HI Market View Commentary 03-21-2022

As we look at the market right now :

Powell Killed the rally today – Because we are behind the curve for inflation

BUT the buy the dipper brought the market back to flat the last 30 minutes

Another 737 crashed in China = Hurts Boeing until the investigation is complete

Disney has an issue between the current CEO and the previous CEO

The share price has suffered and we collar or protect for this very reason

March ends and let’s see a historical good April

March end of the month tax selling

April starts out with new money coming in for the quarter

General: supply chain backlog, War, and higher taxes coming sometime next year, China Covid issues

https://www.briefing.com/the-big-picture

The Big Picture

Last Updated: 18-Mar-22 15:31 ET

The market to remain at battle stations

The stock market appeared to catch lightning in a bottle this week, rallying strongly despite reports that there hasn’t been any major progress in the peace talks between Russia and Ukraine, despite word that China was locking down cities to deal with rising COVID cases, and despite a projection from the Federal Reserve that it is likely to raise the target range for the fed funds rate seven times in 2022, including the rate hike it announced this past week — the first of its kind since December 2018.

Market participants also stared at a Producer Price Index report showing a 10.0% year-over-year increase in the index for final demand… and won.

They watched the 10-yr note yield hit 2.25% immediately after the Fed decision and the 5s10s spread invert… and won.

There seemed to be no stopping the stock market, which had an inclination to get off the mat and start fighting again. It fought the good fight, and it won the battle, but the war is far from over.

Sensing an Opportunity

What hit home for many participants this week is that the stock market was oversold on a short-term basis, and even on a longer-term basis for many stocks that have cratered from last year’s highs.

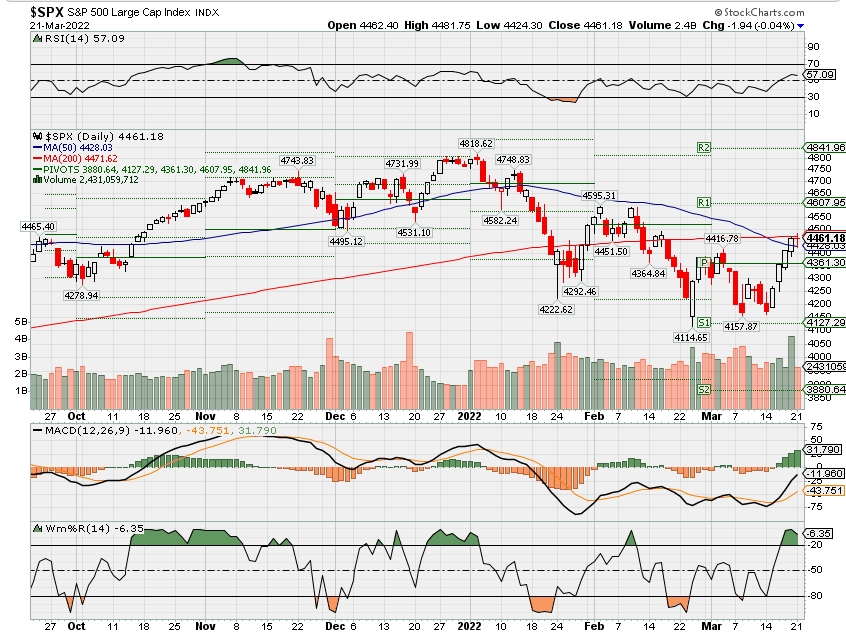

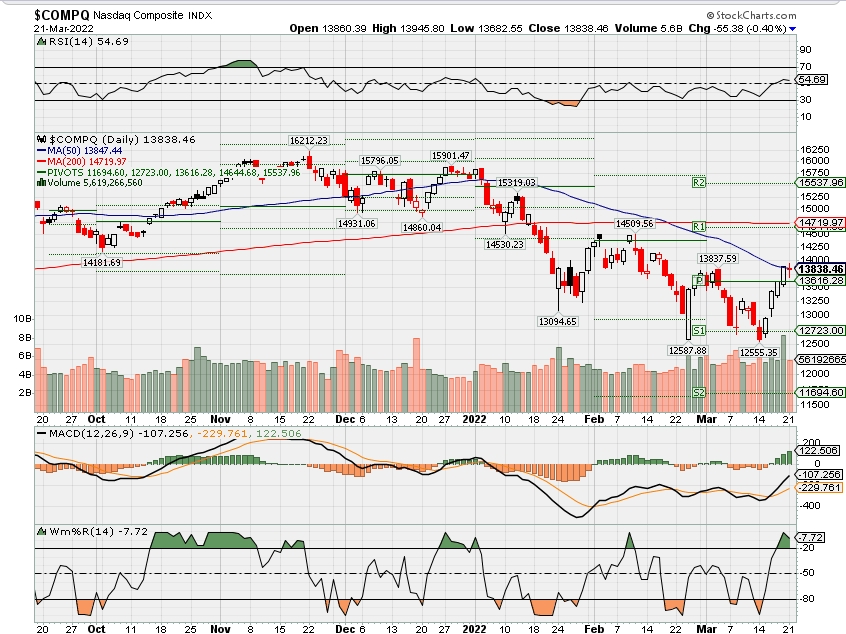

At Monday’s lows, the Nasdaq Composite was down 19.8% for the year and the S&P 500 was down 12.7%. That reality was paired with reports discussing how negative investor sentiment has gotten, how high cash positions have gotten, and how much fund managers have reduced their exposure to stocks, which effectively made a case to wage a contrarian battle for supremacy of the tape.

Sure enough, many of the best-performing stocks this week have been among the hardest-hit stocks this year and/or since their highs last year.

Sensing an opportunity to squeeze short sellers and to take advantage of oversold positions, market participants took an inch of any seemingly good news and went a foot with it.

