HI Market View Commentary 03-30-2020

| Market Recap |

| WEEK OF MAR. 23 THROUGH MAR. 27, 2020 |

| Buoyed by the promise of a massive stimulus package to offset the economic repercussions of COVID-19, the Standard & Poor’s 500 index rallied more than 10%, making last week one of the best on Wall Street in nearly 90 years.

The benchmark average closed at 2,541.47, up from 2,304.92 last Friday, the first weekly gain since the COVID-19 pandemic undermined investor confidence at the end of February. The week kicked off with another three-year low in the S&P on Monday as Washington’s inability to agree on a rescue package weighed on Wall Street and overshadowed the Fed’s massive liquidity injection. The energy sector continued to lose ground amid oversupply pressures, keeping Brent futures near its four-year low, but the sector still rose 9.6% for the week. As the details of a rescue package emerged, stocks moved higher with every sector of the S&P closing in the green. With the energy sector against the ropes, Wall Street analysts are anticipating a wave of mergers and acquisitions to sweep through the utilities sector, which was up 16.4% on the week. CenterPoint (CNP) and PPL (PPL) were among the companies seen as the most likely candidates for a takeover. CNP outperformed other names in the sector with a 31% gain from last week. Boeing (BA) shares more than doubled in price this week and was instrumental in a 15% gain for the industrial sector. The aircraft manufacturer — plagued by setbacks to its flagship aircraft — was catapulted higher by Goldman’s upgrade to buy, as well as CEO David Calhoun’s assurances that the company does not need government aid. Calhoun told investors that the company is “in pretty decent shape” and would not need the government to take an equity stake. The airlines had a good week as well, emerging as the main beneficiary of government aid. Shares of United Airlines were up 34%, while Delta shares gained 38%. Among real estate stocks, Ventas (VTR), which operates senior housing facilities, came out ahead with a 41% gain from last week despite a recent downgrade from Fitch to negative. The stock has fallen by 77% in the past month but was ripe for bottom-fishing after Raymond James issued an upgrade to strong buy from market perform on Wednesday. While all sectors participated in this week’s impressive rebound, some sectors underperformed. The consumer staples sector gained a comparatively anemic 6.5% as outsized-sized gains in Coty (COTY), up 41%, and Sysco (SYY), gaining 43%, were offset by an 8% loss in shares of Kroger (KR) along with heavy profit-taking pressure on Clorox (CLX), down 2.4%, as investors looked for speculative plays elsewhere. The communication services sector advanced by just 5.5% thanks to a 39% gain this week in Live Nation (LYV) and an 18% gain for Charter Communications (CHTR). Despite the widespread cancellation of sporting and entertainment events across the globe, Live Nation was upgraded at Citigroup to neutral from sell as the firm advised investors that not only are the adverse impacts from event cancellations already priced into the stock price, but the potential for a quick recovery in the event sector was likely behind recent insider buying. Gains in the sector were mitigated by selling pressure on CenturyLink (CTL) and News Corp (NWSA). CenturyLink was given a sell rating by Citigroup this week as “revenue erosion and future fiber investment needs” may weigh on the stock in the event of a sustained downturn. |

OK are we at the bottom?

Probably NOT

Just when you think you know it all the market is like a shark and takes everything from you.

You can actively work and making anything to the downside knowing it’s a profit when things come back

Right now, one again, I’m confused by the market

Where will our markets end this week?

Higher

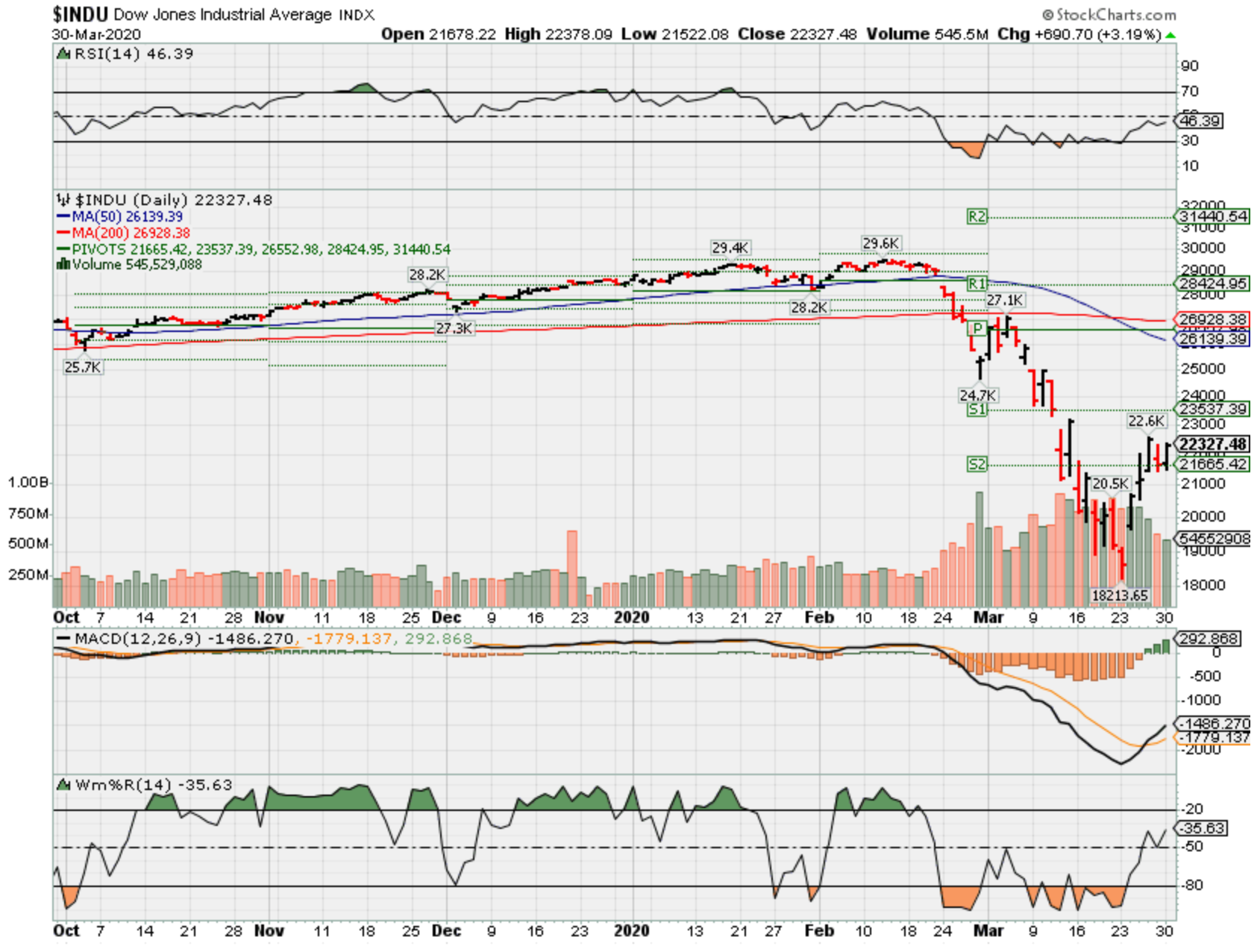

SPX – Bearish

Where Will the SPX end April 2020?

03-30-2020 0.0%

Earnings:

Mon: CALM

Tues: CAG, FLR, MKC, BB

Wed: PVH

Thur: KMX, CCL, WBA

Fri: STZ

Econ Reports:

Mon: Pending Home Sales

Tues: S&P Case Shiller, Consumer Confidence

Wed: MBA, Auto, Truck, Chicago PMI, Construction Spending,

Thur: Initial, Continuing, Trade Balance, Factory Orders, ISM Manufacturing

Fri: Average workweek, Non-Farm Payroll, Private Payroll, Hourly Earnings, Unemployment Rate, ISM Services

Int’l:

Mon –

Tues –

Wed –

Thursday –

Friday-

Sunday –

How am I looking to trade?

Protection still on and coming due 3/27/ 04/03, 04/09

When and how to pick up shares and most likely add more protection/Earnings

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

Consumers could spend $20 billion less for gasoline this April as prices collapse in futures market

PUBLISHED MON, MAR 23 20206:14 PM EDTUPDATED MON, MAR 23 20207:00 PM EDT

Patti Domm@IN/PATTI-DOMM-9224884/@PATTIDOMM

KEY POINTS

- Prices for gasoline in the wholesale and futures markets dropped on Monday as more states told residents to stay home to stop the spread of coronavirus.

- The dip in prices in those markets is a harbinger for lower prices at the pump, which could quickly fall 20% and ultimately reach under $1 in select markets.

- The U.S. refining industry is already gearing up to cut back and could shut down about 30% of its capacity.

Gasoline prices in the wholesale and futures markets crashed on Monday as more states issued stay-at-home orders, severely dampening demand for fuel.

Some spot cash prices around the U.S. were down 40% or more Monday, and futures prices for gasoline in New York Harbor lost 24% for gasoline due for delivery in April. As a result, the prices drivers pay at the pump could fall by as much as 20% in a matter of weeks and in some areas, could reach a low below $1 a gallon ultimately in select markets.

“The reason is clear. No one is driving,” said Daniel Yergin, vice chairman IHS Markit. He said demand for gasoline could fall by about 50% during the coronavirus response period. About a dozen states have required residents to stay home to stop the spread of coronavirus, since California first issued its statewide order Thursday.

Wholesale spot prices for gasoline in New York Harbor on Monday fell to 31 cents per gallon, down 19 cents from Friday’s level. Gasoline in the spot market in Chicago fell to 24.5 cents, down 20 cents. RBOB gasoline futures for April fell 24.5% to $0.45 per gallon.

