HI Financial Services Mid-Week Commentary 08-04-2015

“Remember AAPL is either loved or hated. There is no in-between when it comes to AAPL stock”. – An email to a client this week

The sky is falling and our stock market is sure to tank. Three of our core positions had great earnings, meeting or beating estimates yet have taken a pretty big leg down. AAPL, DIS and BIDU have all crashed pretty hard in the last week. I think it comes down to the market looking for reasons to sell off and take profits. No matter what anyone tells you the Fed raising rates will give us our correction whether it is warranted or not. We had over 4.4 trillion in stimulus put into our economy which mathematically means we are still stimulated until roughly April 2016 when the 6 to 18 months of benefit runs out.

What’s happening this week and why?

Stocks are priced to perfection and have to beat top, bottom and guidance estimates to go higher. Not only do they have to beat but they have to beat by A LOT !!!

Personal Income 0.4 vs est 0.3

Personal Spending 0.2 vs est 0.2

PCE Prices 0.1 vs est 0.2

Construction Spending 0.1 vs est 0.6

ISM Index 52.7 vs est 53.5

Factory roders 1.8 vs est 1.8

ADP employment 185 vs est 220

Trade balance -43.8 vs est -42.7

ISM Services 60.5 vs est 56.3

It is a mixed bag but for the most part good news is bad news. Bad news is good news so the Fed will not raise rates

Where will our market end this week?

This week all depends on Friday and the Non- Farm Payroll numbers. A less than expected number means the Fed will not raise rates and the market might head up to the top end of the range we have been trading in

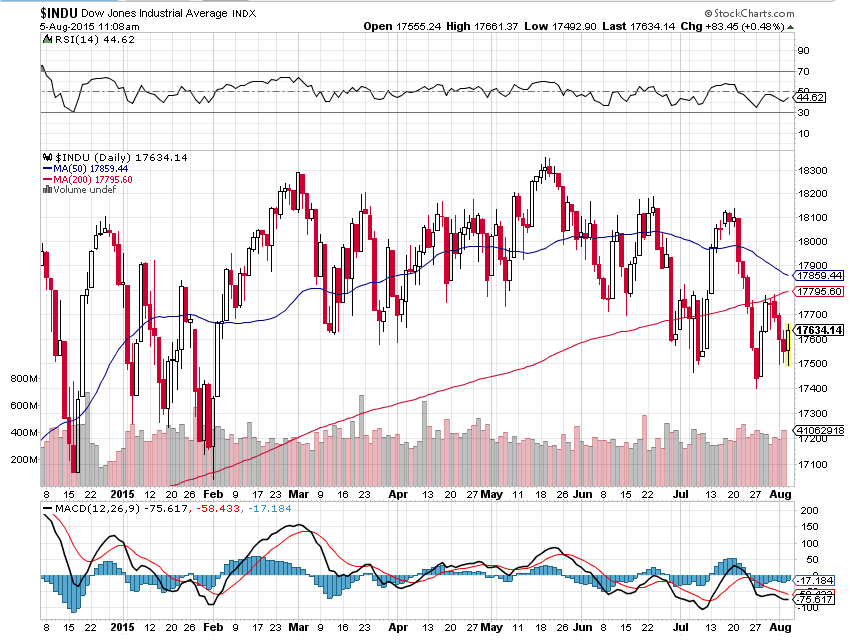

DJIA – Technically bearish and below the 50 & 200 day SMA. The short term trend is lower lows and lower highs

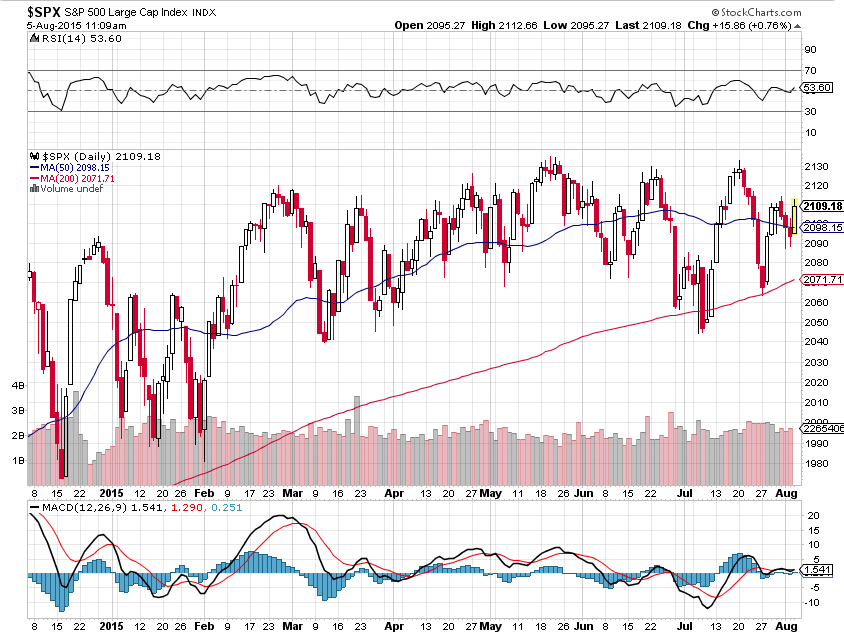

SPX – Bullish with all three crossovers and the 50 SMA is holding. Quite a difference from the DOW but the down is being hit with a couple of big stocks pulling the average down while the S&P is much more diversified

COMP – Bullish with a bounce.

Where Will the SPX end August 2015?

08-04-2015 I think the 2% I expected last month will come this month due to earnings and lower oil

What is on tap for the rest of the week?=

Earnings:

Tues: DIS, AET, BZH, COH, DVN, K, LC, MOS, ODP, S, Z,

Wed: CBS, CLDX, CHK, D, HLF, SODA, TSO, WEN, TSLA,

Thur: NVDA, DDD, DRYS, GRPN, JMBA, JSDA, NDLS, NUS, ZNGA

Fri: HSY, BID

Econ Reports:

Tues: Factory Orders,

Wed: MBA, ADP Employment, Trade Balance, ISM Services

Thur: Initial Claims, Continuing Claims,

Fri: Average Workweek, Hourly Earnings, Non- Farm Payroll, Private Payroll, Unemployment Rate, Consumer Credit

Int’l:

Tues – JP:CN: PMI Composite

Wed – DE:FR:EMU: PMI Composite

Thursday – JP: BOJ Announcement, DE: Manufacturing Orders

Friday – FR:DE: Industrial Production, Merchandise Trade

Sunday – CN: CPI, PPI

How I am looking to trade?

I was prepared for earnings and have had my hedges in place. Disappointed in the earnings and I’m in full collar trasdes to protect on the way down. If you can’t do it I can for you !!!

Questions???

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Article Links can be followed by being a Twitter follower @kevinmhurley

HI Financial Services Mid-Week 06-24-2014