HI Market View Commentary 06-05-2023

https://www.briefing.com/the-big-picture

Six ways to spell relief

This column doesn’t often dwell on the market’s weekly performance, but this week is worth dwelling on because it was a very good week for investors.

Granted it wasn’t all good when looking at the performance of some individual stocks, but in the big picture it was all good and we’ll touch on six reasons why we are drawing that conclusion.

Cracking Open a Six-Pack

1) The debt ceiling deal got done.

The process wasn’t easy nor was it pretty. Once again, market participants had to put up with partisan posturing that made it sound as if this time could be different, meaning the debt ceiling wouldn’t be raised in time to avoid a default. The uncertainty of the situation came to a head when Fitch Ratings said last week that it was putting the U.S. AAA rating on Rating Watch Negative.

It is speculation to say so, yet the move by Fitch presumably lit a fire under negotiators to work out an agreement. Lo and behold, it was announced over the Memorial Day weekend that President Biden and House Speaker McCarthy struck a deal that both leaders called a bipartisan and compromise deal. Critics in both parties found reason to be critical of the deal, but fortunately they were in the minority.

The House voted 314-117 to approve the deal Wednesday night and the Senate fast-tracked passage of the deal in a 63-36 vote Thursday night. There will be no default.

2) Expectations that there will be another rate hike in June got dialed back (in a hurry).

Early Wednesday, the CME FedWatch Tool indicated that there was a 70% probability of another 25-basis points rate hike at the June FOMC meeting. The market got there not long after it was reported that Cleveland Fed President Mester, who does not vote on the 2023 Federal Open Market Committee, told FT that she sees no compelling reason to pause the rate hikes in June. By Wednesday afternoon, though, the probability of a 25-basis points rate hike at the June meeting had plunged to 25.6%.

The catalyst for the abrupt shift in sentiment was remarks made by Fed Governor Jefferson (FOMC voter) and Philadelphia Fed President Harker (FOMC voter).

Fed Governor Jefferson, who is also the nominee for Vice Chair, thinks “…skipping a rate hike at the coming meeting would allow the Committee to see more data before making decisions about the extent of additional policy firming.” Mr. Harker for his part said he thinks the Fed can “take a bit of a skip for a meeting.”

It would be remiss not to add that both Jefferson and Harker implied further rate hikes could still happen. Mr. Jefferson said a pause would not mean the Fed is at the peak rate and Mr. Harker said a skip would not be a pause. In any case, it helped sentiment to hear some less hawkish views regarding the upcoming June FOMC meeting from two voting members versus what Ms. Mester said earlier.

Presently, the CME FedWatch Tool shows a 30.0% probability of a rate hike in June and a 68.1% probability of a rate hike in July. Market participants know the Fed is making its decisions meeting by meeting, so even though there is a strong probability today of a rate hike in July, the market was able to run this week, comforted by the notion that there won’t be a rate hike in June.

3) The S&P 500 showed some fight at 4,200.

The 4,200 level had put up some stern resistance since last August, but the S&P 500 finally peeked its head above the key technical barrier on a closing basis last Friday. It sputtered a bit on Tuesday, slipping below 4,200 on an intraday basis before regrouping and finishing the session above 4,200.

Wednesday was a different story. The S&P 500 opened below 4,200 and remained locked there for the entirety of the session, closing at 4,179. Cutting to the technical chase, the S&P 500 quickly rebounded and finished Thursday’s trade at 4,221 and then pushed as high as 4,289 in Friday’s session.

Clearing 4,200 triggered a mini-breakout effort with the market pinning its sights presumably on 4,300, which is the top end of a 12-month trading range. Aside from that, there is an encouraging technical pattern of higher highs and higher lows that has been established since the October 2022 low.

4) Inflation data this week was better — not good, but better and that helped quiet some rate hike fears.

- The May Consumer Confidence Index report showed consumers expected inflation to average 6.1% over the next 12 months versus 6.2% in April.b. First quarter unit labor cost growth was revised down to 4.2% from the advance estimate of 6.3%.c. The Prices Index for the May ISM Manufacturing Index dropped to 44.2 from 53.2. A number below 50.0 is indicative of contraction.

d. Average hourly earnings growth in May decelerated to 4.3% year-over-year from 4.4% in April.

5) The employment data remained solid for the most part and kept recession concerns at bay.

- Initial jobless claims for the week ending May 27 increased just 2,000 to 232,000 while continuing jobless claims increased by 6,000 to 1.795 million. The key takeaway from the report is that businesses overall remain reluctant to cut staff size in large numbers, leaving the level of initial jobless claims well below what is typically seen in a recession environment (i.e., north of 375,000).b. The April JOLTS – Job Openings Report showed 10.103 million job openings, versus 9.745 million in March, which equates to roughly 1.7 job openings for every officially unemployed worker.c. The Employment Index for the May ISM Manufacturing Index increased to 51.4 from 50.2, which represents a faster expansion in employment.

d. The May Employment Situation Report featured a 339,000 increase in nonfarm payrolls, upward revisions to nonfarm payrolls for April and March, and a moderation in average hourly earnings growth. Overall, the strength in nonfarm payrolls helped assuage concerns at this point about the economy suffering a hard landing. In turn, the jump in the unemployment rate to 3.7% from 3.4% and the dip in average hourly earnings growth on a year-over-year basis should assuage some (certainly not all) of the Fed’s concerns about the tightness of the labor market and wage-push inflation going into its June FOMC meeting.

