HI Market View Commentary 03-11-2024

Fundamental, Technical, Sentiment Analysis ?

Technical Analysis = Short Analysis

Sentiment Analysis = NOW Analysis

Fundamental Analysis = Trumps all and means the most long term

IF you want a copy the analysis email: khurley@hurleyinvestments.com

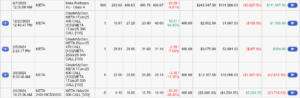

META down big today and it hit its daily average volume in the first two hours of trading

One other interesting factor:

https://www.briefing.com/the-big-picture

The Big Picture

Last Updated: 08-Mar-24 15:20 ET | Archive

Labor market still on the stock market’s side

In his most recent semiannual monetary policy testimony before Congress, Fed Chair Powell said, “there’s no evidence or no reason to think that the U.S. economy is in some kind of short-term risk of falling into recession.”

Some might beg to differ given the longstanding inversion of the Treasury yield curve or the 23 consecutive monthly declines in the Leading Economic Index, but where they can’t quibble with the Fed Chair’s belief is the employment data. It categorically refutes the notion that the U.S. economy would fall into a recession in the short term.

Seeing Is Believing

We will shift our attention to the February Employment Situation Report in due course, but straight ahead is a glimpse of some other employment data that refutes the idea of a recession unfolding in the short term.

We begin with the JOLTS data. This is lagging data admittedly (to wit: we just got January data on March 6), but it is informative nonetheless with respect to the number of job openings.

In January, there were 8,863,000 job openings. That is down from a peak of 12.2 million in March 2022, but it equates to 1.37 job openings for every worker counted as unemployed in the February employment report. There isn’t a shortage of available jobs, then, as one might see in a recession.

There isn’t an excess of initial jobless claims either, as one might see in a recession. This is perhaps the most important indicator for the labor market since initial jobless claims are a leading indicator.

What we know now is that the four-week moving average for initial jobless claims is just 212,250. That is well below averages seen over the course of prior recessions, as seen in the table below, and it signifies that companies in aggregate are still reluctant to let go of their workers. The same goes for the 3.9% unemployment rate seen in February.

| Recession Period | Initial Claims Average | Unemployment Rate Average |

| Jan. 1980 – July 1980 | 512,000 | 7.0 |

| July 1981 – Nov. 1982 | 554,000 | 9.0 |

| July 1990 – March 1991 | 434,000 | 6.1 |

| March 2001 – Nov. 2001 | 416,000 | 4.8 |

| Dec. 2007 – Jan. 2009 | 376,000 | 5.9 |

| Feb. 2020 – April 2020 | 2,405,167 | 7.5 |

Source: NBER; FactSet

38 Straight

Hiring activity has slowed from the frenetic, post-pandemic pace, but February marked the 38th straight month of gains in nonfarm payrolls — and it was a solid increase, too, at 275,000 (the chart below excludes the period from March 2020-August 2020 to improve its readability).

In recessions, payrolls contract for an extended period. There were 14 straight monthly declines in nonfarm payrolls following the popping of the dotcom bubble in 2001. The Great Financial Crisis hurt even more. Monthly declines in nonfarm payrolls were registered in every month from February 2008 to February 2010.

Of note, the four-week moving average for initial jobless claims ran above 300,000 leading up to those respective recessions.

Aside from the encouraging payrolls data, real average hourly earnings remain positive. That is a support for continued growth in consumer spending, which accounts for nearly 70% of GDP.

What It All Means

Payroll gains may not be as robust as they once were, but they are not weak. In turn, average hourly earnings growth may not be as high as it once was, but it is running above the rate of inflation. Initial jobless claims remain low and there is an excess of jobs for unemployed workers still waiting to be filled.

The labor market remains on the economy’s side. That means it also remains on the stock market’s side, because the stock market has been rallying in part on the belief that the economy will not see a recession.

The risk of recession, though, is ever-present. It is part of the business cycle, but a recession warning is not flashing in the employment data — not yet anyway.

What can be seen now in the employment data is an economy still operating in growth mode, which is integral for the positive earnings growth outlook that has underpinned the stock market and has supported multiple expansion.

—Patrick J. O’Hare, Briefing.com

Earnings dates:

COST 3/07

MU 3/30 est

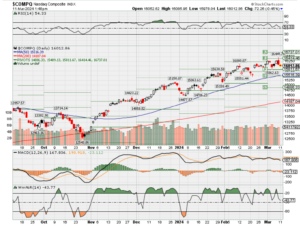

Where will our markets end this week?

