HI Market View Commentary 08-21-2023

OK Let’s start with two ideas today to go over: Index Movements, BIDU Earnings Adjustment

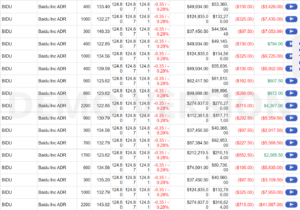

BIDU has earning tomorrow

We are still in BIDU because it is the HI play for the second largest economy

BIDU has 7 different division in 7 different areas in regards to the China economy

We took profits off 155 puts and today we took profits on 145 puts

BIDU protection was adjusted today for tomorrow’s earnings.

Why did we book these profits today

We booked the profits so we can make something to the upside IF BIDU beats on earnings

Anything between $125 where BIDU is trading and $145 where we have our protection would be a NET loss if BIDU goes up

Today’s Positions an hour before the close

Earnings dates:

BIDU – 8/22 est

MU – 9/27

https://www.briefing.com/the-big-picture

The Big Picture

Last Updated: 18-Aug-23 06:48 ET | Archive

Striking better balance with interest rate shift

Interest rates are rising. That is not a new revelation, and it should not be a shock to anyone who has been watching the market for the past few years.

The increase in rates has occurred in response to rising inflation, which has necessitated higher policy rates. Again, not a shock to anyone who has been watching the market for the past few years.

What may be a shock to anyone who has been watching the market only the past few years is that interest rates aren’t as bad as they look. It is the pace at which they have risen that has made them feel bad, but the level of rates themselves is, well, closer to normal before things became abnormal during the 2008 financial crisis.

Tables Have Turned

All else equal, lower interest rates are better for stocks than higher interest rates, but higher interest rates aren’t necessarily a death knell for stocks, particularly if they are driven by stronger than expected economic activity that is good for corporate profit growth.

Higher interest rates, however, create more competition for stocks. They lower the present value of future cash flows and raise the appeal of parking capital in less risky investments like money market funds, highly rated corporate bonds, certificates of deposit, and risk-free Treasuries.

That is why when interest rates were languishing at such low levels during the abnormal, post-2008 period, which got even more abnormal with the COVID response, one often heard the refrain that “there is no alternative” to stocks. That refrain was dubbed “TINA.”

Because market rates and policy rates were so low, savings rates offered by financial institutions were a joke, certificate of deposit rates and money market rates were unappealing, and corporate bond yields forced investors down the quality ladder to get a decent return.

The tables, though, have turned.

Spreadin’ the News

You can find yields north of 5.00% in the Treasury market, in higher-quality corporate bonds, in CDs, in money market funds, and even in some savings accounts.

Of course, that still pales in comparison to the S&P 500, which is up 13.8% for the year as of this writing. Anyone watching the stock market this year, though, knows that return has been cooked so to speak by the outsized gains in a small group of mega-cap stocks. The Invesco S&P 500 Equal-Weight ETF (RSP) is up 4.1% for the year with a higher risk profile than the yield vehicles noted above.

We have made the point in the past, however, that a gain… is a gain… is a gain in the market-cap weighted S&P 500. They aren’t going to discount you at the door when you sell the S&P 500 just because its outperformance has been juiced by a small group of stocks.

The latter point notwithstanding, one assumes a higher risk of capital loss in stocks, so an investment decision between stocks and other instruments boils down to one’s risk tolerance over a specified time horizon. The problem in the abnormal past is that it was a struggle to get real returns in anything other than stocks.

That is no longer the case.

What we see today, too, is that the trailing twelve-month earnings yield for the S&P 500 (4.95%) is less than 70 basis points higher than the yield on the risk-free 10-yr note (4.30%) and is comparable to the yield on the 2-yr note.

The translation is that equity investors aren’t necessarily getting compensated as generously as in the past for taking the added risk of owning stocks. In the abnormal period between 2008 and early 2020, the earnings yield spread over the 10-yr note ranged from 160 to 700 basis points.

What It All Means

It is pretty clear to anyone watching the stock market this year that it has defied most people’s expectations. As we discussed last week, the big run through July has given way to a consolidation period in August, and the bid to trim positions has been encouraged by the jump in long-term rates seen this month.

That is creating competition for stocks, and dare we say, a more normal opportunity for income-oriented investors and investors with a lower risk tolerance.

Importantly for the investor class, it creates an opportunity to strike a better balance and to lower risk in investment portfolios. That’s not a bad thing. Some might even call it a return to normalcy after an extended period of abnormally low interest rates.

—Patrick J. O’Hare, Briefing.com

Where will our markets end this week?

Higher

DJIA – Bearish

SPX –Bearish

COMP – Bearish

Where Will the SPX end August 2023?

08-21-2023 +1.5%

08-14-2023 +1.5%

08-07-2023 +1.5%

Earnings:

Mon: ZM

Tues: BJ, DKS, LOW, M, TOL, URBN, BIDU

Wed: ANF, AAP, FL, KSS, GES, NTAP, SNOW, NVDA

Thur: BURL, DLTR, GPS, INTU, JWN, ULTA

Fri:

Econ Reports:

Mon:

Tue Existing Home Sales,

Wed: MBA, New Home Sales,

Thur: Initial Claims, Continuing Claims, Durable Goods, Durable ex-trans,

Fri: Michigan Sentiment, Powell Jackson Hole Speech

How am I looking to trade?

