HI Financial Services Commentary 07-18-2017

https://youtu.be/QOCASItQ-78 YouTube video link

Our market has had side way movement for 4 to 6 weeks

So on CNBC and Bloomberg the talking heads came up with the great idea that you have to own Financials or Technology?

Technology right now represents growth right now

But probably over valued in what area in Valuations = Earnings to price ratio

What’s the problem with financials – Undervalued right now

Price to earnings multiple financials are ridiculously cheap

But over the last year financials as a sector has grown more than technical’s

Do you have to only own one sector?

AAPL, BIDU, FB,

BAC, ZION, C,

What’s happening this week and why?

Gridlock in Washington even though the Senate and House are Republican controlled

Empire Manufacturing 9.8 vs est 13.0

Export 0.0 vs -0.4

Import 0.1 vs 0.0

NAHB Housing Index 64 vs est 67

Net Long Term TIC flows 91.9B vs 9.7B

Where will our market end this week?

Higher

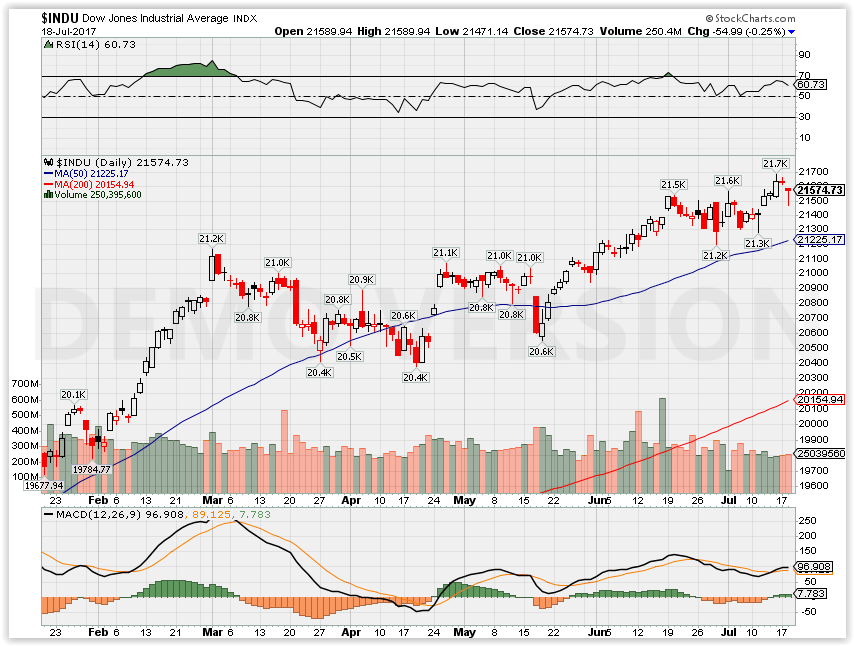

DJIA – Bullish

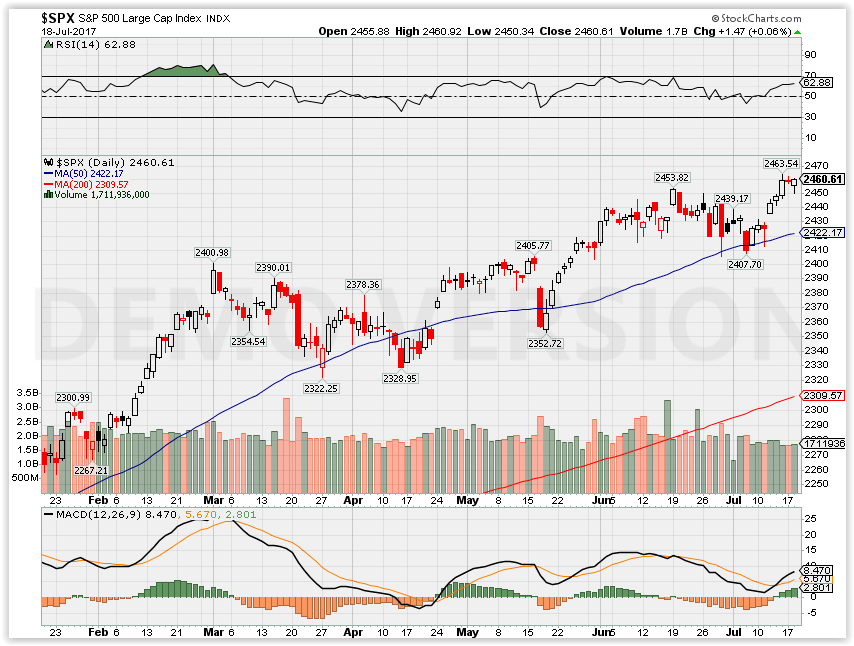

SPX – Bullish

COMP – Bullish

Where Will the SPX end July 2017?

