HI Market View Commentary 05-20-2019

Big money will be out of the market on Wednesday – Friday as we have Memorial Day weekend

Markets are closed next Monday so have a wonderful 3 day weekend

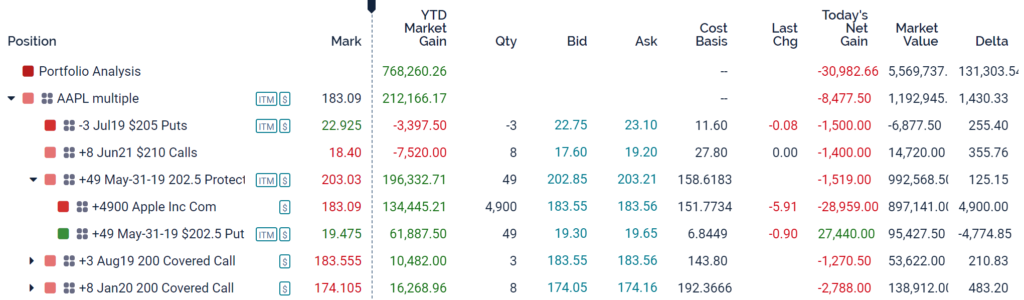

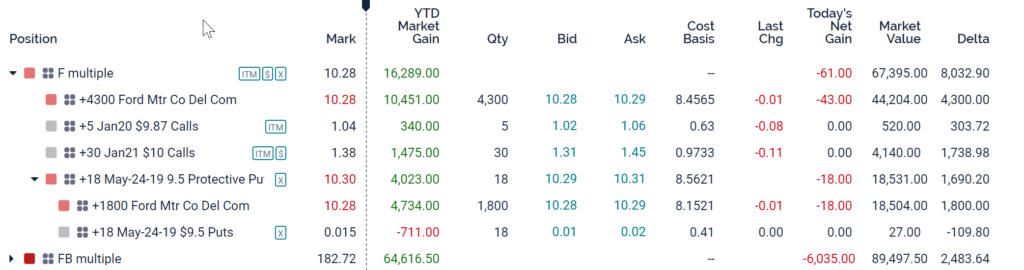

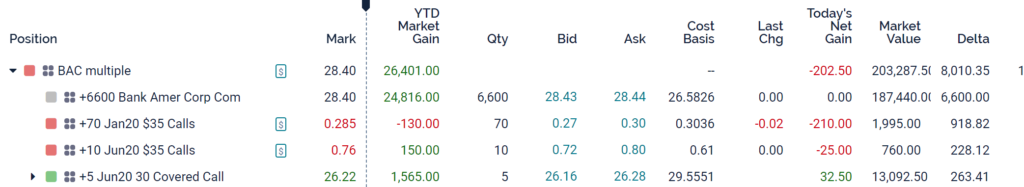

You lost money today? DUH -$28, 586 or 0.409% while the S&P 500 was down -0.67

Our process is to try to made up some of the downward movement on our stocks

F, UAA, DIS, V, FB long calls, BAC, are without protection as we took them off last wek before the options expired

AAPL, BIDU still have protection on the stock

Kevin we are getting killed on BIDU today

What the heck is happing with F losing 7000 Jobs?

BAC long calls are losing tons of money

There are times when it is hard as hell to sit on your hands and allow stocks to move like stocks move. WHY? Because if you are always protected at a cost of an ATM long put you have 28% of your growth you are giving away by buying protection.

