HI Market View Commentary 05-06-2024

www.myhurleyinvestment.com This is the website to go to for the notes and videos

AAPL – What happened and what are you doing now? Beat on the top line missed on the bottom and missed half of the numbers important to AAPL BUT it also announced a 110 billion dollar buyback. We still plan on selling AAPL when it reaches $196-$199. Fully valued on the high side and we are looking for other opportunities

MU – Upgraded after good earnings and MS target price $115 to $150

SQ – Upgraded but had a great earnings and the market punished the stock = This is my new financial

VZ – New tech company for portfolios and expecting a 30% growth to $52 range with a current 6.68% dividend yield

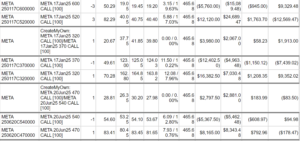

META – we ran the calculations and sold out a great top !!! We also kept positions in place to continue the upside potential movement.

We do what we do for the opportunity

https://www.youtube.com/watch?v=vz7zKrqjOSo

But that opportunity has a cost: Could’a, would’a, should’a

Samsung Electronics’ operating profit jumps 933% in first quarter, beats expectations

PUBLISHED MON, APR 29 20247:55 PM EDTUPDATED MON, APR 29 202410:32 PM EDT

Sheila Chiang@IN/SHEILACHIANG@SHEILACHIANG

KEY POINTS

- Samsung Electronics, the world’s largest memory chip maker, said operating profit jumped 932.8% in the first quarter ending March.

- Citi analysts on Apr. 5 said they see upside of Samsung’s NAND flash memory business from AI computing demand, reiterating their “buy” rating on the firm.

- The South Korean electronics giant saw record losses in 2023 as the industry reeled from a post-Covid slump in demand.

Samsung Electronics on Tuesday said operating profit for the first quarter jumped 932.8% as memory chip prices rebounded on the back of AI optimism.

Here are Samsung’s first-quarter results versus LSEG estimates:

- Revenue: 71.92 trillion Korean won (about $52.3 billion), vs. 71.04 trillion Korean won

- Operating profit: 6.61 trillion Korean won, vs. 5.94 trillion Korean won

Samsung’s revenue for the quarter ending March jumped 12.81% from a year ago, while operating profit soared 932.8% in the same period.

The figures were in line with the company’s guidance earlier this month, where Samsung said operating profit in the January-March quarter likely rose to 6.6 trillion Korean won, up 931% from a year ago. The firm expected first quarter revenue at 71 trillion won.

The South Korean electronics giant saw record losses in 2023 as the industry reeled from a post-Covid slump in demand.

“The company posted KRW 71.92 trillion in consolidated revenue on the back of strong sales of flagship Galaxy S24 smartphones and higher prices for memory semiconductors. Operating profit increased to KRW 6.61 trillion as the Memory Business returned to profit by addressing demand for high value-added products,” Samsung Electronics said in a statement on Tuesday.

Citi analysts said they see upside for Samsung’s NAND flash memory business as a result of AI computing demand. In a note on April 5, they reiterated their “buy” rating on the firm with a target price of 120,000 won — a 56% upside from the closing price of 76,700 won on Monday.

NAND is another staple memory chip alongside DRAM.

“We expect storage (HDD) to be the next bottleneck in AI computing, especially in AI training, and foresee Samsung Electronics to be one of the key beneficiaries of SSD demand momentum for AI training,” said the Citi analysts.

Samsung is the world’s largest manufacturer of dynamic random-access memory chips (DRAM), which are commonly found in a wide range of consumer devices including smartphones and computers.

Samsung said it expects the second quarter to be driven mostly by demand for generative AI, while mobile demand remains stable. Meanwhile, it expects PC demand to be impacted by slow seasonality, which could lead to customers adjusting inventories before new product launches in the second half of 2024.

In a Tuesday earnings call, the firm warned of escalating geopolitical instability and continued cost hikes in major components, particularly memory.

“Profitability in Q2 is expected to be down slightly compared to Q1 and Q3, which is when we released new flagship products this year. In response, we’re focusing on cost competitiveness throughout the R&D, manufacturing and sales processes to achieve solid profitability,” said Samsung, adding that it will continue to boost flagship sales through expansion of Galaxy AI.

Memory business returns to profit

Samsung said its semiconductor business logged a 1.91 trillion Korean won in operating profit in the first quarter, as compared to a loss of 4.58 trillion won in the same period a year ago and a loss of 2.18 trillion Korean won in the fourth quarter.

“We assume the earnings surprise was driven by higher memory price hike on AI-driven strong upturn cycle. We anticipate the company will guide for positive memory market outlook and emphasize its readiness in AI era including HBM (12H HBM3E, HBM4) and foundry/packaging solution,” said SK Kim of Daiwa Capital Markets in emailed comments to CNBC on Monday, ahead of the earnings release.

As AI models become more complex and datasets become larger, these models need memory chips with higher capacities and faster speeds to cater to these workloads.

Kim said in an April 5 report he expects another price hike on memory chips to drive Samsung’s second-quarter earnings on the back of an AI boom and the earthquake in Taiwan.

“Especially, we expect more upside in prices resulting from the earthquake in Taiwan,” said Kim, adding that the earthquake in early April temporarily impacted TSMC’s and Micron’s production.

To meet AI demand, Samsung said it started mass producing HBM3E 8H and V9 NAND in April. It plans to mass produce HBM3E 12H products and a 128GB product based on 1b nanometer 32GB DDR5 within the second quarter.

Despite macroeconomic uncertainty and geopolitical tensions, the firm expects the operational environment to “remain positive with demand” – bolstered by generative AI – in the second half of the year.

Samsung also said development of 3-nanometer and 2-nanometer processes is “progressing smoothly.” Samsung kicked off mass production of 3-nanometer chips in 2022 and plans to start mass producing 2-nanometer chips in 2025.

Galaxy S24 boost

Strong sales of Samsung’s latest smartphone series Galaxy S24 helped to lift revenue and operating profit of the mobile business, the firm said. AI features on the S24 such as Circle to Search, Photo Assist and Live Translate were popular among customers, Samsung said.

However, the firm warned that smartphone demand and shipments could decline in the second quarter because of seasonality.

But the smartphone market could see a rebound in the second half of the year from “stabilizing consumer sentiment, the expansion of AI products and services, and economic growth in emerging markets.”

Samsung said it will continue to expand Galaxy AI to existing and new flagship products to drive further growth.

Growing competition

Many countries in the world are racing to manufacture advanced semiconductors.

Earlier this month, the Biden administration agreed to grant Samsung up to $6.4 billion of funding to create new manufacturing capacity to produce chips in Texas. Micron and TSMC are also poised to receive grants to boost chipmaking in the U.S. after decades of chip production moving to Asia.

Samsung and TSMC are set to face competition from Japan’s Rapidus Corporation, which was recently granted $3.89 billion in additional subsidies from the Japanese government to mass produce 2-nanometer chips from 2027.

There are rising concerns that Samsung Electronics risks losing its leading position to rivals like SK Hynix, the world’s no. 2 memory chip maker.

