HI Market View Commentary 10-30-2023

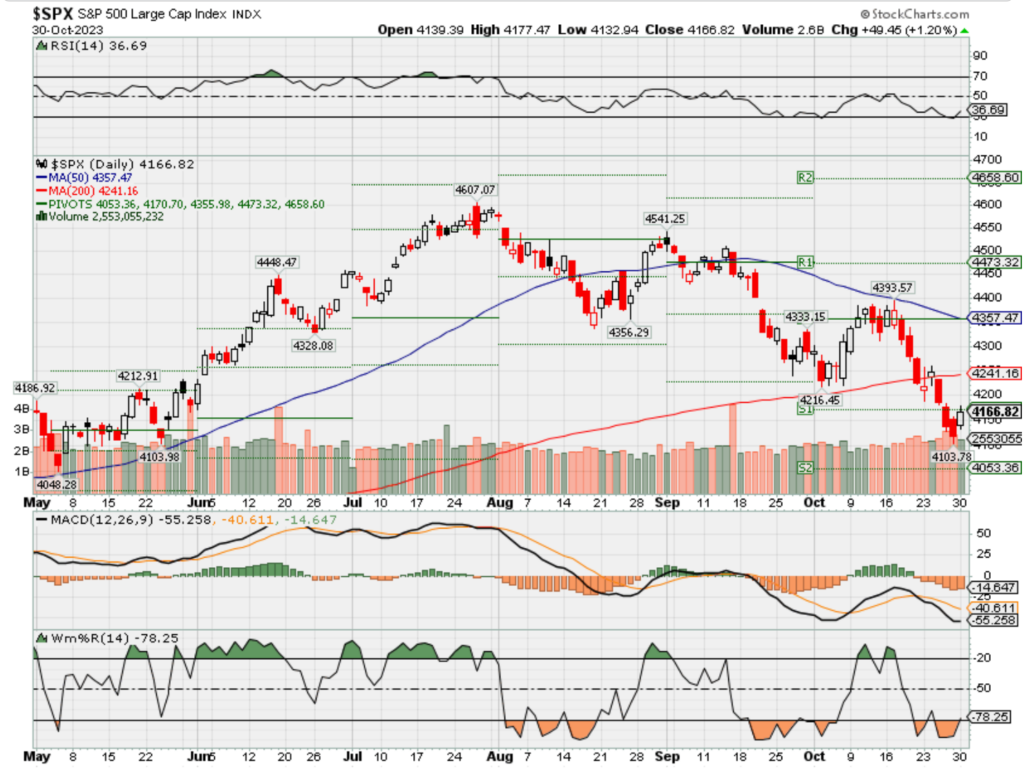

Today’s stock market movement was a ……nothing more than a technical oversold bounce

Question why did we NOT make as much money as the S&P 500 today?= Protection is in place which means me make more on the way down than the stock market loses but we also make less on the way up!!!

We are staying protected until Wednesday afternoon.

IF the fed is going to raise rates this year in is on this meeting because they have a press conference with out end of the year future economic predictions

Someone important said we have a 4875 end of year target for the S&P 500 or 17% increase going into the end of the year

https://www.briefing.com/the-big-picture

The Big Picture

Last Updated: 20-Oct-23 15:32 ET | Archive

Why would the Fed cut rates soon? It won’t, unless…

These are interesting times, which is one way of saying it is hard to know what to make of them.

- We have a geopolitical crisis brewing in the Middle East and Treasury yields are moving higher.

- We have a House of Representatives that lacks a Speaker, meaning business in that chamber will be at a standstill until a new Speaker is elected.

- We have weekly initial jobless claims at their lowest level (198,000) since January and existing home sales running at their lowest annual pace (3.96 million) since October 2010.

- We have a Leading Economic Index that has registered negative readings for the last 18 months and an Atlanta FedGDP Now model estimating 5.4% real GDP growth for the third quarter.

- We have a market-cap weighted S&P 500 that is up 10.3% for the year and an equal-weighted S&P 500 that is down 2.8% for the year.

Something that isn’t surprising is the call for the Fed to start cutting rates in 2024. We’ll call that a conditioned call — and one that is likely to go unanswered.

The Consequence of Loitering

The Fed has raised the target range for the fed funds rate by a total of 525 basis points since March 2022, and yet the unemployment rate remains below 4.0%, median housing prices are still rising, and third quarter real GDP growth, if not 5.0%, looks slated to be well above potential, driven by strength in consumer spending.

We can’t help but think that the Fed is taking this in and thinking “what were we thinking leaving the fed funds rate at 0.00% and continuing with quantitative easing as long as we did?” The Fed might take that thought a step further and concede that there is no way it will be cutting rates anytime soon unless there is a systemic crisis.

The financial crisis of 2008? The COVID pandemic of 2020? Those were true systemic crises that warranted extraordinary Fed action. In both cases, though, the Fed remained enmeshed with a zero-bound policy rate and quantitative easing too long.

A consequence of that loitering is that market participants have come to expect the Fed to ride to the rescue at the first sign of trouble. It is why the market thinks it is entitled to a rate cut at the first signs of slowing in the economy or a 10% drop in the S&P 500.

We think (we hope) Fed Chair Powell learned his lesson in keeping policy too easy for too long. The Fed and others, including us, underestimated just how stimulating all the fiscal stimulus was amidst the COVID crisis. The irony today is that it has sparked concerns about a fiscal crisis that is showing up in increasing term premiums.

The higher rates the market is witnessing today, which are much higher than anything seen over the last 15 years, but which are closer to normal rates seen before the financial crisis, should lead to a slowdown in economic activity.

The housing market has certainly felt the adverse impact of those higher rates, but overall, the economy has shown some surprising resilience so far. Fed Chair Powell said as much this past week, noting that economic evidence is telling the Fed that its policy is not too tight, maybe because rates haven’t been high enough for long enough.

Got Burned Playing with Fire

Inflation got unleashed with the massive supply-demand imbalance in the wake of the global pandemic, the massive increase in the money supply, the massive fiscal stimulus provided by Congress, and the Fed staying at the zero bound and continuing with quantitative easing too long, believing the early signs of inflation would be transitory.