“This is the most dire I have ever seen it for refiners,” said Tom Kloza, global head of energy analysis at Oil Price Information Services.

Gasoline prices in the spot market were about $1.50 per gallon in January, Kloza said.

The market has already been crushed. Gasoline started falling with oil prices early in the year, starting with the loss of demand when China shut down its cities to fight the virus. Then prices fell even more dramatically, when OPEC failed to reach a production deal with Russia.

“It’s beyond a crash,” said Kloza. “It’s unprecedented, but that word is being used a lot.” Kloza said refiners could be forced to cut back capacity by 30%.

At the pump, consumers were still paying an average $2.12 per gallon nationally for unleaded gasoline Monday, according to AAA, but Kloza expects prices to fall sharply. The lowest prices in the U.S. could ultimately be below $1 gallon in some areas, he said.

“I expect that the national retail average for gasoline will be below $2 a gallon by April, and I believe we’re on our way to $1.70 as the national average by the middle of April, and we could go lower if this continues,” said Andrew Lipow, president of Lipow Oil Associates.

Lipow said he believes demand has already dropped by about 25% nationally for gasoline. “Colonial Pipeline, starting tomorrow, is reducing its shipments of gasoline by 20% and a number of refineries are reducing their production by 20%,” he said. “The trend [of demand destruction] is only going to continue to grow as more states and municipalities require the consumer to stay home.”

Kloza expects global oil demand to drop by 12% to 15%, at a time when the world has been adding refining capacity. The U.S. used 9.7 million barrels a day of gasoline last week, and that could fall to about 5 million barrels a day, Kloza said.

“My quick workbook on this suggests whereas last April we spent $1.1 billion a day on gasoline, I think this April we’re looking at $350 million a day. We’re going to be saving $20 billion on gasoline this month,” he said.

Refiner stocks were hit hard Monday. Valero stock was down 15.6% in heavy trading, and Hollyfrontier was off 16%.

https://seekingalpha.com/news/3554704-boeing-reject-aid-government-requires-equity-stake

Boeing would reject aid if government requires equity stake

Mar. 24, 2020 10:49 AM ET|About: The Boeing Company (BA)|By: Yoel Minkoff, SA News Editor

Boeing (BA +14.5%) CEO Dave Calhoun is making his rounds this morning, appearing next on the Fox Business Network.

“I don’t have a need for an equity stake,” he told Maria Bartiromo. “If they forced it, we’d just look at all the other options, and we have got plenty.”

“I want them to support the credit markets, provide liquidity. Allow us to borrow against our future, which we all believe in very strongly and I think our creditors will too. It’s really that simple.”

Calhoun also said federal aid for Boeing, the nation’s largest exporter, is “anything but corporate welfare,” calling it the role of government.

https://www.aier.org/article/layoffs-expected-to-surge/

Layoffs Expected to Surge

– March 23, 2020

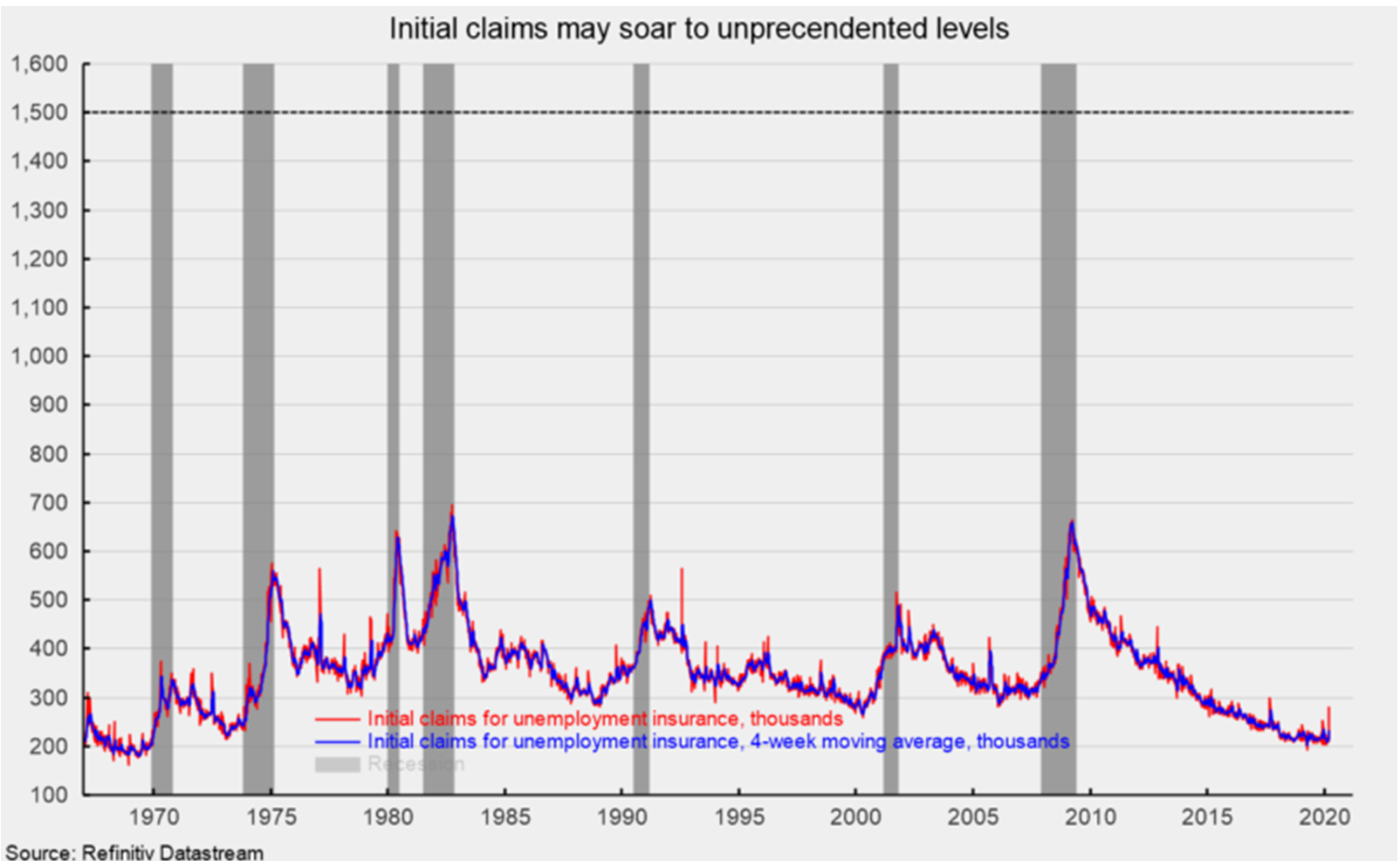

Last week, initial claims for unemployment insurance jumped sharply for the week ending March 14, rising 70,000 to 281,000, the highest level since September 2017 and the largest weekly increase since 2012. The four-week average came in at 232,250 versus 215,750 in the prior week.

According to the Employment and Training Administration within the Department of Labor, “During the week ending March 14, the increase in initial claims are clearly attributable to impacts from the COVID-19 virus. A number of states specifically cited COVID-19 related layoffs, while many states reported increased layoffs in service-related industries broadly and in the accommodation and food services industries specifically, as well as in the transportation and warehousing industries, whether COVID-19 was identified directly or not.”

The range of estimates for initial claims for the upcoming report on Thursday, March 26 go as high as 4 million, with 1.5 million a reasonable prediction. That 1.5 million number would dwarf the worst weekly reports from the 2008-09 recession and the 1982-83 recession (see chart). This is likely to be just the tip of the iceberg when it comes to the effects of the COVID-19 outbreak distorting economic activity. Economic statistics over the next several months are likely to reflect these distortions.

Robert Hughes joined AIER in 2013 following more than 25 years in economic and financial markets research on Wall Street. Bob was formerly the head of Global Equity Strategy for Brown Brothers Harriman, where he developed equity investment strategy combining top-down macro analysis with bottom-up fundamentals. Prior to BBH, Bob was a Senior Equity Strategist for State Street Global Markets, Senior Economic Strategist with Prudential Equity Group and Senior Economist and Financial Markets Analyst for Citicorp Investment Services. Bob has a MA in economics from Fordham University and a BS in business from Lehigh University.

Get notified of new articles from Robert Hughes and AIER.

Former Fed Chairman Ben Bernanke sees ‘very sharp’ recession, followed by ‘fairly quick’ rebound

PUBLISHED WED, MAR 25 20208:51 AM EDTUPDATED WED, MAR 25 202010:02 AM EDT

Jeff Cox@JEFF.COX.7528@JEFFCOXCNBCCOM

KEY POINTS

- Former Federal Reserve Chairman Ben Bernanke expressed optimism about the longer-term picture for the U.S. economy.

- While the country is in for a “sharp, short” recession,” he sees a “fairly quick rebound” ahead.

- Bernanke guided the Fed during the financial crisis and accompanying Great Recession.

Former Federal Reserve Chairman Ben Bernanke sounded an optimistic tone on the longer-term state of the economy, predicting in a CNBC interview Wednesday that while the U.S. is facing an acute recession, it shouldn’t last.

“It is possible there’s going to be a very sharp, short, I hope short, recession in the next quarter because everything is shutting down of course,” he said on “Squawk Box.”

“If there’s not too much damage done to the workforce, to the businesses during the shutdown period, however long that may be, then we could see a fairly quick rebound.”

