HI Financial Services Mid-Week Commentary 05-26-2015

I think that stocks have been this tremendous, tremendous equalizer for people in this country. Guys who can’t make a lot of money at their jobs have been able to make a lot of money in the stock market – Jim Cramer

What’s happening this week and why?

DJIA – 190.48 or 1.04%

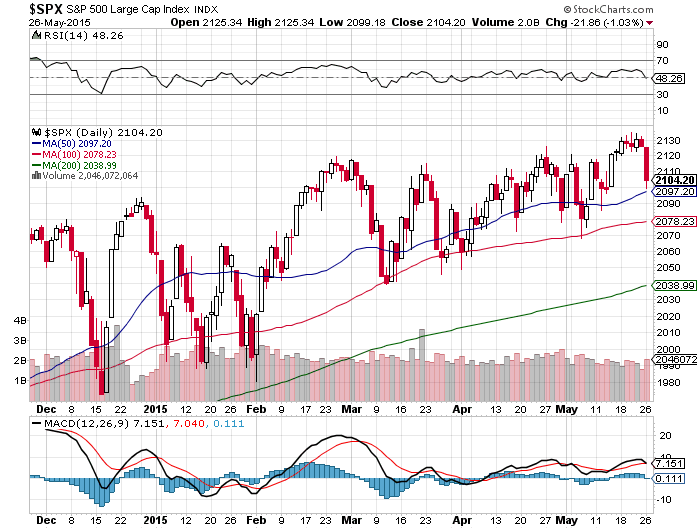

S&P – 21.86 or 1.03%

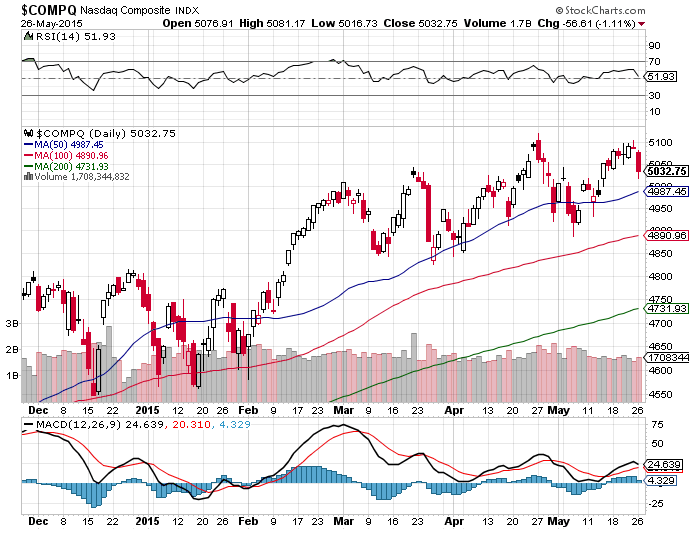

COMP – 56.61 or 1.11%

Today’s loss was news driven or headline risk

Stronger Dollar = Lower commodity pricing (Oil)

Metals should go higher Gold +0.20 Silver -0.016 Copper -0.001

Headline risk: Greece, stronger dollar, Good news is bad news meaning a rate hike is coming

That right now the economy is NOT able to stand on its own two feet – the stimulus is still working its way thru the system and the markets (economy, stock, commodities) are all artificially inflated. Right now the stock market has an 18 multiple that the earnings revenue doesn’t support

Durable Goods -0.5 vs est -0.6

Durable goods ex-trans 0.5 vs est 0.3

Case Shiller 5.0 vs est 4.6

FHFA Housing Index .3 vs est .6

New home sales 517K vs est 510K

Consumer Confidence 95.4 vs est 94.0

Where will our market end this week?

?????? But last day of the month is on Friday so selloff or a short squeeze

GDP number make or break our week

DJIA – Still technically Bullish and bounced off the 50 SMA

SPX – Still bullish with a bounce off the 50 SMA

COMP – Still bullish with a pullback today

Where Will the SPX end May 2015?

05-26-2015 UP 2% for the month

05-19-2015 UP 2% for the month

05-12-2015 Sell in May and go away down 3 to 6% 2050 level

05-05-2015 Sell in May and go away down 3 to 6% 2050 level

04-28-2015 Sell in May and go away down 3 to 6% 2050 level

What is on tap for the rest of the week?=

Earnings:

Tues: AZO, TIVO

Wed: COST, TOL, VAL

Thur: ANF, GME, SAFM

Fri: BIG, GCO

Econ Reports:

Tues: Durable Goods, Durable ex-trans, Case-Shiller, FHFA Housing Manufacturing Index, New Home Sales, Consumer Confidence,

Wed: MBA,

Thur: Initial Claims, Continuing Claims, Pending Home Sales,

Fri: GDP, GDP Deflator, Chicago PMI, Michigan Sentiment

Int’l:

Tues – JP:BOJ Minutes

Wed –

Thursday – JP:CPI, Unemployment Rate, Industrial Production

Friday – EMU: MS Money Supply

Sunday – JP: PMI Manufacturing, CN: CFLP Manufacturing, PMI Manufacturing

How I am looking to trade?

Positions expired to change the Collars and Protective puts that I was in. Right now I am in mostly stock ownership with leap short calls as a little downside protection.

Questions???

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Article Links can be followed by being a Twitter follower @kevinmhurley