Adding protection based on technical analysis on indexes and earnings seasons starts soon

www.myhurleyinvestment.com = Blogsite

info@hurleyinvestments.com = Email

Questions???

F get put to people at $15 booking us a nice profit

Markets Brief: Is the Bond Market’s Recession Indicator Broken?

The yield curve has been inverted for over a year—a traditional omen of an economic downturn.

Tom Lauricella, Caryl Anne Francia

Aug 18, 2023

Share

Check out our weekly markets recap at the bottom of this article, with a look at the stocks that made some of the past week’s biggest moves, including Hawaiian Electric Industries and Farfetch.

For over a year now, the bond market’s most widely followed predictor of an economic downturn has been flashing a clear warning sign: Short-dated bonds have been yielding more than longer-term ones. Yet not only has the economy not slid into a recession, but there are even signs that it’s gaining strength.

Take the Federal Reserve Bank of Atlanta’s GDPNow measure, which attempts to provide a real-time picture of economic growth. It’s suggesting that the U.S. economy is growing at a torrid 5.8% pace in the third quarter.

In fact, investors are so convinced a recession isn’t coming that in recent weeks, bond yields have been rising, in some cases to their highest levels since before the 2008 financial crisis.

Does this mean that what Wall Street calls the inverted yield curve has failed as a bellwether this time around? Not so fast, say some bond market veterans.

“We’re 13 months or so into it now,” says Duane McAllister, portfolio manager at Baird Asset Management. While widespread expectations that a recession would have taken hold by now have been proven wrong, “I don’t think this time is different,” he says. “I think the yield curve will once again be proven a good predictive indicator for the market and the economy.”

McCallister and others point to several reasons the economy has been able to keep trucking along in the face of an inverted yield curve. Most notably, there are the lingering effects of the massive fiscal and monetary stimulus efforts during the COVID-19 pandemic, as well as the long lag time before the Federal Reserve’s rate hikes filter through to the economy.

“There are reasons it hasn’t had a bigger impact right now,” says Mark Lindbloom, portfolio manager at Western Asset Management, but “the yield curve is an important indicator … we’re not willing to exactly write it off.”

Investors also often ignore the impact an inverted yield curve itself will have on the economy. But such impacts take time. “The markets want to run away with things right away. Of course, in the real world it doesn’t work that way,” McCallister says.

U.S. Treasury Yield Curve

Source: Morningstar Direct. Data as of Aug. 16. 2023.

What Is a Treasury Yield-Curve Inversion?

The U.S. Treasury yield curve is essentially a way to depict yields across the maturity of bonds issued by the U.S. government, from short-term debt (Treasury bills) to long-term debt (30-year bonds). The most common way to look at the curve is to chart yields from Treasury two-year notes out to those on Treasury 10-year bonds.

The vast majority of the time, yields from longer maturities are higher than those of shorter-dated bonds, reflecting the greater risks of holding bonds for longer periods. In the case of government bonds, the primary concern is the corrosive impact inflation has on fixed payouts.

But under certain circumstances (such as what’s taking place right now), the shape of the curve is flipped, with short-term yields rising above long-term yields.

The message of an inverted yield curve is that while interest rates are high now, in the future the rate of economic growth and inflation will be slower, and so interest rates will then be lower. Historically, it has taken a recession to realize such a scenario.

Last year, the Fed’s unprecedented series of interest-rate increases lifted short-term Treasury yields above long-term ones. As measured by the yield on the Treasury 2-year note versus the 10-year note, the yield curve first inverted during the current economic cycle in March 2022, and it has remained inverted since early July of that year.

Not only is the curve inverted, but the extent of the inversion is extreme by historical standards; it has been at its widest gap since the 1982 recession. Recently the yield on the Treasury 2-year note stood at 4.93%—0.67 percentage points above the 4.26% yield on the 10-year note.

U.S. Treasury Yields and Federal-Funds Rate

Source: Federal Reserve Economic Database. Data as of Aug. 16, 2023.

John Briggs, global head of economics and markets strategy at NatWest Markets, measures this current inversion as the longest-lived since the 1978-1980 period, which preceded the 1980 recession.

“The yield curve doesn’t traditionally live this negative for this long,” says Mike Cudzil, portfolio manager at Pimco.

Why Inverted Yield Curves Matter

The yield curve is much more than just a chart; it has an economic impact.

Chief among them is that it creates a disincentive for banks to lend. A major source of profit for them is collecting deposits on which they pay short-term rates, then lending that money to borrowers, for which they charge long-term interest rates. If short-term rates are higher than long-term rates, that will generally make loans less profitable.

At the same time, even though the worst of the March regional banking crisis seems to have passed, the ripples are lingering as banks tighten lending standards. “When banks are lending less, there is less money in the system, and the economy will eventually slow,” says McAllister.

