HI Market View Commentary 07-15-2019

When are you adding protection for earnings?

I like to add protection 6-8 weeks past the earnings and add them two week before the actual earnings date

BECAUSE I don’t want to pay extra in volatility and have volatility crush happen to my long put options

Why do you add protection for earnings?

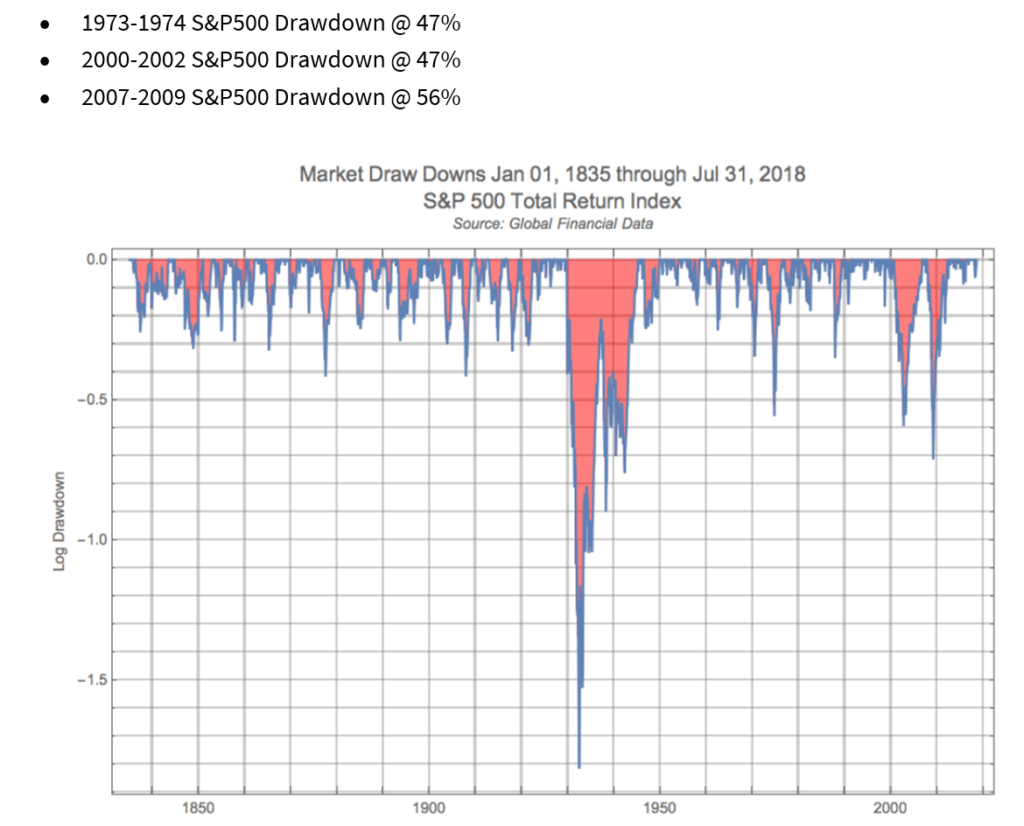

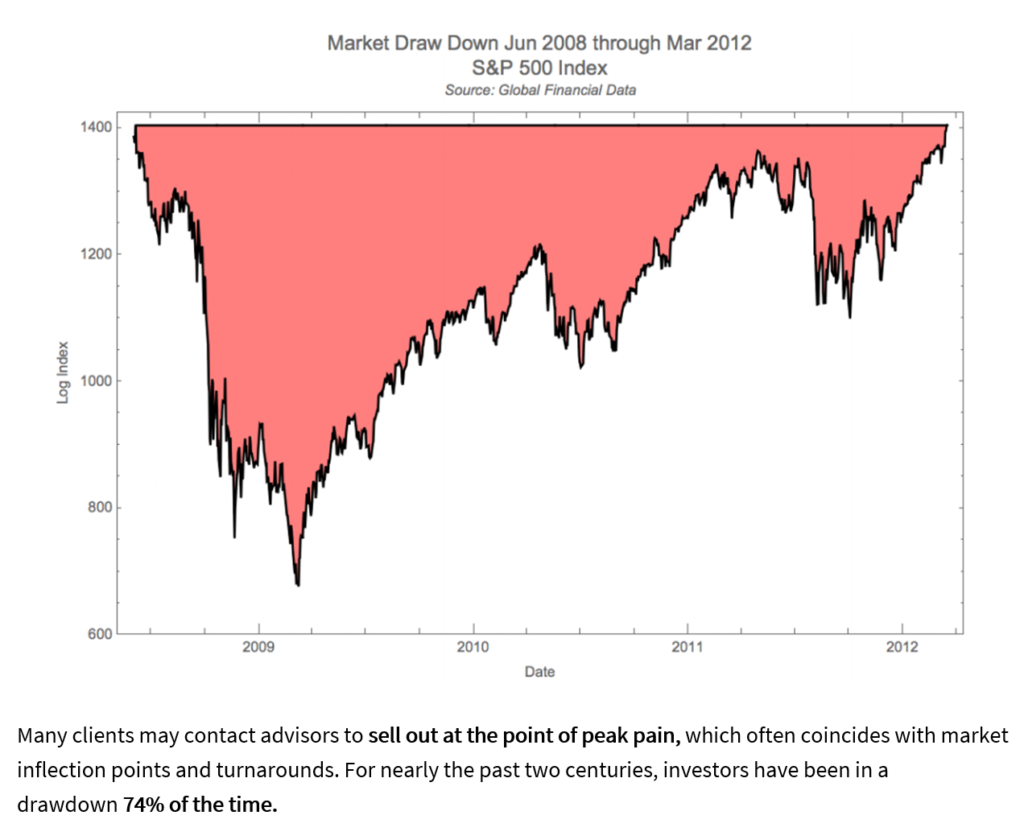

I had protection around earnings shares and the market is fully valued after numerous band aids were put on the last market crash

It is the time that most stocks gap and have significant movement.

I don’t ever want to see a 10% + drop in my stock ownership

I want to take advantage of dollar cost averaging with out having to add more money to the portfolio

How do you know to add protection for earnings?

Because I pay attention to the earnings season and where my stocks have been (price action)

Are you looking for a hard set of rules? She said YES and I told her there is NO HARD set of rules

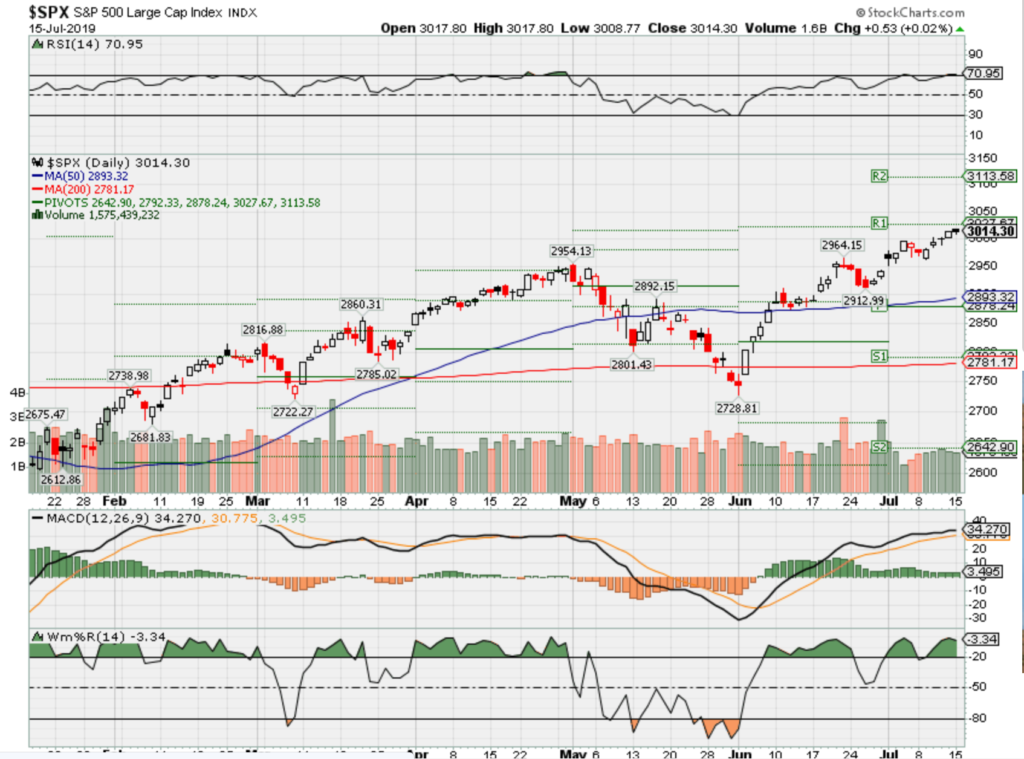

Where will our markets end this week?

Higher

DJIA – Bullish Market

SPX – Bullish

COMP – Bullish

Where Will the SPX end July 2019?

