HI Market View Commentary 08-24-2020

| Market Recap |

| WEEK OF AUG. 17 THROUGH AUG. 21, 2020 |

| The S&P 500 rose 0.7% last week to a fresh record close as the technology, consumer discretionary and communication services sectors posted strong gains, outweighing declines led by energy and financial stocks.

The market benchmark ended the week at 3,397.16, up from last Friday’s closing level of 3,372.85. The new closing high was just slightly above a fresh record intraday high that was also recorded Friday at 3,399.96. The index is now up 5.2% for the year to date after having jumped 15% in the past three months. This week’s record highs came amid a rally in tech, communication services and consumer discretionary heavyweights including Apple (AAPL), Microsoft (MSFT), Facebook (FB), Amazon.com (AMZN) and Alphabet (GOOGL) as the COVID-19 pandemic has increased demand for the companies’ products and services. The gains, however, were kept in check as investors were concerned by an increase in weekly jobless claims. Minutes from last month’s Federal Open Market Committee meeting showed the members of the monetary policy-setting group expected the COVID-19 pandemic would continue to “weigh heavily” on the economy for some time. The technology sector had the largest percentage increase of the week, up 3.6%, followed by a 1.8% rise in consumer discretionary and a 1.6% boost in communication services. However, the energy sector had the largest percentage drop of the week, tumbling 5.7%, followed by a 3.4% drop in financials. Other sectors in the red included utilities, industrials and materials. The gains in Apple’s shares sent the consumer technology company’s market capitalization above $2 trillion to a fresh intraday high Friday just under $500 at $499.47. Apple’s shares closed the week up 8.2% from last Friday. Among the technology sector’s other strong gainers, Microsoft (MSFT) added 2.0%. In consumer discretionary, Amazon rose 4.3% this week as the company unveiled plans to expand its physical offices and add about 3,500 jobs in the cities of New York, Phoenix, San Diego, Denver, Detroit and Dallas. In communication services, Facebook shares climbed 2.2% this week and Alphabet added 4.7%. On the downside, the energy sector’s drop came as crude-oil futures fell amid concerns by the Organization of the Petroleum Exporting Countries about the effects of the continued COVID-19 pandemic on fuel consumption. Decliners in the sector included Exxon Mobil (XOM), down 5.1%, and Chevron (CVX), down 5.8%. The financial sector’s decliners included Citigroup (C), whose shares fell 6.9% as the bank heightened its effort this week to recover portions of a $900 million payment it says it accidentally sent to Revlon Inc. lenders. Next week, the market will get updated housing data Tuesday, including new home sales for July and the Case-Shiller national home-price index for June. Wednesday, investors will see July durable goods orders and core capital goods orders. Thursday’s slate of economic reports include revised Q2 gross domestic product as well as pending home sales for July. Friday, July consumer spending and core inflation and August consumer sentiment are among the reports on tap. Provided by MT Newswires. |

My Expectation is that we will have a volatile, bearish market through September and October

Let’s talk AAPL, 8/24 you have to be on record of owning the stock to receive 3 more shares Monday 08/31

what we did with AAPL= Friday at $498.16-498.68 we took profits on Long Calls

IF you still have bull puts in place I left those alone

IF you still have stock ownership then you had a long put added @ A4500 Oct -02-20

and other positions after monthly options expiration

Where will our markets end this week?

Lower

DJIA – Bullish

SPX – Bullish

COMP – Bullish

Where Will the SPX end August 2020?

08-24-2020 0.0%

08-17-2020 -2.0%

08-10-2020 -2.0%

08-03-2020 -2.0%

Earnings:

Mon: PANW,

Tues: BBY, HRL, MDT, HPE, CRM, TOL, JWN, URBN

Wed: CHS, DKS, NTAP

Thur: ANF, DG, DLTR, TIF, DELL, GPS, HPQ, MRVL, ULTA, VMW

Fri: BIG, SINA

Econ Reports:

Mon:

Tues: FHFA Housing Price Index, New Home Sales, S&P Case Hiller, Consumer Confidence

Wed: MBA, Durable Goods, Durable ex-trans

Thur: Initial Claims, Continuing Claims, GDP, GDP Deflator, Pending Home Sales, Jackson Hole Symposium

Fri: PCE, PCE, Core, Michigan Sentiment, Personal Income, Personal Spending

Int’l:

Mon –

Tues – EUR: GDP

Wed –

Thursday –

Friday-

Sunday –

How am I looking to trade?

