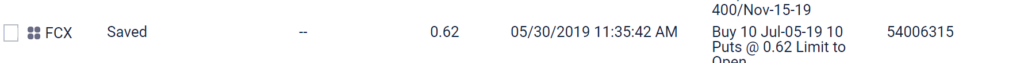

Trade Findings and Adjustments 05-30-2019

FCX

Why lose out on $0.61 of potential profit over a single PENNY $0.01

Or why lose out on 98.39% of the original profit potential over the 1.61% I’m missing

It comes back down to a risk to reward for my personal risk tolerance

I DON’T want to buy the shares which means I would be rolling short puts for a net credit for some time

I don’t like that it broke the $10 round and horizontal support level

Not sure how long it will be with out a China deal to move this stock higher

IF I had to do a trade Visa is it

BTO 162.15 share of stock

STO Jul 05-10 $165 short call for 2.68

Max Profit $5.53 or 3.45% ROI for 36 days

Break even $159.47 on a stagnant moving stock

Support around $159.26 and

Secondary or Adjustment would be to add $160 or $157.50 long calls for the next earnings