HI Market View Commentary 04-10-2023

What do we have this week?

Inflations numbers CPI=Wed, PPI= Thur

First week of Bank Earning = Start of earnings season with JPM reporting on Friday

The saying goes = Don’t fight the fed

Earnings dates:

AAPL – 5/04 AMC

BA – 4/26 BMO

BAC – 4/18 AMC

BIDU – 5/24

CVS – 5/03 BMO

DIS – 5/10 AMC

F – 5/02 AMC

GE – 4/25 BMO

GOOGL – 5/04

JPM – 4/14 BMO

KO – 4/24 BMO

LMT – 4/18 BMO

LUV – 4/27

SQ – 5/04 AMC

UAA – 5/10

V – 4/25 AMC

VZ – 4/24 AMC

https://www.briefing.com/the-big-picture

The Big Picture

Last Updated: 05-Apr-23 14:46 ET | Archive

A high valuation hurdle going into Q1 earnings reporting period

It seems only fitting that the first quarter earnings reporting period will start with a cascade of results from the banking industry — the same banking industry that will purportedly be a big contributor to a sharp slowdown in economic activity, if not a recession, as this year unfolds.

That has been the thinking anyway since the failure of Silicon Valley Bank and Signature Bank in March, which lit the regional bank stocks on fire and triggered a wave of concerns about possible bank runs.

The Federal Reserve has worked to pre-empt such runs. Regardless, the whole episode, which JPMorgan Chase CEO Jamie Dimon said is not over yet and will have repercussions for years to come, has fueled a belief that banks will tighten their lending standards, manage their balance sheets more conservatively, and experience net interest margin pressure as they are forced to raise interest rates on deposit accounts in an effort to keep those deposits from fleeing.

We said in our prior column that it is not a good thing for growth prospects when banks go into protection mode, because credit is the lifeblood of economic expansion. When there are blood clots in the flow of credit, the economy suffers.

In this instance, though, it will be suffering on top of delayed suffering. We say “delayed” because the economy has held up reasonably well despite the Fed’s aggressive rate hikes, yet the lag effect of those rate hikes — and rate hikes by other central banks around the world — should start bubbling to the surface in a more noticeable fashion as the year progresses.

That should ultimately translate into worsening earnings prospects.

Margin Pressures on Display

The prospects as they relate specifically to the first quarter are not good. According to FactSet, the estimated earnings decline for the S&P 500 was -6.6% as of March 31. The bottom-up EPS estimate of $50.75 decreased by 6.3% between December 31 and March 30 compared to an average decline of 2.8% for the past 20 quarters.

Revenue for the first quarter is expected to increase 1.9%, yet that outlook has also been revised lower. On December 31, the revenue growth outlook stood at 3.4%.

The fact that first quarter earnings are projected to decline when first quarter revenues are expected to increase speaks to the margin pressures companies are facing from higher costs, primarily for labor, as well as a slowdown in demand from prior quarters. Revenue growth of 1.9% would be the lowest growth since the third quarter of 2020, according to FactSet.

Ten of the 11 S&P 500 sectors have seen downward revisions to earnings estimates since the end of the fourth quarter. The materials, energy, health care, consumer discretionary, and industrials sectors have paced the revisions. The only sector that has escaped the downward revisions since December 31 has been the utilities sector.

An Egregious Premium Valuation

So, the aggregate earnings estimate for the S&P 500 has decreased 6.3% since December 31, but as of March 31 the S&P 500 was up 7.0% for the year. Go figure.

The basis for the market’s strong showing was the outperformance of the mega-cap stocks. To be fair, the Invesco S&P 500 Equal Weight ETF (RSP) was up 2.3% for the year as of March 31, so the multiple expansion (which is what happens when the price of the index goes up as earnings estimates come down) wasn’t just a “mega-cap thing.”

The latter point notwithstanding, it was rather egregious, given a backdrop that has included higher interest rates, stubbornly high inflation, an ongoing war in Ukraine, and a regional banking crisis, to see the market trading at a premium multiple of 18.2x forward twelve-month earnings on March 31 versus a 10-year historical average of 17.3x.

The historical average, by the way, is computed over a 10-year period when the 10-yr note yield averaged 2.17% and core-PCE inflation averaged 2.12%. Today, the 10-yr note yield sits at 3.29% and core-PCE inflation is up 4.6% year-over-year.

