HI Financial Services Mid-Week 02-03-2015

Sometimes the bad things that happen in our lives put us directly on the path to the best things that will ever happen to us – Unknown

Last week I was bragging about how well I protected my stock positions and how well I was making money in the down market!

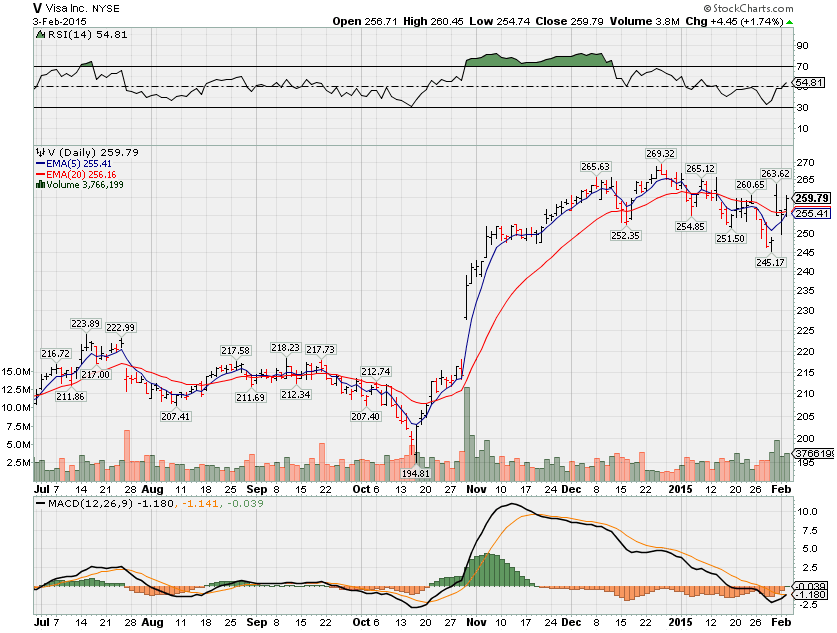

Now the truth about this week – V, AAPL and Now DIS ALL rocked earnings but I still made a mistake. I took off protection the day of earnings and the stock popped and then fell back down. I nailed the top trying to outguess a company’s earnings “reaction” and took off the long put protection to the detriment of the trade. Waiting for technical crossovers is a discipline that I did not exercise in this trade. Now, V may head back higher and it might not hurt the overall trade but I am feeling some painin my trade today because I jumped the gun

What’s happening this week and why?

Oil seems and some analysts are calling the bottom on oil

Greece optimism

Two consecutive down months on the US stock exchanges and that hasn’t happened May & June 2012

China GDP, Manu both down

Euro gain strengthen against the dollar due to stimulus

Personal Income .3 vs est .3

Personal Spending -0.3 vs est -0.2

PCE Prices 0.0 in line with est

ISM Index 53.5 vs est 54.7

Construction Spending 0.4 vs est 0.8

Factory orders -3.4 vs est -0.2

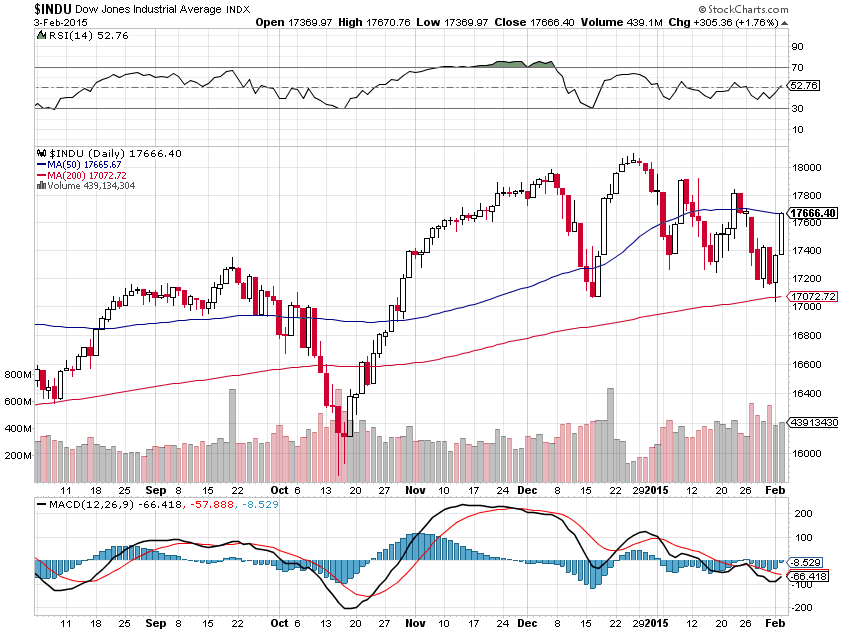

Why did the US markets go up 500 points? = Technical Bounce

Where will our market end this week?

