Trade Findings and Adjustments 02-09-2021

Welcome to a two part series on how HI makes exponential returns in portfolios

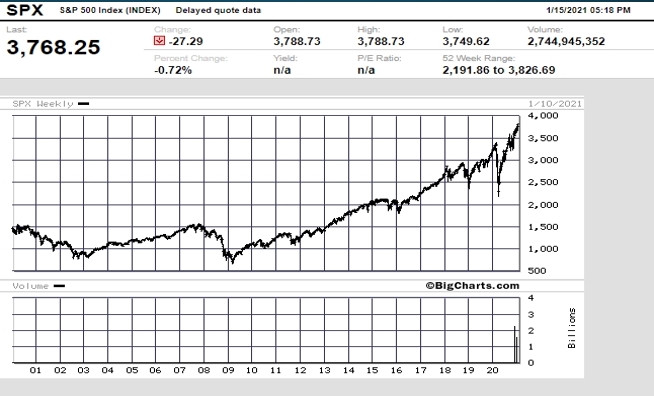

What is the “normal” expected return in the stock market ?= Average % return on the S&P 500

Averages are NOT your friend 7.75 – 7.8

$107.80 * 1.078(itself + Growth 7.8)=116.20 (2nd yr), 125.27, 135.04, 145.57, 156.93, 169.17, 182.36, 196.59

It has taken 20 years to double your portfolio in the Market

IF you are in a fund of ANY kind you will not beat the S&P 500 PERIOD !!!!!

BECAUSE the FEES aren’t included in the posted or average rate of return

Story of the $1

Your dollar increases by 50% and then decreases by 50%

You just had a 0% “Average” return over a two, three, five year, seven, eight , period of time

How much is your dollar worth BECAUSE you are lead to believe that the dollar is still $1

The $1 went to $1.50 with a 50% return and then $1.50 went to $0.75 with a 50% loss and we aren’t even counting the fees. YOUR 0% return is a 25% plus loss in your account

How do I know if I’m in a fund, You can’t own 5.756 shares if you aren’t in a fund

What is an exponential return ? It is adding more shares by using the profits of protection (long put)

Last year the market was up 14.44%

Market id up 14.44 and you made up 20% to the downside = 34.44

You might have 20% more shares of stock than the fund buy and hold

The next year it happens again 14.44% and you still have the previous 20% that you made half of that downward movement 10% plus the 20% = 14.44+30+20= 64.44%

The market just goes up 10% you have a 10% gain on a 1.98.88 or 200% return

IN a 60/40 moderate asset allocation, time horizon, retirement fund, target dated fund IN ANY of these you will never beat the S&P 500 !!!!

60% stocks and 40% bonds = 3-5% return and I get 3% the first year

38% down year = that part down 22.8=38.2

40% bonds make 5%= 45

45+38.2= 83.2

HI Financial Services Mid-Week 04-29-2014