Still letting most thing run but preparing for protection to get us through Oct and then new protection for the election

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

Here’s a list of stock bull markets through time and how this new one stacks up

PUBLISHED TUE, AUG 18 20204:07 PM EDTUPDATED TUE, AUG 18 20206:17 PM EDT

Ralph Orlowski | Bloomberg | Getty Images

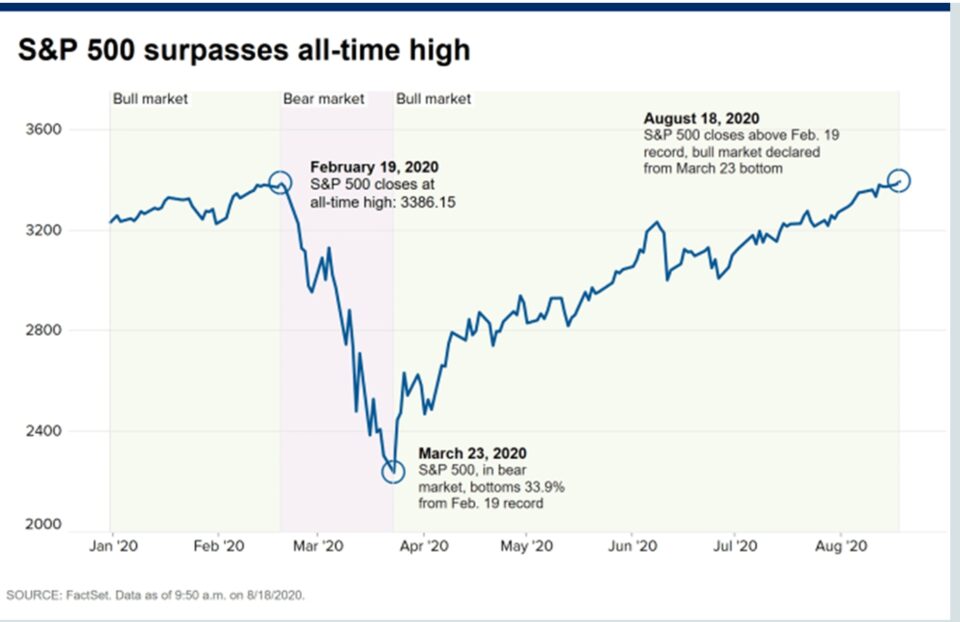

The S&P 500 closed at a record on Tuesday, an achievement that brings an official end to Wall Street’s shortest bear market and confirms the comeback rally as a new bull market.

The broad market index finished the session at 3,389.78, above its previous record close of 3,386.15 that it hit on Feb. 19.

A bear market is defined on Wall Street as a 20% decline in the S&P 500 from close to close. It’s only officially over when the market recovers back to a new closing high.

A bull market is a rally greater than 20%, but only becomes official when the S&P 500 hits a record closing high, according to Howard Silverblatt, senior index analyst at S&P Dow Jones Indices.

While defining a new bull market may be easy enough, Silverblatt explained that dating them can sometimes be confusing. That’s because the lifespan of a bull market, once declared, includes the recovery period from the S&P 500′s bear market bottom.

The new bull market, for example, was confirmed at the close of trading on Tuesday given the S&P 500′s fresh record close. But it’s actually as old as the market’s springtime bottom, which occurred on March 23, when the S&P 500 sank to a low of 2,237.40.

Because the S&P 500 hasn’t made any new lows since that date, strategists consider the bull market to have begun at the March 23 low, when the market’s recovery period started.

That means that bottom was the official end of the bear market and the start of the bull market. The springtime bear market of 2020 began on Feb.19 and shaved off 33.9% from the S&P 500.

This also means that the new bull market is already nearly 5 months old (again, since March 23) with a 51.5% gain.

The comeback has mystified many investors, who didn’t dream the benchmark index could even come close to all-time highs in 2020 after its dramatic Covid-induced sell-off in March. But the index has, little by little, clawed its way back from a bear market.

The S&P 500 climbed 20% in the second quarter, one of its best on record, as Big Tech stocks like Netflix and Amazon outperformed as Americans quarantined at home.

More recently, however, economically sensitive stocks like industrials, energy and financials have generated gains as investors bet on an eventual vaccine and return to a seminormal way of life.

The index is up 9.3% in the third quarter, which began July 1, and up 4.9% for 2020.

