Trade Findings and Adjustments 09-28-2023

PROTECTION !!!

How important is it – DEPENDS on your common sense and patience.

What can cause our market to fall in the next week?= UAW strike getting worse, The Fed talking or raising rates again, economic reports, Bidden investigations, Government funding, End of quarter is Friday =rebalancing

What is a market catalyst for the next week???? Nothing on tap for the next week to push markets higher

You could have guessed we were due for a relief rally

For a review we currently have open:

Nov Monthly 426/410 bear put

Thoughts to justify the trade= I have no idea where the hell the market is going to the next two weeks, probably down after a relief rally, I do know the market has NOT been able to hold the gains

BTO 426 Long put for 9.43 (expensive)

STO 410 Short put for 4.87 (expensive)

Net cost = 9.43 – 4.87 = $4.56

Max Reward = 426-410=$16 – 4.56 cost basis = $11.44

11.44/4.56 = 2.5 reward for every 1 risk

1 to 2.5 risk to reward

Let’s take a look at adjustments for the near term?

IF today is the up day can we take a profit off the bullish (short put) position?

https://www.investopedia.com/terms/l/long_put.asp

Long Put: Definition, Example, Vs. Shorting Stock

By TIM SMITH

Updated January 23, 2021Reviewed by

What Is a Long Put?

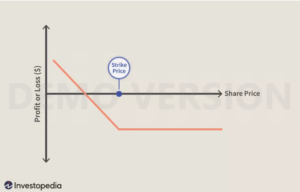

A long put refers to buying a put option, typically in anticipation of a decline in the underlying asset. The term “long” here has nothing to do with the length of time before expiration but rather refers to the trader’s action of having bought the option with the hope of selling it at a higher price at a later point in time.

A trader could buy a put for speculative reasons, betting that the underlying asset will fall which increases the value of the long put option. A long put could also be used to hedge a long position in the underlying asset. If the underlying asset falls, the put option increases in value helping to offset the loss in the underlying.

Image by Julie Bang © Investopedia 2019

KEY TAKEAWAYS

- A long put is a position when somebody buys a put option. It is in and of itself, however, a bearish position in the market.

- Investors go long put options if they think a security’s price will fall.

- Investors may go long put options to speculate on price drops or to hedge a portfolio against downside losses.

- Downside risk is thus limited using a long put options strategy.