SK Hynix on March 19 said it became the first in the industry to mass produce HBM3E, the next-generation of high bandwidth memory chips used in AI chipsets. SK Hynix is the primary supplier of HBM3 chips to Nvidia’s AI chipsets.

Mehdi Hosseini, senior tech hardware analyst of Susquehanna International Group, pointed out in early April that Samsung used to be the market leader in memory, smartphones and display innovations.

Now, Samsung is only “benefiting from the cycle recovery,” he added.

In the first quarter, Samsung managed to regain the top spot in smartphone shipments after losing the crown to Apple in 2023, according to International Data Corp.

Nvidia’s CEO co-founded his $2 trillion company at a Denny’s breakfast booth

Published Sat, May 4 20248:15 AM EDTUpdated 2 Hours Ago

Some people start businesses in their parents’ garages or basements. Others start theirs in college, building a clientele among fellow students.

Jensen Huang started his trillion-dollar tech company Nvidia while eating at a Denny’s restaurant in San Jose, California, he recently told CBS’ “60 Minutes.”

Nvidia, one of the chipmakers behind the burgeoning artificial intelligence industry, is currently worth $2.22 trillion, ranking it among the most valuable companies in the world. But in 1993, it was a business idea shared by three friends and engineers — Huang, Chris Malachowsky and Curtis Priem — who wanted to revolutionize gaming and media with 3D graphics.

In 1993, the trio met at the Denny’s location, Huang said. He was 30 years old, married and a father of two when inspiration struck him at the same restaurant where he once worked as a busboy at age 15, he added

“We came right here to this Denny’s, sat right back there, and the three of us decided to start the company,” said Huang, who remains Nvidia’s CEO today. “Frankly, I had no idea how to do it, nor did they. None of us knew how to do anything.”

From breakfast booth to booming business

By 1995, Nvidia had developed a low-cost computer processing chip called the NV1, according to the company’s website. This helped them snag a partnership with Sega to help make its games accessible on PC.

But the chip was a failure, too “technically poor” to render any significant level of graphics, Huang told graduating students in a May 2023 commencement speech at National Taiwan University.

The mistake nearly pushed the company into bankruptcy. Huang negotiated a contract buyout with Sega that provided Nvidia with a financial lifeline and resources to develop the NV1′s successor.

The new chip, called the RIVA 128, debuted in 1997 and quickly became a commercial success. By the 2010s, Nvidia was diversifying beyond the video game industry to laptop computers, automobiles, artificial intelligence and even cloud-based computing during the Covid-19 pandemic.

Nvidia shares have returned more than 500% since the start of 2023, Goldman Sachs reported last month.

The secret to Huang’s success

The billionaire CEO never anticipated that Nvidia’s diversification — driven by its development of a particularly powerful graphics processing chip — would prepare it for the age of artificial intelligence, he said.

“That was luck founded by vision,” said Huang. “We invented this capability and then one day, the researchers that were creating deep learning discovered this architecture. Because this architecture turned out to be perfect for them … Perfect for AI.”

That particular kind of optimism is a crucial factor to leading a successful life and career, according to cognitive neuroscientist Tali Sharot.

“Optimism changes subjective reality,” Sharot said in a 2012 TED Talk. “The way we expect the world to be changes the way we see it. But it also changes objective reality. It acts as a self-fulfilling prophecy. Controlled experiments have shown that optimism is not only related to success, it leads to success.”

As for Huang, the 61-year-old marveled at how a sit-down at Denny’s launched a tech giant, and said that dedication will take you far.

“This is the most extraordinary thing,” he said. “That a normal dishwasher busboy could grow up to be this. There’s no magic. It’s just 61 years of hard work every single day. I don’t think there’s anything more than that.”

Buffett says Berkshire sold its entire Paramount stake: ‘We lost quite a bit of money’

PUBLISHED SAT, MAY 4 20243:01 PM EDTUPDATED SAT, MAY 4 20244:17 PM EDT

OMAHA, Neb. — Warren Buffett revealed that he dumped Berkshire Hathaway’s entire Paramount stake at a loss.

“I was 100% responsible for the Paramount decision,” Buffett said at Berkshire’s annual shareholder meeting. “It was 100% my decision, and we’ve sold it all and we lost quite a bit of money.”

Berkshire owned 63.3 million shares of Paramount as of the end of 2023, after cutting the position by about a third in the fourth quarter of last year, according to latest filings.

The Omaha-based conglomerate first bought a nonvoting stake in Paramount’s class B shares in the first quarter of 2022. Since then the media company has had a tough ride, experiencing a dividend cut, earnings miss and a CEO exit. The stock declined 44% in 2022 and another 12% in 2023.

Just this week, Sony Pictures and private equity firm Apollo Global Management sent a letter to the Paramount board expressing interest in acquiring the company for about $26 billion. The firm has also been having takeover talks with David Ellison’s Skydance Media.

Paramount has struggled in recent years, suffering from declining revenue as more consumers abandon traditional pay-TV, and as its streaming services continue to lose money. The stock is in the red again this year, down nearly 13%.

Buffett said the unfruitful Paramount bet made him think more deeply about what people prioritize in their leisure time. He previously said the streaming industry has too many players seeking viewer dollars, causing a stiff price war.

Earnings Season:

BABA 05/16

BIDU 05/16

DG 05/30

DIS 05/07 BMO

MU 06/26

O 05/06 AMC

SQ 05/02 AMC

TGT 05/22 BMO

UAA 05/09

https://www.briefing.com/the-big-picture

Earnings dates:

Where will our markets end this week?

Higher – Foolish

DJIA – Bullish

SPX – Bullish

COMP – Bullish

Where Will the SPX end May 2024?

05-06-2024 -2.0%

04-29-2024 -2.0%

Earnings:

Mon: O

Tues: BP, CROX, DUK, LYFT, TWLO, DIS

Wed: UBER, ANMN, AMC, BYND, CPK, NUS, HUBS

Thur: H, PZZA, TPR, AKAM

Fri:

Econ Reports:

Mon:

Tue Consumer Credit

Wed: MBA, Wholesale Inventory

Thur: Initial Claims, Continuing Claims,

Fri: Michigan Sentiment, Treasury Budget

How am I looking to trade?

Mostly letting stocks run = very little protection in place

www.myhurleyinvestment.com = Blogsite

info@hurleyinvestments.com = Email

Questions???

Wall Street’s ugly April gets even worse as it tumbles across the finish line

(Peter Morgan / Associated Press)

By Stan Choe

April 30, 2024 2:02 PM PT

NEW YORK —

More worries about inflation and interest rates staying high knocked U.S. stocks lower on Tuesday as the market closed out its worst month since September.

The Standard & Poor’s 500 tumbled 1.6% to cement its first losing month in the last six. Its momentum slammed into reverse in April, falling as much as 5.5% at one point, after setting a record at the end of March.

The Dow Jones industrial average dropped 570 points, or 1.5%, and the Nasdaq composite lost 2%.

