HI Market View Commentary 10-19-2020

I want to go over how a collar trade “process” works

Usually we like to start with 1000 shares

500 shares will work for collar trading

Minimum is 300 shares

BTO 1000 shares $100 price = 1000×100=100,0000

What is your risk in the trade on a per share basis?= $100

BTO $100 Long Put for $7 per share

New cost basis is= $100 stock price + $7 Long Put price = $107

New risk in the trade= ONLY $7

You protected 93% of the total invested capital

STO a $120 Short call $3

Overall cost basis = $107 – 3 = $104

Overall Risk is $4 or roughly 4% T.I.C.

I would normally ask how much does you stock fall at earnings?= 60% like UAA

SO our $100 stock is trading at $40. What do we do?

-10% = $90 and we still have the right to sell at $100 = 1,111 shares of stock

-20%= $80 and we still have the right to sell at $100 = 1,250 shares of stock

-30%=$70 and we still have the right to sell at $100 = 1,428 shares of stock

-40%= $60 and we still have the right to sell at $100 = 1,666 shares of stock

-50%=$50 and we still have the right to sell at $100 = 2,000 shares of stock

-60%=$40 and we still have the right to sell at $100 = 2,500 shares of stock

| Panic of 1901 | 17 May 1901 | Lasting 3 years, the market was spooked by the assassination of President William McKinley in 1901, coupled with a severe drought later the same year. | ||

| Panic of 1907 | Oct 1907 | Lasting over a year, markets took fright after U.S. President Theodore Roosevelt had threatened to rein in the monopolies that flourished in various industrial sectors, notably railways. | ||

| Wall Street Crash of 1929 | 24 Oct 1929 | Lasting over 4 years, the bursting of the speculative bubble in shares led to further selling as people who had borrowed money to buy shares had to cash them in, when their loans were called in. Also called the Great Crash or the Wall Street Crash, leading to the Great Depression. | ||

| Recession of 1937–38 | 1937 | Lasting around a year, this share price fall was triggered by an economic recession within the Great Depression and doubts about the effectiveness of Franklin D. Roosevelt‘s New Deal policy. | ||

| Kennedy Slide of 1962 | 28 May 1962 | Also known as the ‘Flash Crash of 1962’ | [6] | |

| Black Monday | 19 Oct 1987 | Infamous stock market crash that represented the greatest one-day percentage decline in U.S. stock market history, culminating in a bear market after a more than 20% plunge in the S&P 500 and Dow Jones Industrial Average. Among the primary causes of the chaos were program trading and illiquidity, both of which fueled the vicious decline for the day as stocks continued lower even as volume grew lighter. Today, circuit breakers are in place to prevent a repeat of Black Monday. After a 7% drop, trading would be suspended for 15 minutes, with the same 15 minute suspension kicking in after a 13% drop. However, in the event of a 20% drop, trading would be shut down for the remainder of the day. | ||

| Friday the 13th mini-crash | 13 Oct 1989 | Failed leveraged buyout of United Airlines causes crash | ||

| Early 1990s recession | Jul 1990 | Iraq invaded Kuwait in July 1990, causing oil prices to increase. The Dow Jones Industrial Average dropped 18% in three months, from 2,911.63 on July 3 to 2,381.99 on October 16,1990. This recession lasted approximately 8 months. | ||

| Dot-com bubble | 10 Mar 2000 | Collapse of a technology bubble. | ||

| United States bear market of 2007–2009 | 11 Oct 2007 | From their peaks in October 2007 until their closing lows in early March 2009, the Dow Jones Industrial Average, Nasdaq Composite and S&P 500 all suffered declines of over 50%, marking the worst stock market crash since the Great Depression era. | [16][17] | |

| Financial crisis of 2007–08 | 16 Sep 2008 | On September 16, 2008, failures of large financial institutions in the United States, due primarily to exposure of securities of packaged subprime loans and credit default swaps issued to insure these loans and their issuers, rapidly devolved into a global crisis resulting in a number of bank failures in Europe and sharp reductions in the value of equities (stock) and commodities worldwide. The failure of banks in Iceland resulted in a devaluation of the Icelandic króna and threatened the government with bankruptcy. Iceland was able to secure an emergency loan from the IMF in November. Later on, U.S. President George W. Bush signs the Emergency Economic Stabilization Act into law, creating a Troubled Asset Relief Program (TARP) to purchase failing bank assets. Had disastrous effects on the world economy along with world trade. | [18][19] | |

| 2010 flash crash | 6 May 2010 | The Dow Jones Industrial Average suffered its worst intra-day point loss, dropping nearly 1,000 points before partially recovering. | [24] | |

| August 2011 stock markets fall | 1 Aug 2011 | S&P 500 entered a short-lived bear market between 2 May 2011 (intraday high: 1,370.58) and 04 October 2011 (intraday low: 1,074.77), a decline of 21.58%. The stock market rebounded thereafter and ended the year flat. | [25][26][27] | |

| 2015–16 stock market selloff | 18 Aug 2015 | The Dow Jones fell 588 points during a two-day period, 1,300 points from August 18–21. On Monday, August 24, world stock markets were down substantially, wiping out all gains made in 2015, with interlinked drops in commodities such as oil, which hit a six-year price low, copper, and most of Asian currencies, but the Japanese yen, losing value against the United States dollar. With this plunge, an estimated ten trillion dollars had been wiped off the books on global markets since June 3. |

The HARDEST part of being in the market is being able to wait for the stocks to come back

