HI Market View Commentary 01-29-2019

What I want to talk about today?

Three Quick points:

Fundamentals – Are you doing your weekly research?

AAPL, FOMC Meeting, Friday’s Ave Work Week Number

How are you protecting your investments – Question today from a client

Understand the pros and cons of your system

Collar trade – I don’t think I know everything, stock fall much faster than they go up, I WANT amass a huge amount of shares over my lifetime for covered calls and dividend payment

Anything you make up on the way down and then convert to new shares lowers your cast basis, makes more to the upside and allows ME to weather the new normal/volatility

Where will our markets end this week?

Higher

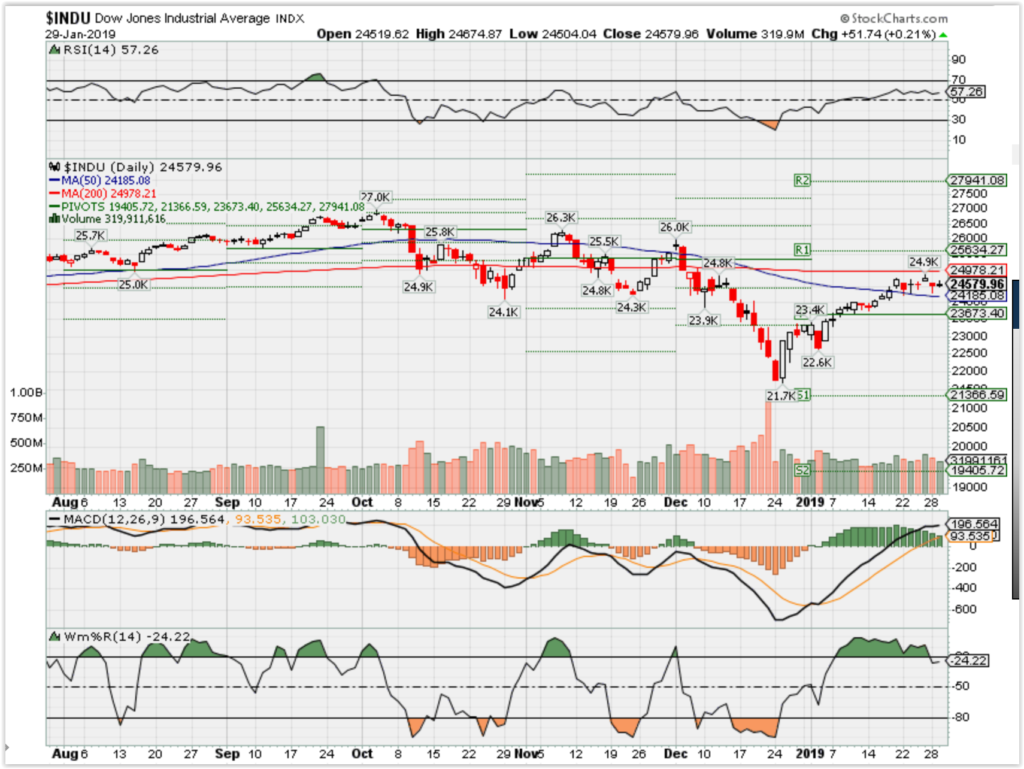

DJIA – Bullish

SPX – Bullish

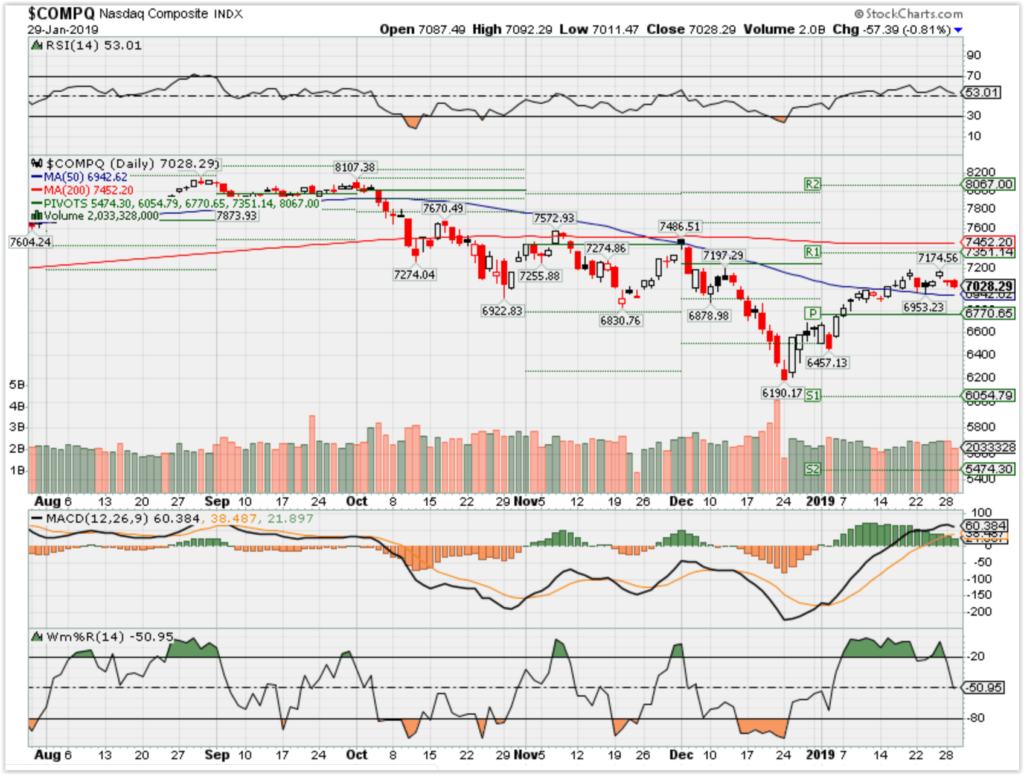

COMP – Bullish

Where Will the SPX end January 2019?

01-29-2019 +2.5%

01-22-2019 +2.0%

01-15-2018 +1.0%

01-08-2019 +2.0%

Earnings:

Tues: MMM, CIT, GLW, DOV, HOG, NUE, PFE, VZ, EBAY, AAPL

Wed: BABA, T, BA, GD, MCD, SIRI, CREE, MSFT, MUR, X, TSLA, V, FB

Thur: BX, CELG, COP, GE, IP, MA, S, UPS, VLD, AMZN

Fri: D, XOM, CVX, HON, JCI

Econ Reports:

Tues: Case Shiller House Price, Wholesale Inv, Consumer Confidence,

Wed: MBA, ADP Employment, Pending Home Sales, FOMC Rate

Thur: Initial, Continuing, Personal Income, Personal Spending, Employment Cost Index, Chicago PMI

Fri: Ave Workweek, Non-Farm Payroll, Private Payroll, Unemployment Rate, Hourly Earnings, ISM Manufacturing Index, Construction Spending, Michigan Sentiment

Int’l:

Tues –

Wed – CN: CFLP Manu PMI

Thursday – CN: PMI Manu Index

Friday-

Sunday – CN: General Services PMI

How am I looking to trade?

Earnings are coming up and protecting through earnings with protective puts and NO short Calls

AAPL – 1/29 AMC

AOBC – 2/28

BIDU – 2/12 AMC

DIS – 2/05 AMC

FB – 1/30 AMC

GOOGL – 2/4 AMC

IBB

MO – 1/31

MRO – 2/13 AMC

MRVL 3/17

OIH

RHT – 3/26

UAA – 2/12 BMO

V – 1/30 AMC