We chronicled our dismay about the Fed sticking with its ultra-easy policy in a November 2021 column here entitled An absurd monetary policy position is a risk we should all see coming. In that piece we wrote,

“The Fed is playing with fire still sitting on the zero bound with the inflation rate at 6.2%, an economy averaging 5.0% real GDP growth, and the unemployment rate at 4.6%. It’s an absurd policy position, because it’s the same position the Fed had when the inflation rate stood at 0.2%, real GDP was negative 31.2%, and the unemployment rate was close to 13.0%.

It won’t surprise us in the least if the stock market keeps running, but, honestly, would it surprise anyone if there is a nasty correction or — egad — a bear market because of an interest rate shock or an exogenous shock?”

We know what 2022 produced for the market: a ramp in the Fed’s tightening efforts, a bear market for stocks, which suffered their worst year since 2008, and the worst year ever for bonds.

So, does the opposite hold true today now that the Fed has raised rates by 525 basis points and reduced its balance sheet by approximately $1 trillion with quantitative tightening? Should the Fed be cutting rates soon?

Some think the Fed should cut rates soon because of the lag effect of its prior rate hikes gathering influence as an economic momentum killer.

In other words, the data-dependent Fed can’t wait for the data to tell it that growth is weak, and inflation is back to its 2.0% target. It needs to be in front of the data, because if the Fed waits for the data, it will be too late. The lag effect will keep coming and the economy will be in recession.

What we know from the available data is that real GDP was up 2.1% in the second quarter, core PCE inflation was up 3.9% year-over-year in August, or nearly twice the rate of the Fed’s inflation target, the unemployment rate was 3.8% in September, or 0.2 below the Fed’s longer-run estimate, average hourly earnings were up 4.2% year-over-year in September, and cash in money-market funds (i.e., idle spending potential) is a whopping $5.61 trillion versus $3.63 trillion when COVID hit.

For added measure, analysts are projecting 12% EPS growth for the S&P 500 in 2024. That’s not exactly a recession forecast.

What It All Means

Fed Chair Powell and his colleagues have been adamant about their mission to get inflation back to 2.0% on a sustainable basis. Fed Chair Powell said the world counts on the Fed to deliver low and stable inflation.

A growing number of Fed officials have conceded that the Fed can “proceed carefully” now when making policy decisions, mindful that there should be a lag effect of prior rate hikes and that the jump in long-term rates has tightened financial conditions (reported in the press as “having done the Fed’s work for it”). None, however, have said they expect to cut rates soon.

Atlanta Fed President Bostic (2024 FOMC voter) came the closest, saying he sees a rate cut in late 2024. The fed funds futures market does, too, except it doesn’t see the first rate cut in late 2024, it sees the third rate cut in late 2024.

That seems ambitious relative to where we are today, particularly with the inflation rate. Remember, the Fed doesn’t just want the inflation rate to get to 2.0%, it wants the inflation rate to stay at 2.0%.

Having erred as badly as it did with its view that inflation would be transitory, and seeing what happened, the Fed is apt to be more patient holding rates where they are than the market would like.

The Fed would cut rates if a true systemic crisis arose. Let’s hope that doesn’t happen. The good news is that the Fed has the interest-rate ammunition now to do something about a systemic crisis. The bad news is that a systemic crisis wouldn’t be good for earnings prospects.

That point aside, the Fed knows too much inflation in the system is its own kind of crisis for American households. Job number one is to get inflation back down to 2.0% where it will stay, and the Fed, burdened by its part in contributing to inflation harming American households, will be patient in that pursuit.

—Patrick J. O’Hare, Briefing.com

(Editor’s Note: the next installment of The Big Picture will be published the week of October 30)

Earnings dates:

AAPL – 11/02 AMC

BABA – 11/16 BMO

BIDU – 11/21 BMO

COST – 12/14 est

DIS – 11/08 BMO

SQ – 11/02 AMC

UAA – 11/08 BMO

MU- 12/21 est

Where will our markets end this week?

Lower to flat

DJIA – Bearish bouncing off oversold

SPX –Bearish but bouncing off oversold

COMP – bearish but bouncing off oversold

Where Will the SPX end Nov. 2023?

10-30-2023 +1.0%

Earnings:

Mon: MCD, DENN, RMBS, RIG, VFC,

Tues: BP, GEHC, SIRI, AMD, CHK, YUMC, PFE

Wed: EL, GRMN, HUM, KHC, YUM, ABNB, CF, DASH, EA, MRO, VAC, NUS, PYPL, QCOM, ROKU, ZG, CVS

Thur: GOLD, LNG, COP, DUK, H, MAR, MUR, PZZA, SHAK, SBUX, WEN, DKNG, RMAX, LLY, AAPL, SQ

Fri: CAH, D, FLR

Econ Reports:

Mon:

Tue Chicago PMI, Employment Cost Index, FHFA Housing Price Index, S&P Case Shiller, Consumer Confidence

Wed: MBA, ADP Employment, Construction Spending, ISM Manufacturing, JOLTS, FOMC Meeting

Thur: Initial Claims, Continuing Claims, Productivity, Unit Labor Costs, Factory Orders

Fri: Average Workweek, Non-Farm Payroll, Private Payroll, Unemployment Rate, Hourly Earnings, ISM Services

How am I looking to trade?

www.myhurleyinvestment.com = Blogsite

info@hurleyinvestments.com = Email

Questions???

Jamie Dimon rips central banks for being ‘100% dead wrong’ on economic forecasts

PUBLISHED TUE, OCT 24 202310:13 AM EDTUPDATED TUE, OCT 24 20234:22 PM EDT

Jeff Cox@JEFF.COX.7528@JEFFCOXCNBCCOM

KEY POINTS

- JPMorgan Chase CEO Jamie Dimon on Tuesday warned about the dangers of locking in an outlook about the economy.

- “Prepare for possibilities and probabilities, not calling one course of action, since I’ve never seen anyone call it,” the head of the largest U.S. bank by assets said in Saudi Arabia.

- Dimon added that he doesn’t think it makes any difference whether the Fed hikes rates another quarter point.

JPMorgan Chase CEO Jamie Dimon on Tuesday warned about the dangers of locking in an outlook about the economy, particularly considering the poor recent track record of central banks like the Federal Reserve.

