HI Financial Services Commentary 10-16-2018

YouTube Link: https://youtu.be/xnMY96CJvmI

What I want to talk about today?

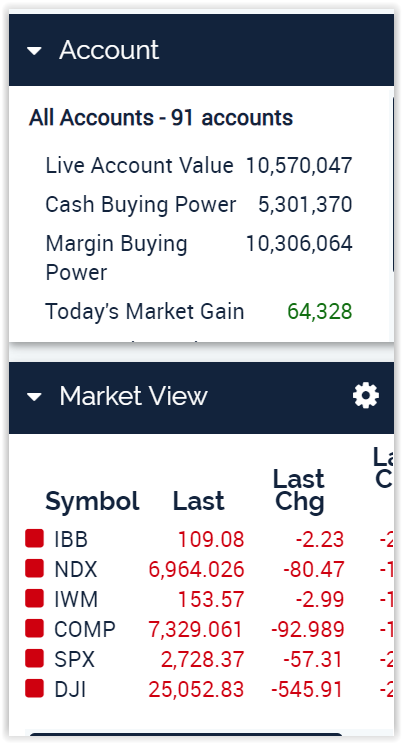

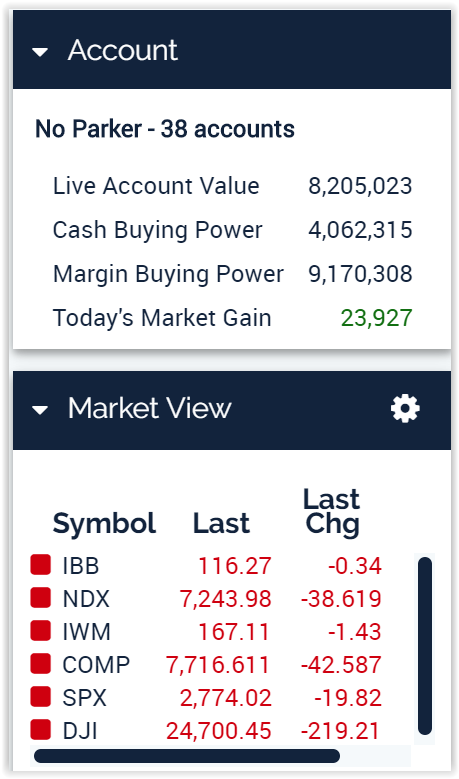

I want to go over my thoughts, worries, and feelings that I’ve gone through in the last two weeks:

When in 2 days you go thru over a 5% decline in the major indexes it is a cause for worry

No Panic – But obviously it could have been the start of a serious correction

Due to tax saving, Christmas Prep and NOW people are buying stocks for the increase in sales

DON’T run out of the store when everything goes on sale

IWM – Nov-23 18 160/168 Bull Call & put a trigger order to add 160 Dec long puts if it trades below $160

F-ing Ford because there is no love

AAPL I have Nov 215, 217.50, 220 225 long puts in place

V on shares have 138 long puts, Looking to add leap long calls $145 2020

Taking profits last Friday and having to hustle on Monday

I DO NOT THINK THE RALLY IS OVER

I worry about Jan 2019

IF you have a 8% growth in a “value” stock – This means 1/3 or 2.66% is tax growth, tariffs are 2% to 3% costs that probably won’t be passed on this quarter, with lower margin/ higher operating expenses 3.33% growth rate

When you have a 10 yr treasury at 3.15-3.16 and a possible 3.5-3.7 return

Typical market patterns aren’t happening this year and maybe its Trump?

Earnings are/should come in great with the last of the tax savings being pushed through the bottom line

The drop was a big drop over two days and 2008 put people into panic

09/26/2018

07/11/2018

05/11/2018 down s little when the market is done a lot!!

What happening this week and why?

Recovery week

Where will our markets end this week?

Higher recoup the 50 SMA

DJIA – BEARISH

COMP – Bearish

Where Will the SPX end October 2018?