Lower

DJIA – Bullish

SPX –Bullish

COMP – Bullish

Where Will the SPX end Feb 2024?

03-11-2024 -2.0%

03-04-2024 -2.0%

Earnings:

Mon: ORCL, MTN

Tues: KSS

Wed: DLTR, LEN

Thur: DKS, DG, ADBE, ULTA

Fri: BKE, JBL

Econ Reports:

Mon:

Tue CPI, CPI Core, Treasury Budget

Wed: MBA,

Thur: Initial Claims, Continuing Claims, PPI, Core PPI, Retail Sales, Retail ex-auto, Business Inventories

Fri: Capacity Utilization, Industrial Production, Michigan Sentiment

How am I looking to trade?

Still protection to get through CPI inflation numbers

www.myhurleyinvestment.com = Blogsite

info@hurleyinvestments.com = Email

Questions???

Powell says the Fed is ‘not far’ from the point of cutting interest rates

PUBLISHED THU, MAR 7 20243:23 PM EST

Jeff Cox@JEFF.COX.7528@JEFFCOXCNBCCOM

KEY POINTS

- Fed Chair Jerome Powell said inflation is “not far” from where it needs to be for the central bank to start cutting interest rates.

- “I think we’re in the right place,” Powell said of the current policy stance.

Federal Reserve Chair Jerome Powell on Thursday indicated that interest rate cuts may not be too far off if inflation signals cooperate.

In remarks to the Senate Banking Committee, the central bank leader didn’t provide a precise timetable of when he sees easing happening, but noted that the day could be coming soon.

“We’re waiting to become more confident that inflation is moving sustainably at 2%. When we do get that confidence, and we’re not far from it, it’ll be appropriate to begin to dial back the level of restriction,” Powell said in response to a question about rates and inflation. He said the cuts would be so the Fed doesn’t “drive the economy into recession rather than normalizing policy as the economy gets back to normal.”

Powell spoke at a time when financial markets have swung considerably in their expectations on Fed policy.

At the beginning of the year, futures traders were betting the Fed would start in March and keep going until it had cut six or seven times this year. The outlook now is for the first cut to come in June, with four reductions totaling a full percentage point by the end of 2024.

Inflation data recently has indicated the pace of price increases is continuing to slow, though the consumer price index rattled markets when it came in higher than expected for January. Still, Powell noted in congressional testimony this week that inflation is progressing lower, though not at the point yet where the Fed is ready to cut.

“I think we’re in the right place,” Powell said of the current policy stance.

Biden’s $7.3 trillion budget for 2025 calls for taxing the rich and corporations to pay for Social Security, Medicare

PUBLISHED MON, MAR 11 20245:00 AM EDTUPDATED 35 MIN AGO

KEY POINTS

- Biden’s 2025 government funding blueprint includes tax hikes on billionaires, corporate profits and other proposals that were in his 2024 budget, which has yet to be approved six months into the fiscal year.

- In late February, lawmakers struck a deal on a $460 billion to fund half of the government for the rest of the fiscal year — the deadline for the second half is March 22.

- This year, the budget also represents the key pillars of Biden’s reelection campaign as the economy has weighed on the president’s approval ratings in polling over the past few months.

President Joe Biden’s 2025 funding proposal released Monday repackaged his tax hike proposals on billionaires and corporations and many other requests from his 2024 budget, which is still under negotiation on Capitol Hill halfway into the fiscal year.

Like all presidential budgets, Biden’s 2025 plan is more of a wish list than it is a policy document.

Biden’s budget comes in at $7.3 trillion in spending proposals, up from $6.9 trillion in 2024 though the two proposals include mirroring requests for boosts to Social Security, Medicare and tax hikes for the wealthy.

This year, as the president faces a likely general election rematch against Donald Trump in November, his budget is also a statement of the Biden campaign’s economic platform.

“It is the most comprehensive and detailed statement of our administration’s values,” White House Council of Economic Advisers Chair Jared Bernstein said Monday on a call with reporters.

Taxing the rich

According to the White House, the budget aims to reduce the federal deficit by $3 trillion over the next 10 years largely by imposing a minimum 25% tax rate on the unrealized income of the very wealthiest households and by reshaping the corporate tax code. Biden’s budget would raise taxes for billion-dollar companies from 15% to 21% and hike the broader corporate tax rate to 28%.