A second impact comes from the overall level of interest rates across the yield curve as measured both on a nominal basis and a so-called real basis, which compares them against the expected rate of inflation. For many years, real yields had been negative, meaning they were below the expected rate of inflation, which encouraged investors to put their money into riskier investments. But now, real yields “are as high as we’ve been for a long time,” says Lindbloom.

Cudzil says Pimco’s base-case forecast is for a recession over the next few quarters. “We do see things slowing—we do see inflation slowing, and we do see growth slowing,” he says. “Whether it’s because of the yield curve, it’s hard to tease all that out. But it does seem that markets are saying monetary policy is in restrictive territory and will need to be eased.”

Read More: When Will the Fed Start Cutting Interest Rates?

Why Has the Yield Curve Been Wrong So Far?

Even as the yield curve has been negative for a sustained period, the economy has continued to chug along. Why the discrepancy?

For the most part, bond-watchers point to underlying forces keeping the economy rolling along, starting with the Fed’s aggressive efforts to pump money into it during the pandemic-driven recession. While the Fed has aggressively raised interest rates, a significant part of the effort was moving monetary policy out of an extremely accommodative stance. “You have to look at the starting point of where we were,” McAllister says. “We were at zero [percent federal-funds rate] for a fairly extended period of time.”

In addition, the Fed was pumping money into the economy in a direct fashion by purchasing bonds—a practice known as quantitative easing. “It was like we went to the wildest, craziest party any of us has ever been to, and they are gradually taking the punchbowl away,” McAllister says.

Then there were the massive amounts of fiscal stimulus (nearly $5 trillion in total) as the government stepped in to help the economy weather the pandemic shutdowns. “With COVID, you had this massive fiscal stimulus, and it went to every segment of the economy. It went to households, it went to businesses, went to nonprofits, it went to state and local governments‚” McAllister explains. “While we’re clearly in the later stages of that, it’s taken a long time for all of those entities to work through that excess cash.”

Economists say that combination of stimulative fiscal and monetary policy has been a key driver sustaining strength in consumer spending and the job market, both of which have been important factors in the solid pace of economic growth.

“It was extremely easy monetary policy, unprecedented fiscal policy,” McAllister says. “It’s going to take longer to have the kind of impact that a 525-basis-point increase by the Fed would have and an inverted curve would have on the economy.”

What Stocks Are Up?

Koninklijke Philips PHG stock jumped after Exor EXXRF bought a 15% stake in the medical device manufacturer for about $2.8 billion. The agreement between the two Netherlands-based companies allows Exor, which also maintains investments in firms that include Stellantis STLA and Ferrari RACE, to raise its stake to at most 20%. “Exor’s investment in Philips, their long-term outlook, and increased focus on healthcare and technology fit well with our strategy and substantial value creation potential,” Philips CEO Roy Jakobs says.

Tencent Music Entertainment TME posted second-quarter results that fell in line with Morningstar senior equity analyst Ivan Su’s expectations, pushing its stock up. Revenue for the China-based music streaming services company grew 6% year over year, which was helped by a 37% increase in subscription revenue. Although it lowered guidance for livestreaming revenue, management still hopes for a margin expansion for the rest of the year, Su says.

Shares for Progressive PGR rose after the insurance provider announced it wrote close to $6 billion in premiums in July, up 21% from the same month last year. Additionally, the firm shared that it earned $5.6 billion in premiums last month, up 20% year over year, while its combined ratio increased to 90.6% from 89.8%. With shares rising above 8% on Aug. 16, Progressive marked its largest intraday percentage increase since March 2020.

Highlighted Advancers

Source: Morningstar, Inc. Data as of Aug. 18, 2023.

What Stocks Are Down?

Hawaiian Electric Industries HE stock plunged as shareholders assess the utility company’s potential liabilities regarding the deadly wildfires in Maui. Damages are estimated at $5.5 billion for the town of Lahaina, which saw the largest fire.

Morningstar strategist Andrew Bischof warns investors of the extreme uncertainty of the stock after residents filed a class-action lawsuit against the electricity provider for not shutting off power before strong winds. As outlets like The Wall Street Journal explain wildfires can occur when wind blows down power-carrying structures or a flying object hits power lines, resulting in big flashes of electricity. “Plaintiffs will need to show that the utility was negligent or could have reasonably prevented a loss,” Bischof says.

Shares for Farfetch FTCH ended the week down after second-quarter results showed declines in growth. The internet retailer’s gross merchandise value declined in the United States and China, both areas being the company’s main markets. Additionally, revenue for the subsidiary New Guards Group declined 42% in the quarter, while the firm’s wholesale-focused brands showed more weakness.

Sea SE stock sank after the company posted lower-than-expected results for its second quarter. The Singapore-based internet retailer generated $3.1 billion in revenue, which is 10% lower than forecasts from FactSet and Morningstar senior equity analyst Kai Wang. “Not only did Sea miss revenue estimates, but concerns over profitability resurfaced as the company indicated there could be periods of operating losses as it begins to focus on growth again,” Wang says.

