HI Financial Services Commentary 02-07-2017

hi Kevin,

i would like to hear if possible your thoughts on trading AMAT collar wise on your next webinar presentation tomorrow.

Also, i know you like F, but i it still seems to me as too volatile in predictability terms. could you update on this equity ? and as i have already asked previously, doesn’t GM look better for the trading business ?

I don’t like GM for two reasons:

GM had to be bailed out with my tax dollars and

Mary Barra is out of her league coming from Pontiac and the car auto arena vs Trucks

Plus I think Fields has been much more industry Proven

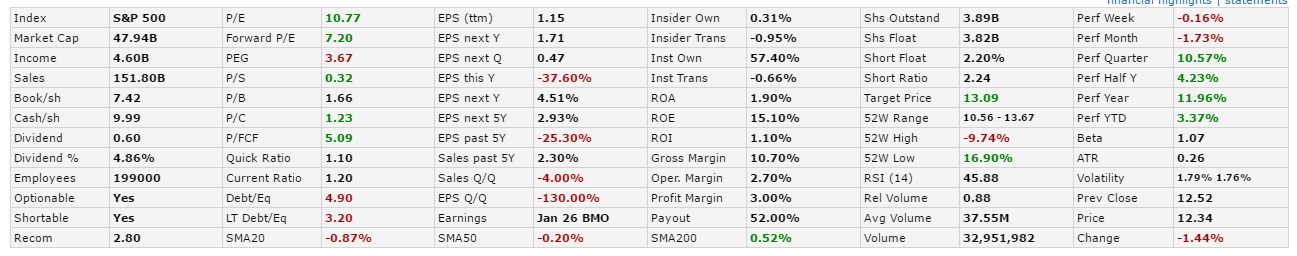

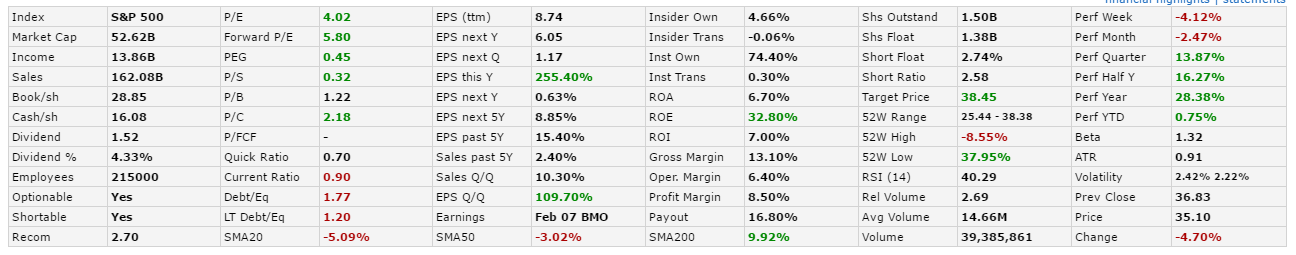

What stands out to you when you just glance at metrics

F

MY deciding factor was this

GM most recent 10 year high was $40.87 on Dec 2013 with a share price of $35.10 = All time highs $5.77

F most recent highs closed at $ 17.41 Aug 2014 with a share price of $12.34 = $ 4.93 = All time high

What’s happening this week and why?

The market dull and boring and not really doing anything

DIS missed their earnings fell over $2.50 but now are only down $0.61 Missed Revenue

French new presidential campaign are starting and going for the next 80 days ,

If the popular presidential candidate gets in She wants a FRexit

Worldwide race to the bottom to devalue currency – Deflation = Need to raise rates

Where will our market end this week?

