HI Financial Services Commentary 02-14-2017

Trump? ‘Complete insanity’ – and the markets are in a fantasy land: Stockman

Sunday, 12 Feb 2017 | 5:04 PM ETCNBC.com

Stockman gives 3 reasons why the market will tank under Trump Friday, 10 Feb 2017 | 9:49 AM ET | 03:20

Stocks are booming under President Donald Trump, but long-time critic David Stockman warns traders are living in a “fantasy land” that can’t last —and Trump’s policies will derail the market for years to come.

The former Reagan administration OMB director appeared on CNBC’s “Futures Now”last week to emphasize that Trump has become seemingly distracted by issues other than his proposed economic agenda.

That should be a particular point of worry for investors, who Stockman argued have been far more optimistic about Trump’s presidency than might be warranted by the facts.

In other words, while all three major market indexes continued to hit record highs last week, the former Reagan aide sees the current market rally as moot and not reflective of the current political climate.

When asked by CNBC whether Stockman is finally going to throw in the towel on his criticisms of the Trump administration, he said, “What’s going on today is complete insanity.”

“The market is apparently pricing in a huge Trump stimulus,” he said. “But if you just look at the real world out there, the only thing that’s going to happen is a fiscal bloodbath and a White House train wreck like never before in U.S. history.”

Since the election, the S&P 500 Index has rallied more than 8 percent, the Nasdaq about 6 percent and the Dow Jones Industrial Average a whopping 10 percent. Last week, all three benchmarks rallied to new record highs.

Yet if anything, according to Stockman’s predictions, those gains may be lost.

Most of Trump’s actions “[have] nothing to do with the economic agenda” he’s proposed, Stockman told CNBC. That, along with a debt ceiling debate that will take place on March 15 in Congress, and a market rally that has gone on for a while, leads Stockman to think that a big downturn is on the way.

“There’s going to be no tax action this year,” said Stockman, echoing the concerns of Goldman Sachs and a few other Wall Street economists who say Trump’s plans for the economy are facing mounting political risks. Last week, the president vowed that tax reform could happen this year, and promised an announcement within the next few weeks.

“If there’s any next year it will be deficit neutral, which means it’s not going to add the $15 to earnings like these people expect,” Stockman said, speaking of the rosy expectations of some analysts who think tax reform could boost corporate earnings in the medium-term.

“My argument is there is not going to be any economic rebound, there is not going to be any profit surge,” Stockman added. “Therefore the market will be repricing dramatically downward once it’s clear that that’s the case.”

Stockman had previously made similar calls on CNBC, even before Trump’s election victory and inauguration. On “Fast Money”in November, he argued that a recession was down the pipeline in 2017 thanks to Trump, following up on comments last year when he urged investors to sell stocks and bonds ahead of the election.

As of Friday morning, the S&P and the Nasdaq were on pace for their third consecutive positive week since the post-election rally, with tech as the leading sector that drove stocks to all-time highs.

Annie PeiAssociate Producer

What’s happening this week and why?

Yellen speak – Time to raise rate and it could be damaging if she doesn’t

PPI .6 vs est .3

Core PPI .4 vs est .2

Wed – tons economic reports and Yellen again

Where will our market end this week?