07-15-2019 +2.5%

07-08-2019 +2.5%

07-01-2019 +2.5%

Earnings:

Mon: C

Tues: SCHW, GS, JNJ, FHN, UAL, WFC, DPZ

Wed: ABT, KHC, USB, AA, EBAY, IBM, KMI, NFLX,

Thur: DOV, MS, NUE, PM, UNP, COF, MSFT, SWKS

Fri: ALV, BLK, SLB

Econ Reports:

Mon: Empire

Tues: Retail, Retail ex-trans, Import, Export, Capacity Utilization, Industrial Production, Business Inventories, Net Long Term TIC Flows, NAHB Housing Market Index

Wed: MBA, Building Permits, Housing Starts,

Thur: Initial, Continuing, Phil Fed, Leading Indicators

Fri: Michigan Sentiment, MONTHLY OPTIONS EXPIRATION

Int’l:

Mon – CN: Industrial Production, GDP, Retail Sales

Tues –

Wed –

Thursday –

Friday-

Sunday –

How am I looking to trade?

I’m preparing for earnings = Adding long puts

AAPL – 7/30 AMC Bull PUT currently on AAPL that I want take the short put off

AOBC – 8/29 est

BA – 7/24 BMO

BIDU – 7/30 est

BAC – 7/17 BMO

CVS – 8/07 BMO

CVX – 8/02 BMO

DIS – 8/06 AMC

F – 7/24 BMO

FB – 7/24 AMC

FCX – 7/24 BMO

MRO – 8/07 AMC

MU – 9/19 est

MRVL 9/05 est

SLB – 7/19 BMO

V – 7/23 AMC

ZION – 7/22 AMC

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

This is what everybody is getting wrong about the banks

PUBLISHED 5 HOURS AGO

Banks kick off the earnings season this week.

Industry heavyweights Citigroup, J.P. Morgan Chase and Bank of America open their books against a backdrop of a Federal Reserve possibly ready to slash rates as soon as this month.

That’s nothing investors should fear for the sector, according to one market watcher.

“There’s a lot of talk that this Fed dovishness could be bad for banks. That’s not what matters to banks. What matters to banks is the difference between the short end and the long end” of the yield curve, Gina Sanchez, CEO of Chantico Global, said Friday on CNBC’s “Trading Nation. ”

Bank profitability depends on their net interest margin, which measures the difference between how much they pay to borrow short-term loans and how much they charge in interest for long-term loans. A steeper yield curve, which compares short-term to long-term yields, allows banks to borrow more cheaply and lend at higher rates of interest.

The spread between the 10-year Treasury note and 2-year has widened after closing in on an inversion earlier this year.

“Banks make a lot of money in [a steep yield curve] environment, and so I actually think that that is not a well understood storyline and everybody who says that a dovish Fed is bad for banks has got the wrong end of the stick. It’s the spread, and that spread is remaining high, and I think that’s good for banks,” said Sanchez.

Financials have also broken out above a key level, which could signal more highs ahead, says Bill Baruch, president of Blue Line Futures.

“Coming out of that weekend when President Trump and President Xi met [in June], we saw asset prices roar higher and the XLF broke out above a trend line dating back to 2018. I’m looking at that trend line as now support,” said Baruch.

After lagging the S&P 500 for most of the year, the XLF financials ETF has broken out over the last month. The XLF, whose stocks include J.P. Morgan and Bank of America, has gained 4% in the past four weeks and kept pace with the broader market gains.

“You’ve got this strong technical momentum out above that trend line so … I’m bullish out above that trend line. Out above $27, $27.50, I like being long the XLF,” said Baruch.

The XLF ETF broke back above $27 in early June and has accelerated above $28 this month. The ETF is now at the highs of the year.

https://seekingalpha.com/article/4273857-baidus-ai-edge-chinese-internet-stocks-shine-comparison

Baidu’s AI Edge; Chinese Internet Stocks Shine In Comparison

Jul. 8, 2019 10:30 AM ET

Summary

Baidu’s chief Robin Li was in the limelight after he was doused with water while he was onstage.

While the local coverage of the event lamented the prank overshadowed the updates on Baidu’s latest artificial intelligence research, I beg to differ.

Baidu’s net cash as well as stakes in iQIYI and Ctrip.com represent more than half its market capitalization.

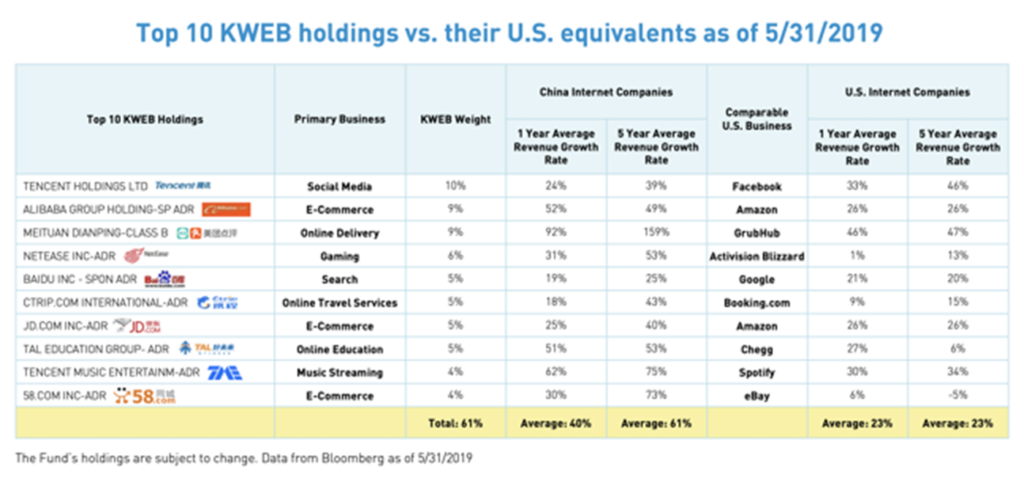

The 1 and 5-year revenue growth rates for the top 10 holdings of the KWEB ETF exceed that of their US counterparts. In terms of valuations, Chinese internet companies are also attractive when compared to their US peers.

Market players could be expecting the Chinese government to be spurred into action given weak June PMI numbers.

By ALT Perspective

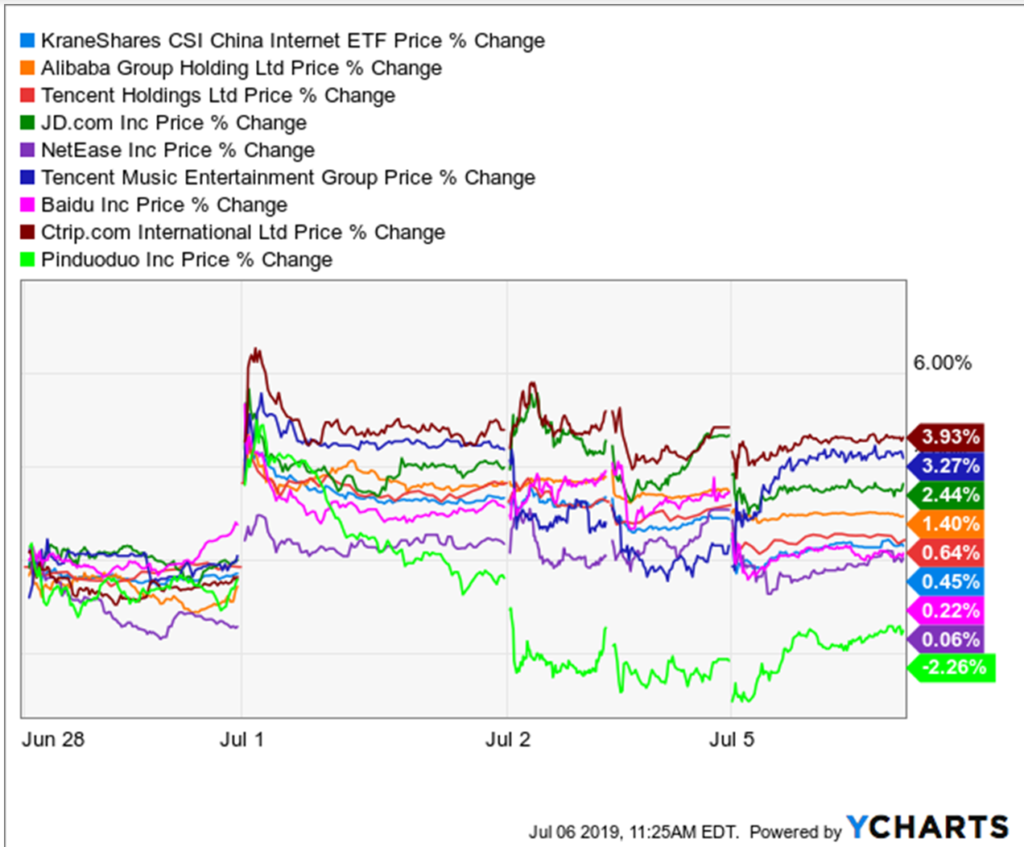

In the holiday-shortened trading week, shares of the prominent few Chinese internet stocks (FXI) (CQQQ) generally moved in a narrow range. In particular, the sector representative ETF, the KraneShares CSI China Internet ETF (KWEB) was up only 0.45 percent for the week. As explained in a past issue of the Chinese Internet Weekly, I found the ETF holding the most relevant stocks in the sector. Hence, allow me to provide an overview of the week’s share price movements of the top few holdings of KWEB as compared with the ETF itself for convenient references in the subsequent sections.

