HI Market View Commentary 05-22-2023

Next Monday our webinar will be on Tuesday because it is Memorial day and the markets are closed

OK let’s talk about a couple of conversations I’ve had over the weekend!

Banks VP of Zions Bank

The Main question “How are banks really?”

30% of lending ability was shot/cancelled when we didn’t roll bonds, and another interest rate hike will cut lending opportunities by another 20%

June 14th , 2023 is the next rate hike will put most banks without capital to lend out

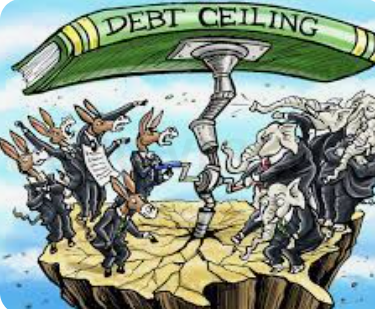

Debt Ceil:

May 17, 2023

Federal Debt Ceiling

Congress is currently debating if the U.S. government debt ceiling will be increased to prevent any defaults. If no agreement is met, the U.S. Treasury will be forced to default on its debt by June 1, 2023.

As per the Debt Ceiling/SIFMA Playbook meeting held on May 3, 2023, the default could follow three possible scenarios:

- Delay in principal payments for maturing bonds. Maturity dates are pushed forward.

- Delay of coupon payments due.

- The maturity date is not extended and no principal payment is made. This is the least likely scenario.

The delay of principal payments for maturing bonds and the delay of coupon payments can both occur in tandem or separately. As the maturity date is not extended and no principal payment is made, this will make the notes non-transferable.

Market volatility is anticipated to increase as the deadline approaches which could very likely be met with a reduction of liquidity.

Out of an abundance of caution, we encourage you to begin communicating with your clients about these potential market events and ensure close monitoring of your customer portfolios.

Lastly, you should consider the likelihood of greater volatility at option expiration which could have an impact on In and Out of the Money option assignments.

Please contact us at 1-800-591-8243 or email us at repsupport@moneyblock.com should you have any questions regarding this matter.

S&P 500 Averages vs real return

Opportunity vs S&P 500

https://www.briefing.com/the-big-picture

The Big Picture

Last Updated: 19-May-23 15:20 ET | Archive

Be careful what you pay (for earnings) out there

The first quarter earnings reporting period is in the home stretch. According to FactSet, 95% of the S&P 500 have reported their results — results that have been better than expected. In fact, 78% of the companies reporting have exceeded earnings estimates versus a 10-year average of 73%.

That upbeat indication should come with an asterisk, however.

Analysts had been aggressive in cutting their earnings estimates ahead of the reporting period. On December 31, first quarter earnings were expected to decline 0.3%. By March 31, they were expected to decline 6.7%. As of today, the blended growth rate for first quarter earnings is -2.2%.

Yes, first quarter earnings have been better than reduced expectations. What they haven’t been is actually good.

Nada, Zero, Zilch

There has been no earnings growth. Nada, zero, zilch. There won’t be any growth in the second quarter either. According to FactSet, second quarter earnings are estimated to decline 6.7%.

No earnings growth for the first half of the year, yet the S&P 500 is up 9.2% year-to-date as of this writing thanks to the leadership of the mega-cap stocks. On an equal-weighted basis, the S&P 500 is up 1.2% year-to-date, which isn’t bad given the absence of earnings growth.

The market, though, is looking further ahead — and there, it likes what it sees. Third quarter earnings are projected to increase 0.7% while fourth quarter earnings are projected to increase 8.1%, according to FactSet.

This year in its entirety looks rather anemic. Earnings for calendar year 2023 are expected to be up 1.0% versus 2022, but, again, the market is looking further out and likes what it sees. Calendar year 2024 earnings are expected to increase 11.7% from calendar year 2023.

Those periods are bridged with an improved view of forward 12-month estimates, which have increased to $228.95 from $226.14 on March 31.

