HI Market View Commentary 12-02-2019

| Market Recap |

| WEEK OF NOV. 25 THROUGH NOV. 29, 2019 |

| The Standard & Poor’s 500 ended the week with a 1% increase since last Friday, ending the month on a positive note and putting the market benchmark’s increase for November at 3.4%.

The index closed Friday’s session at 3,140.98, up from last week’s closing level of 3,110.29. The percentage increase for November marks the S&P 500’s largest one-month rise since June, when it jumped by more than 6%. It is now up 25% for the year to date, with just one month remaining in 2019. This week’s move came in only about 3.5 sessions, as the US stock market was closed all day Thursday in observance of the Thanksgiving Day holiday, and closed three hours early on Friday. The consumer-discretionary sector had the largest percentage gain of the week, up 1.8%, amid optimism for the key holiday-shopping season that kicked off this week. The technology sector had the next-largest gain, up more than 1.7%. Just one sector was in the red for the week as energy was off 1.6%. The positive expectations for holiday sales followed better-than-expected recent quarterly results from retailers including Best Buy (BBY), which raised its full-year guidance earlier this week after the consumer-electronics retailer’s fiscal Q3 results topped analysts’ views. Best Buy’s shares jumped 11% on the week. Adding to the holiday sales cheer, Adobe Analytics on Friday said consumers have already spent $50.1 billion online for the holiday shopping season from Nov. 1 to Nov. 26, up some 16% from the same period last year. Adobe Analytics is projecting $143.7 billion in online holiday shopping spending this year, which would mark a 14.1% increase from last year, as e-commerce retail continues to outpace overall retail. Amid the bullish expectations for online shopping this holiday season, shares of Amazon.com (AMZN) rose 3.2% this week. Gainers in the technology sector this week included Autodesk (ADSK), whose shares rose 8.3% as the design-software and services company reported fiscal Q3 results that beat guidance as strong growth in sales not only outperformed the consensus but it also outweighed a surge in costs. On the downside, the energy sector’s drop came as crude-oil futures fell this week amid weekly data from the Energy Information Administration that showed an increase in US crude stockpiles. The energy sector’s decliners included Cabot Oil & Gas (COG), whose shares fell almost 3% since last Friday as Citigroup cut its price target on the stock to $22 per share from $26. The firm kept its investment rating on Cabot’s shares at buy. Provided by MT Newswires. |

So let me tell you about an experience today and here is the story

Why I Won’t Pay For Club Volleyball-

- Published on January 18, 2016

Dr. Jeffrey Kerns

To My Daughter Allie,

Why I don’t Pay for Club Volleyball:

One of my friends asked, “Why do you pay so much for club volleyball?, Below is a summary of my answer, I wanted you to know what I really “pay” for and what I hope you gain from these experiences. The truth is I never intended to pay for club volleyball.

I pay to assure that you are pushed beyond your perceived limits. I pay coaches to challenge you at every practice and match. I pay them to push and challenge you to the point where you might want to quit because it is so tough. I pay them to build up your confidence at the same time so you don’t. I pay them to coach you in volleyball because I understand that your self-assurance on the court transcends to your everyday life. I pay for you to learn how to set goals and chase down dreams. I pay your coaches to help install a high level of self-confidence that you can and will accomplish the goals you set for yourself. I pay so you have more caring and responsible adults involved in your life. I pay for the days when you arrive at home exhausted from school and you are not psyched to attend position training/weights/plyo-metics, but you do it anyway because it will make you better. I pay for the life lessons that losses, frustrations, and disappointment from competition can provide. I pay for life lessons, victories, and personal/team accomplishments that competition can provide. I pay for these opportunities because I do not have to push or force you to play volleyball, rather your desire to play is unequivocally intrinsic.

I pay for you to have opportunities to take pride in your actions on and off the court. I pay for you to be accountable to others (coaches, teammates, club directors) and to help you understand that you are not the center of the universe. I pay for the opportunity for you to honor your teammates and coaches by always giving your best effort on and off the court. I pay for you to have the leadership opportunities volleyball offers. I pay to provide opportunities for you to help everyone around you improve as a person and teammate. I pay for you to understand that you will forever be surrounded by more talented people and less talented people, and that a true leader has the humility and patience to work with both. I pay for you, my daughter, to learn that it is the accumulation of hours upon hours of practice combined with numerous personal sacrifices to be an overnight success.

No it is not club volleyball that I am paying for, I am paying for the time and conversation with a teenage girl on the way to and from practice. I pay for the smiles and sense of purpose that playing club volleyball provides you. I pay to provide lifelong memories from traveling and going to new places with me. I pay for you to experience new cultures, foods, and cities that we experience by traveling to tournaments. I pay because its clear that volleyball sparks your life, passion, and sense of pride. I pay for help in guiding you down the right path. I pay because club volleyball reinforces the life lessons about hope, compassion, hard work, and commitment to yourself and others, that your mom and I have taught you, and continue to model for you.

Most importantly I pay for the bridge of understanding that volleyball provides a father and daughter.

Love always,

Dad

This Month is one of my favorite months in the stock market because historically this is the best month in the stock market averaging 1.6% gain!!!

In collar trading do you have the patience to wait for your returns?

You get to lower the cost basis of your shares, you get to add share 100% paid for by long put profits,

You get the protection to sleep at night knowing you won’t lose half the portfolio overnight, you have a less volatile portfolio that is NOT letting it all ride

Today didn’t make sense because:

First trading day of the month – new money comes in

ALL 11 sectors up for the year

411 stocks higher in 2019 on the S&P 500

Stocks up since 2018 – 174

Fed is not tightening

Global economy is bottoming

Trade war Truce

Where will our markets end this week?