During the financial crisis that exploded in 2008, Bernanke guided the Fed through its efforts to save the economy. He was the first central bank chairman to pull its benchmark interest rate down to near zero, and the Bernanke Fed implemented a slew of programs that have been resurrected to deal with the current crisis.

While he guided the Fed through the financial crisis and accompanying Great Recession and is recognized authority on the Great Depression, he said the current situation bears only minor resemblance to those two periods.

“This is a very different animal from the Great Depression” which he said “came from human problems, monetary and financial shocks. This is has some of the same feel, some of the feel of panic, some of the feel of volatility that you’re talking about. It’s much closer to a major snowstorm or a natural disaster than a classic 1930′s-style depression.”

In fact, he said, the current situation is almost the opposite of the financial crisis, where problems in the banking system infected the broader economy. This time, issues in the broader economy brought on by the coronavirus are infecting the banks.

He stressed the important of getting the coronavirus itself under control so that policy can do its work.

“Nothing is going to work, the Fed is not going help, fiscal policy is not going to help if we don’t get the public health right, if we don’t solve the problem of the virus, of the infection, so making sure that the risk has declined sufficiently before put people back in the line of fire,” Bernanke said.

“So I think the public health is the most important one,” he added. “If we can get that straight, then we know how to get the economy working again. Monetary and fiscal policy can do their thing and we won’t have anything like the extended downturn we saw even, I don’t think, in the Great Recession, much less the Great Depression of the ’30s.”

Earlier Wednesday, St. Louis Fed President James Bullard expressed similar sentiments about the economy, telling CNBC he expects a big short-term hit but a strong rebound.

He praised the work being done by Chairman Jerome Powell and the rest of the current Fed.

The Powell Fed has pulled benchmark borrowing rates down to near-zero and implemented a slew of programs aimed at keeping liquidity flowing to the financial system and businesses.

“I think the Fed has been extremely proactive, and Jay Powell and his team have been working really hard and gotten ahead of this and shown they can set up a whole bunch of diverse programs that will help us keep the economy functioning during this shutdown period, so that when the all-clear is sounded, we will have a much better rebound than we otherwise would,” Bernanke said.

The coronavirus may be deadlier than the 1918 flu: Here’s how it stacks up to other pandemics

PUBLISHED THU, MAR 26 20201:45 PM EDTUPDATED FRI, MAR 27 20201:24 AM EDT

Berkeley Lovelace Jr.@BERKELEYJR

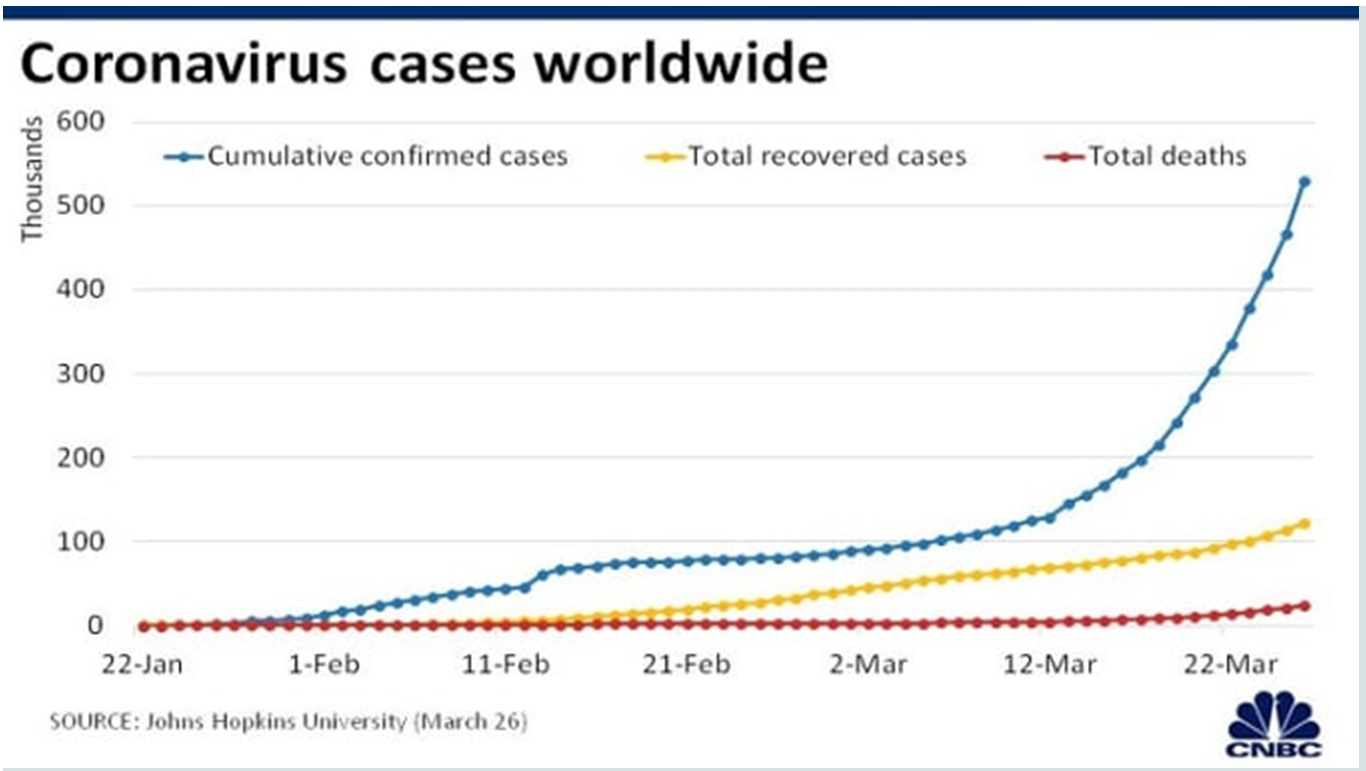

Three months after the coronavirus emerged in China, it has quickly spread to nearly half a million people across the globe, killing more than 22,000 people and bringing the world economy to a near-grinding halt.

Some scientists estimate that millions will ultimately die before COVID-19 runs its course. There’s a lot that infectious disease specialists and scientists still don’t know about the virus. Exactly how deadly and contagious COVID-19 is, is still a matter of debate.

We break down what we know about the virus and how it compares with some of history’s deadliest pandemics and diseases. First, you’ll have to bone up on a bit of epidemiology.

COVID-19

- R naught (a mathematical term that indicates how contagious an infectious disease is): 2

- Mortality rate: 4.5% (this number is in flux)

- World population: 7.8 billion

The mortality rate

The mortality rate is an important metric for epidemiologists because it helps determine just how many people will likely die from a particular disease and its potential impact on health systems, said Isaac Bogoch, a University of Toronto infectious disease specialist.

The mortality rate is basically the number of deaths divided by the number of infections. It’s also called the death rate or case fatality rate. At the beginning of an outbreak, it can be a moving target as more people are tested and an illness like COVID-19 travels to different parts of the world where the mortality rate can widely vary.

Looking at just the number of deaths over the number of cases reported “is only a snapshot,” Maria Van Kerkhove, head of the World Health Organization’s emerging diseases and zoonosis unit, told reporters last week.

A variety of factors affects the mortality rate: geography, the quality of health care, age of the population, life style and underlying conditions. In China, the mortality rate for CV-19 has been 4%. In Italy, it’s about 10%. In Iran, it’s about 7.6%. In Germany, it’s less than 1% and in the U.S., where the outbreak is just getting underway, it’s about 1.5%.

The mortality rate generally drops as testing rises and more patients are identified. But epidemiologists caution that the reverse can be true as U.S. hospitals get inundated and run out of necessary equipment, like ventilators, to treat patients who might have otherwise been saved. They also say it takes weeks for the virus to infiltrate a community and several more before people are sick enough to die. So it will be several months before the true mortality rate can be quantified in the U.S. or elsewhere.

Scientists still don’t know the true extent of the outbreak, so “we don’t know the precise number of those who will die out of those who are infected,” Kerkhove said.

The first estimate of the mortality rate for COVID-19 was roughly 2.3%, according to the WHO. As the death tally rose across the globe, so did the mortality rate, which the WHO revised on March 3 to 3.4%, meaning 3.4% of the population with confirmed infections died. Many scientists think, or are at least hopeful, that the mortality rate will fall as more people are tested and mild cases that have previously gone undetected are identified.

President Donald Trump is in that camp, calling the WHO’s revised estimate of 3.4% a “false number”and that he had a hunch the true mortality rate was well under 1%.

That hasn’t panned out so far, even as much of Europe, parts of Asia and the U.S. dramatically ramp up testing. More cases are being identified, to be sure, but people have been dying at a faster rate.

The current global mortality rate now stands at around 4.5%, which is calculated by dividing the 22,295 deaths by the 495,086 confirmed cases as of Thursday afternoon, according to Johns Hopkins University data. Most scientists agree the mortality rate will fall by the time the disease runs its course.

Scientists also assess the so-called R naught of the disease, a mathematical equation that shows how many people will get sick from each infected person. Just like the mortality rate, the R naught will fluctuate over time as scientists gather more data, and it can vary depending on where someone lives.

Estimates of the R naught for COVID-19 have ranged from 1.4 to about 5. The WHO has estimated the R naught of COVID-19 to be around 1.95 and other estimates from researchers following the outbreak put it around 2.2, meaning about two people will catch the virus from every person who already has it.

The R naught can also be heavily reduced, depending on what a nation does to contain the virus, which is why state and local officials are scrambling across the U.S. to close businesses and keep people indoors. China last week reported its first day with zero new cases after placing much of the nation under lockdown for nearly two months. The R naught can also dramatically increase if a country does nothing.