Earnings Glass Half Full

It is a remarkable earnings view of the world knowing that the Leading Economic Index just registered its thirteenth consecutive monthly decline and there has been hardly any impact on the U.S. labor market from ten consecutive rates hikes by the Fed totaling 500 basis points since March 2022.

In other words, the lag effect of those past rate hikes has been, well, lagging to this point, but decades of economic history suggest that won’t remain the case. Ironically, one component of the improved earnings outlook is that companies will manage to improve profit margins by cutting labor costs.

We see a battle brewing, then, over whether those cuts will be enough to bolster profit margins or whether the cuts themselves will be self-defeating by sapping consumer spending. The answer will lie in just how extensive any job cuts turn out to be.

With the uptick in forward twelve-month earnings estimates, though, and the ramp in calendar 2024 earnings growth estimates, analysts are clearly thinking that the glass on earnings prospects is half full at this point.

Regular readers know that we don’t see it that way, but regardless of how we see things, the market is still buying into the more optimistic view of the earnings outlook, albeit with some subtle reservations.

The outperformance of the mega-cap stocks is predicated in part on the belief that their businesses will hold up better in a softer economic environment and/or recession. The equal-weighted S&P 500, meanwhile, has been moving more gingerly this year, yet it is still up for the year despite a burgeoning slate of softening data like consumer sentiment, ISM Manufacturing, retail sales, and average weekly hours.

What It All Means

The earnings outlook is brightening, according to the consensus view of things. That is a hard view to swallow, but to be fair, the consensus earnings view for the S&P 500 is an aggregate of individual earnings estimates for S&P 500 components.

Some companies will be reporting actual growth, others will not. Some companies will deliver positive earnings surprises, others will not.

One has been rewarded so far this year for owning the market-cap weighted S&P 500, because the biggest stocks have delivered some of the biggest gains. It might surprise some to learn, though, that nearly half of the S&P 500 is down for the year.

2023 may indeed fit the bill of being a “stock picker’s market,” but stock picking has not been easy if you haven’t followed the herd into the mega-cap stocks. It may not get any easier, which isn’t to say it will only get better for the mega-cap stocks, if the economy and earnings go the way the Leading Economic Index suggests they will go.

Therefore, one needs to be careful about overpaying for projected earnings growth whether they are buying the S&P 500 market-cap weighted index, which trades at 18.3x forward twelve-month earnings, versus a 10-year average of 17.3x, or an individual stock.

In aggregate, the earnings growth outlook from here appears relatively attractive, according to estimates, yet the economic growth outlook appears less so. That point might get lost with the Atlanta Fed GDPNow model estimate calling for 2.9% real GDP growth in the second quarter, but the Leading Economic Index suggests it will be found again in the back half of the year.

—Patrick J. O’Hare, Briefing.com

Where will our markets end this week?

Lower

DJIA – Bearish

SPX –Bullish

COMP – Bullish

Where Will the SPX end May 2023?

05-23-2023 -2.0%

05-08-2023 -2.0%

05-01-2023 +2.0%

Earnings:

Mon:

Tues: HPE, HPQ, SPWH

Wed: CHWY, GME, JWN, PVH, CRM

Thur: DG, M

Fri: AVGO, DELL, FIVE

Econ Reports:

Mon:

Tue New Home Sales,

Wed: MBA, FOMC Minutes

Thur: Initial Claims, Continuing Claims, GDP, GDP Deflator, Pending Home Sales,

Fri: Personal Income, Personal Spending, PCE Prices, Core Prices, Durable Goods, Durable ex-trans, Michigan Sentiment

How am I looking to trade?

www.myhurleyinvestment.com = Blogsite

info@hurleyinvestments.com = Email

Questions???

The ‘end of the runway’ is nearing for lofty tech and soggy banks. Get ready, says this strategist

Last Updated: May 15, 2023 at 10:44 a.m. ETFirst Published: May 15, 2023 at 6:45 a.m. ET

By

Barbara Kollmeyer

It’s time to make a move, you’re running out of runway, Mr Market.