Granted rates have come in sharply following the banking crisis, but if one accepts that they have come in because that banking crisis will invite bad economic times that compel the Fed to start cutting interest rates, then one can’t ignore that those bad economic times will also translate into weaker earnings prospects.

Just how much weaker is the $64,000 question.

The current forward twelve-month earnings estimate is $226.54, according to FactSet. At today’s price, that leaves the S&P 500 trading at 18.0x forward twelve-month earnings.

However, if estimates are cut by 10%, the market at today’s prices is trading at 20.0x forward twelve-month earnings. When the Fed made its first rate hike on March 16, 2022, the S&P 500 was trading at 19.0x forward twelve-month earnings.

What It All Means

Clearly, there is a lot riding on the earnings guidance coming out of the first quarter earnings reporting period.

The S&P 500 sits near the upper end of a nine-month trading range, sporting a premium valuation that rests on a favorable outcome for the economy that the Treasury market suggests is unlikely.

Should the earnings guidance defy the Treasury market’s expectations, the stock market could have something to build on — until, of course, rising interest rates get in its way again.

What is standing in its way now is the semblance of a decelerating run by the economy into a high valuation hurdle. Disappointing earnings guidance would trip up the stock market’s rebound effort.

—Patrick J. O’Hare, Briefing.com

Where will our markets end this week?

Higher

DJIA – Bullish

SPX –Bullish

COMP – Bullish

Where Will the SPX end April 2023?

04-10-2023 -2.5%

04-03-2023 -2.5%

03-31-2023 -2.0%

Earnings:

Mon:

Tues: KMX,

Wed: BBBY, SPWH

Thur: DAL, FAST

Fri: C, JPM, UNH, WFC

Econ Reports:

Mon: Wholesale Inventory

Tue

Wed: MBA, Core CPI, CPI, Treasury Budget

Thur: Initial Claims, Continuing Claims, PPI, Core PPI

Fri: Retail Sales, Retail ex-auto, Import, Export, Capacity Utilization, Industrial Production, Business Inventories, Michigan Sentiment

How am I looking to trade?

www.myhurleyinvestment.com = Blogsite

info@hurleyinvestments.com = Email

Questions???

Inflation’s inventory gluts are here to stay and will hit the bottom line in weaker economy: CNBC Supply Chain Survey

PUBLISHED WED, APR 5 20231:34 PM EDTUPDATED THU, APR 6 20234:07 PM EDT

Lori Ann LaRocco@LORIANNLAROCCO

SHAREShare Article via FacebookShare Article via TwitterShare Article via LinkedInShare Article via Email

KEY POINTS

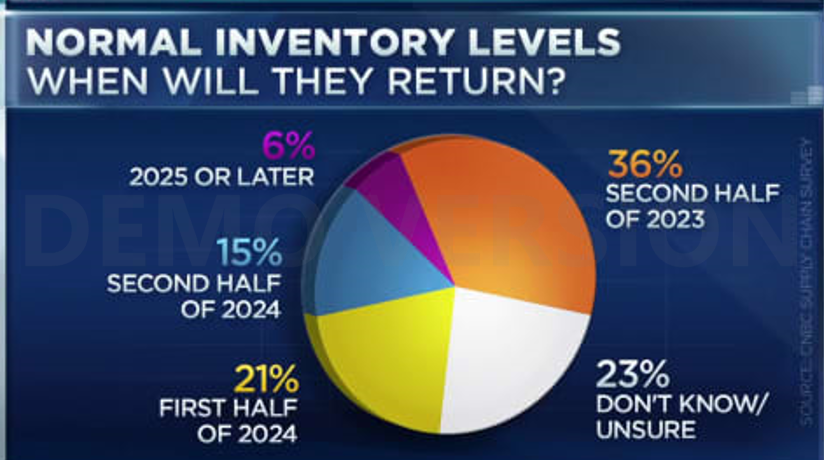

- Only about one-third of supply chain managers think warehouse inventories will return to normal before 2024, according to the new CNBC Supply Chain Survey.

- A little over one-quarter (27%) say companies are selling excess inventory on the secondary market because high storage prices are hitting the bottom line, with impacts to materialize in upcoming quarterly results.

- As expectations rise that Wall Street will revise earnings estimates lower in a weaker economy, almost half of those surveyed said the biggest inflationary pressures they are paying are warehouse costs, followed by rent and labor, and many are continuing to pass those costs on to consumers.