In the latest of multiple warnings about what lies ahead from the head of the largest U.S. bank by assets, he cautioned that myriad factors playing out now make things even more difficult.

“Prepare for possibilities and probabilities, not calling one course of action, since I’ve never seen anyone call it,” Dimon said during a panel discussion at the Future Investment Initiative summit in Riyadh, Saudi Arabia.

“I want to point out the central banks 18 months ago were 100% dead wrong,” he added. “I would be quite cautious about what might happen next year.”

The comments reference back to the Fed outlook in early 2022 and for much of the previous year, when central bank officials insisted that the inflation surge would be “transitory.”

Along with the misdiagnosis on prices, Fed officials, according to projections released in March 2022, collectively saw their key interest rate rising to just 2.8% by the end of 2023 — it is now north of 5.25% — and core inflation at 2.8%, 1.1 percentage points below its current level as measured by the central bank’s preferred gauge.

Dimon criticized “this omnipotent feeling that central banks and governments can manage through all this stuff. I’m cautious.”

Much of Wall Street has been focused on whether the Fed might enact another quarter percentage point rate hike before the end of 2023. But Dimon said, “I don’t think it makes a piece of difference whether the rates go up 25 basis points or more, like zero, none, nada.”

In other recent warnings, Dimon warned of a potential scenario in which the fed funds rate could eclipse 7%. When the bank released its earnings report earlier this month, he cautioned that, “This may be the most dangerous time the world has seen in decades.”

“Whether the whole curve goes up 100 basis points, I would be prepared for it,” he added. “I don’t know if it’s going to happen, but I look at what we’re seeing today, more like the ’70s, a lot of spending, a lot of this can be wasted.” (One basis point equals 0.01%.)

Elsewhere in finance, Dimon said he supports ESG principles but criticized the government for playing “whack-a-mole” with no concerted strategy.

“You can’t build pipelines to reduce coal emissions. You can’t get the permits to build solar and wind and things like that,” he said. “So we better get our act together.”

What it will take to make homes affordable again for millions of Americans

PUBLISHED WED, OCT 25 20238:00 AM EDTUPDATED 2 HOURS AGO

KEY POINTS

- With the average 30-year fixed mortgage rate around 8%, the highest since 2000, home affordability is at its worst level since at least 1989.

- The National Association of Realtors Housing Affordability Index has declined by nearly half since 2020.

- A combination of falling interest rates, rising income and stable to lower home prices is needed, economists say. Building more homes amid sluggish new inventory is also key.

As mortgage rates reached a 23-year high last week, the cry went off across markets and social media: Is housing affordability dead? Has a version of the American dream — home ownership, kids, backyard barbecues — died with it?

The question is sharp because housing affordability has dropped by nearly half since the ultra-low interest rate days of 2021, according to the National Association of Realtors.

The median family was already $9,000 short in August of the income needed to buy the median existing home, the association says, and the recent surge in rates since has moved another five million U.S. families below the qualification standard for a $400,000 loan, according to John Burns Real Estate Consulting. At 3% mortgage rates, 50 million households could get a loan that size. Now it’s 22 million.

While an easing in treasury bond yields this week has brought the 30-year fixed mortgage back a shade below 8%, there is no quick fix.

The qualifying yearly income for a median-priced house in 2020 was $49,680. Now it’s more than $107,000, according to the NAR. Redfin puts the figure at $114,627.

″[These are] stunning numbers that render house affordability even more challenging for too many American families, especially those looking to buy their first home,” bond-market maven Mohamed El-Erian, an advisor to Allianz among many other roles, posted on X.

“It’s a very worrisome development for America,” NAR chief economist Lawrence Yun said.

Affordability depends on three big numbers, according to Yun — family income, the price of the house, and the mortgage rate. With incomes rising since 2019, the bigger issue is interest rates. When they were low, they papered over a surge in housing prices that began in late 2020, helped by people relocating to areas like Florida, Austin, Texas, and Boise, Idaho, to work in their old cities from their new homes. Now, the surge in rates is crushing affordability even as incomes rise sharply and housing prices mostly hang on to the big gains they generated during Covid.

“At the current 8% mortgage rate, mortgage payment[s] are 38% of median income,” Moody’s Analytics chief economist Mark Zandi said. “The mortgage rate has to fall to 5.5%, or the median priced home has to fall by 22%, or the median income has to increase by 28%, or some combination of all three variables.”

At the same time, demand for adjustable-rate mortgages has spiked to its highest level in a year amid the broader slowdown in mortgage applications.

What needs to change to make housing affordable again

All three indicators face a tough road back to “normal,” and normal is a long way from here. A few numbers illustrate why.

The National Association of Realtors measures affordability through its 34-year old Housing Affordability Index, or HAI. It calculates how much income the median family has to have to afford the median existing home, which, right now, costs about $413,000, according to NAR. If the index equals 100, it means the median family has enough income to buy that house with a 20% down payment. The index assumes the family wants to pay 25% of its income toward principal and interest.

The long-term average of the HAI is 138.1, meaning that, normally, the median family has a 38% cushion. Its all-time high was 213 in 2013, after the housing bust and 2008 financial crisis.

Right now, that index stands at 88.7.

A few scenarios using NAR data help illustrate how far affordability is from the average between 1989 and 2019, and what would be required to push it back into a more typical range as the national average for the 30-year ticked lower to 7.98% on Tuesday.

- If home prices are stable, rates need to fall to 3.55% in order to be back to historical average.

- If prices grow 5%, rates need to fall to 3.16%.

- If prices stay the same but incomes increase 5%, rates need to fall to 3.95%

- A mortgage rate that stays around 8% means median home prices need to fall by 35%, to $265,000.

- If rates stay at 8% and prices at current levels, income needs to increase by 63%.

But these numbers understate the challenge of getting affordability back to where Americans are used to seeing it.

Getting back to the affordability people enjoyed during the hyper-low interest rates of the pandemic would take even more: The HAI reached a yearly average of 169.9 that year, a level few think will come back any time soon.