07-18-2017 +2.0%

06-27-2017 -2.0%

What is on tap for the rest of the week?=

Earnings:

Tues: SCHW, BAC, GS, HOG, JNJ, LMT, CSX, IBM, UAL

Wed: MS, GWW, USB, AA, KMI, QCOM, VMI

Thur: ABT, BK, ,DPZ, NUE, UNP, AMD, COF, EBAY, ISRL, ISRG, MSFT, PYPL, WHR, GPRO, SWKS, V

Fri: AAL, SLB

Econ Reports:

Tues: Export, import, NAHB Housing Index, Nat Long Term TIC Flows

Wed: MBA, Building Permits, Housing Starts,

Thur: Initial, Continuing Claims, Phil Fed, Leading Indicators

Fri: OPTIONS EXPIRATION

Int’l:

Tues –

Wed – JP: BOJ Announcement

Thursday –

Friday –

Sunday – JP: PMI Manufacturing

How I am looking to trade?

Earnings List:

AAPL 8/1 AMC

AOBC 9/7 est

BAC 7/18/17

BIDU 7/27 AMC

C 10/12 BMO

CLX 8/3 BMO

DHI 7/26 BMO

DIS 8/8 AMC

F 7/26 BMO

FB 7/26 AMC

NVDA 8/10 AMC

V 7/20 AMC

ZION 7/25 AMC

COST 10/5 AMC

Does the amazon purchase really warrant a $20 drop in stock price and an oversold stock? I don’t think so either and 160 is a support level with the 200 SMA. Again and bullish trade like a protective put, out of the money covered call, bull call, bull put, naked put all can use the 150ish level of support to go directional long calls or the 147 support level

Questions???

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

http://www.cnbc.com/2017/07/14/if-you-like-paying-hefty-tax-bills-stick-with-your-regular-401k.html

If you like paying hefty tax bills, stick with your regular 401(k)

- Most retirement plans now offer the option of saving in a Roth 401(k).

- Many plan participants are sticking with a traditional 401(k), rather than using Roth 401(k).

- Missed opportunity: Saving in a Roth 401(k) today likely means a lower tax bill in retirement, and more estate-planning possibilities.

Sunday, 16 Jul 2017 | 11:00 AM ETCNBC.com

If you are looking forward to a retirement spent paying hefty tax bills, a traditional 401(k) plan may be your twisted ticket to happiness.

Once you turn age 70½, you are forced to start taking money out of your traditional 401(k) annually — the more polite terminology is “required minimum distribution” — and every penny you withdraw will be taxed as ordinary income.

The perverse reality is that the more you have socked away for retirement in traditional accounts, the bigger your RMD tax bills will be, even if you don’t need the cash to cover living expenses. And those RMDs just might boost your taxable income to a level that triggers owing more tax on Social Security benefits and being hit with a higher Medicare premium.

If that’s not your idea of retirement bliss, chances are pretty good there is a great tax-savings move right under your nose that you’re mistakenly passing up.

Vanguard reports that nearly two-thirds of 401(k) plans it administers now have the option of saving in a Roth 401(k), rather than the standard traditional 401(k).

With a Roth 401(k) contributions are made with after-tax income. The payoff comes in retirement when you can either skip RMDs completely (more on this in a second) or take distributions without owing a penny in tax. Yet less than 15 percent of retirement savers with the ability to save in a Roth 401(k) are taking advantage of the Roth option.

“Taxes are the most expensive thing in retirement.”-David Hays, president, Comprehensive Financial Consultants

“I’m from the Midwest, so I use a farm analogy: Do you want to pay tax on the seed or on the harvest,” said David Hays, president of Comprehensive Financial Consultants in Bloomington, Indiana. “The only rational answer is that you pay it on the seed.”

That is, take your tax hit early, by using a Roth 401(k) that is funded with after-tax dollars — paying tax on the seed contribution — with the eventual payoff that you will not owe a penny of tax when it’s time to harvest your savings, in retirement.