6) The move this week wasn’t just a mega-cap move.

Granted there wasn’t much happening for the broader market until Friday’s charge. Entering Friday, the Invesco S&P 500 Equal-Weight ETF (RSP) was down 0.3% for the week versus a 1.0% gain for the Vanguard Mega-Cap Growth ETF (MGK) and a 0.4% gain for the market-cap weighted S&P 500. The “rest of the market,” however, got it in gear Friday, rallying in response to the positive takeaways from the employment report and the Senate’s fast-track passage of the debt ceiling bill.

As of this writing, the Invesco S&P 500 Equal-Weight ETF (RSP) is up 2.0% for the week, as is the market-cap weighted S&P 500. One day does not a trend make, but the move for the broader market on Friday is what you want to see to lend credibility to a breakout effort and/or the sustainability of a bull market.

What It All Means

The concise answer to what it all means is that it has been a very good week for the stock market. We don’t see any reason to expound on things beyond what we saw this week. Sometimes, you just have to be happy with what is right in front of you.

This may have been a shortened week of trading, but it was long on constructive developments that rightfully translated into nice gains for the broader market.

The pull from here won’t be easy, especially with the possibility of another rate hike (if not more) from the Fed and valuation angst still in play, yet the takeaway from this week’s back-end loaded advance is that the market pulled forward a welcome measure of political, monetary policy, technical, economic, and positioning relief.

—Patrick J. O’Hare, Briefing.com

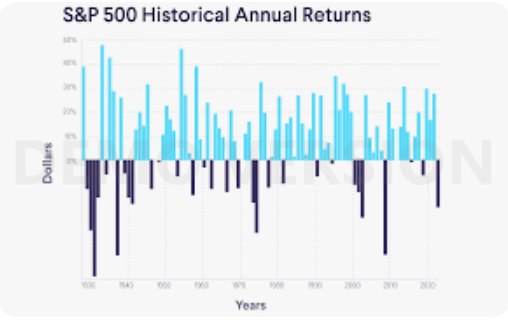

Average Returns?

- Taking a number of past years and take the total return over that period and divide that by the number of years.

- The idea by taking the “average” return over a number of years is thought to give us a decent understanding of where the market will go in the future.

- Fair right? NOOOOOOOOOOOO!!!!!

- Why? The market doesn’t compound at its AVERAGE return.

- So what? The problem is that if you expect the market to do in the future what it did on “average” in the past, your financial plan is going to be WAY off. Your premium financed life insurance policy is dead because the insurance company will want you to pay the premiums out of your pocket.

- Your financial plan that uses average returns (linear) doesn’t actually move that way because the stock market doesn’t compound at its average returns.

Where will our markets end this week?

Higher

DJIA – Bullish

SPX –Bullish

COMP – Bullish

Where Will the SPX end June 2023?

06-05-2023 +2.0%

Earnings:

Mon:

Tues:

Wed:

Thur:

Fri:

Econ Reports:

Mon: ISM Index

Tue

Wed: MBA, Trade Balance, EIA Oil Inventories, Consumer Credit

Thur: Initial Claims, Continuing Claims,

Fri:

How am I looking to trade?

www.myhurleyinvestment.com = Blogsite

info@hurleyinvestments.com = Email

Questions???

Cathie Wood’s Ark Invest misses out on Nvidia’s powerful rally — dumped stock too early, citing high valuation

PUBLISHED TUE, MAY 30 202311:06 AM EDTUPDATED TUE, MAY 30 20231:55 PM EDT

In this article

Cathie Wood, CEO of Ark Invest, speaks during an interview on CNBC on the floor of the New York Stock Exchange (NYSE) in New York City, February 27, 2023.

Brendan McDermid | Reuters

Ark Invest’s Cathie Wood, known for her investments in next-generation technologies, missed out on the jaw-dropping rally in Nvidia — the biggest winner in artificial intelligence this year.

Her flagship Ark Innovation ETF (ARKK) exited Nvidia entirely in early January, before the chipmaker went on to enjoy a powerful rally that propelled it to a $1 trillion market capitalization.

She even trimmed Nvidia holdings in her smaller funds on Thursday when the stock spiked 26% on a huge forecast beat driven by AI chip demand. The ARK Autonomous Tech. & Robotics ETF (ARKQ) now has 4.4% in Nvidia, while its biggest holding is Tesla with a 14% weighting. ARKK and ARKQ are up 8.9% and 5.8% this month, respectively, compared to Nvidia’s 40% gain.

Wood revealed that her reason for dumping Nvidia was its high valuation. Typically though, growth investors like Wood aren’t fazed by how expensive a stock is.

