Trade Findings and Adjustments 06-23-2020

#1 “Time to be patient when it comes to putting more money to work” – by Kevin Hurley…06-09-2020 Trade Findings and Adjustments. I still haven’t gotten into the BA leap calls yet at

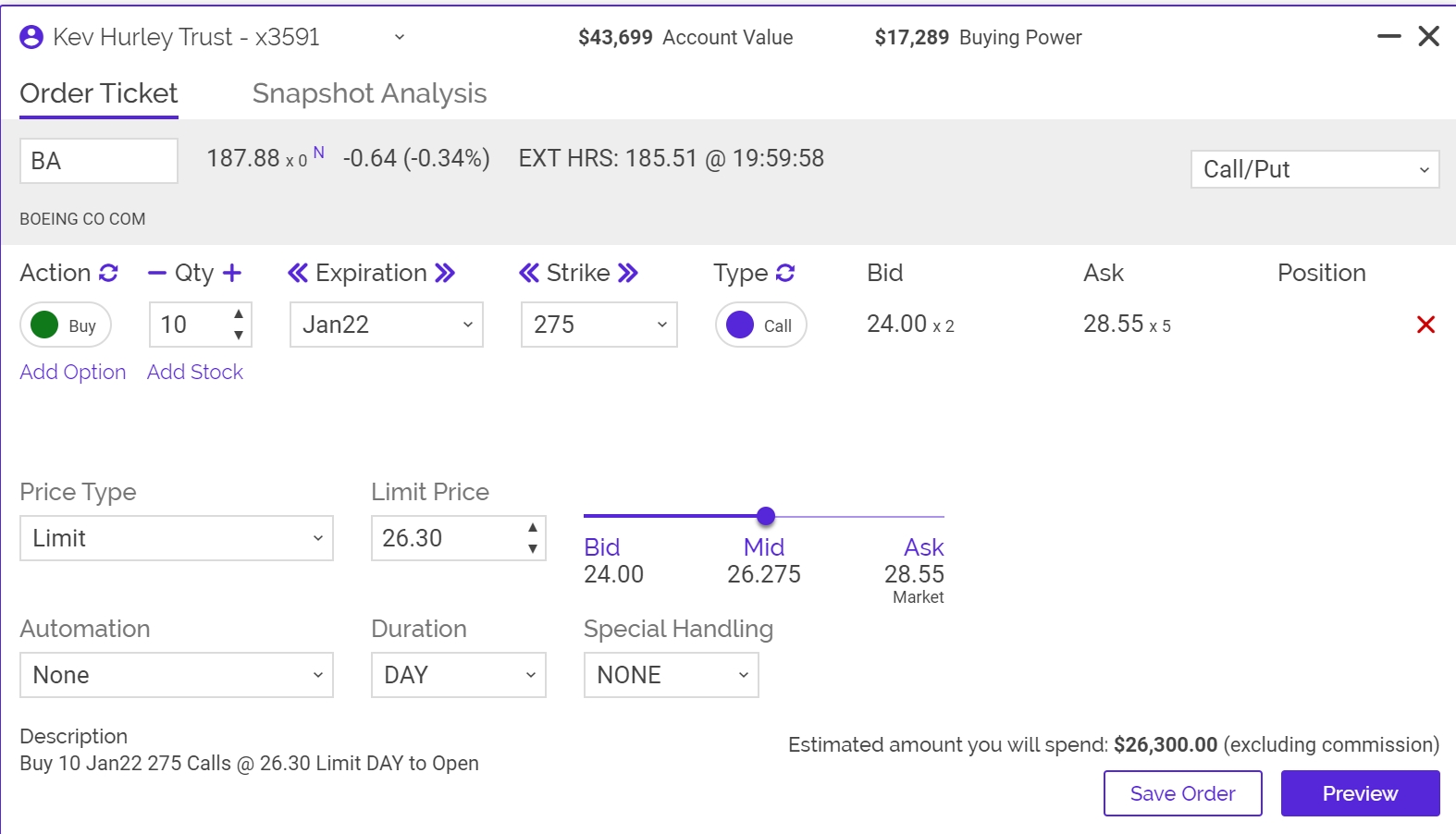

Two week ago IF I want to play resistance 275 Jan 22 Long Call for $36

