HI Market View Commentary 05-10-2021

https://go.ycharts.com/weekly-pulse

| Market Recap |

| WEEK OF MAY. 3 THROUGH MAY. 7, 2021 |

| The S&P 500 index rose 1.2% last week to a fresh record closing high despite weaker-than-expected US job gains for April, as the energy and materials sectors led a strong climb and investors were hopeful the disappointing payrolls will translate to a longer period of easy monetary policy. The benchmark ended the week at 4,232.60, up from the previous week’s closing level of 4,181.17 and marking its highest closing level ever. The S&P 500 is now up by nearly 13% for the year to date. The advance came as many US corporate earnings have surpassed expectations while economic data also have painted the picture of an improving US economy, even if the recovery is a bit bumpy. Weekly jobs data released Thursday showed jobless claims fell below 500,000 last week for the first time since the COVID-19 pandemic began. Monthly jobs data released Friday came in much weaker than expected. US nonfarm payrolls rose by 266,000 last month, a significant disappointment compared with the 1 million jobs increase expected in a survey compiled by Bloomberg and following a downwardly revised 770,000 increase in March. The unemployment rate rose to 6.1% in April from 6% in March, above expectations for a decline to a 5.8% rate. Still, stocks rose as investors took the weaker-than-expected job gains as a sign the Federal Reserve is likely to hold off longer before changing its easy monetary policy. Meanwhile, COVID-19 cases in the US have also been declining as vaccinations continue to be distributed, but other areas of the world continue to struggle, especially India, where cases keep setting new record highs and oxygen availability for patients is low. By sector, energy and materials had the largest percentage increases of the week, up 8.9% and 5.9%, respectively. Other strong gainers included financials and industrials. The downside, meanwhile, was led by consumer discretionary, down 1.2%, and utilities, down 1.1%. The energy sector’s climb came as crude oil futures rose on the week. Gainers included Baker Hughes (BKR), whose shares jumped 23% from last week as Barclays upgraded its investment rating on the energy technology company’s stock to overweight from equal-weight and boosted its price target on the shares to $28 from $25. Baker Hughes also said it and Bloom Energy (BE) agreed to collaborate on the potential commercialization and deployment of low-carbon power generation and hydrogen solutions to aid in energy transition. In materials, shares of Sealed Air (SEE) climbed 16% as the company reported Q1 adjusted earnings per share and revenue above year-earlier results and analysts’ expectations. Sealed Air also boosted its adjusted EPS and revenue guidance for 2021. The decliners in consumer discretionary included shares of Etsy (ETSY), which shed 17% despite the company’s Q1 results coming in above Street consensus estimates. The market was “overly optimistic” on Etsy’s ability to lap its impressive 2020 growth, Morgan Stanley said, adding that the firm sees “risk for further top-line deceleration as the economy reopens further.” Next week’s economic calendar features the April consumer price index on Wednesday, the April producer price index on Thursday, and April retail sales, import prices and industrial production on Friday. May consumer sentiment will also be among Friday’s data releases. Provided by MT Newswires. |

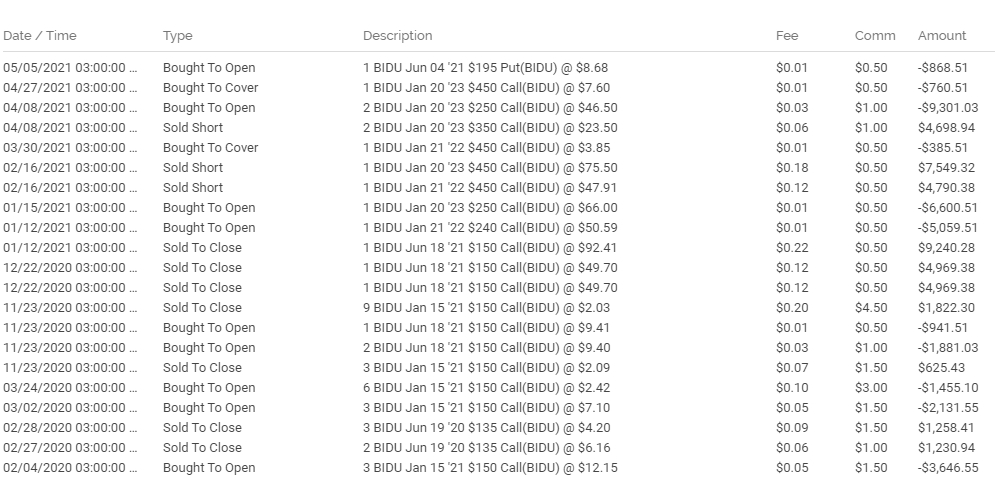

Let’s work through the BIDU questions I have been given recently?!?!?!!!!