As of this writing, the Nasdaq Composite, Russell 2000, S&P 500, and Dow Jones Industrial Average were up 10.4%, 7.5%, 7.0%, and 5.5%, respectively, from their lows on Monday. Even so, they were still down 11.4%, 7.4%, 6.5%, and 4.9%, respectively, for the year.

For some added context, Hong Kong’s Hang Seng Index at Friday’s close was up 17.4% from its low on Tuesday but was still down 8.5% for the year.

Briefly, the Hang Seng went parabolic following reports that Chinese officials were talking up support for the economy, for the markets, for the real estate sector, and for overseas Chinese listings. The latter contributed to the positive-minded action in the U.S. stock market.

It was an undeniably terrific week for the major indices, which comes on the heels of many undeniably bad weeks for most of 2022 so far.

Battle Fronts

Naturally, the question everyone is asking is, will this last? What happens between Russia and Ukraine holds some important answers, but no one knows for sure yet what will happen between Russia and Ukraine, so the answer on that matter is inconclusive.

There is a hope that a ceasefire agreement can be reached and that the conflict will end. There is a fear that Russian President Putin has much different aims for agreeing to a ceasefire than Ukraine does, meaning there is a fear that the tug of war in Ukraine will linger as a battle for investor sentiment that won’t be won easily.

The same rings true for a host of other factors that hold answers for where the stock market is headed.

To be sure, there are a lot of battles for sentiment being fought right now. Those battles are being waged on the following fronts:

- Inflation and where it is headed

- The Federal Reserve and whether it is on track to “thread the needle” removing its policy accommodation or on course to make a policy mistake that tips the economy into recession

- The ceiling for interest rates

- The trajectory of earnings growth estimates

- COVID and how long it will linger as a drag on productivity and disruptor of supply chains

- The matter of valuations

The volatility we have seen so far in 2022 is a byproduct of the heightened uncertainty regarding the outcome of these battles.

The war Russia is waging on Ukraine is the most real battle of all. That’s a life and death battle and so is COVID for some sufferers. The other items are battles in metaphorical terms, which nonetheless are fought in the markets each day.

They matter for investor sentiment, and how those battles are fought and won matter for the direction the capital markets will take.

Running Away

The stock market won the battle this week. It was not defeated by the PPI report, it was not defeated by the lockdown of Chinese cities, and it was not defeated by the Federal Reserve’s hawkish-sounding tone.

It was not defeated because it had already been feeling the agony of defeat in a big way. So, it ran with the hope that a ceasefire agreement between Russia and Ukraine can be reached; it ran with the relief Chinese authorities provided for Chinese stocks; it ran with a sense that China’s COVID-related lockdown won’t last as long nor be as economically disruptive as past lockdowns; and it ran with the idea that the seven rate hikes projected by the Fed for 2022 were already priced into the market.

It ran on short-covering activity; it ran on investment activity; and it ran on just plain old momentum fueled by a fear of missing out on further gains.

It may very well have more room to run before this latest engagement gets bogged down — but we do expect it to get bogged down.

What It All Means

The silliest battle cry we heard this week was a suggestion that the stock market rallied because it was looking ahead to rate cuts in 2023 that would be necessary because the rate hikes in 2022 will choke off economic growth.

That was not the reason.

We saw more reason in the suggestion that the market rallied like it did because it has been pinned to the mat for too long and discovered a burst of adrenaline that helped it get off the mat when many people least expected it.

The battle for sentiment was fought this week and it was won by the bulls, but the battle isn’t over.

The call to battle stations will continue to be heard because there are so many diametrically opposed positions right now regarding the path of inflation, the path of interest rates, the path of earnings estimates, and the path of the economy.

The Federal Reserve sits in the middle of each of those paths. The message Fed Chair Powell delivered on Wednesday was deemed to be reassuring, which is odd since his prevailing message is that the Fed is determined now to use its tools to ensure that higher inflation does not become entrenched. The main tool will be interest rate hikes and the supplementary tool will be the reduction in the Fed’s balance sheet.

We expect the market to remain in a tug of war between potentially good and potentially bad outcomes, which means it will remain at battle stations, giving up ground some weeks and making up ground in other weeks like this past week.

Getting back on the high ground in a more believable fashion, though, is going to require more time, because the Fed is now finally ready it seems to dig in to fight inflation at a time when financial battles and real-life battles are being fought on many disputable fronts.

—Patrick J. O’Hare, Briefing.com

Where will our markets end this week?

Lower

DJIA – Bullish 5,20 day

SPX – Bullish

COMP – Bullish

Where Will the SPX end March 2022?

03-21-2022 -4.0%

03-14-2022 -4.0%

03-07-2022 -2.0%

02-28-2022 -2.0%

Earnings:

Mon: NKE, TME

Tues: CCL, ADBE

Wed: GIS, JKS, FUL, KBH, COOK, TCOM

Thur: DRI

Fri:

Econ Reports:

Mon:

Tues:

Wed: MBA, New Home Sales

Thur: Initial Claims, Continuing Claims, Durable Goods, Durable ex-trans

Fri: Pending Home Sales

How am I looking to trade?

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

Why would I think the back half of the year will be better than now?

Usually midterm boost market return into the end of the year!

‘Extremely awkward’: Bob Chapek and Bob Iger had a falling out, they rarely talk — and the rift looms over Disney’s future

April 12, 2020. That’s the day former Disney CEO Bob Iger’s relationship with his handpicked successor, current Disney CEO Bob Chapek, began to fall apart.

Iger had stunned the world in February of that year by resigning as Disney’s chief executive, effective immediately. He elevated Chapek, whom Iger and the board had long seen internally as the front-runner for the position given his operational experience and decades at the company. Iger would stick around as executive chairman and direct the company’s “creative endeavors” to help with the transition.

