Hurley Investments, LLC

175 W Canyon Crest Road, Ste 101 Alpine, Utah 84004

(888) 287-1030 FAX (801) 820-3180

HI Market View Commentary 01-16-2024

Give me an update: S&P -0.37%, DJIA -0.62%, Nasdaq -0.19%

How did you know???

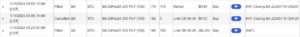

DIS took off 95, 93 Puts 1/12 Friday because the 200SMA held Today +$2.70

JPM closed all the long calls for a profit and sold off shares the day of earnings

Double puts on BA 245, 205 BIDU 118, 110

When do you take these profits = A big up day and we take off he higher, more profitable puts

AAPL puts @ $195

UAA puts @ $8

BAC puts @ $34

META puts @ $370

WE DID A DAY TRADE!!! IF you owned AAPL we did an arbitrage trade by buying BA pus and selling them off for a 15% one day return!!!!

https://www.briefing.com/the-big-picture

The Big Picture

Last Updated: 11-Jan-24 16:21 ET | Archive

Q4 earnings bar is low, but valuation hurdle is high

It is a new year, and a new year in the stock market always starts with a look back at the fourth quarter. That would be fourth quarter earnings, which are going to start trickling out in a steady fashion starting Friday, January 12, and continuing, yes, through March.

This earnings season gets dragged out with fiscal year-end reporting, so much so that the first quarter earnings season starts almost as soon as the fourth quarter reporting period ends.

For those of us covering the earnings announcements, that is our quantitative misfortune. For everyone else, though, it will be a fortune of fundamental news that will shape investment views. That’s no small consideration for a market high on 2024 earnings prospects.

Looky Here

Every earnings reporting period is a look back, but the market is more interested in the look ahead.

A lot of companies don’t provide guidance, but the market makes its inferences nonetheless from the qualitative remarks about business conditions and the tone CEOs and CFOs adopt on their earnings conference calls.

That will be true of the banks, which get things rolling in the early portion of the reporting season. Bank of America (BAC), BNY Mellon (BK), Citigroup (C), JPMorgan Chase (JPM) and Wells Fargo (WFC) will all report their results before the open on Friday, January 12.

These reports will have extra importance this period, because the market has a lot riding on the U.S. economy achieving a soft landing — or no landing at all. The banks have a front row seat to economic activity. In fact, they do the driving in many respects as the issuers of credit, the purveyors of capital, and the stewards of assets.

There will be a lot of interest, then, in what these banks and other banks say about credit quality, deposit flows, asset values, regulatory constraints, and investment banking activity.

The focal point will likely be comments about credit quality since that will be looked at as a harbinger of economic conditions. If there is concerning commentary about a deterioration in credit quality, concerns will build about the economy possibly being headed for a hard landing. If the commentary sounds nonplussed about the credit situation, then market participants will continue to embrace the soft-landing view.

A sidebar to all of that is that the banks are expected to be the biggest drag on the financial sector’s earnings in the fourth quarter. According to FactSet, the blended growth rate for the financials sector is -6.2%. The banks, however, have a blended growth rate of -29.3%.

A Disparate View

There isn’t much earnings growth expected for the fourth quarter. The blended growth rate for the S&P 500 sits at just 0.4%, according to FactSet, down from 8.0% on September 30.

What this suggests is that analysts were slashing their earnings estimates during the quarter — a quarter that saw stock prices surge amid expectations that inflation will continue to come down, that the economy will enjoy a soft landing, and that the Fed will soon be cutting rates.

Of course, when earnings estimates go down and stock prices go up, you get multiple expansion. The forward 12-month P/E ratio for the S&P 500 went from 18.0 on September 29 to 19.6 on December 29. The five-year average is 18.9 and the 10-year average is 17.6, according to FactSet.

That has created a disparate view in front of the reports: the earnings reporting bar has been lowered (a lot) while the valuation hurdle has gone up.

In other words, the companies reporting earnings need at least to get over the low bar with their reports, but to get over the high valuation hurdle, they need guidance (preferably quantitative, but qualitative will suffice in certain cases) that isn’t disappointing or doesn’t sound disappointing.

The current FactSet consensus estimate for the first quarter calls for year-over-year earnings growth of 5.6%. For calendar 2024, the bar is much higher at 11.8%.

The Blended View

Turning back to the fourth quarter, the communication services sector, where Alphabet (GOOG), Meta Platforms (META), and Netflix (NFLX) reside, has the highest projected growth rate at 41.3%. Next is the utilities sector (+32.7%) followed by consumer discretionary (+22.4%), information technology (+15.5%), and real estate (+3.6%).

That’s it. The remaining sectors aren’t expected to deliver any earnings growth.

The energy sector is expected to register a 30.4% year-over-year decline in earnings. The materials sector (-21.1%) and the health care (-21.0%) sectors are the next biggest drags followed by financials (-6.2%), industrials (-2.5%), and consumer staples (-0.1%).

These are blended growth estimates, which take into account actual results from companies that have reported and estimates for companies that have not reported. That means these growth estimates will be shifting as the earnings reporting period progresses.

If history is any indication, the shift in aggregate should be higher by at least two percentage points. When the reporting period is over, therefore, there should not be a zero in front of the decimal point as there is now.

Suffice to say, if there is — or worse, if there is a minus sign in front of the first digit — the fourth quarter reporting period can be deemed a true disappointment.

What It All Means

The stock market’s road ahead is paved with good intentions. There is a good inflation outlook; there is a good economic outlook; and there is a great policy outlook in the market’s mind that includes six rate cuts by the end of 2024.

The stock market’s behavior at the end of 2023 certainly made it appear as if those rate cuts won’t be happening for deleterious economic reasons that would undermine the current earnings outlook. No, they will presumably happen on the back of a smooth glide path for inflation driven by a further easing in supply chain pressures.

It is an optimistic view alright, and all anyone can hope for is that it is right. We’ll soon have a line on that thinking when the fourth quarter earnings results trickle in and the quantitative and qualitative earnings guidance starts flowing out.

—Patrick J. O’Hare, Briefing.com

(Editor’s Note: the next installment of The Big Picture will be posted the week of January 22.)

Earnings dates:

Where will our markets end this week?