Lower

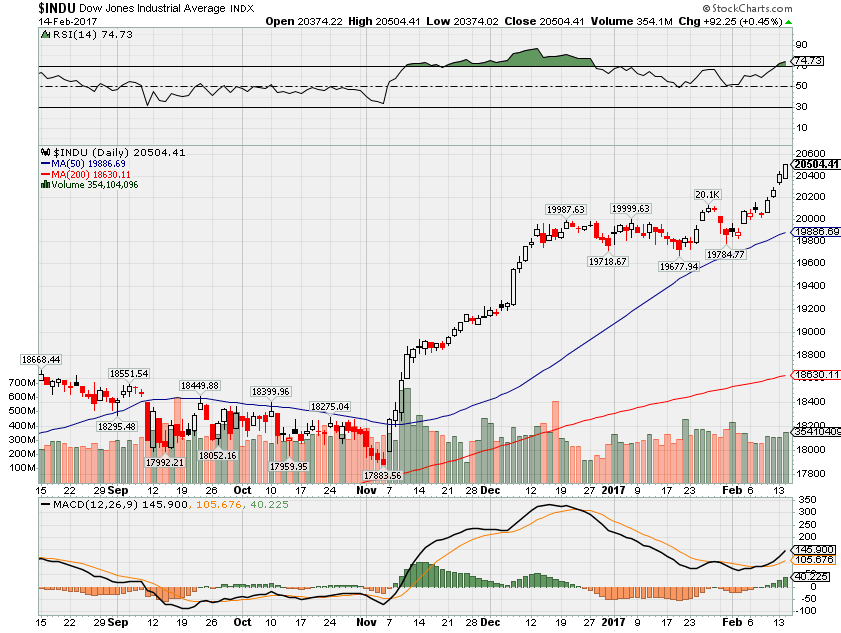

DJIA – Still bullish and over-bought on the RSI

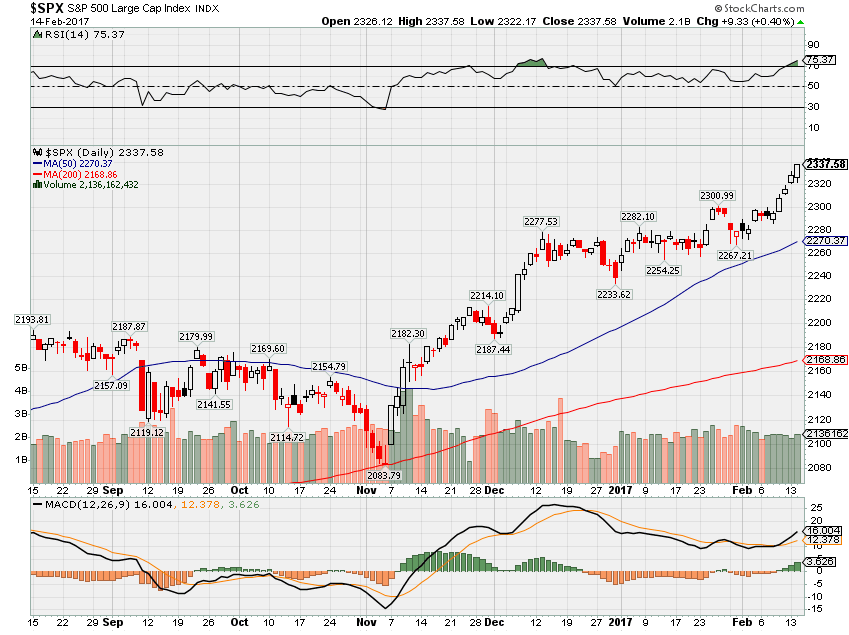

SPX – Bullish and over-bought on the RSI

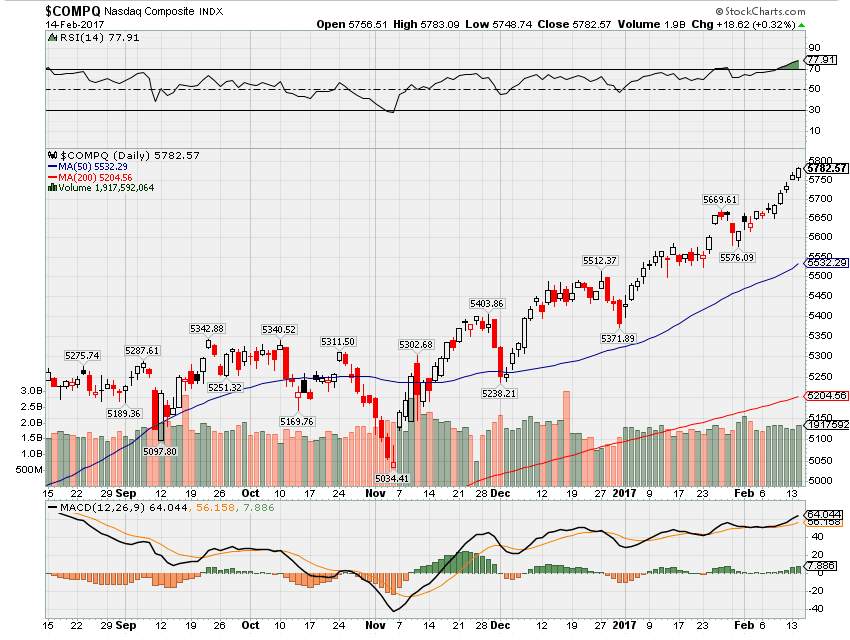

COMP – Bullish and over-bought on the RSI

Where Will the SPX end Feb 2017?