“If the R naught is higher than 1, it will spread and it will be contagious,” Yanzhong Huang, a public health researcher at the Council on Foreign Relations and director of the Center for Global Health Studies at Seton Hall University, said in a phone interview with CNBC last month. “Without any containment measures, technically it can spread to the whole population.”

The number of CV-19 cases and deaths changes by the hour. Some scientists predict half the world’s population will eventually get it.

Here’s how COVID-19 stacks up against other pandemics and serious outbreaks. (The R naught and mortality rates figures are from a March 9 report on deadly outbreaks by financial research firm Morningstar unless otherwise noted.)

Seasonal flu

- R naught: 1.3

- Mortality rate: 0.1%

Many have compared the COVID-19 outbreak to influenza, also known as the common flu, another respiratory illness that has symptoms similar to CV-19.

So far, COVID-19 is proving to be more infectious with an R naught of around 2 than the seasonal flu, which has an R naught of 1.3 and infects up to 49 million Americans each year. Based on the WHO’s most recent mortality rate of 3.4%, the COVID-19 outbreak is shaping up to be at least 34 times deadlier than the flu, which has a mortality rate of about 0.1% and kills 290,000 to 650,000 people per year across the globe. If the current mortality for CV-19 rate holds at 4.5%, it would make this coronavirus 45 times deadlier than the flu.

2009 H1N1

- R naught: 1.5

- Mortality rate: 0.02%

- World population in 2009: 6.79 billion

The H1N1 swine flu emerged in Mexico in April 2009, infecting 60.8 million people in the United States alone and at least 700 million worldwide. An estimated 151,700 to 575,400 people died from the virus across the globe, according to the Centers for Disease Control and Prevention. Epidemiologists estimate it had an R naught of 1.5, making it less infectious than COVID-19.

The mortality rate is estimated at around 0.02% and ”[H1N1] ended up being a lot milder overall than we once feared, but it hit certain subgroups pretty hard,” former FDA Commissioner Scott Gottlieb said.

1957 flu pandemic

- R naught: 1.7

- Mortality rate: 0.6%

- World population: 2.87 billion

The H2N2 virus pandemic was first reported in Singapore in February 1957. It killed an estimated 1.1 million people worldwide and 116,000 in the United States. COVID-19′s R naught of around 2 is in line with the H2N2 virus, but the current virus appears to have a far deadlier potential.

1918 flu pandemic

- R naught: about 1.8

- Mortality rate: 2.5%

- World population: 1.8 billion (est.)

The 1918 flu was one of the most horrific pandemics of the 20th century, hitting those ages 20 to 40 especially hard, according to WHO. COVID-19′s R naught of 2 is slightly more infectious than the 1918 flu.

The 1918 flu, which was known as the Spanish flu, didn’t actually originate in Spain. It had a mortality rate of 2.5% and killed more people — 30 million to 50 million — than the 20 million who died in World War I. If the 4.5% mortality rate of COVID-19 drops, it won’t be as bad as the 1918 flu. If it continues on its current trajectory, it will be almost twice as deadly.

SARS

- R naught: 2 to 5

- Mortality rate: 10%

- World population in 2003: 6.38 billion

Severe acute respiratory syndrome, or SARS, is a coronavirus that emerged in the Guangdong province of southern China in November 2002 but didn’t spread wide enough to become a pandemic. Unlike COVID-19, SARS was generally transmitted only after people started showing symptoms, which helped contain the outbreak. SARS, which infected 8,098 people worldwide by July 2003, is believed to have an R naught of 2 to 5. The mortality rate for SARS, which killed nearly 800 people, is estimated at 10%, according to the CDC.

MERS

- R naught: 0.5

- Mortality rate: 35%

- World population in 2012: 7.13 billion

MERS, which stands for Middle East respiratory syndrome, emerged in Saudi Arabia in 2012 and infected at least 2,494 people across 27 countries, including 858 deaths, according to the WHO. With an R naught of 0.5, MERS is much less infectious than COVID-19′s R naught of 2. It’s much deadlier, however, with a mortality rate of 35%.

Measles

- R naught: 12 to 18

- Mortality rate: unclear

Measles is one of the most contagious viruses in the world with an R naught of 12 to 18, according to a paper published in 2017 in the peer-reviewed journal The Lancet. Determining the mortality rate is difficult.

Before a vaccine was developed in the early 1960s, most cases went unreported, and the CDC estimates up to 4 million people in the U.S. actually caught measles every year, killing 400 to 500 people annually. In 2009, worldwide measles vaccination coverage reached 82%, and from 2000 to 2008, the number of deaths from measles dropped from 733,000 to 164,000, according to the WHO. Measles is a seasonal disease, meaning it comes back every year.

Ebola

- R naught: about 2

- Mortality rate: exceeds 50%

The Ebola virus disease, formerly known as Ebola hemorrhagic fever, was identified in 1976 in the Democratic Republic of Congo near the Ebola River. It doesn’t come back every year, but it has periodically recurred over the last 44 years. Like the current coronavirus, the virus virus has an R naught of 2, according to a report published in 2014. But Ebola is far deadlier, killing more than half the number of people who are infected.

Ebola has spread to more than 31,000 people — mostly in Africa, not including the current outbreak in the Democratic Republic of Congo, according to WHO data. It has killed more than 12,900 people, also excluding the current outbreak.

The death and infection rates for COVID-19 are not set in stone, global health officials say, reminding the public and world leaders that a coordinated response can lower both.

“We cannot say this loudly enough or clearly enough or often enough: All countries can still change the course of this pandemic,” WHO Director-General Dr. Tedros Adhanom Ghebreyesus said on March 11, when the agency declared the COVID-19 pandemic.

In some countries such as Italy, where there are more than 74,000 cases, the country has been under lockdown.

In the U.S., Trump has imposed travel bans for much of Europe and Asia. Roughly half of the nation is under some sort of quarantine for the foreseeable future. The U.S. outbreak is accelerating with hot spots in California, Washington state and New York, which has more than half of the 69,000 U.S. cases. Trump’s coronavirus task force is advising anyone who travels through New York to self-isolate for two weeks and monitor their symptoms if they leave the area.

Dr. Anthony Fauci, director of the National Institute of Allergy and Infectious Diseases, is also asking healthy, young individuals to stay indoors, saying slowing the outbreak will not work without them.

“When I was young, I thought I was invulnerable. We are asking young people to help with the mitigation strategy by staying out the bars, staying out of the restaurants,” Fauci said at a White House briefing on March 17 — St. Patrick’s Day. “We can’t do this without the young people cooperating.”

While governments and the public attempt to slow the spread, health officials and pharmaceutical companies are quickly working to produce a vaccine, with the first human clinical trial beginning last week. Hopes of getting a vaccine to market are high, but doctors are setting expectations low for how quickly it can happen.

It will take a minimum of 12 to 18 months for a vaccine to make it to the market, U.S. officials say. In the meantime, they are fast tracking clinical trials on drugs that show promise in treating the virus, telling people to stay indoors, keep their distance and wash their hands often.

Here’s why stocks are rising on terrible news

PUBLISHED THU, MAR 26 20202:54 PM EDTUPDATED THU, MAR 26 20204:28 PM EDT

Jeff Cox@JEFF.COX.7528@JEFFCOXCNBCCOM

KEY POINTS

- Stock market action Thursday provided some indication that a bottom could be forming.

- The market rose sharply after a historic surge in initial jobless claims, a move consistent with the end of bear markets.

- Conventional wisdom is that bear markets, or 20% drops from 52-week highs, end when the selling has been exhausted.

- There likely will be economic data reports ahead worse than anything the U.S. has ever seen, but they could change course quickly.

It might be premature to declare the bear market dead, but Thursday’s action sure checked off some important boxes.

Conventional Wall Street wisdom is that bear markets, or 20% declines from 52-week highs, die on bad news, and Thursday featured some of the worst the U.S. economy has ever seen.

Nearly 3.3 million Americans filed initial jobless claims for the week ended March 21, marking the worst week ever, by far. The second-worst number came during the 1982 recession, and the report released Thursday more than quadrupled that total.

Yet the market rose, violently so, at one point hitting 20% off the recent lows, which would define a bull market. That came just days after the longest bull market in history took the quickest fall into bear territory ever.

The thinking about bear markets dying on bad news is that the market is always looking ahead, and when it fully prices in all of the awful stuff out there, the selling will stop even if current conditions look bleak.

There wasn’t much sense to be made of the move Thursday, but it did spark talk that the worst of the market damage from the coronavirus crisis could be over.

“The markets and the economy don’t run in parallel. The market’s running way ahead of the economy,” said Randy Frederick, vice president of trading and derivatives at Charles Schwab. “The markets don’t care about what’s happening today, the market cares about what’s happening six months from now.”

If that’s true, then it makes some sense that the market, as measured by the Dow Jones Industrial Average, is rallying after falling some 37% from its historic peak set in February.

‘Indiscriminate selling’ is over

Economists are expecting a steep fall for the economy in the second quarter that could exceed a 20% GDP decline, with some 10 million people out of work and an unemployment rate higher than anything the U.S. has ever seen.

The jobless claims data offered the first test of whether investors would be willing to look through the bad readings and continue buying. There was some speculation that one of the reasons for the rally Thursday was that the number, while much higher than the 1.5 million consensus, wasn’t as bad as some forecasts of up to 4 million.