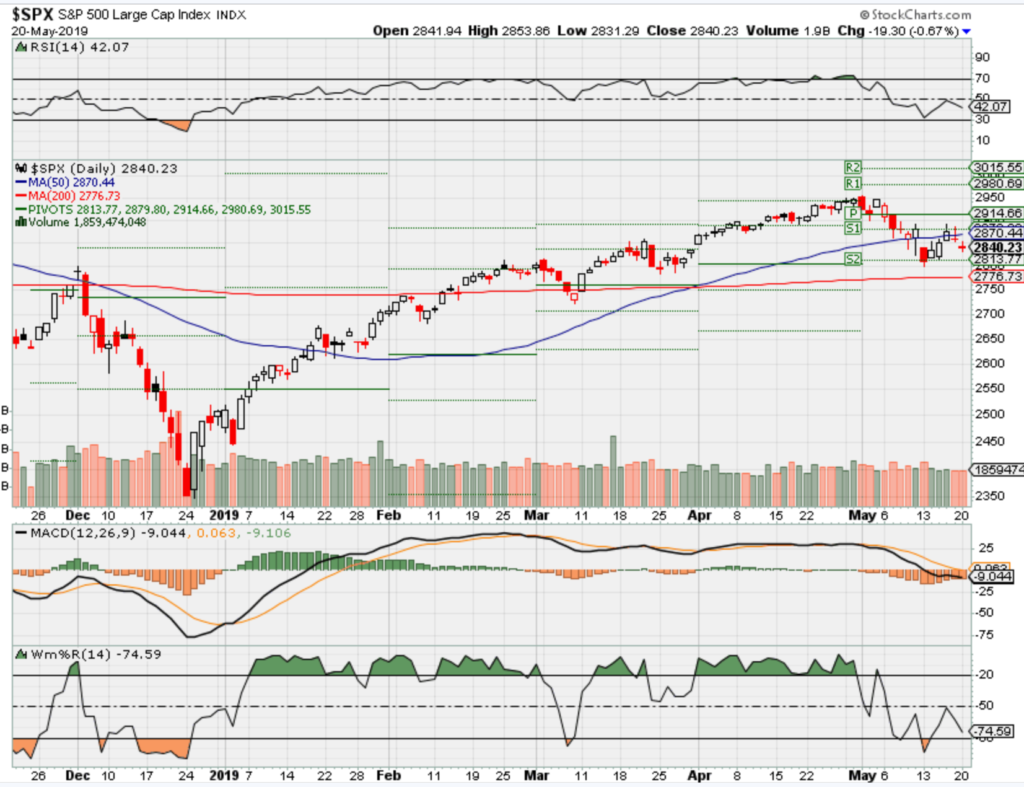

Where will our markets end this week?