Lower

DJIA – Bullish

SPX –Bullish

COMP – Bullish

Where Will the SPX end Jan 2024?

01-16-2024 +2.5%

01-08-2024 +3.0%

Earnings:

Mon:

Tues: GS, MS,

Wed: SCHW, USB, AA, FUL, KMI

Thur: FAST, FHN, KEY,

Fri: SLB

Econ Reports:

Mon: HOLIDAY

Tue Empire Manufacturing

Wed: MBA, Retail Sales, Retail ex-auto, Industrial Production, Capacity Utilization, NAHB Housing Market Index, Fed Beige book

Thur: Initial Claims, Continuing Claims, Housing Starts, Building Permits, Phil Fed

Fri: Existing Home Sales, Michigan Sentiment

How am I looking to trade?

Preparing for earning and may run current long put protection OTM

www.myhurleyinvestment.com = Blogsite

info@hurleyinvestments.com = Email

Questions???

When are you going to have puts in place for earnings?

Depends we will roll ITM down to ATM, We will take off double puts for profits

Fed Governor Bowman adjusts rate stance, says hikes likely over but not ready to cut yet

PUBLISHED MON, JAN 8 20245:34 PM EST

Jeff Cox@JEFF.COX.7528@JEFFCOXCNBCCOM

KEY POINTS

- Federal Reserve Governor Michelle Bowman said Monday interest rate hikes are likely over.

- One of the central bank’s staunchest advocates for tight monetary policy, Bowman said she’s not ready to start talking about rate cuts.

- “In my view, we are not yet at that point. And important upside inflation risks remain,” she said.

Federal Reserve Governor Michelle Bowman, who had been one of the central bank’s staunchest advocates for tight monetary policy, said Monday she’s adjusted her stance somewhat and indicated that interest rate hikes are likely over.

However, she said she’s not ready to start cutting yet.

In remarks delivered at a private event in South Carolina, Bowman noted the progress made against inflation and said it should continue with short-term rates at their current levels.

“Based on this progress, my view has evolved to consider the possibility that the rate of inflation could decline further with the policy rate held at the current level for some time,” she said. “Should inflation continue to fall closer to our 2 percent goal over time, it will eventually become appropriate to begin the process of lowering our policy rate to prevent policy from becoming overly restrictive.”

“In my view, we are not yet at that point. And important upside inflation risks remain,” she added.

As a governor, Bowman is a permanent voter of the rate-setting Federal Open Market Committee. Prior to this speech, she had repeatedly said additional rate hikes likely would be needed to address inflation.

Her comments come a few weeks after the committee, at its December meeting, voted to hold the benchmark federal funds rate at its current target range of 5.25%-5.5%. In addition, committee members, through their closely followed dot-plot matrix, indicated that the equivalent of three quarter-percentage point rate cuts could come in 2024.

However, minutes released last week from the Dec. 12-13 meeting provided no potential timetable on the reductions, with members indicating a high degree of uncertainty over how conditions might evolve. Inflation is trending down toward the Fed’s target, and by one measure is running below it over the past six months.

Bowman said policymakers will remain attuned to how things develop and are not locked into a policy course.

“I will remain cautious in my approach to considering future changes in the stance of policy,” she said, adding that if the inflation data reverse, “I remain willing to raise the federal funds rate at a future meeting.”

The Fed meets again on Jan. 30-31, with markets expecting the committee to stay put on rates and then begin cutting in March. Market pricing indicates a total of 1.5 percentage points worth of reductions this year, or six cuts, according to the CME Group’s FedWatch tracker.

What travelers need to know about the Boeing 737 Max 9 grounding

PUBLISHED MON, JAN 8 20243:25 PM ESTUPDATED MON, JAN 8 20244:16 PM EST

KEY POINTS

- The FAA grounded dozens of Boeing 737 Max 9 planes for inspections after a door plug panel blew out during an Alaska Airlines flight.

- No one was injured in the accident on Flight 1282, but airlines will have to inspect their Max 9 jets.

- Airlines canceled hundreds of flights and waived change fees for travelers.

Airlines have canceled hundreds of flights since the Federal Aviation Administration ordered carriers to take Boeing 737 Max 9 planes out of service for urgent inspections.

Here’s what travelers should know:

Why did the FAA ground the planes?

The FAA grounded more than 170 Boeing 737 Max 9 planes so they can be inspected after a door plug panel blew out on Alaska Airlines Flight 1282 on Friday. No one was seriously injured on the Ontario, California-bound flight, which returned to Portland, Oregon, when the incident occurred minutes into the flight at about 16,000 feet.

Which airlines are affected?

United Airlines and Alaska Airlines are the biggest operators of the Boeing 737 Max 9, with 79 and 65 of the planes in their fleets, respectively.

United canceled 229 mainline flights on Monday, representing about 8% of its schedule, according to FlightAware. The carrier has been using other types of aircraft, where possible, to avoid cancellations.

Alaska Airlines, which has fewer types of planes in its fleet compared to United, canceled 143 flights, about one-fifth of the day’s schedule.

United scrubbed 385 flights over the weekend, while Alaska canceled 328 flights.

Other carriers including Panama’s Copa and Aeromexico are affected by the inspection order. Copa has canceled more than 150 flights since Saturday, and Aeromexico has canceled 100 during that time, FlightAware shows.

The more common Boeing 737 Max 8 plane is not affected.

Can I get a refund if my flight was canceled?

United and Alaska have put travel waivers in place that allow customers to rebook their flights without paying change fees, or to cancel their flights altogether.

How long will the planes be grounded?

The FAA approved Boeing’s inspection instructions for airlines on Monday, a key step in getting the planes flying again. Still, it’s not immediately clear how long the inspections will take.

United said on Monday its inspections had turned up loose bolts on several Max 9 aircraft.

The airline said that the inspections require “a team of five United technicians working for several hours on each aircraft.”

Carriers will likely be able to return the planes to service once they comply with the inspections if they meet the standards.

Which piece of the plane failed and why?

It is not clear what caused the door plug to blow out during the flight. The piece of the aircraft sits where an emergency exit would be on planes that carry more travelers. On planes that are configured for fewer passengers, like United’s and Alaska’s, a traveler sitting in the cabin wouldn’t know that a door-shaped piece is cut in the fuselage.