Data by YCharts

Market participants took their eyes off the screens or were reading all about how President Trump had leveraged Independence Day to pump up emotions and burnish his standing. It was easy to gloss over developments in the Chinese internet space but it was far from quiet. Baidu, Inc.’s (BIDU) co-founder and CEO Robin Li was in the limelight after he became the subject of a prank act. I assess the takeaways from the episode in this week’s Chinese Internet Weekly, in addition to providing updates on the Chinese search giant’s advances in autonomous driving. I will also discuss some of the recent comments in the previous issues calling investors to avoid Chinese companies altogether.

Baidu’s chief Robin Li praised for staying calm following a prank act

On July 3, a participant of the Baidu Create 2019 event in Beijing jumped onstage and emptied a bottle of water over Chinese internet tycoon Robin Li’s head. Even as there were “gasps from the audience,” Robin regained composure within moments of the stunt and continued with his presentation, saying “as you can see, there are many unexpected things in the development of AI too.”

Robin’s calmness and quick-witted response to the humiliating water-dousing earned himself plenty of admirers, with many taking to social media to gush over his “cool demeanor and immaculate appearance, even after being drenched.” While the local coverage of the event lamented the prank overshadowed the updates on Baidu’s latest artificial intelligence (‘AI’) research, I beg to differ.

The event included the introduction of three new smart speakers, as well as the launch of the country’s biggest robo-taxi fleet in Changsha, capital of Hunan province. Passengers would be able to hail a self-driving ride enabled by Baidu’s autonomous driving (‘AV’) and intelligent road infrastructure technologies.

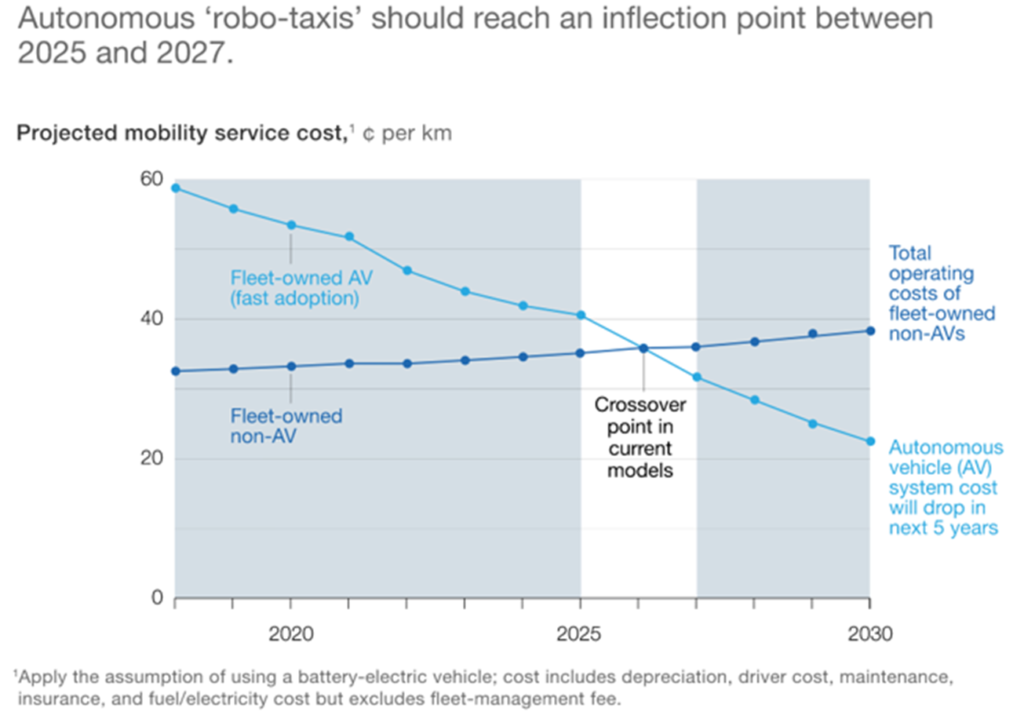

According to a McKinsey study, the cost of the total AV system (including sensors, computing platform, and software) is forecasted to fall rapidly after the technology matures beyond 2023. After an inflection point sometime in 2026, when self-driven transport will reach economic parity with human-driven transport, demand for autonomous vehicles should rise steadily. Exciting developments for a company dismissed as an also-ran after losing nearly 60 percent of its market valuation from its 52-week high, but I believe if not for the disruptive act, would not have garnered as much international attention.

Source: McKinsey

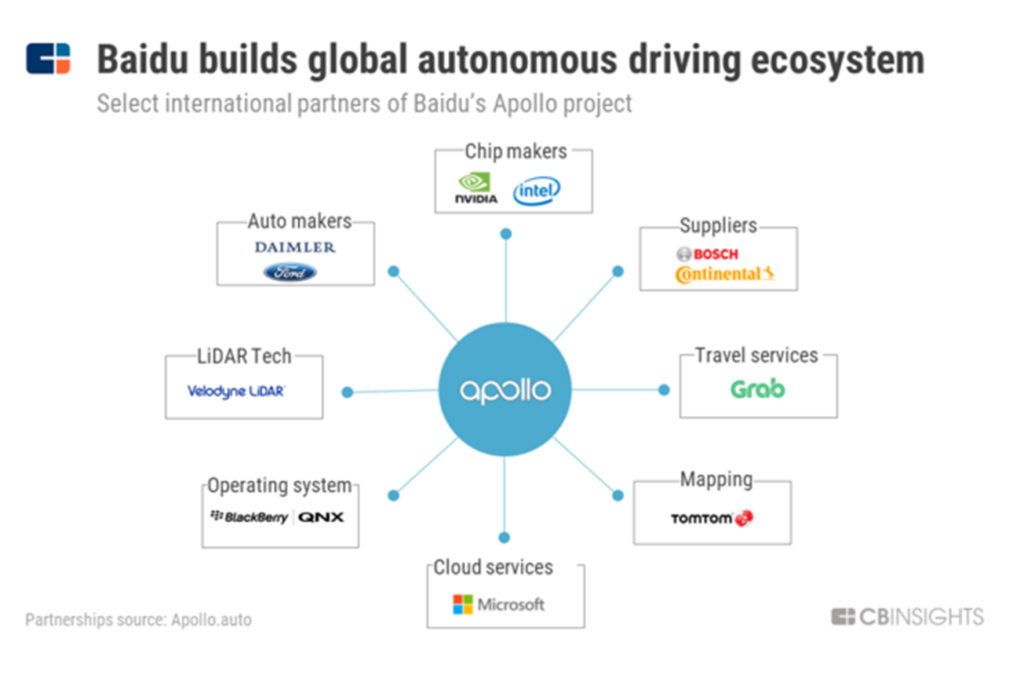

Recognition of Baidu’s strength in AV technologies can be seen from the formation of strategic partnerships with Geely Automobile Holdings Limited (OTCPK:GELYF)(OTCPK:GELYY) and Japan’s Toyota Motor Corp. (TM) (OTCPK:TOYOF). The two car brands which are among the leading manufacturers chose to cooperate with Baidu on areas related to AI and are getting on board Apollo, an open-source AV software platform operated by the latter. Geely’s new vehicles will come equipped with Baidu’s DuerOS for Apollo to a power connected car system.

Cognizant of its smaller size compared to fellow Chinese internet giants, Alibaba (BABA) and Tencent (OTCPK:TCEHY)(OTCPK:TCTZF), Baidu is not naive to go it alone in its AV journey. It has convinced over 130 partners from major OEMs, auto suppliers, to chip manufacturers to join its alliance, so that it can concentrate its resources towards its area of expertise — AI and software development.

Source: CBInsights

The collaboration has borne fruits. During the Baidu Create 2019 event, the company announced several Baidu Apollo milestones including:

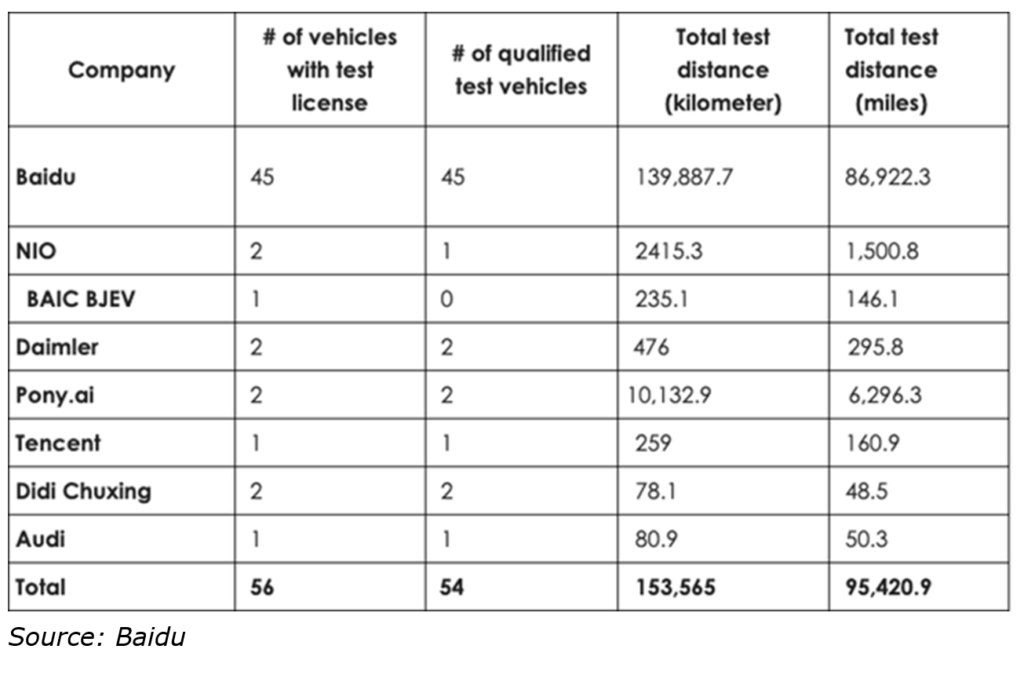

1) surpassing 2 million kilometers for L4 road testing, with Baidu accounting for 91% of the total road tests in Beijing, the leading city for autonomous driving in China, in 2018;

2) accumulating 438 patents in autonomous driving in one year – more than any other company in China;

3) being issued over 100 public road test licenses for autonomous driving, including newly-issued T4 license from the Beijing Municipal Commission of Transport, which represents China’s highest-level permit signifying that an autonomous vehicle possesses the ability to drive on complex urban roads, tunnels, school zones, and other complicated scenarios.

