Trade Findings and Adjustments 03-11-2021

https://www.cnbc.com/2020/10/30/michael-farr-spacs-are-the-new-market-bubble.html

Michael Farr: SPACs are the new market bubble

PUBLISHED FRI, OCT 30 20202:15 PM EDT

Michael K. Farr@MICHAEL_K_FARR

Market bubbles are always a surprise and always expected.

They build in plain view, and ignoring them requires greater and greater effort as they inflate. Onlookers are shocked when they eventually burst, and the weird thing about these unnoticed air pockets is the way they sneak up on you from new and unanticipated areas.

The dotcom bubble grew in a nascent area of technology that was exciting and magical. It reminded me of the rules from the show “Whose Line Is It Anyway?: Where everything is made up and the points don’t matter!”

During the late 1990s, as share prices soared for companies that hadn’t existed even three years before and had silly names like Yahoo and Google, experienced investors and Graham and Dodd disciples like Warren Buffett scratched their collective heads as they were told to ignore more traditional valuation metrics, such as price-to-earnings and price-to-book ratios.

This was a new world where value was determined by the number of clicks and the number of eyeballs a website received.

When old-school disciplined investors questioned the soaring valuations (as measured by traditional metrics), they were dismissed as “not getting it.”

Warren Buffett was said to be getting old and clearly losing a step. But the soaring prices ultimately demand a rationalization, and in the late 90s it was a “paradigm shift” or “new paradigm.” The answer for nonsensical prices was a new nonsensical term uttered with gravitas. It’s a new paradigm. And we were all supposed to nod at the new emperor’s beautiful clothes.

Two new arrivals, or perhaps more accurately, old arrivals given seeming a resurrection as part of another “new paradigm” on today’s investment scene are making my warning system tingle. Though it could be lumbago at my age, I’m beginning to worry about the proliferation of Special Purpose Acquisition Companies, or SPACs, and a metric called the Total Addressable Market, or TAM.

According to Investopedia, a SPAC is “a company with no commercial operations that is formed strictly to raise capital through an initial public offering (IPO) for the purpose of acquiring an existing company.”

Also known as “blank check companies,” SPACs have been around for decades.

In recent years, they’ve gone mainstream, attracting big-name underwriters and investors and raising record amounts of IPO money. In 2020, more than 50 SPACs have been formed in the U.S., raising some $21.5 billion as of the beginning of August.

These funds will be invested by the SPAC on a company or companies to be named later by the expert investment team.

SPACs are dangerous investment vehicles.

Effectively they are a publicly accessible hedge fund. Investors (and I use the term loosely) are investing in the acumen of the company directors who are operating without a business plan but looking to invest/merge with those companies that do. And they are doing so with stock valuations at historically high valuations (especially for those companies most likely to be target acquisitions for SPACs)!

Total Addressable Market, or TAM, is a term that investment analysts use to frame the maximum potential sales universe for a given product or industry sector.

For example, when evaluating a new company that manufactures an innovative new needleless, pain-free injection system, the TAM would include the entire market for flu shots, insulin, tetanus, etc., along with the potential demand for syringes that will be required for the COVID 19 vaccines. An especially creative analyst might even add the potential market demand from illegal heroin use.

An analyst relying on TAM is eager to point out that a growing company in a growing industry has more to recommend than a growing company in a shrinking industry. And that makes sense up to a point.

It is rational to identify sources of potential upside for any company; indeed identifying potential avenues of growth is essential for diligent management. Finance professionals call these kinds of potential but uncertain sources of upside “real options.”

It is perfectly reasonable to be aware of these real options when making investment decisions, but it doesn’t make sense when it is relied upon to the exclusion of the more traditional valuation metrics.

When valuations become bubbly, investors clamor for a new-paradigm explanation to justify sky-high prices that don’t make sense. And what we’ve consistently seen over the years is that when pressed for the need to justify the unjustifiable, analysts and investors can be very creative in coming up with new ways to follow the herd.

I was criticized recently as being one of those stodgy guys who didn’t understand the importance of TAM.

It was posited that I never would have bought Amazon and other tech stocks 25 years ago because I would have been looking for earnings when there were none. By ignoring the TAM for Amazon, for example, I wouldn’t have bought it.

In this case it turns out the critic was correct.

I didn’t buy Amazon until it had real earnings almost 20 years later – after it had proven it could turn the potential of TAM into real revenues and real earnings.

While I lost out on the early years of huge gains in that stock, that same discipline that relies on sound fundamentals also kept me from buying dozens and dozens of other companies that are no longer in business (remember TheGlobe.com, JDS Uniphase and Pets.com?).