For a bottom to start forming “we’ll need to see investors using that term, that it’s less bad,” said Quincy Krosby, chief market strategist at Prudential Financial. “That’s typically what you wait for to begin to invest in earnest instead of just trading.”

Krosby said that market action before the claims report had been encouraging as Wall Street saw massive rallies Tuesday and Wednesday as well.

“The indiscriminate selling that you saw in order to raise money has eased, and that also matters,” she said.

A bottom, but maybe not the bottom

While the data is likely to continue to be bad for a couple of months, a pronounced recovery is expected to follow. Federal Reserve Chairman Jerome Powell told NBC’s “TODAY” show Thursday that he sees a “good rebound” in subsequent quarters and pledged the central bank will to whatever it can to ensure that the recovery “is as vigorous as possible.”

That kind of talk is raising hopes in the market.

“I think the market has reached a bottom,” Peter Boockvar, chief investment officer at Bleakley Advisory Group, told CNBC’s “Power Lunch,” though using a long “a” in describing the situation.

“I think all the bad news we’re going to hear about the virus over the next four to six weeks, all the terrible economic data we’re going to see over the next four to six months, that has been priced in,” he added. “The next question for the market is what happens after … we get to the fall and the economy starts to recover? Is it a ‘V’ bottom recovery, or is it something that’s going to take a lot more time? Unfortunately, I’m in the latter camp.”

At that time, Boockvar said, investors have to be reevaluate how much they’re willing to pay for stocks. Will it be the 19 times earnings they were paying just before the market collapsed, or will it be a lesser multiple?

Of course, by then conditions will have changed considerably.

In addition to seeing, hopefully, a coronavirus under control, there will be stimulus in the system unlike anything the world has ever seen.

The Fed has cut short-term borrowing rates to zero and instituted a slew of liquidity infusions that has been valued as high as $6 trillion. On top of that, Congress is on the cusp of passing its own measure valued at more than $2 trillion.

“We’ve got a blank check in the form of monetary policy from the Fed. We’ve not got a blank check, but the largest check ever written by Congress on the fiscal side. The third side is really the medical progress,” Schwab’s Frederick said. “It takes all three of these approaches to solve it. Only two do we have control over. The third is controlled by the calendar and Mother Nature. That’s the tough part.”

The S&P 500 just hit a level that could spark the next meltdown

PUBLISHED THU, MAR 26 20207:21 PM EDT

Stephanie Landsman@STEPHLANDSMAN

The stock market’s three day win streak may be in jeopardy.

Canaccord Genuity’s Tony Dwyer warns the S&P 500 just hit a level that sets the stage for another meltdown as the country copes with the coronavirus impact.

“We put 2,575 as a level for this relief rally,” the firm’s chief market strategist told CNBC’s “Trading Nation” on Thursday.

The S&P 500 is coming off its biggest three day gain since 1933. On Thursday, it closed up more than 6% to 2,630. However, it’s still almost 23% off its record high.

The S&P isn’t the only index seeing upside momentum. The Dow is also seeing its best three day run since the 1930s.

Dwyer cites human nature of fear as the likely catalyst to interrupt the latest leg higher.

“Once you make a panic low, you typically have this relief rally,” Dwyer said. “Unfortunately, the vast majority of time you go back down and test that low.”

But his forecast isn’t all doom and gloom. It carries optimism, too.

“You’ve already panicked, so down 34% at the low to say that it’s going to get significantly worse is not the case,” he added. “The time to be cautious was in January and February. We made the panic low. While we may test that low, it’s not the time to get scared.”

Dwyer, a long-term bull, has warned for weeks the coronavirus pandemic would spark a deep economic shock.

On Thursday, the first signs were in the weekly initial jobless claims data. They surged beyond three million to an all-time high in the week ending March 21.

But he sees it as a temporary — albeit severe —setback.

‘The rebound is going to be extraordinary’

“There is unbelievable monetary and fiscal stimulus that has come into play,” Dwyer said. “I know once we bottom out after the COVID-19 weakness has hit its limits, I think the rebound is going to be extraordinary.”

His game plan: Wait until stocks test the recent low before putting new money to work.

“Now is the time to think, as we pull back from this quick jump we had, what you want to buy for the intermediate term in a new bull market,” Dwyer said.

Quick Picks & Lists | Editors’ Picks

Baidu, Alibaba, And Tencent: Becoming Indispensable

Mar. 30, 2020 10:53 AM ET

: Alibaba Group Holding Limited (BABA), BIDU, CQQQ, FXI, KWEB, MCHI, TCEHY, TCTZF, Includes: BDNCE, CMG, DIN, DPZ, JD, MCD, NTES, SNAP, TAL, VIPS, WEN, ZM

Summary

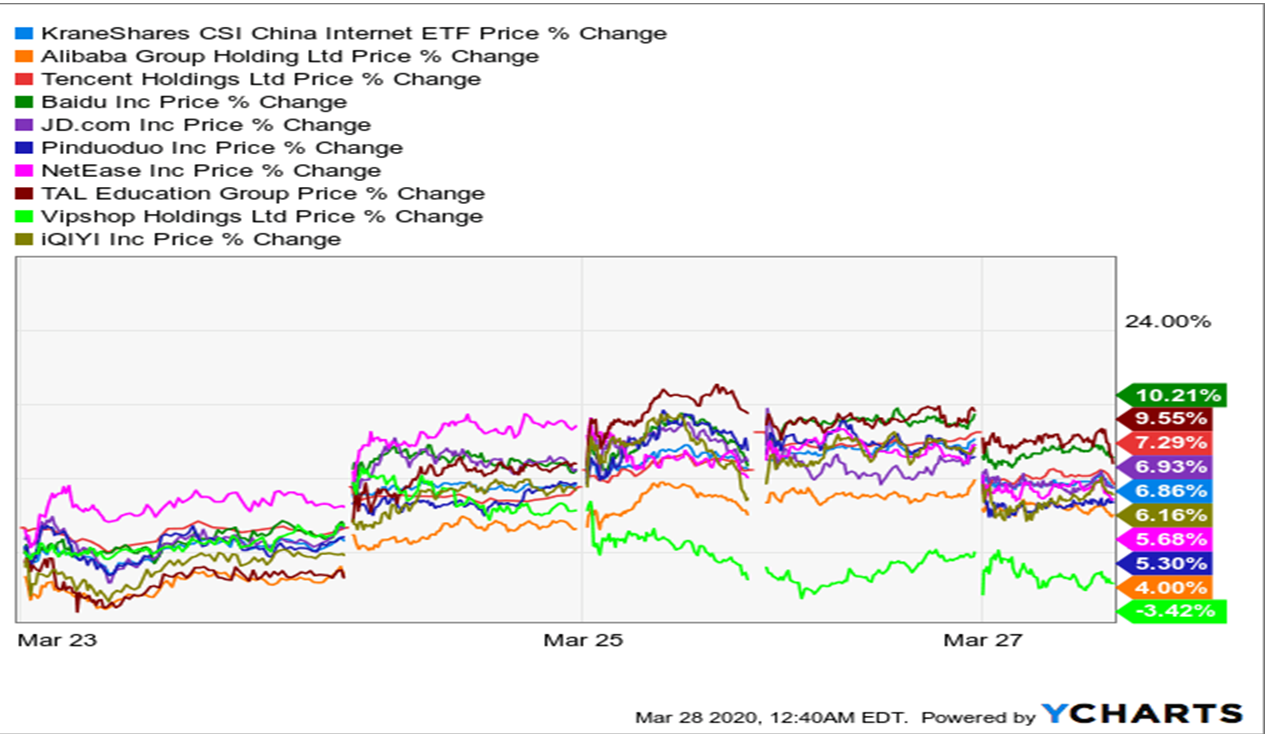

Chinese internet stocks generally had a good rally, spurred by the global coordination of economic rescue packages.

Surveys and big data revealed that Chinese consumers are returning, amid the ongoing normalization in the populous country.

Baidu, Alibaba, and Tencent continue to make themselves indispensable amid the coronavirus outbreak. I elaborate how they are doing this.

The Chinese government is making numerous policies aimed at improving trade. This is a boon to retail and by extension, e-commerce.

Despite a relief package that would have been easily deemed a shock-and-awe kind in a typical financial or natural disaster, the $5 trillion injection pledged by G20 countries could only serve as a mitigation to the economic fallout from the pandemic. It’s not because market players are insatiable – the current situation is unequivocally unprecedented. We are struggling to battle with the unknown, guaranteeing that the decision-making process for both governments and businesses is extremely challenging.

A natural disaster strikes and we deal with the aftermath, usually confined to a specific zone. For an earthquake, we could have aftershocks which would probably cease within a week or so. The entire country rallies to tackle the rebuilding and maybe we have friendly nations providing some assistance.

Unfortunately, in this case, the coronavirus pandemic takes weeks to wreck its full damage on the population and its menacing disease, COVID-19, lingers around for longer, causing the government to resort to economically devastating lockdowns. To make matter worse, many countries are hit almost simultaneously.

Even though the pace at which the COVID-19 outbreak spreads in each country differs, we have seen respective governments imposing export bans on essential medical supplies to ensure the security of supply for their people. Some countries have taken a step further, restricting the exports of agricultural products. We are also probably still far from experiencing a truly global pandemic yet, with the 1.4 billion strong India and a similarly-sized Africa continent reporting relatively lower numbers of confirmed cases of COVID-19.

Nonetheless, the coordinated effort thus far was sufficient to keep the stock markets from tanking again and even enabling what some termed as a ‘dead cat rebound’, before Friday’s selloff ending a three-day rally. Stocks of Chinese companies (CQQQ)(FXI)(MCHI) benefited from the global sentiment recovery and gained as well.