The timing of a CEO change at arguably the world’s most famous entertainment company couldn’t have been worse. Just weeks after Iger stepped down, Disney began closing its theme parks around the world during the initial stages of the Covid-19 quarantine.

Iger and Chapek seemed to be ready for the pandemic challenge together.

“I can’t think of a better person to succeed me in this role,” Iger said March 11, 2020, during the company’s annual shareholder meeting, a day before the company announced it would begin closing its parks.

Chapek returned the optimism.

“I’ve watched Bob [Iger] lead this company to amazing new heights, and I’ve learned an enormous amount from that experience,” Chapek said.

One month after those comments, with everyone stuck at home, then-New York Times media columnist Ben Smith published a story after reaching Iger by email. He reported Iger wasn’t going to turn Chapek to the wolves as a brand-new CEO while the world was falling apart. Iger told Smith he would stick around to help run the company.

“A crisis of this magnitude, and its impact on Disney, would necessarily result in my actively helping Bob [Chapek] and the company contend with it, particularly since I ran the company for 15 years!” Iger said in his email.

Chapek was furious when he saw the story, according to three people familiar with the matter. He had not expressed a need or desire for extra help. He wasn’t looking for a white knight. Iger had postponed his retirement as CEO three times already. Chapek felt he was essentially doing it again, leaving him as a hapless second banana, according to people familiar with his thoughts. Chapek was already reporting to Iger, the board’s chairman, anyway.

The Disney board had little interest in starting a brawl, especially given the state of the company and the world, the people said. Three days after Smith’s story was published, Disney accelerated its timeline and named Chapek to its board.

“It was a turning-point moment,” said one of the people familiar with Chapek’s reaction to Iger’s interview with Smith.

Since that incident, Iger and Chapek haven’t been able to mend their relationship, according to about a dozen people familiar with the matter who spoke with CNBC for this story. The people asked to remain anonymous because the relationship and discussions about it are private.

In the months that followed, Chapek began making key decisions about Disney’s future — including a dramatic reorganization of the company and outing actress Scarlett Johansson’s salary following a dispute over her Marvel movie “Black Widow” — without Iger’s input. Internal messages about business strategy from both men would sometimes conflict, as it became clear the executives weren’t speaking with one voice, several people noted.

While much of the public narrative has centered around Iger’s “long goodbye” — he departed as chairman in January — Chapek, 61, has actually been firmly in control of Disney for more than 18 months.

Normal times would have allowed Iger and Chapek to work more closely. Instead, the two executives barely spoke to each other. Chapek has a small circle of close confidants with whom he makes major decisions — longtime right-hand man Kareem Daniel, chief of staff Arthur Bochner, and, to some degree, Chief Financial Officer Christine McCarthy, whom Iger promoted to the role in 2015, according to people familiar with the matter.

Iger hasn’t been part of that circle.

Late last year, just weeks before his departure as executive chairman, Iger threw himself a going-away party, inviting more than 50 people at his house in Brentwood, a suburban Los Angeles neighborhood. He spoke at length about his time at Disney in front of the crowd. Chapek attended, but there was little interaction between the two men, according to people who attended the party. Guests — including veteran Disney executives and on-camera talent, such as broadcasters Robin Roberts, David Muir and Al Michaels — sat at two long tables at Iger’s house.

Iger and Chapek sat at opposite tables. Chapek sat near several of his direct reports, including Daniel. Iger sat next to film director and mogul Steven Spielberg. While Iger spent about 10 minutes publicly praising former colleagues, he barely mentioned Chapek, said the people.

“It was extremely awkward,” said one of the guests, who asked to remain anonymous because the party was private. “The tension was palpable.”

Both Iger and Chapek declined to comment on their relationship with each other.

Iger’s shadow

Chapek’s decision to move away from Iger showed chutzpah, but it also put him on an island against a Disney icon, who also happened to be the chairman of his company and a large shareholder. He also hasn’t been able to benefit from the myriad relationships Iger developed from decades at Disney.

Anyone succeeding Iger, who had been Disney’s CEO since 2005, was going to have a difficult time filling his shoes. Iger was generally beloved by Hollywood and highly respected as a CEO, particularly after orchestrating a series of intellectual property acquisitions — of Pixar, Marvel and Lucasfilm — which will likely go down in media history as three of the smartest deals ever. Iger, 71, has even flirted with running for president of the United States.

Chapek, meanwhile, has a harder exterior and at times, according to colleagues, struggles with emotional intelligence — which happens to be Iger’s strength.

The differences between the executives’ leadership styles have come to light quickly in Chapek’s tenure.

Disney’s public spat last year with Johansson over compensation after “Black Widow” streamed on Disney+ at the same time it hit theaters during the pandemic embarrassed Iger, who prided himself on smooth relationships with A-list talent. While the controversy happened under Chapek’s watch as CEO, Iger was still chairman and working with creative talent.

This month, Chapek’s public acknowledgement that he let Disney employees down by not fighting harder against Florida’s “Don’t Say Gay” legislation has been another reminder to Iger loyalists that Disney’s brand may be at risk with Chapek at the helm. Weeks before, Iger took a public stance against the legislation.

The messy execution has angered Disney employees. Deadline reported it spoke with several longtime Disney employees who said Chapek’s handling of the situation led to “the worst week they’ve ever had working at the company.” Several Disney employees have called Iger in recent weeks to express their disappointment in Chapek, according to two people familiar with the matter. Chapek met with creative leaders at Disney earlier this month to hear their concerns about his response to the bill, CNBC previously reported.