Shares for CVS Health CVS declined after Blue Shield of California announced it will drop CVS subsidiary Caremark as its pharmacy insurance manager. The healthcare plan provider will instead partner with several firms, including Amazon.com’s AMZN pharmacy subsidiary and entrepreneur Mark Cuban’s Cost Plus Drug Company.

The contract deal may signal a change in the competitive field of pharmacy benefit management service companies. “CVS’ dominance of the PBM business looks likely to decline materially in the near future with this and the other contract losses, which creates another hurdle to its double-digit earnings growth ambitions,” Morningstar senior equity analyst Julie Utterback says.

Highlighted Decliners

Source: Morningstar, Inc. Data as of Aug. 18, 2023.

The challenge for automakers is making EVs actually affordable: Fmr. Ford CEO Mark Fields

Hosted by Brian Sullivan, “Last Call” is a fast-paced, entertaining business show that explores the intersection of money, culture and policy. Tune in Monday through Friday at 7 p.m. ET on CNBC.

Ford CEO received ‘reality check’ after taking electric F-150 on road trip

Acknowledged challenges his customers face

By Johnathan Jones, The Western Journal

Published August 16, 2023 at 3:10pm

Ford CEO Jim Farley acknowledged the challenges his customers face when charging electric vehicles after he embarked on a trip across Route 66 out west this past week.

On social media, Farley said he spent the week driving an electric F-150 Lightning.

During the voyage, the CEO said he stopped off to charge the truck at a power station in Coalinga, California, where his options were limited. He described the moment as a “reality check” for Ford owners.

“No surprise charging can be a challenge, but still learning a lot seeing firsthand the issues our customers face,” he told his followers on X, which was formerly known as Twitter.

“This is why we’re working w/ @Tesla to provide @Ford drivers access to +12,000 superchargers & our EV certified dealers are installing fast chargers at their dealerships.”

Farley added, “Will help us improve the EV experience for our customers.”

In a short clip, Farley surrendered, “Charging has been pretty challenging.”

He added, “It was a really good reality check of the challenges of what our customers go through and the importance of fast charging.”

One issue Farley encountered in California was a slow charging time.

Surrounded by Tesla Supercharger stations, which Ford’s line of electric vehicles cannot yet use, Farley explained he hooked up to a low-speed charger.

He said it took 40 minutes for the charger to get the truck’s battery to only 40 percent. Farley documented the trip on both X and LinkedIn.

The Ford CEO encountered a similar issue while driving from Baker, California, to Las Vegas, he said.

Insider reported the Tesla Supercharger network will be available to Ford customers in the spring.

Farley vowed to continue to work on offering Ford’s EV customers better charging options and has committed the company to produce more electric vehicles.

He told NPR on Sunday that in spite of issues with the F-150 Lightning, the company intends to set itself up to roll out 600,000 EVs by the end of the year.

The Lightning has been criticized for its insufficient towing range, as compared to traditional F-150s, and the trucks are known to deplete their batteries much faster in cold weather conditions.

This article appeared originally on The Western Journal.

Goldman names China stocks set for a bounce — and 2 make its list of top buy-rated picks

PUBLISHED THU, JUL 27 20237:32 PM EDT

Goldman Sachs has identified a number of Chinese stocks to buy after the government announced a number of major fiscal stimulus measures this week.

“The window for the ‘China trade’ has opened,” its analysts led by Kinger Lau said in a July 26 research note.

“At the stock level, we emphasize a select group of GS Buy-rated companies that appear well-placed in stimulus-exposed areas, notably the platform economy, consumer services, electric vehicle supply chain, renewables, hi-tech manufacturing, new infrastructure, and late-cycle property plays.”

China’s Politburo, the decision-making body of the country’s Communist Party, held its July meeting on Monday. It pledged to “adjust and optimize policies in a timely manner” for its beleaguered property sector, along with other measures designed to boost domestic consumption demand and resolve local debt risks.

The event typically sets the tone for the country’s economic policies for the second half of the year, and Goldman noted that initial market reaction to the meeting was positive.

The bank added that it expects Chinese stocks to “trade better” in the coming months. “The post-event market price actions are encouraging, but policy follow-through and implementation is required to sustain the recovery trade,” its analysts noted.

A ‘tactical bounce’

Goldman said that, although structural growth concerns remain, the meeting “reaffirms our view that the policy put has been activated, and the window for a tactical bounce for Chinese stocks is now open.”

Goldman screened for buy-rated stocks in several areas related to China’s policy announcement, including internet giants Tencent and JD, as well as its medical platform JD Health.

In real estate, Goldman is buy-rated on property software company Beike and on mobile components company BYD Electronic as well as online recruitment firm Kanzhun.

Search engine giant Baidu and drinks company China Resources Beer are also picks of the bank, and appear on its Asia-Pacific conviction list of top buy-rated stocks.

— CNBC’s Michael Bloom and Clement Tan contributed to this report.

What China’s big earnings say about the consumer

PUBLISHED THU, AUG 17 20238:36 PM EDT

KEY POINTS

- com, Tencent and Alibaba this month reported results for the three months ended June that pointed to a steady pick-up in consumer spending that quarter, but with less clarity on whether that growth has continued.

- JD’s electronics revenue rose but sales from general merchandise dropped in the quarter ended June.