The Chinese Internet sector representative ETF, the KraneShares CSI China Internet ETF (KWEB), rose 6.9 percent for the week, recouping some losses from the previous week’s 7.8 percent decline. Among the key holdings of the KWEB ETF, Baidu (BIDU) jumped 10.2 percent while TAL Education (TAL) rose 9.6 percent.

Tencent Holdings (OTCPK:TCTZF)(OTCPK:TCEHY) and its investee company JD.com (JD) also fared well, closing up 7.3 percent and 6.9 percent respectively. Alibaba Group (BABA) did not do as well but still gained a respectable 4.0 percent. Vipshop Holdings (VIPS) was the outlier, ending in the negative territory, down 3.4 percent. However, it is important to note that the e-commerce player that coins itself “China’s leading online discount retailer for brands” is up low double-digit percentage from early March, and some 80 percent higher than late August when it began to report earnings that vastly surpassed consensus estimates.

As explained in a past issue of the Chinese Internet Weekly, I found the KWEB ETF holding the most representative stocks in the sector. As such, an overview of the week’s share price movements of the top few holdings of KWEB as compared with the ETF itself is provided as follows for convenient reference especially for the stocks mentioned in this article.

Data by YCharts

In the subsequent sections, I will update on the key developments at Alibaba and Tencent, after a quick follow-up on the previous issue. I will also discuss in depth the implications regarding the series of trade concessions China has made in recent months.

China is back in business, and consumers are back too

Comments in my recent articles lambasted me for touting a pro-China stance. However, that is misconstruing my intention. In addition, I am not alone and others have put it more bluntly, blaming the western leaders blatantly. Writers from reputable American media including The Wall Street Journal and Bloomberg have criticized the government handling of the pandemic. I mention this not to denigrate the U.S., the country which has always bounced back from difficulties, but to reiterate what I have been saying in the past weeks: China is back in business and we should not ignore the opportunities presented there.

To sweeten the idea, consumers are back too. A recent survey conducted by the Boston Consulting Group revealed that “although a substantial percentage of Chinese consumers are planning spending reductions in the categories that appear among our top 10 losers in China, a significant percentage of Chinese consumers are also planning spending increases in those same categories.” The net effect showed there were “some positive signs of potential recovery in the coming months.”

According to BCG, the categories that saw both planned spending decreases and planned spending increases include away-from-home food and restaurants, vacation and leisure travel, luxury brands and products, public transportation, athletic equipment and clothing, and entertainment.

We have seen the share prices of restaurant stocks like McDonald’s (MCD), Wendy’s (WEN), Domino’s Pizza (DPZ), Dine Brands Global (DIN), Chipotle (CMG), and many others crater two weeks ago as lockdowns were being announced across much of the western world. The market reaction was understandable, given the shutdowns of outlets and consumers’ aversion to prepared food with heightened concern over hygiene.

In late January and much of February, the situation was the same in China. However, diners have been returning. A brokerage was said to have noted the increase in restaurant visits via proxy – dishwashers were running more frequently. Apparently, smart dishwashers are connecting to the WiFi network and transmitting data to the manufacturer who then sells the data.

Some readers cautioned that China could face a relapse with a possible second or even third wave of COVID-19 outbreaks. The same could be said for any country now suffering from the pandemic. However, I believe the spread from a second outbreak, if it indeed occurs, would be much quickly contained than the first.

Following the lockdown in Wuhan, the Chinese quickly understood the gravity of the situation and took the necessary precaution, including the use of face masks. Those without the proper gears took the effort to improvise (see the photograph as follows). That was before China and the world was aware of the COVID-19 statistics that we are now seeing.

In contrast, despite widespread warning to stay at home and hammering home the importance of social distancing, many spring breakers in the U.S. reportedly insisted on partying even as the number of COVID-19 cases then already hitting more than 9,000 with at least 150 dead.

On the other hand, the Chinese government has ensured strict compliance of its stay-at-home orders and even as businesses are restarting, workers are duly protected. The following photograph shows a Chinese worker at an information desk at Beijing Capital Airport clearly taking no chance. So, tell me, which country should I be more worried about a second wave?

Baidu, Alibaba, and Tencent are making themselves indispensable amid the coronavirus outbreak

I highlighted the various ways that Alibaba and Tencent have contributed to the stay-at-home and work-at-home phenomenon in prior articles. However, it seems the internet giant duo are making themselves more entrenched in the Chinese way of life than ever.

A QR-based health code system embedded in the Alipay app operated by Ant Financial, the finance affiliate controlled by Alibaba Group, helps the Chinese authorities determine who is allowed the freedom of movement and who is required to self-quarantine or enter a supervised quarantine facility.

Tencent collaborated with a unit of China’s top economic planning body to design a similar feature made available through a mini-program within WeChat, the ubiquitous messaging app. The underlying technology was launched by the Chinese government and adapted for use on Tencent’s and Ant Financial’s platforms.

It’s not just public facilities that rely on the system which is already deployed in over 200 cities. Security personnel at dining establishments and shopping malls are also demanding diners and shoppers display a green code symbolizing clearance before allowing them to enter. The multiple daily usages of the apps ensure loyalty and increase the frequency in which the users check out offers as well as the monetization opportunities through advertising.

Tencent has gone one step further, partnering with local disease control and prevention departments to launch a health tracking system catering specifically to students. The technology will come in handy as millions of students are scheduled to return to school as education facilities across China prepare to receive them physically for the first time in weeks. Talk about getting people hooked when they young, this is it. This is likely not something that Snapchat (SNAP) can do in the U.S.

It doesn’t end there – the health information collected will be shared with WeChat Work, a business communication and office collaboration platform. Education officials and school teachers are supposedly able to track the health status of their students via their WeChat Work accounts. Such integration and reliance on the WeChat app would inevitably result in higher DAUs and engagements.

As an indication that the telecommuting and remote working/schooling demand is very strong and an area of sustained growth, Tencent has decided to boost mid-career hires by more than 25 percent this year to staff additional positions in WeChat Work, telemedicine, and online classes catering to children.

The manpower increase is necessary because Tencent is not resting on its laurels. Just as ByteDance’s (BDNCE) Douyin has an international version – TikTok – Tencent Meeting has VooV, dubbed by some as Tencent’s answer to video-conferencing service Zoom (ZM). One feature embraced by users is an aggressive beauty filter.

It is possible that VooV can take off globally, given that Zoom is blocked in China, and many MNCs that have staff in China might decide to simply use VooV across the entire organization to save the hassle of switching. While VooV is understood to be inferior to Zoom at the moment, it could quickly catch up. Tencent Meeting was upgraded over 14 versions in a matter of 40 days, no small feat.

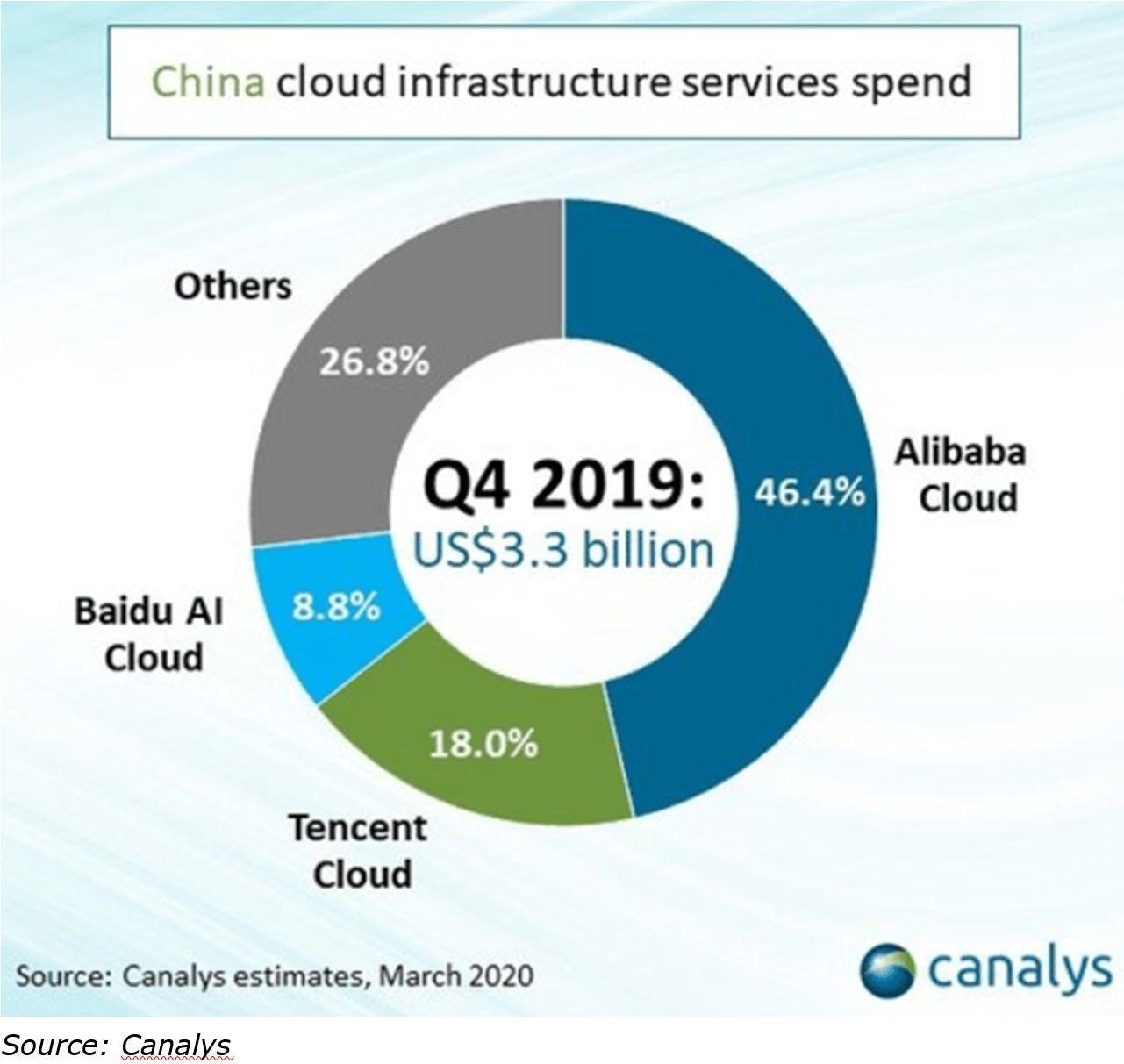

An understated beneficiary of higher off-premise business working is the greater use of the cloud. According to industry research firm Canalys, China’s cloud infrastructure spend in Q4 2019, prior to the epidemic-led lockdowns, grew by 66.9 percent to $3.3 billion.