Stocks began sinking as soon as trading began, after a report showed U.S. workers won bigger gains in wages and benefits than expected during the first three months of the year. While that’s good news for workers and the latest signal of a solid job market, it feeds into worries that upward pressure remains on the economy and inflation.

It followed a string of reports this year that have shown inflation remains stubbornly high. That has caused traders to largely give up on hopes that the Federal Reserve will deliver multiple cuts to interest rates this year. And that in turn has sent Treasury yields jumping in the bond market, which has cranked up the pressure on stocks.

Tuesday’s losses for stocks accelerated at the end of the day as traders made their final moves before closing the books on April, and ahead of an announcement by the Federal Reserve on interest rates scheduled for Wednesday afternoon.

No one expects the Federal Reserve to change its main interest rate at this meeting. But traders are anxious about what Fed Chair Jerome H. Powell may say about the rest of the year.

Traders are now mostly betting the Fed will cut rates either one or zero times through the balance of 2024, according to data from CME Group. That’s a big letdown after traders came into the year forecasting six or more cuts.

The Fed itself was earlier penciling in three cuts to rates during 2024, but top officials have recently hinted that rates may stay high for longer as they wait for more confirmation inflation is heading down toward their 2% target. The Fed’s main interest rate is sitting at the highest level since 2001, which puts downward pressure on the economy and investment prices.

Without the benefit of easing interest rates, companies will need to deliver bigger profits in order to support their stock prices, which critics have called broadly too expensive following their run to records.

GE Healthcare Technologies tumbled 14.3% after it reported weaker results and revenue for the latest quarter than analysts expected. F5 dropped 9.2% despite reporting a better profit than expected. Its revenue fell short of forecasts, and it said customers were remaining cautious and forecasting largely flat IT budgets for the year.

McDonald’s slipped 0.2% after its profit for the latest quarter came up just shy of analysts’ expectations. It was hurt by weakening sales trends at its franchised stores overseas, in part by boycotts from Muslim-majority markets over the company’s perceived support of Israel.

Helping to keep the market’s losses in check was 3M, which rose 4.7% after reporting stronger results and revenue than forecast. Eli Lilly climbed 6% after turning in a better profit than expected on strong sales of its Mounjaro and Zepbound drugs for diabetes and obesity. It also raised its forecasts for revenue and profit for the full year.

All told, the S&P 500 fell 80.48 points to 5,035.69. The Dow dropped 570.17 points to 37,815.92, and the Nasdaq composite fell 325.26 points to 15,657.82.

This earnings reporting season has largely been better than expected so far. Not only have the tech companies that dominate Wall Street done well, but so have companies across a range of industries.

That’s a change from the recent past, and it helped push strategists at Deutsche Bank to raise their forecast for full-year earnings growth for the S&P 500. Many companies are topping forecasts because they’ve been able to wring more profit out of each dollar of revenue than analysts were expecting, according to Binky Chadha, chief strategist at Deutsche Bank.

Such strength could support stock prices even if interest rates end up staying high, according to Kristy Akullian, head of iShares Investment Strategy, Americas.

“Equities don’t need Fed rate cuts for the rally to continue, all they need is solid earnings growth,” she said.

In the bond market, the yield on the 10-year Treasury rose to 4.68% from 4.61% just before the morning release of the report on employee wages and benefits.

The two-year Treasury yield, which more closely tracks expectations for the Fed, jumped back above the 5% level to 5.03% from 4.97% late Monday.

In stock markets abroad, Japan’s Nikkei 225 rose 1.2% after reopening following a holiday. The government reported stronger-than-expected gains in industrial production for March.

Indexes were mixed across much of the rest of Asia but lower in Europe.

Choe writes for the Associated Press

Marathon Oil Reports First Quarter 2024 Results

NEWS PROVIDED BY

May 01, 2024, 16:30 ET

Returned $350 Million to Shareholders and Sanctioned Equatorial Guinea Drilling Program

HOUSTON, May 1, 2024 /PRNewswire/ — Marathon Oil Corporation (NYSE: MRO) reported first quarter 2024 net income of $297 million or $0.52 per diluted share, which includes the impact of certain items not typically represented in analysts’ earnings estimates and that would otherwise affect comparability of results. Adjusted net income was $317 million or $0.55 per diluted share. Net operating cash flow was $757 million or $861 million before changes in working capital (adjusted CFO). Free cash flow (FCF) was $271 million or $239 million before changes in working capital and including Equatorial Guinea (E.G.) distributions and other financing (adjusted FCF).

Highlights

- Continued delivery on sector-leading commitment to return at least 40% of adjusted CFO to shareholders; returned $349 million or 41% of adjusted CFO to shareholders during first quarter, including $285 million of share repurchases and $64 million base dividend

- Strong financial and operational quarter with no change to full-year production or capital spending guidance

- Generated $271 million of FCF and $239 million of adjusted FCF during first quarter, despite no E.G. cash dividends; expect catch-up in E.G. cash dividends during second quarter

- Delivered first quarter oil production of 181,000 net bopd and first quarter oil-equivalent production of 371,000 net boed, inclusive of winter weather downtime, primarily in the Bakken

- Reiterated midpoints of full year production and capital spending guidance and on track to deliver 2024 program that benchmarks at top of peer group on combination of FCF, capital efficiency, and shareholder returns

- Enhancing capital efficiency and resource recovery organically through extended laterals and ongoing progression of refrac and redevelopment opportunity set

- Brought online 12 three-mile wells during first quarter, delivered at a total per foot well cost more than 20% below comparable two-mile lateral wells; first three-mile Permian pad achieved an average per well 30-day IP rate of over 5,000 net boed

- Disclosing approximately 600 high-quality refrac and redevelopment opportunities across the Bakken and Eagle Ford, with approximately 30% concentrated on the acquired Ensign acreage

- Continued to progress development of E.G. Regional Gas Mega Hub

- Realized uplift in value during first quarter from shift to global LNG pricing for Alba LNG sales

- Sanctioned two Alba infill wells with first gas from both wells expected in 2025

- Enhanced financial flexibility through successful offering of $1.2 billion aggregate principal five and ten-year notes; proceeds used to pay off entirety of remaining variable-rate Term Loan balance and expected to deliver $20 million of annualized net interest savings

“With first quarter results, we continued to build on our multi-year track record of consistent operational execution, strong financial results, and compelling return of capital to our shareholders,” said chairman, president, and CEO Lee Tillman. “During first quarter, we improved our capital efficiency by bringing online 12 three-mile laterals, including one of the strongest pads industry has delivered in the Permian Basin; we enhanced our financial flexibility through a highly successful $1.2 billion bond offering; and we continued to progress the E.G. Regional Gas Mega Hub by sanctioning two high-confidence, low-execution risk infill wells on the Alba Block. The combination of outstanding performance from our extended lateral program and material additions to our refrac and redevelopment opportunity set continue to enhance and further extend our decade-plus of development well inventory life. Bottom line, I’m proud of our team, as we executed according to our plan during first quarter while holding true to our core values of safety and environmental excellence. We remain fully on track to deliver a 2024 program that provides a sector-leading combination of free cash flow, capital efficiency, and shareholder returns.”