Down

DJIA – Still bullish but moving sideways

SPX – Bullish but double top forming

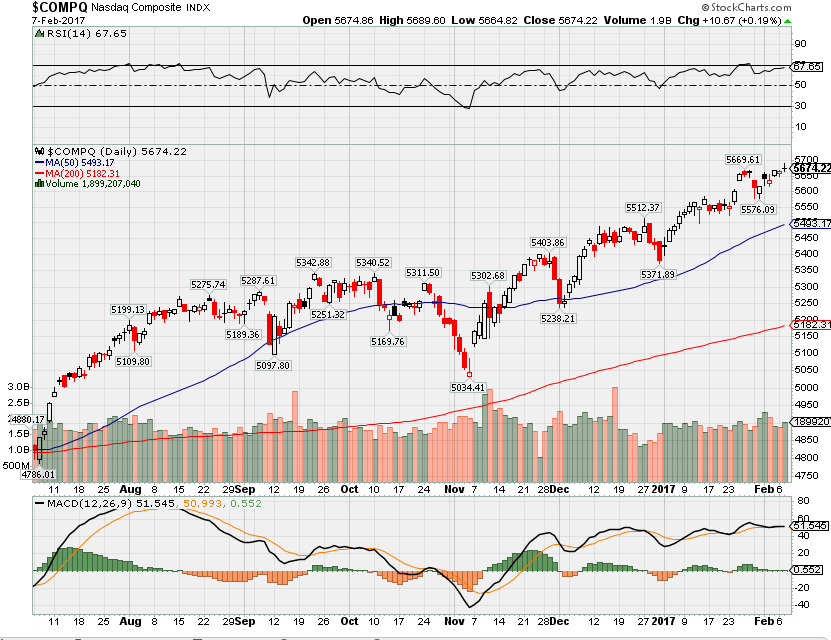

COMP – Still bullish but losing our step pattern to the upside

Where Will the SPX end Feb 2017?

02-07-2017 -2.5%

01-31-2017 -2.5%

What is on tap for the rest of the week?=

Earnings:

Tues: AKAM, BWLD, DTYS, GM, GNW, GILD, ICE, MOS, MYGN, NGL, PNRA, SOHU, DIS

Wed: ALK, CTL, DNB, FISV, GT, OC, PDM, PRU, TSLA, TWX, WFM,

Thur: ATVI, CLF, KO, CMI, CVS, K, NE, NVDA, P, TWTR, WU, YELP, YUM, ZNGA

Fri:

Econ Reports:

Tues: Trade Balance, Jolts Job Openings, Consumer Credit

Wed: MBA, Crude,

Thur: Initial, Continuing Claims, Wholesale Inventories

Fri: Export, Import, Michigan Sentiment, Treasury Budget

Int’l:

Tues – DE: Industrial Production

Wed – JP: Machine Orders

Thursday – CN: Merchandise Trade Balances

Friday – FR:GB: Industrial Production

Sunday – JP: GDP

How I am looking to trade?

I’m basically collared or protective put for earnings BUT

AAPL, V, BABA, have short puts in a put calendar strategy to make back the cost of long puts

Only stock with Leap short calls is V @ 90 Jan 18 strike for $4.05 credit

AT NO TIME would I place short calls on AAPL with the repatriation possibility

Earnings Chart

BIDU 02/23 est

DIS 02/07 est

NVDA 02/15 est

AOBC 03/02 est

Questions???

Most of what I’m trying to find are stocks that didn’t run last year

AND most of those happen to be what I was in last year= AAPL, BA, F, BIDU, BABA, DIS, V,

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Look out: Gold and bonds are sending a signal reminiscent of 1987 and 1973 market crashes

Monday, 6 Feb 2017 | 7:17 AM ETCNBC.com

If bond yields and gold rise in tandem, the market may turn the opposite way. At least, that’s what historic parallels suggest.

Higher gold prices paired with rising bond yields is one trend to watch to signal impending market volatility, according to a new report from Bank of America Merrill Lynch. Both the stock market crash of 1973-1974 and Black Monday in October 1987 were preceded by three quarters of rising bond yields and rising gold, according to the report by strategist Michael Hartnett and colleagues.

The thinking is that if interest rates and gold rise in tandem, it signals rising inflation, which lead the Federal Reserve to increase its short-term interest rate targets. Rate hikes tend to be bad news for the economy and for stocks in particular.

To Hartnett’s point, inflation expectations have recently risen considerably, thanks to the election of Donald Trump as well as the Fed’s decision to raise rates in December.

In the markets, gold is positive this year, rising nearly 6 percent, and it has just concluded its best week since April after sliding in the third and fourth quarters of 2016. The 10-year Treasury yield rose considerably in the second half of 2016, but is lower in 2017.

“For years, gold was the inflation play and the fear play, and I would say that we probably had a bit of both over the past few months, regardless of what end of the political spectrum you’re on,” Zachary Karabell, head of global strategy at Envestnet, said Thursday on CNBC’s “Trading Nation.”

“So the Fed raising rates in December, even though they didn’t do anything this week, is an indication that there’s some modest anticipation of inflation,” he said.

In its post-meeting statement Wednesday, the Fed shed little light on its rate-raising plans. In December, it indicated it expects three rate increases this year.

HI Financial Services Mid-Week 06-24-2014