Total test distance driven on Beijing roads

Source: Baidu

Outside of China, Baidu has also proved its mettle on California roads. The distance driven by its autonomous vehicles was the furthest by a non-U.S. project in 2018. At 330.9km before each human intervention, Baidu was also ranked among the top 10 globally on that metric.

Source: Nikkei Asian Review

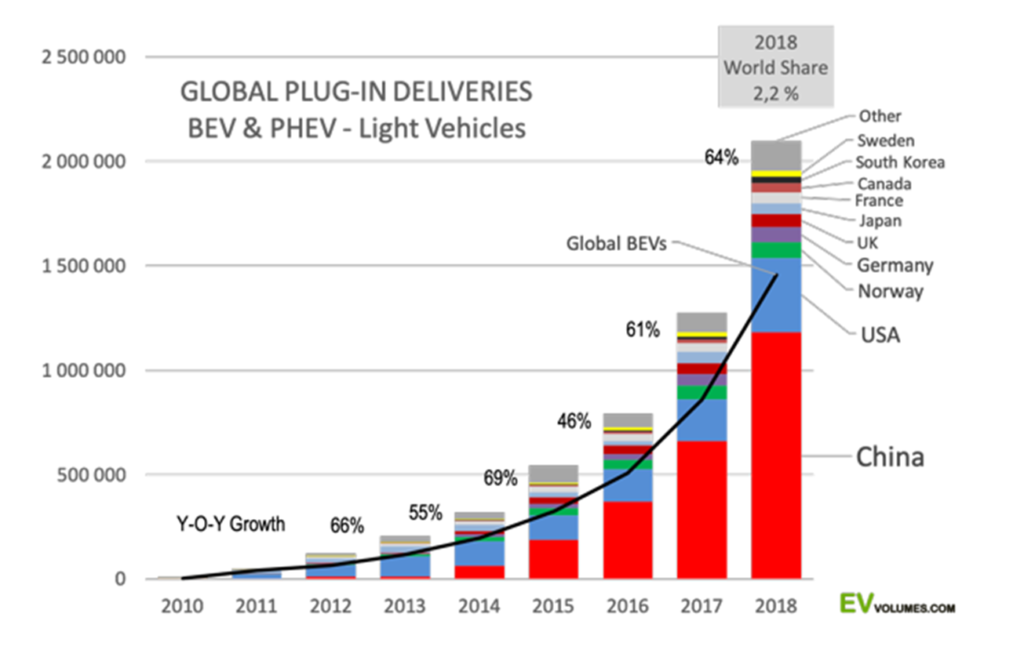

Baidu’s lead in AV is particularly beneficial given the receptivity of both the Chinese government and Chinese consumers towards new technologies. Take electric vehicles as an example. China quickly overtook other countries in the adoption and since 2017, the plug-in deliveries of BEVs and PHEVs in China have exceeded the sum of deliveries in the rest of the world.

Source: EV-volumes.com

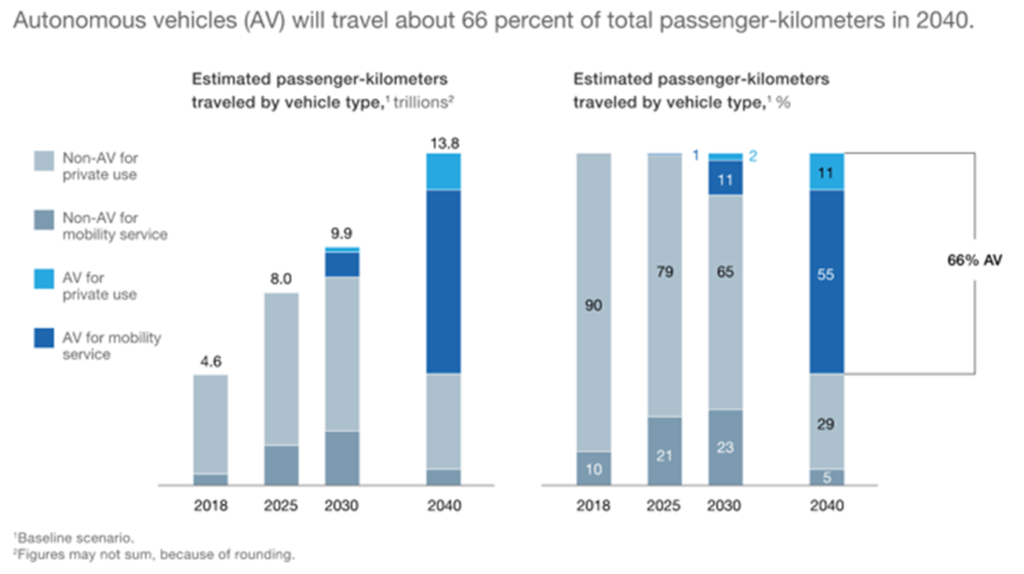

Specifically, the combined AV for both private usage and mobility service will account for two-thirds of the total passenger-kilometers in 2040 or a staggering 9.11 trillion passenger-kilometers.

Source: McKinsey

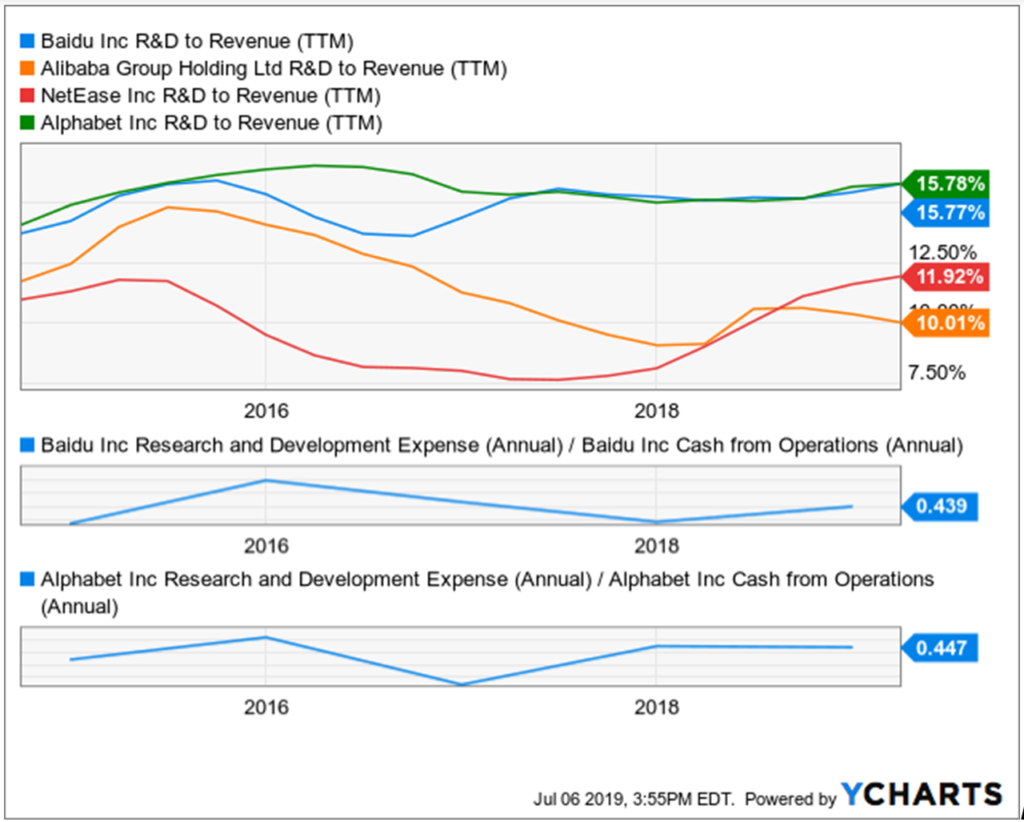

All these achievements have not come about at an over excessive cost to Baidu and its shareholders. Baidu’s R&D expenses to Revenue on a trailing-twelve-month basis is around 15.8 percent, very similar to its American peer in search, Alphabet Inc. (GOOG)(GOOGL). While its Chinese internet peers like Alibaba spent less on R&D relative to its revenue, that’s largely because of their disparate business models. For those who deem the operating cash flow is more relevant than revenue, you will be pleased to know that Baidu’s R&D expenses to cash from operations ratio is also very close to that of Alphabet.