Bullish

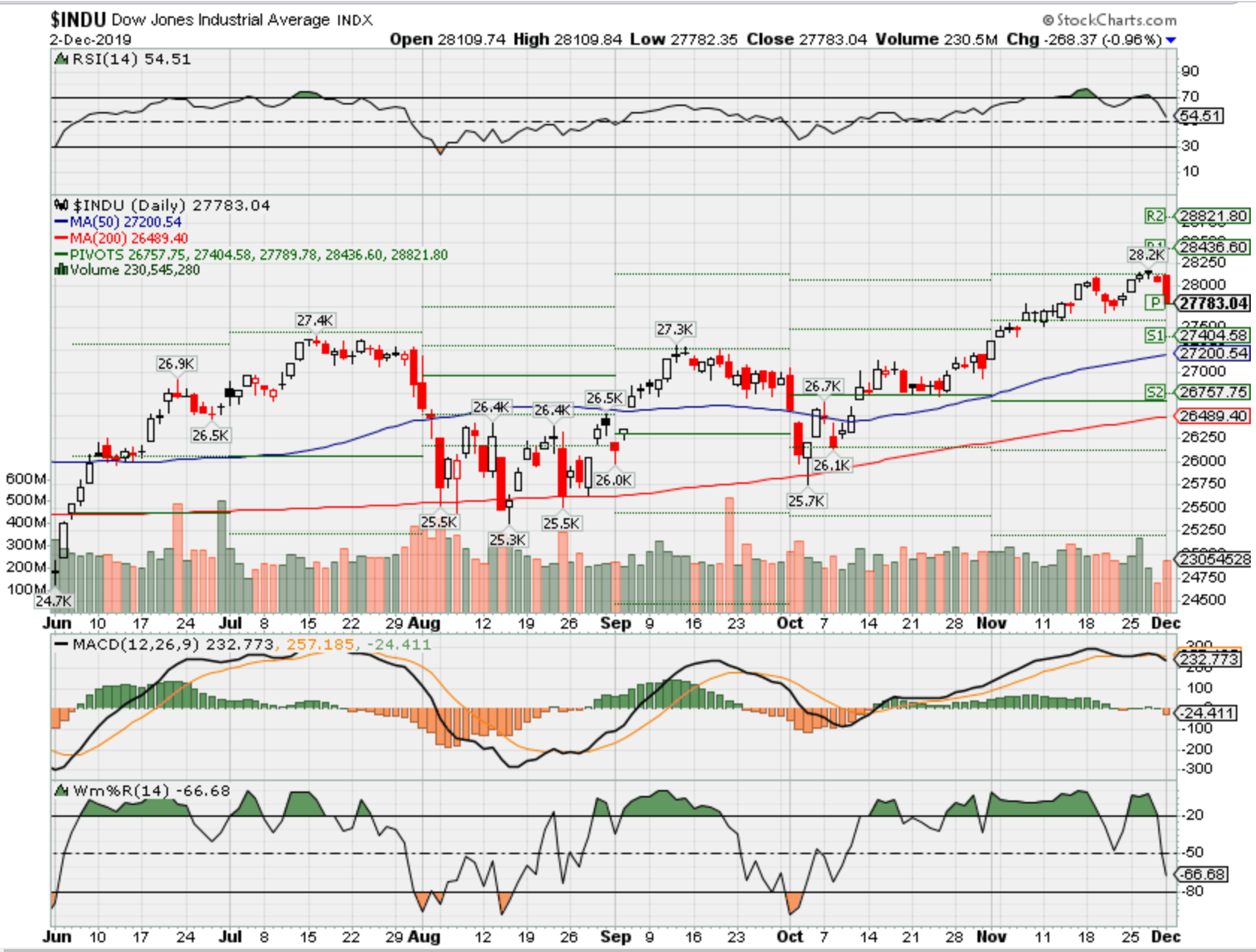

DJIA – Bullish

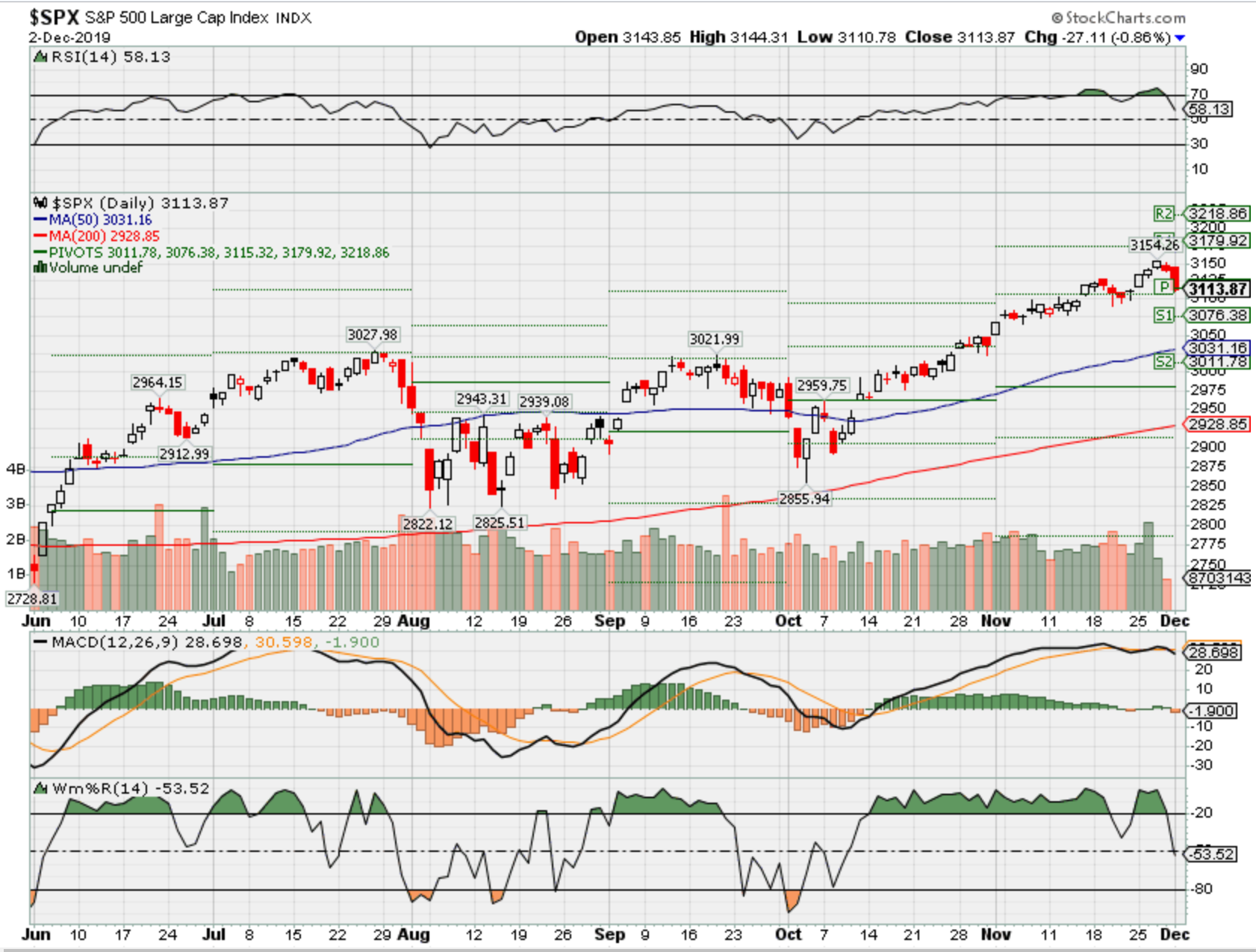