Affordability became stretched partly because home prices rose 38% since 2020, according to the NAR, but more important was the jump in average interest rates from 3% in 2021 to as high as 8% last week. That’s a 167% jump, driving a $1,199 increase in monthly payments on a newly bought house, per NAR.

Higher wages are a plus, but not enough

Rising incomes will help, and median family incomes have climbed 16% to more than $98,000 since 2020. But that isn’t nearly enough to cover the affordability gap without devoting a higher share of the household paychecks to the mortgage, said Zandi.

Aside from the raw numbers, the direction of monetary policy will keep incomes from fixing the housing problem, said Doug Duncan, chief economist at Fannie Mae. The Federal Reserve has been raising interest rates precisely because it thinks wages have been growing fast enough to reinforce post-Covid inflation, Duncan said. Year-over-year wage gains slipped to 3.4% in the most recent job-market data, he said, and the Fed would like wage growth to be lower.

Downward pressure on home prices would help, but it does not look like they will decline by much. And even if home prices do the decline, that trend won’t be sustainable unless America builds millions of more homes.

After prices surged from 2019 through early 2022, it was easy to assume a big price correction coming, but it hasn’t happened. In most markets, prices have even begun to turn up a little bit. According to the realtors’ association, the median price of an existing home dropped by more than $35,000 in late 2022 but has risen by $45,000 since its low in January.

Not enough new housing in America

The biggest reason is that so few homes are up for sale that the laws of supply and demand aren’t working normally. Even with demand hit by affordability woes, buyers who are out there have to compete for so few homes that prices have stayed close to balanced.

“Boomers are doing what they said they were going to do. They are aging in place,” Duncan said. “And Gen X is locked into 3% mortgages already. So it’s up to the builders.”

The builders are kind of a problem, said Redfin chief economist Daryl Fairweather. They’ve been boosting profits this year, and BlackRock’s exchange traded fund tracking the industry is up 41%, but Fairweather said they’ve barely begun to address a long-term housing shortage Freddie Mac estimated at 3.8 million homes before the pandemic, a number that has likely grown since.

Builders have begun work on only 692,000 new single-family homes this year, and 1.1 million including condominiums and apartments, she said. So it will take nearly four years to build enough houses to rebuild supply, and that leaves out new household formation, she added. Meanwhile, apartment construction has already begun to slow, and builders are pulling back on mortgage buydowns and other tactics they have used to prop up demand.

There are reasons to believe more buyers could materialize. Duncan said the millennial generation is just moving into peak home buying years now, promising to add millions of potential buyers to the market, with the biggest annual birth cohorts reaching the average first-time purchase age of 36 years around 2026. If rates do begin to decline, Fairweather predicts that will bring more buyers back into the market, but inevitably push prices back up toward previous peaks, which there had been signs of earlier this year when mortgage rates dipped to 6% in early March.

“We need a couple of years more building at this pace, and we can’t sustain the demand because of high interest rates,″ Fairweather said.

The Fed and the bond market are big problems

There are two problems with mortgage rates right now, economists say. One is a Fed that is determined to not declare victory over inflation prematurely, and the other is a hypersensitive bond market that sees inflation everywhere it looks, even as the rate of price increases throughout the economy has dropped markedly.

Mortgage rates are 2 percentage points higher than in early March – even though trailing 12-month inflation, which higher interest rates theoretically hedge against, has dropped to as low as 3.1% from 6% in February. That’s still above the Fed’s 2% target for core inflation, but a measure of inflation excluding shelter costs — which the government says are up 7% in the last year despite declines or much smaller gains in housing prices reported by private sources — has been 2.1% or lower since May.

The Fed has only raised the federal funds rate by three-fourths of a point since then, as part of its “higher for longer” strategy — maintaining higher interest rates rather than aggressively adding more rate hikes from here. The biggest reason mortgages have surged of late is the bond market, which pushed 10-year Treasury yields up by as much as 47%, for a full 1.6 percentage points. On top of that, the traditional spread between 10-year treasuries and mortgages has widened to more than 3 percentage points — 1.5 to 2 points is the traditional range.

“It’s hard to justify the runup in rates, so it might just be volatility,” Fairweather said.

Even so, few economists or traders expect the Fed to push rates lower to help housing. The CME FedWatch tool, which is based on futures prices, predicts even if the central bank is done, or at least near done with its rate hikes, it won’t begin to cut rates until next March or May, and only modestly then. And spreads will likely remain extra-wide until short-term interest rates drop below the rates on longer-term treasuries, Duncan said.

It could take until 2026 to see a ‘normal’ real estate market

To get affordability back to a comfortable range will take a combination of higher wages, lower interest rates and stable prices, economists say, and that combination may take until 2026 or later to coalesce.

“The market is in a deep, deep freeze,” Zandi said. “The only way to thaw it out is a combination of lower prices, higher incomes and lower rates.”

In some parts of the country, it will be even harder, according to NAR. Affordability is even more broken in markets like New York and California than it is nationally, and moderate-income markets like Phoenix and Tampa are as unaffordable now as parts of California were earlier this year.

Until conditions normalize, the market will be the domain of small groups of people. Cash buyers will have an even bigger edge than normally. And, Yun says, if a buyer is willing to move to the Midwest, the best deals in the country can be found in places like Louisville, Indianapolis and Chicago, where relatively small rate cuts would push affordability near long-term national norms. Meanwhile, it’s going to be a slog across the nation.

“Mortgage rates will not go back to 3% – we’ll be lucky if we get back to 5,” Yun said.

U.S. oil is back, and ExxonMobil’s $60 billion deal isn’t even the biggest signal

PUBLISHED SUN, OCT 15 202310:00 AM EDTUPDATED SUN, OCT 15 20231:04 PM EDT

KEY POINTS

- Domestic oil production hit an all-time high last week, marking a full recovery from the Covid pandemic after drilling had dropped more than 25% between pre-Covid peaks and a bottom in early 2021.

- The comeback is being driven by the Permian Basin in Texas, where ExxonMobil is now consolidating its position with a $60 billion acquisition of Pioneer Natural Resources, and which has low production costs per barrel and easy pipeline access that pays off faster than offshore drilling.