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

https://www.cnbc.com/2019/01/29/apple-q1-2019-earnings.html

Apple shares jump after barely beating on earnings, and iPhone sales drop 15% from last year

PUBLISHED 3 HOURS AGO | UPDATED MOMENTS AGO

- Apple reported the numbers for its fiscal first quarter under a new structure.

- iPhone revenue came in just slightly below projections.

- Apple reported a gross margin in its services segment of 62.8 percent.

Apple reported earnings for its December quarter Tuesday that largely fell in line with expectations. But, iPhone revenue came in just slightly below projections.

Here’s how the company did compared with what Wall Street projected:

- EPS: $4.18, vs. $4.17 forecast by Refinitiv consensus estimates

- Revenue: $84.3 billion, vs. $83.97 billion forecast by Refinitiv consensus estimates

- Q1 iPhone revenue: $51.98 billion, vs. $52.67 billion forecast by Refinitiv consensus estimates

- Q1 services revenue: $10.9 billion, vs. $10.87 billion forecast by Refinitiv consensus estimates

- Projected Q2 revenue: between $55 billion and $59 billion, vs. $58.83 billion forecast by Refinitiv consensus estimates

Shares of Apple rose 6 percent in extended trading, to an off-hour price of around $165. The stock closed at $157.92 on Jan. 2, the day Apple lowered revenue projections for the quarter and knocked 10 percent off the stock.

Apple reported the numbers for its fiscal first quarter under a new structure, offering gross margin figures for its services and products segments and withholding unit sales numbers for its most popular products like the iPhone. The new structure, announced in November, was intended to shift focus from the iPhone onto other growth metrics.

Apple saw a sharp decline in iPhone revenue during the quarter, denting the company’s main revenue stream, and posted a gross margin on its product business of 34.3 percent, an increase of 60 basis points from the previous quarter.