To be sure, some on Wall Street have varying views of what defines a bull or bear market but these are the most widely accepted definitions.

Subscribe to CNBC PRO for exclusive insights and analysis, and live business day programming from around the world.

Kohl’s sees billions in market share up for grabs as retailers go bankrupt, shut stores

PUBLISHED TUE, AUG 18 202012:03 PM EDT

KEY POINTS

- “We’re really set up to capture what will be billions of dollars market share opportunity in the future,” Kohl’s Chief Executive Michelle Gass said Tuesday during a conference call.

- Forty-four retailers — including Stein Mart, Pier 1 Imports, J.C. Penney, Sur la Table and Neiman Marcus — have filed for bankruptcy in 2020 so far.

- More than 6,000 permanent store closures have been announced.

Kohl’s sees an opportunity in the coronavirus pandemic to steal market share from struggling retailers and win over new customers as competitors go bankrupt and liquidate their stores.

“We’re really set up to capture what will be billions of dollars market share opportunity in the future,” Chief Executive Michelle Gass said Tuesday during a conference call.

She said the company is “actively pursuing opportunities to capture dislocated market share from competitors and store closures,” with its more than 1,100 locations, 95% of which are situated outside of enclosed shopping malls. Much of the malaise in retail of late has stemmed from traditional mall-based retailers such as department stores and apparel brands.

“Even in the midst of the pandemic, we are acquiring new customers and see great potential looking forward,” Gass explained. “We are leveraging our past strategies and increasing our marketing investment in locations where competitors are closing stores.”

Forty-four retailers — including Stein Mart, Pier 1 Imports, J.C. Penney, Sur la Table and Neiman Marcus — have filed for bankruptcy in 2020 so far, according to S&P Global Market Intelligence. And more than 6,000 permanent store closures have been announced already, Coresight Research said.

The turmoil is making the industry’s strongest retailers even stronger as they scoop up market share and lost customers while leaving the weakest companies even worse off, analysts say.

Kohl’s thinks it will be able to capitalize on this billion-dollar market share opportunity because its stores offer a broader array of merchandise, beyond just clothing, which includes toys, workout accessories and electronics.

“We have a playbook that we’ve used in past at a very localized level to go after those customers, new customer acquisition and go after that market share,” Gass said Tuesday morning. “So we have begun to deploy that strategy for us.”

Kohl’s shares fell more than 15% in intraday trading after the company said sales fell 23% during the fiscal second quarter largely because the pandemic forced it to close its stores for 25% of the quarter. The company also offered a grim outlook for the remainder of the year, saying the back-to-school season has been off to a “soft” start.

The Fed is expected to make a major commitment to ramping up inflation soon

PUBLISHED TUE, AUG 4 20203:43 PM EDTUPDATED TUE, AUG 4 20207:58 PM EDT

Jeff Cox@JEFF.COX.7528@JEFFCOXCNBCCOM

KEY POINTS

- The Federal Reserve is completing a yearlong policy review and is expected to announce the results soon.

- One big change would be a harder commitment to getting inflation higher, through a pledge not to raise rates until it hits at least 2%.

- Markets have been betting on higher inflation, with surging gold prices, a falling dollar and a rush to inflation-indexed bonds.

In the next few months, the Federal Reserve will be solidifying a policy outline that would commit it to low rates for years as it pursues an agenda of higher inflation and a return to the full employment picture that vanished as the coronavirus pandemic hit.

Recent statements from Fed officials and analysis from market veterans and economists point to a move to “average inflation” targeting in which inflation above the central bank’s usual 2% target would be tolerated and even desired.

To achieve that goal, officials would pledge not to raise interest rates until both the inflation and employment targets are hit. With inflation now closer to 1% and the jobless rate higher than it’s been since the Great Depression, the likelihood is that the Fed could need years to hit its targets.

The policy initiatives could be announced as soon as September. Addressing the issue last week, Fed Chairman Jerome Powell said only that a yearlong examination of policy communication and implementation would be wrapped “in the near future.” The culmination of that process, which included public meetings and extensive discussions among central bank officials, is expected to be announced at or around the Federal Open Market Committee’s meeting.

Markets are anticipating a Fed that would adopt an even more accommodative approach than it did during the Great Recession.

“We remain firmly of the view that this is a deeply consequential shift, even if it is one that has been seeping into Fed decision-making for some time, that will shape a different Fed reaction function in this cycle than in the last,” said Krishna Guha, head of global policy and central bank strategy at Evercore ISI.