WATCH NOW

VIDEO01:25

CNBC supply chain survey: 36 percent think inventories will normalize in second half of 2023

Bloated warehouse inventories are an expensive pressure eating away at the bottom line of many companies, and for many, the excess supply and associated costs of storage won’t abate this year, according to a new CNBC Supply Chain Survey.

Just over one-third (36%) said they expect inventories to return to normal in the second half of this year, with an equal percentage expecting the gluts to last into 2024 — 21% saying a return to normal can occur in the first half of the year, and another 15% expecting normal activity by the first half of 2024. But uncertainty about inventory management is significant, with almost one-quarter (23%) of supply chain managers saying they are not sure when gluts will be worked off.

“We don’t expect significant decreases in inventory levels within our network in 2023,” said Paul Harris, vice president of operations for WarehouseQuote. “Several of our manufacturing clients are experiencing dead/bloated inventory challenges due to over-ordering in the container grid-lock from prior quarters. A majority have elected to keep the inventory on hand and are opposed to liquidating.

A total of 90 logistics managers representing the American Apparel and Footwear Association, ITS Logistics, WarehouseQuote, and the Council of Supply Chain Management Professionals, or CSCMP, participated in the survey between March 3-21 to provide information on their current inventories and the biggest inflationary pressures they are facing, and often passing on to the consumer.

What’s sitting in warehouses, and what companies are doing about it

Logistics experts tell CNBC that 20% of their excess inventory sitting in warehouses is not seasonable in product nature. Slightly more than half of survey participants said they would keep the items in warehouses. But a little over one-quarter (27%) said they are selling on the secondary market because inventories impact a company’s bottom line through elevated storage prices.

Harris told CNBC many clients with perishable goods are selling them on secondary markets to avoid destroying products. “However, if a secondary market is not an option, they are forced to destroy the product,” he said. “If it’s a consumable, they are donating the goods to take tax deductions.”

Investors are worried about the earnings and margin trends and expect Wall Street to revise estimates lower. The supply chain pressures will be among the factors that weigh on quarterly numbers.

“Inventory carrying costs continue to rise, driven by inflationary pressures and late shipments,” said Mark Baxa, CEO of CSCMP. “This means that with every day that passes, three things are happening … growing sales risk, margin pressure, and D&O [deteriorated and/or obsolete].”

Almost half surveyed said the biggest inflationary pressures they are paying are warehouse costs, followed by the “other” category, which includes rent and labor.

ITS Logistics told CNBC that many clients across industries have been using ocean containers, rail containers and 53-foot trailers for storage because distribution centers were full.

“These charges will start materializing in Q2 or Q3 financial results,” said Paul Brashier, vice president of drayage and intermodal at ITS Logistics.

The survey found 50% of respondents saying the average length of time they are using ocean containers for storage is over four months.

“We are seeing similar trends in our data and ecosystem,” Brashier said.

More inflation costs going to the consumer

Traditionally, warehousing costs and the associated labor costs are passed on to the consumer, increasing or sustaining the price of a product. Nearly half (44%) of survey respondents said they are passing on at least half of their increased costs, if not more, to consumers.

“It’s clear that supply chain challenges and all their associated costs continue to stir inflationary pressures,” said Stephen Lamar, president and CEO of the American Apparel and Footwear Association. “Given ongoing inventory concerns and the fragile nature of our logistics system, there are other pressures and uncertainty.”

His group is calling for West Coast port labor negotiations to be quickly finalized and for the government to “aggressively remove other cost pressures,” a reference to Section 301 tariffs on Chinese imports, which he said continue to make supply chains more expensive.

Manufacturing orders and the economic outlook

Recent data on manufacturing has shown a deterioration in the economy, with the ISM Manufacturing index in contraction level based on March data released this week. The U.S. services sector slipped closer to contraction in March, according to the ISM Services Index, with sharp declines in new orders, exports and price.

Looking at the health of manufacturing orders for the next three months, 40% of logistics managers surveyed said they are not cutting orders, while a little under one-fifth (18%) said they are cutting orders by 30%.

Inventory levels and consumer consumption are two factors influencing manufacturing orders.

These orders help gauge China GDP as it reopens from its strict Covid protocols, since the country relies on manufacturing and trade for its economic growth.

FreightWaves SONAR intelligence shows a slight uptick in ocean freight orders and recovery from the massive drop ahead of Lunar New Year, but the longer trend line remains a decrease in ocean bookings.