- Theme parks have done well as tourism has picked up domestically.

Tencent sign is seen at the World Artificial Intelligence Conference (WAIC) in Shanghai, China July 6, 2023.

Aly Song | Reuters

BEIJING — Corporate earnings releases are picking up on a few bright spots for China’s consumer in a competitive market where people are less willing to open their wallets.

JD.com, Tencent and Alibaba this month reported results for the three months ended June that pointed to a steady pick-up in consumer spending that quarter, but with less clarity on whether that growth has continued.

Here’s where companies said they saw consumer-related growth, according to public disclosures and FactSet transcripts of earnings calls:

JD.com

Electronics and home appliance revenues rose by 11.3% to 152.13 billion yuan ($20.98 billion) in the three months ended June.

But general merchandise revenue fell by 8.6% from a year ago to 81.72 billion yuan.

Marketing revenue rose by 8.5% to 22.51 billion yuan.

Tencent

Livestreaming e-commerce saw 150% year-on-year growth in gross merchandise value in the second quarter to an unspecified number. GMV measures total sales value over a certain period of time.

On an annualized basis, that livestreaming GMV “is in the tens of billions” yuan.

WeChat Mini program e-commerce has GMV “in the trillions” of yuan on an annualized basis. GMV for physical products has exceeded 1 trillion yuan on an annualized basis.

Advertising revenue across all categories — except automotive — is up double-digits from a year ago in recent weeks. Ad sales rose by 34% to 25 billion yuan in the quarter ended June.

Overall, Tencent reported earnings for the quarter that missed expectations, but showed a third-straight quarter of revenue growth.

Alibaba

Direct China commerce sales, primarily from Tmall Supermarket and Tmall Global, grew by 21% year-on-year to 30.17 billion yuan.

The overall Taobao and Tmall Group saw revenue grow by 12% to 114.95 billion yuan.

A recovery in offline shows and the movie theater box office boosted Alibaba’s ticketing and movie studio units. Video platform Youku also saw subscription revenue rise. In all, digital media and entertainment revenue surged by 36% year-on-year to 5.38 billion yuan — and its first profitable quarter.

Local services revenue rose by 30% to 14.5 billion yuan. That was driven by orders on food delivery app Ele.me and growth in Alibaba’s map app Amap, which sells services such as ride-hailing and hotel booking.

Alibaba management did not provide much detail on the state of the consumer since the end of June.

Overall, Alibaba’s earnings soundly beat expectations for the quarter.

China consumption amid sluggish growth

Data for July have pointed to a slowdown in China’s economy, including a modest 2.5% year-on-year increase in retail sales.

Theme parks, however, have done well as tourism has picked up domestically.

Shanghai Disney saw record high revenue, operating income and margin during the latest quarter, the company said.

Universal Studios Beijing “enjoyed its most profitable quarter,” Comcast said. The park opened in September 2021, during the pandemic.

Listed companies don’t capture all major channels for online spending in China. ByteDance, which is not publicly listed, has become another e-commerce platform through its Douyin app, the local version of TikTok.

Consumers in China spent 1.41 trillion yuan in purchases from merchants on Douyin, up 76% from the previous year, according to The Information. ByteDance did not immediately respond to a request for comment.

ByteDance’s smaller rival Kuaishou is set to release earnings Tuesday, as are Chinese tech giant Baidu and video content platform iQiyi. E-commerce giant Pinduoduo has yet to announce when it’s scheduled to release earnings.

Other companies in China, or those with exposure to China, have showed some pockets of growth, albeit compared to a low base in 2022 when the metropolis of Shanghai was locked down for two of the three months in the second quarter.

Here’s what some have said so far:

Adidas

Revenues in Greater China grew 16% in the second quarter, reflecting double-digit sell-out growth in both wholesale and its own retail outlets.

Anta

The Chinese sportswear company said its Anta brand retail sales value rose by high single digits in the second quarter from a year ago. Its Fila brand saw high teens growth year-over-year. The company’s Descente, Kolon Sport and other brands saw growth of 70% to 75% year-on-year.

Apple

Apple CEO Tim Cook said the iPhone maker saw “an acceleration‘’ in China, with 8% year-on-year quarterly sales growth to $15.76 billion. That’s a reversal of a 3% year-on-year drop in the prior quarter.

The company said it saw “a June quarter record in Greater China” in the wearables, home and accessories category, as overall product group saw sales increase by 2% year-on-year to $8.3 billion.

Li Ning

The company said June quarter retail sell-through of Li Ning point of sale, excluding its “young” brand, increased by mid-teens on a year-on-year basis.

Starbucks

China comparable store sales increased 46%, but the average ticket size was slightly smaller, down 1%.

— CNBC’s Arjun Kharpal contributed to this report.

Disclosure: Comcast is the owner of NBCUniversal, parent company of CNBC.

Walmart and Target face similar problems — but only one is thriving

PUBLISHED THU, AUG 17 20233:51 PM EDTUPDATED FRI, AUG 18 20239:32 AM EDT

Melissa Repko@IN/MELISSA-REPKO@MELISSA_REPKO

KEY POINTS

- Target and Walmart posted sharply divergent fiscal second-quarter results and offered starkly different outlooks for the months ahead.