10-16-2018 0.0%

10-09-2018 +1.5%

10-02-2018 +1.5%

Earnings:

Tues: BLK, DPZ, FHN, GS, GWW, JNJ, MS, UNH, CREE, CSX, IBM, INKR, NFLX

Wed: USB, AA, KMI

Thur: DOV, NUE, PM, AXP, ISRG, PYPL

Fri: HON, PG, SLB, VFC

Econ Reports:

Tues: Capacity Utilization, Industrial Production, NAHB Housing Market Index, Net Long Term Tic Flows, Jolts,

Wed: MBA, Housing Starts, Building Permits,

Thur: Initial, Continuing, Phil Fed, Leading Indicators,

Fri: Existing Home Sales, OPTIONS EXPIRATION (monthly)

Int’l:

Tues –

Wed –

Thursday –

Friday-

Sunday –

How am I looking to trade?

So I got fearful and put long puts on everything starting last Tuesday, Wednesday for this coming earnings.

I then took profits on Friday and Monday morning put the protection back on for earnings.

AAPL 11/01 AMC

AOBC 12/06

BABA 11/02 BMO

BAC 10/15 BMO

BIDU 10/25

DIS 11/08 AMC

F 10/24 AMC

FB 10/30 AMC

FCX 10/24 BMO

MO 10/25 BMO

MRVL 11/29

RHT 12/19

UAA 10/30

V 10/24 AMC

ZION 10/22

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

https://www.barrons.com/articles/dow-drops-831-points-and-no-one-has-a-clue-1539204862

DOW DROPS 832 POINTS AND NO ONE HAS A CLUE / BARRON´S MAGAZINE

| Etiquetas: Bond Markets, Financial Markets, Interest Rates, Investment Strategies, Stock Markets

Dow Drops 832 Points and No One Has a Clue

By Ben Levisohn

Stocks just suffered a drubbing like few others—and no one really knows why. Even worse, there’s little agreement on what comes next.

The S&P 500slumped 3.3% to 2785.68, its biggest decline since Feb. 8, while the Dow Jones Industrial Averagedropped 831.83 points, or 3.1%, to 25,598.74, also its largest since Feb. 8. The Nasdaq Composite dropped tumbled 4.1% to 7422.05, its biggest one-day slide since June 2016.

Usually when the market tumbles so dramatically we can pinpoint a reason. Maybe bond yield’s spiking dramatically, or a new tariff was imposed, or an economic data point suggested that the Fed would have to start tightening rates. But there was no headline today, just the culmination of weakness that began when September turned to October.

As with February’s correction, a rapidly rising 10-year yield seemed to be the impetus for the initial weakness, but it was weakness that seemed limited to the Nasdaq and its highflying coteries of tech stocks like Netflix(NFLX) and Amazon.com(AMZN). If the rise in yields was caused by better-than-expected growth, as it was assumed, then buying Financials and other sectors that benefit from a stronger economy should continue to do well. But yesterday’s report from the IMF suggesting slower global growth put a crack in that story, one that had already been suggested by the outperformance of Utilities. And Fastenal’s(FAST) earnings today suggested that Industrial stocks are starting to feel the pinch from cost inflation.

That combination of higher rates, slower growth and rising costs is, how shall we say this, not good for the market. And the question now is whether the market finds a bottom soon or if we get a repeat of February’s correction.

The optimists suggest there’s no reason to fear the pullback. Merion Capital Group’s Rich Farr, for instance, highlights the strong economic backdrop, the relative strength in credit markets and the fiscal stimulus still coursing through the economy, which suggests that the market should still have upside ahead of it. If the market were to head lower, it would be for one of two reasons: Tensions between the U.S. and China get worse or the Federal Reserve raises interest rates too high. Regarding the former, Farr hopes “cooler heads will prevail.” And if the Fed hikes into slower growth, “stocks have peaked,” he explains. “But if Fed pauses, then stocks have not. Today, the odds of a Fed pause have gone up.”

Sill, it pays to remember that the last time the 10-year Treasury was near these levels–it closed at 3.221%–was in 2011, when the S&P 500 was trading at 13.1 times. Today, it was trading at about 16 times, observes MKM’s Michael Darda. To get back to those valuation levels, the market can continue falling, remain rangebound as earnings grow, bond yields could fall, or some combination of the three, he explains

Of course, there’s one other possibility: We could be witnessing the end of the bull market. I’m not ready to go there yet, but others certainly are. I spoke with Leuthold Group’s Doug Ramsey, and he contends that’s what’s happening. He cites the rapidly rising yields–rate of change matters more than level, he says–the end of central-bank bond buying, and the market’s narrow breadth as all suggesting a top. In fact, the only things that makes him think that might not be the case is the strength of the leading indicators, and the fact that the yield curve hasn’t inverted. He’d already lightened up on stocks, before today’s drop.