The myth of the lower tax bracket

While Roth 401(k) plans are positioned as ideal for millennials who have yet to hit their peak earnings (tax rates), 40- and 50-somethings who’ve been using a traditional 401(k) for a few decades can add valuable tax diversification by switching over and doing some Roth saving.

“Taxes are the most expensive thing in retirement,” said Hays. “Think about it, you pay 30 percent or so every time you want to access your money.

“The Roth 401(k) is an absolute necessity,” he added. “It allows you to position yourself so you are not forced to access your tax time bomb in retirement when you need money. ”

For the record, anyone can contribute to a Roth 401(k). There are no income limits. Employer matching contributions will continue to be made into a traditional 401(k) account.

A common argument for sticking with a traditional 401(k) is that reducing your taxable income this year with your pretax contributions is more valuable to you if your expectation is that you will be in a lower tax bracket in retirement.

Be careful with this assumption. If the bulk of your retirement savings are in traditional 401(k) plans and individual retirement accounts, the RMDs are likely to keep your rate from plummeting, especially once you add in other income sources such as Social Security and, perhaps, a pension.

How Much More Spendable Income Can a Roth IRA offer over a Traditional IRA?

| Change in tax rate | 25 years old | 30 years old | 35 years old | 40 years old | 45 years old | 50 years old | 55 years old | 60 years old | 65 years old |

| 10% | 35% | 34% | 32% | 31% | 29% | 27% | 25% | 23% | 21% |

| 9% | 33% | 32% | 30% | 29% | 27% | 25% | 24% | 22% | 20% |

| 8% | 31% | 30% | 28% | 27% | 25% | 24% | 22% | 20% | 18% |

| 7% | 29% | 28% | 27% | 25% | 24% | 22% | 20% | 18% | 16% |

| 6% | 28% | 26% | 25% | 23% | 22% | 20% | 18% | 17% | 15% |

| 5% | 26% | 25% | 23% | 22% | 20% | 19% | 17% | 15% | 13% |

| 4% | 24% | 23% | 22% | 20% | 19% | 17% | 15% | 14% | 12% |

| 3% | 22% | 21% | 20% | 18% | 17% | 15% | 14% | 12% | 10% |

| 2% | 21% | 20% | 18% | 17% | 15% | 14% | 12% | 11% | 9% |

| 1% | 19% | 18% | 17% | 15% | 14% | 12% | 11% | 9% | 7% |

| Stays the same | 18% | 17% | 15% | 14% | 13% | 11% | 9% | 8% | 6% |

| -1% | 16% | 15% | 14% | 12% | 11% | 10% | 8% | 6% | 5% |

| -2% | 15% | 14% | 12% | 11% | 10% | 8% | 7% | 5% | 3% |

| -3% | 13% | 12% | 11% | 10% | 8% | 7% | 5% | 4% | 2% |

| -4% | 12% | 11% | 10% | 8% | 7% | 6% | 4% | 3% | 1% |

| -5% | 11% | 9% | 8% | 7% | 6% | 4% | 3% | 1% | 0% |

| -6% | 9% | 8% | 7% | 6% | 4% | 3% | 2% | 0% | -2% |

| -7% | 8% | 7% | 6% | 4% | 3% | 2% | 0% | -1% | -3% |

| -8% | 7% | 6% | 4% | 3% | 2% | 1% | -1% | -2% | -4% |

| -9% | 5% | 4% | 3% | 2% | 1% | -1% | -2% | -3% | -5% |

| -10% | 4% | 3% | 2% | 1% | 0% | -2% | -3% | -5% | -6% |

Source: T. Rowe Price.

A few years ago, T. Rowe Price ran the numbers to see how much more income you might have in retirement if you saved in a Roth IRA rather than a traditional IRA, assuming different retirement tax rates. The concept is the same for 401(k) plans.

If your retirement tax rate stays the same as your current tax rate, T. Rowe found that a Roth is the better investment. A 40- or 50-something would need their retirement tax rate to be 8 to 10 percentage points lower to justify sticking with the traditional today. Unless you’re making a move from Fifth Avenue to off-the-grid, that seems unlikely.

You also might want to stop taking long-term retirement planning advice from your tax pro.

“We have clients who tells us their CPA insists the traditional is the better option,” said Elijah Kovar, a partner at Great Lakes Financial in Minneapolis. “Of course they do.

“A CPA is tax-reactive; they look at last year’s returns and search for ways to reduce your current tax bill,” he added. “We are taking a bigger-picture look on how to minimize taxes in retirement.”