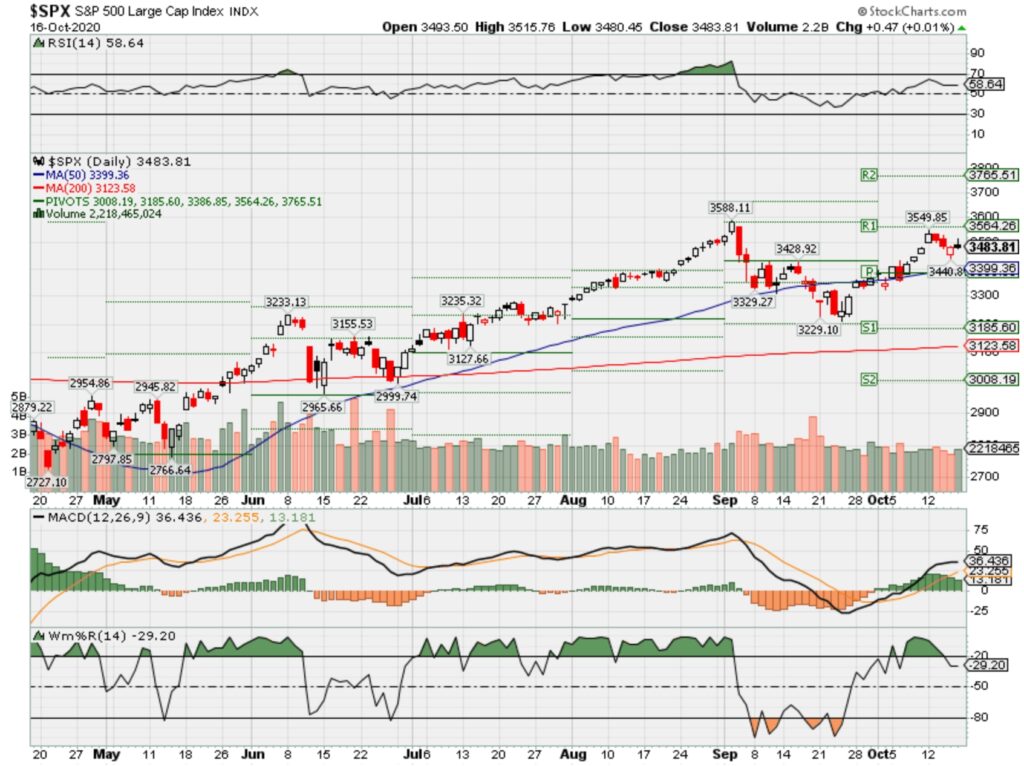

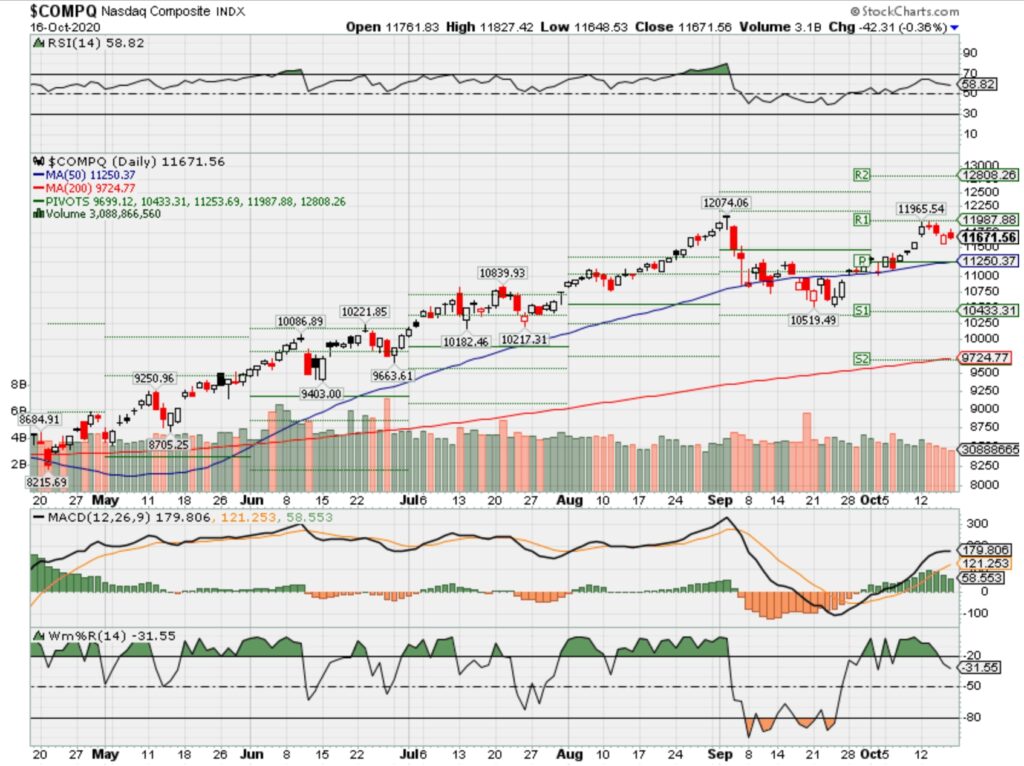

Where will our markets end this week?

Higher

DJIA – Bullish

SPX – Bullish

COMP – Bullish

Where Will the SPX end October 2020?

10-19-2020 +2.0%

10-12-2020 0.0%

10-05-2020 -5.0%

09-28-2020 -5.0%

Earnings:

Mon: HAL, IBM, AMTD, ZION,

Tues: LMT, PM, PG, NFLX, SNAP,

Wed: ABT, VZ, LVS, TSLA, VMI, KEY

Thur: ALK, AAL, ARCH, T, CCL, KO, KMB, NUE, PHM, SIRI, UNP, VLO, AMZN, COF, INTC

Fri: FHN, HON

Econ Reports:

Mon: NAHB Housing Market Index

Tues: Housing Starts, Building Permits,

Wed: MBA,

Thur: Initial Claims, Continuing Claims, Existing Home Sales, Leading Indicators

Fri:

Int’l:

Mon – CN: GDP, Retail Sales, Industrial Production

Tues –

Wed –

Thursday –

Friday-

Sunday –

How am I looking to trade?

All positions are mostly protected and now looking for OTM covered calls to add for full collar positions. Just trying to get to the elections and earnings.

EARNINGS

AAPL 10/29 AMC

BA 10/28 BMO

BIDU 11/05 est

LLY 10/27 BMO

DIS 11/12 AMC

F 10/28 AMC

FB 10/29AMC

KEY 10/21 BMO

UAA 11/02 BMO

V 10/28 AMC

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

When is the best time to have protection on?

When you have tech crossover, one – two weeks before earnings (ATM !!!), Prior to a management or new product announcement

China is snapping up Japanese government bonds, and it’s not just for the returns

KEY POINTS

- China bought 1.46 trillion yen ($13.8 billion) in medium to long-term Japanese government bonds on a net basis between April and July. That was 3.6 times more than the same period last year.

- In the same period, the U.S. increased its purchases by only 30%, in comparison. Europe, meanwhile, sold off 3 trillion yen worth of JGBs.

- Yields on such bonds are near zero, making them an unlikely option as an investment. But analysts told CNBC there are other reasons why China would want to buy those bonds.

SINGAPORE — China’s recent purchase of Japanese government bonds surged to the highest level in more than three years – as the country more than tripled its holdings between April and July this year, compared to the previous year.

During those three months in 2020, China bought 1.46 trillion yen ($13.8 billion) of medium- to long-term JGBs on a net basis, according to Japanese media Nikkei, which cited data from Japan’s finance ministry and its central bank. That was 3.6 times more than the same period last year.

In comparison, the U.S. increased its purchases by only 30% in the same period, that data reportedly showed. Europe, meanwhile, sold off 3 trillion yen worth of JGBs, according to Nikkei.

Yields on JGBs are around zero, making them an unlikely option as an investment since the returns are comparatively low.

But analysts told CNBC there could be other reasons why China would want to buy those bonds.

“One of the odd things about the current environment is that JGBs are no longer an obviously unattractive fixed income security, depending on the currency you are funding the purchase in,” said Ross Hutchison, investment director of global fixed income at Aberdeen Standard Investments.

For instance, China can actually earn more on the investment by buying 30-year JGBs in the Japanese yen and swapping their currency exposure back into U.S. dollars, said Hutchison. It can pick up an additional 0.56% by doing so, according to him. Longer term bonds typically have higher yields as investors need to take on higher risks for holding on to them for a longer period of time.