- For years, Wall Street has pushed oil and gas companies to cut capital spending and boost buybacks and dividends, but production has risen about 3 million barrels/day from the bottom, and could rise by nearly 1 million more by 2025.

After three and a half years, a tripling in the S&P 500 Energy Index, and many soon-to-be-forgotten culture-war volleys, the U.S. Department of Energy announced Oct. 12 that U.S. crude oil production had hit an all-time high of 13.2 million barrels per day, entirely wiping out Covid-era losses of more than 3 million barrels per day.

The news came a day after a $60 billion deal between Exxon Mobil and independent oil producer Pioneer Natural Resources. The combination of recovering production, sustained pressure from Wall Street for cost containment and high stock dividends, and consolidation like the Exxon-Pioneer hookup is not a coincidence.

The energy sector’s big stock move in 2021 and 2022 was mostly a recovery from a disastrous decade for Big Oil, when tens of billions of cash flow were lost on unprofitable fracking wells, and of a consolidation that was good for company profits, dividends and shareholder returns.

The foundation of the 2010s oil business was cracking when Covid broke it, said Rob Thummel, senior portfolio manager at Tortoise Ecofin in Kansas City, Mo. Monthly production topped out at 13 million barrels per day in November 2019 and hit 9.9 million by February 2021.

“Capital discipline in the U.S. industry hasn’t gone away, and oil is at $85 to $90 a barrel,” he said.

So, what brought Big Oil back, and what’s next?

Here are seven important factors that played into U.S. oil’s recent history and will influence its future.

Why the shale drilling bust ended

Oil broke gradually and then suddenly. The S&P 500 Energy Index lost 40% of its value between 2014 and 2019. But the pandemic drove the fast part of the bust, in part by leading Wall Street to insist on further cuts in capital spending, Thummel said.

What brought it back was renewed demand and higher prices.

Recessions end, and oil demand has slowly rebounded after the 2020 downturn and lingering supply-chain shock. And rising prices for WTI crude – which careened during Covid to less than $15 a barrel, shot back to $120 in 2022, and is now near $90 – can make previously-unprofitable plays work, he said.

The U.S. production rebound is more concentrated

Big Oil isn’t back all over America: Production is still down sharply in Oklahoma and North Dakota. It hasn’t changed much in Alaska, where production is in a long-term tailspin. And offshore oil drilling in the Gulf of Mexico recovered to 2 million barrels a day, but hasn’t grown.

Instead, the surge is concentrated in the Permian Basin region of Texas and New Mexico, where production costs are among the lowest in the country, said Alexandre Ramos-Peon, head of shale well research at Rystad Energy. Oil from the Permian Basin costs an average of $42 a barrel to produce, he said, with North Dakota in the high $50s to $60.

North Dakota is also hampered by weaker access to pipelines than the Permian Basin, where many producers can use pipelines that lie entirely within Texas, skirting federal regulation of interstate pipelines. That’s only one example of a relaxed regulatory environment in Texas, compared to places like climate-conscious Colorado, the nation’s No. 4 oil producer, where output is still down 3 million barrels per month, said Jay Hatfield, CEO of Infrastructure Capital Advisors in New York.

“There’s this place called Texas that doesn’t really know what energy regulation is,” he said.

Where oil companies have been spending their money

U.S. oil companies cut capital spending to $106.6 billion last year from $199.7 billion in 2014, according to Statista, contributing to the decline in oil production and arguably delaying the recovery. And they put that money to work paying higher dividends and doing stock buybacks, Thummel said.

According to Energy Department data, oil and gas companies paid out about $75 billion per quarter in the last year. The share of oil-company operating cash flow going to shareholders rose to half of operating cash flow from about 20% in 2019, the department says.

The link between Exxon-Pioneer deal and peak barrels

Offsetting the decline in capital spending is higher productivity per well — while all of the U.S. oil production is back, the closely watched Baker-Hughes rig count is barely half of 2018 levels. The average production per rig of new wells just topped 1,000 barrels a day, up from 668 four years ago, according to the Energy Department. So the industry didn’t have to add a ton of new wells or drill in as many new places to recover fully.

On CNBC last week, ExxonMobil CEO Darren Woods said the company did the merger because it thinks its technology and scale can raise the productivity of Pioneer’s fields.

“Their [Pioneer’s] capabilities, bringing in their Tier 1 acreage, our technology, our development approach, frankly, brings higher recovery at lower cost,” Woods said.

That suggests more mergers to come as rivals like Chevron also make plays to boost their presence in U.S. shale, especially in the Permian Basin, Hatfield said. Chevron already has made several shale-related acquisitions in recent years, including $7.6 billion for PDC Energy this year and $5 billion for Noble Energy in 2020. Independent producers are under more pressure than more-stable super-majors to pay very high dividends to justify the risk of oil-price fluctuations, which will mean tighter constraints on their ability to keep up in technology and scaling of operations, he said.

U.S. crude, energy security and Big Oil economics

As a result of the rebound in crude, is American repatriating its oil? A little, says Hatfield. Permian shale right now is much cheaper to produce than offshore oil, comes with much less political risk than offshore drilling in much of the developing world, and takes much less time to make a profit than offshore wells. That’s leading companies like Exxon to bet more heavily on Permian shale than offshore drilling, he said.

“The super-majors are taking capital out of offshore,” Hatfield said. “They are reducing overseas development because it is more risky.”

The biggest part of the equation is that time equals risk, Ramos-Peon said. Global oil producers aren’t squeamish about investing in parts of the world where governments change, but the years-long investment cycles in offshore drilling make the much shorter turnarounds in Texas appealing to companies like ExxonMobil, which is one of the industry’s biggest offshore players.

“In the Permian, you get your capital back in a little over a year,” Hatfield said. “The return on investment is much faster and much higher because the wells begin to produce so quickly.″

What oil’s recent trading and Israel-Hamas mean for gas prices

Gas prices tend to move in tandem with the price of crude oil, which has dropped to about $88 per barrel from $94 in September, driving a 20-cent per gallon drop in the nationwide average price for regular. But the influence of OPEC, whose coordinated production cuts in June have driven prices up 35 cents, often offsets what domestic producers do, Ramos-Peon said. And right now there is the added uncertainty of whether the Israel-Hamas war will result in a slash in production from Iran, whose government supports the Hamas rebels who launched bloody attacks into Israel, he said.