Return of Capital & Balance Sheet Enhancement

Marathon Oil’s percentage of CFO framework provides clear visibility to significant return of capital to equity investors, ensuring the shareholder gets the first call on cash flow generation. In a $60/bbl WTI or higher price environment, the Company targets returning a minimum of 40% of CFO to equity investors.

During first quarter, Marathon Oil returned 41% of adjusted CFO to equity investors. First quarter return of capital totaled $349 million, including $285 million of share repurchases and the $64 million base dividend.

Over the trailing ten quarters, since significantly increasing return of capital to equity investors under its current Return of Capital Framework, Marathon Oil has returned $5.8 billion to shareholders. Over this timeframe, Marathon Oil has executed $5.2 billion of share repurchases that have reduced its outstanding share count by 29%, contributing to significant growth in per-share metrics.

During first quarter, the Company successfully completed a public offering of $1.2 billion aggregate principal amount of five and ten-year notes, with a weighted average interest rate of 5.5%. Net proceeds from the offering were used to repay the entirety of outstanding borrowings under the Company’s variable-rate Term Loan facility and are expected to deliver $20 million of annualized net interest savings.

1Q24 Financials

CASH FLOW AND CAPEX: Net cash provided by operations was $757 million during first quarter or $861 million before changes in working capital. First quarter capital expenditures totaled $603 million, consistent with the Company’s prior guidance that 2024 capital expenditures would be approximately 60% weighted to the first half of the year.

BALANCE SHEET AND LIQUIDITY: Marathon Oil ended first quarter with total liquidity of $2.2 billion, including $49 million of cash and cash equivalents and $2.1 billion of available borrowing capacity on its revolving credit facility that matures in 2027. All three primary credit rating agencies continue to rate Marathon Oil investment grade.

ADJUSTMENTS TO NET INCOME: The adjustments to net income for first quarter increased net income by $20 million, primarily due to the income impact associated with unrealized losses on derivative instruments.

1Q24 Operations

UNITED STATES (U.S.): U.S. production averaged 326,000 net boed during first quarter 2024. Oil production averaged 172,000 net bopd. January winter storms negatively affected first quarter oil production by 4,000 net bopd, with the impact primarily concentrated in the Bakken, consistent with prior guidance.

First quarter U.S. unit production cost averaged $6.77 per boe, above the high end of the annual guidance range, consistent with seasonally higher workover activity and lower first quarter production levels. U.S. unit production costs are expected to decline as production increases in coming quarters. The midpoint of Marathon Oil’s full year 2024 U.S. unit production cost guidance remains unchanged.

Excluding joint venture wells, the Company brought a total of 49 gross Company-operated wells to sales during first quarter. First quarter Eagle Ford production averaged 127,000 net boed, including 65,000 net bopd, with 27 gross Company-operated wells to sales. Bakken production averaged 105,000 net boed, including 68,000 net bopd, with 18 gross Company-operated wells to sales. Permian production averaged 48,000 net boed, including 28,000 net bopd, with four gross Company-operated wells to sales. With no gross operated wells to sales, Oklahoma production averaged 45,000 net boed, including 10,000 net bopd.

Marathon Oil continues to organically improve capital efficiency and enhance resource recovery through longer laterals and the ongoing progression of its refrac and redevelopment program. During first quarter, the Company brought 12 three-mile lateral wells to sales (eight in Bakken, three in Permian, one in Eagle Ford) with a total per foot well cost more than 20% below comparable two-mile lateral wells. The Company’s first three-mile lateral pad in the Permian achieved an average per well 30-day IP rate of 5,265 boed (62% oil, 3 wells), and contributed to significant sequential production growth in the Permian. Derisked by recent well results and ongoing technical work, Marathon Oil has also disclosed a refrac and redevelopment opportunity set of approximately 600 high-quality wells, complementary and additive to the Company’s decade-plus of primary drilling inventory. Approximately 30% of the Company’s total refrac and redevelopment opportunities are concentrated on the Ensign Eagle Ford acreage, representing upside to the Company’s acquisition basis.

INTERNATIONAL: During first quarter, Marathon Oil realized the uplift in value from the shift to global LNG pricing for Alba LNG sales. Prior to 2024, the Company primarily sold natural gas to equity method investees via Gas Sales Agreements (GSAs) in the form of feedstock for methanol (to AMPCO, MRO 45% interest) and LNG (to EG LNG, MRO 56% interest) at long-term fixed prices ($0.24 per mcf). Whereas the GSA with AMPCO continues until 2026, the GSA with EG LNG expired, as did the legacy Henry Hub-linked contract under which EG LNG sold Alba LNG.

Beginning January 1, 2024, under new contractual agreements, Marathon Oil is responsible for directly marketing its own share of Alba LNG. The majority of its expected LNG sales over the next five years are covered by a previously announced TTF-linked LNG sales agreement. All 2024 Alba LNG cargos have been contracted at a mix of TTF and JKM indexed pricing. Under the new contractual agreements, Marathon Oil assumes responsibility for shrink and plant losses during liquefaction, which results in a reduction to reported net production and sales volumes for Alba gas sold as LNG. The Company is also subject to an LNG lifting schedule, which may result in an underlift or overlift position.

Starting in first quarter, the revenue from Marathon Oil’s Alba LNG sales into the global market are consolidated in the Company’s financial statements. EG LNG now processes Marathon Oil’s Alba LNG under a tolling and profit-sharing agreement. The tolling and profit-share fees are recorded as related party expense (shipping, handling and other operating expense) in Marathon Oil’s consolidated financials and Marathon Oil’s share of this income for EG LNG is included in income from equity method investments. Equity method accounting continues to be applied to the Alen third party gas, which is also processed by EG LNG under a tolling and profit-sharing agreement.

During first quarter, E.G. production averaged 45,000 net boed, while total sales volumes averaged 43,000 net boed, as a 2,000 net bopd condensate overlift was more than offset by a 24,000 net mcfd (4,000 net boed) LNG underlift. While Marathon Oil continued to sell Alba gas to AMPCO at a fixed-price, during first quarter, the Company began optimizing its operations by diverting a portion of its Alba gas from AMPCO methanol sales to higher-margin LNG sales. Marathon Oil’s Alba LNG sales achieved a realized price of $7.21 per mcf during first quarter, consistent with the Company realizing the uplift in value from the shift to global LNG pricing. Total International net income was $82 million during first quarter, including $39 million of net income from equity method investees. The Company did not receive any cash distributions from equity method companies during first quarter, but expects to receive catch-up dividends from equity method companies during second quarter.

During first quarter, Marathon Oil and its partners also made a final investment decision on two Alba infill wells and have successfully contracted a rig within the West Africa region, expecting a first half 2025 spud date. First gas from both wells is expected during the second half of 2025 and is expected to largely mitigate Alba field base decline for two years, contributing to a relatively flat production profile from full year 2024 to full year 2026. Capital expenditures in 2024 are modest, limited to long lead equipment, and are already included in the Company’s full year 2024 capital budget. The Company anticipates capital spending of approximately $100 million for the infill project in 2025.