02-14-2017 -2.5%

02-07-2017 -2.5%

01-31-2017 -2.5%

What is on tap for the rest of the week?=

Earnings:

Tues: AIG, DVN, DBD, DPS, FOSL, LC, TMUS

Wed: AMAT, CBS, CF, CSCO, DENN, GRPN, KHC, LAD, MRO, MAR, NTES, NTAP, PEP, SODA,

Thur: CAB, DF, DUK, GNC, H, MGM, SWC, WM, WEN

Fri: CPB, CQP, DE, FLR, SJM, VFC

Econ Reports:

Tues: PPI, Core PPI,

Wed: MBA, Crude, CPI, Core CPI, Empire Manufacturing, Retail Sales, Retail Sales ex-auto, Capacity Utilization, Industrial Production, NAHB Housing Market Index, Business Inventories, Net Long Term TIC Flows

Thur: Initial, Continuing Claims, Housing Starts, Building Permits, Phil Fed,

Fri: Leading Indicators, OPTIONS EXPIRATION

Int’l:

Tues – Yellen Speaks

Wed – Yellen Speaks

Thursday –

Friday – GB: Retail Sales

Sunday – JP: Merchandise Trade, All Industry Index

How I am looking to trade?

Adjusting Collar trades by Bull Putting the long puts on the collar

Earnings Chart

BIDU 02/23 est

AOBC 03/02 est

Questions???

Most of what I’m trying to find are stocks that didn’t run last year

AND most of those happen to be what I was in last year= AAPL, BA, F, BIDU, BABA, DIS, V,

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Trump trade lifts stocks to more records as S&P reaches $20 trillion in market cap

Monday, 13 Feb 2017 | 4:21 PM ETCNBC.com

U.S. stocks climbed to new record highs Monday as investors remained bullish on President Donald Trump‘s economic agenda.

“The market is going on the optimism of the Trump tax plan that will be announced soon,” said Robert Pavlik, chief market strategist at Boston Private Wealth. “This is very good news for the market.”

The Dow Jones industrial average rose about 140 points, with Goldman Sachs contributing the most gains, to post its 22nd record close since Nov. 8. The S&P 500 gained 0.5 percent, with financials rising more than 1 percent to lead advancers, to notch its 14th record close since the U.S. election.

S&P also reached $20 trillion in market cap for the first time ever. It needed to break above 2,324.22 to reach the milestone, according to data from Howard Silverblatt, senior Index analyst at S&P Dow Jones Indices.

“The SPX extended its uptrend to a new all-time high last week, resolving another consolidation phase to the upside,” said Katie Stockton, chief technical strategist at BTIG, in a note. She added that “short-term overbought conditions are not likely to be a near-term hindrance, particularly given the widespread breakouts that have occurred.”

The Nasdaq composite advanced 0.5 percent as Apple shares closed at an all-time high. The index also posted its 23rd record close since Trump was elected.

“There is a bullish bias remaining in the market after Trump said there will be a phenomenal tax plan coming,” said Nick Raich, CEO of The Earnings Scout. “I think investors don’t want to be on the wrong side of that if the plan is as phenomenal as he says it is.”

Last week, Trump said his administration will be announcing a “phenomenal” tax plan over the next two or three weeks. Since then, equities have continued to grind higher into record territory.

“There is some momentum buying here on the resurgence of the Trump trade,” said Peter Cardillo, chief market economist at First Standard Financial, noting that stocks in Europe and Asia also traded higher on Monday.

