Trade Findings and Adjustments 3-10-2020

In ALL Honesty the market is stacked against you

You buy a position and you have a one out of three chance to make money IF the position goes up

IF it is sideways or down you lose money 1 out of 3 = 33% chance to be profitable

IF you trade only options you have 1 out of 5 chance with volatility, time decay, theoritcal data

WHAT do you do to beat the market odds

The reason why we collar trade is some form and add shares with long put profits

80% of the Portfolio should be in collar trades

10% Spreads and 10% cash

Collar trading and/or long put profits

Stock purchased @ $100 per share and 1000 shares = $100,000

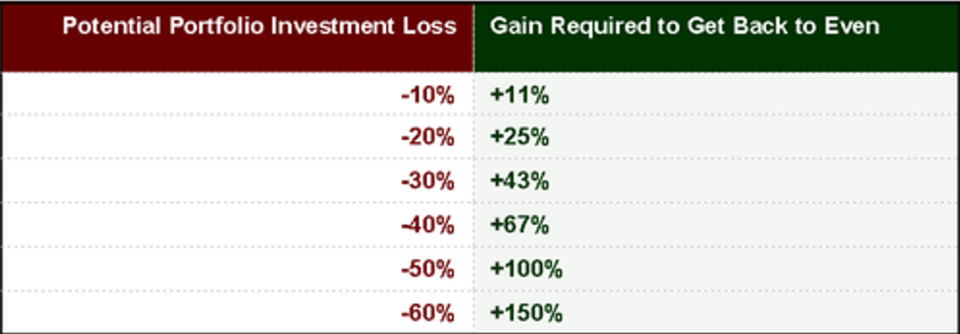

Loses 10% = 90,000

Loses 20% = 80,000

Loses 30% = 70,000

Loses 40% = 60,000

Loses 50% = 50,000

SO let’s BTO a long put for earning roughly 3 months out in time 6%

We buy a $100, 3 month out in time long put for $6,000

So we lose 35% like BA, F, AAPL, BAC,

Stock is worth $65,000 or $65 per share of stock

IF you have the long put it will worth at least $35,000

That if the long put value is 38,000 you have the opportunity to add more shares

WHY is this important?

IF you take out the cost of the long put you have 32K in profit

NOW IF you DON’T add shares and the stock gets back to 100K you will have 132K or a 32% ROI

Here is your SECRET

32K/65 = 492 shares of stock

You add 500 more shares of stock to your position

You now have 1000+new almost 100% paid for 500 shares and the stock takes off

1500 @ 80 = 120K

1500 @ 90 = 135K

1500 @ 100 = 150K

THIS IS the POWER of the Collar Trade

You need at least 300 shares to expect to add shares when collar trading

ANYTHING you make to the downside is profit when stocks come back up

www.hurleyinvestments.com www.myhurleyinvestment.com www.KevinMhurley.com