2024 Guidance

Marathon Oil’s originally provided 2024 production, capital expenditure, cost, and tax guidance ranges are all unchanged as the Company remains on track to deliver a 2024 program that benchmarks at the top of its peer group on the combination of FCF, capital efficiency, and shareholder returns. The Company continues to expect its capital program to be heavily weighted to the first half of the year, with production expected to increase from first quarter levels. At the midpoint of annual guidance, the Company expects its $2 billion capital program to deliver 190,000 net bopd, 390,000 net boed, and approximately $2.2 billion of adjusted FCF, assuming $80/bbl WTI, $2.50/MMBtu Henry Hub, and $10/MMBtu TTF. Cash flow sensitivities to WTI, Henry Hub, and TTF commodity prices are provided in the Company’s first quarter 2024 earnings presentation.

A slide deck and Quarterly Investor Packet will be posted to the Company’s website following this release. On Thursday, May 2, at 9 a.m. ET, the Company will conduct a question-and-answer webcast/call, which will include forward-looking information. The live webcast, replay and all related materials will be available at https://ir.marathonoil.com/.

About Marathon Oil

Marathon Oil (NYSE: MRO) is an independent oil and gas exploration and production (E&P) company focused on four of the most competitive resource plays in the U.S. – Eagle Ford, Texas; Bakken, North Dakota; Permian in New Mexico and Texas, and STACK and SCOOP in Oklahoma, complemented by a world-class integrated gas business in Equatorial Guinea. The Company’s Framework for Success is founded in a strong balance sheet, ESG excellence and the competitive advantages of a high-quality multi-basin portfolio. For more information, please visit www.marathonoil.com.

Media Relations Contact:

Karina Brooks: 713-296-2191

Investor Relations Contacts:

Guy Baber: 713-296-1892

John Reid: 713-296-4380

Non-GAAP Measures

In analyzing and planning for its business, Marathon Oil supplements its use of GAAP financial measures with non-GAAP financial measures, including adjusted net income (loss), adjusted net income (loss) per share, net cash provided by operating activities before changes in working capital (adjusted CFO), free cash flow, adjusted free cash flow and reinvestment rate.

Warren Buffett says AI scamming will be the next big ‘growth industry’

PUBLISHED SAT, MAY 4 202411:58 AM EDTUPDATED SAT, MAY 4 20241:09 PM EDT

KEY POINTS

- “When you think about the potential for scamming people … if I was interested in investing in scamming, it’s gonna be the growth industry of all time and it’s enabled, in a way” by AI, Warren Buffett said.

- “Obviously, AI has potential for good things too, but … I do think, as someone who doesn’t understand a damn thing about it, it has enormous potential for good and enormous potential for harm,” he added.

Warren Buffett isn’t jumping on the artificial intelligence bandwagon just yet, warning about the technology’s potential for harm.

“When you think about the potential for scamming people … if I was interested in investing in scamming, it’s gonna be the growth industry of all time and it’s enabled, in a way” by AI, Buffett said at Berkshire Hathaway’s annual shareholder meeting on Saturday. Buffett pointed to the technology’s ability to reproduce realistic and misleading content in an effort to send money to bad actors.

Scammers are known to use AI voice-cloning and deep-fake technology to manipulate videos and images that impersonate an individual’s family and friends to ask for money or personal information.

“Obviously, AI has potential for good things too, but … I do think, as someone who doesn’t understand a damn thing about it, it has enormous potential for good and enormous potential for harm — and I just don’t know how that plays out,” Buffett added.

AI has been the talk of Wall Street for more than a year, as investors bet on the technology’s potential to drive higher profits going forward. Stocks such as Nvidia and Meta Platforms have skyrocketed during the AI boom, up 507% and 275%, respectively since the end of 2022.

However, the investing legend admitted he’s not familiar with AI and likened its potential that of the atomic bomb’s during the 20th century.

“I don’t know anything about about AI. That doesn’t mean I deny its existence or importance or anything of the sort,” Buffett said, speaking in a cautious tone. “We let the genie out of the bottle when we developed nuclear weapons and that genie has been doing some terrible things lately, and the power of that genie is what scares the hell out of me.”

“I don’t know any way to get the genie back in the bottle, and AI is somewhat similar. It’s part of the way out of the bottle, and it’s enormously important and it’s going to be done by somebody … whether it’s going to change the future of society, we will find out later,” Buffett added.

Apple announces largest-ever $110 billion share buyback as iPhone sales drop 10%

PUBLISHED THU, MAY 2 202412:00 PM EDTUPDATED THU, MAY 2 20247:11 PM EDT

KEY POINTS

- Apple’s fiscal second-quarter earnings were slightly higher than Wall Street expectations, but showed overall revenue down 4%, and iPhone sales falling 10%.

- The iPhone maker announced that its board had authorized $110 billion in share repurchases, the largest in company history.

- Apple CEO Tim Cook told CNBC that quarterly sales suffered from a difficult comparison to the year-earlier period.

Apple shares climbed 7% in extended trading on Thursday after the iPhone maker reported fiscal second-quarter earnings that topped estimates and announced an expanded stock buyback program.

Apple announced that its board had authorized $110 billion in share repurchases, a 22% increase over last year’s $90 billion authorization. It’s the largest buyback in history, ahead of Apple’s previous repurchases, according to data from Birinyi Associates.

However, overall sales fell 4% and iPhone sales fell 10% year over year during the quarter, which Apple attributed to a tough comparison versus last year.

Here’s how Apple did versus LSEG consensus estimates in the quarter ended March 30:

- EPS: $1.53 vs. $1.50 estimated

- Revenue: $90.75 billion vs. $90.01 billion estimated

- iPhone revenue: $45.96 billion vs. $46.00 billion estimated

- Mac revenue: $7.5 billion vs. $6.86 billion estimated

- iPad revenue: $5.6 billion vs. $5.91billion estimated

- Other Products revenue: $7.9 billion vs. $8.08 billion estimated

- Services revenue: $23.9 billion vs. $23.27 billion estimated

- Gross margin: 46.6% vs. 46.6% estimated

Apple did not provide formal guidance, but Apple CEO Tim Cook told CNBC’s Steve Kovach that overall sales would grow in the “low single digits” during the June quarter.

Apple posted $81.8 billion in revenue during the year-ago June quarter and LSEG analysts were looking for a forecast of $83.23 billion.

On an earnings call with analysts, Apple finance chief Luca Maestri said the company expected the current quarter will deliver double-digit year-over-year percentage growth in iPad sales. What’s more, he said the Services division is forecast to continue growing at about the current high rate it’s achieved during the past two quarters.

Apple reported net income of $23.64 billion, or $1.53 per share, down 2% from $24.16 billion, or $1.52 per share, in the year-earlier period.

Cook told CNBC that sales in the fiscal second quarter suffered from a difficult comparison to the year-earlier period, when the company realized $5 billion in delayed iPhone 14 sales from Covid-based supply issues.