Stocks had already rallied sharply since Trump’s election on hopes of not just corporate tax cuts, but also deregulation and government spending. But before last week’s break to new highs, U.S. equities had traded mostly sideways for more than a month as investors searched for clues about when these proposals would become reality.

There are no major economic data due Monday, but investors will be looking ahead to Federal Reserve Janet Yellen‘s testimony on Capitol Hill, slated for Tuesday.

“The Fed’s statement on February 1 didn’t provide any additional clues on monetary policy direction, and as of last week, markets were only pricing in 13.3% chance for a rate hike in March and 23.7% in May,” said Hussein Sayed, chief market strategist at FXTM, in a note. “… it’s going to be interesting on which side will Yellen move the needle.”

On the earnings front, Restaurant Brands International, Teva Pharma and First Data were among the companies posting quarterly results before the bell. Arch Capital Group, Noble Energy, Vornado Realty and OneMain Holdings are all due to report after the market close.

U.S. Treasurys traded lower Monday, with the benchmark 10-year note yield rising to 2.431 percent and the short-term two-year note yield advancing to 1.19 percent. The dollar rose 0.17 against a basket of currencies, with the euro near $1.0604 and the yen around 113.61.

Overseas, European equities traded mostly higher, with the pan-European Stoxx 600 index advancing 0.75 percent. In Asia, stocks closed higher, with the Nikkei 225 rising 0.41 percent and the Shanghai composite gaining 0.63 percent.

| Symbol | Name | Price | Change | %Change | |

| DJIA | Dow Industrials | 20504.41 | 92.25 | 0.45% | |

| S&P 500 | S&P 500 Index | 2337.58 | 9.33 | 0.40% | |

| NASDAQ | NASDAQ Composite | 5782.57 | 18.62 | 0.32% |

The Dow Jones industrial average gained 142.79 points, or 0.70 percent, to close at 20,412.16, with Caterpillar leading advancers and Verizon lagging.

The S&P 500 rose 12.15 points, or 0.52 percent, to end at 2,328.25, with financials leading 10 sectors higher and telecommunications lagging.

The Nasdaq composite advanced 29.83 points, or 0.52 percent, to close at 5,763.96.

About nine stocks advanced for every five decliners at the New York Stock Exchange, with an exchange volume of 798.70 million and a composite volume of 3.327 billion at the close.

The CBOE Volatility Index (VIX), widely considered the best gauge of fear in the market, traded near 11.1.

High-frequency trading accounted for 52 percent of February’s daily trading volume of about 6.8 billion shares, according to TABB Group. During the peak levels of high-frequency trading in 2009, about 61 percent of 9.8 billion of average daily shares traded were executed by high-frequency traders.

2 Clear Instances Of Irrational Exuberance

Feb. 12, 2017 7:52 PM ET

|

|

About: Amazon.com, Inc. (AMZN), FB

Long/short equity, value, contrarian, research analyst

(1,138 followers)

Summary

Companies that are innovative and at the center of an emerging industry are tempting to invest in, but in many cases they are exuberantly priced.

Investors should follow the well-know adage “Buy when everyone is selling and sell when everyone is buying.”

Although I have been a bull about these two stocks in the past, I now think it is time to take profits.

The U.S. stock market saw solid gains in 2016, buoyed by a post-election rally. Each of the three major stock indexes closed 2016 with gains, and the Dow Jones Index (NYSEARCA:DIA) is near all-time highs and has breached the 20,000 level.

The Shiller P/E ratio for the S&P 500 may indicate that the stock market is hitting worrying levels. The Shiller “cyclically adjusted price-to-earnings ratio” (CAPE) is calculated using price divided by the index’s average historical earnings, adjusted for inflation. This ratio is based on Yale economics professor Robert Shiller’s research, which found 10-year stock market returns were negatively correlated to high CAPE ratio readings on a relative basis.

Although I think the stock market will perform well under the Trump Administration, it is noteworthy that the current level on the Shiller P/E ratio was also reached before the 1929, 2000, and 2008 plunges. Whether or not you believe a stock market correction is imminent, this elevated level should provide investors with more caution in picking stocks and should push them to ensure they are not invested in overvalued stocks. With this in mind, I offer investors two stocks which I believe are significantly overvalued at the current trading level: Facebook (NASDAQ:FB) and Amazon (NASDAQ:AMZN).