SPX – Bullish

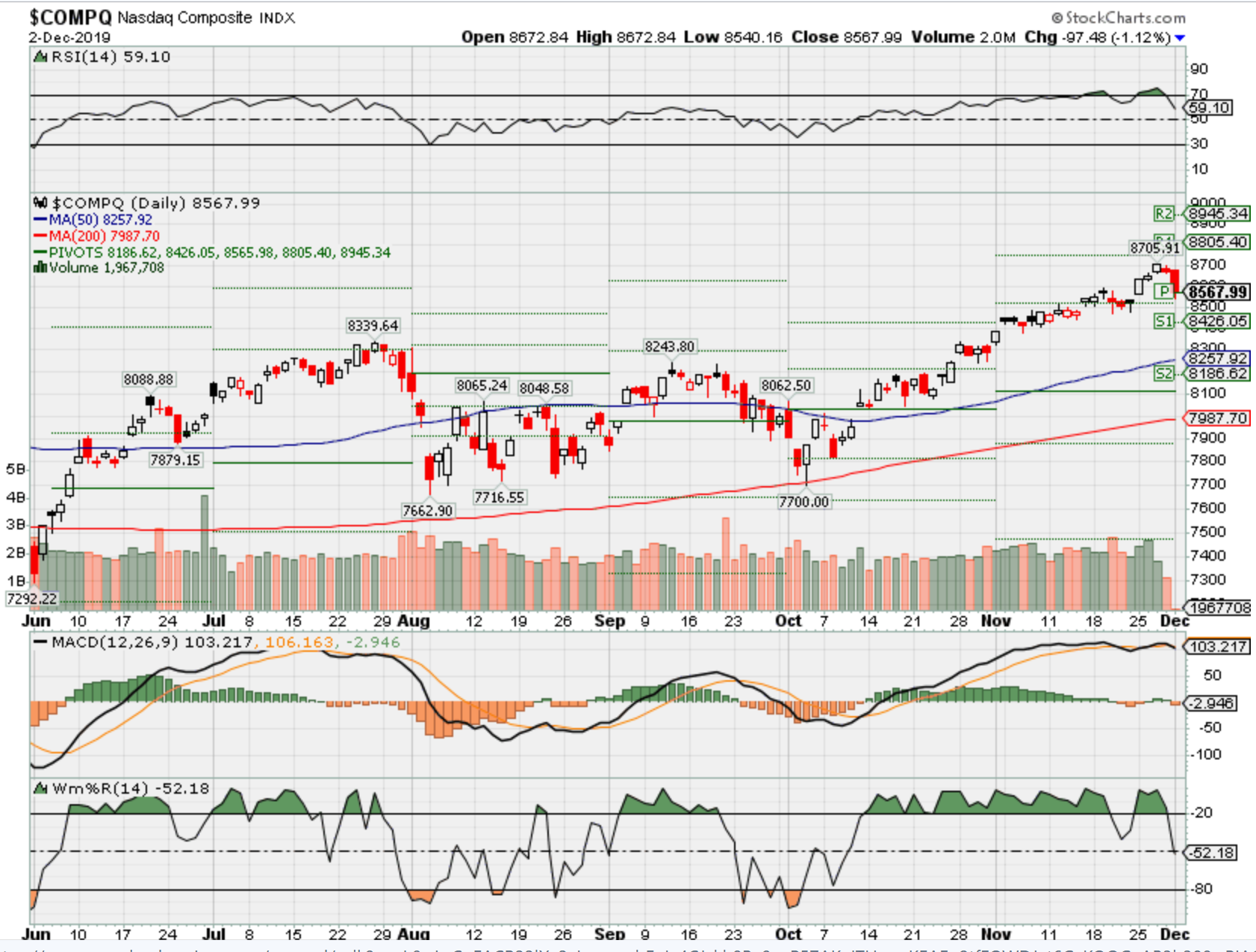

COMP – Bullish

Where Will the SPX end Dec 2019?