The National Transportation Safety Board has recovered the door, which was spotted by a schoolteacher in Oregon. Examining the door, its fasteners and other details will be key to the NTSB’s investigation into the rare accident, but results of that could take weeks, if not months, to piece through.

JPMorgan Chase profit falls after $2.9 billion fee from regional bank rescues

PUBLISHED FRI, JAN 12 202412:01 AM ESTUPDATED FRI, JAN 12 202410:04 AM EST

KEY POINTS

- The bank said quarterly earnings slipped 15% to $9.31 billion, or $3.04 per share, from a year earlier.

- Excluding the fee tied to the regional banking crisis and $743 million in investment losses, earnings would have been $3.97 per share, according to JPMorgan.

- Shares of JPMorgan rose 1.9% during premarket trading.

JPMorgan Chase said Friday that fourth-quarter profit declined after paying a $2.9 billion fee tied to the government seizures of failed regional banks last year.

Here’s what the company reported versus what analysts surveyed by LSEG, formerly known as Refinitiv, expected:

- Earnings per share: $3.04, may not compare with $3.32 expected.

- Revenue: $39.94 billion vs. $39.78 billion expected.

The bank said quarterly earnings slipped 15% to $9.31 billion, or $3.04 per share, from a year earlier. Excluding the fee tied to the regional banking crisis and $743 million in investment losses, earnings would have been $3.97 per share, according to JPMorgan.

Revenue climbed 12% to $39.94 billion, edging out analysts’ expectations.

JPMorgan CEO Jamie Dimon said full-year results hit a record because the largest U.S. bank by assets performed better than expected on net interest income and credit quality. The bank said it generated nearly $50 billion of profit in 2023, $4.1 billion of which came from First Republic.

Just as it did during the 2008 financial crisis, JPMorgan emerged larger and more profitable from last year’s regional banking chaos after acquiring First Republic, a midsize lender to wealthy coastal families. The Federal Deposit Insurance Corporation hit large U.S. banks with a special assessment to replenish losses from a fund that helped uninsured depositors of seized regional banks.

Shares of JPMorgan rose 1.9% during premarket trading.

Despite his bank’s performance, Dimon struck a cautious note on the American economy.

“The U.S. economy continues to be resilient, with consumers still spending, and markets currently expect a soft landing,” Dimon said in the release.

But deficit spending and supply chain adjustments “may lead inflation to be stickier and rates to be higher than markets expect,” he said. Risks to markets and economies include central banks’ steps to rein in support programs and wars in Ukraine and the Middle East, he added.

“These significant and somewhat unprecedented forces cause us to remain cautious,” he said.

While the bank has navigated the rate environment capably since the Federal Reserve began raising rates in early 2022, smaller peers have seen their profits squeezed.

The industry has been forced to pay up for deposits as customers shift cash into higher-yielding instruments, squeezing margins. At the same time, rising yields mean the bonds owned by banks fell in value, creating unrealized losses that pressure capital levels.

Concern is also mounting over rising losses from commercial loans, especially office building debt, and higher defaults on credit cards.

Beyond guidance on net interest income and loan losses for this year, analysts will want to hear what Dimon has to say about banks’ efforts to tone down coming increases in capital requirements.

Beaten-down shares of banks recovered in November on expectations that the Fed had successfully managed inflation and could cut rates this year.

Shares of JPMorgan jumped 27% last year, the best showing among big bank peers and outperforming the 5% decline of the KBW Bank Index.

Bank of America shares fall after company reports lower fourth-quarter profit, hit by regulatory charge

PUBLISHED FRI, JAN 12 20246:49 AM ESTUPDATED FRI, JAN 12 20244:01 PM EST

KEY POINTS

- Bank of America shares fell Friday after the firm reported declining fourth-quarter earnings amid hefty one-time charges.

- The bank said it was hit by a pretax charge of $1.6 billion in the quarter related to the transition away from the London Interbank Offered Rate.

- Bank of America stock is down 2.6% this year after a mere 1.7% gain in 2023.

Bank of America shares fell 1.1% Friday after the firm reported declining fourth-quarter earnings amid hefty one-time charges.

Here’s what the company reported compared to Wall Street expectations, according to LSEG, formerly known as Refinitiv:

- Earnings per share: 70 cents, adjusted vs. 68 cents expected.

- Revenue: $22.1 billion vs. $23.74 billion expected.

Bank of America said its net income fell to $3.1 billion, or 35 cents per share, in the fourth quarter, down more than 50% from $7.1 billion, or 85 cents per share, a year ago.

The bank, based in Charlotte, North Carolina, said it was hit by a pretax charge of $1.6 billion in the quarter related to the transition away from the London Interbank Offered Rate. The results also included a special $2.1 billion fee charged by the Federal Deposit Insurance Corporation. The fee is tied to the failures of Silicon Valley Bank and Signature Bank. Excluding items, the company said it earned 70 cents per share, which outpaced analysts’ expectations.

However, revenue of $22.1 billion fell short of Wall Street’s estimates for the first time in two years and was down 10% from the year-ago period.

“We reported solid fourth quarter and full-year results as all our businesses achieved strong organic growth, with record client activity and digital engagement,” CEO Brian Moynihan said in a statement. “Our expense discipline allowed us to continue investing in growth initiatives. Strong capital and liquidity levels position us well to continue to deliver responsible growth in 2024.”

The nation’s second-largest bank posted a $1.1 billion provision for credit losses, up $12 million from the same quarter last year.

Bank of America said its net interest income decreased 5% to $13.9 billion due to higher deposit costs and lower deposit balances, which more than offset higher asset yields.

The bank was supposed to be one of the biggest beneficiaries of higher interest rates last year, but it has underperformed its peers because the lender had piled into low-yielding, long-dated securities during the Covid-19 pandemic. Those securities lost value as interest rates climbed.

Revenue from consumer banking dipped 4% to $10.3 billion, while sales and trading revenue went up 3% to $3.6 billion.

Bank of America stock is down 2.6% this year after a mere 1.7% gain in 2023. The S&P 500 financial sector gained 10% last year.