Perhaps the biggest division between Chapek and Iger was a more mundane one — Chapek’s decision to remove so-called profit-and-loss, or P&L, power from many of Disney’s veteran division leaders and consolidate all of that control under Daniel.

While public controversies generate headlines, it’s likely to be Chapek’s internal changes, and how successful they become, that will determine his future as Disney’s CEO.

Centralizing Disney leadership

In October 2020, about eight months after he took over as CEO, Chapek announced Disney was strategically reorganizing its media and entertainment businesses. This was Disney’s second major reorganization in less than three years. The key part of the announcement was the following:

“The new Media and Entertainment Distribution group will be responsible for all monetization of content —both distribution and ad sales — and will oversee operations of the Company’s streaming services. It will also have sole P&L accountability for Disney’s media and entertainment businesses.”

Those two sentences upended how Disney has done business for decades. The change gave Daniel, the leader of the new Media and Entertainment Distribution group, called DMED internally, one of the most important jobs in the history of media. The decision was instantly polarizing, leading to a burst of internal frustration among some veteran Disney employees who no longer controlled the budgets of their divisions, according to people familiar with the matter.

Chapek wants to streamline Disney so content decisions across distribution platforms can be made in synchrony. Instead of division heads running their own fiefdoms, Chapek and Daniel can steer Disney by controlling the budgets of each group and deciding where content ends up — streaming or cable or broadcast or movie theaters. Executives can then focus on making content, or selling ads, or building streaming technology, with direction from Chapek and Daniel. Historically, the heads of Disney TV or ESPN or Hulu or film would run their entire businesses.

Conceptually, Chapek’s idea actually isn’t all that different from what Iger had begun to put in place with the organization of Disney+. In early 2018, Iger met with Robert Kyncl, chief business officer at Google’s YouTube, according to people familiar with the meeting. Before Google, Kyncl had worked for seven years at Netflix, overseeing content partnerships.

Kyncl told Iger if he wanted Disney to start trading at Netflix-like multiples — which were, at the time, orders of magnitude higher than Disney’s — Iger needed to run operations like a technology company. Google separated its content and distribution divisions. The same roles didn’t live within smaller groups, the way Disney had been structured for years.

Kyncl declined to comment to CNBC about the meeting.

If Disney wanted investors to see its burgeoning streaming service as the growth engine in a digital-first world, Iger realized he needed to centralize power around Disney+. According to two people familiar with the meeting, Iger urgently asked then-Disney head of strategy Kevin Mayer to return from the Consumer Electronics Show in Las Vegas so Iger could show him a new organizational structure, which he drew on a whiteboard in front of Mayer. Mayer would become the head of Disney’s new direct-to-consumer unit, in charge of the company’s streaming platforms: Disney+, Hulu and ESPN+. Disney officially reorganized in March 2018.

Power struggles followed. Mayer and Disney TV studio head Peter Rice fought about who had the authority to decide which shows aired on Disney+. Rice’s principal issue was that content executives could no longer have direct conversations with Hollywood talent and tell them whether Disney would make their show or not. Rice feared losing greenlight power would affect Disney’s relationship with Hollywood. If studio executives didn’t have the power to approve projects, they’d quickly lose credibility with creators, who would want to speak with the people at Disney who possessed that authority.

Iger had to solve the disputes by making control decisions on the fly. Mayer won the main argument — he would have greenlight power for Disney+. Mayer left Disney in 2020 to become TikTok’s CEO, months after Iger chose Chapek as CEO.

Mayer and Rice declined to comment for this story.

While Chapek didn’t consult Iger about his October 2020 reorganization, he did cite many of the same principles that Kyncl and Iger discussed in 2018.

“Managing content creation distinct from distribution will allow us to be more effective and nimble in making the content consumers want most, delivered in the way they prefer to consume it,” Chapek said in a statement announcing the changes.

When he became CEO, Chapek went on a listening tour of executives to find out what was working and what wasn’t. He heard from both distribution and content executives that the current arrangement had become dysfunctional.

Chapek decided to reverse Iger’s decision to have greenlighting authority rest with the head of the streaming services. He gave that power back to content heads, who have more money than ever before to make programming — Disney plans to spend a record $33 billion on content for fiscal 2022. That’s largely pleased Disney’s content leaders, who can now tell creators directly whether Disney will work with them, according to people familiar with the matter.

But with Daniel getting P&L control, long-term Disney executives also lost the ability to run the businesses of their own divisions. Some creative leaders didn’t mind, preferring to focus on making content rather than selling advertising or working on wholesale distribution agreements with pay-TV providers. Others didn’t appreciate their loss of control over budgets.

Kelly Campbell’s decision to leave her job running Hulu to lead NBCUniversal’s Peacock in October was at least partially motivated by her desire to have more control over a business than what Disney allowed her, according to a person familiar with her thinking.

Campbell declined to comment for this story.

One film executive told CNBC that Disney operated smoothly when Alan Bergman, chairman of Disney Studios, and Alan Horn, former chief creative officer of Disney Studios, were in charge of the studio’s P&L. Film producers knew standard facts, such as a movie’s marketing budget or a film’s release date. In the new world, with Daniel in charge, it’s much harder to find out answers because the creative point people simply don’t know, the person said.

Others saw Chapek’s restructuring as simply pushing the envelope on a trend Iger already started —making it clear to Wall Street that streaming was the company’s new priority. By putting Daniel in charge of a variety of different budgets, Chapek could more easily steer all of Disney in the same direction. Decisions could be made more quickly.

This month, Disney put its new Pixar movie “Turning Red” directly on Disney+ instead of in theaters first. That decision would have taken “months” under Iger’s structure, with division heads flexing their power and knowledge of the market, according to three people who participated in the discussions. Instead, the debate took weeks, with Pixar executives ultimately agreeing that the movie should go to Disney+ first, the people said. “Turning Red” is the No. 1 film premiere on Disney+ globally to date, based on number of hours watched in the first three days.