Lower

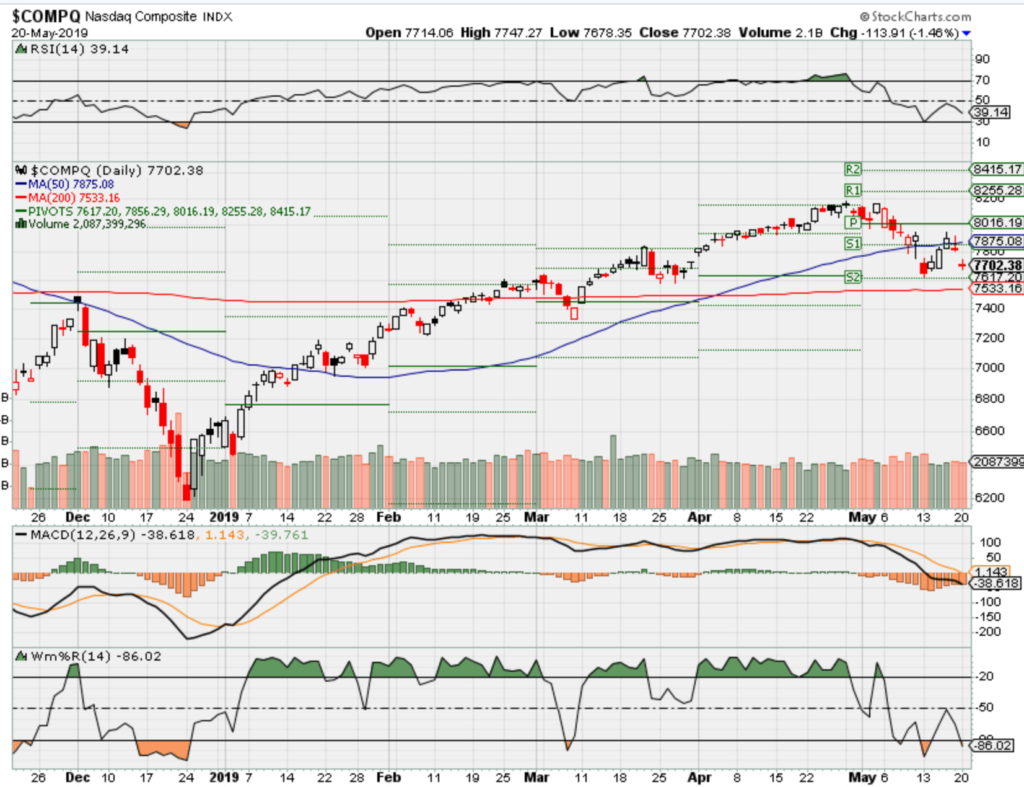

DJIA – Bearish

SPX – Bearish

COMP – Bearish

Where Will the SPX end May 2019?

05-20-2019 -1.0%

05-13-2019 0.0%

05-06-2019 3.0%

04-29-2019 3.0%

Earnings:

Mon: NDSN

Tues: AZO, HD, JCP, KSS, TJX, JWN, TOL, URBN

Wed: TGT, LOW, VFC, CTRP, LB, NTAP

Thur: BBY, BJ, HPQ, INTU, ROST

Fri: BKE, FL

Econ Reports:

Mon:

Tues: Existing Home Sales

Wed: MBA, FOMC Minutes

Thur: Initial, Continuing, New Home Sales,

Fri: Durable Goods, Durable ex-trans

Int’l:

Mon –

Tues –

Wed –

Thursday –

Friday-

Sunday –

How am I looking to trade?

Extending protection out from Earnings

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

A Short squeeze is when there are a larger number of shorts (+2.0%) of the float and to cover the squeeze people start bidding the stock price up as they are covering there short positions to lock in a profit.

https://seekingalpha.com/article/4265242-3-reasons-park-money-disney#alt1

3 Reasons To Park Your Money With Disney

May 20, 2019 8:50 AM ET

Summary

Disney has done a big theme park attraction opening before with what was the biggest movie of all time. The results speak for themselves.

The magic of Harry Potter brought Comcast better results too.

If we run the numbers, Disney seems poised to beat revenue expectations this quarter and next.

To say that The Walt Disney Company (NYSE: DIS) has caught the attention of Wall Street is an understatement. The shares are up more than 25% year-to-date, and you would have to live under a rock to not know how well Avengers: Endgame is doing. Investors seem to be focused on the company’s Studio Entertainment business and the future with Disney+. However, there are several reasons that Disney’s Parks and Resorts business could be a solid reason to buy the shares today. The park’s Star Wars: Galaxy’s Edge attractions should help drive earnings not only this year, but well into the future.

What do you do with a big box office hit? Create a theme park attraction.

It’s certainly no secret that Disney has some of the most successful theme parks in the world. In the most recent quarter, the company generated more than 40% of its revenue from Parks and Resorts. Disney plans to open Star Wars: Galaxy’s Edge attraction in Disneyland on May 31 of this year, followed by the Disney World opening on August 29. The Star Wars franchise has been around for decades, yet these attractions according to Disney are, “the largest Disney has ever created.”

To get an idea of how these openings may drive Disney’s earnings, it makes sense to look at other big theme park openings. Since Star Wars is an iconic franchise, it only makes sense to look at attractions tied to equally significant movie properties.

Start at the top

The first reason investors should park their money with Disney is tied to previous experience opening a large theme park attraction. While it seems a near certainty that Avengers: Endgame will become the biggest box office hit of all time, at this moment, Avatar still holds that title. The popularity of Avatar led Disney, 20th Century Fox, and James Cameron’s Lightstorm Entertainment to sign an exclusive worldwide licensing agreement for the theme park rights. Nearly 6 years after this agreement, Pandora – The World of Avatar opened.

Theoretically customers are excited about new rides and attractions and Disney has seen this play out over and over again. In the quarter prior to the Avatar opening, Disney’s Parks and Resorts revenue was $4.3 billion, an increase of 9% annually. During this same quarter, operating margin came in at $750 million, or 17.4%.

Immediately following the Avatar opening, the lift in Disney’s results was obvious. Parks and Resorts reported revenue of $4.89 billion, which was a 12% increase year-over-year. Along with a faster revenue growth rate, Disney benefitted from better leverage at its parks and reported an operating margin of $1.17 billion, or 23.9%.

