Trade Findings and Adjustments 07-11-2019

Earnings are coming up so I would be looking to be in collar trades or protective puts

My little slush fund account has no stock ownership, only options which are NOT marginable.

Which means I need to find a stock /ITM CC/ Protective Put stock ownership earning play

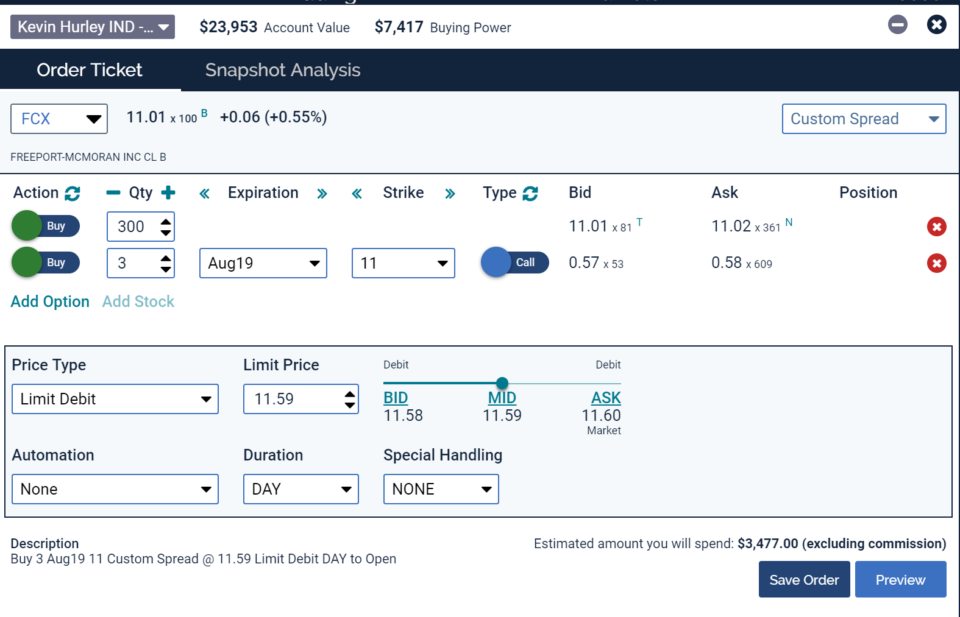

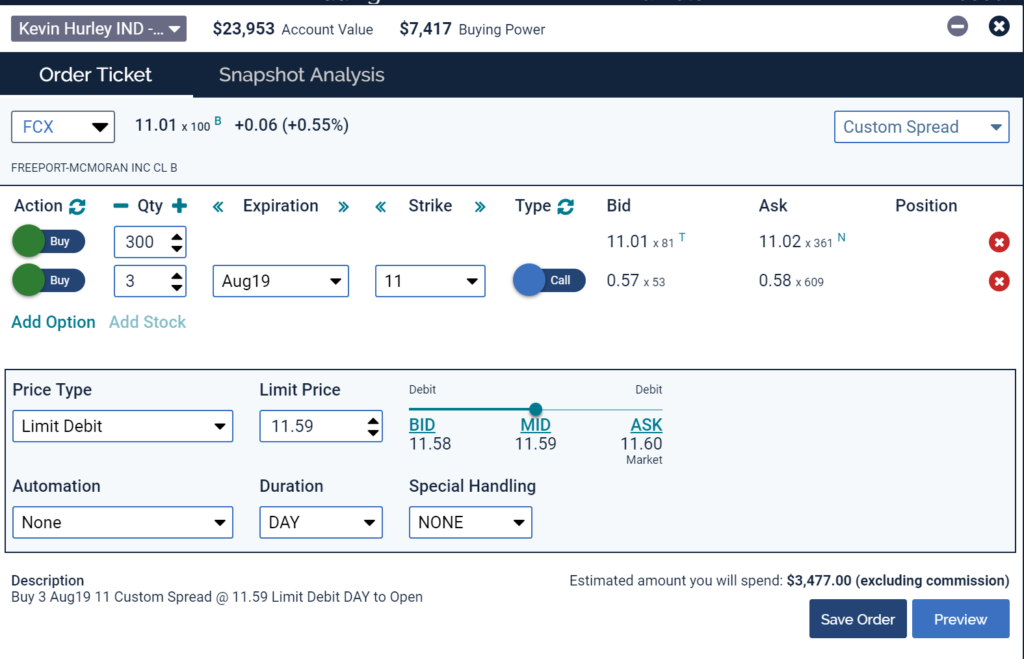

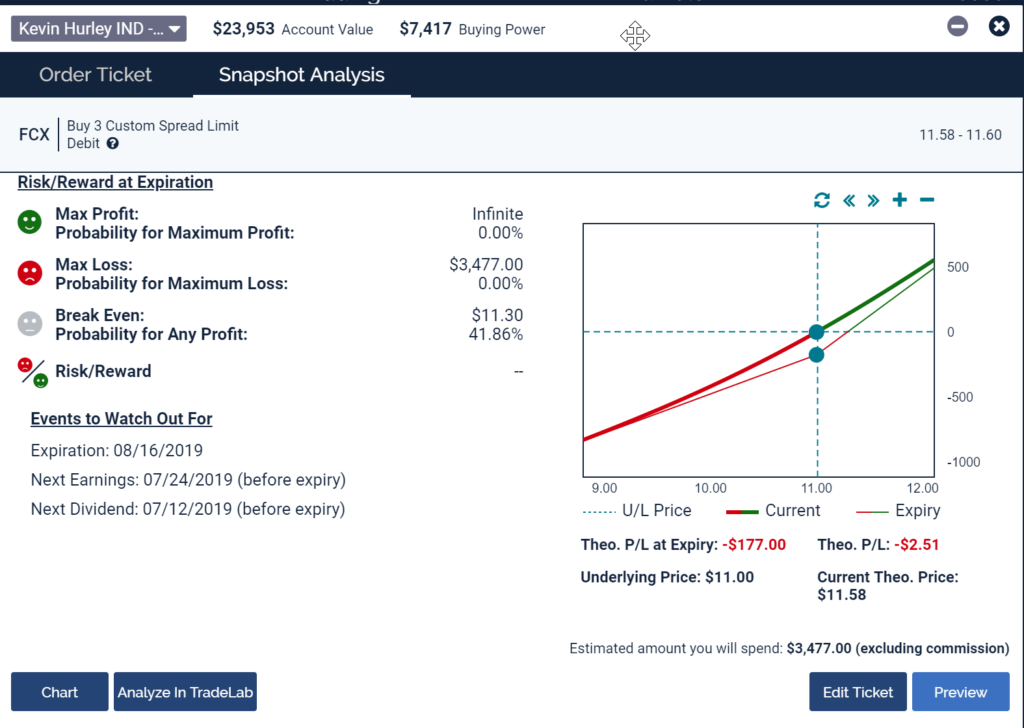

FCX Protective Put

BIDU vs BABA

Which one is better?

BIDU / Metric/ BABA

2.91M shares traded 17.47 = BABA

1.60 Beta 2.31 = BIDU

349.51 M outstanding shares 2,592.18M = BIDU

8.65 Earnings 4.98 = BIDU

13.23 Valuation 33.52 = BIDU

46.21 Profit Margin 45.09 = BIDU

14.17 ROE 20.42% = BABA

15.83 NET Profits 21.14 = BABA

15.60 Insider ownership 48.49 = toss up BABA

79.90 Institutional Owner 42.90 = BIDU

0.00 Short Float 6.36% = BIDU www.hurleyinvestments.comwww.myhurleyinvestment.comwww.KevinMhurley.com