“If you remove that $5 billion from last year’s results, we would have grown this quarter on a year-over-year basis,” Cook said. “And so that’s how we look at it internally from how the company is performing.”

Apple said iPhone sales fell nearly 10% to $45.96 billion, suggesting weak demand for the current generation of smartphones, which were released in September. The sales were in line with analyst estimates, and Cook said that without last year’s increased sales, iPhone revenue would have been flat.

Mac sales were up 4% to $7.45 billion, but they are still below the segment’s high-water mark set in 2022. Cook said sales were driven by the company’s new MacBook Air models which were released with an upgraded M3 chip in March.

Other Products, which is how Apple reports sales of its Apple Watch and AirPods headphones, was down 10% year over year to $7.9 billion.

During the quarter, Apple released its first new major product category in years, the Vision Pro virtual reality headset, but the $3,500 device is expected to sell in low quantities, especially compared to Apple’s major product lines.

“We’re only scratching the surface there so we couldn’t be more excited about our opportunity there,” Cook said.

Apple has not released a new iPad since 2022, which is a drag on sales. Revenue for the division fell 17% to $5.6 billion. Apple is expected to announce new iPads on May 7 that could revive demand for the product line.

Cook said that Apple has “big plans to announce” at its iPad product event next week and at the Worldwide Developers Conference in June.

The company’s Services business was a bright spot during the quarter. Sales rose 14.2% to $23.9 billion. That’s how Apple reports revenue from its subscription services, warranties, licensing deals with search engines, and payments. The company has a broad definition of subscribers, including users subscribing to apps through Apple’s App Store. It counts over 1 billion paid subscriptions.

Sales in Greater China, Apple’s third largest region, were off 8% to $16.37 billion in revenue, which was significantly better than the $15.25 billion in sales expected by FactSet analysts, potentially quelling investor worries the iPhone maker may have been losing market share to local competitors such as Huawei.

“I feel good about China. I think more about long term than to the next week or so,” Cook said.

Cook told CNBC that iPhone sales grew in China during the quarter, which “may come as a surprise to some people.”

In addition to the buyback authorization, Apple said it would pay a 25-cent dividend, a 1-cent increase.

Correction: Cook said that Apple has “big plans to announce” at its iPad product event next week and at the Worldwide Developers Conference in June. An earlier version misstated the context of the plans.

AI engineers report burnout and rushed rollouts as ‘rat race’ to stay competitive hits tech industry

PUBLISHED FRI, MAY 3 20247:00 AM EDTUPDATED FRI, MAY 3 202410:42 AM EDT

KEY POINTS

- Artificial intelligence engineers at top tech companies told CNBC that the pressure to roll out AI tools at breakneck speed has come to define their jobs.

- They say that much of their work is assigned to appease investors rather than to solve problems for end users, and that they are often chasing OpenAI.

- Burnout is an increasingly common theme as AI workers say their employers are pursuing projects without regard for the technology’s effect on climate change, surveillance and other potential real-world harms.

Late last year, an artificial intelligence engineer at Amazon was wrapping up the work week and getting ready to spend time with some friends visiting from out of town. Then, a Slack message popped up. He suddenly had a deadline to deliver a project by 6 a.m. on Monday.

There went the weekend. The AI engineer bailed on his friends, who had traveled from the East Coast to the Seattle area. Instead, he worked day and night to finish the job.

But it was all for nothing. The project was ultimately “deprioritized,” the engineer told CNBC. He said it was a familiar result. AI specialists, he said, commonly sprint to build new features that are often suddenly shelved in favor of a hectic pivot to another AI project.

The engineer, who requested anonymity out of fear of retaliation, said he had to write thousands of lines of code for new AI features in an environment with zero testing for mistakes. Since code can break if the required tests are postponed, the Amazon engineer recalled periods when team members would have to call one another in the middle of the night to fix aspects of the AI feature’s software.

AI workers at other Big Tech companies, including Google and Microsoft, told CNBC about the pressure they are similarly under to roll out tools at breakneck speeds due to the internal fear of falling behind the competition in a technology that, according to Nvidia CEO Jensen Huang, is having its “iPhone moment.”

The tech workers spoke to CNBC mostly on the condition that they remain unnamed because they weren’t authorized to speak to the media. The experiences they shared illustrate a broader trend across the industry, rather than a single company’s approach to AI.

They spoke of accelerated timelines, chasing rivals’ AI announcements and an overall lack of concern from their superiors about real-world effects, themes that appear common across a broad spectrum of the biggest tech companies — from Apple to Amazon to Google.

Engineers and those with other roles in the field said an increasingly large part of their job was focused on satisfying investors and not falling behind the competition rather than solving actual problems for users. Some said they were switched over to AI teams to help support fast-paced rollouts without having adequate time to train or learn about AI, even if they are new to the technology.

A common feeling they described is burnout from immense pressure, long hours and mandates that are constantly changing. Many said their employers are looking past surveillance concerns, AI’s effect on the climate and other potential harms, all in the name of speed. Some said they or their colleagues were looking for other jobs or switching out of AI departments, due to an untenable pace.

This is the dark underbelly of the generative AI gold rush. Tech companies are racing to build chatbots, agents and image generators, and they’re spending billions of dollars training their own large language models to ensure their relevance in a market that’s predicted to top $1 trillion in revenue within a decade.

Tech’s megacap companies aren’t being shy about acknowledging to investors and employees how much AI is shaping their decision-making.

Microsoft Chief Financial Officer Amy Hood, on an earnings call earlier this year, said the software company is “repivoting our workforce toward the AI-first work we’re doing without adding material number of people to the workforce,” and said Microsoft will continue to prioritize investing in AI as “the thing that’s going to shape the next decade.”

Meta CEO Mark Zuckerberg spent much of his opening remarks on his company’s earnings call last week focused on AI products and services and the advancements in its large language model called Llama 3.

“This leads me to believe that we should invest significantly more over the coming years to build even more advanced models and the largest scale AI services in the world,” Zuckerberg said.

At Amazon, CEO Andy Jassy told investors last week that the “generative AI opportunity” is almost unprecedented, and that increased capital spending is necessary to take advantage of it.

“I don’t know if any of us has seen a possibility like this in technology in a really long time, for sure since the cloud, perhaps since the Internet,” Jassy said.

Speed above everything

On the ground floor, where those investments are taking place, things can get messy.

The Amazon engineer, who lost his weekend to a project that was ultimately scuttled, said higher-ups seemed to be doing things just to “tick a checkbox,” and that speed, rather than quality, was the priority while trying to recreate products coming out of Microsoft or OpenAI.

In an emailed statement to CNBC, an Amazon spokesperson said, the company is “focused on building and deploying useful, reliable, and secure generative AI innovations that reinvent and enhance customers’ experiences,” and that Amazon is supporting its employees to “deliver those innovations.”

“It’s inaccurate and misleading to use a single employee’s anecdote to characterize the experience of all Amazon employees working in AI,” the spokesperson said.