Biotech and pharma companies are betting on a promising class of cancer drugs to drive growth

PUBLISHED SUN, JAN 14 20248:12 AM ESTUPDATED SUN, JAN 14 20241:00 PM EST

Annika Kim Constantino@ANNIKAKIMC

KEY POINTS

- An established but promising group of cancer drugs was a red-hot market in 2023, and more acquisitions and advancements are expected in the year ahead.

- That was one clear takeaway from the JPMorgan Healthcare Conference in San Francisco.

- Researchers say those drugs could have less toxicity – or unwanted effects on your body that could lead to harm – than standard chemotherapy.

SAN FRANCISCO — An established but promising group of cancer drugs was a red-hot market in 2023, and more companies could look to the treatments to fuel growth in the year ahead.

That was one clear takeaway from the JPMorgan Healthcare Conference in San Francisco, the nation’s largest gathering of biotech and pharmaceutical executives, analysts and investors.

During the four-day event, the biotech and pharmaceutical industry signaled its enthusiasm for antibody-drug conjugates, or ADCs, which deliver a cancer-killing therapy to specifically target and kill cancer cells and minimize damage to healthy ones. Meanwhile, standard chemotherapy is less selective – it can affect both cancer cells and healthy cells.

Johnson & Johnson last week announced a $2 billion acquisition of ADC-developer Ambrx Biopharma to beef up its existing pipeline of ADCs, which some researchers believe could be heralding a “new era” for cancer treatment. Other drugmakers such as Pfizer and Merck, which closed some of the more than 70 ADC-related deals over the last year, said those drugs will be key growth drivers for their businesses.

Interest in the drugs will only continue this year, as some analysts expect more dealmaking and advancements in ADCs currently in development.

The factors fueling the recent rise of ADCs will not abate this year, and a fear of missing out among businesses that have not entered the market will only push more companies to enter the space, Andy Hsieh, an analyst at William Blair & Company, told CNBC.

Those factors include increased confidence in ADC technology among companies and researchers, the potentially longer market exclusivity of those drugs and the rise of attractive ADCs from drugmakers in Asia.

The drugs also have potential to draw huge profits: ADCs could account for $31 billion of the $375 billion worldwide cancer market in 2028, according to a report citing estimates from the drug market research firm Evaluate. The market for those drugs in 2023 was estimated to be worth around $9.7 billion, another report from research firm MarketsandMarkets said.

“It’s kind of like FOMO, right? Everyone wants to gain exposure to [ADCs] and basically make it a cornerstone of their entire corporate strategy,” Hsieh told CNBC. “I really don’t see any sort of slowing down and it will very much, in our view, be a continuation of the 2023 momentum.”

Why ADCs have become popular

ADCs aren’t new.

Roughly a dozen have won approvals from regulators worldwide, with the earliest coming in 2000. But dealmaking started to pick up in 2020 and “really take off” in 2022 and 2023, according to Daina Graybosch, senior research analyst at Leerink Partners covering immuno-oncology.

She called the recent rise of ADCs a “multi-decade innovation cycle,” where it took several years for the industry to make some “fundamental transformative innovation, which then unlocked more investment and a lot more potential.”

Improvements in ADC technology appeared to have made some newer iterations of the drugs more safe and effective, which boosted the industry’s confidence in their potential and encouraged more investments in the space. The steady surge of approvals and acquisitions over the last several years also contributed to that confidence, convincing some companies that ADCs have a “lower-risk development path,” Hsieh said.

Graybosch highlighted an ADC jointly developed by AstraZeneca and Japanese drugmaker Daiichi Sankyo called Enhertu, which she called the first of “the next-generation ADC” that had a greater breadth of treatment compared to older versions of the drugs. For example, Enhertu became the first ADC to show the ability to treat breast cancer patients with both high and low levels of a protein called HER2, which controls how breast cells grow, divide and repair damage.

Drugmakers have fine-tuned key components of ADCs over the last several years, such as the chemical bond that helps those drugs deliver a cancer-killing therapy to cancer cells, according to William Blair’s Hseih. He said companies are learning how to maximize the efficacy of those drugs “without getting into too much side effects.”

ADCs still have their drawbacks — for example, cancer tumors can develop resistance to them over time. And not all newer ADCs in development are successful: Last month, Sanofi scrapped its only experimental ADC after it fell short in a late-stage trial in lung cancer patients.

Graybosch also noted that companies from Japan and China have emerged as effective ADC developers that are rapidly “innovating tweaks” to the drugs and bringing ADCs to the market that could be better than older versions of the drugs.

U.S. and U.K.-based companies are inking deals with those international drugmakers, such as two licensing agreements GSK signed late last year with Chinese-based Hansoh Pharma for ADCs targeting several types of cancer.

The complexity of ADC technology has likely become another motivation for companies to invest in and develop the drugs, Hsieh noted. He said it could reduce the chances that other companies will create biosimilars, allowing drugmakers to keep ADC prices high for longer periods of time.

Gilead’s approved ADC for breast cancer, Trodelvy, has a U.S. list price of more than $2,000 per vial. But some ADCs on the market have far higher list prices: An advanced ovarian cancer drug from biotech company ImmunoGen costs more than $6,000 per vial as of 2022.

List prices are before insurance and other rebates.

How some drugmakers are betting on ADCs

Merck now expects $20 billion in new cancer drug sales by the early to mid-2030s, thanks in part to its recent investments in ADCs, executives announced during the conference. That’s double the estimate the company provided during the same conference last year.

The raised forecast signals Merck’s confidence in the future of its cancer drug offerings, even as its blockbuster immunotherapy Keytruda nears a loss of exclusivity in 2028. That will expose it to generic competition.

Merck executives highlighted its up to $5.5 billion licensing agreement with Daiichi Sankyo to jointly develop three of the Japanese drugmaker’s experimental ADCs. This year, the company hopes to win an approval for one of those ADCs for the treatment of non-small cell lung cancer.

″….We have a leading position now in antibody-drug conjugates, and we’ve done that through what I think is very smart deal-making,” Merck CEO Robert Davis said. He added that “what all of that really translates to is the potential for growth.”