I bet we all wish we had.

Bill Gates, Elon Musk and Mark Cuban quit these 3 bad habits before they became successful

8:30 AM ET Mon, 8 Oct 2018

Habits and routines are powerful. They help us every day, freeing up brain space and releasing us from making countless decisions. But not every habit is good, and not breaking a bad one can hold you back from success.

If you’re struggling to overcome certain vices, take some inspiration from Bill Gates, Elon Musk and Mark Cuban. The three billionaires are successful now but have all had to quit common bad habits over the course of their careers.

Bill Gates the procrastinator

Find yourself putting things off until the last minute? So did a young Bill Gates.

The Microsoft co-founder was a heavy procrastinator during his undergraduate years at Harvard University. (Gates dropped out after two years.)

“People thought that was funny,” he told students at the University of Nebraska-Lincoln’s College of Business Administration. “That was my positioning: the guy who did nothing until the last minute.”

The now-billionaire received a sobering reality check when he entered the business world, where deadlines must be met and timeliness is prized. “Nobody praised me because I would do things at the last minute,” Gates said. As a result, he tried to “reverse” this habit and become more like the students he knew in college “who were always organized and had things done on time.”

He’s still a work in progress, Gates says, but admits that “procrastination is not a good habit.”

If you find yourself getting side-tracked at work, try this tip from “Shark Tank” star Kevin O’Leary: Stick to a set schedule.

“Prioritize every 15 minutes of your day,” he advises. Also ask yourself if what you’re doing is making you money. “That makes it easy to snap out of it,” says O’Leary.

Elon Musk the caffeine addict

The Tesla founder recently copped to working 120 hours a week, leaving little room for shuteye. To compensate for this sleep deprivation, Musk used to drink large amounts of caffeinated beverages.

“There were probably times when I had like eight [diet cokes] a day or something ridiculous,” Musk told the German automobile magazine Auto Bild in 2014. “I think these days it’s probably one or two, so it’s not too crazy.”

He also struggled with a coffee addiction. “I used to have so much coffee…that I’d get really wired,” said Musk. “I’d get over-caffeinated and it wouldn’t be good.”

Health experts say that consuming too much caffeine can increase anxietyand stress levels and creates a toxic cycle of fatigue, which leads to increased coffee consumption, which impairs your sleep, which leads to more fatigue the next day, which leads to more caffeine consumption.

Instead, take a page from Musk and swap out a daily coffee for some good ol’ H2O. If you can’t quit cold-turkey, slowly decrease the amount of caffeinated beverages you consume each day.

Mark Cuban the bad communicator

Yelling is not an effective way to get your point across. Mark Cuban had to learn that the hard way in his 20s.

“I would yell at my partner [Martin Woodall],” Cuban admitted on “The Jamie Weinstein Show” podcast.

The two co-founded the early computer systems venture MicroSolutions and would butt heads over how best to run the company. “We could drive each other crazy,” Cuban wrote on his blog. “He would give me incredible amounts of s— about how sloppy I was. I would give him the same amount back because he was so anal he was missing huge opportunities.”

In time, Cuban learned that yelling did more harm than good. “That just increases stress,” he said on the podcast. “When you increase stress — the people around you, productivity, profitability [and] competitiveness decline.”

To be an effective leader, you must be able to get your ideas across and receive buy-in from those around you. LinkedIn CEO Jeff Weiner says there’s even an interpersonal skills gap in the labor market across the United States.

Luckily, communication is a skill you can learn. Pay attention to your tone of voice, facial expression and gestures and make sure to listen more than you’re talking.

Disclaimer: CNBC owns the exclusive off-network cable rights to “Shark Tank.”

https://www.cnbc.com/2018/10/08/the-last-time-unemployment-was-this-low-something-bad-happened.html

The last time unemployment was this low, we were hit with a recession

- The last time the unemployment rate was lower than the current 3.7 percent came in December 1969, when it hit 3.5 percent.

- Shortly after hitting that level, the economy tipped into one of the mildest recessions the U.S. has ever seen.

- Some experts worry that the economy and could overheat and the Fed could help hasten a downturn by raising interest rates.