- Walmart’s online sales in the U.S. rose in the three-month period, while Target’s fell.

- The contrasting results illustrate some of the companies’ fundamental differences, but also capture how some retailers are having more success than others.

A customer pushes a shopping cart full of groceries outside a Wal-Mart in Rogers, Arkansas, left, and a pedestrian passes a Target store in the Tenleytown neighborhood of Washington, D.C.

Getty Images

Target and Walmart are both catering to thriftier shoppers, but the two big-box retailers have seen very different outcomes when it comes to winning their dollars.

Target missed Wall Street’s sales expectations for the fiscal second-quarter. Walmart beat Wall Street’s revenue estimates for the three-month period. Target slashed its forecast for the year, while Walmart raised its outlook.

The companies’ diverging performances illustrate some of the retailers’ fundamental differences.

Walmart, the nation’s largest grocer, makes more than half of its annual revenue from selling groceries — a category that shoppers buy even when times are tight. Target draws only about 20% of its yearly revenue from grocery, making it rely more on sales of items such as clothing, earrings and throw pillows that customers may skip when feeling frugal.

Target, which tends to draw a more affluent customer than Walmart, may also be seeing a more dramatic swing in spending as consumers shell out on Taylor Swift tickets and European vacations. Those shoppers could also be trying to balance splurging on services with shopping at places perceived to be cheaper, such as Walmart or TJX Companies-owned T.J. Maxx, Marshalls and Home Goods, which posted year-over-year sales and profit growth earlier this week.

Yet Target’s and Walmart’s contrasting results also capture how some retailers are having more success than others catering to fickle consumers and navigating economic headwinds.

Wall Street added to the confusion with its own counterintuitive moves. After earnings reports, it snapped up Target’s stock on Wednesday and sold off Walmart’s shares on Thursday. The potentially surprising moves could reflect the companies’ recent stock performance, since shares of Walmart are up about 10% this year compared with Target shares’ decline of about 13% during the same period.

Despite the differences, the companies showed they still have much in common. Target and Walmart leaders offered similar descriptions of American consumers who now think twice before spending money on nonessential items while paying more for food.

“As we look at the consumer landscape today, we recognize the consumer is still challenged by the levels of inflation that they’re seeing in food and beverage and household essentials,” Target CEO Brian Cornell said on a call with reporters. “So that’s absorbing a much bigger portion of their budget.”

Walmart Chief Financial Officer John David Rainey echoed similar sentiments, describing consumers as “choiceful or discerning” on a call with CNBC.

Yet both executives added that shoppers can be persuaded to spend, with a good deal or when getting ready to celebrate holidays or seasonal events.

Here’s a closer look at three key ways that Target’s and Walmart’s most recent quarterly results diverged:

Online winners and losers

As shoppers head out into the world again, some retailers have seen double-digit declines in online spending.

Target followed that pattern in the second quarter. Its digital sales dropped by 10.5% year over year.

Walmart bucked the trend. E-commerce sales rose 24% for Walmart U.S. in the second quarter.

Both retailers pointed to curbside pickup as a major driver of online sales — a key differentiator from competitor Amazon.

Walmart chalked up online sales gains to store pickup and delivery, as well as more advertising revenue. It also credited its third-party marketplace, which is Walmart’s take on Amazon’s online business model. The online marketplace is made up of vendors who list items on Walmart’s website, which helps to expand the merchandise assortment and comes with a higher profit margin than selling online items directly.

Customers are also visiting Walmart’s website and app more often, Rainey said. The number of weekly active digital users grew more than 20%, he said on the company’s earnings call. The number of customers buying items on Walmart’s marketplace increased 14% in the second quarter, with double-digit growth across home, apparel and hard lines, a category that includes sports equipment and appliances.

Target has lagged behind in online sales. But it is making moves to try to turn around trends.

The retailer will roll out a remodel of its digital experience in the next three months, Target Chief Growth Officer Christina Hennington said on an earnings call Wednesday. She said the website will “include different landing experiences, more personalized content, enhanced search functionality, ease of navigation and other updates to bring more joy and convenience to our digital guests.”

Walmart, for its part, refreshed the look of its website and app in the spring.

Target will dangle another perk to attract more online business. Starting this summer, it is adding Starbucks drinks to curbside pickup at most stores.

Mixed reads on discretionary spending

For more than a year, Americans have generally shown reluctance to spring for new outfits, gadgets or other items that they can live without.

That’s made life harder for retailers, which rely on big-ticket and impulse-driven purchases to buoy sales. The merchandise tends to drive higher profits than selling the basics such as milk, bread and paper towels.

Rainey, Walmart’s CFO, pointed to signs that may be changing. He said there was “modest improvement” in discretionary goods in the second quarter, even though general merchandise sales still dropped by low double digits year over year. He said sales of blenders, hand mixers and other kitchen tools popped, as some consumers cook more at home.

Target didn’t see the same relief. Sales of frequency categories, such as food and beauty items, weren’t enough to offset weaker discretionary sales at the retailer.