Rare heir bonus

Another benefit of saving in a Roth 401(k) is that once you retire, you can roll over the account into a Roth IRA. No taxes are due on that move. And once the money is in the Roth IRA, you have officially escaped the grip of Internal Revenue Service RMDs.

If you want to spend some of the money, your withdrawals will be tax-free. Or you can just let the money keep growing free of taxes for your heirs. Yes, they will be required to take distributions immediately after you die, but they, too, will owe no income tax on the distributions as long as you had the IRA for at least five years.

Kovar notes that the Stretch IRA is on the hot seat in Washington. If that tax break is reduced or eliminated, it would trigger bigger tax bills for anyone inheriting traditional (read: taxable) IRA assets. “We’re planning on the Stretch IRA going away,” said Kovar. “That makes having money in a Roth even more compelling.”

Carla FriedSpecial to CNBC.com

Retirement at 65 becomes a reach for some, as seniors stay in the workforce

- Nearly 20 percent of people over 65 are still working, the highest level in at least 5 decades.

- “It is financially driven,” AARP’s Jean Setzfand explained to CNBC.

- Seniors are working at higher levels than teenagers.

Sunday, 16 Jul 2017 | 9:00 AM ETCNBC.com

A person’s 65th birthday used to be a milestone. That was the age at which your working days were over and your retirement began.

For millions of Americans nowadays, however, that’s no longer possible. Nearly 20 percent of people age 65+ are still working full or part-time—the highest rate since 1962. After the end of the Great Recession, more seniors were forced to stay in the workforce for longer, in order to make ends meet.

“It is financially driven,” AARP’s senior vice president of programs Jean Setzfand told CNBC’s “On the Money” in a recent interview.

“Our research shows us that 34 percent of the people we surveyed tell us that financial drivers are a major reason why they’re staying in the workforce,” she added.

In 2000, 13 percent of Americans age 65 and over were still working full or part time, according to data from Pew Research. Currently, that number has grown to 19 percent yet by 2021, the Bureau of Labor Statistics estimates 32 percent of boomers will still be on the job.

Meanwhile, even that number is expected to increase. With fewer pensions and not enough retirement savings, retiring at 65 isn’t financially possible for many.

For decades, companies have been “moving away from pensions to 401(k) defined-contribution plans,” Setzfand said. “What happens there is you have a lower base of guaranteed income. Everyone is really reliant on Social Security as that floor. They no longer have that traditional pension that lasts them through their lifetime.”

Setzfand said that according to AARP research, about 55 million private-sector employees in the U.S. don’t have access to workplace retirement savings plans.

The organization also found that without a retirement plan at work, only 5 percent of people open their own individual retirement account (IRA). Setzfand said that makes saving for retirement “15 times harder for them.”

According to the Labor Department, the number of people in the labor force between the ages of 25 to 54 isn’t projected to change much between now and 2024.

However, seniors are more likely to be working than teenagers. Today, there are more workers in the 55-and-over group than there are in the 16- 24 age group—and that gap is expected to widen.

But AARP’s Setzfand said that’s a good thing, because “19 percent of the folks that we talk to actually wanted to stay in the workplace because they actually enjoy it.”

Work is “a social outlet, they feel productive. So there’s a good reason for people to actually want to stay in the workplace longer,” she said. “Because we’re actually living longer and what greater way to stay engaged but at the workplace.”

Here’s how Buffett partner Charlie Munger applies psychology to economics

Thursday, 29 Jun 2017 | 7:30 PM ETBerkshire Hathaway executives Warren Buffett and Charlie Munger have been business partners and friends for nearly 60 years and each has greatly influenced the other.

“Every time I’m with Charlie, I get at least some new slant on an idea that causes me to rethink certain things,” Buffett said in a joint interview with Munger on CNBC’s “On The Money.”

Munger’s deep understanding of psychological influence over business and career decisions may be to thank.

In the early 1990s, Munger gave several speeches on the intersection of economics and psychology. During a speech at Harvard University, Munger notes that trying to keep those two concepts separate was costing him “a lot of money.”

Munger shared a list of 24 psychological tendencies that he’s aware of when making business and career decisions. A recent video by investment firm Tiny Capital and animation studio Thinko illustrates an abridged version of this speech:

In the speech, Munger paired the following psychological phenomena with business examples to demonstrate how psychology and economic decision-making go hand in hand:

Pavlov’s theory of classical conditioning

Munger says he has never taken a course in psychology or economics, but he did learn about Russian physiologist Ivan Pavlov in his high school biology class.