Source: Canalys

Although Alibaba lost some market share (from 47.3 percent to 46.4 percent) from Q3 2019, it remained the leading provider by far and with the overall market expanding so quickly, its cloud business still gained substantially on an absolute basis.

Tencent Cloud retained its second position and significantly expanded its share of the market from 15.4 percent in the third quarter to 18 percent in the fourth quarter. Baidu AI Cloud also did well, growing its market share to 8.8 percent in the fourth quarter, from 8 percent in the previous quarter, entrenching its third-place ranking. Baidu developed mapping tools which aided in the tracking of the initial spread of the coronavirus which sped up local response efforts.

The Chinese government’s trade tariff reduction is a boon to retail and by extension, e-commerce

While global attention is focused on the coronavirus pandemic, China has been working on improving its trade activities with countries worldwide, even when it was busy fighting its own outbreak back in January-February. In mid-December 2019, China’s Customs Tariff Commission announced a tentative reduction in the import tax rates on 859 goods to be effective from January 1, 2020.

The official notice cited motivations such as the desire to “optimize the trade structure”, “promote high-quality economic development”, and to “better meet the needs of people’s lives” for the move. The idea is to encourage the import of overseas goods that are relatively scarce in China or have superior characteristics. The items that will enjoy the lower import taxes include frozen pork, frozen avocados, non-frozen orange juice, Brazilian nuts, etc.

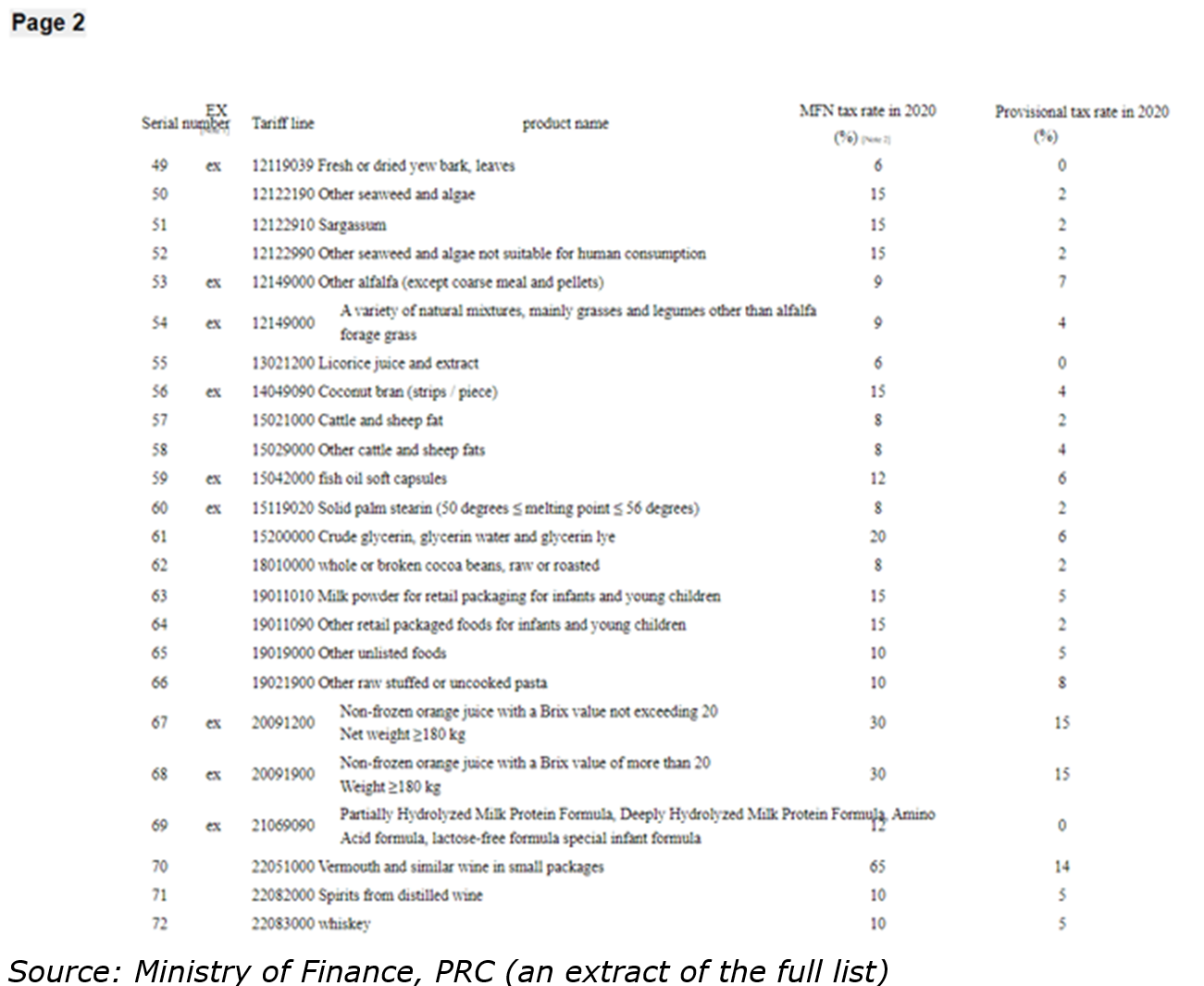

The reductions on some items are generous. For instance, certain types of non-frozen orange juice have their import tax provisionally halved, from 30 percent to 15 percent. Notably, milk powder for infants and young children meant for retail sale would see the import tax provisionally revise from 15 percent to 5 percent (see the extract of the full list – translated by Google – as follows).

Source: Ministry of Finance, PRC (an extract of the full list)

In 2008, Chinese consumers suffered a widespread food safety incident in the form of contaminated dairy products. Milk and infant formula along with other food materials and components were uncovered to be adulterated with the toxic chemical melamine. Numerous infants and toddlers were diagnosed with kidney stones and other health ailments after being fed affected dairy materials. Despite an intense crackdown on the culprits, parents in China still predominantly do not trust locally produced infant formula years after the scandal.

As a result, overseas-made dairy products are highly popular in China, making them a key category of items fueling the ‘daigou’ business. ‘Daigou’ is a form of trade whereby travelers bring products bought from outside China into the country. This can be done either illegally or legally exploiting loopholes to circumvent import tariffs imposed on overseas goods.

Alibaba has over 60 percent market share of the cross-border e-commerce import market in China, mainly thanks to the popularity of Tmall Global. Its cross-border import business was boosted by the acquisition of NetEase’s (NTES) Kaola last year. The lowered import tariffs should spur the higher purchase of the applicable items.

With the lion’s share of the cross-border import business, Alibaba stands to benefit the most from the favorable policy. JD Worldwide, JD.com’s cross-border platform, could also gain given its reputation for high-quality goods.

While the tariff reduction is supposedly valid for only one year, the Chinese government has shown its intention to reduce the cost of imports, supporting consumerism which has become an increasingly important pillar to the economy. China would be expected to continue introducing policies and measures conducive to global trade as it signals to the global community its commitment to international cooperation. This bodes well for e-commerce players.

On February 6, 2020, the State Council Customs Tariff Commission of China released more pleasing trade policy moves. The authorities declared the halving of the previously announced increases in the tax rate on 5,078 U.S. goods valued at USD75 billion. The official statement framed it as a reaffirmation of their commitment to “alleviate economic and trade frictions and expand economic and trade cooperation” between the two countries.

The lowering of the tariffs would go some way to entice businesses to consider U.S. goods and make the import targets Beijing agreed to on January 15 when the two parties signed the “Phase One” trade deal more achievable.

Besides the tariff reduction, the authorities also announced the temporary import tax waiver for products deemed essential in their fight against the novel coronavirus outbreak. While limited in scope compared to the entire product list that China imports, the selected items are the prevailing hot-selling products both offline and online. Thus, this policy would again benefit the cross-border import businesses of the Chinese e-commerce players.

In mid-February, the commission issued two further notices, one after another. The first directive declared that importers are able to apply for exemptions to trade tariffs on 696 types of U.S. goods, ranging from energy products, petrochemicals, to agricultural items, subject to unspecified conditions and quotas. A later announcement stated that additional tariffs on 65 U.S. goods such as aircraft and timber parts would be exempted for one year effective from February 28.