Lots of people made a lot of money on JDS Uniphase. But there were buyers of the stock at $153 a share. And a few months later it was at $2.

In 2016, Hollywood stuntman Eddie Braun decided he wanted to jump over the Grand Canyon on a motorcycle. He succeeded, but that doesn’t mean it was a good idea to try it in the first place!

In the same vein, many people have made good money (and will continue to do so) flipping speculative stocks that are short on sound fundamentals. But that doesn’t mean that those were sound investment decisions. If you want to gamble, go to Vegas!

Watching the funds that are flowing into SPACs along with the rise of TAM as a way of getting around fundamental valuations is making me remember market bubbles past.

There were different explanations for the Nifty Fifty in the 1970s and the housing speculation that was fueled by no-doc and sub-prime mortgages and off-balance sheet SIVs in the mid 2000s. I’ve seen it before. It ends painfully.

During the housing and banking bubbles of 2007, I wrote my second book, “The Arrogance Cycle:”

If you think you can’t lose, think again. It’s worth dusting it off. One of the things I wrote about was the haughty, meanness of arrogance.

“Arrogance was epitomized by that know-it-all kid in your class who was always waving his hand with or without the correct answer. Arrogance was the supremely confident athlete of modest ability who sneered at lesser players and wouldn’t let them on his team.”

Arrogant know-it-alls don’t brook questions or fact-finding. They want to bully you back into line.

The strains of SPACs and TAM are striking chords of warning for me. And while it’s clearly a different tune, it rhymes.

Our clearly articulated investment discipline demands earnings growth, strong returns on equity, reasonable amounts of debt, and strong balance sheets.

These touchstones of healthy companies have seen us through decades of sunny and stormy market days.

Total Addressable Market is not irrelevant, but it is only a small part of evaluating growth and the justification of debt. It is not, by any stretch of the imagination, the central metric for investment suitability.

We are very comfortable with our current holdings, and our research never stops: searching for new opportunities, but also always questioning if our current holdings still justify our investment thesis.

When folks begin to argue that it’s different this time, be scared. Be very scared. Stick to your discipline and stay focused on your long-term goals.

—CNBC contributor Michael Farr is CEO of Farr, Miller and Washington. See disclosure.

https://seekingalpha.com/article/4396737-5-dangerous-bubble-stocks-dont-be-bag-holder

5 Dangerous Bubble Stocks: Don’t Be The Bag Holder

Dec. 30, 2020 1:03 PM

- Trees do not grow to the sky. Consider taking gains on some of the high flyers.

- Beyond growing market share, there are a multitude of other factors that need to go right for these companies to become profitable.

- In these particular names I see problems related to unit economics, lack of barriers to competition and increasing regulation.

I am hereby delivering a warning that much of the market is in bubble territory. The unfortunate truth is that those who benefit from the bubble’s inflation are rarely the same entities as those left holding the bag. In the past it has been institutions who ride the bubble up and pass the high-priced shares off to inexperienced individual investors for the way back down.

That’s why we are here on Seeking Alpha today, educating ourselves so that we are not the bag holders. To that end, I will discuss what I view as the five most dangerous bubble stocks, but first I want to discuss a topic that I feel is broadly misunderstood, what a bubble actually is.

I feel like most people consider a stock market bubble to be just an extreme form of overvaluation. This is an understandable viewpoint because these stocks are in fact extremely overvalued, but there’s more to it than that. A bubble and the thought pattern that allows it to form is a fundamentally different concept than overvaluation.

In any valuation there’s some wiggle room and some judgment calls so fully qualified, intelligent analysts will often come up with different fair value numbers and these can frequently be as much as 50% different. Maybe one analyst thinks it will grow at a CAGR (compound annual growth rate) of 3% and another thinks it will be 5%. When combined with different discount rates due to differing perceptions of the level of risk, this can result in widely different fair value estimates.

These sorts of discrepancies in outlooks result in overvalued and undervalued stocks depending on where the market consensus lies relative to the reasonable range of expected outcomes.

A bubble is not caused by the market being a bit optimistic on its assumptions. Bubbles are caused by a fundamentally different thesis in which the view is that X stock will take over the world.

- Digital currency will replace the U.S. dollar as the dominant currency

- Electric vehicles will eliminate ICE

- Marijuana will displace a large portion of modern medicine

- Marijuana will replace alcohol and tobacco as the recreational drug of choice

- Space travel will become the new logistics platform

- Space tourism will displace beach vacations

- Home-sharing will replace the hotel industry

- Ride-sharing will eliminate the need for personal vehicles

- Autonomous driving will replace human drivers

- Plant-based meat will replace animal meat

- Food delivery will fundamentally alter consumption patterns

- Gyms, calisthenics, and merely going for a jog will be replaced by digital workout platforms

- Video conferencing will replace in-person meetings

Bubble stocks require changes at a level that’s the economic equivalent of the laws of physics. The extremity of these stock prices requires a sea change in consumer behavior and, in some cases, even changes to international laws.