The practice of a currency swap is when two parties exchange an equivalent amount of money with each other in different currencies, in order to protect themselves from further exposure to exchange rate risk, for instance.

“Many reserve managers buy JGBs and then swap or hedge the currency back into dollars, earning an additional ‘basis’ premium,” said David Nowakowski, a senior strategist of multi-asset and macro at Aviva Investors.

It’s also possible that China may be trying to manage the appreciation of the yuan, as the Chinese currency spiked against the Japanese yen in June, Hutchison pointed out. Selling off the yuan to buy JGBs, which are denominated in yen, could help to curb some of that appreciation.

The yuan has also broadly spiked against the U.S. dollar this year, as the Chinese economy gathers momentum again after what may have been the worst of the coronavirus pandemic.

Another factor is that in comparison to its global counterparts, Japanese government bonds do not have the lowest yields, Nowakowski said.

“Even with a zero yield — in fact JGB yields are slightly below 0% — Japan’s bond market is more attractive than many other countries’ bonds, with Sweden, Switzerland, and core Eurozone countries all having deeply negative yields,” he said.

Treasury yields globally this year have gone down as investors flocked to the safety of government bonds amid the worsening pandemic. As prices go up, yields fall as they move inversely to each other.

Here are the top moments and highlights from Day 2 of Amy Coney Barrett’s confirmation hearings

Tucker Higgins@IN/TUCKER-HIGGINS-5B162295/@TUCKERHIGGINS

KEY POINTS

- Judge Amy Coney Barrett got her first shot to address questions live from members of the Senate Judiciary Committee on Tuesday, the second day of the Trump appointee’s Supreme Court confirmation hearings.

- The 7th U.S. Circuit Court of Appeals judge spent the first hours of the hearing fielding questions on abortion, the Second Amendment, her view of the role of precedent and an upcoming case on the Affordable Care Act, also known as Obamacare.

- Barrett largely refused to say how she’d rule on specific cases and whether precedents like Roe v. Wade should be overturned.

- She said she had made no commitments to any members of the executive branch and declined to commit to recusing herself from potential election cases involving President Trump.

Judge Amy Coney Barrett got her first shot to address questions live from members of the Senate Judiciary Committee on Tuesday, the second day of the Trump appointee’s Supreme Court confirmation hearings.

The 7th U.S. Circuit Court of Appeals judge spent the hearing fielding questions on abortion, the Second Amendment, her view of the role of precedent and an upcoming case on the Affordable Care Act, also known as Obamacare.

Following the model set by previous nominees, Barrett largely refused to address specific cases. She declined to say whether the landmark abortion precedent Roe v. Wade should be overturned, despite repeated prodding from the committee’s top Democrat, Sen. Dianne Feinstein of California, and other members of the committee.

Barrett repeatedly assured senators that she had no agenda, but refused to say much more, declining even to address a question about whether President Donald Trump could delay the November election.

She refused to commit to recusing herself from potential cases on the upcoming election between Trump and Democratic nominee Joe Biden, but said she had made no deals with anyone in the executive branch.

Democrats, who recognize they are unlikely to be able to stop Barrett’s nomination, have sought to highlight Supreme Court arguments scheduled for a week after Election Day on the constitutionality of Obamacare, and the prospect of a conservative court dooming the law.

Sen. Kamala Harris, the Democratic nominee for vice president and a member of the Judiciary Committee, quizzed Barrett about Obamacare for the bulk of her allotted time.

“I’m not here on a mission to destroy the Affordable Care Act,” Barrett said during the hearing.

Barrett provided her most candid answers in response to personal questions.

Answering an inquiry from Sen. Lindsey Graham, R-S.C., the committee chairman, Barrett said the confirmation process has been “excruciating,” but that she was “committed to the role of law and the role of the Supreme Court in dispensing equal justice for all.”

The 48-year-old judge told Sen. Dick Durbin, D-Ill., that she wept with her teenage daughter when she watched a video of the killing of George Floyd, a Black man who died in police custody in May.

Tuesday’s format all but guaranteed a long day. Each of the 22 senators on the committee — 12 Republicans and 10 Democrats — have half an hour for questions. Follow-ups will be permitted on Wednesday, and outside groups are expected to address the committee on Thursday.

Barrett is expected to be approved by the Judiciary Committee on Oct. 22. She is likely to be confirmed by the full Senate later in the month.

The hearings began at 9 a.m. ET and concluded around 8:15 p.m. ET. The top moments are below.

Barrett says she will not stroll in ‘like a royal queen’

Graham, who opened the hearings noting that he is facing a reelection challenge in South Carolina, spent a good portion of his allocated question time asking Barrett about her view of the role of “stare decisis,” a Latin phrase meaning “to stand by things decided.”

The doctrine generally means that Supreme Court justices try not to overturn previous cases without good reasons. It has taken on a new significance given Democrats’ worries that Barrett will push to overturn Roe v. Wade if she is confirmed.

Barrett told Graham that she will not be able to march into the Supreme Court and immediately overturn Roe, or other cases.

“Judges can’t just wake up one day and say, ‘I have an agenda, I like guns, I hate guns, I like abortion, I hate abortion,’ and walk in like a royal queen and impose their will on the world,” Barrett said.

Later, pressed by Feinstein on whether she agreed with the late Justice Antonin Scalia, for whom Barrett clerked, who said that the court’s abortion precedents should be overturned, Barrett refused to answer at least three times.

“Whether I say I love it or I hate it, it signals to litigants that I may tilt one way or another in a pending case,” Barrett said.

Process has been ‘excruciating,’ Barrett says

Barrett got her first opportunity to speak about the personal challenges of the confirmation process in response to a question from Graham about why she accepted Trump’s nomination.

“This is a really difficult, some might say excruciating process,” Barrett said. “We knew that our lives would be combed over for any negative detail, we knew our faith would be caricatured, we knew our family would be attacked.”

“What sane person would go through with that if there wasn’t a benefit on the other slide?” she asked.

“The benefit I think is I’m committed to the role of law and the role of the Supreme Court in dispensing equal justice for all,” she said. “I am not the only person who could do this job, but I was asked, and it would be difficult for anyone.”

“My family is all in on that because they share my belief in the rule of law,” Barrett said.

Barrett won’t say whether Trump can delay election

In response to a question from Feinstein about whether Trump could lawfully delay the Nov. 3 election, Barrett said she couldn’t answer without becoming essentially a “legal pundit.”

“Senator, if that question ever came before me, I would need to hear arguments from the litigants, and read briefs, and consult with my law clerks, and talk to my colleagues, and go through the opinion writing process,” Barrett told Feinstein.