Data by YCharts

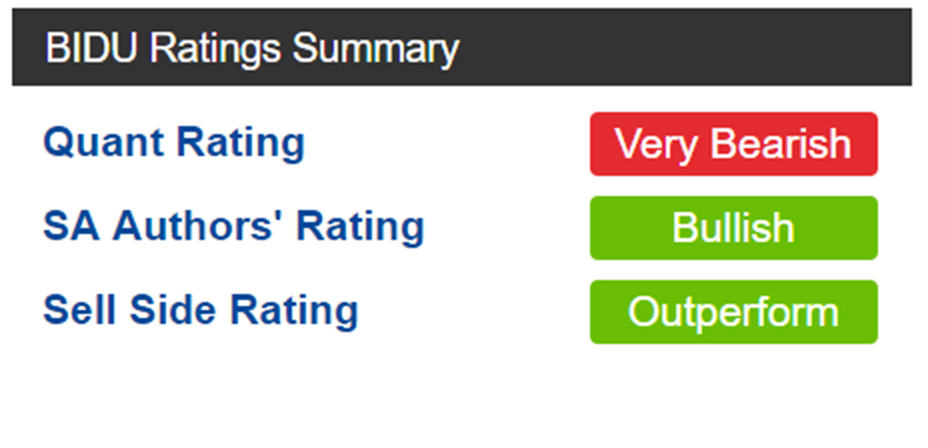

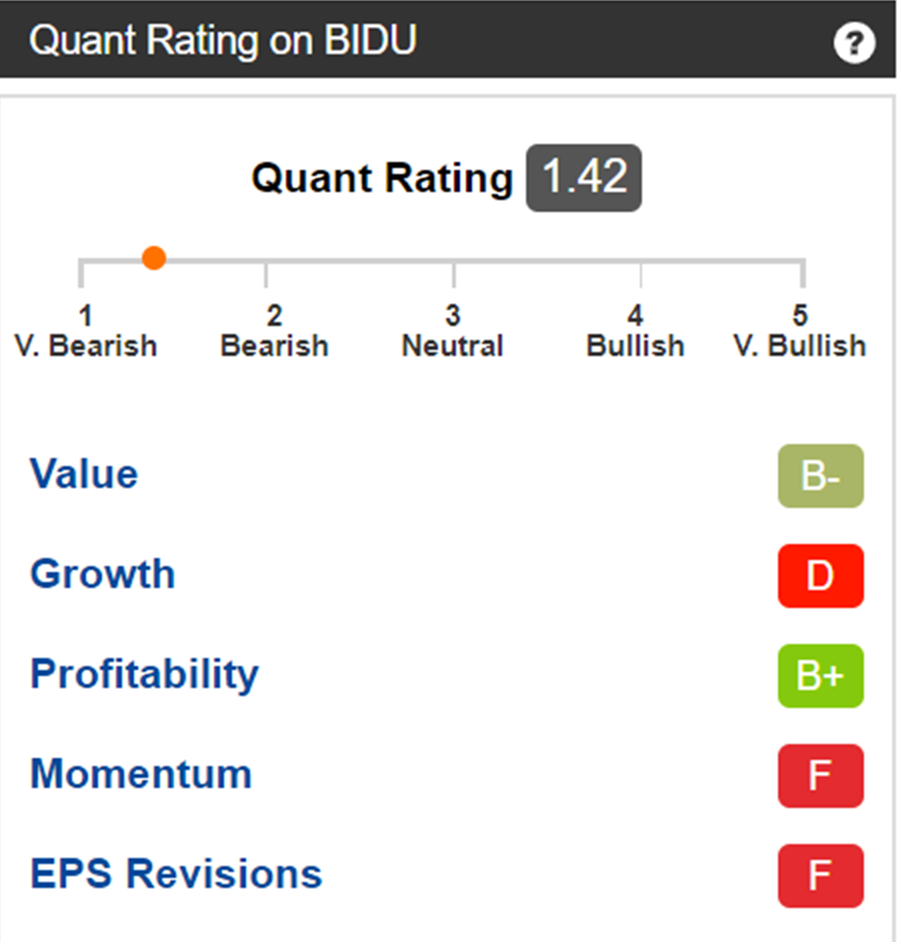

In spite of the numerous ground-breaking developments announced during Baidu Create 2019, the share price hardly got a lift. Ostensibly, based on the current ‘very bearish’ quant rating on Baidu, the search engine giant compares poorly with its peers on the growth, momentum, and EPS revisions metrics, even as its profitability has been above average. Seeking Alpha authors and sell-side analysts probably are ostensibly more tolerant of the short-term challenges Baidu is facing and are confident of its prospects in the mid-to-longer term.

Source: Seeking Alpha Quant Rating

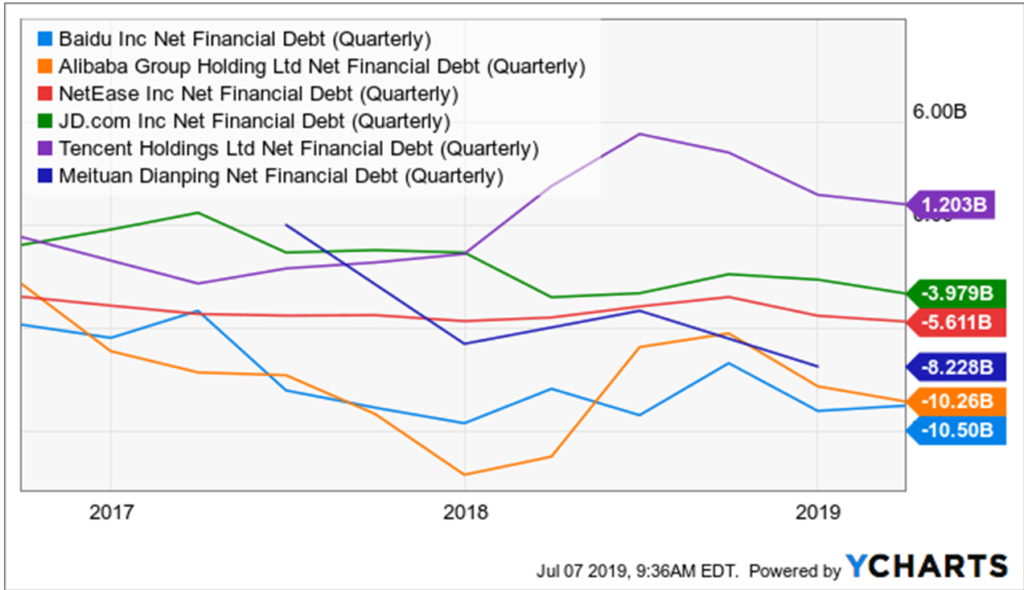

Why should shareholders give Baidu another chance, after it delivered a negative earnings surprise in the quarter ending March 2019 following 10 consecutive earnings beat? Well, for one, at $10.5 billion, it has the highest net cash on its balance sheet even among its larger internet peers. It also has stakes in leading video-streaming provider iQIYI (IQ) and travel services operator Ctrip.com (CTRP) valued at an estimated $11 billion combined.

Data by YCharts

At a market capitalization of around $41 billion currently, stripping of its net cash and investments, Baidu’s core business and whatever it could eventually profit from its AI capabilities are apparently worth only less than $20 billion. To put this into perspective, Pinduoduo (PDD), the e-commerce player with a strong foundation in rural customers, is valued at around $23 billion despite substantial losses with no near-term profitability expected.

Stocks of Chinese-based companies: Not worth the time to consider an investment?