I don’t mean to suggest that all of these stocks are doomed. In most bubbles there are some winners. Back in 2000, Amazon (AMZN) participated in the dot com bubble and it too had a very bubble style “take over the world” thesis:

– Amazon will displace a massive share of retail:

Well, 20 years later, Amazon sort of did take over the world. Clearly those who were smart enough or lucky enough to be in Amazon did phenomenally well.

Results like that are rare and the vast majority of the dot coms failed miserably. Quite frankly, changing the world is hard, and even well-run companies attempting to do so are in for quite a challenge.

The problem, and why the bubble in these spaces is so dangerous for the overall health of the market, is that all of these valuations are based on a hypothetical total addressable market. Further, even when/if the potential disruption happens there are often no mechanisms to ensure that the disruptor is the one who captures the value.

Thus, the five most dangerous bubble stocks are those that are likely to fail even if the anticipated sea change happens.

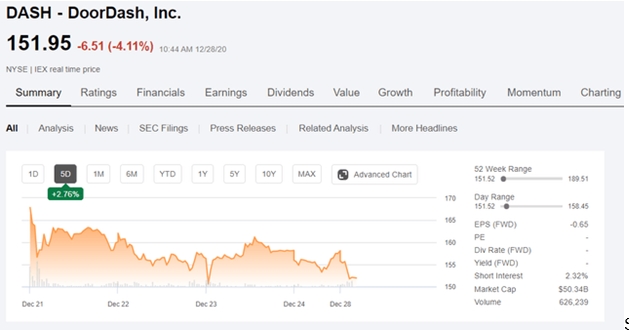

#1 DoorDash (DASH)

#2 Zoom Video Communications (ZM)

#3 Aphria (APHA)/Tilray (TLRY)

#4 Airbnb (ABNB)

#5 Uber Technologies (UBER)

The Unit Economics problem – DASH and UBER

DoorDash has quickly become the leader in the food delivery space and it seems as though they simply out-executed Uber Eats and other competitors. So in stating my bearish viewpoint I want to make it clear that I consider DoorDash to be best of breed. It’s simply the case that the unit economics of food delivery just don’t work.

Over the past few years, the number of delivery orders has grown dramatically. This makes it appear as though the space has long-term viability. However, much of the growth came from two factors that are not sustainable:

- COVID-19 made stay at home mandatory or close to mandatory for many, thereby creating unnaturally large demand for food delivery.

- Special promotions and negative margins have made delivery prices palatable to consumers.

I think most would agree with me that COVID-19 is a temporary demand driver. The second point is where I want to spend some time diving in. All of the major food delivery companies have been running at margins that are not sustainable in an attempt to capture market share. This has created an artificial growth in demand volume.

Frankly getting dinner delivered is a highly elastic service and the volume of demand at a price point of $3-$5 delivery is much higher than the demand at $10-$15.

Demand has spiked because these companies have done so many promotions that delivery costs to consumers have been roughly in that $3-$5 range. This price point is not enough and leads to the delivery companies having negative earnings. As seen below, even DoorDash, which has the greatest market share and is the best run of its peer set, has negative earnings

Consider the full variable cost of delivering food.

- 15-45 minutes of driver time

- Gas

- Wear and tear on vehicle

- Liability insurance to protect against delivery crashes/damages

Depending on location that’s at least $8. If we factor in the overhead of having to create and maintain the massive logistics network, there needs to be significant gross margin over variable cost to make these companies profitable.

Thus, the viable delivery fee range is somewhere north of $10 and at that price point demand falls off substantially. Who is going to order a $6.50 meal at Taco Bell and pay $10 to have it delivered?

I’m sure some people will, but it isn’t going to be enough to justify anywhere close to a $50B market cap. In order for DASH to work as a stock, demand growth would have to continue to be explosive and an enormous percentage of the population would have to be OK with paying $10-$15 delivery fees.

That’s a tall ask and I don’t see it happening. $50B is far too much for a company that may never be profitable.

UBER has the same problem for the same reasons in its Uber Eats division, but it also has a unit economics problem in its ride-sharing business.

Even as the most established player in the space and a $93B market cap, UBER is still showing negative profitability.

I fully understand the concept of a subscale company being not yet profitable, but UBER is massive and fully scaled up. Adding volume will not make it profitable. They need to improve gross margins per ride.