“If I gave off-the-cuff answers I would be basically a legal pundit and I don’t think we want judges to be legal pundits, I think we want judges to approach cases thoughtfully and with an open mind,” she added.

https://platform.twitter.com/embed/index.html?creatorScreenName=tuckerhiggins&dnt=false&embedId=twitter-widget-0&frame=false&hideCard=false&hideThread=false&id=1288818160389558273&lang=en&origin=https%3A%2F%2Fwww.cnbc.com%2F2020%2F10%2F13%2Famy-coney-barrett-confirmation-hearings-top-moments-from-day-2.html&siteScreenName=CNBC&theme=light&widgetsVersion=ed20a2b%3A1601588405575&width=550px Trump, who is behind in national and state polls against Biden, has pushed for a delay to the election, arguing without evidence that mail-in voting is vulnerable to mass fraud. The Constitution provides Congress with the power to set the date of the presidential election.

Barrett says she has made no commitments to Trump on Affordable Care Act or other cases

Trump has suggested that his nominees to the top court would dismantle Obamacare, and said they would overturn Roe v. Wade. Barrett said that she has not discussed any cases with members of the executive branch, including the president, and has made no deals.

“No one ever talked about any case with me, no one on the executive branch side of it,” Barrett said in response to questioning from Sen. Chuck Grassley, R-Iowa.

“Just as I didn’t make any commitments and was not asked to make any commitments on the executive branch side, I can not make any commitments to this body either,” she said.

Barrett specifically addressed the Nov. 10 case on Obamacare, emphasizing that she had made no guarantee to strike it down.

“Absolutely not,” she said. “I was never asked, and if I had been that would have been a short conversation.”

She said that her past critiques of Supreme Court decisions upholding the ACA had no bearing on the legal questions at issue in the upcoming case, and that she wasn’t hostile to the law.

Barrett says she won’t commit to recusing from potential election cases

Barrett also refused to commit to Sen. Patrick Leahy, D-Vt., that she would recuse herself from any election disputes arising from the November election.

“He’s counting on you to deliver him the election,” Leahy told her, referring to the president.

Barrett said that under the Supreme Court’s rules, recusal decisions are made in consultation with the full court.

“While it is always the decision of an individual justice, it always happens with the consultation of the full court. So I cannot offer an opinion on recusal without short circuiting that whole process,” she said.

Barrett later told Sen. Chris Coons, D-Del., that she would consider the appearance of bias when making a decision about whether to recuse.

“I certainly hope that all members of the committee have more confidence in my integrity than to think that I would allow myself to be used as a pawn to decide this election for the American people,” Barrett said. “So that would be on the question of actual bias.”

“And you asked about the appearance of bias,” she added. “And you’re right that the statute does require a justice or judge to recuse when there is an appearance of bias. And what I will commit to every member of this committee, to the rest of the Senate, and to the American people, is that I will consider all factors that are relevant to that question.”

‘We wept together’: Barrett says she watched video of George Floyd killing

Sen. Dick Durbin. D-Ill., asked Barrett whether she had watched the video of the death of George Floyd, a Black man whose killing in Minneapolis police custody earlier this year spawned months of protests against state violence against African Americans.

Barrett said that she had seen the video and that it affected her deeply, citing her two Black children.

She said she and her teenage daughter Vivian, whom she adopted from Haiti, “wept together in my room.”

“My children, to this point in their lives, have had the benefit of growing up in a cocoon where they have not experienced hatred or violence,” Barrett said.

Buffett, quoting partner Munger, says there are three ways to go broke: ‘liquor, ladies and leverage’

KEY POINTS

- Warren Buffett believes investors should avoid using borrowed money to buy stocks.

- “It is crazy in my view to borrow money on securities,” he tells CNBC. “It’s insane to risk what you have and need for something you don’t really need.”

Warren Buffett believes investors should avoid using borrowed money to buy stocks.

“It is crazy in my view to borrow money on securities,” he told CNBC on Monday. “It’s insane to risk what you have and need for something you don’t really need. … You will not be way happier if you double your net worth.”

In the “Squawk Box” interview, Buffett shared the wit and wisdom from Vice Chairman Charlie Munger.

“My partner Charlie says there is only three ways a smart person can go broke: liquor, ladies and leverage,” he said. “Now the truth is — the first two he just added because they started with L — it’s leverage.”

The Oracle of Omaha explained the perils of using debt and leverage in his 2017 annual letter to shareholders released on Saturday.

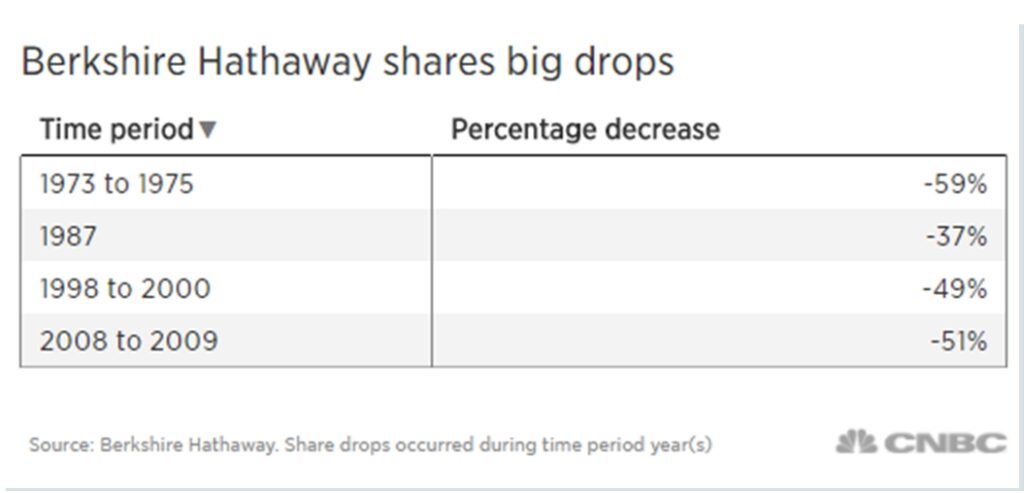

“Berkshire, itself, provides some vivid examples of how price randomness in the short term can obscure long-term growth in value. For the last 53 years, the company has built value by reinvesting its earnings and letting compound interest work its magic. Year by year, we have moved forward. Yet Berkshire shares have suffered four truly major dips,” he wrote.

He shared the data that revealed Berkshire Hathaway’s stock declined by a range of 37 percent to 59 percent multiple times over the last five decades.

“This table offers the strongest argument I can muster against ever using borrowed money to own stocks. There is simply no telling how far stocks can fall in a short period,” he wrote in the letter. “Even if your borrowings are small and your positions aren’t immediately threatened by the plunging market, your mind may well become rattled by scary headlines and breathless commentary. And an unsettled mind will not make good decisions.”

Walmart divides Black Friday deals into 3 separate events that kick off online

KEY POINTS

- Walmart said Wednesday that it will have in-store Black Friday sales, but it’s breaking them up into three different sales events.

- The big-box retailer is taking safety precautions, such as having employees distribute sanitized shopping carts and limiting the number of customers inside the store.

- Scott McCall, executive vice president and chief merchandising officer for Walmart U.S., said the company wants to deliver on low prices, convenience and safety — no matter how customers choose to shop.