Indeed, Powell said the policy statement will be “really codifying the way we’re already acting with our policies. To a large extent, we’re already doing the things that are in there.”

Guha, though, said the approach “would be sharply more dovish even than the strategy followed by the [Janet] Yellen Fed” when the central bank held rates near zero for six years even after the end of the Great Recession.

All in on inflation

One implication is that the Fed would be slower to tighten policy when it sees inflation rising.

Powell and his colleagues came under fire in 2018 when they enacted a series of rate increases that eventually had to be rolled back. The Fed’s benchmark overnight lending rate is now targeted near zero, where it moved in the early days of the pandemic.

The Fed and other global central banks have been trying to gin up inflation for years under the reasoning that a low level of price appreciation is healthy for a growing economy. They also worry that low inflation is a problem that feeds on itself, keeping interest rates low and giving policymakers little wiggle room to ease policy during downturns.

In the latest shot at getting inflation going, the Fed would commit to enhanced “forward guidance,” or a commitment not to raise rates until its benchmarks are hit and, in the case of inflation, perhaps exceeded.

In recent days, Fed regional Presidents Robert Kaplan of Dallas and Charles Evans of Chicago have expressed varying levels of support for enhanced guidance. Evans in particular said he would like to keep rates where they are until inflation gets up around 2.5%, which it has not been for most of the past decade.

“We believe that the Fed publicly would welcome inflation in a range of 2% up to 4% as a long overdue offset to inflation running below 2% for so long in the past,” said Ed Yardeni, head of Yardeni Research.

The market weighs in

The investing implications are substantial.

Yardeni said the approach would be “wildly bullish” for alternative asset classes and in particular growth stocks and precious metals like gold and silver. Guha said the Fed’s moves would see “real yields persistently lower, the dollar lower, volatility lower, credit spreads lower and equities higher.”

Investors have been making heavy bets that would be consistent with inflation: record highs in gold, sharp declines in the U.S. dollar and a rush into TIPS, or Treasury Inflation Protected Securities. TIPS funds have seen six consecutive weeks of net inflows of investor cash, including $1.9 billion and $1.5 billion respectively during the weeks of June 24 and July 1 and $271 million for the week ended July 29, according to Refinitiv.

Still, the Fed’s poor record in reaching its inflation target is raising doubts.

“If there’s any lesson that should have been learned by all the world’s central banks it’s that picking an inflation target is easy. Trying to actually get there is extraordinarily difficult,” said Peter Boockvar, chief investment officer at Bleakley Advisory Group. “Just manipulating interest rates doesn’t mean you get to some finger-in-the-air inflation rate that you choose.”

Boockvar doubts the wisdom of wanting to crank up inflation at a time when unemployment is so high and the economic recovery in jeopardy.

“It doesn’t make any economic sense whatsoever,” he said. “The consumer is very fragile right now. The last thing we should be shooting for is a higher cost of living.”

Pearson appoints former Disney exec Bird as new chief

PUBLISHED MON, AUG 24 20205:02 AM EDT

KEY POINTS

- Bird pushed digital to consumer sales at Walt Disney.

- He will replace John Fallon on Oct. 19.

- Shares up 1.5%.

Global education publisher Pearson has appointed Andy Bird as its next chief executive, turning to a media veteran who helped build Walt Disney’s consumer digital business to see it through its latest transformation.

Pearson said Bird was due to start his new job on Oct. 19, with current boss John Fallon remaining in the role until that date. Fallon, who had been due to step down this year, will then quit the board while remaining as an advisor until the end of the year.

The British company, the world’s biggest education publisher, has cut thousands of jobs and restructured over recent years to sell textbooks and courseware online, after a rapid move to digital sales sparked repeated profit warnings.

“Because of (Bird’s) experience and skills, he is extremely well placed to continue the transformation of Pearson, leading it to a new era of growth and enhancing value for all our shareholders,” Chairman Sidney Taurel said.

Earlier this year Pearson maintained its dividend payout to shareholders even as many major British companies were forced by the Covid-19 crisis to reduce their payouts, as the pandemic helped accelerate a shift to digital learning as schools and colleges shut.

Bird, who was chairman of Walt Disney International until 2018, is currently a non-executive director at Pearson and was appointed to the board on May 1.

Credit Suisse said the appointment was likely to be taken positively but challenges remain.