12-02-2019 +1.6%

Earnings:

Mon:

Tues: MRVL, CRM

Wed: CPB. FIVE. SPWH, TYLS

Thur: DG, EXPR, KIRK, KR, MIK, TIF, AOBC, ULTA

Fri: BIG, GCO

Econ Reports:

Mon: Construction Spending, ISM Manufacturing

Tues:

Wed: MBA, ADP Employment, ISM Services

Thur: Initial, Continuing, Trade Balance, Factory Orders,

Fri: Average Workweek, Non-Farm Payroll, Private Payroll, Hourly Earnings, Unemployment Rate, Michigan Sentiment, Wholesale Inventories, Consumer Credit

Int’l:

Mon –

Tues –

Wed –

Thursday –

Friday-

Saturday/Sunday –

How am I looking to trade?

Going long into the end of the year

AOBC – 12/05 AMC

MRVL 12/03 AMC

www.myhurleyinvestment.com = Blogsite

support@hurleyinvestments.com = Email

Questions???

Tesla Cybertruck tug-of-war with a Ford F-150 is high stakes and highly unlikely

PUBLISHED TUE, NOV 26 20195:33 PM ESTUPDATED TUE, NOV 26 20197:06 PM EST

KEY POINTS

- Tesla CEO Elon Musk says the forthcoming Cybertruck performs better than a Ford F-150.

- A video Musk had made portrays the all-wheel-drive Tesla vehicle pulling a rear-wheel-drive Ford F-150 uphill.

- A Ford X exec, Sunny Madra, tweeted at Musk, challenging him to a fair fight. But a Ford spokesperson says the tweet was tongue-in-cheek.

Tesla CEO Elon Musk boasted this week on Twitter that his company’s forthcoming Cybertruck is a “Better truck than an F-150, faster than a Porsche 911.” He followed that claim by posting a video of the Cybertruck prototype ostensibly hauling a Ford F-150 uphill.

However, Musk and Tesla didn’t say which exact configuration of the Cybertruck, or F-150, they used for the stunt. And some viewers lobbed criticisms of an unfair fight at Musk, after seeing what was apparently an all-wheel-drive Cybertruck pulling a rear-wheel-drive Ford F-150 in the Tesla video.

On Monday, Ford X Vice President Sundeep (Sunny) Madra clapped back at Musk, urging him to send over a Cybertruck for an “apples to apples” tug-of-war test.

While fans of both companies are clamoring to see it, that contest is not likely to happen.

A Ford spokesperson told CNBC that Madra’s tweet was “tongue-in-cheek to point out the absurdity of Tesla’s video, nothing more.”

Tesla should be cautious about putting its Cybertruck prototype, and all the proprietary design and tech elements within it, into the hands of a competitor, too.

Auto industry analysts viewed Tesla’s bravado as fun marketing, but nothing more.

Sam Abuelsamid, principal research analyst at Navigant Research and an engineer, said, “Automakers do this kind of nonsense all the time, but Tesla takes it to the extreme.”

In its own stunt video this summer, Ford took its EV F-150 prototype to a train yard and pulled 42 F-150s loaded on 10 double-decker rail cars. Ford is partnering with another would-be Tesla competitor, Rivian, to make its push into electric vehicles.

Karl Brauer, executive publisher of Cox Automotive, said of the supposed tug-of-war captured on video, “It’s great for publicity, it’s great for media attention, and that’s all Elon is chasing right now.”

Ford, its partner Rivian, and General Motors are all expected to bring new electric pickups to market before or during the same time frame as the Tesla Cybertruck. Tesla said it should be nearing start of production for the Cybertruck in late 2021.

“This will be the first time Tesla will launch an all-new vehicle type after competitors have launched their pure-electric, all-new vehicles that directly compete with Tesla,” Brauer said. “I think he’s got much bigger things to worry about than glass that does or doesn’t break or whether or not his truck can pull another truck around.”

Musk’s track record doesn’t bode well for a tug-of-war happening for real, either.

In early November, for example, the Tesla leader taunted one of his biggest critics, Greenlight Capital’s David Einhorn. But he then invited the short seller to visit Tesla’s facilities to see how well the electric-car company is operating.

Einhorn, who taunted the CEO back in his reply, said yes to the invitation. But Tesla and Musk had yet to make arrangements for the visit, the investor tweeted on Nov. 22.

Brauer and Abuelsamid said if such a contest does ever become a reality, it would be best to put Ford’s all-electric F-150 prototype against the Tesla Cybertruck prototype. Or, Abuelsamid suggested, for both American automakers to use towing tests by SAE International, which assists in setting industry regulations and standards.

“There are other standardized metrics you can use for evaluating trucks that are standard for that market segment,” Abuelsamid said. But he added, given they’re prototypes, “it’s probably better to drop the whole thing. It’s irrelevant.”

After Musk made such bold claims, risk of embarrassment and loss of credibility for the CEO is very high. It’s equally high, if not more so, for Ford, whose F-series trucks have maintained their bestselling status for 42 years.

Still, Musk tweeted that he’ll aim to make this stunt happen, with a webcast, next week.

A self-proclaimed Musk fan, physicist Neil deGrasse Tyson, questioned Musk’s claims about the Cybertruck’s superior performance against an equivalent Ford truck.

He tweeted to the Tesla CEO, “Electric vehicles are famously heavy — over both axles. It’s all about the weight borne by spinning tires. That’s the source of traction, not the engine power.” And “We all love Torque. But high Torque just spins a tire in place if there’s not enough weight to provide traction.”

Ultimately, if the companies ever agree to an “apples to apples” competition, Tyson had a suggestion for the experiment’s design. He tweeted: “Fully load the F150, giving highest traction to its rear wheels, then try to drag that up the hill. I otherwise agree: Load both to the max and the highest torque wins.”

FAA says it again: Boeing’s 737 Max is not ready for certification

PUBLISHED TUE, NOV 26 20196:11 PM ESTUPDATED WED, NOV 27 20192:56 PM EST

KEY POINTS

- For the third time in two weeks, the FAA says publicly it will take all the time it needs to deem the Max safe.

- CNBC has asked Boeing if it sticks by its guidance of the 737 Max potentially returning to commercial service by the end of January. The company says it has not changed its outlook.