For shoppers who can’t part with Black Friday traditions, Walmart said Wednesday that it still plans to have in-store events featuring deep discounts.

Yet the holiday sales days will come with pandemic-related precautions. Stores will open at 5 a.m. local time. Customers must line up single-file before they enter. Stores will limit the number of people inside. Employees will distribute sanitized shopping carts. And some, dubbed health ambassadors, will greet shoppers and remind them to put on a mask.

Walmart is planning to take steps to discourage crowds and nudge some bargain hunters online, too. The company said it will split up Black Friday into three different holiday sales events, staggered throughout the month of November. Each will begin on its website and hit stores a few days later.

Customers can also pick up purchases at the store without stepping inside by using curbside pickup.

Scott McCall, executive vice president and chief merchandising officer for Walmart U.S., said the company wants to deliver on low prices, convenience and safety — no matter how customers choose to shop.

“We’ve been very thoughtful as we planned this year’s event,” he said in a news release. “By spreading deals out across multiple days and making our hottest deals available online, we expect the Black Friday experience in our stores will be safer and more manageable for both our customers and our associates.”

Walmart’s first Black Friday event will start online Nov. 4 and in stores Nov. 7 and feature toys, electronics and home products. The second event, focused on electronics such as TVs, smartphones, computers and tablets along with some items from other merchandise categories, will begin online Nov. 11 and in stores Nov. 14. And the third event will kick off online Nov. 25 and in stores Nov. 27 — the same day as the usual post-Thanksgiving shopping event. It will have a range of items from electronics and toys to apparel and seasonal decor.

Retailers have been cautious about their holiday sales outlook, as they try to predict shoppers’ appetite for celebrating the season and exchanging gifts during a global health crisis and a recession. The National Retail Federation, which usually puts out its forecast in early October, has yet to weigh in.

Deloitte and Accenture, however, have shared mixed pictures of how the typically busy shopping period may play out. Deloitte predicted that holiday retail sales will increase between 1% and 1.5%, but said that will hinge on how much wealthy Americans splurge and how much lower-income families pull back. Customers surveyed by Accenture, however, said they plan to spend an average of about $540 — nearly $100 less than last year.

Major retailers, including Walmart, Target and Best Buy, have tried to encourage customers to start their holiday shopping earlier than usual by starting sales events in October. Walmart began its “Big Save Event” on Sunday, just a few days before the start of Amazon Prime Day on Tuesday. Walmart’s event runs through Thursday.

https://seekingalpha.com/article/4379398-bank-of-america-this-be-problem

Bank Of America: This Could Be A Problem

Oct. 16, 2020 9:35 AM ET

Summary

On a YTD basis, shares of Bank of America Corp. have experienced declines of more than -30%, which is roughly in line with financial sector performances in 2020.

However, the bank displayed critical weaknesses in several important areas in its latest earnings report, and this suggests BAC could face difficulties over the next few months.

We plan to stay long BAC while share prices are able to maintain support in the lower $20s and price/book valuations remain at favorable levels within the sector.

As is often the case, the financial sector is starting to set the tone for the current earnings season, and all eyes are centered on the post-pandemic performances of Bank of America Corp. (NYSE:BAC). Unfortunately, the bank showed weaknesses in several important areas, and this suggests that the stock could face difficulties as income investors are trading into the final months of 2020.

In our view, certain weaknesses were visible for Bank of America during the market’s most recent reporting period. However, the firm did beat consensus estimates for per-share earnings, and these somewhat mixed results suggest that all is not lost for income investors.

From a technical chart perspective, shares of BAC still look to be supported into the low $20s, and we will maintain our long position in Bank of America as long as this critical support zone holds true.