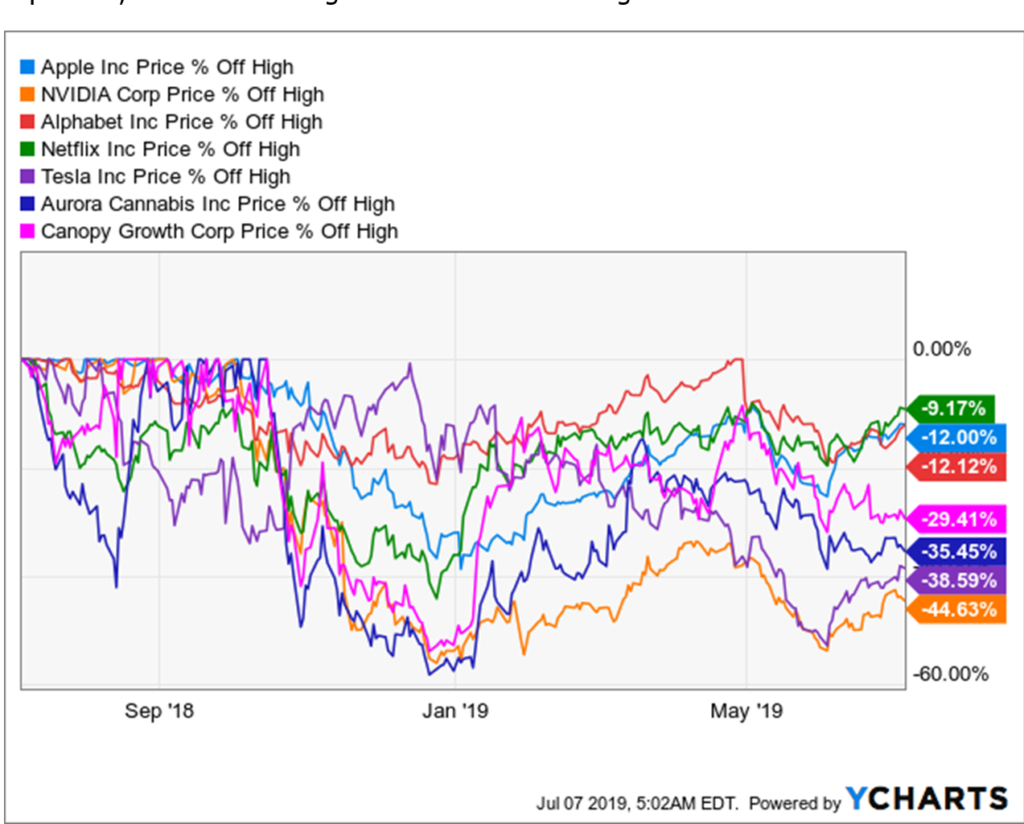

My last article which discussed the implications of Altaba’s (AABA) dissolution on Alibaba attracted several commentators dismissive of investments in Chinese-based companies. Such comments are actually quite prevalent in prior issues of Chinese Internet Weekly. Some shareholders had bought stocks like JD.com (JD), Baidu, Tencent, and Alibaba at or near their historic highs and are understandably upset with their purchases. Nevertheless, it should be noted that many prominent American companies popularly covered by fellow Seeking Alpha authors such as Netflix (NFLX), Nvidia (NVDA), Tesla (TSLA), Canopy Growth (CGC), as well as blue chips Apple Inc. (AAPL), and Alphabet, are also trading below their recent highs.

Data by YCharts

What’s alluring about Chinese internet stocks? The most basic metric to compare technology companies is arguably revenue growth, and those based in China have the results to prove their worth. The 1- and 5-year revenue growth rates for the top 10 holdings of the KWEB ETF averaged 40 percent and 61 percent, respectively, compared to the 1- and 5-year growth rates of 23 percent for their US counterparts.

Source: KraneShares

Concerns over the impact of the trade war on the Chinese internet companies appear to be unduly. Krane Funds Advisors, the investment manager for the KWEB ETF, estimated that less than 5 percent of the revenue generated by the companies held came from outside China, much of which came from neighboring Asian countries.

“Internet-based companies such as Tencent, Alibaba, Baidu, Ctrip, and Weibo are all focused on the Chinese domestic market and have limited exposure to global trade policy.” – Krane Funds Advisors

In terms of valuations, Chinese internet companies are also attractive when compared to their US peers. Based on a comparison made in May 2019, KWEB’s P/E was 21.5 and forward P/E was 18, while U.S. internet stocks (referencing the Dow Jones Internet Composite Index) had a P/E of 48.3 and forward P/E of 29.9. That was before the recent run-up in the stock market.

For those keen on the Chinese internet sector, the KWEB ETF seems to be a compromise between the potentially higher returns stocks that a targeted investment can bring and lower returns but likely at a lower risk from investing in a basket of stocks. Personally, I am on the adventurous side and prefer to invest in companies directly. In addition, I do not like some of the companies that the KWEB ETF has in its portfolio and feel that the managers could have invested into them due to the need for diversification and representation. What’s your take? Share with the Seeking Alpha community via the comments field.

Market Outlook

The Caixin China PMI for manufacturing slid into contraction territory in June. At 49.4, it was the second lowest since June 2016. More worryingly, the sub-index for new orders sank into contractionary territory, indicating that the dependable domestic demand also was disappointing. The gauge for new export orders likewise found itself back in contractionary mode, in spite of some support from front-loading efforts by exporters attempting to ship out goods before additional tariffs kicked in. The seasonally adjusted Chinese Services Business Activity Index remained in expansion mode but fell from 52.7 in May to 52.0 in June.

The weak readings signal an ongoing challenging macro environment in China and that is certainly not helpful for Chinese internet companies. Nevertheless, just as bad employment or inflation data in the U.S. indicates that the Federal Reserve might lower the interest rate, something pleasing to investors, market players could be expecting the Chinese government to be spurred into action upon such macro headwinds. If the latter scenario materializes, the Chinese internet stocks would certainly find interest among investors.

Disclosure: I am/we are long BABA, NTES, JD, TCEHY. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I may initiate a Long position in BIDU over the next 72 hours.

https://seekingalpha.com/article/4273961-apple-worst-case-scenario

Apple: The Worst Case Scenario

Jul. 8, 2019 7:31 PM ET

Summary

Analyst puts sell rating on stock with $150 target.

Reasoning has to do with product cycle disappointment.

Services growth will be key over next 12 months.

Shares of technology giant Apple (NASDAQ:AAPL) dipped more than two percent on Monday, helping to lead US markets lower. The decline came after analyst Jun Zhang at Rosenblatt cut the name to sell, citing fundamental deterioration over the next 12 months. Today, I wanted to examine the pieces of this note, as it would likely represent the worst case scenario for the name.

According to a key Apple watcher, Zhung has the lowest price target of any major analyst at $150, roughly 25% below where shares are currently. What really interests me is the quote that Apple is not a short, because of its cash pile and large buyback. Personally, I think if you think a stock should be at a level this much below where it is, you should be recommending a short position. Investors often get annoyed with some analyst ratings like these, or times when an analyst has a price target below where the stock is yet still has a buy rating (or a sell rating with a higher target).

Perhaps, the most interesting part of the note is that the analyst isn’t citing just one particular item for this negative piece. This could include items like the China trade war that hasn’t been completely solved yet, or increased regulation on big tech names from US or foreign governments. Instead, Zhang came out firing, basically saying Apple will disappoint everywhere, so let’s look at the main points of his argument.

- New iPhone sales will be disappointing.

- iPad sales growth will slow in the second half of 2019.

- Other product sales growth, such as the HomePod, AirPod, and Apple Watch, may not be meaningful to support total revenue growth.

- After strong service revenue growth over the last 4-6 quarters and the launch of Apple Music and news, we believe service revenue growth will also decelerate.

Since the iPhone still represents the majority of revenues, let’s start there. There are some thoughts out there about this cycle being a little soft, primarily as consumers wait for a 5G offering next year. The biggest upgrade focus this year is rumored to be on the camera side, while some nice extras like sharing battery power would be welcomed. In my opinion, the biggest item to watch will be pricing, especially after last year’s effective pricing raise. The good news is that as we move into the holiday quarter and beyond, the year over year comparisons get a lot easier thanks to last year’s big sales miss.

The iPad could be the big wildcard here, just because there are various reportsout there talking about either a late 2019 or early 2020 launch for new Pro versions. Apple launched two new iPad Pro models in the fall of 2018, helping sales of the tablet in the holiday period. However, if we look at this device’s history, the iPad Pro doesn’t always get refreshed exactly a year after each version is launched, so there’s the potential that hundreds of millions or even more than a billion worth of revenues could get pushed out of the holiday period into a calendar 2020 quarter.

The “other products” category is perhaps where I disagree most with the analyst note. The Apple Watch continues to sell well as the product continually gets better, and the second generation AirPods will probably be just as popular or more than the original. As for the HomePod, I wouldn’t be surprised to see a price cut to stimulate sales growth, especially if a second generation version is launched this fall. Targeting the home and increasing wearable sales is going to be key for Apple’s next revenue leg up.

The decelerating services growth idea is an interesting one, just because things like Apple Music and others launched in recent years have pushed the base number so much higher, along with the accounting change last year that boosted reported numbers. Over the next year, investors will closely be watching to see how News Plus, the streaming services, and things like Apple Pay are rolled out and expanded. With so many eyeballs focusing on the services segment as Apple’s key future growth pillar, you don’t want to see negative stories like this one on News Plus, suggesting that publishers are not generating the income that was projected.

Could Apple drop to $150 in the next year or so? It seems possible if you consider the levels shares dropped to in the past year when iPhone sales disappointed. However, I don’t think it is as likely unless we get a major negative turn in the US/China trade war. This is because you have much lower expectations this time around, a higher dividend and lower share count, along with the strong possibility that the Fed and other central banks will lower rates to keep economic growth moving along. In the end, I see Monday’s analyst note as the worst-case scenario for Apple.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

If the S&P 500 hits this level, it could signal a market top

PUBLISHED MON, JUL 8 2019 12:01 PM EDT

Stocks’ record run has hit a wall over the Independence Day holiday stretch.

The and Dow retreated for a second trading day in a row Monday after a massive advance in June.

The markets could still have more room to run before hitting their next level of resistance, said Mark Newton, technical analyst at Newton Advisors.

“We certainly have stretched the upper end of it. But I do think we can make a bit more progress over the next four to six weeks,” Newton said Friday on CNBC’s “Trading Nation. ” “I’m still bullish on the S&P. I think we likely get up to 3,040 to 3,070 or so before we stall out.”

The S&P 500 would need to rally another 3% to reach the upper end of that range at 3,070. Any move over 2,996 would mark an all-time high.

Lagging sectors joining in on the recent move higher also give Newton hope that the rally can continue through the summer.