Target’s Hennington said trends in discretionary categories “remain soft overall.” She pointed out some exceptions, including the popularity of a Taylor Swift vinyl and colorful Stanley tumblers designed with Chip and Joanna Gaines.

Both retailers, however, said they’re stocking up on essential items and placing more modest orders for discretionary stuff. Target, for instance, said at the end of the second quarter, its overall inventory levels fell year over year — but it intentionally reduced discretionary inventory even more.

Optimism vs. pessimism about what’s ahead

Retailers have plenty to worry about as food prices remain high, interest rates rise and student loan payments return.

But Walmart and Target struck contrasting tones when speaking about the months ahead.

Target CEO Cornell said sales trends improved in July, but not enough to keep the company from cutting its outlook for the year. When asked about back-to-school shopping, Cornell and Chief Financial Officer Michael Fiddelke stressed it was very early in the season.

Walmart hit a more confident note. On the earnings call, CEO Doug McMillon said general merchandise sales outperformed the company’s expectations. He said the popularity of GLP-1 drugs, medications such as Ozempic that are used for diabetes and weight loss, could also drive foot traffic and revenue going forward.

And, he added, “the trends we see in general merchandise sales make us feel more optimistic about those categories in the back half of the year.”

McMillon said back-to-school has gotten off to a better start than the company predicted. He said that spending tends to correlate with consumer spending later in the year — which could be a positive sign for the critical holiday season.

“Typically when back-to-school is strong, it bodes well with what happens with Halloween and Christmas and GM [general merchandise] in the back half,” he said.

Target shared similar hopes that customers will open up their wallets and reverse the retailer’s sales slump as the season of pumpkin spice and gift-giving approaches. It saw traffic and sales trends improve in July, which it credited in part to spending for the Fourth of July holiday.

“We know our guests want to celebrate culturally and seasonally relevant moments and will be leaning into those moments in a big way in the third quarter and the upcoming holiday season,” Hennington said.

https://www.cnbc.com/2023/08/18/iphone-15-usb-c-charging-would-be-biggest-upgrade-in-years.html

The iPhone 15 could get one of the biggest upgrades in years: A new charging port

PUBLISHED FRI, AUG 18 20233:55 PM EDTUPDATED FRI, AUG 18 20236:36 PM EDT

KEY POINTS

- The next iPhones, expected to be launched in the coming weeks, could have a feature that no iPhone has ever had — a generic charging port.

- The USB-C connector would replace Apple’s proprietary port, the Lightning port, which has graced the bottom of every iPhone model released since 2012.

- The shift would be one of the biggest improvements to the iPhone in years for consumers.

Apple will “comply” with European Union regulation that requires electronic devices to be equipped with USB-C charging, said Greg Joswiak, Apple’s senior vice president of worldwide marketing. That will mean Apple’s iPhones, which currently use its proprietary Lightning charging standard, will need to change to support USB-C.

Jakub Porzyck | Nurphoto | Getty Images

The next iPhones, expected in September as usual, could have a feature that no iPhone has ever had: a generic charging port.

The new iPhone models could include a USB Type-C charger port on the phone’s bottom, according to analysts and media reports. That’s the same charging port that’s used on nearly every laptop sold in the past few years, as well as Android phones, iPads, and other gadgets from Kindles to headphones to drones and heated blankets.

The USB-C connector would replace Apple’s proprietary port, the Lightning port, which has graced the bottom of every iPhone model released since 2012.

The shift would be one of the biggest improvements to the iPhone in years for consumers.

IPhone users would no longer need to bring two different cables for their phone and other gadgets while traveling. Android users could borrow chargers from people who own iPhones. IPhone users could borrow chargers from anyone using a newer laptop. Schools and businesses could standardize on one type of charger for their entire fleet of devices. USB-C could even allow iPhones to access faster charging speeds.

While Apple hasn’t confirmed that its new iPhones will feature a USB-C charging port, and didn’t respond to a request for comment, the change is bound to happen.

A new regulation passed by the European Union last year requires USB-C ports on new smartphones by 2024. Apple is unlikely to produce an iPhone model solely for the European market. “Obviously, we’ll have to comply,” Greg Joswiak, Apple’s chief marketer, said last year.

Consumer benefits, like the reduced “lock-in” to a single manufacturer, helped form the reasoning behind the new regulations. The EU estimates the rule could save Europeans 250 million euros per year on chargers. The EU also said old chargers account for about 11,000 tons of e-waste per year in the region.

Apple opposed the law. In a 2021 letter, Apple said that the regulation would hamper future charging innovation, could require it to take devices off the market early, and could confuse consumers with additional information.

“We are concerned that regulation mandating just one type of connector for all devices on the market will harm European consumers by slowing down the introduction of beneficial innovations in charging standards, including those related to safety and energy efficiency,” Apple said in the letter.

Whenever Apple changes the ports on its devices, skeptics believe it’s just an effort to make more money on its premium-priced cables. Apple’s most capable USB-C cable retails for $39.

For example, when Apple added USB-C chargers to MacBook laptops starting in 2015, it drew jokes about the dongles required to plug older accessories into the new laptops.