Pfizer hopes ADCs will help the company turn around after a rocky 2023. Shares fell roughly 40% last year as Pfizer grappled with weakening demand for its Covid products and other commercial missteps.

Pfizer CEO Albert Bourla told reporters that the company’s $34 billion acquisition of ADC-developer Seagen would help restore investor confidence in Pfizer, especially now that the deal is officially closed.

Bourla noted that antibody-drug conjugates have become the hottest area of oncology, adding that Seagen’s expertise in ADCs will give Pfizer a huge advantage in developing those drugs further and establishing itself as a leader in cancer treatment.

Pfizer believes the Seagen acquisition will bring in more than $10 billion in risk-adjusted sales by 2030. Seagen specifically brings four approved cancer drugs, including three ADCs, which will beef up Pfizer’s own ADC portfolio.

Hertz makes ‘agile’ decision to shift strategy and sell EVs, Teslas

PUBLISHED SUN, JAN 14 20249:00 AM ESTUPDATED SUN, JAN 14 20249:02 AM EST

KEY POINTS

- Hertz announced last week that it would be selling roughly a third of its fleet of electric vehicles, or roughly 20,000 cars that are predominately Teslas.

- That signaled a further reversal away from the car-rental company’s previously stated goal of converting at least 25% of its entire fleet of cars to EVs by the end of 2024.

- Weakening demand, declines in consumer spending and a more competitive EV market have led several automakers to cut plans to produce more EVs and prices of existing cars.

Hertz surprised many onlookers last week when the car-rental company announced it would be selling about a third of its global electric vehicle fleet, reversing course on several big bets it had placed on EVs.

The move seemingly followed the rest of the auto industry, which has quickly shifted its position on EVs after years of aggressive plans and projections, with several automakers cutting production of vehicles or reducing prices as inventory has built up in recent months.

In October, General Motors and Honda Motor announced that they were canceling plans to jointly develop affordable EVs in the face of slowing demand. Over the course of 2023, Tesla cut the prices of its cars across the world, aiming to reignite demand as consumer spending slowed and the EV market became even more crowded.

Hertz CEO Stephen Scherr told CNBC’s Jim Cramer on “Squawk on the Street” on Thursday that the company’s move, which followed large purchase orders of Tesla and GM EVs, was “responding to the reality, which is we’re trying to bring supply in line with demand.”

“The reality of EVs and Tesla’s being the best-selling car will, at some point, render them the best rental car,” Scherr said. “It’s not yet, so we may have been ahead of ourselves in the context of how quickly that will happen, but that will happen.”

Hertz said it would be selling about 20,000 electric vehicles. It would then use some of those proceeds to buy internal combustion engine cars. The company would also be taking a $245 million incremental net depreciation expense as a result.

However, Hertz said in a regulatory filing that it expects to improve its bottom line by an amount equal to $245 million over the next two years by replacing those EVs with internal-combustion-engine cars.

The company had already indicated on its third-quarter earnings call in October that it was slowing its purchase of EVs, citing MSRP declines in EVs driving down the fair market value of its cars. The company said about 11% of its entire fleet in October was EVs.

On Oct. 25, 2021, Hertz first announced plans to grow its fleet of battery-electric vehicles with “an initial order of 100,000 Teslas by the end of 2022.”

A commercial featuring repeat Super Bowl champion Tom Brady, alongside parked Tesla Model 3 electric sedans in a Hertz garage, accompanied the announcement.

Wedbush analyst Dan Ives said on CNBC’s “Last Call” on Thursday that the move to sell part of its Tesla fleet is a “black eye for Hertz,” adding that he believes Hertz miscalculated how its move to introduce EVs and Teslas to customers would play out from a marketing and roll-out standpoint.

Part of Hertz’s original thesis into investing in EVs is that customers would be eager to rent them for a variety of reasons, such as trying one for the first time, avoiding high gas prices or choosing a more environmentally friendly rental car.

Scherr said that sort of experimentation was happening, but “not happening at a level of demand that justifies us maintaining a fleet of this size at this moment in time.” Tesla’s recent decision to lower the price of its vehicles also weighed into Hertz’s decision given the impact on deprecation, Scherr added.

Hertz had previously set a goal to have a quarter of its fleet be EVs by the end of 2024. Scherr said taking this course instead was about financial performance and operational integrity.

“A smart company is one that’s agile, makes an adjustment, takes away the distraction — financial and operational — and moves on,” Scherr said.

Why the U.S. may extend its run as the world’s leading economy

PUBLISHED WED, JAN 10 202412:41 PM EST

Carlos Waters@IN/CARLOSWATERS/@CARLOS_WATERS

The U.S., China and India may take turns leading the global economy this century, according to an analysis from the Centre for Economics and Business Research.

The CEBR forecast suggests China could potentially take the top spot as the world’s largest economy by gross domestic product as early as 2037. The forecast also sees potentially strong growth in other countries such as India.

“The ranking of which is the largest economy in the world — that doesn’t take into account things like living standards. On that measure, China is absolutely nowhere near catching up with the U.S.,” said Nina Skero, chief executive of the CEBR.

Economists believe that a large and fast-growing GDP can signal a nation’s military power, economic influence and international significance.

“It would be naive to say it doesn’t matter,” said Mariana Mazzucato, a professor of economics at the University College London. “But unless we solve the biggest problems of our time around health, climate, digital and also AI with a global lens, then we’re not going to be better off.“

Around the world, policymakers are spending large sums of public funds to prepare for social and environmental challenges that may be ahead.

“I don’t want to contain China. I just want to make sure that we have a relationship with China that’s on the up and up,” said President Joe Biden at a September 2023 press conference.

Leaders from India and China have strengthened their diplomatic ties with the U.S. in 2023. President Xi Jinping of China in particular sought to repair relations with Washington after a tumultuous start to the decade.

Business confidence in China is weakening, prompting the government to continue increasing its stimulus spending. China was previously expected to overtake the U.S. economy by 2028, according to the CEBR.

“The main issue facing China today is that the population, the private sector, the investors don’t have long-term confidence about the Chinese economy,” said Yasheng Huang, professor of global economics and management at the MIT Sloan School of Management.

Population growth has stalled in China and in the U.S. in the 21st century, but India in particular may benefit from a so-called “demographic dividend” where the working-age population is growing in a well-capitalized business environment.