Source: Author via TradingView

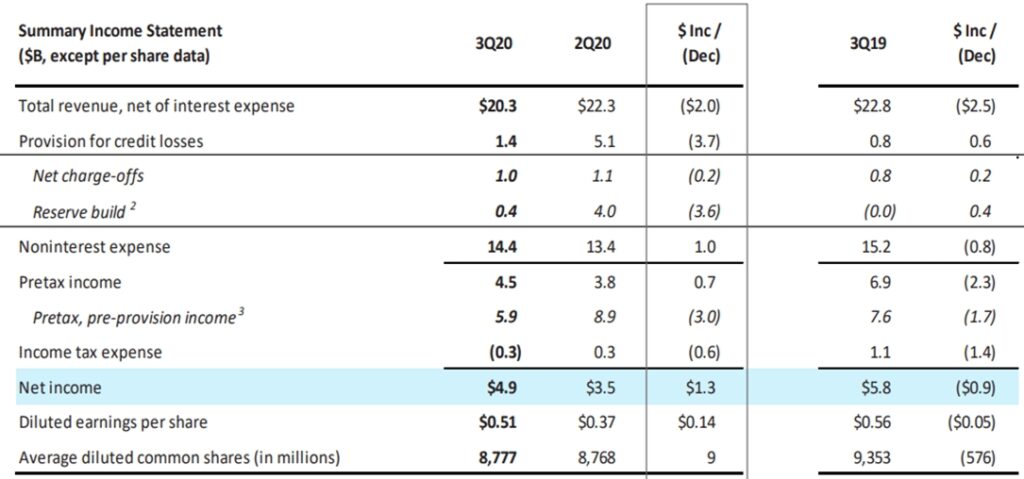

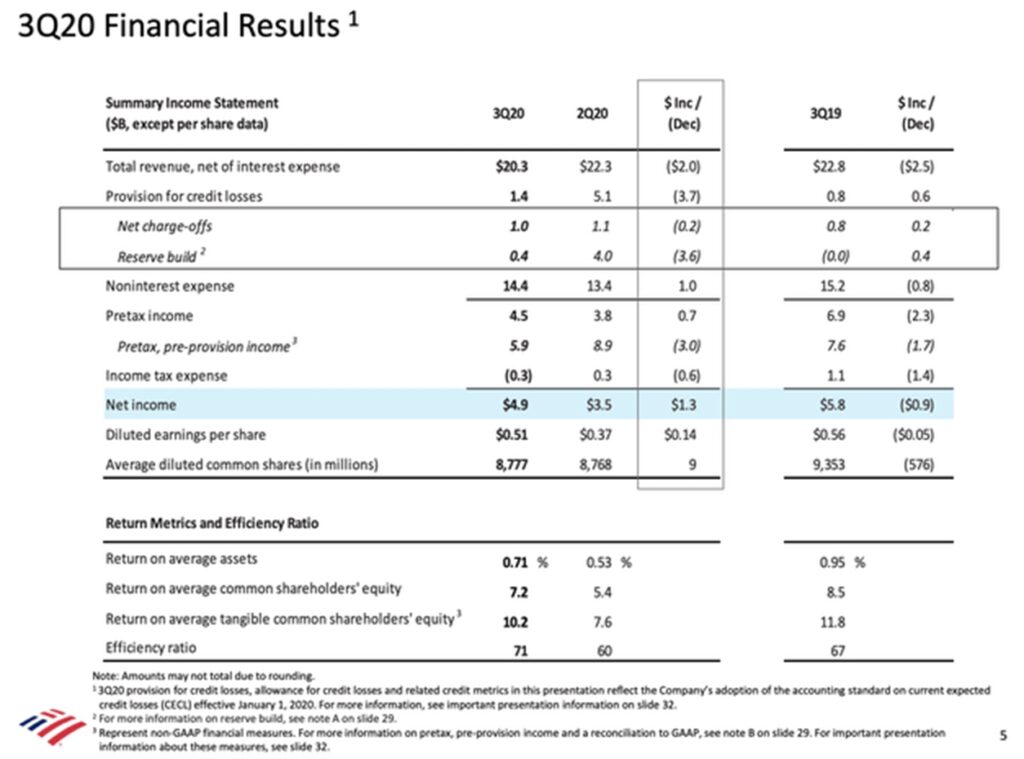

For the third-quarter period, Bank of America reported earnings of $4.9 billion (or $0.51 per share), which beat analyst estimates calling for earnings of $0.49 per share. On the surface, this might seem like enough of a reason to start initiating buy positions in shares of BAC stock; however, income investors must note that this performance actually marks an annualized decline of -15.6% in Bank of America’s profitability figure.

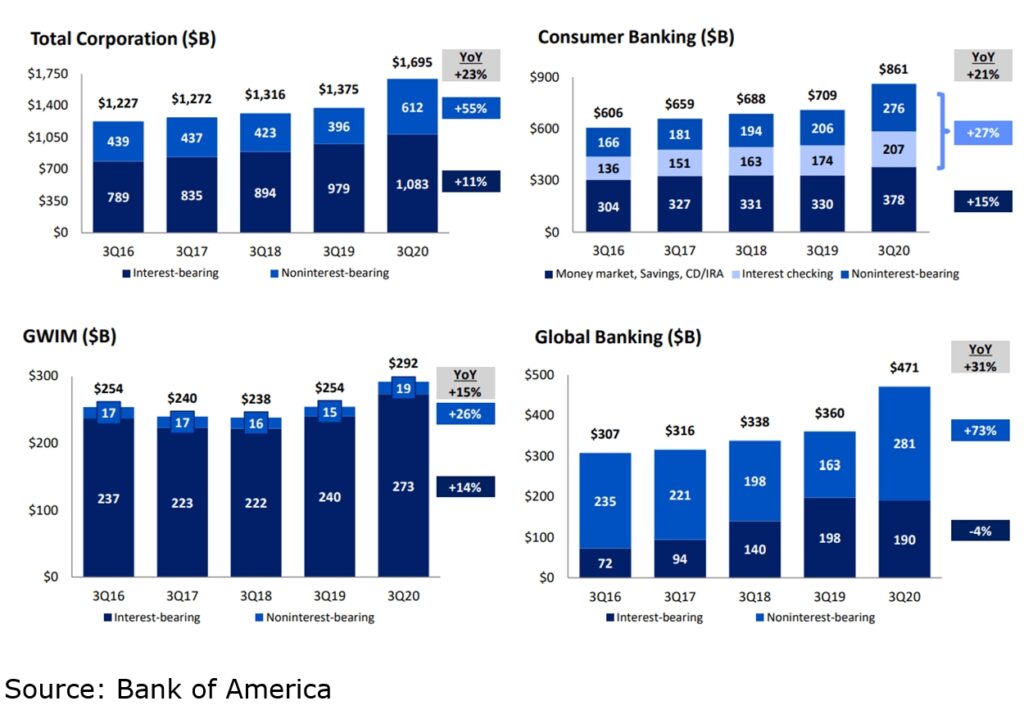

Source: Bank of America

Additionally, we can see that Bank of America’s revenue figure also unveiled critical weaknesses at $20.45 billion (clearly below the market’s consensus estimates calling for revenues of $20.8 billion).

Overall, this is likely a performance that could cause problems for the stock going forward and this is why it is important for income investors to remain mindful of upcoming chart patterns and technical trends which might invite further clues as to what is likely to come next for the stock.

Getting into the specifics, it might be easy to see why income investors are worried. Bank of America is generally considered to be one of the most vulnerable mega-banks in terms of its ability to overcome negative changes in market interest rates. Of course, this is a problem for several reasons because it suggests that the financial sector as a whole might be in trouble after the Federal Reserve has signaled historic lows in interest rate policy (likely until 2023).

Amongst this group, Bank of America stands to lose the most given the fact that it holds the number one position in terms of U.S. deposit market share:

As we’ve said, the financial sector is often responsible for “setting the tone” for what is likely to come later in each U.S. corporate earnings season. However, the trends that are visible here might actually be much more important for investors because bank performances could turn out to work as a leading indicator of what we can reasonably expect to see in the economy as a whole.

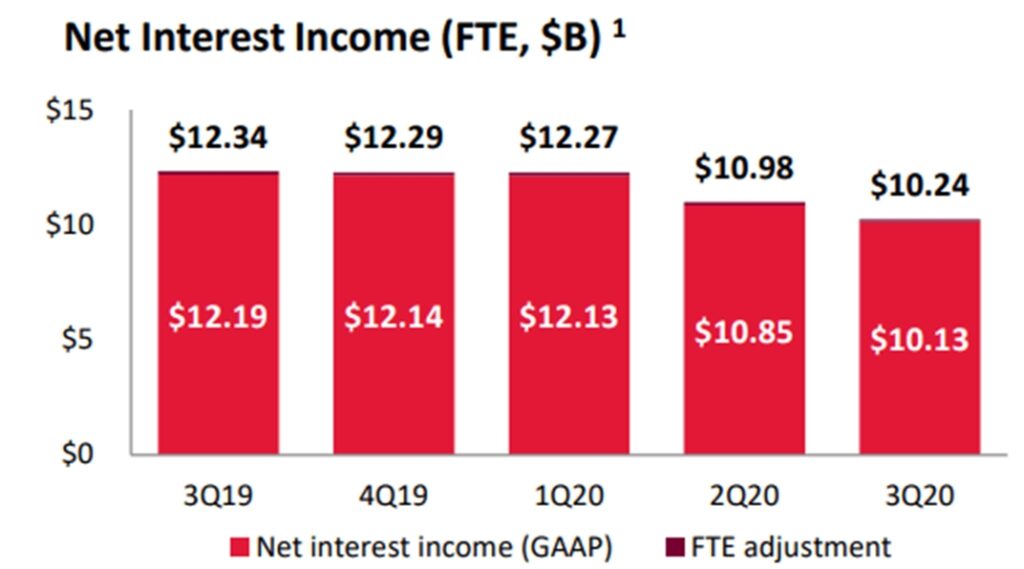

Changes in U.S. interest rates have the potential to put pressure on net interest income and, unfortunately, this has already become fully apparent in the operational results recorded by Bank of America. Of course, the coronavirus pandemic has already caused an immeasurable amount of harm in terms of its costs in human life, but the economic effects are likely to remain long after the surge in COVID-19 cases has run its course.