“I believe crude prices will stay around the current level in the short term, and in the long term should trend down,″ he said. “If there are sanctions against Iran, that will be bad for consumers.”

Short-term shale plays, oil consumption and climate change

What’s good for oil companies in the short-term doesn’t change the longer-term trajectory of the oil market or carbon reduction.

Meeting climate goals has more to do with long-term shifts in energy use than with short-term production targets, Ramos-Peon said. Rystad expects U.S. production to rise to 13.6 million barrels per day next year and 13.9 million in 2025, he said. After that, forecasts get more difficult because so much can change, but by late this decade oil consumption should peak before beginning to ebb, he said.

Even as more cars go electric, demand from older cars and uses of oil in chemicals will keep the oil business very large, Ramos-Peon said. And the risk that the business will erode will make drillers focus on shale more than offshore drilling, Hatfield said

“In the context of not knowing for sure, why wouldn’t you want a return on your investment in three years rather than 30?” he said.

Short-term, the biggest threat to the rosy scenario is that oil-industry cash flows are falling sharply from a peak last year. The Energy Department says its survey of 139 producers, foreign and domestic, shows a 36% drop in second-quarter operating cash flows from 2022. Profits are narrowing for the first time in two years, the department said.

Then again, the price of crude has risen $16 a barrel since the end of the second quarter. And in the oil business, price rules everything.

Big pharma’s blockbuster obesity drug battle is just getting started, and it’s headed for $100 billion

PUBLISHED SAT, SEP 9 20239:19 AM EDT

KEY POINTS

- Novo Nordisk and Eli Lilly are both over a century-old, but one of their biggest successes ever is just taking hold, the blockbuster obesity drugs Ozempic, Wegovy and Mounjaro, the latter of which just saw its quarterly sales grow year over year from $16 million to nearly $1 billion.

- Pfizer, Amgen and other pharmaceutical companies are rushing to develop weight-loss drugs, though they may not be available for another year or more.

- Barclays predicts a $100 billion global market for obesity drugs by around 2030.

- And that’s without the latest headlines that these drugs are now also being investigated as treatments for dementia and addiction.

In their most recent earnings reports, Novo Nordisk and Eli Lilly proved why they are the undisputed heavyweights in the prizefight for control of the rapidly growing weight-loss medications market. Beyond staggering sales figures for Novo’s Ozempic and Wegovy and Lilly’s Mounjaro, news of a study showing Wegovy can reduce the risk of heart disease and the anticipated approval of even more powerful prescription drugs to treat obesity will only strengthen the position of these venerable pharmaceutical giants, which have been in business for 100 years and 147 years, respectively.

Even so, their competitors are not ceding the market to the current leaders. Pfizer, Amgen and other pharmaceutical companies are rushing to develop weight-loss drugs, though they may not be available for another year or more.

“We think it’s Novo and Lilly, and everyone else is just scrambling to keep up,” said Emily Field, head of European pharmaceutical equity research at Barclays, which predicts a $100 billion global market for this class of drugs by around 2030. Since Wegovy and Mounjaro have been on the market, “neither company can make the drug fast enough,” she said. “For both, demand has outpaced even their most bullish assumptions of what they’re able to supply.”

“It’s my top priority … expanding the capacity of our ability to make not just Mounjaro but other drugs like it in our pipeline to meet the challenge here,” Lilly CEO David Ricks told CNBC’s Jim Cramer in August.

Ozempic and Wegovy are both GLP-1 agonists, substances originally formulated by Novo to treat type 2 diabetes. Besides controlling blood sugar, GLP-1s affect hunger signals to the brain, tricking the body into feeling full and slowing the rate at which the stomach empties. The sales growth has been so sharp that Novo Nordisk contributed the majority of recent economic growth for its home nation of Denmark.

The Food and Drug Administration approved Ozempic in 2017 for diabetes and Wegovy in 2021 to treat obesity. Over time, both reduce body weight by about 15%. Mounjaro, introduced in 2022 to treat diabetes, contains GLP-1, plus GIP, a similar appetite suppressor that can lead to weight loss. All three drugs are prescribed as injectable pens that patients self-administer weekly.

On August 8, Lilly reported that its second-quarter income jumped 85% from the same period a year ago, driven in large part by Mounjaro, which generated $979.7 million in sales for the quarter, compared to $16 million in the year-ago period and $569 million in the first quarter of this year. In December, analysts at SVB Securities projected that Mounjaro sales could reach $26.4 billion by 2030.

A month earlier, Lilly released data from a phase three trial of the drug, showing that it helped patients with obesity, though not diabetes, lose up to 26.6% of their body weight after 84 weeks of treatment. Mounjaro is currently only approved by the Food and Drug Administration to treat diabetes, but the company has filed for FDA approval of Mounjaro specifically to treat obesity, which could come later this year or in early 2024.

Novo traded earnings jabs with its opponent on August 10, reporting that in the first six months of this year, sales of Wegovy soared 344% in the U.S. alone to nearly $1.7 billion, while sales of Ozempic jumped 50% to more than $3.7 billion. According to financial analyst firm FactSet, sales of Wegovy and Novo’s other weight-loss injectable, Saxenda, could reach $6.1 billion before the year is out and $15 billion annually by 2030. (Saxenda, on the market since 2015, reduces weight by 6%-8%.)

Potentially bigger news came a couple of days earlier, when Novo released headline results of SELECT, a multi-year clinical trial of Wegovy, showing that it reduced the risk of major cardiovascular events such as heart attacks or strokes by 20%, compared with a placebo. During the earnings call with analysts, Novo CEO Lars Fruergaard Jorgensen said that the SELECT trial “underlines the importance of recognizing obesity as a serious chronic disease.”

The company expects to file for regulatory approvals of a label indication expansion for Wegovy in the U.S. and the European Union this year, adding the drug’s cardiovascular benefits.

The search for new potential uses of these drugs with difficult health care issues continues, with the latest headlines saying obesity drugs are now being investigated as potential treatments for dementia and addiction, too.