“Our customers are holding on to their older iPhones a bit longer than in the past. When you paired this with the macroeconomic factors particularly in emerging markets, it resulted in iPhone revenue that was down 15 percent from last year,” CEO Tim Cook said on the company’s earnings call.

Revenue for the company’s services segment — a catch-all category that includes Apple Pay, Apple Music and iCloud storage — topped $10.9 billion, though, marking a 19 percent year-over-year increase. Apple reported a gross margin in its services segment of 62.8 percent. That’s well above the 38 percent margin it reported for its overall business.

“We’re very happy not only with the growth but also the breadth of our services portfolio. Our revenue from services has grown from less than $8 billion in calendar [year] 2010 to over $41 billion in calendar

[year]

2018,” Cook said.

Revenue shortfall

Apple’s total sales of $84.3 billion represent a year-over-year decline of 5 percent, making for the first annual revenue decline during a holiday season quarter since 2001.

Apple has said said 100 percent of that decline was driven by performance in China, where the company saw almost $5 billion less in revenue than the year-ago period.

“For perspective, despite the challenging December quarter, our revenue from China grew slightly for the full calendar year,” Cook said on the call. “Macroeconomic factors will come and go but we see great upside on continuing to focus on the things that we can control.”

Product growth outside the iPhone

Cook’s warning earlier this month of weaker iPhone sales rubber-stamped a months-long conversation around shrinking smartphone sales and market saturation. Apple isn’t breaking out unit sales for the iPhone or its other major product lines, but reported revenue figures that fell right in line with expectations.

Here’s how the product lines break down:

- iPhone: $51.98 billion vs. $52.67 billion estimated

- iPad: $6.73 billion vs. $5.90 billion estimated

- Mac: $7.42 billion vs. $7.42 billion estimated

- Wearables, Home and Accessories: $7.31 billion vs. $7.33 billion estimated

Apple’s Wearables, Home and Accessories category — previously called Other Products — grew 33 percent from the year-ago period, making it the fastest growing revenue segment during the quarter. Revenue for the iPad grew 17 percent, and revenue for the Mac grew 9 percent.

Chief Financial Officer Luca Maestri said on the company’s earnings call that Apple now has 900 million installed iPhones in use around the world, and 1.4 billion total installed devices.

This is a developing story. Please check back for updates.

Government shutdown cost US economy $3B in permanent losses: CBO

By Thomas BarrabiPublished January 28, 2019U.S. EconomyFOXBusiness

The record-setting government shutdownOpens a New Window.that paralyzed key institutions for weeks came with a hefty price tagOpens a New Window., according to a report by the Congressional Budget Office released Monday.

The 35-day shutdown, which arose as a result of a dispute over funding for a U.S.-Mexico border wall favored by President Trump, will cost the U.S. economy $11 billion, according to the CBO’s report. That total includes $3 billion in lost economic activity during the fourth quarter of 2018 and a further $8 billion in the first quarter of 2019. The lost economic activity equaled 0.1 percent of real gross domestic product (GDP) in the fourth quarter and 0.2 of real GPD in the first quarter of 2019. While the CBO estimated that the U.S. economy will recover $8 billion as business activity resumes and workers are paid, some $3 billion in lost economic activity will never be recovered.

“In CBO’s estimation, the shutdown dampened economic activity mainly because of the loss of furloughed federal workers’ contribution to GDP, the delay in federal spending on goods and services, and the reduction in aggregate demand (which thereby dampened private-sector activity),” the report said.

President Trump agreed to back a temporary deal that would fund the government for three weeks while Congressional leaders on both sides of the aisle negotiate a border security package. Trump, who had sought more than $5 billion in funding for a border wall, has threatened to shut down the government again if no deal is reached.

The CBO noted that its report did not include the financial impact of some side effects of the shutdown, such as a reduced access to loans or businesses who were unable to obtain federal permits because key government agencies were closed.

The report estimated that roughly 800,000 federal workers went without pay during the shutdown.

https://seekingalpha.com/article/4236345-bank-america-back#alt1

Bank Of America Is Back

Jan. 29, 2019 2:00 PM ET

Summary

Bank of America is a high quality compounder that has been growing earnings at a double digit rate.

The bank is a top tier U.S bank that treats its shareholders well and focuses on responsible, consistent growth.

BAC still carries the scar of its huge $16.6 billion fine from 2014, but that’s precisely why the opportunity exists.

Bank of America (BAC) is a leading bank in the U.S banking system. With assets of more than $2.3 trillion, loans of more than $950 billion and deposits just shy of $1.4 trillion, BAC represents a true banking behemoth.

Despite significant improvements in important financial metrics such as net earnings growth, return on equity and efficiency ratios, BAC still trades at a discount to U.S peers. At the same time, the bank has been growing earnings at a double digit pace, treating its shareholders exceptionally well, and growing its book value gradually and responsibly.