As with any corporate reorganization, the proof will be in the results. Disney has a target of 230 million to 260 million global Disney+ subscribers by the end of 2024, compared with about 130 million Disney+ subscribers today. If Disney can get there, Chapek and Daniel can claim success — assuming they also revive the company’s shares, which have fallen about 30% in the past 52 weeks, even as crowds have returned to Disney’s theme parks around the world.

Kareem Daniel

Daniel’s P&L oversight for all movie, TV and film distribution, advertising, sales, technology and other divisions — jobs that used to be done by a cadre of Disney employees with 20 or 30 years experience each — gives him one of the most powerful jobs ever created in media. Disney’s fiscal 2021 revenue topped $67 billion and has a market capitalization of about $240 billion. Disney routinely outspends all other global companies by billions of dollars a year on entertainment content.

Iger never agreed with giving Daniel so much control. The former CEO felt stripping division heads of their budget control wasn’t the right structure for Disney because the company was too diverse and complex.

Daniel is a polarizing figure among colleagues who have worked with him.

He’s described by five former and current co-workers as smart, hard-working and gregarious. He studied electrical engineering and got an MBA from Stanford. He’ll slap people’s backs and is fun to engage with outside of work, three of the people said. He’s demanding of his direct reports and holds them accountable, the people said.

Daniel is Black, an extreme rarity among the primary leaders of global media companies. He’s the first Black senior executive ever to report directly to the Disney CEO in the history of the company. That carries weight with certain employees, who respect the symbolism of a minority leader in such a high-profile role.

Like Chapek, Daniel has worked in a variety of Disney units, including studio distribution, consumer products, games and publishing, Walt Disney Imagineering, and corporate strategy. He’s been close to Chapek for two decades, first working for him as an MBA intern in 2002. When Daniel moved to corporate strategy, he again worked with Chapek on a variety of projects in 2007 and 2008. He worked under Chapek in distribution for Walt Disney Studios in 2009, when he was part of the M&A team that bought Marvel Entertainment, before following him to consumer products in 2011.

Chapek was particularly impressed with Daniel’s consumer focus when the two worked together to shorten the theatrical window from four months to three months at the end of 2009, according to a person familiar with the matter.

But some of the same people who note Daniel’s strengths also told CNBC the job may be too big for him — or almost anyone.

“He arguably has the most important job at Walt Disney, outside of CEO, and he has almost no experience running any of these businesses that were previously run by people that had decades of experience,” said one former coworker.

Chapek disagrees with that assessment, according to a person familiar with his thinking. He understands the job is massive in scope but feels that Daniel is suited to handle it given his varied experiences at Disney, including as president of consumer products, games and publishing, and president of operations at Walt Disney Imagineering.

Since his promotion announcement in October 2020, Daniel hasn’t done any published or televised interviews. He declined to comment for this story.

‘One Disney’

Ideally, Chapek would like consumers to experience a more unified digital Disney experience, whether it’s logging into Disney+ or buying merchandise from the online Disney store or managing theme park experiences with Disney’s Genie service, which is a kind of digital concierge. Internally, some employees informally speak of this grand challenge of unifying Disney technology and experiences as “One Disney.”

Chapek and Daniel want to hasten the pace of Disney’s digital transformation. In January, Chapek established company goals to “set the stage for our second century, and ensure Disney’s next 100 years are as successful as our first.” Two of the main themes were breaking down silos and innovation.

Disney, by nature and history, isn’t a technology company, even though it’s trying to restructure itself to be like one. In general, its employees don’t have the same type of technological know-how that you’d find at Apple and Google.

That’s problematic for a company that wants to trade at a technology-like multiple. According to a person familiar with the matter, Disney has struggled to build back-end technology to sell advertising on all of its streaming services — Hulu, Disney+ and ESPN+ — and traditional distribution channels. Disney+ and ESPN+ run on streaming infrastructure from BAMTech, a spin-off of MLB Advanced Media that Disney bought in 2017. Hulu has its own separate infrastructure.

Chapek and Daniel are still trying to streamline the organizational structure. Disney hires people dedicated to marketing or selling ads for its streaming services, ESPN, ABC and Disney’s entertainment cable networks, including some from its acquisition of 21st Century Fox. Those jobs can be duplicative and work against a “One Disney” experience.

Chapek has several times mentioned Disney building its own metaverse, although he hasn’t gone into detail about what exactly that means. Last month, Chapek promoted veteran executive Mike White to be Disney’s senior vice president in charge of “next generation storytelling.” In a memo seen by CNBC last month, Chapek said White’s goal will be “connecting the physical and digital worlds” around Disney entertainment.

Chapek will also have to decide what to do with Disney’s current assets. Some media analysts, such as LightShed’s Rich Greenfield, have argued Disney would be best off spinning out ESPN and combining it with a digital sportsbook. But that hasn’t been Chapek’s priority. ESPN relies on traditional TV affiliate fees, and it may not be strategically aligned with Disney’s direct-to-consumer ambitions, but the company has no plans to spin off or sell the sports network, said people familiar with the matter. ESPN has considered licensing its name to sports betting companies, but Disney isn’t interested in buying one, the people said.

Chapek will need time to show his own employees and shareholders that he can be trusted to accomplish goals he lays out. Nearly everyone interviewed for this story said that while Chapek may not be a “people person,” he’s a skilled and determined operator. Disney’s fiscal first-quarter results blew away analyst estimates on earnings per share, revenue and total Disney+ subscribers.

Several current Disney executives noted that Chapek’s No. 1 priority — setting up Disney for a digital world where streaming dominates and legacy distribution models fade away — is exactly what Iger believed in. That adds an element of sorrow to the men’s failed relationship. Their end goals are the same.