“The demographics [in India] are still very youthful compared to other large Asian economies such as Japan, South Korea or China,” said Rajiv Biswas, Asia-Pacific chief economist at S&P Global Market Intelligence. “That gives India the potential to be growing at quite a rapid pace,” he told CNBC in an interview.

https://www.ksl.com/article/50842286/whats-getting-more-expensive–and-cheaper–at-the-grocery-store

What’s getting more expensive — and cheaper — at the grocery store

By Alicia Wallace, CNN | Posted – Jan. 14, 2024 at 8:01 p.m.

Eggs and ham prices went up the most in December, while overall food prices continued to register modest price increases, according to the Bureau of Labor Statistics’ latest Consumer Price Index report. (Victor J. Blue, Bloomberg/Getty Images)

NEW YORK — The trip to the grocery store is getting easier on the wallet.

Food at home prices rose a modest 1.3% for the year ended in December, according to the Bureau of Labor Statistics’ latest Consumer Price Index report, released Thursday.

That’s the lowest annual increase registered since June 2021 and a far cry from the 11.8% increase registered in December 2022.

Overall food prices were up 0.2% on a monthly basis, matching the rate of increase seen in November, CPI data shows. For the year, food prices are up 2.7%, remaining below the overall inflation rate of 3.4%.

Driving that increase is the food away from home category (meals and snacks at restaurants, vending machines and other venues), which is up 5.2% annually.

“Food away from home’s increase is down from March’s multidecade peak of 8.8%, but still faster than any time between 1983 and 2020,” Bill Adams, chief economist for Comerica Bank, wrote Thursday. “Wages for lower-paid occupations like restaurant jobs are growing faster than the U.S. average, creating price pressures that restaurants are passing on in higher prices.”

He added: “But the big picture is that the economic dislocations caused by the pandemic are fading, economic growth is settling into a more normal pace, and labor shortages are much less of an issue, helping bring inflation back to normal.”

Where prices went higher

If the lure of a fox, a box, a mouse and a house were not enough to encourage Sam-I-Am to chow down on some green eggs and ham, Thursday’s inflation data surely won’t help matters either.

Eggs and ham prices went up the most in December as compared to other food categories tracked in the CPI.

Prices of eggs (the standard, non-green-yolked variety) shot up 8.9% from November, marking the highest monthly increase since January of last year as bird flu has once again struck the industry. For now, economists believe this latest avian flu won’t be as severe as the one in 2022 that devastated flocks and sent egg prices sky-high (at one point rising 70% year over year).

For the 12 months that ended in December, egg prices are down 23.8%.

Also in December, those Christmas hams saw some inflation as well. Ham prices rose 2.6% for the month (2.9% excluding canned ham), BLS data showed.

Fats, oils and peanut butter products saw a similar increase of 2.6% in December, while raw beef steak prices picked up 2.4%.

On an annual basis, the highest price hikes continue to be in the categories of frozen noncarbonated juice and raw beef steaks, which are up 19.1% and 11.2%, respectively.

The tubes of frosty juice have shot up in price because of bad weather (hurricanes, in particular) and a devastating citrus disease. And recent bouts of extreme drought in the United States have resulted in a reduction of cattle herds, constricting beef supply.

Crackers (+7.7%), baby food (+7.3%) and sugar (+6.9%) also are seeing some of the highest gains from a year ago.

“I think people are particularly annoyed when they do things like go to the grocery store and see high prices,” Wendy Edelberg, director of The Hamilton Project and senior fellow in economic studies at Brookings, told CNN. “But so many of these prices that we see day in and day out, these prices have the potential to just outright fall.”

Where prices are falling

Some products are getting easier on the wallet and at a good time for those fresh New Year’s resolutions: Notably, lettuce, which was down 4% from November and 16.7% from the year before.

Potatoes are getting cheaper as well, dropping 2.8% from November and declining annually at the same rate.

Aside from eggs and lettuce, the categories seeing the largest annual price declines as of December are tomatoes (-7.2%), apples (-5.9%), and fresh vegetables overall (-4.8%).

Other annual declines were seen across the dairy aisle, including cheese, butter and milk, which were down 3.3%, 2.9% and 1.8%, respectively.

https://www.marketbeat.com/slideshows/insider-selling/

12 Stocks Corporate Insiders are Abandoning

Written by MarketBeat Staff

January 16, 2024

SHARE

An insider transaction occurs when a company executive that has non-public information about a company buys or sells shares of their company’s stock. Insiders, such as CEOs, COOs, and CFOs, are required by law to regularly report their stock purchases and sales to the Securities and Exchange Commission.

Tracking a company’s insider transactions is a metric that can be used to identify the direction that its executives believe that its stock is heading. If several insiders sell shares of their company at once, they may believe that the company will have weak future earnings and that the share price will decline in the near future.

For example, if Microsoft’s CEO, CFO, and COO all recently sold shares of Microsoft stock, that would be an indication that there could be unreported news that may negatively affect Microsoft’s stock price.

This slideshow lists the 12 companies that have had the highest levels of insider buying within the last 180 days.

#1 – CME Group (NASDAQ:CME)

Dollar Amount of Shares Sold

$16,602,576.01

Number of Insider Stock Sales in the Last 180 Days

15

Volume of Shares Sold

79,880

Who Sold Shares

Bryan T Durkin (Director), Daniel R Glickman (Director), Dennis Suskind (Director), Derek Sammann (Insider), Elizabeth A Cook (Director), Hilda Harris Piell (Insider), Julie Holzrichter (COO), Julie Winkler (Insider), Martin J Gepsman (Director), Sunil Cutinho (Insider), Terrence A Duffy (CEO), Timothy Francis Mccourt (Insider) and Timothy S Bitsberger (Director)

About CME Group

CME Group Inc, together with its subsidiaries, operates contract markets for the trading of futures and options on futures contracts worldwide. It offers futures and options products based on interest rates, equity indexes, foreign exchange, agricultural commodities, energy, and metals, as well as fixed income and foreign currency trading services. READ MORE

#2 – Jabil (NYSE:JBL)