With just 35 days left in 2019, the FAA is making it increasingly clear it is unlikely to recertify the Boeing 737 Max this year, a target Boeing has been eyeing for months.

For the third time in two weeks, the FAA said publicly it will take all the time it needs to deem the Max safe. The FAA issued a new statement, saying, “The FAA has not completed its review of the 737 Max aircraft design changes and associated pilot training. The agency will not approve the aircraft for return to service until it has completed numerous rounds of rigorous testing.”

CNBC has asked Boeing if it sticks by its guidance of the 737 Max potentially returning to commercial service by the end of January. The company says it has not changed its outlook.

This is the latest move by the FAA to publicly push back on Boeing’s belief that Max deliveries could resume soon. In its most recent 737 Max progress report issued on Nov. 11, Boeing said it is “possible that the resumption of Max deliveries to airline customers could begin in December, after certification, when the FAA issues an Airworthiness Directive rescinding the grounding order.”

Boeing’s suggestion the Max is close to returning did not sit well with the FAA and Administrator Steve Dickson. Four days after Boeing’s statement, Dickson released an internal letter he sent to the FAA’s associate administrator who oversees the Max certification process. “The FAA fully controls the approval process,” Dickson wrote.

The message could not be missed: The FAA will not rush the certification of the Max simply because Boeing believes the process should be completed by a certain date. To drive that point home, Dickson posted a video message to FAA employees the following day saying, “I’ll support the time that you need to conduct a thorough, deliberate process for a safe return to service.”

For the 737 Max to be recertified to fly this year it will have to clear several hurdles in a short time. For starters, the FAA must conduct Human Factors Testing to evaluate the revamped MCAS flight control software.

That testing, which takes up to three to four days is expected to start next week, according to one person familiar with the Max timeline. By mid-December, the Max may finally make its certification flight. When it’s over, it could take a week or two to analyze the data and complete a final report on that flight.

In addition, the Joint Operational Evaluation Board simulator trials with line pilots evaluating the updated training for the Max still needs to take place. Finally, the FAA’s Flight Standardization Board needs to file its report on MCAS, which then will start a public comment period of one to two weeks.

Only after all of those steps are completed will the FAA lift the grounding of the Max with an Airworthiness Certificate. In its latest statement, the FAA said, “Issuance of the Airworthiness Certificate is the final FAA action affirming that each newly manufactured 737 Max is airworthy.”

Black Friday shoppers spend record $7.4 billion in second largest online sales day ever

PUBLISHED SAT, NOV 30 201912:28 PM EST

KEY POINTS

- Black Friday online sales reached $7.4 billion, the second largest online shopping day ever, behind last year’s Cyber Monday, according to Adobe Analytics.

- Abode still predicts an even larger Cyber Monday, estimating sales of $9.4 billion.

- “Small Business Saturday” has taken in about $470 million as of 9 a.m. ET, on pace to top $3 billion, according to Adobe.

Black Friday shoppers spent $7.4 billion online, the second largest Internet shopping day ever, according to data compiled by Adobe Analytics.

The $7.4 billion marked the biggest sales day ever for Black Friday and trailed only last year’s Cyber Monday’s $7.9 billion for the number 1 spot of all-time in online revenue, according to Adobe’s data. The average order value per consumer, at $168, was up nearly 6% year-over-year and also set a new Black Friday record. Adobe Analytics measures transactions from 80 of the top 100 U.S. online retailers.

“Small Business Saturday” has already seen $470 million in online spend, up 18% over last year, as of 9 a.m. ET. Sales are on pace to surpass $3 billion for the day, said Adobe.

“With Christmas now rapidly approaching, consumers increasingly jumped on their phones rather than standing in line,” said Taylor Schreiner, principal analyst and head of Adobe Digital Insights, in a statement. “Small Business Saturday will accelerate sales for those retailers who can offer unique products or services that the retail giants can’t provide.”

Online sales are up about 20% from last year, according to Adobe. The jump in cyber activity is a sign consumers are becoming more comfortable buying larger items at discount prices without going to the store. Adobe is still expecting spending on Cyber Monday this year to hit an even bigger record $9.4 billion, an 18.9% jump from a year ago.

Shoppers have already spent $4.2 billion online on Thanksgiving Day, a 14.5% increase from last year and a record high, Adobe said Friday. Some of the most popular purchased items include Disney’s “Frozen 2” toys, video games such as FIFA 20 and Madden 20, and electronics such as Apple Airpods and Samsung TVs.

While some traditional brick-and-mortar stores have successfully transitioned to online shopping, such as Target and Walmart, others including Kohl’s, Gap and Macy’s have struggled. Target’s stock has risen about 95% this year and Walmart has surged nearly 30% while Kohl’s, Gap and Macy’s shares are down 25% or more year to date.

Powell says the Fed is ‘strongly committed’ to 2% inflation goal, a sign that rates are likely to hold steady

PUBLISHED MON, NOV 25 20197:00 PM ESTUPDATED TUE, NOV 26 20197:43 AM EST

Jeff Cox@JEFF.COX.7528@JEFFCOXCNBCCOM

KEY POINTS

- Fed Chairman Jerome Powell says the central bank is “strongly committed” to maintaining 2% inflation.

- The remarks are further indication that the central bank is unlikely to raise rates anytime soon.

- Powell also draws attention to low labor force participation and middling wage gains.

With the final 2019 meeting of Federal Reserve policymakers just two weeks away, Chairman Jerome Powell signaled that interest rates are unlikely to rise anytime soon, saying Monday that the central bank remains firmly committed to meeting its inflation goals.

The Fed considers a 2% inflation rate to be a sign of sustainable growth and a level that keeps interest rates high enough to allow for mobility in the event of an economic downturn. However, inflation has run well below that level for 2019 despite three interest rate cuts over the past four months.