Clearly, Federal Reserve responses to the pandemic have included macroeconomic strategies that eventually made it much more difficult for the big banks to generate profits through the initiation of loans and the collection of deposits.

Source: Bank of America

In Q3, Bank of America’s net interest income figure dropped to $10.2 billion and net interest margin came in at 1.72%, with both figures missing analyst expectations for the period.

Lower consumer fees and reduced interest rates were particularly impactful in the bank’s consumer business and this turned out to be one of the most striking figures in Bank of America’s most recent quarterly report. For the period, net interest income figures generated by the firm indicated annualized declines of 17%, but targeted comments from CEO Brian Moynihan suggested that declines in net interest income are likely to improve in the coming quarters.

Source: Bloomberg

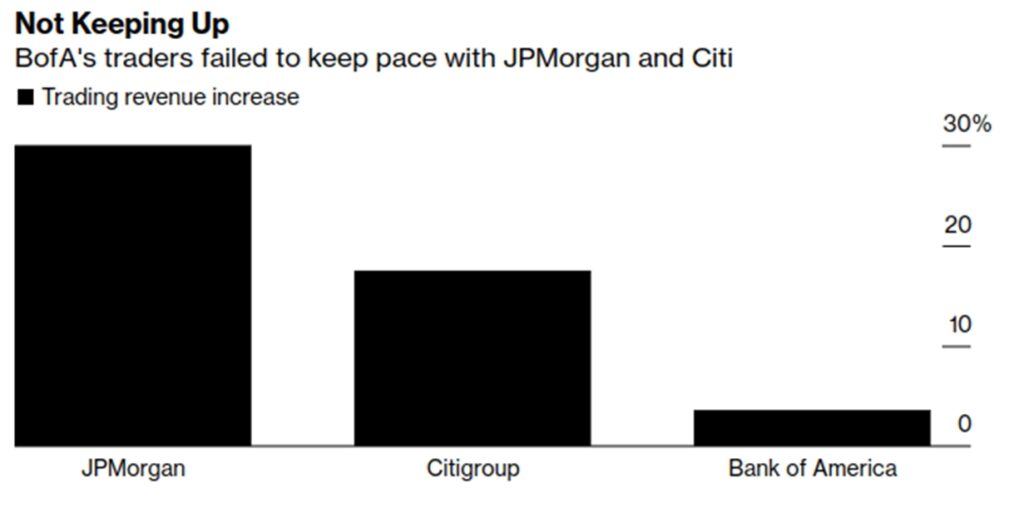

To make matters worse, trading revenues at Bank of America have fallen behind the pack in terms of the bank’s ability to keep up with financial heavyweights like JPMorgan Chase (NYSE:JPM) and Citigroup (NYSE:C). Specifically, bond trading revenues generated by Bank of America came in at $2.1 billion for the period, and this fell far below the market’s consensus estimates of roughly $2.3 billion.

On the positive side, it should be noted that Bank of America’s revenue from equities trading did manage to meet market expectations (at $1.2 billion). However, it is still clear where the momentum is headed in these areas and the most recent figures suggest that Bank of America is currently falling behind in these critical metrics.

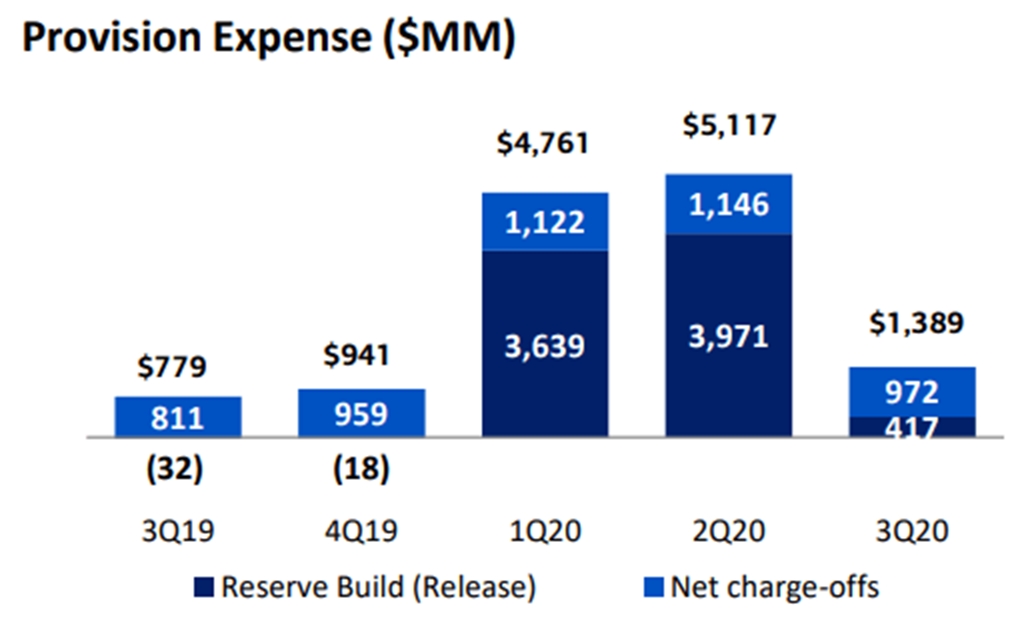

Source: Bank of America

In our view, the most encouraging signs are coming from Bank of America’s credit loss provisions, which came in at $1.4 billion for the period. But while this might sound like an intimidating number, income investors must note that BAC set aside a massive $5.1 billion during the second-quarter period (which creates a total of $9.8 billion when combined with the bank’s credit loss provisions from the first-quarter period).

Of course, similar trends were seen in both Citigroup and JPMorgan Chase, but these are still encouraging results that suggest the worst of the economic distributions might already be behind us.

Source: Author via TradingView

On a YTD basis, shares of BAC have experienced declines of more than 30%, but this is roughly in line with what has been seen throughout the rest of the financial sector in 2020. Specifically, the KBW Bank Index is also showing YTD declines of more than 30%, and this is why income investors should be looking at the sector as a potential value play within the context of the market’s post-coronavirus recovery.

As we have stated previously, we plan to hold BAC long positions as long as share prices are able to maintain support in the lower $20s, and we are encouraged by the fact that Bank of America’s price-to-book value is now trading at 0.8560x, which brings us back to valuation levels that were largely present during the initial pro-growth period outlined by U.S. President Donald Trump back in 2016-2017. For these reasons, we will reluctantly hold our long positions in BAC and use the stock’s attractive dividend yield as an incentive to exercise patience while long-term market trends begin to normalize.

Thank you for reading. Now, it’s time to make your voice heard.

Reader interaction is the most important part of the investment learning process. Comments are highly encouraged! We look forward to reading your viewpoints.

Disclosure: I am/we are long BAC, JPM. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

https://seekingalpha.com/article/4379185-bank-of-america-perfection-not-needed

Bank Of America: Perfection Not Needed

Oct. 15, 2020 6:48 AM ET

Summary

BoA didn’t have a perfect Q3, but the bank generated nearly $5 billion in profits.