Published 3:36 PM ET Mon, 8 Oct 2018 Updated 5:18 PM ET Mon, 8 Oct 2018CNBC.com

The near-50-year low in the unemployment rate signifies that a lot of good things have happened for the economy, but also could point to some bad things that could happen.

In fact, the last time the headline jobless level was lower, an economic downturn followed. December 1969 saw the rate fall to 3.5 percent, and it was at 6.1 percent a year later when the economy struggled through problems in 1970 that sound a lot like conditions now. The current unemployment rate is 3.7 percent.

Back then, the economy was coming off what at that point had been its longest expansion ever, a nearly nine-year period of prosperity that came amid aggressive fiscal expansion to finance the Vietnam War.

Growth finally started to peak, though, as 1969 came around, and by early the following year, the expansion was over.

That’s the bad news.

The good news is that what followed was a nine-month slump that is one of the mildest recessions in U.S. history. GDP was negative only twice during the year — a 0.6 percent decline in the first quarter, then a 4.2 percent drop in the fourth quarter. In between there were increases of 0.6 percent and 3.7 percent. And by the time November 1970 rolled around, the economy was back on its feet en route to a three-year expansion that saw GDP growth average 5.1 percent a year.

In fact, some economists don’t even count the 1970 downturn as a recession, instead considering it a pause in growth that quickly abated.

Investing experts are conflicted over whether the current economy is just getting revved up, on its way to another 1970-style slowdown, or ready to tumble into a late-1970’s-style inflationary spiral that will precede a much sharper downturn. GDP grew 2.2 percent in the first quarter this year and 4.2 percent in the second, and may have registered above-4 percent growth in the third quarter.

“It doesn’t give you a warm and fuzzy feeling when you see these types of unemployment rates,” said Jim Paulsen, chief investment strategist at The Leuthold Group. “I don’t really see very high odds of anything like the ’70s. That said, I think we’ve got all the makings of a normal cyclical buildup in costs and inflation.”

Put another way, while there are some similarities between the 2018 landscape and what happened in the 1970s, there are conditions in place now — demographics, technology, monetary policy — that argue against a return to a condition so drastic that former Fed Chairman Paul Volcker had to take the country into recession to cure it.

Fundamentals also are much better now than they were then. Business and consumer confidence is soaring, corporate profits are near record highs and interest rates, while rising, are still low.

But the sudden deterioration of any of those conditions, much like the slowdown happening in other parts of the world, is what worries Paulsen.

“You could get yourself into a situation where you’re growing more slowly,” he said. “A milder version, but nonetheless a version, of [a late-1970s economy] is a possibility.”

Paulsen worries that an overheating in the economy eventually could lead to trouble, paving the way for another tightening in financial conditions that brings the expansion to a halt. Inflation measures have been creeping higher, resulting in a push to a seven-year high in the 10-year yield.

One area of worry is the Federal Reserve.

The central bank is on a rate-hiking cycle that began in December 2015 and likely will continue through next year and perhaps into 2020. Market participants worry that the Fed will keep hiking until it inverts the yield curve, a condition where short-dated yields exceed their longer-duration counterparts. That has been a reliable recession indicator for 50 years, and it’s close to happening again.

The idea that “this time is different,” pushed by Fed officials and elsewhere, could lead investors to be complacent, said Mark Holman, CEO of TwentyFour Asset Management.

“In the absence of a major surprise, some kind of big macro problem somewhere, I think it’s going to be a mild recession and won’t last very long,” he said. “I would caveat that by saying it depends on what tips us in.”

For clues as to when and how the next recession will take hold, Holman recommends watching the Fed’s survey of loan officers, which describes current lending conditions and serves as a benchmark for how loose or tight fiscal conditions are at a given point in time.

“The day the curve does invert, your senior officers at all the big banks in the U.S. are going to be discussing their credit lending strategy,” he said. “Tightening isn’t just what the central bank does.

Ultimately, he sees recession hitting around 2020. Investors should start thinking about that day coming, though he said it’s probably premature to begin adjusting portfolios.

https://www.cnbc.com/2018/10/03/amazon-hourly-workers-lose-monthly-bonuses-stock-awards.html

Amazon’s hourly workers lose monthly bonuses and stock awards as minimum wage increases

- Amazon warehouse workers are no longer eligible to receive monthly bonuses and stock awards.