A new week is pointing to a perky start for Wall Street, with stock futures in the green. But one might wonder “What gives?” as old worries — banking sector concerns and a debt-ceiling standoff — lurk, and some market observers assure the S&P 500 SPX is going nowhere until those are resolved.

But that index may be nearing the breaking point sooner than any Washington solution can get there, judging by the technical setup, says our call of the day from BTIG’s chief market technician, Jonathan Krinsky.

“We think we are reaching the end of the runway, where either banks need to begin to rally, or tech needs to fall. We continue to think it’s the latter and saw the start of that move on Friday,” Krinsky told clients in a note. The Nasdaq Composite COMP didn’t go careening south, but did see its first drop in three sessions, losing 0.3%.

And Krinsky added that the largest six-weighted names in the Nasdaq are pushing into major resistance levels. That is Microsoft MSFT, Apple AAPL, Amazon AMZN, Nvidia NVDA, Alphabet GOOGL and Meta META.

If tech names start to give way, that won’t be good for the S&P 500 given the weighting of the sector in that index, he said, adding that a bank rally would be better news, though it seems less likely.

Using exchange-traded funds as proxies, Krinsky notes that tech is up 21% year to date, via the Technology Select Sector ETF XLK, while regional banks, via the SPDR S&P Regional Banking ETF KRE, are down 40%.

There is another headwind for the S&P 500 this week that he and others are watching — May options expiries, with those for the VIX VIX set for Wednesday and S&P 500 options for Friday. In each of the last six years, and 11 of the last 14, Krinsky noted that the S&P has been negative during this week, with an average loss of 1.3%.

Michael Kramer, founder of Mott Capital Management, also weighs in here, blaming some of the market churn on the run-up to those expirations.

“Generally, these option expirations have kept the market rangebound; currently, support for the S&P 500 is at 4,100 and resistance around the 4,150 level. This week’s focus will be on the bulls’ attempt to surpass the 4,150 mark for the S&P 500, while the bears are eager to bring it below 4,100,” he said.

Mott notes the stock market has consistently seen activity surges between 1:30 and 2 p.m. daily, and since jobs data earlier this month, a “notable” rise in demand has led to afternoon rallies for the S&P 500. He thinks this all looks mechanical, “indicating a buy-at-any-cost mentality,” and that options-related flows and hedging activity are probably an influence here.

Once those options expirations are through this week, many of the related effects for the market will probably vanish, he expects, though volatility may rise ahead of an appearance by Fed Chair Jerome Powell on Friday.

“Additionally, we know that the options market has placed the call wall at 4,200 for some time, and that is the options market’s way of saying it isn’t bullish on the market above 4,200 either,” added Kramer.

Ford Capital Markets Day With David Alton Clark – Bullishness Intact

May 22, 2023 3:40 PM ETFord Motor Company (F)BYDDF, BYDDY, F.PB, FPD, GM, TSLA2 Comments2 Wall Street Breakfast

5.75M Followers

We’re discussing Ford’s (NYSE:F) Capital Markets Day with David Alton Clark, who runs the Winter Warrior Investor on Seeking Alpha.

Listen to Wall Street Breakfast on the go on Apple Podcasts and Spotify

- 0:13 – Ford’s Capital Markets Day – bullishness intact

- 4:00 – Glad Ford didn’t raise guidance in last earnings call

- 5:20 – Jim Farley as CEO – Why David loves him

- 7:10 – Ford competitors: Tesla (TSLA), (GM) and BYD (OTCPK:BYDDF)

- 9:30 – What would turn David bearish on Ford?

Transcript

Rena Sherbill: David Alton Clark, who runs the Winter Warrior Investor Investing Group on Seeking Alpha and has been writing for us for a very long time, welcome to Wall Street Breakfast’s new afternoon edition. Great to have you.