The bank predicted being done with reserve builds, as nonperforming loans remain minimal.

The stock remains cheap at 1.2x TBV and a 3% dividend yield.

Looking for more investing ideas like this one? Get them exclusively at Out Fox The Street. Get started today »

Despite the negative reaction to Q3 results from Bank of America (BAC), the large bank stock remains a perfect rotation play. The banking business generated billions in profits during the worst of the virus crisis, while BoA is poised to benefit from an economy rebound and higher interest rates down the road. My investment thesis remains very bullish on the stock and the sector due to cheap valuations.

Not Perfect

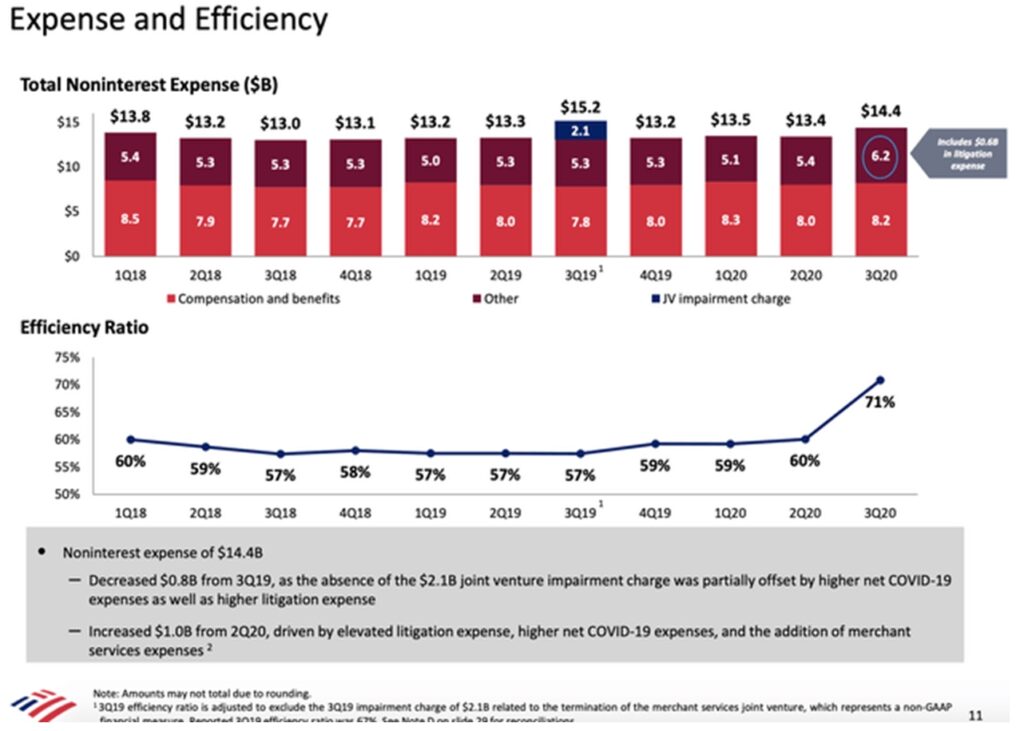

The Q3 results of BoA were far from perfect. The bank saw a higher efficiency ratio and revenues dipped due to COVID-19, but BoA still managed to generate $4.9 billion in net income and grow tangible book value.

The stock continues to trade as if another financial crisis is about to destroy the bank. In reality, BoA has already survived the worst of the crisis with provisions for credit losses in excess of actual net charge-offs by $4.4 billion in the last two quarters alone.

Revenues even took a $2.0 billion hit from the prior quarter due to lower interest rates. BoA saw net interest income dip $740 million sequentially and over $2.0 billion since Q1 due to net interest yields collapsing to 1.72%.

The bank still generated Q3 pretax, pre-provision income of $5.9 billion. The number was down $3.0 billion from the prior quarter, but the amount is still rather large considering the economy is in recovery mode here.

Source: BoA Q3’20 presentation

After years of improving efficiency ratios, BoA has taken a hit in the last couple of quarters. The lower revenues, combined with higher expenses related to COVID-19, caused the ratio to technically jump to 71% in the last quarter. Part of the increase was $600 million in litigation expenses, but the other part was just higher compensation expenses as the bank fought to keep business going.

Source: BoA Q3’20 presentation

A lot of these costs will normalize with revenues again growing in 2021. Revenues will rise as interest rates rebound on an economic recovery and BoA strips out some of the increased COVID-19 costs.

The CFO guided on the Q3 earnings call to Q4 noninterest expenses of $13.7 billion, which includes ~$200 million in merchant services expenses:

With respect to expense in Q4, we don’t expect to have a similar amount of litigation expense, and we don’t expect a repeat of the Q3 activity with respect to processing unemployment insurance claims. Therefore, we believe absent other unexpected changes, our Q4 expense number should be in the neighborhood of around $13.7 billion.

Credit Issues

The biggest risk with BoA is likely concerns that the company hasn’t taken enough provision charges. The bank only took a $1.4 billion charge in Q3 after $5.1 billion in Q2. It took a $4.8 billion charge in Q1 for total provisions YTD of only $11.3 billion.

As with other banks, BoA has dealt with customer deferrals due to COVID-19 issues that have kept some net charge-offs lower than expected. The bank only took a $972 million net charge-off in Q3, only up a meager $161 million from Q3 last year. In fact, the consumer banking division had a $0.3 billion reserve release due to an improved economic outlook and lower card balances.

Now though, active consumer deferrals are down to only 100K accounts and $9 billion in deferral balances. The major issue are commercial loans, with criticized utilized exposure soaring $10 billion from Q2 to $36 billion.

The amount is 6.6% of commercial loans, but once the company looks under the hood of areas under stress such as CRE, it isn’t scary. The $60 billion loan balance includes mostly collateral loans with low LTVs. The actual risk of loan losses to BoA is rather low, which explains the low nonperforming assets of only $4.6 billion and a meager 48 basis points to loans.

While the market is concerned about bank credit quality with the stock falling 5%, CEO Brian Moynihan was clear BoA is unlikely to build more reserves:

Having said all this around credit, we don’t expect to see a meaningful increase in net charge-offs to mid next year. And we expect that the reserve builds are behind us, which means the P&L impact of those losses should be in our financials already.

BOA already has $19.6 billion in reserves, suggesting it will report limited loan provisions going forward. The large bank is likely to release reserves going forward.

Takeaway

The key investor takeaway is that BoA shouldn’t be trading so close to TBV of $20.23 per share. The stock isn’t the cheapest in the large bank sector, but BoA doesn’t have the same risk and regulatory issues of Citigroup (C) and Wells Fargo (WFC), while it’s trading at a far better valuation than JPMorgan Chase (JPM).

The quarterly results this year haven’t been perfect, but BoA has proven resilient during the virus crisis. The bank has plenty of capital to survive and now offers investors a nearly 3% dividend yield.

Disclosure: I am/we are long C, WFC. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.