- Amazon made the change as it announced a minimum-wage increase on Tuesday.

- The change could make some longtime workers to make less money, according to The Guardian.

Published 3:51 PM ET Wed, 3 Oct 2018 Updated 10:17 AM ET Thu, 4 Oct 2018CNBC.com

Amazon‘s minimum-wage increase for its hourly workers comes with a trade-off: no more monthly bonuses and stock awards.

Amazon confirmed in an email to CNBC that the company is getting rid of incentive pay and stock option awards as it increases the minimum wage to $15 per hour. The company, however, stressed that the wage increase “more than compensates” for the loss in other benefits.

“The significant increase in hourly cash wages more than compensates for the phase out of incentive pay and [restrictive stock units],” Amazon’s spokesperson said in an emailed statement. “We can confirm that all hourly Operations and Customer Service employees will see an increase in their total compensation as a result of this announcement. In addition, because it’s no longer incentive-based, the compensation will be more immediate and predictable.”

Additionally, workers affected by the change will get a chance to review the new pay structures and share any concerns they might have with the company, according to a person familiar with the matter.

The confirmation follows multiple reports on Wednesday that some of Amazon’s warehouse employees say they will make less as a result of this change. The Guardian said warehouse workers currently receive one Amazon share (worth $1,959) at the end of every year, on top of another single share reward every five years. Yahoo Newsnoted that warehouse workers can earn up to 8 percent of their monthly income every month, which could be as much as $3,000 a year for some workers. Workers were notified of the change on Wednesday, according to Bloomberg.

Amazon disclosed in its announcement on Tuesday that it is replacing the stock awards program with the minimum-wage increase because employees prefer the “predictability and immediacy of cash” compared with stock awards. The company didn’t say anything about the monthly bonuses.

The announcement served as a good publicity event for Amazon, which has recently been criticized for the low wages and poor working conditions at its warehouses. Two of Amazon’s biggest critics, Sen. Bernie Sanders and the Trump White House, both applauded the move on Tuesday.

https://www.cnbc.com/2018/10/05/these-stocks-are-the-biggest-winners-when-rates-are-surging.html

When interest rates jump, these are the best-performing stocks in the Dow

- Shares of J.P. Morgan surge an average of 5.2 percent over a one-month span when ratesare rising sharply, while Goldman’s stock averages a gain of 3.9 percent in such instances.

- DowDuPont, Exxon Mobil and Visa are also among the best-performing stocks in this environment.

- Strong economic data and comments on U.S. monetary policy from the top Federal Reserve official have been a boon for interest rates as they reach multiyear highs.

- Walmart and Coca-Cola struggle during periods of higher rates.

Published 12:49 PM ET Fri, 5 Oct 2018 Updated 1:36 PM ET Thu, 11 Oct 2018CNBC.com

Interest rates are surging and stocks like J.P. Morgan Chase and Goldman Sachs would make great additions to a portfolio in times like these, if history is any indication.

Shares of J.P. Morgan surge an average of 5.2 percent over a one-month span when rates are rising sharply, while Goldman’s stock averages a gain of 3.9 percent in such instances. Banks usually benefit from higher rates as they make loans more profitable.

DowDuPont, Exxon Mobil and Visa are also among the best-performing stocks in this environment. When rates move sharply higher, DowDuPont and Exxon Mobil both average gains of 3.5 percent, while Visa posts averages a rise of 3.4 percent.

CNBC used analytics tool Kensho to determine the best-performing stocks in the Dow Jones Industrial Average when the 10-year Treasury note yield rises 25 basis points or more over a span of 30 days. There have been 18 instances of such a move happening since 2008. Last week alone, the 10-year yield rose more than 15 basis points.

Strong economic data and comments on U.S. monetary policy from the chairman of the Federal Reserve were a boon for interest rates last week.

On Friday, the Labor Department reported that the unemployment rate dropped in September to its lowest level since 1969. Wages, meanwhile, grew by 2.8 percent on a year-over-year basis.

The U.S. services sector also expanded at its fastest rate on record last month, according to data released by the Institute for Supply Management.

Meanwhile, Fed Chairman Jerome Powell said Wednesday that the central bank was “a long way” from getting interest rates to neutral, signaling more rate hikes are coming. The Fed has already raised rates three times this year and is expected to do so again in December.