The inventory glut is affecting trucking logistics in multiple ways. Not only are trucks moving fewer containers from the ports, they are also moving less from the warehouses to the retail stores. Data from Motive, which tracks trucking visits to North American distribution facilities for the top five retailers by volume, shows a drop in truck visits from warehouses.

“The decline in visits to retail warehouses indicates weakness in consumer demand, but surprisingly may also be a sign of recovery in the supply chain,” said Shoaib Makani, founder and CEO of Motive. “With lead times to replenish inventory reduced from 2021 and 2022 highs, retailers are burning off existing inventories with the confidence that they will be able to replenish quickly.”

Even with orders increasing, the inventory headwinds are a source of concern for logistics experts.

“This survey confirms that we remain in an era of serious supply chain cost-to-serve challenges,” Baxa said. “Warehousing costs are contributing to these challenges that shippers are facing today and on the road ahead.”

FreightWaves and ITS Logistics are CNBC Supply Chain Heat Map data providers.

JPMorgan CEO Says Bank Crisis Not Over, America Shifting Into a ‘Vicious Cycle’

JPMorgan Chase CEO Jamie Dimon in Washington, on April 9, 2019. (Jeenah Moon/Reuters)

By Tom Ozimek

April 4, 2023Updated: April 5, 2023

JPMorgan CEO Jamie Dimon said in a letter to shareholders that the U.S. banking crisis is not over, and that even when it does end, its impact will linger for years, while warning that America seems to moving into a “vicious cycle.”

“As I write this letter, the current crisis is not yet over, and even when it is behind us, there will be repercussions from it for years to come,” Dimon wrote in the wide-ranging 43-page missive that included the ominous warning that storm clouds threaten the U.S. economy.

The collapse of Silicon Valley Bank (SVB) triggered a crisis of confidence in the U.S. banking sector, prompting financial authorities to rush through a rescue package to stem a potential run on bank deposits that threatened broader financial instability.

“Any crisis that damages Americans’ trust in their banks damages all banks—a fact that was known even before this crisis,” Dimon wrote.

In the two weeks since the failure of SVB, roughly $213 billion in deposits have been pulled from America’s domestically chartered commercial banks as skittish savers rushed to withdraw their money, according to the latest seasonally adjusted Federal Reserve figures on deposit outflows.

While some argue that’s a relative drop in the bucket compared to the roughly $16 trillion in total deposits held in U.S. domestic banks, experts have warned that the deposit flight is a factor contributing to tighter lending standards, with small businesses especially vulnerable to what some believe is a looming credit crunch.

“Regarding the current disruption in the U.S. banking system, most of the risks were hiding in plain sight,” Dimon wrote, including exposure to rising interest rates, which materialized when the Federal Reserve set out on an aggressive rate-hiking cycle in a bid to tame soaring inflation.

Dimon faulted regulators for not including interest-rate risk in stress testing, which exacerbated the risks.

When the crisis does eventually pass, it will lead to changes in the regulatory framework, Dimon argued, while cautioning against “knee-jerk, whack-a-mole, or politically motivated responses that often result in achieving the opposite of what people intended.”

Rather than rushing to over-regulate, Dimon urged U.S. financial authorities to “deeply think through and coordinate complex regulations” in order to achieve stated goals while getting rid of “costly inefficiencies and contradictory policies.”

“America has had, and continues to have, the best and most dynamic financial system in the world—from various types of investors to its banks, rule of law, investor protections, transparency, exchanges, and other features,” he wrote.

“We do not want to throw the baby out with the bath water.”

Recession Odds Rise

Dimon said that the banking sector turmoil from the collapse of SVB—along with the failure of Swiss lending giant Credit Suisse—have made a recession more likely.

“The failures of SVB and Credit Suisse have significantly changed the market’s expectations, bond prices have recovered dramatically, the stock market is down, and the market’s odds of a recession have increased,” he wrote. “And while this is nothing like 2008, it is not clear when this current crisis will end.”

While the crash in 2008 hit large banks, mortgage lenders, and insurers with global interconnections, “this current banking crisis involves far fewer financial players and fewer issues that need to be resolved,” Dimon wrote.

“It has provoked lots of jitters in the market and will clearly cause some tightening of financial conditions as banks and other lenders become more conservative,” Dimon continued, referring to the potential for a credit squeeze.

While he predicted that credit supply would face a squeeze, Dimon said it’s unclear whether the disruption would slow consumer spending.