In a speech in Providence, Rhode Island, Powell expressed a sense of urgency in meeting the inflation part of the Fed’s dual mandate. He said low inflation expectations feed on themselves and make it tougher for the Fed to support the economy.

The chairman said in prepared remarks that “it is essential that we at the Fed use our tools to make sure that we do not permit an unhealthy downward drift in inflation expectations and inflation. We are strongly committed to symmetrically and sustainably achieving our 2 percent inflation objective so that in making long-term plans, households and businesses can reasonably expect 2 percent inflation over time.”

A symmetric goal means policymakers would be content with inflation running a little above or below 2%. Other Fed officials have said that a period of time above 2% would be fine, with some members suggesting the Fed make an express commitment not to raise rates until the goal is met. Higher rates are used to keep inflation low.

The Fed’s next policy meeting is Dec. 10-11.

Broadly speaking, Powell repeated language he and other officials have used lately, saying he sees “the current stance of monetary policy as likely to remain appropriate” and “well positioned” so long as current “generally good” conditions persist. The Federal Open Market Committee at its October meeting cut its benchmark rate another quarter point to a range of 1.5%-1.75%.

“At this point in the long expansion, I see the glass as much more than half full. With the right policies, we can fill it further, building on the gains so far and spreading the benefits more broadly to all Americans,” he said.

In addition to the inflation commitment, Powell also elaborated on another issue that has gained more attention in recent days, namely the still-low labor force participation rate in the U.S. as well as the fairly muted wage gains.

While the current labor force participation level is 63.3%, the highest in more than six years, Powell said it still is low compared with other countries and is another area of focus the Fed could use to ensure that the benefits of the decade-long recovery are spread more evenly. The prerecession participation rate was above 66%.

Powell said the Fed can help the participation and wage issues “by steadfastly pursuing our goals of maximum employment and price stability” though he said broader programs to support higher wages and a more engaged labor force are “beyond the scope of monetary policy” and more suited to legislators in Congress.

“These policies could bring immense benefits both to the lives of workers and families directly affected and to the strength of the economy overall,” he said.

Charles Schwab just broke one of Warren Buffett’s biggest rules about acquisitions

PUBLISHED MON, NOV 25 20192:21 PM ESTUPDATED TUE, NOV 26 201910:14 AM EST

KEY POINTS

- Warren Buffett has said in the past that companies should not use their shares to make acquisitions.

- It’s one of many rules about market buying and spending that the Berkshire Hathaway chairman and CEO has laid out over the years.

- He supports stock buybacks at companies, including Apple, but also thinks many corporations misuse share repurchases.

- Berkshire has a record near-$130 billion in cash, but in the current market environment Buffett has said buying parts of companies through stock purchases makes more sense than overpriced acquisitions.

With two huge mergers being the talk of Wall Street, which one would Warren Buffett do?

On Monday Charles Schwab announced a $26 billion all-stock deal for TD Ameritrade. LVMH, meanwhile, approved on Sunday a $16 billion all-cash deal for Tiffany’s.

Most investors know that Buffett, chairman and CEO of Berkshire Hathaway, is full of advice for individual investors. But the Oracle of Omaha’s market musings — doled out year after year across decades of annual letters to Berkshire shareholders and interviews — are also reflected in the actions of major corporations and the ways in which they leverage their balance sheets.

The two big corporate acquisitions show divergent paths when it comes to one of Buffett’s strongly stated beliefs about making deals: Don’t use your own stock. Use cash. Buffett’s rules of the road for acquisitions have been expressed in years of shareholder letters.

His advice to CFOs, implicitly, shows up in these letters, according to the editor of “The Essays of Warren Buffett” and George Washington University professor Lawrence Cunningham. Read enough of them and the 89-year-old chief executive of Berkshire Hathaway gets around to giving his distinctively value-tinged, commonsense approaches to accounting, mergers, stock buybacks, dividends and other tricks of the trade to build value.

“Everyone sort of nods when they’re reading, but then they don’t listen,” said Cunningham, a corporate-governance expert at George Washington University Law School. The fifth edition of the book-length distillation of Buffett’s decades of shareholder letters just came out. “Then they go make the mistakes themselves.”

Berkshire famously never has paid a cash dividend, for example, and has moved more slowly on stock buybacks than most companies of its size (its market capitalization is $535 billion).

Especially, Buffett sounds repeated warnings on the subject of acquisitions, though Berkshire itself has been a serial acquirer — either of whole companies like Geico and the Burlington Northern Railroad or of big stakes in public companies like Apple, IBM and American Express.

Buffett’s preference for cash over stock in M&A can be summed up this way:

If a company is in a position to buy a rival, it’s probably in better shape than the target is, and that means its stock is worth more of a premium, Buffett wrote in 1997. Paying cash helps the acquirer avoid giving away the appreciation of its existing business to holders of the company getting bought out, which, if you’re doing it right, is larger than the gain likely to come from the acquisition, he wrote.

“For a baseball team, acquiring a player who can expected to bat .350 is almost always a wonderful event — except when the team must trade a player hitting .380 to make the deal,” Buffett wrote.

In one instance of Buffett going public with this belief about giving away shares in a deal he chastised then Kraft CEO Irene Rosenfeld in 2010 for using Kraft shares in a takeover of Cadbury. He did break his own all-cash rule once, notably, using a combination of cash and shares to buy Burlington Northern, at the time Berkshire’s biggest acquisition ever.

News of the Schwab and LVMH deals hit just as a new edition of the Buffett book is hitting the stands. And the headlines underscore how timely Buffett’s advice remains for corporate titans. The 89-year old has long been known in his personal life for being a bit of a miser, eating McDonald’s for breakfast and living in the same modest home in Omaha for decades. When it comes to spending a company’s cash or stock, in acquisitions or otherwise, his grip on his wallet is no more loose.

Why Schwab analysts say the stock deal is OK

Analysts who cover the brokerage industry say Buffett’s words are wise, but the specifics of the Schwab-TD Ameritrade deal make the decision to finance it with stock a reasonable one.