Improving Metrics

Bank of America has recently released wonderful numbers for the fourth quarter of 2018. In the past quarter of 2018, BAC generated net revenues in the amount of $22.7 billion, up 11 percent compared to the same quarter last year. But the bank scored high on where it counts, the bottom line. Earnings were $0.7 per share, up 250 percent compared to the same quarter last year, driven by revenue growth, efficiency gains and fewer shares outstanding.

BAC has done a wonderful job in cutting costs, which translated into much better efficiency ratios. In the past quarter, the bank recorded an adjusted efficiency ratio (rate of expenses from revenues) of 58.5 percent, compared to an efficiency ratio of 62.7 percent in the same quarter last year. Many investors many not remember this, but the bank’s efficiency ratio back in 2014 was a staggeringly high 88.25 percent. So much has been done on that front, thanks to “New BAC” efficiency plan. Today BAC is one of the most efficient banks in the U.S banking system in terms of efficiency ratios. For comparison, even Wells Fargo (WFC), which has been implementing a very aggressive cost cutting plan, is only down to 63.5 percent, roughly 500 basis points behind BAC.

BAC is becoming smaller in physical terms but not in the scale of business. The bank has closed 136 branches across the U.S in the past quarter alone, while at the same time has increased the number of its mobile users by 9 percent. And it shows in the numbers. The bank has recorded an impressive return on equity of 11 percent compared to 7.9 percent back in December 2017. That’s a significant improvement. To get some perspective, Wells Fargo has been able to record an impressive return on equity of 12.89 percent in the past quarter, much higher than that of BAC’s, but the rate of improvement has been much lower. Wells Fargo has been able to improve from an ROE of 12.4 percent back in December 2017 to the current ROE of 12.89 percent, while BAC has reached its current ROE of 11 percent from a significant jump from previous lowly 7.9 percent at the end of 2017.

A Capital Return Story

The investment theme in BAC is not only about revenue growth, but also about consistent growth in capital distribution to its shareholders. For example, in 2018 the bank has returned a total of $25.6 billion to its shareholders through share repurchase and dividend payments. For comparison, that’s only slightly less than the $25.8 billion that Wells Fargo has returned to its own shareholders in 2018.

What The Market Is Missing

It is really hard not to love BAC. A growing loan book, improved efficiency and double digit growth in earnings. Yet, investors do seem to have their reservations about this amazing bank. The main concern evolves around the bank historic involvement in the financial crisis, that many fail to forget.

You see, BAC has previously admitted to allegations that it had knowingly sold toxic mortgages to investors in the course of the financial crisis. In issuing bad subprime loans, the bank helped fuel a housing bubble that would ultimately burst in late 2007. In fact, as a result of this fiasco, the bank has agreed to pay a total of $16.6 billion in August 2014 – the largest fine for a bank in the history of the U.S banking system. Since that time, valuation for BAC has lagged that of peers, both in good and bad times alike. But so many things have changed since then. BAC has successfully “cleaned” its balance sheet from bad debts, has improved its efficiency ratios, and is much more diversified in terms of revenue streams than it previously has been.

Valuation Is A “BUY”

Due to the sharp decline in the shares of U.S banks during the fourth quarter of 2018, BAC is currently trading close to its valuation of two years ago.

You can easily watch the gradual rise in revenues and earnings over the past five years (white and blue lines, respectively) versus the recent sharp decline in valuation – both in terms of book value ratio (green line) and in terms of price to earnings multiple (brown line). I believe that this represents a very attractive entry point to a high quality earnings compounder.

Risks

There are two main risks in this investment – a business risk and a macro risk. The business risk will materialize if BAC is unable to pursue its “New BAC” efficiency plan. The second risk will materialize if The U.S experiences a slowdown, which is likely to significantly increase the rate of its nonperforming loans.

My Bottom Line

BAC has been, and still is, a high quality compounder in the U.S banking system. The bank has been successful in growing its loan book, increasing its return on equity and treating its shareholders especially well. Current valuation presents a good entry point for years of compounding ahead.

Disclosure: I am/we are long WFC. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Visa starts using its own network for transactions in Argentina

Jan. 29, 2019 1:17 PM ET|About: Visa Inc. (V)|By: Liz Kiesche, SA News Editor

Visa (V -1%) starts VisaNet processing in Argentina, a move that Visa says will increase its share of domestic transaction processing in Latin America and the Caribbean region by more than 10 percentage points.

In January, Visa began processing Argentina’s domestic Visa payments on VisaNet—its own global network capable of handling more than 65,000 transaction messages a second.

Previously, domestic payments were handled by Prisma, an independent company authorized by Visa to serve as an acquirer-processor for local businesses and to issue Visa cards through local financial institutions

Previously: Visa and NFL extend partnership through 2025 season (Jan. 29)