Dollar Amount of Shares Sold

$43,359,690.22

Number of Insider Stock Sales in the Last 180 Days

22

Volume of Shares Sold

338,959

Who Sold Shares

Christopher S Holland (Director), Daryn G Smith (SVP), Francis Mckay (SVP), Gerald Creadon (EVP), Kenneth S Wilson (CEO), Kristine Melachrino (SVP), Mark T Mondello (Chairman), May Yee Yap (SVP), Michael Dastoor (CFO), Roberto Ferri (SVP), Steven A Raymund (Director), Steven D Borges (CEO) and Thomas A Sansone (Director)

About Jabil

Jabil Inc provides manufacturing services and solutions worldwide. It operates in two segments, Electronics Manufacturing Services and Diversified Manufacturing Services. The company offers electronics design, production, and product management services; electronic circuit design services, such as application-specific integrated circuit design, firmware development, and rapid prototyping services; and designs plastic and metal enclosures that include the electro-mechanics, such as the printed circuit board assemblies (PCBA). READ MORE

#3 – Teladoc Health (NYSE:TDOC)

Dollar Amount of Shares Sold

$1,787,559.62

Number of Insider Stock Sales in the Last 180 Days

18

Volume of Shares Sold

78,373

Who Sold Shares

Adam C Vandervoort (Insider), Andrew Turitz (EVP), Arnnon Geshuri (Insider), Claus Torp Jensen (Insider), Daniel Trencher (Insider), Jason N Gorevic (CEO), Karen L Daniel (Director), Mala Murthy (CFO), Michael Willem Waters (COO), Richard J Napolitano (CAO), Stephany Verstraete (CMO) and Vidya Raman-Tangella (Insider)

About Teladoc Health

Teladoc Health, Inc provides virtual healthcare services in the United States and internationally. The company operates through two segments, Integrated Care and BetterHelp segments. The Integrated Care segment offers virtual medical services, including general medical, expert medical, specialty medical, chronic condition management, and mental health, as well as enabling technologies and enterprise telehealth solutions for hospitals and health systems. READ MORE

#4 – Unity Software (NYSE:U)

Dollar Amount of Shares Sold

$49,292,842.83

Number of Insider Stock Sales in the Last 180 Days

35

Volume of Shares Sold

1,534,504

Who Sold Shares

Anirma Gupta (SVP), Carol W Carpenter (CMO), David Helgason (Director), John S Riccitiello (CEO), Lake Group LLC Silver (Director), Luis Felipe Visoso (CFO), Marc Whitten (Insider), Mark Barrysmith (Insider), Michelle K Lee (Director), Robynne Sisco (Director), Shlomo Dovrat (Director) and Tomer Bar-Zeev (Insider)

About Unity Software

Unity Software Inc operates a real-time 3D development platform. Its platform provides software solutions to create, run, and monetize interactive, real-time 2D and 3D content for mobile phones, tablets, PCs, consoles, and augmented and virtual reality devices. The company offers its solutions directly through its online store and field sales operations in North America, Denmark, Finland, the United Kingdom, Germany, Japan, China, Singapore, and South Korea, as well as indirectly through independent distributors and resellers worldwide. READ MORE

#5 – Neurocrine Biosciences (NASDAQ:NBIX)

Dollar Amount of Shares Sold

$36,279,552.52

Number of Insider Stock Sales in the Last 180 Days

19

Volume of Shares Sold

286,267

Who Sold Shares

Darin Lippoldt (Insider), David W Boyer (Insider), Eiry Roberts (Insider), Gary A Lyons (Director), Ingrid Delaet (Insider), Jude Onyia (Insider), Julie Cooke (Insider), Kevin Charles Gorman (CEO), Kyle Gano (Insider), Matt Abernethy (CFO) and William H Rastetter (Director)

About Neurocrine Biosciences

Neurocrine Biosciences, Inc discovers, develops, and markets pharmaceuticals for neurological, endocrine, and psychiatric disorders. The company’s portfolio includes treatments for tardive dyskinesia, Parkinson’s disease, endometriosis, and uterine fibroids, as well as clinical programs in various therapeutic areas. READ MORE

#6 – O’Reilly Automotive (NASDAQ:ORLY)

Dollar Amount of Shares Sold

$40,221,266.35

Number of Insider Stock Sales in the Last 180 Days

15

Volume of Shares Sold

42,154

Who Sold Shares

Andrea Weiss (Director), Carl David Wilbanks (SVP), Christopher Andrew Mancini (SVP), Dana Perlman (Director), Doug D Bragg (EVP), Gregory L Henslee (Chairman), Jay D Burchfield (Director), Jonathan Wyatt Andrews (SVP), Lawrence P Oreilly (Director), Thomas Hendrickson (Director) and Wild Tamara F De (SVP)

About O’Reilly Automotive

O’Reilly Automotive, Inc, together with its subsidiaries, operates as a retailer and supplier of automotive aftermarket parts, tools, supplies, equipment, and accessories in the United States and Mexico. The company provides new and remanufactured automotive hard parts and maintenance items, such as alternators, batteries, brake system components, belts, chassis parts, driveline parts, engine parts, fuel pumps, hoses, starters, temperature control, water pumps, antifreeze, appearance products, engine additives, filters, fluids, lighting products, and oil and wiper blades; and accessories, including floor mats, seat covers, and truck accessories. READ MORE

#7 – Procter & Gamble (NYSE:PG)

Dollar Amount of Shares Sold

$28,512,483.17

Number of Insider Stock Sales in the Last 180 Days

21

Volume of Shares Sold

185,989

Who Sold Shares

Andre Schulten (CFO), Balaji Purushothaman (Insider), Gary A Coombe (CEO), Jon R Moeller (CEO), Ma Fatima Francisco (CEO), Matthew W Janzaruk (CAO), Moses Victor Javier Aguilar (Insider), R Alexandra Keith (CEO), Shailesh Jejurikar (COO) and Susan Street Whaley (Insider)

About Procter & Gamble

The Procter & Gamble Company provides branded consumer packaged goods worldwide. It operates through five segments: Beauty; Grooming; Health Care; Fabric & Home Care; and Baby, Feminine & Family Care. The Beauty segment offers conditioners, shampoos, styling aids, and treatments under the Head & Shoulders, Herbal Essences, Pantene, and Rejoice brands; and antiperspirants and deodorants, personal cleansing, and skin care products under the Olay, Old Spice, Safeguard, Secret, and SK-II brands. READ MORE