By opening a new attraction that guests wanted to visit, Disney not only grew revenue at a 3% faster rate, but also increased its operating margin by more than 6%. This seems like a decent lift from a new attraction, but is this a unique occurrence? There is at least one other case study that suggests Disney’s upcoming Star Wars attraction will help drive the company’s sales and profits.

This isn’t exactly magic

The second reason investors should park their money with Disney is connected to Comcast’s (NASDAQ: CMCSA) experience opening The Wizarding World of Harry Potter. Warner Bros. and Universal Studios came to an agreement to develop the attraction in 2007. Three years after, Diagon Alley, Harry Potter and the Escape from Gringotts and the Hogwarts Express were brought to the world.

In a similar manner to Disney’s experience, Comcast witnessed an even more pronounced uptick in its results after Harry Potter came to town. In the quarter a year prior to these attractions, Comcast’s Theme Parks division reported revenue of $487 million, which was an increase of 5.4% year-over-year. During this same quarter, Theme Parks showed an operating margin of $101 million or 20.7%.

After the Harry Potter opening, Comcast’s Parks revenue popped to $615 million or an increase of 12.6% annually. With such a significant draw for the park, the division’s operating margin increased to $171 million or 27.8%. It seems obvious that there is a direct correlation between opening a new theme park attraction and better financial results.

Betting on Parks’ performance to keep investors on the Edge of their seat

The third reason for investors to park their money with Disney is it looks like Disney has a chance to post better than expected revenue for this next quarter. In addition, this outperformance has a chance to continue into the following quarter as well. Breaking down the potential performance of each segment gives us a view of what investors might expect.

One of Disney’s largest divisions is Media Networks, which has been reporting revenue of between $5.5 billion and $6 billion over the last several quarters. In last year’s similar quarter, Media Networks reported revenue of $6.2 billion. It’s worth noting that about two-thirds of this revenue is derived from Cable Networks (think ESPN), which reported 2% annual revenue growth last quarter. Given this next quarter is usually stronger for the Media division, it’s not far-fetched to expect an annual increase of 2% to $6.3 billion in the June quarter.

The company’s Studio Entertainment division is expected to get a big lift from the combined success of Captain Marvel and Avengers: Endgame. That being said, Disney’s CFO Christine McCarthy tried to temper investors’ excitement in the last conference call. She said, “Given the size of cast involved…the cost to produce a film of that scale of magnitude and length, while we expect the results for this film to be terrific, they will be tempered somewhat by the cost structure.”

The key to getting a sense of how Studio Entertainment might do this year, we can compare the box office receipts in comparable time frames. Last year, Disney had Avengers: Infinity War and Incredibles 2 was in theaters for 15 days before the end of the quarter. Infinity War generated about $2 billion in sales, while Incredibles 2 did $1.2 billion. It’s likely given the timing that at least half of the sales from Incredibles 2 fell into the next quarter last year.

Captain Marvel and Avengers: Endgame should almost completely book in the current quarter given their release dates. Disney should also get some revenue from Aladdin sales, which opens May 24. Captain Marvel has already been an unabashed hit, with a worldwide gross of $1.1 billion. If we compare this to roughly half of the revenue for the short release of Incredibles 2, this suggest Captain Marvel should add about $500 million of gross receipts compared to last year’s quarter.

Avengers: Endgame has been a massive hit, eclipsing Infinity War with over $2.5 billion in gross receipts. This puts Endgame a solid $500 million ahead of Infinity War with more to come. Aladdin is a tougher comparison, as the last movie was both animated and released 27 years ago. Based on gross receiptsof the original Aladdin in 1992, adjusting for inflation, the original film gross today would be worth about $900 million. Even if Aladdin only captures 25% of this total in the first few days of release, this would represent an additional $225 million in gross receipts.

Comparing the two periods, last year Disney posted about $2.6 billion in gross receipts and the company generated $2.9 billion in revenue in the June 2018 quarter. This year, theoretically Disney could post gross receipts of at least $3.8 billion. Two things to keep in mind, one is Endgame’s sales continue to climb. Two, receipts for Aladdin may capture more than 25% of gross receipts (a conservative estimate). It seems possible Studio Entertainment could end up with receipts north of the $4 billion mark easily. For our estimates, I’m comfortable assuming revenue from the division of between $4.5 and $5 billion.