“You look at financials starting to participate. That’s a big plus for stocks being that they’re almost 13% of the S&P. Health care and transports have also been coming back so those are all encouraging signs,” Newton said. “Near term I do think it’s right to bet on higher prices in July and into August before we see any real slowdown,” he said.

Mark Tepper, president of Strategic Wealth Partners, said easing monetary policy should support the stock market this year, even if the Federal Reserve does not come out quite as dovish as expected.

“The market was basically expecting a 50 basis point cut this month, it’s probably going to be more like 25 basis points so I do believe the Fed is going to cut so the cut is not off the table. It’s just probably going to be a little bit smaller,” Tepper said during the same segment.

A strong June jobs report released Friday tempered expectations for multiple rate cuts this year. The current chances of a 25 basis point rate cut at the July meeting sits at 93%, according to CME Group fed funds futures.

“The market is going to trade sideways and range-bound through the rest of the year so what should you be doing as an investor? I think it makes sense to have dry powder if you have it. So identify companies where you really like their long-term story, you believe in their long-term thesis and you identify any pullbacks and when those stocks pull back you buy them at entry points that you think are attractive,” Tepper said.

https://seekingalpha.com/article/4274985-disney-time-take-profit?dr=1#alt1

Disney: Time To Take The Profit

Jul. 15, 2019 11:32 AM ET

Summary

Disney still has room to grow.

It is an excellent company with a grand strategy.

Not worth getting and it might be time to sell.

Walt Disney (DIS) is expected to perform weakly next year but is expected to perform modestly in the following years. This is in part to the spectacular year it has been having with Avengers and the Disney/Pixar rollout.

Investing in the company presents a comfortable risk-reward proposition with minor downside and favorable upside potential, and as for its price, it is overpriced with small dividends.

In a past article, I explained Disney´s advantages and synergies, considering the Fox merger deal. After that, I have spoken against investing in Netflix (NFLX) for its long term prospects and short term risks.

Disney and AT&T (T) may dethrone Netflix in streaming, but is it worth to take the stock at these prices? I think Disney will deliver a week performance, and it could be time to sell or reduce, and it is not a good time to get in.

The Strategy in a Nutshell

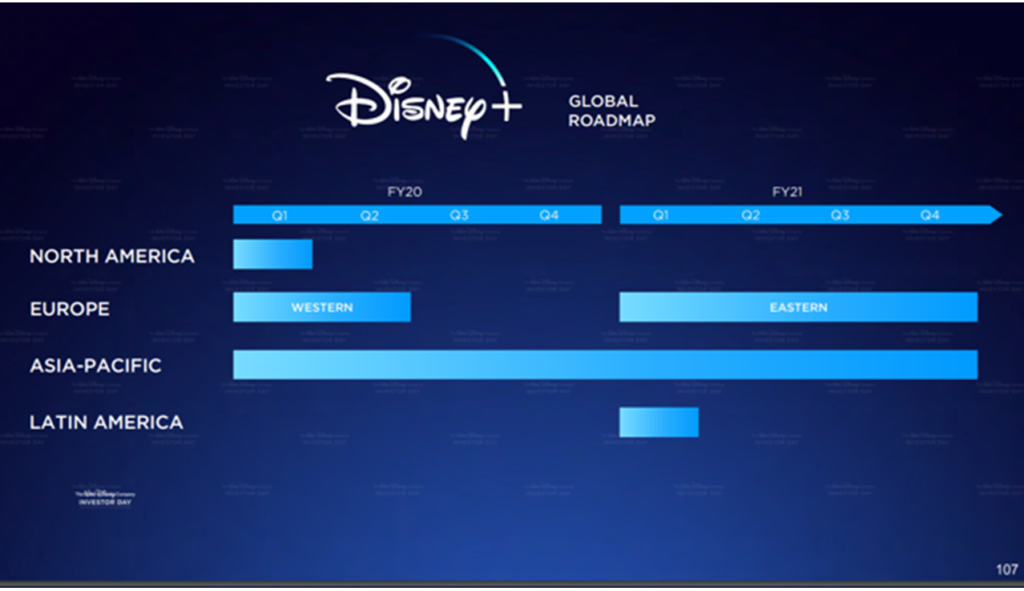

Disney is now in full control of Hulu, it has Hotstar in Asia, ESPN+ and later this year will launch Disney+ to complement its streaming strategy. While Disney will receive the revenue from the subscription service, it will put in jeopardy the current revenue it receives from licensing its content.

Source: Investor day presentation

The rollout plan for Disney will conclude at the end of 2021, and Disney+ is expected to reach profitability until 2024, which means that the next five years could be rough for Disney´s fundamentals

So what does this all mean? Well, from a financial perspective, we expect Disney+’s operating results during the first couple of years post-launch to reflect the aggressive early investments we’re making because we want to set the business up for long-term success. We expect operating losses to peak between fiscal 2020 and fiscal 2022, and we expect Disney+ to achieve profitability in fiscal 2024. – Christine McCarthy – Senior Executive Vice President and Chief Financial Officer

The amount of content Disney will be able to leverage is astounding. Removing its content from Netflix (NFLX) will definitely be felt. However, with the recent jump in Disney stock, it feels pointless to risk going into a significant transitional period for a potential gain that is already here.

Valuation

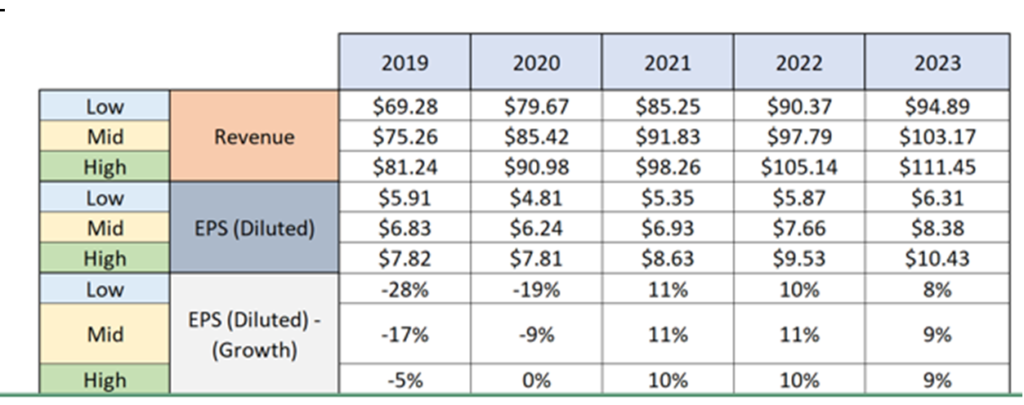

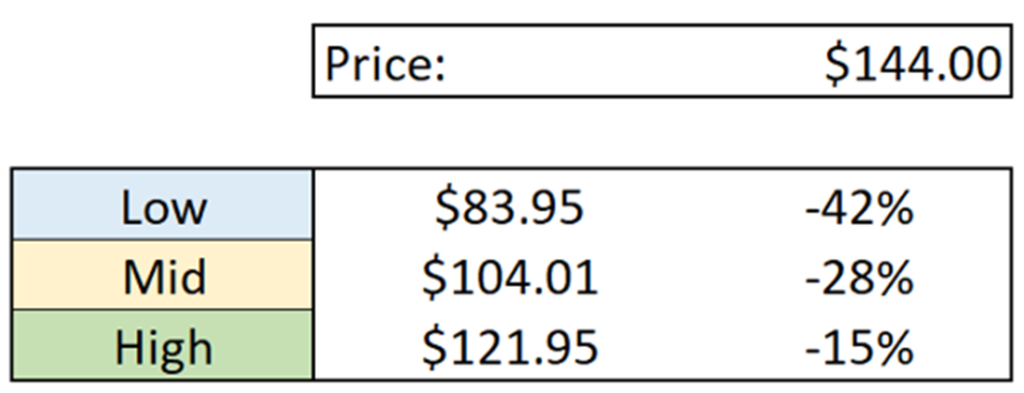

Projecting That revenue growth is in the range of 8.9% and 12.4%, estimating that gross margin should range 40% and 41%, assuming G&A as a percentage of revenue should vary 22.1% and 20.3% we have the following chart.

Source: Author’s Charts

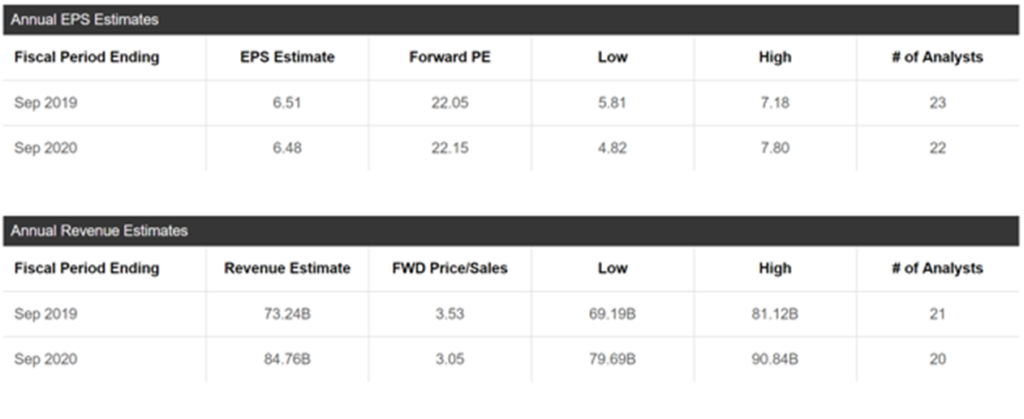

These approximations are in line with what the market expects for Disney in the next couple of years, as the image below shows.