Consumer spending, which drives over 65 percent of the U.S. economy, has so far held up fairly well. In February, consumer spending grew 0.2 percent month over month, though when adjusted for inflation, it actually dipped 0.1 percent. The slowdown in spending growth in February—the latest month of available data—followed a sharp increase of 1.8 percent in January, which was the highest pace of growth in the measure in two years.

“By sometime late this year or early next year, we expect consumers will have spent the bulk of their remaining excess savings,” Dimon wrote.

“It remains to be seen whether this will cause a little bit of a cliff effect or whether consumer spending will simply slow down. Either way, this will add to whatever recessionary pressures there are sometime in the future,” he predicted.

In the here and now, Dimon said he sees signs of strength in the U.S. economy, including solid consumer spending, recovering supply chains, a healthy jobs market, and higher wages.

Looking ahead, however, he sees trouble brewing.

“The current crisis has exposed some weaknesses in the system,” Dimon wrote, adding that America faces a range of “unique and complicated issues.”

‘Storm Clouds Ahead’

Besides the expected depletion of consumer excess savings, Dimon pointed to other factors clouding the economic outlook.

This includes possibly persistent inflation, huge geopolitical strains, the unpredictable trajectory of the Russia–Ukraine war, and large quantitative tightening and “other unknowns” that reduce liquidity and trigger higher long-term interest rates.

Dimon blamed “unprecedented” fiscal spending over the past few years for pushing inflation to multi-decade highs and forcing the Federal Reserve into a rapid interest-rate hiking cycle to try quash it.

“Fiscal stimulus is still surging through the system,” he said, insisting that it’s been inflationary and that multiplier effects of the stimulus mean that it still putting upward pressure on prices.

More deficit spending down the road—estimated at between $1.4 trillion and $1.8 trillion per year over the next three years—is another factor that makes inflation harder to root out.

Nearly 12 years of quantitative easing, whereby the Fed expanded its balance sheet by buying government securities, drove interest rates down to near zero and flooded the economy with cheap money, consequently boosting stocks, real estate, and other assets.

“Importantly, this also increased bank deposits from $13 trillion to $18 trillion (and the now-famous uninsured deposits from $6 trillion to $8 trillion),” Dimon wrote.

As the Fed grapples with high inflation, it has reversed more than a decade of quantitative easing and has been reducing its balance sheet in what’s known as quantitative tightening, a process “whose full effect may not be known immediately,” Dimon said.

So far, the Fed has reduced its holdings of securities by around $550 billion and has committed to slashing those holdings by nearly $100 billion per month.

While the Fed’s balance sheet has shrunk, deposits at banks have fallen by more than $1 trillion from their recent April 2022 peak.

“Unfortunately, some banks invested much of these excess deposits in ‘safe’ Treasurys, which, of course, went down in value as rates rose faster than most people expected,” Dimon said.

It’s precisely this dynamic that was widely blamed for the collapse of SVB, which failed when investors rushed to withdraw their uninsured deposits when they got wind of a $1.8 billion loss the bank took when it liquidated its portfolio of Treasury holdings that had fallen in value.

The current process of quantitative tightening, which the Fed has pledged to carry out at a pace of around $1 trillion per year, puts upward pressure on interest rates and makes debt-servicing costs higher.

“While the central banks of the world are now selling instead of buying securities, the governments of the world have larger debts to finance. The United States alone needs to sell $2 trillion in securities, which must be absorbed in the market,” Dimon wrote.

The Russian war in Ukraine is also having an impact on global energy and food prices, Dimon said, adding that he sees a risk that energy and food insecurity could trigger “another level of geopolitical dislocation” in the form of a huge wave of migration.

Dimon believes we are shifting from a savings glut to scarcity of capital, along with higher interest rates and higher inflation than in the recent past.

“Essentially, we may be moving, as I read somewhere, from a virtuous cycle to a vicious cycle.”

Apple CEO Tim Cook shares one of Steve Jobs’ best ‘innovation’ tricks: It’s ‘one of the things I loved about him’

Published Fri, Apr 7 20238:30 AM EDTUpdated Sun, Apr 9 20239:17 AM EDT

Patrick T. Fallon | AFP | Getty Images

Since Tim Cook became CEO of Apple, he’s worked to cement his own legacy — but he still admires his predecessor Steve Jobs’ leadership style.