When Apple removed the headphone jack from the iPhone in 2016, it spurred months of commentary, both for and against the “courageous” change, about whether Apple was pushing people to its more expensive wireless AirPods. It still inspires takes today about whether it was the right decision; most Android phones have followed suit.

But while Apple makes money from its cables, and has a program where accessory makers pay for access and official Apple parts called “MFi,” Apple’s strategic focus is making sure that its products work together without major flaws so its users continue to buy new iPhones. It’s not nickel-and-diming dongles and accessories.

Cable sales are reported in Apple’s Wearables, Home, and Accessories product line, which reported $41 billion in revenue in 2022, although Apple Watches and headphones make up the majority of the sales. That’s much smaller than the $205 billion in iPhone sales Apple reported during the year.

Possible downsides

Apple’s argument that a new charger will cause confusion holds more water. With the Lightning port, companies that wanted to make officially approved accessories have to apply for Apple’s program, and pay for access to specifications and official Apple parts. For consumers, this meant that while there were a few knockoff Lightning devices to avoid, at most stores, the dock or clock or cable users purchased would just work.

USB-C is a different beast. It’s a “standard,” which means the exact specifications are published by a group of companies and individuals working together. Anyone can use those specifications to build cables, and you don’t need to enroll in an Apple-administered program.

This also means that many iPhone users will learn that not all cables with a USB-C connector are created equal. Some cables can transfer data quickly, and some can’t. Back when the standard was first introduced, some cables could even cause damage to devices because they were misconfigured, though this hasn’t been as common in recent years. Some cables even support “Thunderbolt,” a modern data transfer standard for powerful accessories such as monitors or docks, although at a higher price. There are websites that test and approve cables that are “compliant” with the USB-C standard.

Apple will likely let users know if a cable is appropriate for charging an iPhone, through software warnings, what it carries at its retail operation, and through its MFi program.

But it’s clear that the charger port switch raises possibilities for frustrating situations that didn’t exist when Apple stuck with its proprietary charger. Apple’s current troubleshooting document for USB-C charging issues on Mac tells users to test with Apple’s official cables and power adapters.

The world won’t change overnight when Apple’s iPhones have USB-C ports. Apple still develops some of its own proprietary charging standards, such as MagSafe, which uses magnets to affix a charging puck to the back of an iPhone. Its Apple Watch uses a unique magnetic charger as well. Even after using USB-C as the only charging port on its MacBook laptops for years, Apple recently introduced a proprietary magnetic charger on recent models.

Eventually, Apple watchers predict, the company is likely to try to remove ports entirely from the iPhone, but until then, Apple aficionados with multiple products will still need to carry several different charging cables.

Still, the USB-C port is a step in the right direction for iPhone users, even if Apple is grumbling along the way. Apple preferred an approach that would standardize charging bricks but allow cables to be specific for a type of device.

“What that allows you to do is have over a billion people — it’s not a small number of people have that connector on the left [pointing to the Lightning cable] — to be able to use what they have already, and not have to be disrupted,” Apple’s senior vice president of worldwide marketing, Greg Jozwiak, said in 2022.

Police warn parents to be careful about back-to-school social media posts

By Alex Cabrero, KSL-TV | Posted – Aug. 21, 2023 at 7:38 a.m.

Police warn parents to be careful about back-to-school social media posts

SARATOGA SPRINGS — Your social media feeds are about to be full of them — photos of kids as they head back to school.

Parents everywhere not only want to dress up their kids in their best clothes for the first day but getting those first day photos is also important.

Many parents love posting those photos on social media.

However, if you do, police departments are reminding parents it’s important to make sure you’re not giving away too much.

“With social media, we are just being aware that what we post can be impactful towards us,” said detective Spencer Stansfield with the Saratoga Springs Police Department.

Stansfield is also a school resource officer, and he said it’s not so much those first-day back pictures, it’s more about what is on the signs and chalkboards some of those photos contain.

“What classroom our kids are going to be in, the grades they’re in. That gives us an age, how old they are. The school, their location, the name of their teacher,” he said.

The police department posted a Facebook message warning parents that predators and scammers could use that info to endanger their child or their family.

“I don’t want to be an alarmist, but those are scary things for parents, and you certainly have to be careful,” Earl Foote said.

Foote is the CEO of Nexus IT, which is a cybersecurity company based in Salt Lake City. He said it’s a good idea to make sure your privacy settings are locked down so those photos can’t be seen by everyone.

“There are people who use publicly available content of minors for malicious purposes,” Foote said.

He also encouraged parents to create subsets on social media platforms of people they know in real life and trust.

That way parents can choose who among their social media friends can see the pictures, and it doesn’t get seen by all their followers.

“It doesn’t take that long to do that,” Foote said. “Fifteen minutes, maybe a half hour tops. I think it’s absolutely worth the security and safety of children to do it.”

Stansfield said he doesn’t have any specific examples of this happening in Saratoga Springs but said the potential is always there.

“You never know in today’s society,” he said. “We don’t want to make parents scared. We just want to educate and inform them of what may be out there.”

HI Financial Services Mid-Week 06-24-2014