David Alton Clark: Hey, thanks a lot, Rena. Glad to be here.

RS: Well, we’re talking Ford (F), which is a stock that you’ve written about, today they had their Capital Markets Day, and we were just talking about some of the takeaways that we’ve had from our initial, kind of listen and watch of the event. The stock has seen some volatility in the recent hours.

The thing that analysts were most pointing to and something you iterated in your article in the middle of April was around their EV ambitions, around their electric vehicle numbers, whether or not they were going to be able to hit 2 million units in North America by the end of 2026. So, talk to investors maybe about your general takeaway and whether or not that bullishness is still permeating through your thesis? What did they say about the EV numbers?

DAC: Thanks, Rena. Yes, the bullishness is still resonating with me. They did a really great job of laying out the roadmap ahead. They’re planning on lowering costs across the board. They’re reorganizing the entire distribution plan. They’ve got three new contracts with nickel and lithium suppliers for the batteries that they just signed this morning, so they’re vertically integrating. And they’ve got two plants that they’re standing up in Tennessee and Kentucky, that they’re expecting to get 30% cost savings on those because they’re implementing new software packages and the development teams. It’s one-of-a-kind, the first time they’ve ever had the teams, the engineers, and the facility teams working together to develop the facilities.

RS: And what do you have to say about the EV numbers in particular?

DAC: The EV numbers sound, like, they’re going to be able to make that number, especially with building in the Ford Pro transit unit, which is a bulk of their EV vehicles are actually in the Ford Pro segment that are for companies like delivery vehicles and those types of things. So, those should be able to come through.

As far as the plants that they’re standing up and the raw materials and the thing that they’ve really focused on is reducing the battery size by increasing the efficiency of the vehicles. And so, as far as what they laid out today, it sounds like, they’re going to be able to hit those numbers.

RS: Why do you think that it’s not the bullishness that you feel isn’t more reflected in the immediate reactions in the market?

DAC: Well, a big issue with anytime you’re in a situation like this, they’ve got huge plans. There’s a lot of moving parts. There’s a lot that could go wrong. Back in the day when I was an auditor with EY, I actually audited Ford, and I was on the cost reduction and avoidance team, and that was one of my specialties back in the day. And one of the things that’s really tough when you’re doing something like this is, they’re changing everything all at once. It’s all happening at one time.

They’ve got new deals for raw materials. They’ve got new plans for how they’re going to manufacture the vehicles. And so, there’s a lot that – of uncertainty there in regards to cost savings and margins. So, it’s a lot harder to forecast in this type of an environment when you’re in the middle of a big change. So, I can see why there’s a lot of people that think that they may not be able to come through.

RS: Which speaks a little bit to the disappointment that was felt in the marketplace after they didn’t raise guidance in their recent earnings call, what was your feeling about that?

DAC: I’m kind of glad that they didn’t raise guidance. Farley has – CEO Farley, he has had a little bit of an issue of being overly bullish in the past. And I think that that has come back to bite him, especially when he had to come back a couple quarters ago and say that they left $2 billion on the table. I think that made a big impression on him. So, rather than overpromising and underdelivering, I think now they’re in the bucket where they’re under promising and hoping to overdeliver.

On the second part of that is, there’s probably a good reason for that. A lot of what I said just a minute ago in the times of, when you’re making these huge changes across the Board and every segment, it’s harder to forecast. And then the other part that I think, it makes a good reason why they shouldn’t do that is, even though they did have a good quarter, this quarter, it’s kind of like when you’re cleaning out your house. You get a lot of – when you take up the trash, well, that’s a big chunk that happens right up front. But then after you’re done doing that, you’re sweeping up the corners, the dust out of the corners and stuff, there may not be that, as much profits and revenues to gather up in the coming months.

RS: That’s an evocative metaphor, I like it. I haven’t heard that before. What are your thoughts about Jim Farley as CEO? Some people call him a visionary, some people, like you said, have some complaints, where do you fall?