Core Holdings:

BIDU – 5/18 AMC

COST – 5/27 AMC

DIS – 5/13 AMC

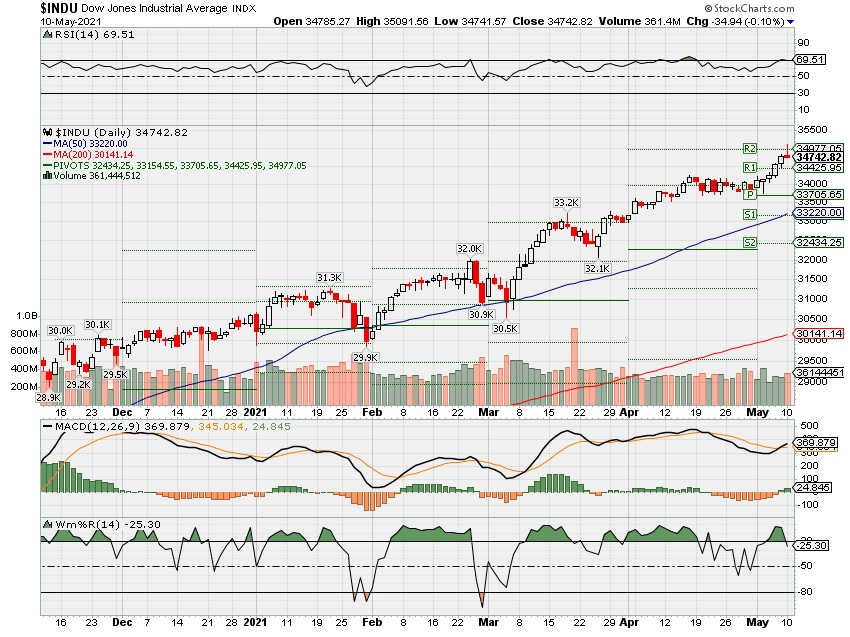

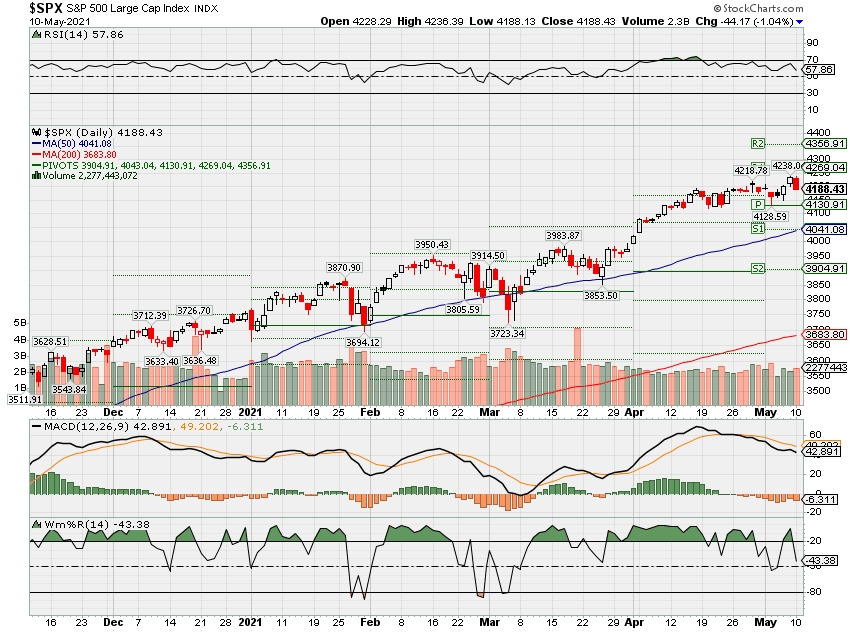

Where will our markets end this week?

Higher

DJIA – Bullish

SPX – Bullish

COMP – Bullish

Where Will the SPX end May 2021?

05-10-2021 4.0%

05-03-2021 4.0%

04-26-2021 4.5%

04-19-2021 2.0%

Earnings:

Mon: MAR, DDD, PRPL, WYNN

Tues: EA, VIZO

Wed: WEN

Thur: ABNB, DDS, BABA, DIS

Fri: JD

Econ Reports:

Mon:

Tues: NFIB Small Business Optimism

Wed: MBA, CPI, Core CPI, Treasury Budget

Thur: Initial Claims, Continuing Claims, PPI, Core PPI

Fri: Retail Sales, Retail Ex-Auto, Michigan Sentiment, Industrial Production, Capacity Utilization, Business Inventories, Import, Export

Int’l:

Mon –

Tues –

Wed –

Thursday –

Friday-

Sunday –

How am I looking to trade?