(Source: Multpl.com)

Companies that are innovative and at the center of an emerging industry are tempting to invest in, but in many cases they are exuberantly priced. The prospect of dominating a growing industry brings hoards of investors willing to bid up the price of these nascent companies. The adage “Buy when everyone is selling and sell when everyone is buying” helps investors to avoid these securities. Facebook and Amazon are clearly companies that are inanely priced and should be avoided.

The proliferation of social media has clearly influenced the lives of billions. The operative question for investors to ask, though, is whether these companies are prudent investments. Many pundits opine this is a burgeoning trend that will be a cornerstone of society with near-limitless potential. The truth is that although it is clear that social media has become a cornerstone of society and Facebook has entrenched itself in the industry, at its current valuation FB is not a prudent investment.

I have been following Facebook since its IPO, and I have been bullish on the name since it languished in the high teens, following its share lockup period expiration (around 180 days after its IPO). I invested in FB through common shares and LEAPS call options.

My common shares have since gone up 5x ($23 cost basis), and my call options have appreciated more than 3,000%. I took half of my profits in the call options in 2014, for tax reasons. Subsequently, I sold the rest of my call options in late 2015, when the stock traded around $80 per share. (I would have held onto them longer but the options expired in mid-January 2015.) Despite having to take my profits derived from my call options, I remained bullish on FB and continued to hold onto my common shares.

However, I have subsequently sold off my entire position in Facebook, as I believe the stock has become overvalued. After having followed this stock so closely over the years, it was hard for me to say goodbye, but it is important not to let emotion cloud one’s investing judgment. As such, I have taken my profits and moved on from Facebook.

Time to Sell

Facebook stock has soared in the past few years, and I think now is the perfect time to take your profits. First, from a tax perspective, with capital gains and ordinary income tax rates expected to decline under the Trump Administration, investors with significant appreciation above their cost basis can lock in these gains at a lower tax rate then they could in 2016. Of course, those rates are likely to remain over the course of Trump’s administration, but I don’t think Facebook can maintain this trading level for much longer.

At the current trading level, Facebook’s market capitalization is a staggering $400 billion, which puts it as one of the most valuable publicly traded companies in the US. Investors are being overly sanguine about FB’s growth prospects, as it is trading at $134 per share, while it is only generating quarterly EPS of $1.44. There are a number of reasons, which I will discuss below, why I do not think FB will be able to justify its current lofty valuation.

Fake News Filtering Negative Impact

A risk that no one is really talking about is the impact from fake news filtering on Facebook’s bottom line. I believe the recent fake news fiasco will hurt the company’s revenue growth in the coming quarters. By filtering and removing fake news articles and click-bait sites, Facebook will face less demand for its ads. I do not have specific numbers, but it is probable that a number of these click-bait companies rely greatly on sponsored posts to direct traffic to their sites. By creating a wall to having sponsored posts, Facebook is limiting the number of advertisers who will purchase ads on its network. Therefore, the demand for FB ads is likely to be stilted by this initiative, which is very negative, especially considering the maxed-out ad rates, which I will discuss further below.

There is no doubt that the removal of fake news will improve the user experience and help society to disseminate more accurate information, but Facebook’s revenue will markedly be hurt by this change.

Furthermore, in the Q3 and Q4 conference calls, CFO David Wehner guided that 2017 will be a year of assertive investment and higher expenses. Slower revenue growth, coupled with higher expenses, should provide investors with caution.

Market Saturation

Over the past decade, Facebook has experienced tremendous user growth. This has allowed it to charge more for its ads, since there was growing demand from advertisers to get into more News Feeds and increase their reach. However, as of December 2016, FB reached 1.86 billion monthly average users. With such a massive base of users already, it is difficult for FB to grow its user numbers much further. With roughly 3.5 billion people on the planet having access to the internet, it has already garnered over half of that market.