All of this has led the 10-year U.S. note yield — which is used as a benchmark to determine mortgage rates — to jump from around 3.06 percent on Monday to above 3.2 percent, near its highest levels in more than seven years.

Worst performers

But while stocks like J.P. Morgan, Goldman Sachs and Visa do well when rates are surging, Walmart and Coca-Cola struggle.

Walmart averages a loss of 0.8 percent when rates rise 25 basis points or more in one month, the worst performance of any Dow member in those instances since 2008. Coca-Cola, meanwhile, drops an average of 0.4 percent.

Johnson & Johnson, Procter & Gamble and Verizon also average losses when rates rise sharply.

These stocks usually pay high dividends, which become less attractive when interest rates rise.

A market bottom is forming, and it will lead to new record highs, Wall Street bull Jeff Saut says

Stephanie Landsman | @stephlandsman

Published 3 Hours AgoCNBC.com

Long-time bull Jeffrey Saut suggests it could be a less chaotic week for investors.

According to the Raymond James chief investment strategist, last week’s “minicrash” is not indicative of any fundamental changes in the economy or markets, and there’s evidence a market bottom is forming.

“The trading pattern today has been a multiswinging pattern between up and down and that’s usually how bottoms are formed,” he said Monday on CNBC’s “Trading Nation.”

Despite his reassuring read on the market, the Dow and S&P 500couldn’t muster a close in positive territory. The Dow saw its fourth negative session in five, and the S&P registered its seventh down day in eight.

“It’s just like a heart attack patient doesn’t get right up off the gurney and run the 100-year dash. It needs to convalesce for a few days,” Saut said. “The equity markets are going to do the same thing.”

Saut, who has been touting the merits of the stock market for years, sees almost a decade left in the secular bull market. But that doesn’t mean he hasn’t warned of short-term hiccups, and this latest pullback was no different — except he acknowledges underestimating its magnitude.

“Two weeks ago on Tuesday, our short-term proprietary model flashed a sell signal. We wrote about it. We told people to abandon trading positions,” Saut said.

Now he’s telling clients to start putting money to work again.

“Earnings season is coming up. I think that’s going to be the catalyst for the equity markets to trade back up to new all-time highs,” he said.

Even though his firm doesn’t put out official year-end targets, Saut expects the S&P 500 to exceed 3,000 by the end of the year, about 8.5 percent above the current level.

Larry Fink: Investors were running from stocks even before last week’s plunge due to ‘more fear’

- BlackRock Chairman and CEO Larry Fink says he saw huge outflows before last week’s stock plunge due to “more fear” among investors.

- Wednesday and Thursday saw the heaviest selling of the week, when the Dow plummeted nearly 1,400 pointsin the two sessions.

Berkeley Lovelace Jr. | @BerkeleyJr

Published 5 Hours Ago Updated 3 Hours AgoCNBC.com

BlackRock Chairman and CEO Larry Fink said Tuesday he saw huge outflows before last week’s stock plunge due to “more fear” among investors.

“There’s a huge commentary that we are at peak earnings,” Fink, CEO of the world’s largest money manager, said in a “Squawk Box” interview. He added that commentary is debatable, and his firm expects a “couple more good quarters.”

“Companies are having margin pressures because of rising wages, which may be a good thing for the overall economy but not as good for corporate profitability,” he said. “Overall, you’re seeing more consternation, more fear.”

Fink also said most stocks are in correction phase right now.

Wednesday and Thursday saw the heaviest selling of the week, when the Dow Jones Industrial Average plummeted nearly 1,400 points, or more than 5.2 percent, in the two sessions.

The Dow and S&P 500 fell more than 4 percent for the week despite strong gains Friday. The Nasdaq dropped nearly 3.75 percent for the week.

Concerns that the Federal Reserve under Jerome Powell might raise rates more than forecast helped fuel last week’s decline. The Fed hiked rates three times this year, and one more is expected in December.

Stock futures were higher on Tuesday as investors looked ahead to a slew of corporate earnings releases.

Earlier Tuesday, BlackRock reported better-than-expected earnings for the third quarter as its assets under management grew by 8 percent on a year-over-year basis. BlackRock has $6.4 trillion assets under management.

HI Financial Services Mid-Week 06-24-2014