Earnings and adding protection where needed

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

https://www.ksl.com/article/50161598/gephardt-is-cryptocurrency-actually-a-viable-currency

Gephardt: Is cryptocurrency actually a viable currency?

By Matt Gephardt and Sloan Schrage, KSL TV | Posted – May 7, 2021 at 9:29 a.m.

Gephardt: Is cryptocurrency actually a viable currency?

MIDVALE — Bitcoin. Dogecoin. Ether. Digital dollar options are expanding. Their volatile values are setting record highs and lows. As more companies accept digital currency, are people actually spending it?

Spending Cryptocurrency

Bernie and Brothers Barber Co. in Midvale will take cash, cards, or if you like, Bitcoin.

“It’s the currency of the future,” said owner and barber, Bernie Hiett. “I wanted to be the first on it!”

Hiett loves the idea of cryptocurrency and its decentralized nature, specifically the part that allows her and her patrons to cut out the middleman.

“You’re not really paying a bank or a credit card processor – anything like that,” she explained. “So, it’s a good way to kind of skip that.”

Cryptocurrency is sort of like cash, but instead of handing off a dollar bill, you hand off a piece of computer code. Unlike a dollar, which has a fixed value, crypto is decentralized, meaning it is not tied to any physical coins or bills and there is no central authority overseeing its value.

So how much is a bitcoin worth?

Volatile Values

Good question, as we discovered when we tried to pay Bernie and Brothers the equivalent of $10.

In the time it took to open a cryptocurrency exchange app, scan a QR code and click send, the value went up by seven cents – almost a 1% increase in just 90 seconds.

That volatility is the reason you have been hearing a lot about cryptocurrencies lately.

On April 1, 2020, a single bitcoin was worth $6,671 according to CoinDesk. By April 15 of this year, its value shot up nearly tenfold to $63,346. That value plunged to $48,542 just 10 days later.

While seven extra cents on a $10 transaction isn’t a big deal, such flux does make cryptocurrency tough to spend.

Which begs the question: Is cryptocurrency really a practical currency?

“That has definitely dampened its adoption for currency purposes, like for paying for haircuts, buying pizzas, and buying real estate,” said Scott Condie, associate professor of economics at Brigham Young University. “When someone gives you cryptocurrency, you don’t have a good sense for exactly what that will buy five minutes from now, or an hour from now, or a week from now,” he explained.

Investment vs. Currency Condie sees cryptocurrencies more as a long-term investment than a currency.

Most Bitcoin owners seem to agree. A recent MoneyMagnify survey found 62% of people who have cryptocurrency believe it is their ticket to wealth. Still, if you want to use it as a practical currency, no question – more companies will take it, including Starbucks, Tesla, and even Utah’s own Overstock.com, which has accepted it for years.

“I do think Bitcoin is a viable currency,” said Overstock CEO Jonathan Johnson.

“At Overstock, we see people using it every day.” Though Johnson admitted, it is not a lot of people. “It is still a very small percentage of our sales, about a quarter of 1%,” he said.

Johnson explained the number of people buying their furniture, appliances, and other goods in Bitcoin fluctuates with the cryptocurrency market itself.

As its value drops, people spend the digital currency. When the value skyrockets – not so much.

“People view it as an investment holding, and I think they are hesitant to spend it because they want it to go up,” he said.

Exactly how many customers have paid with Bitcoin at Bernie and Brothers barbershop? Two, if you count me. Still, Hiett remains a believer that crypto will be a mainstream currency in the not-too-distant future.

“I think it will be pretty commonplace at some point,” she said. “It’s a workable currency right now so I don’t see why you wouldn’t take it.”

One thing you should know: If you decide to buy into cryptocurrency, you will get a key – a password of sorts.

If you forget it, tough.

In fact, a recent analysis by the cryptocurrency-data firm Chainalysis found $140 billion worth in bitcoin could be lost forever, due to forgotten passwords.

Cryptocurrency investors should be prepared to lose all their money, Bank of England governor says

PUBLISHED FRI, MAY 7 20216:03 AM EDTUPDATED FRI, MAY 7 20218:10 AM EDT

KEY POINTS

- When asked about the rising value of cryptocurrencies, Bank of England Governor Andrew Bailey said: “They have no intrinsic value.”

- “I’m going to say this very bluntly again,” he added. “Buy them only if you’re prepared to lose all your money.”

- The prices of digital currencies from bitcoin to dogecoin have climbed wildly this year.

LONDON — Cryptocurrencies “have no intrinsic value” and people who invest in them should be prepared to lose all their money, Bank of England Governor Andrew Bailey said.