Heart benefits, and doctor pressure, may force Medicare to cover

Results like these may well prod government and private insurers to reimburse more patients for the high price tag of weight-loss prescriptions. By law, Medicare hasn’t covered them since 2006, though some select Medigap and Medicare Advantage plans for retirees do. As of late July, Medicaid programs in nine states covered Wegovy, which costs $1,349 monthly. Private insurers often do not cover GLP-1 drugs prescribed for weight loss only.

Conversely, Medicare, Medicaid and most private insurers cover Ozempic ($936 per month) when it’s prescribed for type 2 diabetes treatment, but not for weight loss. Coverage for Mounjaro ($1,023 per month) to treat diabetes varies based on an individual’s insurance plan and drug benefits.

Based on the SELECT study — Novo will release full results later this year — most payers may ultimately cover weight-loss drugs if a patient’s provider prescribes them to treat or prevent cardiovascular conditions, which can be exacerbated by diabetes and obesity.

“They’re going to have no choice at this point,” said Dr. Wajahat Mehal, director of the Yale School of Medicine’s Metabolic Health and Weight Loss Program, whose patients respond well to GLP-1s. The SELECT results “are going to put pressure on insurance companies” to cover those drugs, he said.

On July 20, a bipartisan group of U.S. senators and representatives reintroduced the Treat and Reduce Obesity Act, which would reverse the federal ban on Medicare coverage of obesity drugs. “With obesity rates on the rise in our country, we must do more to combat this epidemic head on,” said Democratic Senator Tom Carper of Delaware. “Too many of those in need are being denied care because of the high cost of medications or inaccessible treatment options.” Added Republican Senator Bill Cassidy of Louisiana, “Expanding Medicare coverage to the treatments patients need enables them to improve their health and benefits us all.”

Novo and Lilly have lobbied Congress on behalf of the legislation, originally introduced in 2021, and have endorsed its reintroduction. Novo has also courted members of the Congressional Black Caucus and influential Black Americans to have Medicare cover weight-loss drugs. According to the CDC, nearly 50% of non-Hispanic Black adults are classified as obese, the highest rate for any race or ethnicity.

The push by pharma giants for expanded coverage of these new blockbusters comes as the federal government is for the first time forcing drug companies to negotiate with Medicare over some of their most successful products, and several recent news reports speculated that Ozempic will be a top target for negotiated prices in the future. The pharmaceutical industry is challenging the new law’s constitutionality in court.

Attitudes about obesity being transformed

Overall, per the CDC, obesity in the U.S. affects 100 million (41.9%) adults and 14.7 million (19.7%) children and accounts for approximately $147 billion in annual health care costs. Historically, obesity has been considered a behavioral and lifestyle condition among people lacking the willpower to moderate eating habits and exercise regularly. But those attitudes have been changing, not only in society at large but also among health care providers.

In 2013, the American Medical Association recognized obesity as a disease, which was a huge step forward in the field of medicine, as well as for pharmaceutical companies to develop a new generation of weight-loss drugs that are more effective and safer than other obesity products, such as Contrave, Orlistat, Qsymia and Imcivree.

“We’ve actually been in obesity research for more than 25 years,” said Camilla Sylvest, executive vice president, commercial strategy and corporate affairs at Novo. “A lot of things have changed in society in the meantime, not only that we have new weight-loss products on the market, but there’s also a much greater understanding of why obesity is a disease and why it needs to be treated.”

All that has increased the interest in treating obesity, “and therefore demand for Wegovy has exploded,” Sylvest said. Indeed, new prescriptions for Wegovy and Ozempic have risen by 297% percent and 140%, respectively, since a little more than a year ago, according to analysts at Cowen. What’s more, Novo and Lilly have each seen their stock prices more than double in the past three years.

It’s no surprise, then, that Novo and Lilly have had trouble keeping up with demand for their weight-loss drugs. In May, Novo reduced the U.S. supply of Wegovy starter doses to ensure access for existing patients, and in its recent earnings report said it expects that to continue into the fall. Likewise, in its second-quarter earnings call, Lilly executive vice president Mike Mason told analysts, “We do still expect to see tight supply and some spot outages on Mounjaro through the end of the year.”

In 2021, Novo announced plans to invest nearly $2.6 billion to build three new ingredients manufacturing facilities and to expand an existing production site in Kalundborg, Denmark. Then last May, the company committed $2.3 billion to expand its site in Hillerød, Denmark. In April, Lilly said it is investing an additional $1.6 billion in its two new factories in Boone County, Indiana, bringing the company’s total commitment to the site to $3.7 billion.

Meanwhile, neither Big Pharma giant is resting on its weighty laurels, as both have increased their R&D budgets toward oral versions of their diabetes and obesity drugs, targeting patients who would prefer a pill instead of a jab. Plus, pills taken once daily may be cheaper to manufacture than single-dose pens used weekly.

Novo is in phase three clinical trials of oral versions of GLP-1, which it says could be even more effective in treating type 2 diabetes and obesity. It expects to file for FDA approval later this year.

At an American Diabetes Association event in June, Lilly released phase two data for orforglipron, its first oral drug for obesity, saying it achieved up to 14.7% weight reduction after 36 weeks. The company also released phase two data from trials on retatrutide, an injectable obesity medication that achieved up to 17.5% weight reduction after 24 weeks.

Pfizer was testing two different oral drugs to treat type 2 diabetes and obesity, but is now focusing on one, danuglipron, after phase two trial results. “While we have our data from the type 2 diabetes study [of danuglipron], we are still studying the potential in obesity,” a Pfizer spokesperson said in an email. “When we have this information, which should be later this fall, we will make a plan for what the phase three [trial] will look like.”

In December, Amgen reported that in phase one tests of its injectable obesity drug, AMG133, patients showed a weight loss of 14.5% after 12 weeks of treatment. Phase two trials are ongoing, with data expected in 2024, and a product launch is not likely before 2026.

So as their competitors continue to develop competitive therapies for diabetes and obesity, “Novo and Lilly will duke it out,” said Emmanuel Papadakis, an industry analyst at Deutsche Bank.

Once they can supply enough products to keep up with the overwhelming demand, don’t be surprised to see direct-to-consumer ads for Wegovy and Mounjaro popping up on the evening news. “Both companies over time will be investing considerably to establish their marketing presence,” he said, “to the extent that it’s needed.”