DAC: I love him. He’s Ford through and through. He did a great job today. He kicked off the meeting in the morning, and then they had the three different segment leaders, and then they had the CFO. And then they all got up there together. And Farley, he does a good job of delegating. He let all those people talk and then he would jump in and kind of give his little extra spice onto whatever they had said. I really think that he’s great, a great leader for Ford.

One of the things he said that I thought really resonated with me is, this certain time is his vision. His vision for the future that this is just the beginning. They’ve got second generation vehicles planned; third generation, they’re already looking at. They’re planning out for the next 100 years, and he feels like this is the exact same time frame for Ford as it was back when they rolled out the Model T in the 1920s. It’s all happening all over again with the electrification, all the new software, where everyone’s fully connected, they’re going to have – it’s just a whole new Ford and a whole new way to produce vehicles, and get them to the customers.

RS: There’s certainly a lot of change happening in pretty much every sector you look at, there seems to be a lifetime of disruption about to hit us all. And as we look out at the auto sector or whatever sector you call it, I’m not sure what sector it’s called at this point considering there’s so much tech involved in so many other parts. But looking at the makers of these electric vehicles, and let’s say for lack of a better term, the auto sector, what are the competitors or who are the competitors that you think are playing at the same level as Ford? Or do you see competitors playing at the same level as Ford?

DAC: I see, of course, Tesla, GM. GM is still probably their major equivalent competitor, but Tesla BYD is basically taking over in China. And Ford is, there – I just announced they’re kind of backing out of China. So, that could be part of the reason why they’re not upping the guidance, because they’re going to have to probably reduce some – discontinue some operations in China because that market is just going down to, like, to the lowest common denominator of the small compact EVs, which they’re not even planning on competing in that market.

So that’s and –Ford thinks, from what they said today is, like, they’re not competing with Tesla or BYD, they’re going to stick to what they’re great at, the truck segment. And then their next-gen vehicle is actually going to be a three-row crossover similar to what Ford Expedition would be, but they’re totally starting from a whiteboard. They’re totally revamping the vehicle. It won’t be just a Ford Expedition with an electric battery stuck in it. It’s going to be a completely new vehicle and that’s how they’re planning on saving on costs and saving on battery costs.

They’re trying to work on the efficiency of the new vehicles. So that their batteries will be small, a third smaller than these batteries that other EV vehicles are working on right now, because they’re developing these efficient vehicle bodies.

RS: So, we’re just giving listeners a taste of your thoughts and analysis on Ford. For those wanting deeper dives, check out Winter Warrior Investor, that’s David Alton Clark’s Investing Group. I promise you, you won’t be sorry if you check it out.

As we get into the kind of final stretch of this conversation and I’m excited to have you back for many more in our podcasting family. But as we get to the end of this conversation, what would you say might put, I mean, you discussed the bearish case on Ford just now you laid out, kind of the bearish thesis, what would make you change your opinion on them?

DAC: It would be a major change in their tone as far as their plans. They laid out pretty specific plans today. And so, I have written articles before where Farley is on Strike 2. Strike 3, he might be out of there. So, they have made some – that’s kind of why the stock is down at the bottom of the range, and that’s where I kind of like to buy in. But they need to come through on these plants that they’ve laid out, especially the ones for today. And so, if we’re two, three quarters into this and then they have to come up and say, hey, guess what, we were really wrong about this, and we’re changing our guidance. But, we’re planning that. We think we’re still going to make it or whatever. That would probably be, when I would make a change.

And the other thing, too, is that, I am bullish on Ford, but I always layer into position. So, I’ve only bought an initial position in Ford right now. So, I have dry powder that I’m waiting to add to the position. So, if something goes awry to where they don’t hit their targets like they’re talking about, I’m – I’ll either – I may sell out completely or I may just not add any more to the position and leave it at a small, I think it’s like 1% right now.

RS: Well, it’s great food for thought and nice realistic expectations to set into investors heads, always good to have realistic expectations. David, I appreciate you joining us today and look forward to the many other conversations we’re going to be having.