“I knew I couldn’t be Steve [when I became CEO],” Cook, 62, told GQ on Monday. “I don’t think anybody could be Steve. I think he was a once-in-a-hundred-years kind of individual, an original by any stretch of the imagination. And so what I had to do was to be the best version of myself.”

But that doesn’t mean Cook couldn’t take a leadership trick or two from Jobs’ book. In particular, Cook said he admired how Jobs held everyone at Apple to the same standard of creativity and boundary pushing — no matter whether they worked in engineering, marketing or any other department.

“One of the things I loved about him was he didn’t expect innovation out of just one group in the company or creativity out of one group,” Cook said. “He expected it everywhere in the company.”

Cook experienced it firsthand. Before taking Apple’s reins as CEO in 2011, he was the company’s chief operating officer, overseeing the company’s worldwide sales and operations. And in that role, he was expected to be inventive.

“When we were running operations, we tried to be innovative in operations and creative in operations, just like we were creative elsewhere,” Cook said. “We fundamentally had to be in order to build the products that we were designing.”

The concept helped Cook win over naysayers after he became CEO, some of whom said he wasn’t enough of a “product guy” to fill Jobs’ shoes.

Under his leadership, Apple has grown into a multitrillion-dollar company. Cook oversaw the launch of Airpods, Apple Watch and the M1 processor, a next-generation chip now found in most of the company’s newer products.

Apple has also expanded its service-based offerings — most prominently including Apple TV+, its subscription media streaming platform.

Cook couldn’t have spearheaded any of those initiatives without learning from Jobs first, he said at Vox Media’s 2022 Code Conference in Los Angeles: “He was the best teacher I ever had, by far. Those teachings live on, not just in me, in a whole bunch of people who are [at Apple].”

Today, the Apple CEO still uses some of Jobs’ old traditions, like 9 a.m. meetings every Monday, he told GQ. But it’s not out of nostalgia, he added.

“We don’t really look back very much at all in history,” Cook said. “We’re always focused on the future and trying to feel like that we’re very much sort of at that starting line where you can really dream and have big ideas that are not constrained by the past in some kind of way.”

https://usnewzpress.com/post/10968/disney-family-sues-company-for-creative

China is facing a population crisis but some women continue to say ‘no’ to having babies

PUBLISHED SUN, APR 9 202310:04 PM EDTUPDATED MON, APR 10 20234:20 AM EDT

Charmaine Jacob@CHARMAINEMJACOB

SHAREShare Article via FacebookShare Article via TwitterShare Article via LinkedInShare Article via Email

KEY POINTS

- China is facing a population crisis in part due to more women choosing to focus on their careers and personal goals, instead of starting a family.

- The Chinese government abolished its one-child policy in 2016, and scrapped childbirth limits in 2021 — but married couples are still having fewer children.

- China’s National Bureau of Statistics reported that the population dipped to 1.412 billion last year from 1.413 billion in 2021.

China’s population dipped to 1.412 billion last year from 1.413 billion in 2021, according to its National Bureau of Statistics.

D3sign | Moment | Getty Images

China is facing a population crisis in part due to more women choosing to focus on their careers and personal goals, instead of starting a family.

Already grappling with an aging population and poised to be overtaken by India as the world’s most populous country, China continues to struggle to boost its birth rate.

The Chinese government abolished its one-child policy in 2016 and scrapped childbirth limits in 2021. However, married couples are having fewer children — or choosing to not have any at all, said Mu Zheng, assistant professor at the department of sociology and anthropology at the National University of Singapore.

“Covid continues to have many negative repercussions and has caused an overall sense of uncertainty towards the future,” Mu told CNBC. “There’s a sense of helplessness that is prohibiting many women from wanting to have children.”

WATCH NOW

VIDEO08:27

India’s population will overtake China’s – what does that mean for the world?

The rising cost of living is also steering more people away from wanting to expand their family, she added.

China’s National Bureau of Statistics reported that the population dipped to 1.412 billion last year from 1.413 billion in 2021. The natural growth rate was negative for the first time since 1960, according to Wind data.

Career and freedom remain a priority

China has a larger population of mothers in the workforce compared with countries in the West, Andy Xie, an independent economist, told CNBC.

“There is a desire to have a career in China and being a stay-home mother is never a goal. It doesn’t even appear on the radar for most women,” Xie said.

As more women attain higher qualifications and rise up the ranks in the workplace, they expect their husbands to earn more than them, according to Xie.