Source: Seeking Alpha

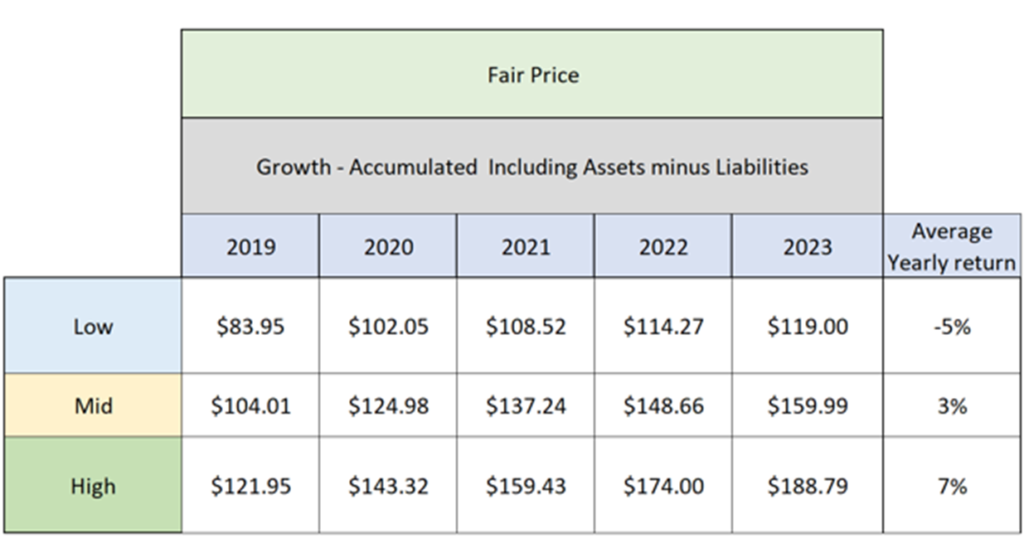

I like to use Peter Lynch’s ratio when valuing a stock. This method uses the ratio between the expected earnings growth plus dividends and the P/E of the stock to determine its fair value. A stock that has a 1:1 ratio is reasonably priced. The higher the number, the more underpriced the stock is.

Source: Author’s Charts

With this valuation, arguably, the stock is at worst overvalued by 42% and at best overvalued by 15%. So the stock is overvalued

Source: Author’s Charts

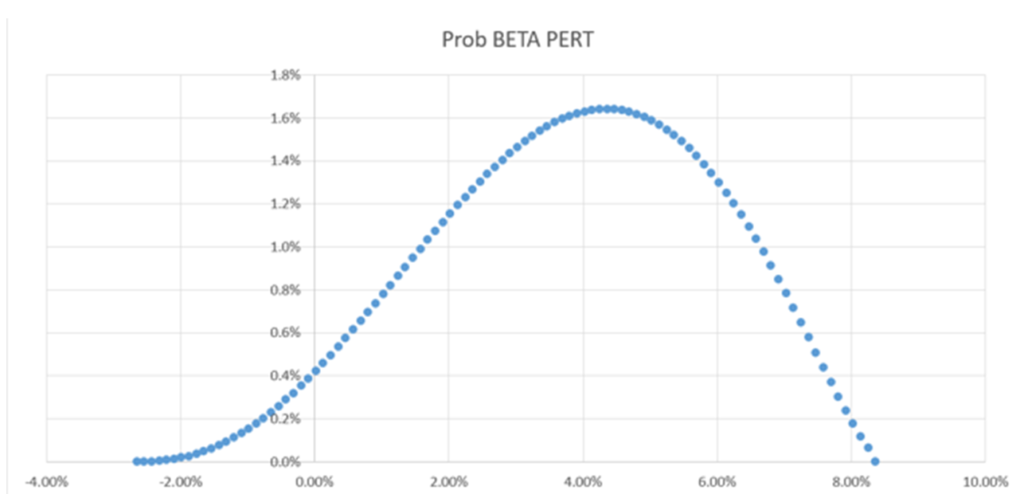

Constructing an adjusted Beta Pert risk profile for the long-term prospects of the stock, we can calculate the risk profile for the company

Source: Author’s Charts

The risk profile shows there is a 22.56% probability that Disney will trade at a lower price than it is today. The upside could be up to 7.01% yearly return. The statistical value of investing in Disney is only 1.8%.

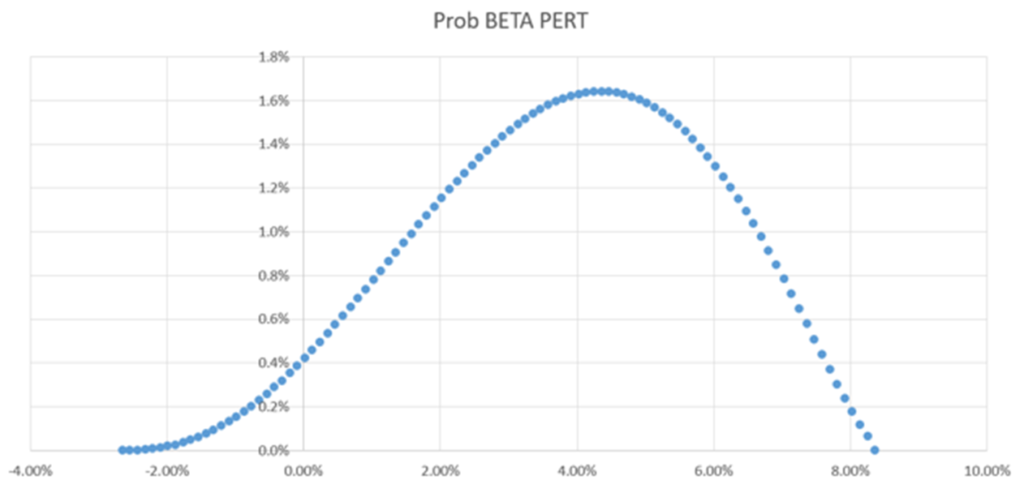

However, this valuation does not consider the return from dividends, when we take into account the dividends we have the following chart.

Source: Author’s Charts

Using this chart to build the New Beta Pert Chart, we have the following results.

The risk profile shows there is a 10.97% probability that Disney will trade at a lower price than it is today. Considering the potential downside, upside, and the likelihood of each, the statistical value of the opportunity of investing now, is of 3.3%. This is not a significant number.

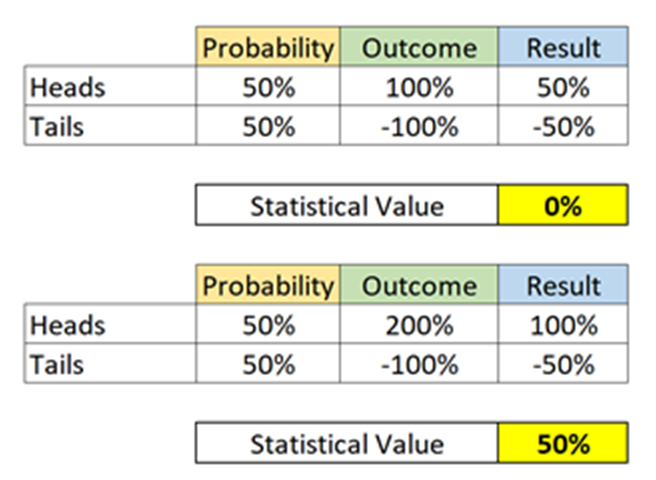

Let’s explain in greater detail the statistical value of the opportunity to invest in a company. The statistical value is the sum of all the possibilities that an event or a proposition have multiplied by their respective output.

Betting heads on a coin flip, where if you win, you will get 100% return, but if you lose, you will lose 100%, has a statistical value of 0%. If someone were to bet an infinite number of coin flips, they would end up with the same money they began.

On the other hand, if the odds of the coin flip were heads, you win 200%, and tails, you lose 100%, the statistical value of the bet would be 50%.

The statistical value of 3% that Disney has is quite small and might not justify investing in the company. If one wanted to minimize risk, there are better stocks that have similar risk profiles but better upside potential.

Conclusions

The core business of Disney is robust, but the current price is overvalued, and even if streaming pushes Disney to the top side of the estimates, it might not give a payback big enough to justify holding the stock.

It might not be a good idea to enter the stock now, and it could be time to reduce or sell the stock. The possible upside does not justify the valuation nor the risk. The company could end up underperforming or even losing.

Disney is undoubtedly a great company, and its streaming plans are exciting, but the potential upside is small compared to the size of the business and the risk it poses. It is undoubtedly the right way to go business-wise, but as investors, there are better options, like AT&T (T) or Flexible solutions (FSI) both have better dividends and comparable risk profiles.

If there is anything in this article, you agree or disagree with or would like me to expand further on; I would sincerely appreciate you leaving a comment. I will address it as soon as possible.

Disclosure: I am/we are long DIS, FSI, T. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I might end my Long position in Disney soon.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

HI Financial Services Mid-Week 06-24-2014