In the late 19th century, Pavlov studied whether external stimuli could start the digestion process by giving food to dogs after ringing a metronome. The dogs would learn to associate the ringing with incoming food and would start to salivate.

Pavlov called creating this association “conditioning,” according to the PBS show “A Science Odyssey.”

“Well, the truth of the matter is that Pavlovian association is an enormously powerful psychological force in the daily life of all of us,” Munger says. “And, indeed, in economics we wouldn’t have money without the role of so-called secondary reinforcement.”

Munger says three-fourths of advertising works on pure Pavlovian conditioning. He mentions Coca-Cola as an example.

“They want to be associated with every wonderful image: heroics in the Olympics, wonderful music, you name it,” he says. “They don’t want to be associated with presidents’ funerals and so forth.”

The bystander effect and social proof

Munger and Buffett have publicly and repeatedly shared their rejection of the market efficiency theory, which states it is impossible for companies to beat the market through stock picking. In the speech, Munger slightly brags about their success outside of this theory, calling it “a wonderful economic doctrine that had a long vogue” despite Berkshire Hathaway’s success.

Munger uses the examples of the bystander effect and social proof to demonstrate that many investors are just a bunch of followers.

“The bystander effect occurs when the presence of others discourages an individual from intervening in an emergency situation,” according to Psychology Today. The concept was popularized after the infamous murder of Kitty Genovese in 1964. She was reportedly stabbed to death outside her home while bystanders observing the scene did nothing.

In this moment the witnesses are said to have exhibited social proof, a phenomena researcher Robert Cialdini describes as “when people … do things that they see other people doing.”

“Now, one of the explanations is that everybody looked at everybody else and nobody else was doing anything,” Munger says in his speech, “and so there’s automatic social proof that the right thing to do is nothing.”

Munger compares those bystanders to “big-shot businessmen” who, instead of betting against the market, simply make investments others are making.

“There are microeconomic ideas and gain/loss ratios and so forth that also come into play,” Munger says. “I think time and time again, in reality, psychological notions and economic notions interplay, and the man who doesn’t understand both is a damned fool.”

http://www.cnbc.com/2017/06/29/investor-in-martin-shkreli-fund-felt-betrayed-by-pharma-bro.html

Investor in Martin Shkreli’s fund testifies she felt ‘betrayed’ by ‘pharma bro,’ who dragged out paying her for months

- The first witness at Martin Shkreli’s securities fraud trial took the stand to testify.

- Sarah Hassan, daughter of major pharma exec Fred Hassan, described being impressed at first by Shkreli’s purported investment success.

- It took Hassan months to get Shkreli to pay her money he owed her.

Thursday, 29 Jun 2017 | 5:18 PM ETCNBC.com/

The daughter of a well-known pharmaceuticals executive testified Thursday she felt “betrayed” by Martin Shkreli after the “pharma bro” dragged his feet for months in paying out her supposedly profitable hedge fund investment — only to tell her the money had been used without her permission to capitalize his new drug company.

“I was upset. I saw that as being my cash,” testified Sarah Hassan about learning from Shkreli in early 2013 that there was no money left in his hedge fund MSMB Capital after his decision to close it.

“To be frank, I felt somewhat betrayed at this point,” Hassan, 27, told jurors in Brooklyn, New York, federal court. “I was told I could get my cash from the fund months ago.”

“It just wasn’t right,” said Hassan, who was the first witness to testify in Shkreli’s criminal trial on charges of securities fraud.

Hassan said that when Shkreli, 34, had told investors he was closing the fund, he offered to pay out all of their investments either in cash, in stock of his new drug company Retrophin, or a combination of both.

She eventually, almost a year later, ended up getting her principal investment, and then some, along with a bunch of Retrophin stock that resulted in a steep profit.

Hassan may have been very fortunate to do so.

She testified that in January 2011, shortly before he invested $300,000 of her own money in MSMB Capital, Shkreli during a dinner in Manhattan told her the hedge fund had between $40 million and $50 million under management.

In fact, prosecutors have said in an indictment, two months before that MSMB Capital had just $700 on hand, as a result of Shkreli’s ongoing trading losses.

Hassan also testified that several times she felt compelled to tell Shkreli not to publicly suggest, falsely, that her dad Fred Hassan was either an investor with Shkreli or an advisor to his then-start-up Retrophin.