Last year marked the beginning of the generative AI boom, following the debut of OpenAI’s ChatGPT near the end of 2022. Since then, Microsoft, Alphabet, Meta, Amazon and others have been snapping up Nvidia’s processors, which are at the core of most big AI models.

While companies such as Alphabet and Amazon continue to downsize their total headcount, they’re aggressively hiring AI experts and pouring resources into building their models and developing features for consumers and businesses.

Eric Gu, a former Apple employee who spent about four years working on AI initiatives, including for the Vision Pro headset, said that toward the end of his time at the company, he felt “boxed in.”

“Apple is a very product-focused company, so there’s this intense pressure to immediately be productive, start shipping and contributing features,” Gu said. He said that even though he was surrounded by “these brilliant people,” there was no time to really learn from them.

“It boils down to the pace at which it felt like you had to ship and perform,” said Gu, who left Apple a year ago to join AI startup Imbue, where he said he can work on equally ambitious projects but at a more measured pace.

Apple declined to comment.

An AI engineer at Microsoft said the company is engaged in an “AI rat race.”

When it comes to ethics and safeguards, he said, Microsoft has cut corners in favor of speed, leading to rushed rollouts without sufficient concerns about what could follow. The engineer said there’s a recognition that because all of the large tech companies have access to most of the same data, there’s no real moat in AI.

Microsoft didn’t provide a comment.

Morry Kolman, an independent software engineer and digital artist who has worked on viral projects that have garnered more than 200,000 users, said that in the age of rapid advancement in AI, “it’s hard to figure out where is worth investing your time.”

“And that is very conducive to burnout just in the sense that it makes it hard to believe in something,” Kolman said, adding, “I think that the biggest thing for me is that it’s not cool or fun anymore.”

At Google, an AI team member said the burnout is the result of competitive pressure, shorter timelines and a lack of resources, particularly budget and headcount. Although many top tech companies have said they are redirecting resources to AI, the required headcount, especially on a rushed timeline, doesn’t always materialize. That is certainly the case at Google, the AI staffer said.

The company’s hurried output has led to some public embarrassment. Google Gemini’s image-generation tool was released and promptly taken offline in February after users discovered historical inaccuracies and questionable responses. In early 2023, Google employees criticized leadership, most notably CEO Sundar Pichai, for what they called a “rushed” and “botched” announcement of its initial ChatGPT competitor called Bard.

The Google AI engineer, who has over a decade of experience in tech, said she understands the pressure to move fast, given the intense competition in generative AI, but it’s all happening as the industry is in cost-cutting mode, with companies slashing their workforce to meet investor demands and “increase their bottom line,” she said.

There’s also the conference schedule. AI teams had to prepare for the Google I/O developer event in May 2023, followed by Cloud Next in August and then another Cloud Next conference in April 2024. That’s a significantly shorter gap between events than normal, and created a crunch for a team that was “beholden to conference timelines” for shipping features, the Google engineer said.

Google didn’t provide a comment for this story.

The sentiment in AI is not limited to the biggest companies.

An AI researcher at a government agency reported feeling rushed to keep up. Even though the government is notorious for moving slower than companies, the pressure “trickles down everywhere,” since everyone wants to get in on generative AI, the person said.

And it’s happening at startups.

There are companies getting funded by “really big VC firms who are expecting this 10X-like return,” said Ayodele Odubela, a data scientist and AI policy advisor.

“They’re trying to strike while the iron is hot,” she said.

‘A big pile of nonsense’

Regardless of the employer, AI workers said much of their jobs involve working on AI for the sake of AI, rather than to solve a business problem or to serve customers directly.

“A lot of times, it’s being asked to provide a solution to a problem that doesn’t exist with a tool that you don’t want to use,” independent software engineer Kolman told CNBC.

The Microsoft AI engineer said a lot of tasks are about “trying to create AI hype” with no practical use. He recalled instances when a software engineer on his team would come up with an algorithm to solve a particular problem that didn’t involve generative AI. That solution would be pushed aside in favor of one that used a large language model, even if it were less efficient, more expensive and slower, the person said. He described the irony of using an “inferior solution” just because it involved an AI model.

A software engineer at a major internet company, which the person asked to keep unnamed due to his group’s small size, said the new team he works on dedicated to AI advancement is doing large language model research “because that’s what’s hot right now.”

The engineer has worked in machine learning for years, and described much of the work in generative AI today as an “extreme amount of vaporware and hype.” Every two weeks, the engineer said, there’s some sort of big pivot, but ultimately there’s the sense that everyone is building the same thing.

He said he often has to put together demos of AI products for the company’s board of directors on three-week timelines, even though the products are “a big pile of nonsense.” There’s a constant effort to appease investors and fight for money, he said. He gave one example of building a web app to show investors even though it wasn’t related to the team’s actual work. After the presentation, “We never touched it again,” he said.

A product manager at a fintech startup said one of his projects involved a rebranding of the company’s algorithms to AI. He also worked on a ChatGPT plug-in for customers. Executives at the company never told the team why it was needed.

The employee said it felt “out of order.” The company was starting with a solution involving AI without ever defining the problem.

An AI engineer who works at a retail surveillance startup told CNBC that he’s the only AI engineer at a company of 40 people and that he handles any responsibility related to AI, which is an overwhelming task.

He said the company’s investors have inaccurate views on the capabilities of AI, often asking him to build certain things that are “impossible for me to deliver.” He said he hopes to leave for graduate school and to publish research independently.

Risky business

The Google staffer said that about six months into her role, she felt she could finally keep her head above water. Even then, she said, the pressure continued to mount, as the demands on the team were “not sustainable.”

She used the analogy of “building the plane while flying it” to describe the company’s approach to product development.

The Amazon AI engineer expressed a similar sentiment, saying everyone on his current team was pulled into working on a product that was running behind schedule, and that many were “thrown into it” without relevant experience and onboarding.

He also said AI accuracy, and testing in general, has taken a backseat to prioritize speed of product rollouts despite “motivational speeches” from managers about how their work will “revolutionize the industry.”

Odubela underscored the ethical risks of inadequate training for AI workers and with rushing AI projects to keep up with competition. She pointed to the problems with Google Gemini’s image creator when the product hit the market in February. In one instance, a user asked Gemini to show a German soldier in 1943, and the tool depicted a racially diverse set of soldiers wearing German military uniforms of the era, according to screenshots viewed by CNBC.

“The biggest piece that’s missing is lacking the ability to work with domain experts on projects, and the ability to even evaluate them as stringently as they should be evaluated before release,” Odubela said, regarding the current ethos in AI.

At a moment in technology when thoughtfulness is more important than ever, some of the leading companies appear to be doing the opposite.

“I think the major harm that comes is there’s no time to think critically,” Odubela said.

Block shares jump on better-than-expected first-quarter results

PUBLISHED THU, MAY 2 20244:17 PM EDTUPDATED THU, MAY 2 20247:31 PM EDT

MacKenzie Sigalos@KENZIESIGALOS

KEY POINTS

- Block reported first-quarter earnings after the bell that beat analysts’ estimates.

- The company reported $5.96 billion in revenue, vs. $5.82 billion expected.