Looking at 21st Century Fox (21CF), last quarter the division produced $373 million in revenue in just 11 days. Using this as a template, in the current quarter 21CF would generate about $3.1 billion in revenue. Disney’s Consumer Products & Interactive Media generated about $1 billion in revenue in last year’s similar quarter. Given the huge success of Endgame, and the pre-sale of products related to this and Captain Marvel, it’s not unreasonable to expect 15% growth year over year. This division, which is now Direct-to-Consumer & International grew by 15% last quarter on a year-over-year basis.

This leads us to the Parks and Resorts division. We saw from Disney’s experience with Avatar a lift in revenue of about 3%. Comcast’s experience with Harry Potter drove a faster revenue growth rate of 7%. During the June 2018 quarter, Parks and Resorts generated $5.2 billion in revenue, which represented an annual growth rate of 6%. With the addition of Galaxy’s Edge it’s not unreasonable to expect a lift of 3% to 7% to this growth rate. This would indicate revenue growth of 9% to 13% annually or $5.6 to $5.9 billion.

Adding it up

In the June quarter, analysts are calling for revenue of $20.91 billion in revenue. If we look at the combination of assumptions, investors should feel good about Disney’s ability to beat expectations. At the low end, Disney could report revenue of $20.7 billion. However, at the high end, the company’s revenue would come in at $21.5 billion. In addition, I believe these are relatively conservative assumptions and we’re essentially working with Studio numbers that still have two more weeks to climb.

In addition, Star Wars: Galaxy’s Edge is the largest addition Disney has ever done by its own admission. It seems possible that this attraction could increase Parks and Resorts sales by a larger amount than assumed. The bottom line is Disney’s stock is up this year already, but beating expectations in the current quarter should provide a further lift in the stock. The August opening of Galaxy’s Edge in Florida should give a lift to September results as well. The bottom line, is Long-term investors should feel comfortable parking their funds in Disney stock.

Disclosure: I am/we are long CMCSA. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

https://seekingalpha.com/news/3465167-facebook-sets-swiss-fintech-blockchain-payments

Facebook sets up Swiss fintech for blockchain, payments

May 17, 2019 5:53 PM ET|About: Facebook, Inc. (FB)|By: Jason Aycock, SA News Editor

Facebook (NASDAQ:FB) has established a financial technology company in Switzerland, enabling a focus on payments and blockchain.

Libra Networks was established in Geneva, and the company is owned by Ireland’s Facebook Global Holdings II.

The commercial register shows the company is set up to offer financial and technology services and develop related hardware and software.

That could mean advancements on a Facebook-based cryptocurrency — one that would be tied to the U.S. dollar and potentially much more stable than Bitcoin.

Previously: Report: Facebook looking to VC funding for cryptocurrency (Apr. 08 2019)

Apple stock could jump by as much as 530%, despite Trump’s trade war on China

Editor-at-Large

Yahoo FinanceMay 17, 2019

At least from a technical analysis perspective, Apple’s stock is poised to laugh in the face of President Donald Trump’s raging trade war with China.

Apple’s (AAPL) stock has formed what traders call a “golden cross” chart pattern. The formation — typically a bullish signal —happens when a short-term moving average crosses over a longer term moving average.

One could see that formation below for Apple, compliments of Miller Tabak strategist Matt Maley. It’s interesting that the stock has made this pattern considering the fundamental risk to Apple’s business model from the now heightened U.S.-China trade war.

Maley notes that Apple’s stock has acted very well after its last three golden cross patterns. Actually, the gains that have ensued border on insane — Maley’s research shows gains of 530%, 110% and 130% (see prior rallies below), respectively, over the past decade.

“If things calm down [on the trade front] (which might be a BIG “if”), the upside could be quite bright for this Apple,” Maley says.

Maley isn’t all in on Apple, however. While the stock may be poised to rally, it’s not without greater than normal risk for the tech giant.

HI Financial Services Mid-Week 06-24-2014