Fred Hassan was CEO and chairman of Schering-Plough before it merged with Merck in 2009, and was chairman of Bausch & Lomb for three years after that. He now is a managing director at the private equities investment firm Warburg Pincus.

His daughter said she was surprised, several times, to see her father mentioned as a consultant to Retrophin in news articles. She also was “quite surprised” to see her father’s email address was among the addresses in a group email that broke down how much people had invested in Retrophin, “because he certainly wasn’t an investor.”

Sarah Hassan said she first invested $300,000 with Shkreli’s hedge fund after meeting him through a colleague of her father, former Bausch & Lomb CEO Brent Saunders. She testified that Saunders had told her Shkreli was “a rising star in the hedge fund world.”

Her investment amount represented about 30 percent of her personal net worth of $1 million, she said, and she made the investment because he was interested in developing a business relationship with Shkreli.

When she made that investment, Hassan said, she was told she could get her money out of the fund on one month’s notice. She also said she was told that MSMB Capital invested in a “mix” of equities, and did not as a rule hold more than 5 percent of its assets under management in a single equity position.

Hassan said she was “ecstatic” over the months to receive emailed statements showing a solid profit for her money.

Her first statement from Shkreli, emailed on March 2, 2011, claimed that MSMB Capital had earned a return of 4.24 percent on its stock positions in the prior month, the first full month she had her money in the fund.

But in reality, prosecutors say, Shkreli blew effectively all of MSMB Capital’s assets in a disastrous short position he took on Orexigen Therapeutics shares, which left the fund with with a $7 million debt to Merrill Lynch

However, by the end of 2011, Hassan testified, Shkreli had told her the investment had grown to more than $365,000.

That had purportedly grown to more than $435,000 by mid-2012, Hassan testified, reading from an email she received updating her on her investment.

Hassan said she did become curious as to why those statements showing her investment returns, which had previously been emailed every month or so, over time became more sporadic.

However, “I was thrilled” to learn her stake had increase so much, she said.

“It was a very significant return. This was the single biggest investment I had, so to see it as the best performing [one] was exciting.”

Hassan said she was “surprised” to hear in late 2012 that Shkreli planned to wind down MSMB to focus on a different investment strategy.

She noted that Shkreli claimed the fund had an almost 80 percent return on assets under management since it was started in 2009, well outpacing the benchmark S&P 500 stock index. She said it would be unusual for a hedge fund to close when it was doing so well.

Hassan described her frustration over how Shkreli for months dragged his feet in disbursing what she had been told was then more than $435,000 in funds at MSMB, net of fees, by the time Shkreli told her he was closing the hedge fund. That represented a return of more than 45 percent on her original investment.

Hassan said that after months of asking him about the money, Shkreli told her the money had been used to fund Retrophin, his new drug company.

“I would like you to tell me would like you to tell me why you are refusing to return my calls,” Hassan wrote Shkreli in one email. “I asked for my funds to be returned to me fully in cash.”

It was only after almost a year of being told of MSMB’s wind-down that she managed to get $400,000 in cash paid to her by Retrophin — not Shkreli —,and more than 58,000 shares of Retrophin stock.

But that came only after she agreed to sign a settlement agreement and promised not to sue for over the situation.

She later sold those shares for $900,000, she testified.

And her family’s hedge fund, Dynagrow, which she manages, itself realized a profit of almost $1.3 million after selling Retrophin shares it had acquired as a result of a $125,000 initial investment by that fund, Hassan testified.

Prosecutors have argued that Hassan and other investors were unaware of the fact that Shkreli, contrary to the glowing financial statements he sent them, was losing money at MSMB Capital, and then another hedge fund he started, MSMB Healthcare.

They allege he looted millions of dollars from Retrophin to repay the investors he had defrauded at his hedge funds.

When asked by a prosecutor whether she had had any contact with Shkreli since finally receiving her a pay-out for her hedge fund investment with him, Hassan said, “Not really.”

She also said she had never invested with him again.

Asked why, Hassan said, “I have a very troubling experience in the past, so it’s not something I would choose to opt in on again in the future.”

During an aggressive cross-examination of Hassan, Shkreli’s lawyer Benjamin Brafman underscored the fact that she had eventually gotten well more than her original investment back, and that Retrophin became a successful company.

“At the end of the day you made a hefty profit?” Brafman asked.

Hassan said, “Yes, even more than I asked for.”

HI Financial Services Mid-Week 06-24-2014