“We can do all of our investments by asking those in the top one and two percent to pay more into the system,” White House Office of Management and Budget Director Shalanda Young said on a call with reporters on Monday.

Biden will also seek to shore up Medicare and Social Security, in part by relying on new, federal negotiating powers for Medicare prescription drugs and by seeking other savings in housing, health insurance and more.

Biden previewed many of the themes of his budget blueprint in his State of the Union address on Thursday.

“Do you really think the wealthy and big corporations need another $2 trillion in tax breaks? I sure don’t. I’m going to keep fighting like hell to make it fair!” he said in a fiery, partisan speech in the Capitol.

Biden’s populist, progressive, tax-the-rich funding plan is not a novel proposal from his White House.

Since he took office in 2021, Biden and congressional Democrats have repeatedly proposed increasing taxes on the very wealthiest to raise revenue. But the idea made very little headway even when Democrats controlled both houses of Congress.

After Republicans assumed the House majority in 2023, the billionaire tax plans were put on ice indefinitely.

House Republicans tried to preempt Biden’s budget proposal last week by passing their own 2025 budget resolution in a party-line committee vote. That proposal would aim to reduce the ballooning federal deficit by some $14 trillion over the next decade, in part by dismantling Biden’s landmark Inflation Reduction Act, which has provided massive investments in clean energy and the green economy.

“Congressional Republicans give their toplines, which have rosy economic projections that don’t fit reality,” Young said Monday. “Congressional Republicans don’t tell you what they cut, who they harm.”

House Republican leaders, including Speaker Mike Johnson, R-La., on Monday slammed Biden’s budget request, calling it “a roadmap to accelerate America’s decline.”

“The price tag of President Biden’s proposed budget is yet another glaring reminder of this Administration’s insatiable appetite for reckless spending and the Democrats’ disregard for fiscal responsibility,” Johnson and his House Republican colleagues wrote in a statement.

2024 budget still unfinished

The two competing budget proposals are no surprise in a deeply divided Washington, one where compromise has been a rare commodity during 2024.

Back-and-forth disagreements in Congress have meant that six months into the fiscal year, lawmakers have still not settled on a permanent budget.

Over the past six months, fierce battles in Congress led to several near government shutdowns, and cost former Republican House Speaker Kevin McCarthy his job.

In the meantime, the government was keeping the lights on via temporary spending bills.

Finally, in late February, lawmakers struck a deal on a $460 billion bill to fund half of the government for the rest of the fiscal year. Funding for the other half must be settled by March 22 or the government will go into partial shutdown.

Despite that dysfunction, Biden did not dilute any part of his progressive budget requests for 2025, though that may have made it easier for the polarized Congress to swallow.

Eyes on November

This year, the budget also represents Biden’s economic platform for his reelection campaign. As the president pursues his reelection bid, there are no signs of softening his pressure campaign against wealthy interests.

“Republicans will cut Social Security and give more tax cuts to the wealthy,” Biden declared in his State of the Union address Thursday. “I will protect and strengthen Social Security and make the wealthy pay their fair share!”

Voter sentiments about Biden’s economy may be starting to brighten after months of gloomy approval ratings, according to recent polls.

In a Wall Street Journal survey taken in February, Biden received his highest grade on the economy during the campaign so far. Forty percent of voters approved of his handling of the economy, a 4-point increase from the same question in December.

Still, Biden needs to catch up to compete with voter perceptions of what Trump’s economy was like.

In a CBS/YouGov poll also taken in February, 55% of survey respondents said Biden’s policies would make prices more expensive while only 34% said the same of Trump’s policies.

Meanwhile, Biden’s reelection campaign is working to try and convince voters that post-pandemic jumps in the cost of living are, in fact, merely a product of unfair corporate pricing tactics, the same ones that the Biden administration has been cracking down on in the past year.

Last week, Biden announced the launch of a “Strike Force on Unfair and Illegal Pricing,” a group that will be jointly led by the Federal Trade Commission and the Department of Justice. Its goal is to put pressure on companies to lower prices.

“President Biden is fed up with corporate practices that unfairly raise costs for consumers,” National Economic Council Director Lael Brainard told reporters last week. “And he’s taking action.”