Digital currencies like bitcoin, ether and even dogecoin have been on a tear this year, reminding some investors of the 2017 crypto bubble in which bitcoin blasted toward $20,000, only to sink as low as $3,122 a year later.

Asked at a press conference Thursday about the rising value of cryptocurrencies, Bailey said: “They have no intrinsic value. That doesn’t mean to say people don’t put value on them, because they can have extrinsic value. But they have no intrinsic value.”

“I’m going to say this very bluntly again,” he added. “Buy them only if you’re prepared to lose all your money.”

Bailey’s comments echoed a similar warning from the U.K.’s Financial Conduct Authority.

“Investing in cryptoassets, or investments and lending linked to them, generally involves taking very high risks with investors’ money,” the financial services watchdog said in January.

“If consumers invest in these types of product, they should be prepared to lose all their money.”

Bailey, who was formerly the chief executive of the FCA, has long been a skeptic of crypto. In 2017, he warned: “If you want to invest in bitcoin, be prepared to lose all your money.”

Bitcoin is up over 90% this year, thanks in part to rising interest from institutional investors and corporate buyers such as Tesla. The electric car firm bought $1.5 billion worth of bitcoin earlier this year, and the value of its holdings have since risen to nearly $2.5 billion.

Proponents of bitcoin see it as a store of value akin to gold because of its scarce supply — only 21 million bitcoins can ever be minted — arguing that the cryptocurrency can act as a hedge against inflation as central banks around the world print money to relieve coronavirus-battered economies.

However, skeptics view bitcoin as a market bubble waiting to burst. Michael Hartnett, chief investment strategist at Bank of America Securities, said bitcoin’s rally looks like the “mother of all bubbles,” while Alvine Capital’s Stephen Isaacs said there are “no fundamentals with this product, period.”

Alternative digital currencies have made even larger gains than bitcoin. Ether, the native token of the Ethereum blockchain, has seen returns of more than 360% year to date, while meme-inspired crypto dogecoin is up a whopping 12,500%.

Analysts have attributed dogecoin’s rise to tweets from celebrities like Tesla’s Elon Musk and Mark Cuban, as well as retail investors buying the token on the free-trading app Robinhood. David Kimberley, an analyst at U.K. investing app Freetrade, described the dogecoin rally as “a classic example of greater fool theory at play,” referring to the practice of selling overvalued assets to investors who are willing to pay a higher price.

At the same time, central banks are considering whether to issue their own digital currencies. Last month, the Bank of England launched a joint taskforce with the Treasury aimed at exploring central bank digital currencies, or CBDCs. Such a currency would exist alongside cash and bank deposits rather than replacing them, the bank said.

Fed warns about potential for ‘significant declines’ in asset prices as valuations climb

PUBLISHED THU, MAY 6 20214:00 PM EDTUPDATED THU, MAY 6 20215:17 PM EDT

Jeff Cox@JEFF.COX.7528@JEFFCOXCNBCCOM

KEY POINTS

- Rising asset prices are posing increasing threats to the financial system, the Federal Reserve warned in a report Thursday.

- Fed Governor Lael Brainard said the situation bears watching and points up the importance of making sure the system has proper safeguards.

- “Asset prices may be vulnerable to significant declines should risk appetite fall,” the central bank said.

Rising asset prices in the stock market and elsewhere are posing increasing threats to the financial system, the Federal Reserve warned in a report Thursday.

In its semiannual Financial Stability Report, the central bank said that while the system overall has remained largely stable even through the Covid-19 pandemic, future dangers are rising, in particular should the aggressive run on stocks tail off.

Investors have snapped up equities, corporate bonds and cryptocurrencies. They’ve poured billions into blank-check companies called SPACs, and the market has been mostly brisk for traditional initial public offerings.

Fed Chairman Jerome Powell and others have been asked repeatedly about whether they’re concerned over the rising prices. Powell specifically has said that as long as interest rates stay low, the valuations are justified.

However, the report notes that there’s danger lurking should market sentiment change.

“High asset prices in part reflect the continued low level of Treasury yields. However, valuations for some assets are elevated relative to historical norms even when using measures that account for Treasury yields,” the report states. “In this setting, asset prices may be vulnerable to significant declines should risk appetite fall.”

In an accompanying statement, Fed Governor Lael Brainard said the situation bears watching and points out the importance of making sure the system has proper safeguards. She specifically mentioned having banks increase their capital requirements during economic expansions as a buffer against downturns.

The report also mentions risk at hedge funds and other nonbank financial institutions on several occasions as potential threats to the system.

“Vulnerabilities associated with elevated risk appetite are rising. Valuations across a range of asset classes have continued to rise from levels that were already elevated late last year,” Brainard said. “The

combination of stretched valuations with very high levels of corporate indebtedness bear watching because of the potential to amplify the effects of a re-pricing event.”