DAC: Thank you, Rena. I appreciate it. It was good to see you.

RS: Absolutely. Thank you.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Apple trades flat despite rare downgrade. Here’s what the pros have to say

PUBLISHED MON, MAY 22 20234:35 PM EDT

Market Movers rounded up the best reactions from investors and analysts as Apple shares traded flat despite a downgrade to hold from buy at Loop Capital.

The pros, including Jim Cramer, discussed the firm’s prediction that the megacap tech company will miss its revenue forecast this quarter due to a 10% cut in iPhone builds and shipments.

Apple beat revenue expectations last quarter but had said revenue this period will fall by about 3% from the prior year.

The stock finished the trading day half a percent lower.

Apple is currently held in Cramer’s Charitable Trust portfolio.

China Action Against Micron Called Political, Seen Crimping Sales

- 04:16 PM ET 05/22/2023

The Chinese government’s move to ban Micron Technology‘s (MU) memory chips from its network infrastructure could reduce the U.S. chipmaker’s revenue by a low- to high-single-digit percentage, the company said Monday. MU stock fell on the news.

Chief Financial Officer Mark Murphy disclosed the impact of China’s actions at the JPMorgan Technology, Media and Communications Conference in Boston.

On Sunday, the Cyberspace Administration of China said Micron’s products had failed its network security review, Reuters reported. The regulator then barred operators of key infrastructure from buying from Micron.

The revenue impact would be in the low single digits if China’s action is limited to networking companies, Needham analyst Rajvindra Gill said in a note to clients. Further, the impact would be high single digits if enterprise and data-center customers are included, Gill said.

MU Stock Drops After Report

“While this newest layer of geopolitical conflict adds near-term risk, we continue to believe the broader memory market is improving off the bottom,” Gill said. He rates MU stock as buy with a price target of 71.

On the stock market today, MU stock dropped 2.9% to close at 66.23.

Micron makes DRAM and Nand memory chips and competes with South Korea’s Samsung Electronics and SK Hynix as well as Japan’s Kioxia.

Latest Salvo In Tech Trade War

The actions by CAC are the latest salvo in a tech trade war between the U.S. and China. The Biden administration has imposed a series of export controls on chipmaking technology to China and moved to prevent Micron rival Yangtze Memory Technologies from buying certain U.S. equipment.

“We believe the move is all political and a way for China to retaliate against recent moves by the U.S. (adding Yangtze Memory to entity list; restricting Nvidia‘s (NVDA) H100 for AI purposes),” CFRA Research analyst Angelo Zino said in a note to clients. Zino rates MU stock as buy.

“We expect the overall (revenue) impact to be less than 5% as tech device sales persist for now,” Zino said.

Most of Micron’s revenue in China is from smartphone and personal computer makers, not makers of servers and other tech infrastructure.

‘Political Actions Pure And Simple’

“No one should understand this decision by CAC as anything but retaliation for the U.S.’s export controls on semiconductors,” Holden Triplett, founder of Trenchcoat Advisors and a former FBI counterintelligence official in Beijing, told Bloomberg.

“No foreign business operating in China should be deceived by this subterfuge. These are political actions pure and simple, and any business could be the next one to be made an example of,” Triplett said.

Micron ranks third out of 10 stocks in IBD’s Computer-Data Storage industry group, according to IBD Stock Checkup. Further, MU stock has a middling IBD Composite Rating of 63 out of 99.

IBD’s Composite Rating is a blend of key fundamental and technical metrics to help investors gauge a stock’s strengths. The best growth stocks have a Composite Rating of 90 or better.

Follow Patrick Seitz on Twitter at @IBD_PSeitz for more stories on consumer technology, software and semiconductor stocks.

Debt ceiling: Washington grapples with ‘hard choices’ if no deal is in place by June 1

- Washington Correspondent

Mon, May 22, 2023 at 10:48 AM MDT

Washington is publicly planning for what the world could look like on June 1 if no debt-ceiling deal is in place.