(Source: Facebook Conference Call)

Moreover, Facebook appears to have reached a saturation in terms of the percentage of monthly active users that are daily active users, with it being stuck at 66% since Q1 2016. Therefore, with engagement levels appearing to be saturated as well, the company will struggle to generate more advertising dollars from each user.

(Source: Facebook Conference Call)

Many bulls may argue that Facebook still has the other roughly 1.7 billion users to add to its platform. However, as shown in the chart below, the average revenue per user in these other countries is much lower. The US and Canada segment remains leaps and bounds above other continents in terms of average revenue per user.

(Source: Facebook Conference Call)

Moreover, FB bulls have been arguing that Facebook’s Internet.org initiative will bring on many more users to its platform once it provides internet access to them. Again, however, these users will not provide much incremental revenue. The average revenue per user in the rest of world category, which includes developing countries, was only $1.41, which is a far cry from the $19.81 for US and Canada users.

Additionally, the growth in average revenue per user from Q3 2016 to Q4 2016 was prodigious. Although this is a positive in one sense, it does provide me with caution when coupled with the engagement levels appearing to stagnate and rhetoric from CFO David Wehner, during the company’s Q3 conference call, that expectations for ad load will “play a less significant factor driving revenue growth after mid-2017.”

It is important to realize that he guided for ad loads not being maxed until mid-2017, which means that impact didn’t affect Q4, but will cause stagnating growth moving forward. In fact, during the Q4 conference call, Mr. Wehner said “ad load also contributed to our strong results.” He also cited user growth and time spent on Facebook as drivers, but as I outlined above, I believe those will not be significant revenue drivers moving forward either.

To me, that statement means that FB management believes it has maxed out its ad load rate. With FB constantly testing how its changes impact user behavior, it is likely that management has reached an optimal ad load rate, and increasing it further will have an adverse effect.

With Mr. Wehner later providing color that ad load has been one of the three primary factors fueling advertising growth in the past, that statement is rather alarming.

Final Remarks on Facebook

Facebook has been one of my favorite investments, but all good things must come to an end. It has been a great ride, but with growth concerns being pronounced, it will be difficult for FB to justify its current, lofty valuation. Time to pull the trigger and take your profits.

Amazon

Amazon’s prevalence in the news is astounding. The number of new business avenues the company is entering is staggering. It is entering industries, from grocery delivery to content creation, and even just released a retail store plan called Amazon Go. With quarterly revenue of over $22 billion and many new initiatives being launched, investors are willing to pay a significant premium for this stock. With an annualized P/E ratio of approximately 660, it is evident that investors are sanguine about this company’s prospects. Although I believe Amazon is an innovative company with a unique business model, I do not believe this valuation is justified.

Cash Flow Valuation

CEO Jeff Bezos has advised AMZN’s valuation must not be analyzed with respect to its price-to-earnings multiple alone. Mr. Bezos explained that “percentage margins are not one of the things [they] are seeking to optimize. It’s the absolute dollar free cash flow per share that you want to maximize. If you can do that by lowering margins, we would do that. Free cash flow, that’s something investors can spend.” As the chart below indicates, it appears Amazon has done an exceptional job of generating free cash flow.

AMZN Free Cash Flow (Annual) data by YCharts

However, even valuing AMZN on this metric shows it is overvalued on a relative basis. It is notable to mention Amazon is currently trading at a much higher price-to-free cash flow multiple than other technology companies. For example, AMZN’s price-to-free cash flow is nearly 3x Microsoft’s (NASDAQ:MSFT) and considerably more than Google’s (GOOG, GOOGL). Although, one may argue Amazon is experiencing more growth than those companies. By comparison, Google’s revenue growth is not too far off, and both have considerably higher margins, which provide for more sustainable growth.

Additionally, it is worth noting that Amazon is trading at a significantly higher cash flow multiple than its retailer competitors. Once again, its growth is much higher than Wal-Mart’s (NYSE:WMT) and Target’s (NYSE:TGT), but this gives an indication of what multiple Amazon will trade at once its growth begins to slow down.

AMZN Price to Free Cash Flow (Annual) data by YCharts

The primary reason there is trepidation on my part about Amazon ever justifying this lofty valuation is because it competes in industries that are categorized by fierce competition: retail, shipping and technology.