In 2020, female students accounted for almost 42% of doctorate degree enrollment, and a significantly higher number of women enrolled for a master’s degree than men, Statista data showed.

“Men face a tremendous burden as women would demand financial security from them,” and in turn wouldn’t want to get married either, according to Xie who said that “people used to be criticized for being single, but there’s no social stigma against it anymore.”

A mother and her baby play on a slide at Wukesong shopping district in Beijing on May 11, 2021.

Noel Celis | Afp | Getty Images

Awen, a 31-year-old freelance designer from Shenzhen who would only give her first name, says she’s happy being single right now. All the women who shared their personal experiences for this story were only comfortable sharing their first names.

“Saving money and focusing on my career are my priorities now, I already feel so exhausted after work, I can’t imagine how parents with children feel.”

She said most husbands in China often do not play a pivotal role in a child’s upbringing, and the burden falls entirely on mothers instead.

“Many women don’t want to get married because the housework and babysitting duties will fall on them,” Awen said. “So if women feel that they need to do housework, earn money, and do everything by themselves, why not just be alone?”

But that doesn’t mean her parents are convinced.

“My parents want our bloodline to stay alive, so that means have many children and grandchildren,” Awen said.

Helping women strike the balance

Trip.com is one Chinese company that takes pride in trying to encourage more women to have children.

In an organization where more than half of its 30,000 employees are women, the online travel agency came up with its own solution to encourage women in the company to have more children.

“We only give women seven to eight years to build a career, a family, and have children,” CEO Jane Sun told CNBC last month, adding that the timeline is “very tight.”

Many young employees are already 28-years-old when they get their PhDs, and pregnancies after 35 years of age come with higher risks, she pointed out.

Trip.com offers subsidies from $15,000 to $300,000 to help employees who are Chinese nationals offset the hefty cost of freezing eggs, she said.

WATCH NOW

VIDEO01:58

Trip.com Group’s CEO discusses what the company is doing to support women

When the initiative first started in 2018, more than 50 employees contacted the firm’s welfare team to find out if they were eligible, she added.

“We are amongst the first, or maybe the only Chinese company, that offers this option,” according to Sun. “You always have to offer the option up, and whether people take it or not is completely up to them.”

Pregnant employees are offered free taxi rides to and from work, and receive cash benefits when their child is born and starts school, she added.

Can anyone freeze their eggs?

But there’s a caveat. Women in China who want to freeze their eggs must be married, according to Chinese regulations.

However, some women in China want children but may not be ready to get married, said Mu the assistant professor from NUH.

“Women are now more economically independent … so marriage is not such an attractive option to many of them,” she said.

According to data from CEIC, 7.64 million couples got married in 2021, a decline from 8.14 million in 2020.

I am very happy with my child, but I sometimes regret becoming a mother.

Shannon

A SINGLE MOTHER

Additionally, women who divorce after having children face social stigma and struggle to balance their career while raising a child alone.

“I don’t think it’s shameful to be a single mother, but I kept it a secret from my colleagues as I don’t want them to look at me differently,” said Shannon, a 36-year-old mother from Shenzhen.

Shannon told CNBC her father said: “It’s better to have gotten divorced than never getting married at all.”

A maternity nurse performs a health check on a newborn baby.

Sopa Images | Lightrocket | Getty Images

Although she is happier after the divorce, being a single mother comes with difficulties she never expected, she told CNBC, highlighting that she struggles with not having enough time and freedom to do what she wants.

“I am very happy with my child, but I sometimes regret becoming a mother,” Shannon said. “I’ll never want to have another kid and I don’t want to get married again.”

China’s southwestern province of Sichuan announced at the start of the year that unmarried residents are able to reap the same benefits of married couples, a move it hopes will increase the country’s birth rate, Reuters reported.

Such actions could possibly help solve low fertility in China since it is “decoupling the connections between marriage and fertility,” Mu said.

Housing concerns

High property prices in China continue to hinder many couples who might want to settle down, said Xie the economist.

Owning property in China is a “really strong symbol,” and people would often want to buy a house before tying the knot.

However, “housing cost is a big concern for anyone who wants to get married,” Xie said.

“It needs to come down by at least 50% to make marriage more desirable,” according to the economist.

“There are no single silver bullets here,” he added. “Housing availability and price are contingent on marriage and the number of children” that couples have.

— CNBC’s Daisy Cherry and Ulrica Lin contributed to this report.

HI Financial Services Mid-Week 06-24-2014