“At 25x expected revenue for this year, however, $NVDA is priced ahead of the curve,” she said in a Twitter post on Monday.

Meanwhile, ARKK doesn’t own any of the semiconductor names and other AI-related stocks that had a big move up recently alongside Nvidia, including AMD, Taiwan Semiconductor or C3.ai.

“Active management seeks to find potential winners but can often miss out with security-selection decisions,” said Todd Rosenbluth, head of research at VettaFi. “This is why some investors are turning to broad-based thematic index ETF strategies.”

Rosenbluth said Global X Artificial Intelligence & Technology ETF (AIQ), iShares Robotics and Artificial Intel Multisector ETF (IRBO), and ROBO Global Artificial Intelligence ETF (THNQ) are three AI-focused exchange-traded funds that have benefited from owning Nvidia.

AI winners elsewhere?

Wood said she believes better opportunities to ride the AI boom are elsewhere. She called Tesla “the most obvious beneficiary of the recent breakthroughs in AI.”

The innovation investor said the Elon Musk-led electric vehicle company is trading at six times revenue. She said she’s betting on its autonomous-driving ambitions as Tesla aims for a total addressable market of $8 trillion to $10 trillion in revenue in self-driving mobility by 2030.

Wood previously said biotech firm Exact Sciences, ARKK’s seventh-biggest holding, is also a leader in AI in terms of its data on cancer and its molecular diagnostic-testing franchise.

In its base case, Ark believes Exact Sciences could compound at an average annual rate of 25%, reaching $140 by 2027. The stock traded around $83 a share on Tuesday.

https://www.cnbc.com/2023/06/04/spider-man-across-the-spider-verse-domestic-box-office-opening-.html

Spider-Man: Across the Spider-Verse’ opens to $120.5 million, second-highest debut of 2023

PUBLISHED SUN, JUN 4 202311:46 AM EDT

KEY POINTS

- Sony’s “Spider-Man: Across the Spider-Verse” opened to $120.5 million at the domestic box office this weekend.

- It was the second-biggest opening of 2023, just behind Universal’s “Super Mario Bros. Movie.”

- The film also marks the third-best opening weekend for any Spider-Man film, animated or live-action.

Still from Sony’s “Spider-Man: Across the Spider-Verse.”

Sony

Spider-Man returned to the big screen this weekend, webbing up an estimated $120.5 million at the domestic box office.

Sony’s “Spider-Man: Across the Spider-Verse,” the much anticipated sequel to the Academy Award-winning “Spider-Man: Into the Spider-Verse,” had the second-biggest opening of 2023, just behind Universal’s “Super Mario Bros. Movie.”

The film also marks the third-best opening weekend for any Spider-Man film, animated or live-action.

“As a PG animated film, ‘Across The Spider-Verse’ is able to capture a younger audience beyond the core fans of the live action PG-13 films and thus ensures the long-term cross-generational appeal of the character and the movies,” said Paul Dergarabedian, senior media analyst at Comscore. “This is money in the bank for the studio and movie theaters.”

“Across the Spider-Verse” is estimated to have pulled in more than 9 million moviegoers over the weekend, according to data from EntTelligence. Tickets for the film represent around 56% of all foot traffic to theaters from Thursday through Sunday, the data firm reported.

Additionally, 29% of patrons saw the film in a premium format, paying an average of $4.52 more per ticket.

“This debut is further proof that audiences are eager for fresh, edgy takes on both superhero and animated movies,” said Shawn Robbins, chief analyst at BoxOffice.com.

Sony’s animated Spider-Man sequel arrives on the heels of several strong box office openings, including Disney and Marvel’s “Guardians of the Galaxy: Vol. 3” and Disney’s “The Little Mermaid.”

With another $10.2 million in ticket sales during its fifth weekend in theaters, “Guardians of the Galaxy: Vol 3” has generated around $322.7 million domestically. The film has tallied $780.1 million globally.

“The Little Mermaid” saw a 58% drop in ticket sales from its first weekend to its second, on par with industry averages, adding $40.6 million to its cumulative global take. The film has secured $186.2 million in domestic ticket sales and stands at $326.7 million globally.

Additionally, Disney’s “The Boogey Man” opened to $12 million in domestic ticket sales and Universal’s “Fast X” added $9.24 million in ticket sales over the weekend, bringing its domestic haul to $128.4 million.

At present, the year-to-date domestic box office tally stands at around $3.6 billion, just 21.9% behind prepandemic levels, according to data from Comscore. The 2023 box office so far this year is 27.9% above the same period in 2022.

“Between Spidey’s big start, ‘Little Mermaid’s’ strong hold, ‘Boogeyman’s’ horror offering, the holdover prowess of ‘Guardians’ and ‘Fast X,’ and plenty more to come, theater owners, studios, and audiences are now heading full throttle into the most exciting summer market in four years,” Robbins said.

Disclosure: Comcast is the parent company of NBCUniversal and CNBC. NBCUniversal distributed “The Super Mario Bros. Movie” and “Fast X.”

HI Financial Services Mid-Week 06-24-2014