Bird will purchase shares in the company worth $3.75 million. His pay package which includes salary, a cash allowance and participation in an incentive plan, will need to be approved by shareholders at a special meeting, and his appointment remains conditional on that approval.

https://www.riaintel.com/article/b1n00lklkzhlgz/a-looming-threat-to-wealth-managers-has-arrived

A Looming Threat to Wealth Managers Has Arrived

Financial advisors who reported losing business in 2020 due to technology lost an average of more than one-fifth of their book, a Broadridge survey shows.

August 18, 2020

(Illustration by RIA Intel)

The Covid-19 pandemic has accelerated changes already underway in the wealth management industry: The market downturn in the spring tested the health of some companies for the first time. The virus’ limitations on life and business forced financial advisors to entirely rethink how they communicate with clients (and how they find and interact with prospective ones).

Now, because of the pandemic, a looming threat to wealth management firms has reached the forefront and is costing them clients.

The majority of advisors (87%) have experienced “sustained changes in investor communication and engagement” in 2020 and they were not equipped to accommodate that; 77% say they have lost business because they did not have the appropriate technology tools to interact with clients, according to a survey of 254 advisors in North America by Broadridge, the brokerage technology company.

On average, advisors who reported losing any business said they lost one fifth (21.7%) of their book.

The pandemic caused consumers to spend more time reviewing their personal finances online and reevaluate which institutions they bank or invest with, according to a report also published Tuesday by Aite Group, a research and consulting firm focused on financial services. Any company that was reliant on a physical presence to operate or grow has not navigated the pandemic as well as competitors with chic mobile apps and easy, effective ways to communicate with customers online.

And the companies lagging behind on technology can’t delay improving it any longer because consumers are not expected to revert to their old preferences; these are here to stay. The pandemic has heightened their expectations and they’re leaving companies that don’t meet them for ones that do.

At wealth management firms, this problem compounds itself. When an institution loses desirability to clients, it also loses desirability to financial advisors, who are either losing clients already, or recognize they could. This is troubling advisors, a group of professionals fixated on growing their businesses and routinely rank it as a top priority in Schwab Advisor Services’ annual RIA Benchmarking study.

Half of financial advisors (51%) surveyed by Broadridge said they often think of leaving their current firm for one with better technology tools. Younger advisors — which there aren’t enough of and are highly sought after by firms — are even more likely to leave (59% often think of doing so for one with better technology).

“Financial advisors are reliant on their firms for technology that allows them to best serve their clients wherever they may physically be and whatever market conditions are like that day. In the fallout from the pandemic, wealth firms are going to face increased pressures to invest in modernizing their advisor technology or risk losing their advisors to firms that already have next-generation wealth platforms,” Michael Alexander, president of Wealth Management at Broadridge Financial Solutions, said in the report.

Before advisors in the U.S. complain too much, remember, things could be worse.

Advisors surveyed in the U.S. seem to have it better than the ones in Canada, at least when it comes to marketing. Almost every advisor in the U.S. (95%) said they get enough marketing support from their firms to grow their practice, but only 59% of Canadian advisors feel the same. Half of all Canadian advisors said they receive no marketing support at all.

Advisors use social media all wrong, but 67% of them in the U.S. are “very satisfied with the tools they are provided to interact with clients and prospects over social media. In Canada, only 17% of advisors said the same, according to Broadridge.

https://www.investopedia.com/terms/b/behavioralfinance.asp

Behavioral Finance

By WILL KENTON

Reviewed By ERIC ESTEVEZ

Updated Jul 28, 2020

TABLE OF CONTENTS

- What Is Behavioral Finance?

- Understanding Behavioral Finance

- Behavioral Finance Concepts

- Biases Studied

- The Stock Market

What Is Behavioral Finance?

Behavioral finance, a sub-field of behavioral economics, proposes that psychological influences and biases affect the financial behaviors of investors and financial practitioners. Moreover, influences and biases can be the source for explanation of all types of market anomalies and specifically market anomalies in the stock market, such as severe rises or falls in stock price.

Behavioral Finance

Understanding Behavioral Finance

Behavioral finance can be analyzed from a variety of perspectives. Stock market returns are one area of finance where psychological behaviors are often assumed to influence market outcomes and returns but there are also many different angles for observation. The purpose of classification of behavioral finance is to help understand why people make certain financial choices and how those choices can affect markets. Within behavioral finance, it is assumed that financial participants are not perfectly rational and self-controlled but rather psychologically influential with somewhat normal and self-controlling tendencies.