It’s possible Disney employees and the broader media and entertainment world simply get used to Chapek’s method of leadership with time. Chapek clearly isn’t Iger, but perhaps his biggest challenge will be convincing everyone it’s OK not to be.

Chapek’s contract is up at the end of February 2023.

Iger regrets how the change of control has transpired, one person said. But he’s also not returning to Disney, he told Kara Swisher in a January interview.

“I was CEO for a long time,” Iger said. “You can’t go home again. I’m gone.”

Disclosure: NBCUniversal is the parent company of CNBC.

These charts show how much it costs to charge an EV vs. refueling a gas vehicle

KEY POINTS

- While gas prices have soared in the wake of Russia’s invasion of Ukraine, so have electricity prices – particularly in some parts of the U.S. that have been big markets for Tesla’s EVs.

- So, is it still true that it’s much cheaper to “refuel” an EV? CNBC crunched the numbers.

It has been true for years: Mile for mile, it’s cheaper — generally much cheaper — to recharge an electric vehicle than it is to refuel one with an internal-combustion engine.

That has been a key selling point for Tesla and other EV makers, particularly in times when gas prices have soared, such as now. But this time there’s a wrinkle: While gas prices have indeed soared in the wake of Russia’s invasion of Ukraine, so have electricity prices — particularly in some parts of the U.S. that have been big markets for Tesla’s EVs.

That raises a question: Is it still true that it’s much cheaper to “refuel” an EV? The charts below, which show how much the cost to add 100 miles of range to the average EV or internal-combustion vehicle has changed in different markets over time, help us find the answer.

The first chart, using nationwide figures, provides a baseline. The others use data specific to Boston and San Francisco, two markets where EVs are popular — and where electricity tends to be more expensive than the national average.

https://datawrapper.dwcdn.net/pZT4x/1/ https://datawrapper.dwcdn.net/mjkdL/1/ https://datawrapper.dwcdn.net/TD8W6/1/ The answer in all three cases is that — even with regional surges in the price of electricity — it’s still quite a bit more expensive to fill your gas tank than it is to charge your EV’s battery.

Electricity rates have roughly kept pace with gas price increases in Boston and San Francisco. Yet, on average across the U.S., adding 100 miles of range in your internal-combustion vehicle has become more expensive, relative to charging an EV an equivalent amount, over the last couple of months.

Is that likely to change? While oil prices are nearly certain to fall in the coming months as producers increase output, it’s unlikely that the price of electricity will rise enough to make EVs less affordable over their life cycles than internal-combustion alternatives.

Using February data, Jeffries analyst David Kelley recently calculated that the total lifetime cost of ownership of an EV is about $4,700 less than that of an internal-combustion vehicle. He said that cost difference is likely to increase as more EVs come to market — and as battery prices continue to fall — over the next couple of years.

How we crunched the numbers

We had three questions in mind when we put together these charts:

- How much does it cost to add 100 miles of range to the average ICE vehicle and the average EV?

- How have those costs changed over the last three years? (Going back three years to February of 2019 gives us a pre-pandemic baseline.)

- How have those costs varied between different parts of the U.S.?

For gasoline, the Environmental Protection Agency reported that the average new vehicle sold in the U.S. in 2020 had a combined fuel-economy rating of 25.7 miles per gallon. Driving 100 miles in that average vehicle would use 3.9 gallons of gas. (Figures for 2021 haven’t been released yet.)

On the electric-vehicle side, the EPA’s efficiency rating for EVs — called “MPGe”, for miles per gallon equivalent — gives consumers an idea of how far an EV can travel on 33.7 kilowatt-hours (kWh) of charge. Why 33.7 kWh? That’s the amount of electricity that is chemically equivalent to the energy in a gallon of regular gasoline.

The average MPGe rating for 2022-model-year EVs sold in the U.S. is about 97, so driving 100 miles in that hypothetical average vehicle would use 34.7 kWh of electricity.

The charts above compare how the price of 3.9 gallons of gas has changed relative to the price of 34.7 kWh over time, using monthly data from the U.S. Energy Information Administration (for gas prices) and the U.S. Bureau of Labor Statistics (for electricity rates) from February 2019 through February 2022.

—CNBC’s Crystal Mercedes contributed to this article.

Most medical debt will be wiped from consumer credit reports

KEY POINTS

- A large number of U.S. consumers will have their medical debt wiped from their credit reports, the nation’s largest credit reporting agencies announced Friday.

- Equifax, Experian and TransUnion said in a joint statement they would remove nearly 70% of medical collection debt accounts from consumer credit reports after conducting months of market research.

- The changes will start to take place this summer.

A large number of U.S. consumers will have their medical debt wiped from their credit reports, the nation’s largest credit reporting agencies announced Friday.

Equifax, Experian and TransUnion said in a joint statement they would remove nearly 70% of medical collection debt accounts from consumer credit reports after conducting months of market research. The changes will start to take place this summer.

“After two years of the COVID-19 pandemic and a detailed review of the prevalence of medical collection debt on credit reports, the NCRAs (nationwide credit reporting agencies) are making changes to help people to focus on their personal wellbeing and recovery,” the companies said.

Starting July 1, medical debts that were sent to debt collectors and eventually paid off will no longer be included on consumer credit reports. In the past, debts that were paid after being sent to collections could be included on credit reports for seven years. Consumers will also now have a year before unpaid medical collection debt appears on credit reports after being sent to collections. That’s up from the current six months, which the agencies said will offer people more time to work with their insurance or health-care providers.

Starting in the first half of 2023, Equifax, Experian and TransUnion will also stop including medical debts in collection that are below $500 on credit reports.