“Buffett has over $100 billion in cash. Schwab had about $20 billion at Sept. 30, so could not have financed this entire transaction with cash,” wrote Argus Research analyst Stephen Biggar in an email.

Morningstar analyst Michael Wong said for Schwab shareholders the deal probably would have been more accretive if it was cash financed, but he does think that TD Ameritrade would have balked at a $26 billion valuation in cash. “Even if Schwab shareholders gave up a little bit of the value by issuing shares, both are better off from this deal.”

That’s because the long-term synergies that would result from the combination of the similar businesses — which should reach into billions of dollars — would have required a much higher cash premium in a deal. A stock deal allows shareholders to benefit from those synergies — albeit always uncertain in the initial estimation on deal date — that can accrue over time.

Schwab is trading at 19.5x 2020 earnings, while AMTD is at 16.5x. Both stocks have risen since news of the deal was first broken by CNBC.

“Both shares rising is an indication that investors see the merit in the expected 15%-20% cash EPS accretion by this third year,” Biggar wrote. “While true that financing is currently inexpensive, keep in mind Schwab is trading at 19.5x 2020 earnings, while AMTD is at 16.5x, so Schwab is buying a similar revenue stream with a more favorable currency.”

Biggar also noted that TD Ameritrade shares are 43% held by Toronto-Dominion, a large shareholder unlikely to sell.

Schwab did not respond to a request for comment.

Where Buffett sees market opportunity

Buffett also says to consider buying part of the business rather than all of it. Buying shares in open markets, as Berkshire often does (it has reported stakes in about 45 other public companies) lets Buffett and his team, led by vice chair Charlie Munger and investment officers Todd Combs and Ted Weschler, avoid paying takeover premiums in order to get a piece of the business, while still building value for Berkshire stockholders.

In fact, right now that is Buffett’s publicly stated preference. Even as Berkshire’s cash hoard has grown to near-$130 billion, Buffett has been reluctant to make big deals. Buffett wrote in last year’s annual letter that he continues to hunt for the “elephant-sized” acquisition:

“In recent years, the sensible course for us to follow has been clear: Many stocks have offered far more for our money than we could obtain by purchasing businesses in their entirety. That disparity led us to buy about $43 billion of marketable equities last year, while selling only $19 billion. Charlie and I believe the companies in which we invested offered excellent value, far exceeding that available in takeover transactions. … That disappointing reality means that 2019 will likely see us again expanding our holdings of marketable equities. We continue, nevertheless, to hope for an elephant-sized acquisition.”

Buffett on buybacks and dividends

Here are some more of Buffett’s biggest beliefs for the C-suite.

Don’t fall in love with your own management skills. Too many acquirers think their kiss alone will turn a toad of a company into a prince, Buffett wrote in a witty 1981 letter. It rarely happens. That leads to Buffett’s most famous rule of acquisitions: It’s better to buy a good company at a fair price than a fair company at a good price, an idea he explained in 1992.

“We have occasionally tried to buy toads at bargain prices,” Buffett said. “Clearly our kisses fell flat. We’ve done well with a couple of prices — but they were princes when purchased. At least our kisses didn’t turn them into toads.”

A similar combination of skepticism (about the market) and belief (in Berkshire’s own business) explains why Buffett doesn’t believe in cash dividends, Cunningham said.

Dividends should be paid in cash only when the company doesn’t have a better place to invest the money in its own business, a point Buffett explained in 1984 with a math-dense illustration of why that’s rarely so for a well-run company.

Buy more of your own stock. One place where the cash can often be put to good work is on stock buybacks, as long as management is disciplined, Buffett said, on a topic he has revisited five times in shareholder letters, as recently as 2018. Bought at the right price, the shrinking share base will boost earnings per share.

But management too often falls for the hype around their own stock and overpay, Buffett wrote in the bubble year of 1999. At Berkshire the rule had long been that the company won’t pay more than 110% of shares’ intrinsic value, a subjective measurement of the value of future cash flows projected by management, but it has more recently broken that rule to snag large blocks of shares when they became available.

“By making repurchases when a company’s market value is well below its business value, management clearly demonstrates that it is given to actions that enhance the wealth of shareholders, rather than to actions that expand management’s domain but that do nothing for (or even harm) shareholders,” Buffett wrote in 1984. “Investors should pay more for a business that is lodged in the hands of a manager with demonstrated pro-shareholder leanings than for one in the hands of a self-interested manager marching to a different drummer.″

Look beyond earnings. One place where Buffett isn’t all that traditional is in thinking about earnings, Cunningham said. While Berkshire follows accounting rules in reporting its results, Buffett is open about the fact that he thinks more about other measures of economic results than accounting earnings. Beginning In 1980, he has devoted parts of several letters to a concept he calls “look-through earnings,″ advocating for investors and managers to look beyond reported profits and losses under generally accepted accounting principles.

In Berkshire’s case the big difference between the two is that its reported profits can fluctuate based on the value of its investment holdings. A U.S. accounting rule requires earnings to incorporate unrealized gains, including on investments such as Apple and Bank of America. Buffett said the resulting volatility can mislead investors.

And Buffett reserves particular scorn for managers who put too much emphasis on consistent yearly growth in earnings per share, Cunningham said. Berkshire doesn’t issue profit guidance, unlike more than half of big companies, because he thinks “no one has any idea what next year looks like.”

But the avoidance of short-term forecasts, and the emphasis on steady quarterly profit gains they induce, is only part of a good CFO’s task of communicating clearly and promoting a stable financial base for their company, Cunningham said. Buffett thinks of steady financial stewardship as the center of an ongoing strategy to attract shareholders who behave like Berkshire’s — they hold the shares a long time and give management running room to succeed. That’s the CFO’s ultimate job, he said.