The report notes that particular sectors including energy, travel and hospitality have particularly high vulnerabilities because of their sensitivity to the pandemic. The Fed also talks about potential threats from money market and open-end funds.

The Fed goes into a few specific scenarios that show potential risks to the system. It specifically talked about the Archegos Capital Management episode, when the firm could not meet margin calls, causing several large banks to take big losses.

“While broader market spillovers appeared limited, the episode highlights the potential for material distress at [nonbank financial institutions] to affect the broader financial system,” the report said.

Overall, the Fed said the current state of the system is sound, with household balance sheets in good shape, and corporations supported by an improving economy and low interest rates that have allowed default rates to fall.

Even the $1.7 trillion in student loans pose “limited” risks to the economy, given that most education debt is held by the top 40% of earners.

A survey the Fed conducted across a variety of 24 market contacts showed that the biggest worry is virus-related, specifically focusing on vaccine-resistant variants. That’s followed by a sharp increase in interest rates, a surge in inflation, and tensions between the U.S. and China.

Under Armour upgraded by UBS and Barclays after earnings beat with both firms predicting big gains

PUBLISHED WED, MAY 5 20215:52 AM EDTUPDATED WED, MAY 5 20219:45 AM EDT

Under Armour’s earnings beat didn’t get much initial love from investors, but two Wall Street firms said Wednesday the report showed it was time to buy the stock.

The apparel company beat Wall Street expectations with its first-quarter results on Tuesday, but the stock fell 1.2% amid the broader market decline. Analysts at Barclays and UBS stepped in on Wednesday morning, upgrading the stock and saying that the results were a sign of things to come.

Why UBS Sees Massive Upside for Under Armour After Earnings

May 5, 2021 10:40 am

Under Armour Inc. (NYSE: UAA) reported its most recent quarterly results on Tuesday, and the report earned a fair amount of praise from analysts. While COVID-19 has been transformative for many companies, this sports apparel firm took the opportunity to get a leg up on the competition.

UBS was one of the more bullish analyst firms after the report. It upgraded Under Armour to a Buy rating from Neutral and raised its price target to $36 from $26, implying upside of 82.6% from the most recent closing price of $19.72.

Overall, the firm believes Under Armour’s effort to improve its margins has progressed far ahead of what’s priced into the stock. The market thinks strong fourth and first quarter results were due to fiscal stimulus and an unusually benign promotional environment, with both likely reversing in 2022. UBS thinks Under Armour’s gains will be long-lasting and that margin expansion should drive a 94% increase in 2023 earnings compared with 2019.

UBS detailed in its report:

UAA’s 1Q21 gross margin increased ~370 bps y/y. While a favorable promotional environment contributed to the gain, we see 4 other drivers: 1) Supply chain efficiencies; 2) Improved quality of sale (e.g. fewer Off-Price channel sales); 3) Mix shifts (to DTC and Asia); and 4) Better inventory management. These more than offset increased freight costs. The important point is we think these drivers will continue to push UAA’s GM% higher and this makes UAA a good stock to own post-pandemic. We like stocks that have self-help stories which will cause EPS to surprise after the reopening-driven spending surge plays out and we think UAA fits this theme.

At the same time, better margins are the main reason UBS is updating its estimates going forward. The firm raised its 2021, 2022 and 2023 estimates by 21%, 36% and 66%, respectively.

Excluding Wednesday’s move, Under Armour stock had outperformed the broad markets with a gain of about 39% year to date. In the past 52 weeks, the share price was closer to 146% higher.

Under Armour stock traded up about 8% Wednesday to $21.30, in a 52-week range of $6.37 to $21.59. The consensus price target is $15.75.

The time to negotiate an annual month of remote work may be now

Monica Buchanan Pitrelli@MONICAPITRELLI

In addition to on-site yoga classes and ergonomic desks, companies may have a new wellness initiative up their sleeves — granting workers an annual period of remote work.

Remote work has proved popular with many workers, with 54% of employees saying they want to keep working from home after the pandemic ends, according to a survey by the Pew Research Center.

But that’s not likely to happen. Many more companies are expected to transition to hybrid work arrangements this year for the best of both working worlds — flexibility with the focus of an office environment, less loneliness yet less of a commute.

Yet, a hybrid schedule of say, three days in the office and two days out will not allow for one of the greatest perks of the work-from-home scheme: the extended “workcation.”

Workcations — and their lesser-known cousin, the wellness sabbatical — blur the lines between work and vacation. They’re work, for sure, but with a better view. Research shows they can be a therapeutic change of pace that supplement, rather than replace, regular vacation time.