The company’s incredibly low profit margins are evidence of this intense competition. Bulls argue that once Amazon beats the competition in the various industries, it will be able to enjoy pricing power. However, as soon as it begins to increase its prices, competition will erode these margins away. With Amazon not having any significant competitive advantages in these industries, it will continue to suffer low margins.

I will now delve into a couple of examples of the company’s recent initiatives and explain why it will not exhibit pricing power in these segments.

Amazon Fresh

Amazon’s grocery delivery initiative, Amazon Fresh, was released in August 2007 and has slowly expanded from its initial location in Seattle to select cities in California, and most recently, Boston and the UK. Along with the delivery service, Amazon launched Dash, which will enable customers to scan items to instantly add them to their queues. The device will create an ease of purchase and has the potential to turn families into habitual Amazon grocery purchasers. This industry, which is categorized by low margins, will not be a cash cow, but certainly has the ability to be accretive to the company. The number of infrastructure investments required to make this a significant contributor to the bottom line is staggering, however.

(Source: Amazon Fresh)

Amazon Web Services

Furthermore, Amazon Web Services (AWS) has been a hugely profitable segment for AMZN in the past. However, with the influx of competition, the industry is being commoditized. In the last quarter alone, the company experienced a slowdown in this segment, with 47% y/y growth, down from 69% in the same period a year ago.

During the earnings call, in the Q/A session, management discussed how price cuts impacted AWS’s quarterly segment results, saying “we had seven price cuts in Q4, essentially timed for December 1, so about 1/3 of the impact was seen in Q4.” That means Q1 2017 will bear the brunt of those cuts. Moreover, management went on to say that cuts are “going to be constant in this business.” With price cuts further cutting into the profitability of this segment, I believe this will weigh on AMZN’s profitability moving forward.

(Source: Earnings Call Presentation)

Content Investments

To provide enough value to Amazon Prime Members, the company has had to invest substantially in content. Moreover, during the earnings call, management discussed the company had stepped up investment in the second half of last year, including spending marketing dollars to grow its Prime Video customers. Additionally, management guided that it “will continue to invest in 2017 and likely beyond.”

Investing in this content is necessary for the company to provide Amazon Prime Members with enough value to continue their membership. However, the competition for content continues to heat up, and as such, the prices for this content will rise and impinge upon profitability as well as free cash flow.

Netflix (NASDAQ:NFLX) is the most obvious competitor for video content. However, Hulu, which is co-owned by Disney (NYSE:DIS), Comcast (NASDAQ:CMCSA), Fox (NASDAQ:FOX) and Time Warner (NYSE:TWX), has been becoming a bigger player in the market and has gained a number of exclusive rights of late. For example, in late December, Hulu signed a multi-year deal to be the exclusive streaming home of dozens of movies, such as Mulan, Pocahontas and Hercules.

With respect to music content too, Amazon faces competition from numerous players. The notable competitors are Apple (NASDAQ:AAPL), Pandora (NYSE:P) and Spotify (Private:MUSIC), but there a number of other smaller competitors as well. Moreover, Sprint (NYSE:S) just entered the industry as a competitor with its $200 million purchase for a 33% stake in Jay Z’s music streaming service. Moving forward, Amazon will have to pay substantially more for content, due to this added competition, which will impinge upon margins.

Final Remarks on Amazon

With the company facing competition from numerous fronts, its profitability and growth from the important AWS segment has been declining, and will likely continue to as well. Additionally, with the top line not growing as fast as analysts have been expecting, and rising content costs impinging upon the profitability of gaining Prime Members, I am bearish on Amazon’s future.

Bottom Line

With the market reaching levels which suggest frothy valuations, it becomes increasingly important to find undervalued opportunities. I believe Facebook and Amazon are certainly not such opportunities and should be avoided at their current trading levels. Remember, “Buy when everyone is selling and sell when everyone is buying.”

Note: To get my latest updates, just click on my profile and hit the “Follow” button.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

About this article:

Expand

HI Financial Services Commentary 04-13-2016