Trade Findings and Adjustments 04-25-2024

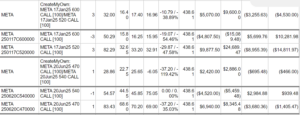

META on Monday we sold around $481 and change Booking a 220% ROI or more

Why did we sell META?= Because it was fully valued, your investing methodology has to be always taking a profit somewhere in your process.

If you are going directional you have no “real adjustments” you are just reacting and trading as an event.

We NEED to talk about investing as a process vs an event :

HI currently has leap bull calls in place

What is our next step for Leap bull calls placed 2 months ago?

CLOSE them out for a 0.71% or more I DID Dominion

Commons sense says not a great time for a trade unless it is longer term and energy related

D or EIX Covered Call strategy looks good