Will annual remote work become the norm?

“A block of time is an interesting concept,” said Lynne Cazaly, a workplace specialist and author of “Agile-ish: How to Create a Culture of Agility.”

She said the idea could be attractive during certain seasons (summers, yes, but also snowy winters), school holidays and other “tricky times of the year.”

If you’re not offering these kinds of evolving benefits, there’s a competitive disadvantage.

Lynne Cazaly

WORKPLACE SPECIALIST AND SPEAKER

Short durations of remote work would also let employers compete with companies that are instituting indefinite flexible work arrangements, said Cazaly.

“Many leading indicator companies — like Spotify, Twitter, Square, Unilever, Atlassian — have said their employees can forever work from home,” she told CNBC. “Companies … know there is a growing war for talent … if you’re not offering these kinds of evolving benefits, there’s a competitive disadvantage there.”

Just look at Google. In an email to employees last week, CEO Sundar Pichai announced workers could now take four “work-from-anywhere weeks” (up from two) to give “everyone more flexibility around summer and holiday travel.”

Fewer pandemic-style problems

The problems many employees felt working from home for the past year — such as isolation and lack of social interaction with colleagues — aren’t as likely with short-term stints away from the office.

In fact, workers who use the time to travel can improve their mental well-being, rather than harm it, said Susie Ellis, CEO of the Global Wellness Institute.

“Academics have actually studied the impact of sabbaticals on well-being, whether the traditional one-year academic variety or a-month-or-more work sabbatical,” she said. “The research indicates [they] decrease people’s stress, boost overall wellbeing and help people work more creatively.”

Employers’ concerns may be equally as manageable. According to a survey by PricewaterhouseCoopers, 68% of executives said workers should be in the office at least three days a week to maintain company culture, once the pandemic subsides. For employees working that schedule, one month of remote work is akin to asking for 12 additional off-site days a year.

Furthermore, the move to hybrid schedules means the old way of working (with everyone in the office) and pandemic-style working (with everyone online) may both become a thing of the past, said Cazaly, adding that a mix of “people here, there and anywhere is where it’s at” now.

Will it work for your industry?

While some industries cannot easily work from home — retail, construction, entertainment and health care, to name a few — Pew’s research showed a majority of workers in these industries can:

- information and technology: 84%

- banking, finance, accounting, real estate or insurance: 84%

- education: 59%

- professional, scientific and technical services: 59%

Yet among those sectors, another obstacle awaits — buy-in from company leadership. From Facebook to Google, the tech industry is embracing the flexible work trend, while the titans of banking have started to publicly reject it.

JPMorgan Chase chairman and CEO Jamie Dimon indicated last week he is no fan of the work-from-home trend, while Goldman Sachs CEO David Solomon called it “an aberration that we’re going to correct as quickly as possible.”

Jaya Dass, managing director of recruitment agency Randstad in Singapore and Malaysia, cautions employees to do a “reality check” before requesting remote work opportunities.

“Being able to work collaboratively and determine work outcomes in a remote setting is not as easy as it sounds,” she said. “If your performance does not meet your manager’s expectations this past year, they may be waiting for you to return to the office to assess if remote work is the variable factor that is impacting your work.”

At the same time, Dass noted it wouldn’t be wise for businesses to unnecessarily decline employees’ annual remote work requests, or else “you may risk losing their trust and loyalty to the company.”

Tips for getting an annual period of remote work

1. Don’t wait

When is the right time to ask for annual remote work? “Now, now, now,” said Cazaly, adding that some companies may revert to pre-Covid work practices as time passes.

2. Do your research

Review your employee handbook or speak with someone in human resources to determine if your company already has a remote work policy, said Amanda Augustine, a career coach at the resume writing service TopResume.

“If no such policy exists, don’t let this deter you,” she said. “Instead, search online for news of other organizations — ideally competitors, companies that share similar traits or that your CEO admires — that have stated they plan to allow at least some of their employees to continue telecommuting after the pandemic.”

3. Be strategic

Consider your manager’s personality when deciding how to start the conversation.

“If your boss prefers people who are direct, schedule a meeting with a clear objective: ‘I’d like to schedule some time with you to discuss extending my period of remote work,’” Augustine said.

If your manager is less direct, broach the subject during your next one-on-one meeting. Either way, make sure the conversation takes place over video, not via phone, said Augustine.

“This will allow you to observe your manager’s body language and help you gauge whether your proposal is being well-received,” she said.

4. Arm yourself with data

Use research to explain how remote work can be a win-win for you and your employer.

“Studies have shown that companies that offer work-flexibility options can avoid employee burnout, increase retention rates, decrease absenteeism, improve productivity and improve overall employee morale,” said Augustine.