Unfortunately, margins are being squeezed from both sides. Customers have gotten used to a certain price point, and since UBER is still competing with Lyft (NASDAQ:LYFT) and traditional taxis for market share, raising prices could be detrimental.

On the cost side, UBER already is on thin ice. After factoring in gas and wear on vehicles, wages to drivers are extremely low, leading to driver protests. UBER has temporarily calmed the storm by scoring a big victory in November when Proposition 22 passed which allowed the workers to continue to be classified as contractors rather than employees.

UBER and Lyft both rose dramatically on that day, but I view it as more of a pyrrhic victory as an extreme amount of lobbying capital was spent to win that vote (InsuranceJournal pegs it at $200mm spent). More importantly, the current compensation scheme is still too low and it’s only a matter of time before the protests or just rising minimum wages in general force UBER to better compensate its drivers. So with it being difficult to raise prices and costs likely trending up, I don’t see any pathway where UBER can become sufficiently profitable to justify its $93B valuation.

Let us say, for example, that videoconferencing continues to dominate business travel and almost entirely replaces in-person meetings. Further let us assume this behavior continues after the pandemic. That still in no way means Zoom Video will be the winner.

Zoom is presently barely profitable because the monetization of their services is still in the early innings. It’s very easy to get everyone to want to use what’s admittedly a great service for free but quite a bit harder to get them to pay for it when there are so many free versions available.

Unlike DoorDash, this is not a unit economics problem. The variable cost for Zoom is just some processing/server space which is not all that substantial and the value to the consumer can be quite high. Thus, there’s a fairly large range in which both the consumer and the producer obtain a large surplus.

Instead, the problem is on the competition side. There are almost no barriers to stop other larger competitors from coming in and offering a lower price point than what Zoom would need to offer to make sufficient profits.

Since variable costs are so low, it will be a race to zero in which the videoconferencing companies monetize their services at progressively lower price points. Since much of the service already is free, what I mean by this is progressively more features will be offered for little or no money.

The endgame winner will be the consumer, continually having access to great products for little to no cost.

When Google (NASDAQ:GOOG) (NASDAQ:GOOGL), Microsoft (NASDAQ:MSFT) and other truly massive companies are competing in the videoconferencing space, I just don’t see how Zoom can successfully monetize to a great enough degree.

Hats off to Zoom for advancing the space in terms of quality of product and ease of use, but that can so easily be replicated that there are no barriers to others outcompeting Zoom.

A $107B market cap demands that Zoom not only maintain a massive market share, but can somehow monetize it to a far greater degree despite mounting competition from the giants.

Aphria/Tilray (the companies are merging) is in a similar boat in that there’s no mechanism to protect the incumbents from new entrants.

I’m personally skeptical about the safety/efficacy of marijuana-based products whether it’s medicinal or recreational. However, this skepticism is not required for my bearish stance on these stocks.

Even if the products are great, the real challenge to those already in the space will be full legalization in the U.S.

Full legalization is coming to the U.S., and as we have seen in Canada, (where legalization is much further along) when that happens, anyone can pour into the space and disrupt the high gross margins that are being enjoyed today. Large swaths of farmland can be converted to grow cannabis and just about any retail space can become a dispensary.

Supply of anything cannabis will be high and prices will fall dramatically.

I believe the market may have conflated volume growth with profit growth in this space. It may very well be the case that sales volumes will increase explosively for the foreseeable future, but because of the upcoming supply glut, it simply will not translate into sufficient profits.

At just a couple of billion of market cap, these aren’t of the same magnitude as the other bubble stocks we are discussing today, but the investment case looks rather ugly. Profits are negative today and increasing legalization is poised to make profitability even worse.

Scale is not the key to margins – Airbnb

ABNB is not yet profitable.

With many of these fresh IPOs, I feel like negative earnings are brushed off a bit too early. The general assumption is that they are young and growing and that once they reach full scale they will be profitable.

Well, with Airbnb it already seems to be at full scale. It has global listings and is the biggest hotel alternative booking platform in the world. Let us put its size into perspective by comparing its $93B market cap to that of the long-time hotel industry leaders.

Marriott (NASDAQ:MAR) – $41B

Hilton (NYSE:HLT) – $29.5B

Host Hotels and Resorts (NASDAQ:HST) – $10.1B

Hyatt (NYSE:H) – $7.3B

If being more than twice the size of Marriott is not scaled up I don’t know what is. I see competition as a continued source of margin pressure going forward.

Competition

The nature of the business is that people use Airbnb to temporarily rent out their owned real estate. The real estate and the location are controlled by the individual and that person is incented to rent it out on whatever platform gives them the biggest cut.