Here’s the average net worth of Americans broken down by age — see how you compare

Find out how your net worth stacks up to others your age.

Updated Fri, Oct 27 2023

You may think the term “net worth” only applies to celebrities and CEOs, but it’s something we all have — and we all should know it.

Your net worth, calculated by the total value of your assets minus your debt, is essentially a snapshot of where you stand financially as a whole, taking into account how much you owe and the value of the things you own. You can think of it like a report card on your financial health.

And although net worth varies widely based on a person’s circumstances, like their income, cost of living, family inheritances, housing status (renter or buyer) and educational background, knowing the net worth of someone your same age is a good benchmark to help you see where you stand compared to the average.

Here’s a breakdown of both median and average American net worth by age, according to the Federal Reserve’s Survey of Consumer Finances published in October 2023. Keep in mind the average figures are skewed by the most affluent households in the U.S., making the median net worth figures a better indicator of where Americans at every age actually stand.

Household net worth by age

| Age of head of family | Median net worth | Average net worth |

| Less than 35 | $39,000 | $183,500 |

| 35-44 | $135,600 | $549,600 |

| 45-54 | $247,200 | $975,800 |

| 55-64 | $364,500 | $1,566,900 |

| 65-74 | $409,900 | $1,794,600 |

| 75+ | $335,600 | $1,624,100 |

Source: The Federal Reserve Survey of Consumer Finances, published October 2023

Everything that goes into your net worth

As we mention above, your net worth is calculated by adding up your total assets (like earned income) and then subtracting your liabilities (such as debt).

Your assets can include anything you own that has value, like:

- Cash

- Investments

- Retirement accounts

- Property

- Jewelry

- Art

- Collectibles

Your liabilities can include any and all debt, like:

- Credit card debt

- Student loans

- Mortgages

- Auto loans

In simple terms, net worth looks at the difference between what you owe and the assets you own. A few simple ways to increase your net worth is by growing your assets through investing in the market or by saving more in a deposit account that earns a high amount of interest — the top ones are offering above 5% APY these days. UFB High Yield Savings is rated by CNBC Select as one of the top high-yield savings accounts due to its very strong APY and its lack of monthly fees.

How to track your net worth

It’s normal for your net worth to change over time as you borrow and pay off debt, accrue assets and grow your investments.

Over time, you can make it part of your financial routine to check in on this number. Doing so can help clarify your priorities — should you borrow money right now to pursue more education? Is now the time to buy a home? Knowing your net worth can help you assess whether your next financial move is a good one.

Empower (formerly Personal Capital) and Mint are two platforms that make tracking your net worth easy. With either app, users can link all of their accounts, like checking, savings, money markets, CDs, investments, retirement accounts, credit card accounts and loans, giving them one place to see everything.

Empower has its own net worth calculator and Mint has a net worth-specific dashboard that calls out your progress each month.

Bottom line

Your net worth, like your credit score, is an important number you should track in order to have a clear picture of your financial health. Keep an eye on yours as you pay off debt, borrow more money or grow your cash.

The U.S. consumer is ‘walking towards a cliff,’ strategist warns

PUBLISHED THU, OCT 26 20236:01 AM EDTUPDATED THU, OCT 26 202312:19 PM EDT

KEY POINTS

- Trouble is brewing for the U.S. economy and its pivotal consumer component, one strategist says.

- “I think the U.S. consumer is walking towards a cliff, basically,” Chris Watling, chief executive of financial advisory firm Longview Economics, told CNBC’s “Squawk Box Europe.”

- Data suggests the U.S. economy may have turned in another stellar performance, heading into the final part of the year.

Trouble is brewing for the U.S. consumer, according to one strategist, and a substantial labor market downturn could kick-start a recession.

“I think the U.S. consumer is walking towards a cliff, basically,” Chris Watling, chief executive of financial advisory firm Longview Economics, told CNBC’s “Squawk Box Europe” on Wednesday.

He said that a slew of recent economic indicators had showed consumers are quickly running out of excess cash, while household savings are coming under pressure.

“Of course, retail sales have been quite strong for the last few months and everyone gets quite excited about that, but, actually, if you look at what’s going on, the household savings ratio has been run down, and, in fact, real income growth has been negative for three months,” Watling said.

“So, it’s not quite all good news. I mean, quite the reverse, I think there are some real challenges coming for the U.S. consumer.”

His comments were made even as data suggests the U.S. economy may have turned in another stellar performance, heading into the final part of the year.

Gross domestic product posted a 4.9% annualized gain for the third quarter, according to a Commerce Department report Thursday.

The latest GDP data reflects the strongest U.S. economic output since the final three months of 2021, when growth was just shy of 7%.

Many strategists, asset managers and CEOs remain concerned about the longer-term economic outlook and will continue to closely monitor forward-looking signals for clues on whether the U.S. can avoid a recession.

The U.S. economy and its pivotal consumer component have been written off many times before, but the Federal Reserve’s move to keep liquidity flowing in the sector has partly helped to keep growth afoot.

‘The U.S. is in for a tough time’

“We see at the margins the consumer is under a lot of pressure and, in fact, the labor market is under a lot of pressure as well. We had a good payrolls month, but if you look at a lot of the indicators of where the labor market is likely to go, a lot of them are fraying at the edges,” Watling said.

“We’re going to get to the point in the next few months when I think the labor market starts to deteriorate more meaningfully and that’ll kick-start the recession when we get there,” he added.

Asked what his forecast would likely mean for the stock market, Watling replied: “I think leadership probably is changing in this stock market. Tech has been under a lot of pressure since July, and I think the stock market is struggling to know really exactly where it wants to go.”

“From our point of view though, I can see a bounce for a month or two. It’s been quite beaten up, markets have been coming down since July but I think net-net, you want to be underweight equities if you are looking beyond the next few months,” he continued. “I think the U.S. is in for a tough time.”

— CNBC’s Jeff Cox contributed to this report.

Correction: This article has been updated to correct the date of Chris Watling’s interview with CNBC’s “Squawk Box Europe.”

HI Financial Services Mid-Week 06-24-2014