Cazaly agrees: “Companies know that happier employees are more engaged, productive and stay longer.”

5. Show you’re a hard worker

Even though remote work has shown productivity gains in the past year, companies may push back against short-term remote requests if they are concerned staff won’t work efficiently away from the office, said Cazaly. To combat this, demonstrate you have a great work ethic and are committed to your role, she said.

Augustine calls this sharing “your professional wins.” Remind your boss of the goals you’ve met or exceeded since you started working from home, she said.

6. Prepare for objections

Prior to making your case, eliminate possible objections from your employer. Boost your Wi-Fi, purchase a new router, fix lighting for video calls and purchase noise-canceling headphones, Augustine advised.

Then assure your managers that while you’re away, you’ll be accessible and will never compromise on quality work, said Randstad’s Dass.

If employers balk at a one-month request, ask to combine two weeks of remote work with two weeks of vacation time.

Kristen Graff, a Singapore-based sales and marketing director, negotiated with her employer to spend a month in Hawaii this summer with time evenly split between vacation and remote work.

“I know I’m probably the exception, but I didn’t want four weeks of vacation,” said Graff, adding that one of the things she most wanted was a “change in environment … from a productivity and inspiration point of view.”

Graff said she would be interested in an annual period of remote work, but she feels the idea is “really dependent on the person.”

“It takes a lot of self-motivation,” she said. “You have to work, otherwise you’ll ruin it for everybody.”

Fed’s Evans says employment and inflation need to pick up before policy changes

Jeff Cox@JEFF.COX.7528@JEFFCOXCNBCCOM

KEY POINTS

- Chicago Fed President Charles Evans said employment and inflation will have to pick up before he will change his position on policy.

- Evans said he wouldn’t mind seeing inflation run around 2.5% for some time.

- He expressed optimism over the state of the jobs market, despite the disappointing growth in April.

Chicago Federal Reserve President Charles Evans told CNBC on Monday that employment and inflation will have to pick up substantially before he will change his position on monetary policy.

Speaking after Friday’s hugely disappointing jobs report, the central bank official said he still thinks the employment picture is strong, though significant areas of weakness remain.

“It’s a little more complicated. We’re restarting the economy. A lot of sectors are experiencing growth pains,” Evans said on CNBC’s “Squawk Box.” “Hopefully, it’s just a one-month kind of thing and we’re going to get better employment. I certainly think so.”

Nonfarm payrolls increased by just 266,000 in April, well below the 1 million estimate. That left total employment more than 7.5 million below February 2020, the month before the Covid-19 pandemic declaration.

Evans noted that the job market continues to receive strong policy support through the trillions spent in Congress and the Fed’s own policies.

But as the economy has improved, investors have begun to wonder when the Fed might start pulling back on its measures. The central bank is holding short-term borrowing rates near zero and continues to buy at least $120 billion of bonds a month.

Evans indicated that the key measures the Fed watches – employment and inflation – remain a good deal from levels that would persuade him to tighten.

“I think it’s going to take quite some time for us to actually see it in the data, assess it,” he said. “I can’t give you a time frame.”

In addition to the weak jobs number, inflation remains below the Fed’s 2% average target. Evans said it likely will take months to hit that goal, adding that he would be comfortable if inflation ran a little hot for a while.

“To average 2% you’ve got to be above 2% for some period of time,” he said. “So inflation rates of 2.5% don’t bother me as long as it’s consistent with averaging 2% over some period of time.”

While the market is anticipating that the Fed at least will decrease the pace of its bond purchases by late 2021 or early the following year, Evans did not provide an estimate.

“We’re just going to have to see how the data come out this year,” he said. “When they’re stronger, when we’re close to our employment mandate and inflation’s picking up, we’ll be talking about that.”

Cathie Wood’s ARK Innovation ETF Is Selling Off—and It May Get Worse

By

May 6, 2021 12:24 pm ET

One of the hottest exchange-traded funds is sliding again, and the selloff may only get worse.

The ARK Innovation ETF (ticker: ARKK) delivered a 153% return in 2020. But it’s now giving up those gains quickly. The ETF, which is actively managed by ARK Invest CEO Cathie Wood and her team, is down 27% over the last three months, including an 13% decline in the past week alone. It was falling again on Thursday, down 2.6% to $108.62 at 11:56 a.m.

The ETF focuses on “disruptive innovation” stocks in areas like biotech, robotics, artificial intelligence, blockchain, and financial technology. It’s a concentrated, thematic-based fund that takes big swings on a handful of high-growth stocks.