The successive breaking down of trade barriers and positive signaling bodes well for the mending of relations between the two major trading partners. The consequent improvement in trade would benefit the e-commerce players while the improvement in sentiment could help to lift the ‘China discount‘ on the wide spectrum of Chinese stocks.

Furthermore, the dribs and drabs manner in which the announcements were made was a smart move as it kept the media distracted from the coronavirus outbreak, at least for a day whenever a new notice was released. I expect the Chinese government to maintain this pattern of small policy releases over the year as they see the benefit of steady progress on the trade narrative versus the impact from a one-off event like the Phase One signing ceremony.

As with other directives and contrary to popular belief, the policymakers are not completely dictatorial. Before the formalization of major policies, there are often notices released in the form of ‘consultation’ on the government website publicly accessible. Even after the effective date of a policy, there could be fine-tuning and adjustments according to feedback from the ground.

Hence, subsequent revisions could again feed the media with positive vibes on the trade front. Most importantly, e-commerce companies are among the key beneficiaries of these continuous flow of positive policies.

Disclosure: I am/we are long BIDU, BABA, NTES, JD, TCEHY. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Mortgage bankers warn Fed mortgage purchases unbalanced market, forcing margin calls

PUBLISHED SUN, MAR 29 20209:24 PM EDTUPDATED MON, MAR 30 202012:02 PM EDT

KEY POINTS

- The Mortgage Bankers Association warned that the housing market could face a ” large-scale disruption,” due to actions by the Fed that were meant to help the mortgage market.

- The Fed bought $183 billion of purchases last week of mortgage-backed securities, in an effort to drive down rates, and they did.

- But the Fed’s actions, amid a volatile market environment, helped add further strains that resulted in blowing up a widespread hedge that mortgage bankers use to protect themselves against rate increases, and now some lenders are facing margin calls that are eroding their working capital and threaten their ability to operate.

The Mortgage Bankers Association in a dire letter to regulators Sunday warned that the U.S. housing market is “in danger of large-scale disruption,” due to efforts by the Federal Reserve that were intended to help rescue the mortgage market.

At issue are the Fed’s unprecedented $183 billion of purchases last week of mortgage-backed securities. The purchases were meant to drive down rates, and they did.

But together with the storm that gripped financial markets from the coronavirus, they also effectively blew up a widespread hedge that mortgage bankers use to protect themselves against rate increases. The hedge pays them if the prevailing rate in the market is higher than the mortgage rate they locked in with the customer.

The system works well unless mortgage rates are highly volatile. It is generally considered to be a safe trade: the hedge simply protects the lender against higher rates until the mortgage closes. But compounding the problem, many customers couldn’t close on their loans because of quarantines, leaving the mortgage lenders with only the cost of the hedge and no off-setting loan.

The huge volatility in mortgage bonds created massive margin calls from the broker-dealers, who wrote the hedges, to their mortgage bankers.

Some of these mortgage bankers are now facing margin calls of tens of millions of dollars that could drive them out of business, according to Barry Habib, founder of MBS Highway, a leading industry advisor who was among the first to publicly sound the alarm bell last week.

Hardest hit are independent mortgage bankers who wrote about 55% of the $2.1 trillion mortgages created last year and can have higher leverage.

In its letter to regulators, the MBA said: “The dramatic price volatility in the market for agency mortgage-backed securities [MBS] over the past week is leading to broker-dealer margin calls on mortgage lenders’ hedge positions that are unsustainable for many such lenders.”

The letter went on to say, “Margin calls on mortgage lenders reached staggering and unprecedented levels by the end of the week. For a significant number of lenders, many of which are well-capitalized, these margin calls are eroding their working capital and threatening their ability to continue to operate.”

Some lenders, the letter said, may not be able to meet their margin calls in a day or two.

The Fed came into the mortgage market forcefully two weeks ago when rates began to rise because a large array of investors were selling mortgage securities to raise cash, in part, to offset big losses in the stock market. There was also fear that borrowers wouldn’t be able to pay.

In the week of March 16, the Fed bought $68 billion of mortgages. But the market still saw massive selling, prompting the Fed to come in with an additional $183 billion of purchases last week. The combined $250 billion in mortgage purchases by the Fed over two weeks was $84 billion more than the Fed had bought over any four-week period during the financial crisis in 2009.

Ironically, the MBA had urged the Fed to come in strongly to help the mortgage market. “We understand that when the Fed came into the market, they couldn’t come in surgically. They didn’t have a scalpel. They only have a sledgehammer,” MBA chief economist Micheal Frantantoni told CNBC.

The New York Fed appears to have adjusted its purchases in response to the industry outcry. It purchased $40 billion of mortgages Friday, $10 billion less than it planned to buy, and it plans to do another $40 billion Monday but could end up doing less.

“We are expecting the Fed to modulate their purchases,” Frantantoni said.

But Habib said the Fed needs to go further than just modulate.

“This is a collapse of the system,” Habib said. “It’s as simple as the Fed stops buying for a period of time.”

While CNBC has learned that the MBA has made its concerns known to the Fed and other regulators, the specific request in the MBA letter went to the Financial Industry Regulatory Authority and the Securities and Exchange Commission. The MBA asked for regulatory relief for the broker-dealers who provide the hedges. Regulators have recommended a best practices guideline to collect margin on any variation above $250,000.

The MBA asked FINRA and the SEC to issue guidance urging lenders not to escalate the margin calls to “destabilizing levels.”

https://www.ksl.com/article/46735631/what-utahns-need-to-know-about-unemployment-insurance

What Utahns need to know about unemployment insurance

By Graham Dudley, KSL.com | Posted – Mar. 27, 2020 at 7:37 p.m.

SALT LAKE CITY — Utah’s unemployment claims skyrocketed last week after the state government took aggressive measures to fight the COVID-19 pandemic, closing restaurants to dine-in customers and limiting the size of gatherings.

There were 19,591 new unemployment claims from March 15-21; 37% of those claimants were from the food service industry, according to the Utah Department of Workforce Services.

As some Utah counties move toward stay-at-home orders and the number of confirmed COVID-19 cases continues to rise, there’s no telling how many Utahns may ultimately lose income as a result of the coronavirus. Here are some tips for navigating unemployment during the COVID-19 pandemic, courtesy of the Department of Workforce Services:

Q: Will the government stimulus package affect my unemployment eligibility?

A: Utah Department of Workforce Services spokeswoman Brooke Porter Coles says funds an individual receives from the stimulus package — $1,200 for most Americans — are not considered earned income and will not affect their unemployment eligibility.

Q: Who is eligible for unemployment insurance?

A: According to this guide from the Department of Workforce Services, eligibility for unemployment insurance is dependent upon a few basic criteria, including how long you’ve been working and how you left your job. Eligibility factors include:

- being connected to the workforce long enough (generally at least five quarters)

- being “able and available” to work; that is, actually capable of coming to work (and not showing COVID-19 symptoms)

- being laid off through “no fault of your own”

Specific to COVID-19, the department says employees are still eligible if they:

- were laid off temporarily, with the expectation of coming back

- are in quarantine, but not showing symptoms of COVID-19 and will return to work

- are “able and available,” but can’t go to work because the workplace itself has been quarantined

My staff and I are getting a lot of questions about who is eligible for unemployment benefits. This FAQ is a great place to start. https://jobs.utah.gov/covid19/uifaqemployees.pdf … #covid #unemployment #coronavirus

Q: So people who actually contract COVID-19 are not eligible for unemployment?

A: The Department of Workforce Services says people who are not “able and available” should still file a claim. Porter Coles said eligibility is determined on a case-by-case basis.

“We don’t want them to weed themselves out and therefore miss benefits they may have been eligible for,” she said. “We encourage any individual who has questions about their eligibility to apply and let us make that determination.”

Q: What if my job plans to hire me back when they can?

A: These workers are considered “job attached,” Brooke Powers said, and are still eligible for unemployment as long as they’re not receiving paid leave or other payments from the employer. “I think it’s also important to note that the majority of people who are applying for unemployment insurance right now are job attached, which is encouraging,” Porter Coles said. “They will be able to hopefully return to those employers once things begin to return to normal, whenever that may be.”

Q: What if my hours were reduced?

A: You may still be eligible for some assistance if you were previously full-time, depending on your earnings.

Q: I drive for Uber, and business is way down lately. Can I file for unemployment?

A: For the state’s purposes, gig economy workers are considered self-employed and are not eligible for unemployment insurance, though they may be eligible for food stamps and other programs.

However, the New York Times reports that the just-passed stimulus package expands the list of people who would be eligible for benefits — so if COVID-19 has curbed your income in any way, now’s the time to apply.

Q: Will I have work-search requirements attached to my benefits? How can I look for work during a pandemic?

A: The Utah Department of Workforce Services generally requires applicants to make four job contacts weekly; however, applicants may be granted a work search deferral at this time.

Q: How long will it take to be paid if I am eligible?

A: Processing unemployment payments generally takes about 14-21 days. Porter Coles said the department is doing its “very best, with the high demands we have right now, to still meet those expectations.” The government’s stimulus check (or direct deposit) for individuals is similarly expected to take up to three weeks.

Q: So how do I apply?

A: Porter Coles encourages unemployed Utahns to apply for benefits online at jobs.utah.gov/ui/home. “Not only does that help us to meet the needs, but it also helps them,” Porter Coles said. “The less people we have to divert to answering the phone calls, the more people we can put on processing their claims and get people through that quicker, so they can begin seeing their benefit.”

HI Financial Services Mid-Week 06-24-2014