Medical debt, which can be extremely unpredictable, can cause even the most fiscally rigorous Americans to end up missing payments, which can result in lower credit scores that will hinder their ability to get the best credit or loan rates.

A February report by the Consumer Financial Protection Bureau estimated there is $88 billion in medical debt on consumer credit records as of June 2021. Most medical debts in collection on consumer credit reports are under $500, it added.

Black and Hispanic consumers, young adults and low-income individuals are all more likely to have medical debt than the national average, the report said. Older adults and veterans are also “heavily impacted” by the debt, it said.

Biden warns Xi of global backlash if China helps Russia’s attack on Ukraine

Christina Wilkie@CHRISTINAWILKIE

KEY POINTS

- President Joe Biden spoke to Chinese President Xi Jinping for nearly two hours on Friday morning, largely about the Russian invasion of Ukraine.

- Moscow has asked Beijing for assistance in its war, and Biden’s goal was to spell out for Xi the negative consequences awaiting China if Xi agrees to the request.

- Biden and Xi both agreed to work for peace in Ukraine, but deeply disagreed on who is responsible for the Russian invasion.

- Xi suggested the United States had forced Putin’s hand — echoing one of Moscow’s favorite talking points.

WASHINGTON — President Joe Biden held a nearly two-hour phone call on Friday morning with Chinese President Xi Jinping to discuss Russia’s invasion of Ukraine.

The call was seen as a critical test of whether Biden could convince China to stay on the sidelines of the conflict in Ukraine, and to turn down Russian requests for military or economic aid.

Both Biden and Xi agreed on the need to promote peace and assist with the humanitarian disaster created by the invasion. But they disagreed deeply on who is responsible for the suffering in Ukraine, with the Chinese leader refusing to hold Russia singularly accountable for the unprovoked invasion.

Instead, official readouts from Beijing made it clear that Xi’s position was that the U.S. and Europe had provoked Russian President Vladimir Putin into attacking Ukraine by expanding NATO into Eastern Europe.

Biden’s warning for Xi

During the call, Biden “described the implications and consequences if China provides material support to Russia,” the White House said.

Pentagon officials said last week that Moscow has asked Beijing for military and economic assistance to wage its war against Ukraine, and that initial intelligence reports suggested China had agreed.

Following the call Friday, neither Chinese nor American officials would say whether Biden had shifted Xi’s thinking on Russia in any way.

The White House stressed that Biden’s goal had never been to secure assurances directly from Xi that China would not help Russia, merely to clarify the choices facing Beijing.

“The President really laid out in a lot of detail the unified response, not only from governments around the world but also the private sector, to Russia’s brutal aggression in Ukraine,” a senior administration official told reporters on Friday afternoon.

Biden “made clear that there would likely be consequences for those who would step in to support Russia at this time,” said the official, who spoke on the condition of anonymity.

Beijing’s view of Ukraine

According to a readout of the call from the Chinese Ministry of Foreign Affairs, Xi told Biden that the United States and China each had an obligation to promote peace in Ukraine.

“The Ukraine crisis is not something we want to see,” Xi reportedly said to Biden.

But even as he decried the human cost in Ukraine of Russia’s invasion, Xi still refused to directly blame Putin or the Kremlin for what is happening there.

Instead, Xi suggested Europe and the United States forced Putin’s hand — echoing one of Moscow’s favorite talking points.

“He who tied the bell to the tiger must take it off,” Xi said to Biden, according to a longer readout of the call released by the Ministry of Foreign Affairs.

The Chinese idiom is one that Xi has used before, and it means that whoever created the problem must solve it. In Xi’s view, Putin is the tiger and NATO tied the bell.

For now, however, China said Xi told Biden its pressing priorities are “to keep the dialogue and negotiation going, avoid civilian casualties, prevent a humanitarian crisis, and cease hostilities as soon as possible.”

To that end, Beijing is “ready to provide further humanitarian assistance to Ukraine and other affected countries,” the state readout said.

The Chinese government said Xi also referenced a “six-point initiative on the humanitarian situation in Ukraine,” but the foreign ministry did not provide details on what that would entail.

Still, the mere fact that China will provide humanitarian assistance to Ukraine is a sign that, at least on the surface, Xi’s ironclad alliance with his ally Putin may be under strain.

Russia’s isolation

Spokesmen for both the Russian and Chinese governments publicly deny that Russia has reached out to China for help waging its war against Ukraine.

But the unprecedented economic sanctions imposed on Russia by NATO members and G-7 countries in response to the invasion have left the Kremlin isolated and, some analysts say, desperate for financial assistance and military supplies.

Defense officials said China appeared to be open to supplying Russia with military supplies, but there are few indications so far that China will overtly help Moscow evade economic sanctions.

Beijing has little interest in becoming embroiled in the economic battle between Russia and the rest of the developed world.

“China is not a party to the crisis, nor does it want the sanctions to affect China,” Foreign Minister Wang Yi said during a phone call Monday with Spain’s foreign minister, Jose Manuel Albares.

The call between Biden and Xi began just after 9 a.m. Eastern and lasted just shy of two hours. That’s an unusually long time for a presidential call with the leader of a U.S. adversary.

Xi and Biden “share the view that China and the US need to respect each other, coexist in peace and avoid confrontation, and that the two sides should increase communication and dialogue at all levels and in all fields,” the Chinese readout said.

Where Will Meta Platforms Be in 3 Years?

By Brett Schafer – Mar 21, 2022 at 8:56AM

- Meta Platforms is the parent company of Facebook, Instagram, and Oculus.

- The stock is down 40% year to date on weak first-quarter guidance.

- The company is investing over $10 billion a year into its virtual reality and metaverse division.