The fund’s top 10 holdings account for nearly half the portfolio. Tesla (TSLA) is its top holding at about 11% of assets, followed by Square (SQ) at 6.5%, Teladoc Health (TDOC) at 6.3%, and Roku (ROKU) at 5.5%. The rest of its top 10 consists of Zillow Group (Z), Zoom Video Communications (ZM), Baidu (BIDU), Shopify (SHOP), Spotify Technology (SPOT), and Exact Sciences (EXAS).

Many of these stocks have tumbled as market leadership shifted from high-growth, high-multiple stocks to value and cyclicals. While the ETF offers exposure to many innovative areas of tech that may be great long-term bets, it’s ailing as investors’ appetite for risk cools off and crowded momentum trades reverse.

Tesla, for instance, is down 22% in the last three months. Zoom, Zillow, and Baidu are off about 30%. Spotify and Exact Sciences are each down 25%. Teladoc is dragging the portfolio down too, losing 47% in the last three months, including a 21% slump since April 26.

The ETF is still a giant with $21 billion in assets, making it one of the largest actively managed ETFs. But it’s shedding assets; investors redeemed $770 million in shares over the past week and $866 million overall in the past month, according to FactSet.

Ark client portfolio manager Renato Leggi says the ETF has had net inflows of $6.8 billion for the year, including $992 million from February 19 to May 4. “Flow data is sensitive to the end-point,” he said in an interview. “We’ve seen inflows even in volatile markets.”

Still, the redemptions may be adding to the selling pressure in some of the ETF’s small- and midcap holdings, though it’s unlikely to have much impact on megacaps like Tesla or Baidu.

Investors who bought in recent months may be sitting on heavy losses. The majority of the inflows into the ETF have come in the last 9 months, according to the Bear Traps Report. That implies that 50% of the money in the ETF is now underwater, the report said.

“With over half of inflows losing money, this speaks to a rising number of investors cutting losses,” according to the report. “Meanwhile, we are hearing ARKK is not available for borrow (to short) anymore at Interactive Brokers.”

The technical indicators aren’t looking good either. The ETF had a “very bearish close” on Wednesday, Bear Traps said, and it breached its 200-day moving average on Thursday morning for the first time in more than a year. Falling below that level implies that “meaningful selling” may still be coming, according to Bear Traps.

“We’ve always said we’re going to underperform in a risk-off market,” Leggi says. He adds that the ETF has been “very active” over the last week, buying stocks such as Invitae (NVTA), Twilio (TWLO), DraftKings (DKNG), UiPath (PATH, and Skillz (SKLZ). The ETF also added to its position Teladoc.

Some analysts have soured on the fund. CFRA downgraded its rating on the ETF from five stars to two stars on April 30.

“A two-star to us means it has less likelihood of outperforming over the next 9 months,” says Todd Rosenbluth, head of ETF and Mutual Fund Research at CFRA. The underlying portfolio ran up in price so much that it’s now far less attractive, he says. And the ETF’s fees, charging 0.75% in an expense ratio, coupled with its average risk/reward, have made it less attractive.

Morningstar analyst Robby Greengold is also bearish. The ETF “favors companies that are often unprofitable, highly volatile, and could plummet in tandem,” he wrote in a report. Wood’s investing style views risk through the lens of bottom-up stock picking, rather than trying to simulate risk exposure of the overall portfolio across a variety of market conditions, he adds. And as the ETF’s asset base has swelled, “the fund has become less liquid and more vulnerable to severe losses.”

Leggi says that strict portfolio risk controls, like stop-loss orders, would only hamstring the fund. “Were very contrarian and have a long term view, but we’re not buy and hold investors,” he says.

Granted, the ETF’s record remains stupendous, at least for investors who caught the wave on the way up. From its October 2014 launch, through February 2021, the ETF’s 36% annualized return beat every other actively managed ETF in the mid-growth category, according to Morningstar. It also topped the Russell Midcap Growth Index’s 15% return and the Nasdaq Composite’s 19% gain.

But catching the ETF at the right time has been crucial. The bulk of its outperformance came in 2017 and 2020, according to Morningstar, but it fell behind its category in 2015 and has underperformed indexes and peers in market corrections.

Leggi expects the rotation into cyclicals like energy and financial to dissipate and says those sectors are particularly “vulnerable to disruption” over the long-term. “Our performance tends to turn midway through a risk off period,” he adds, “and in subsequent risk-on periods we tend to outperform.”

Write to Daren Fonda at daren.fonda@barrons.com

3 comments

I was suggested this blog by my cousin. I am not sure whether this post

is written by him as nobody else know such detailed about my difficulty.

You’re amazing! Thanks!

New Member Introduction – Happy to Join the Community

Very shortly this web site will be famous

amid all bblogging and site-building viewers, due to it’s good articles or reviews