“The CFO is the public face of a company’s shareholder orientation,” Cunningham said. “If the CFO doesn’t want activist shareholders telling them what to do, speak day to day is high-quality language. That attracts high-quality investors. Ask yourself, What would Buffett like to do? And you’ll get shareholders like that.″

On the long-term view, Morningstar’s Wong said the Schwab deal shows concern well beyond the next quarter.

He said Schwab made this deal now because its future competitive set may not be limited to a handful of online brokers, but the Wall Street giants like Bank of America, J.P. Morgan and BlackRock, as technology allows the biggest firms to go down-market in terms of average client size, direct to investors through online arms, and across more business segments.

It is not just going to be E-Trade, TD Ameritrade, Vanguard and Fidelity in 10 years’ time when it comes to online and wealth management competition, and Schwab is thinking long-term by preparing for greater competition today, even if it costs them in stock, Wong said.

Biggar said there is a “first-mover advantage” for Schwab in an industry that is fragmented today. “Future big tie-ups will necessarily mean less competition, while Schwab will have already gotten approval – i.e. regulatory scrutiny will be much higher when future partners will be trying to justify themselves as a second player with a 30-40% market share.”

U.S. Proposes Duties on $2.4 Billion of French Goods Over Tech Tax

By William Horobin , Jenny Leonard , and Laura Davison

December 2, 2019, 3:53 PM MST Updated on December 2, 2019, 4:44 PM MST

Potential targets for duties include wine, cheese, handbags

USTR exploring similar probes of Austria, Italy and Turkey

The U.S. proposed tariffs on roughly $2.4 billion in French products, in response to a tax on digital revenues that hits large American tech companies including Google, Apple Inc., Facebook Inc. and Amazon.com Inc.

“France’s digital services tax discriminates against U.S. companies,” the office of the United States Trade Representative said in a statement Monday.

USTR Robert Lighthizer said the agency is also exploring whether to open investigations into similar digital taxes by Austria, Italy and Turkey. The move comes hours after President Donald Trump announced a barrage of other tariffs on steel and aluminum from Argentina and Brazil.

“USTR’s decision today sends a clear signal that the United States will take action against digital tax regimes that discriminate or otherwise impose undue burdens on U.S. companies,” Lighthizer said in the statement. “The USTR is focused on countering the growing protectionism of EU member states, which unfairly targets U.S. companies.”

The tariffs would be imposed after a public comment period concludes in early 2020 and interested parties have a chance to weigh in on the proposed duties.

Wine, Cheese

Monday’s report concludes more than four-month-long probe, known as a Section 301 investigation, into France’s tax regime, which Lighthizer in July said “unfairly targets American companies.” The same law was used last year to examine China’s intellectual property practices that led to tariffs on more than $360 billion in Chinese goods.

QuickTake: How ‘Digital Tax’ Plans in Europe Hit U.S. Tech

Trump in August suggested tariffs of up to 100% on French wine and told aides that while he’s not generally empathetic with U.S. tech companies, he believes it should be the U.S. — not any other country — that taxes them, people familiar with internal deliberations said.

In the statement Monday, USTR said the proposed action includes “additional duties of up to 100% on certain French products.”

Sparkling wine, cheeses, handbags and makeup are on the list of potential tariff targets, according to the notice. An official at the French Finance Ministry declined to comment and said Minister Bruno le Maire would speak on the matter Tuesday.

Trump, Macron

The U.S. move is a setback for efforts to stop a conflict over digital tax from intensifying. President Donald Trump and France’s Emmanuel Macron agreed in August to try to find a compromise, but a 90-day deadline for talks expired last week without a resolution.

The U.S. tariffs and the French tax are likely to be a priority during a meeting between Trump and Macron on Tuesday, on the sidelines of a NATO conference in London.

Macron argues that moving ahead with a tax on tech companies is necessary because the structure of the global economy has shifted to one based on data, rendering current systems archaic. His government is trying to use France’s national tax as a bargaining chip, saying it would withdraw it if there is agreement on an international solution — in talks under the stewardship of the Organization for Economic Cooperation and Development.

There were signs of progress in recent weeks when the OECD proposed a “unified approach” to merge proposals that differed over whether to single out digital companies or have a broader approach. But French Finance Minister Le Maire said ahead of the USTR announcement that the U.S. has backed off from supporting an OECD compromise.

Global Solution

“They’ve said they aren’t sure they want a solution at the OECD,” Le Maire said on radio station France Inter. “We will never abandon our will to tax digital giants in a fair way.”

Senators Chuck Grassley and Ron Wyden, the bipartisan duo leading the Finance Committee, called the French digital services tax “unreasonable, protectionist and discriminatory,” in a statement.

“We encourage other member states considering similar actions to work within the OECD framework toward a comprehensive solution,” they said.

The Internet Association, which represents tech companies, said France’s levy is “one of a growing number of concerning unilateral tax regimes around the world,” and advocated for a global solution in response to the announcement.

Digital Sales

France’s tax, retroactive to January, affects companies with at least 750 million euros ($830 million) in global revenue and digital sales of 25 million euros in France. While most of the roughly 30 businesses affected are American, the list also includes Chinese, German, British and French companies.

The French government says it’s urgent to overhaul tax rules because the average tax rate for digital companies in the European Union is only 9.5%, compared with 23.2% for other companies.

An attempt to agree on a Europe-wide tax fell through earlier this year when four countries — Sweden, Finland, Denmark and Ireland — declined to sign off on it. But Margrethe Vestager, currently the EU’s antitrust chief, said last week the bloc would try to find unity again if there isn’t a global agreement.

Other European countries are also planning to levy a digital tax without waiting for the OECD. Italy’s government has said it will implement a tax on digital revenues Jan. 1, and Boris Johnson‘s conservative party, which leads the polls in the U.K. election, has committed to a digital services tax.

(Updates with comment from Senators Grassley and Wyden.)

HI Financial Services Mid-Week 06-24-2014