Higher by another 1% and it is due to oil rebounding and earnings

DJIA – Almost bullish with a tech bounce off the 200 SMA and almost above the 50 SMA

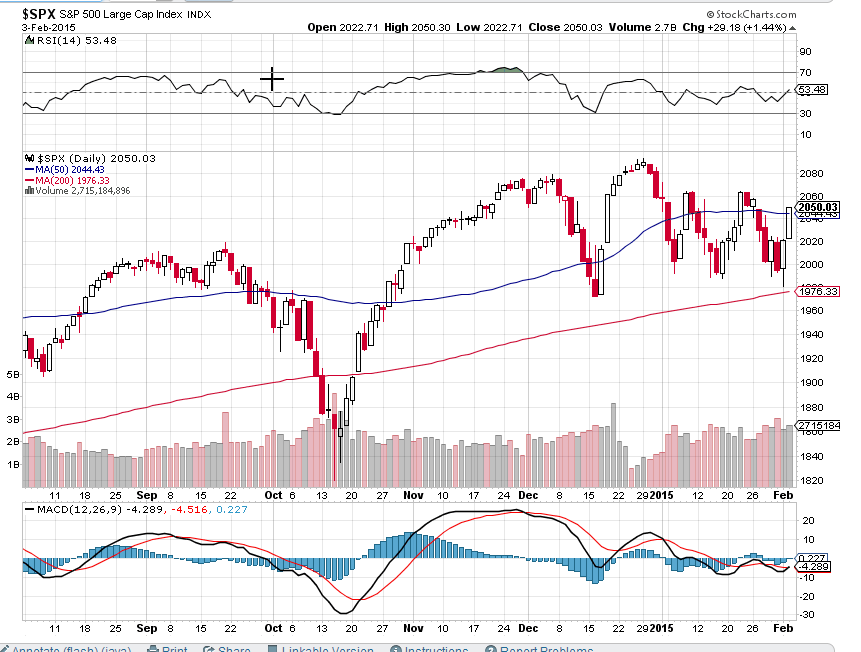

SPX – Almost bullish with a bounce off the 200 SMA and crossed above the 50 SMA

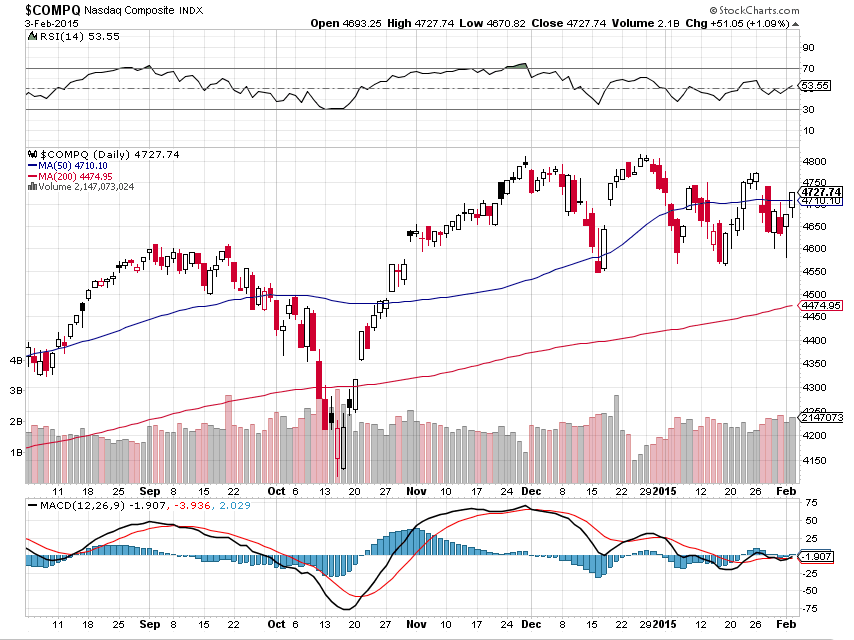

COMP – Almost bullish with another bounce off the 4600 level

Where Will the SPX end January 2015?

02-03-2015 Feb will finish at new market highs

01-27-2015 Feb my guestimate is 2050 or slightly positive

What is on tap for the rest of the week?=

Earnings:

Tues: DIS, AFL, CMG, GRD, WYNN

Wed: ALL, BSX, CLX, GM, GSK, HUBG, GMCR, MRK, RL, PRU, UA, YUM WHR

Thur: ATVI, BLL, BWLD, CMI, DWKN, EL, GPRO, GRUB, ICE, LNKD, LGF, MCK, NUS, P, PM ,PPL, SIRI, S, TWTR, YELP

Fri: D

Econ Reports:

Tues: Factory Orders, Auto, Truck

Wed: MBA, Crude, ADP employment, ISM Services

Thur: Initial Claims, Continuing Claims, Challenger Job Cuts, Trade Balance, Productivity, Unit Labor Costs

Fri: Ave Workweek, Non-Farm Payrolls, Private Payrolls, Hourly Earnings, Unemployment rate, Consumer Credit

Int’l:

Tues – CN:JP: PMI Composite

Wed – FR:DE:EMU: PMI Composite

Thurs –

Friday – DE: Industrial Production

Sunday –

How I am looking to trade?

I am prepared for earnings BUT I am adjusting bullish/good earnings companies to make money on a bullish run

My core positions that are bullish AAPL, DIS, V, F

Still Have BIDU, NVDA,

1st I am creating my earnings list so I don’t miss an earnings for a company I trade

AAPL – 01/27 AMC

BABA – 01/29 BMO

BIDU – 02/11 AMC

CLDX – 03/02 BMO

D – 02/06 AMC

DIS – 02/03 AMC

F – 01/29 BMO

FB – 01/28 AMC

LNCO – 02/26

NVDA – 02/11 AMC

SNDK – 01/21 AMC

V – 01/29 AMC

VZ – 01/22 BMO

WBA – 03/24

ZION – 01/26 AMC

SBUX – 01/22 AMC

MS – 01/20 BMO

PCLN – 02/19

NKE 3/19

RHT 3/26

Questions???

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Article Links can be followed by being a Twitter follower @kevinmhurley

HI Financial Services Mid-Week 04-29-2014