#8 – Palantir Technologies (NYSE:PLTR)

Dollar Amount of Shares Sold

$68,143,762.68

Number of Insider Stock Sales in the Last 180 Days

22

Volume of Shares Sold

3,577,220

Who Sold Shares

Alexander C Karp (Insider), Alexander D Moore (Director), Alexandra W Schiff (Director), David A Glazer (Insider), Eric H Woersching (Director), Heather A Planishek (Insider), Lauren Elaina Friedman Stat (Director), Ryan D Taylor (Insider), Shyam Sankar (Insider) and Stephen Andrew Cohen (Insider)

About Palantir Technologies

Palantir Technologies Inc builds and deploys software platforms for the intelligence community in the United States to assist in counterterrorism investigations and operations. The company provides Palantir Gotham, a software platform which enables users to identify patterns hidden deep within datasets, ranging from signals intelligence sources to reports from confidential informants, as well as facilitates the handoff between analysts and operational users, helping operators plan and execute real-world responses to threats that have been identified within the platform. READ MORE

#9 – Regeneron Pharmaceuticals (NASDAQ:REGN)

Dollar Amount of Shares Sold

$34,994,986.05

Number of Insider Stock Sales in the Last 180 Days

15

Volume of Shares Sold

41,586

Who Sold Shares

Arthur F Ryan (Director), Bonnie L Bassler (Director), Christine A Poon (Director), Christopher R Fenimore (SVP), Huda Y Zoghbi (Director), Marion Mccourt (EVP), Michael S Brown (Director), Neil Stahl (EVP), Plew Daniel P Van (EVP) and Robert E Landry (CFO)

About Regeneron Pharmaceuticals

Regeneron Pharmaceuticals, Inc discovers, invents, develops, manufactures, and commercializes medicines for treating various diseases worldwide. The company’s products include EYLEA injection to treat neovascular age-related macular degeneration and diabetic macular edema; myopic choroidal neovascularization; diabetic retinopathy; neovascular glaucoma; and retinopathy of prematurity. READ MORE

#10 – Signet Jewelers (NYSE:SIG)

Dollar Amount of Shares Sold

$15,630,431.56

Number of Insider Stock Sales in the Last 180 Days

29

Volume of Shares Sold

195,218

Who Sold Shares

Brian A Tilzer (Director), Howard A Melnick (Insider), Joan M Hilson (Insider), Mary Elizabeth Finn (Insider), Oded Edelman (Insider), Stash Ptak (Insider), Stephen E Lovejoy (Insider), Virginia Drosos (CEO), William Brace (Insider) and Zackery A Hicks (Director)

About Signet Jewelers

Signet Jewelers Limited operates as a diamond jewelry retailer. It operates through three segments: North America, International, and Other. The North America segment operates jewelry stores in jewelry stores in malls, mall-based kiosks, and off-mall locations in the United States and Canada primarily under the Kay Jewelers, Kay Jewelers Outlet, Jared The Galleria Of Jewelry, Jared Vault, Zales Jewelers, Zales Outlet, Diamonds Direct, James Allen, Banter by Piercing Pagoda, and Peoples Jewellers names, as well as operates online through its digital banners, James Allen and Blue Nile. READ MORE

#11 – Sun Country Airlines (NASDAQ:SNCY)

Dollar Amount of Shares Sold

$67,392,184.83

Number of Insider Stock Sales in the Last 180 Days

24

Volume of Shares Sold

4,183,598

Who Sold Shares

Brian Edward Davis (CMO), David M Davis (CFO), Eric Levenhagen (Insider), Erin Rose Neale (SVP), Grant Whitney (SVP), Gregory A Mays (COO), John Gyurci (VP), Jude Bricker (CEO), Sca Horus Holdings, Llc (Major Shareholder) and William Trousdale (VP)

About Sun Country Airlines

Sun Country Airlines Holdings, Inc, an air carrier company, operates scheduled service, charter, and cargo businesses in the United States, Latin America, and internationally. The company serves leisure and visiting friends and relatives passengers, and charter customers; and provides crew, maintenance, and insurance services to amazon.com services, Inc with flights to destinations in Canada, Mexico, Central America, and the Caribbean. READ MORE

#12 – Zscaler (NASDAQ:ZS)

Dollar Amount of Shares Sold

$50,121,807.03

Number of Insider Stock Sales in the Last 180 Days

26

Volume of Shares Sold

279,410

Who Sold Shares

Ajay Mangal (Major Shareholder), Amit Sinha (Director), Andrew William Fraser Brown (Director), Dali Rajic (COO), Jagtar Singh Chaudhry (CEO), Karen Blasing (Director), Remo Canessa (CFO), Robert Schlossman (Insider), Scott C Darling (Director) and Syam Nair (Insider)

About Zscaler

Zscaler, Inc operates as a cloud security company worldwide. The company offers Zscaler Internet Access solution that provides users, workloads, IoT, and OT devices secure access to externally managed applications, including software-as-a-service (SaaS) applications and internet destinations; and Zscaler Private Access solution, which is designed to provide access to managed applications hosted internally in data centers, and private or public clouds. READ MORE

#13 – Gartner (NYSE:IT)

Dollar Amount of Shares Sold

$41,612,660.47

Number of Insider Stock Sales in the Last 180 Days

18

Volume of Shares Sold

105,784

Who Sold Shares

Akhil Jain (EVP), Alwyn Dawkins (EVP), Craig Safian (CFO), Eugene A Hall (CEO), James C Smith (Director), Michael Patrick Diliberto (EVP), Richard J Bressler (Director), Robin B Kranich (EVP), Valentin Sribar (EVP) and William James Wartinbee III (SVP)

About Gartner

Gartner, Inc operates as a research and advisory company in the United States, Canada, Europe, the Middle East, Africa, and internationally. It operates through three segments: Research, Conferences, and Consulting. The Research segment delivers its research primarily through a subscription service that include on-demand access to published research content, data and benchmarks, and direct access to a network of research