You’re reading a free article with opinions that may differ from The Motley Fool’s Premium Investing Services. Become a Motley Fool member today to get instant access to our top analyst recommendations, in-depth research, investing resources, and more. Learn More

The social media giant is investing heavily to grow its metaverse segment. Will that bet pay off?

Earnings season has been brutal for many investors, especially for those who own technology and internet stocks. Even though we are less than three months into 2022, many high-growth stocks are down 30% or more already this year, which can be tough to stomach. Meta Platforms ( FB -2.07% ), the parent company of Facebook, Instagram, WhatsApp, and Oculus, is one of these stocks. Shares are down 40% year to date after the company put out poor guidance for the first quarter and has been hit by the broad market sell-off to start 2022.

If you’re thinking of buying the dip on Meta Platforms stock, it might be smart to model out and estimate how big this business could be in a few years. Where will Meta Platforms be three years from now? Let’s take a look.

Solid earnings, but poor guidance

On Feb. 2, Meta Platforms put out its earnings for the last three months of 2021. Revenue grew 20% year over year to $33.7 billion in the quarter, and earnings per share (EPS) was $3.67, slightly down from the year-ago period. Both of these numbers were right around analyst expectations.

User numbers came in a bit weak compared with expectations. Total daily active users (DAUs) were 1.93 billion versus 1.95 billion expected, and monthly active users (MAUs) were 2.91 billion versus 2.95 billion expected. However, the company made up for this user shortfall with average revenue per user (ARPU) of $11.57, which was better than the $11.38 analyst predictions.

All these fourth-quarter numbers were fine, but the big surprise was Meta’s guidance for the first quarter of 2022. Revenue for Q1 is expected to be between $27 billion and $29 billion, which was much less than the $30.1 billion analysts were expecting. Given this disappointment, Meta’s stock plunged 20% in the days following the report, accounting for a lot of the stock price decline.

Family of apps and reality labs

When it changed its name from Facebook to Meta Platforms, management decided to switch up how the company reported its financials. It now has two segments: “family of apps” (Facebook, WhatsApp, Instagram) and “reality labs” (the metaverse and virtual reality division). The family of apps division, though marred by controversy, has continued to grow both revenue and profits over the past few years. From 2019 to 2021, revenue for the segment grew from $70 billion to $115.7 billion, and operating income grew from $28.5 billion to $56.9 billion.

With a market cap of $556 billion, that gives Meta’s stock a dirt cheap price-to-operating-income (P/OI) of 9.8 based on its family of apps division. So why are investors discounting family of apps so much when the social media apps have continued to grow and increase their profitability?

The uncertainty comes from Meta’s other segment, reality labs, which houses Oculus and its virtual/augmented reality research divisions. The division burned $10.2 billion in 2021, which is right around the annual burn rate Mark Zuckerberg said the division will run at for the foreseeable future. With only $2.2 billion in 2021 revenue (a small amount for a company of this size), there is still a long way for this division to grow and a lot of uncertainty over whether these investments will ever turn into a viable business. Given this uncertainty and how much money the division is expected to lose, it is understandable that investors are nervous about these moves from Meta Platforms.

Returning capital to shareholders

The good thing about this business, as compared to practically any other that is burning $10 billion a year on a venture-style bet, is that it is still able to generate tons of cash for shareholders. In 2021, Meta Platforms generated $39 billion in free cash flow, up from $23.6 billion in 2020, which is highly impressive given how much money the reality labs division is losing.

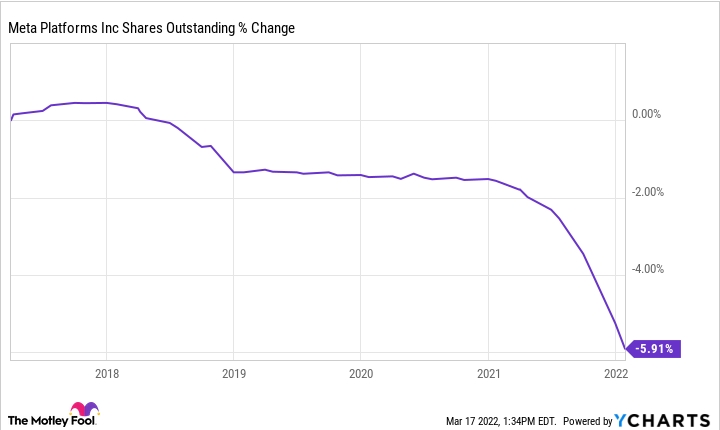

With so much cash coming in, Meta Platforms has started returning some to shareholders in the form of share repurchases. Meta’s share count has come down by 5.9% in the last five years, with the majority of that drop coming in the last year or so. For reference, management spent $19 billion on buybacks just in Q4 of 2021. At its current market cap of $556 billion, Meta should be able to reduce its share count by around 7% in 2022 if it spends all of its 2021 free cash flow on share repurchases.

FB Shares Outstanding data by YCharts

So where will Meta Platforms be in three years?

Given the differences between Meta’s two operating segments, it is hard to evaluate where this business will be at the start of 2025. It is likely the reality labs division will still be burning $10 billion a year, as that is Zuckerberg’s stated plan right now. Family of apps is harder to predict because of the nature of the social media industry. However, if we assume revenue will grow at 10% a year (which would be a big slowdown from its historical growth rate) over the next three years with stable operating margins, Meta’s family of apps division will be generating around $76 billion in annual operating income three years from now.

Subtract $10 billion in reality labs losses and Meta Platforms’ consolidated operating income could be $66 billion in 2024. At its current market cap of $556 billion (which doesn’t include any benefits from buybacks), that would give the stock a P/OI of 8.4. Unless something drastic happens with the overall stock market from now until then, I think there is a chance Meta Platforms stock could be significantly higher three years from now.