One of the key aspects of behavioral finance studies is the influence of biases. Biases can occur for a variety of reasons. Biases can usually be classified into one of five key concepts. Understanding and classifying different types of behavioral finance biases can be very important when narrowing in on the study or analysis of industry or sector outcomes and results.

KEY TAKEAWAYS

- Behavioral finance is an area of study focused on how psychological influences can affect market outcomes.

- Behavioral finance can be analyzed to understand different outcomes across a variety of sectors and industries.

- One of the key aspects of behavioral finance studies is the influence of psychological biases.

Behavioral Finance Concepts

Behavioral finance typically encompasses five main concepts:

- Mental accounting: Mental accounting refers to the propensity for people to allocate money for specific purposes.

- Herd behavior: Herd behavior states that people tend to mimic the financial behaviors of the majority of the herd. Herding is notorious in the stock market as the cause behind dramatic rallies and sell-offs.

- Emotional gap: The emotional gap refers to decision making based on extreme emotions or emotional strains such as anxiety, anger, fear, or excitement. Oftentimes, emotions are a key reason why people do not make rational choices.

- Anchoring: Anchoring refers to attaching a spending level to a certain reference. Examples may include spending consistently based on a budget level or rationalizing spending based on different satisfaction utilities.

- Self-attribution: Self-attribution refers to a tendency to make choices based on a confidence in self-based knowledge. Self-attribution usually stems from intrinsic confidence of a particular area. Within this category, individuals tend to rank their knowledge higher than others.

Biases Studied in Behavioral Finance

Breaking down biases further, many individual biases and tendencies have been identified for behavioral finance analysis, including:

Disposition Bias

Disposition bias refers to when investors sell their winners and hang onto their losers. Investors’ thinking is that they want to realize gains quickly. However, when an investment is losing money, they’ll hold onto it because they want to get back to even or their initial price. Investors tend to admit they are correct about an investment quickly (when there’s a gain). However, investors are reluctant to admit when they made an investment mistake (when there’s a loss). The flaw in disposition bias is that the performance of the investment is often tied to the entry price for the investor. In other words, investors gauge the performance of their investment based on their individual entry price disregarding fundamentals or attributes of the investment that may have changed.

Confirmation Bias

Confirmation bias is when investors have a bias toward accepting information that confirms their already-held belief in an investment. If information surfaces, investors accept it readily to confirm that they’re correct about their investment decision—even if the information is flawed.

Experiential Bias

An experiential bias occurs when investors’ memory of recent events makes them biased or leads them to believe that the event is far more likely to occur again. For example, the financial crisis in 2008 and 2009 led many investors to exit the stock market. Many had a dismal view of the markets and likely expected more economic hardship in the coming years. The experience of having gone through such a negative event increased their bias or likelihood that the event could reoccur. In reality, the economy recovered, and the market bounced back in the years to follow.

Loss Aversion

Loss aversion occurs when investors place a greater weighting on the concern for losses than the pleasure from market gains. In other words, they’re far more likely to try to assign a higher priority on avoiding losses than making investment gains. As a result, some investors might want a higher payout to compensate for losses. If the high payout isn’t likely, they might try to avoid losses altogether even if the investment’s risk is acceptable from a rational standpoint.

Familiarity Bias

The familiarity bias is when investors tend to invest in what they know, such as domestic companies or locally owned investments. As a result, investors are not diversified across multiple sectors and types of investments, which can reduce risk. Investors tend to go with investments that they have a history with or have familiarity.

Behavioral Finance in the Stock Market

The efficient market hypothesis (EMH) says that at any given time in a highly liquid market, stock prices are efficiently valued to reflect all the available information. However, many studies have documented long-term historical phenomena in securities markets that contradict the efficient market hypothesis and cannot be captured plausibly in models based on perfect investor rationality.

The EMH is generally based on the belief that market participants view stock prices rationally based on all current and future intrinsic and external factors. When studying the stock market, behavioral finance takes the view that markets are not fully efficient. This allows for observation of how psychological factors can influence the buying and selling of stocks.

The understanding and usage of behavioral finance biases is applied to stock and other trading market movements on a daily basis. Broadly, behavioral finance theories have also been used to provide clearer explanations of substantial market anomalies like bubbles and deep recessions. While not a part of EMH, investors and portfolio managers have a vested interest in understanding behavioral finance trends. These trends can be used to help analyze market price levels and fluctuations for speculation as well as decision-making purposes.

HI Financial Services Mid-Week 06-24-2014