The immediate economic effects of the first-ever true default in American history are far from clear. They are being debated as negotiators remain divided across a range of issues.

Time is running low to strike a deal and then get it into law ahead of the key deadline just 10 days away. President Joe Biden and House Speaker Kevin McCarthy are meeting Monday at 5:30 pm ET for yet another round of talks.

Treasury Secretary Janet Yellen maintains that a deal needs to be reached and “it’s not an acceptable situation for us to be unable to pay our bills.”

Her first priorities if there is no deal by June 1 would include paying for interest on existing debt as well as making sure Social Security recipients and military employees get their checks on time, she said Sunday on NBC’s “Meet the Press.

“There will be hard choices to make about what bills go unpaid” if the talks fail or are too slow.

But there is a view in Washington among some Republican lawmakers that economic unrest could be limited initially. That was echoed Monday by Strategas Securities Managing Director Jeannette Lowe, who said Yellen’s approach could mean June 1 “actually wouldn’t be a real default.”

If June 1 arrives with no deal, the government would then “maybe withhold payments to government contractors and that’s where you could see a risk” especially for companies tied to sectors like defense and health care, Lowe said.

Stifel Chief Washington Policy Strategist Brian Gardner agrees with that view, while noting “the caveat that none of this has been tested.”

He said in a separate interview there’s a chance that an “X-date” on or around June 1 could arrive without a deal and “we may not get the bang that everyone is expecting” if politically and economically vital groups like bondholders, Social Security recipients and members of the military see no immediate interruption.

All bets would be off, of course, with a protracted default. The White House has said that would lead to a sharp recession and the stock market plummeting 45%.

GOP skepticism of the June 1 deadline

The debate over short-term effects comes after negotiations in Washington ground to a halt for large stretches over the weekend with both sides calling the other side unreasonable.

Negotiations were revived by a phone call Sunday between Biden and McCarthy,but the dynamic is being complicated by growing discontent from both the left and right flanks.

Biden tried to strike an upbeat tone late Sunday night, telling reporters as he returned from Asia that he monitored the latest round of negotiations and “it went well.”

The idea that June 1 may not be as hard a deadline as many fear is also being echoed by some Republicans, including one crucial moderate.

“There’s something called a nontechnical default,” said Rep. Brian Fitzpatrick (R-PA) on CBS’s ‘Face the Nation’ suggesting an initial breach could lead to less dire economic scenarios if US Treasury bondholders are still being paid on time.

“The math tells us there is a little bit of wiggle room” to give the negotiators more time to operate, he added, quickly note that a downgrade of the US credit rating and market volatility remain ever-present risks.

His clear preference is a deal as soon as possible to take default off the table.

‘Some bills have to go unpaid’

Analysts at the Bipartisan Policy Center recently compiled a list of key government payments that could be at risk in early June, including $47 billion in Medicare payments due June 1 followed by $25 billion in Social Security checks scheduled for June 2.

Those payments are just a few of the billions upon billions that flow out of the Treasury each day to pay for things like veterans’ benefits, federal salaries, tax refunds, Medicaid, government contractors and more.

Shai Akabas, the group’s director of economic policy, warned in a recent briefing with reporters that no matter what policymakers predict, things could get very unpredictable quickly if the X-date is breached.

“The steps that we could see in the aftermath of crossing the X date or some other extraordinary circumstances taking place I think will quickly be taken out of the hands of policymakers and put into the hands of market participants, investors, businesses, individuals in the economy,” he said.

Gardner also laid out in Monday’s conversation myriad ways that a reaching an X-date could go sideways quickly. There are the questions of whether Treasury’s systems would hold up and how investors would react in the face of an unprecedented default.

But if it comes to it, he says, “the level of political pressure will depend on who doesn’t get paid.”

Ben Werschkul is Washington correspondent for Yahoo Finance.