-end Pro models with extra bells and whistles. That bigger-screened regular iPhone 14 might be appealing to folks who want the largest display on an Apple phone but who haven’t wanted to shell out more than $1,000 for the iPhone Pro Max.

You might also want to think of it as a long-term purchase. You use your phone every day. You probably use it to take pictures, maybe play games. So if you’re hanging on to it for a few years, maybe you should buy the latest model when it comes out — and if you can’t afford it right now, consider budgeting for it next year. It’ll get software updates for years to come.

The same goes for the Apple Watch. Apple’s expected to introduce a new mid-tier Apple Watch SE model. That was last updated in 2020, so it should be a big upgrade to the budget-friendly model and will likely bring over some features that have been found in more expensive models for the past couple of years. Plus, Bloomberg says Apple is planning a new high-end Apple Watch Pro that could be more rugged. So, if that’s up your alley, you might also want to wait.

The decision’s up to you. But it seems that some folks don’t always know to expect new iPhones in September. At this point, I recommend you just wait to see what your options are. It can’t hurt!

These are Wall Street’s favorite Dow stocks, and where analysts think they’re going

PUBLISHED SUN, AUG 28 20227:29 AM EDT

Fears over even higher Federal Reserve interest rates dragged stocks last week, but Wall Street analysts still see upside in some individual names.

The Dow Jones Industrial Average lost 4.2% for the week, with the bulk of that decline coming Friday, when the 30-stock average slid about 1,000 points after Fed Chair Jerome Powell warned there could be “some pain” ahead as the central bank tries to rein in inflation. The S&P 500 and Nasdaq Composite also suffered steep weekly losses.

Only two of the 30 Dow components posted a gain for the week: Chevron and Boeing. That said, there are some Dow stocks that could rally going forward, according to analysts.

To find these names, CNBC Pro used FactSet to screen the Dow for the following criteria:

- Buy ratings from more than 50% of analysts covering them

- Potential upside of at least 10%, based on the average price target

Here are the stocks that made the cut:

WALL STREET’S DOW FAVORITES

| SYMBOL | NAME | SECTOR/SPACE | (%) BUY RATING | UPSIDE TO AVG PRICE TARGET AS OF AUG. 25 (%) |

| MSFT | Microsoft Corporation | Technology | 82.6 | 20.2 |

| CRM | Salesforce, Inc. | Technology | 79.6 | 32.8 |

| DIS | Walt Disney Company | Consumer Services | 72.4 | 20.7 |

| V | Visa Inc. Class A | Finance | 71.4 | 26.8 |

| BA | Boeing Company | Industrials | 66.7 | 26.7 |

| WMT | Walmart Inc. | Consumer Non-Cyclicals | 56.8 | 12.6 |

| HD | Home Depot, Inc. | Consumer Cyclicals | 52.9 | 18.5 |

| GS | Goldman Sachs Group, Inc. | Finance | 51.9 | 14.4 |

Source: FactSet

Microsoft is the most beloved stock on the list, with 82% of analysts rating the tech giant a buy. Analysts also see upside of 20% for the name as of Aug. 25.

Shares of Microsoft have struggled this year, losing roughly 20% in that time. However, JPMorgan’s Mark Murphy said in a note earlier this month that the company is “weathering the storm.”

Salesforce, Disney and Visa also have buy ratings from more than 70% of analysts covering them. However, Visa is by far the relative outperformer, having lost just 6.3% this year. Meanwhile, Salesforce and Disney are down 35% and 26%, respectively, for 2022.

To be sure, Salesforce has the biggest potential upside of any stock on the list at more than 30% as of Aug. 25. Analysts on average see Disney going up 20% and Visa 27%.

Other names that made the list are Boeing, Walmart, Home Depot and Goldman Sachs.

HI Financial Services Mid-Week 06-24-2014