Thus, there’s an inherent price competition between ABNB and others like Home Away as well as some of the traditional hotel brands which are getting into the home rental game.

This dynamic will continually squeeze the percentage fee that ABNB can take on its listings.

Here’s ABNB’s profitability so far.

One could argue that the $650mm loss in the trailing 12 months was pandemic-related, but it was still a loss of $486mm in 2019.

Beyond the profitability issues, I find it rather absurd that a company with $4.8B annual revenue pre-pandemic or $3.6B in trailing 12 months could be worth a $93B market cap.

This pricing means that in order to grow into its valuation, ABNB not only has to multiply its revenues, but it has to also find a way to dramatically improve profit margins.

Growing both revenues and margins to that degree is quite a challenge, and because so much success already is baked in I don’t think investors are being properly compensated for that risk.

Wrapping it up

Perhaps some investors are extremely brilliant and can somehow pick the next Amazon, but the majority of these bubble companies will not take over the world and will never grow into their ample market capitalizations. There are just too many layers of difficulty to have that level of growth.

- The originally predicted disruption must happen.

- This disruption must somehow be defensible such that the disruptor captures the value rather than a disruptor of the disruptor.

- The margins which are currently negative for most of these must somehow turn positive and customers must still want the product at the new price point.

Caveat Emptor – the exciting growth stocks may not be as great as they seem.

Rather than investing in these bubbly stocks, consider a different style of investing in which the stock prices are fully justified by strong and growing earnings. At REIT Wealth Builder I select profitable, reliable businesses to build a growing stream of dividend income.

Commentary: Stock Trades Take Days to Settle. Unnecessary Risk Results.

“The three-day delay creates the potential for the systemic failures that became visible in the recent meme stock trading saga”

At the height of the GameStop frenzy, the platform Robinhood had to restrict trading. The organization that cleared its trades had demanded it put up more capital. That’s a prime example of how the structure of the settlement system traps otherwise useful resources, says former senior Nasdaq executive Eric Noll.

“During those three days, risk is being carried by people other than the customers who made the trade,” Noll writes in a Barron’s commentary. The problem is inherent in the system known as T+2, under which trades settle on the trade date plus two days.

Moving to real-time settlement could release up to $13 billion a day, according to the Depository Trust & Clearing Corporation. Doing so would be complex and expensive—and it should happen anyway, says Noll. “These reasons are all red herrings.” If anything good comes of the meme-stock saga, let it be this.

—Matt Peterson

David Tepper is getting bullish on stocks, believes rising rates are set to stabilize

PUBLISHED MON, MAR 8 20218:07 AM ESTUPDATED MON, MAR 8 20219:19 AM EST

KEY POINTS

- Tepper, founder of Appaloosa Management, said it’s very difficult to be bearish on stocks right now.

- He thinks the sell-off in Treasurys that has driven rates higher is likely over.

David Tepper, founder of Appaloosa Management whose comments have been known to move markets, said it’s very difficult to be bearish on stocks right now and thinks the sell-off in Treasurys that has driven rates higher is likely over.

The major market risk has been removed, Tepper said, adding that rates should be more stable in the short term.

“Basically I think rates have temporarily made the most of the move and should be more stable in the next few months, which makes it safer to be in stocks for now,” Tepper told CNBC’s Joe Kernen, who shared the comments on “Squawk Box.”

Bond yields have jumped sharply over the past few weeks amid higher inflation expectations, which put pressure on risk assets. The 10-year Treasury yield climbed from 1.09% at the end of January to above 1.60% on Monday. The swift advance in yields hit tech stocks particularly hard as these companies have relied on easy borrowing for superior growth.

Tepper believes Japan, which had been a net seller of Treasurys for years, could start buying the U.S. government bonds again following the surge in yields. The potential buying could help stabilize the bond market, Tepper said.

“That takes a major risk off the table, and it’s very difficult to be bearish,” Tepper told Kernen.

Another bullish catalyst for stocks in the near term is the coronavirus fiscal stimulus package that was just approved by the Senate, Tepper said.

The Democrat-controlled House is projected to pass the $1.9 trillion economic relief and stimulus bill later this week. President Joe Biden is expected to sign it into law before unemployment aid programs expire on March 14.

The hedge fund manager also said “bellwether” stocks like Amazon are starting to look attractive after the pullback. Shares of the e-commerce giant have fallen 9.7% over the past month, while Apple has dropped more than 11% during the same period.

A year ago before stocks really began to drop because of the pandemic, Tepper warned that the virus could be a game changer for markets.