- Block, formerly known as Square, ended the year with 57 million monthly transacting actives for Cash App in March, up 6% year over year.

Block reported first-quarter earnings after the bell Thursday that exceeded analysts’ estimates. The stock rose more than 7% in extended trading.

Here’s how the company did, compared with analysts’ consensus estimates from LSEG.

- Earnings per share: 85 cents adjusted vs. 72 cents expected

- Revenue: $5.96 billion vs. $5.82 billion expected

Block, formerly known as Square, posted $2.09 billion in gross profit, up 22% from a year ago. Analysts tend to focus on gross profit as a more accurate measurement of the company’s core transactional businesses.

The company reported net income of $472 million, or 74 cents per share, more than quadruple the net income of $98.3 million, or 16 cents per share, a year earlier.

The company raised its adjusted EBITDA forecast for the second quarter to $690 million from $670 million.

The Cash App business, which is the company’s popular mobile payment platform, reported $1.26 billion in gross profit, a 25% year-over-year jump. Block, run by Twitter co-founder Jack Dorsey, said its Cash App Card monthly active users increased to 24 million in March.

Block ended the year with 57 million monthly transacting actives for Cash App in March, up 6% year over year. Inflows per transacting active were $1,255, up 11% year over year.

Block is also more focused on integrating Afterpay, the buy now, pay later company it bought for $29 billion in 2021. Afterpay struggled following the deal, posting big losses.

Block has slimmed down operations in recent months. In January, Dorsey reportedly said in a note to staffers that the company had laid off a “large number” of workers. This followed a round of layoffs in December.

Chief Financial Officer Amrita Ahuja said in a call with CNBC that the company is raising its outlook for the year to reflect its strong performance in the first quarter.

Dorsey’s note to shareholders began by directly addressing a question that he said he often fields: “Why the hell are you all spending so much time on bitcoin?”

“Less than 3% of company resources are dedicated to bitcoin-related projects,” Dorsey wrote. “But why spend time on bitcoin at all? We believe the world needs an open protocol for money, one that’s not owned or controlled by any single entity.”

He said bitcoin will ultimately help Block “serve more people around the world faster.” He said Block will be investing 10% of its gross profit from bitcoin products into purchases of bitcoin for investment.

“We were one of the first public companies to put bitcoin on our balance sheet,” he wrote.

The $220 million the company invested in bitcoin has grown 160% to $573 million as of the end of the first quarter, according to Dorsey.

Federal probe into Block

Cash App remains a significant contributor to overall profitability at the company.

Ahuja told CNBC that the fintech firm has seen “continued resilience of spend” with not only growth in actives, but also growth in spend per monthly active user on a year-over-year and quarter-over-quarter basis.

“Which shows us, again, continued resilience of this customer base and strong engagement with our product,” said Ahuja.

Shares in Block dropped 8% on Wednesday after an NBC investigation reported that U.S. prosecutors were probing the company’s compliance practices based on information leaked to them by a former employee of the company.

“Most of the transactions discussed with prosecutors, involving credit card transactions, dollar transfers and bitcoin, were not reported to the government as required,” the NBC story alleged.

The whistleblower reportedly gave the government materials showing breaches in know-your-customer and anti-money-laundering rules, as well as evidence indicating that management ignored these lapses.

Unlike past reports of possible wrongdoing at the company, the latest allegations encompass both Cash App and the company’s Square point-of-sale technology. It also includes within its scope international payments, sanctioned nations, and alleged breaches of the Office of Foreign Assets Control. In September, Alyssa Henry stepped down as Square CEO. Dorsey stepped in to fill the role, and no successor has been announced.

A separate NBC report published in February found that two whistleblowers had gone to the U.S. Treasury’s Financial Crimes Enforcement Network, or FinCEN, to share similar allegations. The popular payment app “had no effective procedure” to establish the identity of its customers, two whistleblowers told officials, according to NBC.

Analysts for Macquarie wrote in a note Wednesday that should the federal probe find merit in these claims, they see greater potential for fines or behavioral remedies such as robust oversight teams and infrastructure rather than “something structural like limitations on the types of business it can do.”

Last year, short seller Hindenburg Research levied similar claims, alleging that Block allowed criminal activity to operate with lax controls and “highly” inflates Cash App’s transacting user base, a key metric of performance.

Hindenburg described Block’s internal systems as a ”‘Wild West’ approach to compliance.”

— CNBC’s Michael Bloom and Kate Rooney contributed to this report.

Disney set for its first earnings report since proxy battle win against Nelson Peltz

- Senior Reporter

Mon, May 6, 2024, 12:01 PM MDT

Disney (DIS) will report its fiscal second quarter earnings before the bell on Tuesday — its first earnings report since the media giant successfully fended off a high-profile proxy fight with activist investor Nelson Peltz.

As a reminder, Disney recently adjusted its reporting structure after CEO Bob Iger reorganized the company into three core business segments: Disney Entertainment, which includes its entire media and streaming portfolio; Experiences, which encompasses the parks business; and Sports, which includes ESPN networks and ESPN+.

Over the past year, Disney has been grappling with challenges that include a declining linear TV business, slower growth in its parks business, and profitability hurdles in streaming. But a recent turnaround plan from CEO Bob Iger has investors more bullish in recent months.

Here’s how Wall Street expects Disney to perform, according to consensus estimates compiled by Bloomberg:

- Total revenue:$22.10 billion versus $21.82 in Q2 2023

- earnings per share:$1.10 versus $0.93 in Q2 2023

- Entertainment revenue: $10.31 billion

- Sports revenue: $4.33 billion

- Experiences revenue: $8.18 billion

- Disney+ subscribers:71 million versus a loss of 4 million subscribers in Q2 2023

Disney’s stock has been on a tear since the start of the year, up about 30% compared to the S&P 500’s (^GSPC) 10% rise over that same time period.

The bullish sentiment has been driven by improved financials along with a slew of fresh announcements the company revealed in February — just ahead of its proxy fight win.

At the time, Disney disclosed a dividend boost and new share repurchase program in addition to confirming it’s on track to meet or exceed its $7.5 billion annualized savings target by the end of fiscal 2024.

The company also announced a $1.5 billion investment into Epic Games and doubled down on sports streaming with the reveal of an upcoming joint venture partnership with Fox and Warner Bros. Discovery. Disney is also working on a separate sports streaming platform for ESPN, set to debut in fall 2025.

“Sentiment has improved, but we do not see much change in the financial outlook, with the biggest question on ESPN OTT still ahead,” Macquarie analyst Tim Nollen wrote in a note to clients ahead of the results.

Related to sports, Disney has reportedly agreed to increase its media rights deal with the NBA to $2.6 billion, up from the previous $1.5 billion. The NBA’s current rights deal expires at the end of next season.

“I don’t know that [Disney has] a lot left in its pocket for this earnings report,” Doug Creutz, managing director at TD Cowen, told Yahoo Finance. “I think numbers will be fine, but I don’t think you’ll see nearly as much ‘new news’ as we did three months ago.”

HI Financial Services Mid-Week 06-24-2014