Primary exit at $270-$275 I exit my trade for a profit

Secondary exit I will dollar cost average

TODAY you can get into he same trade @ $26.30

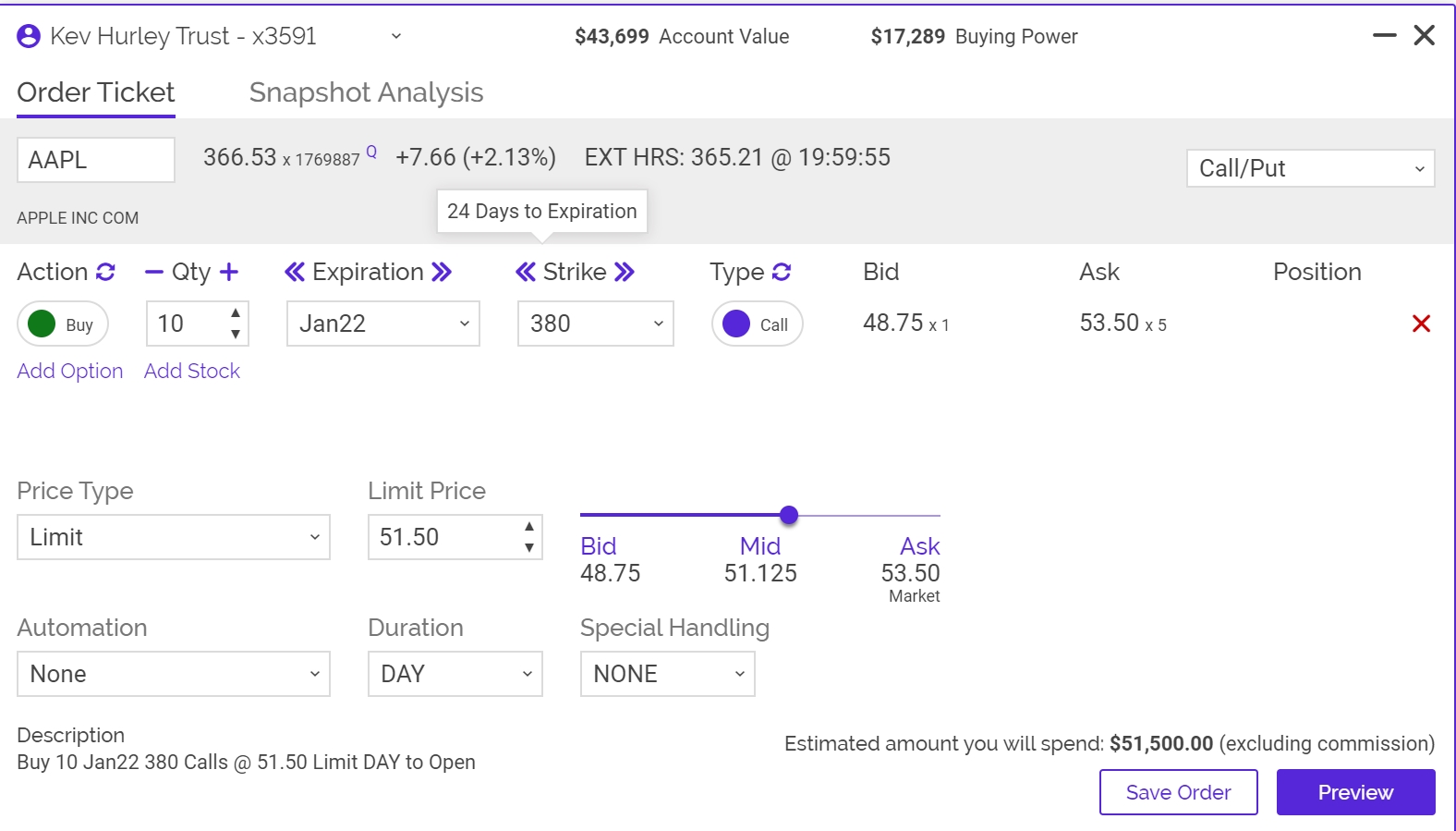

IF I want play the long term rebound to $380-$400

IF I want play the long term rebound to $380-$400

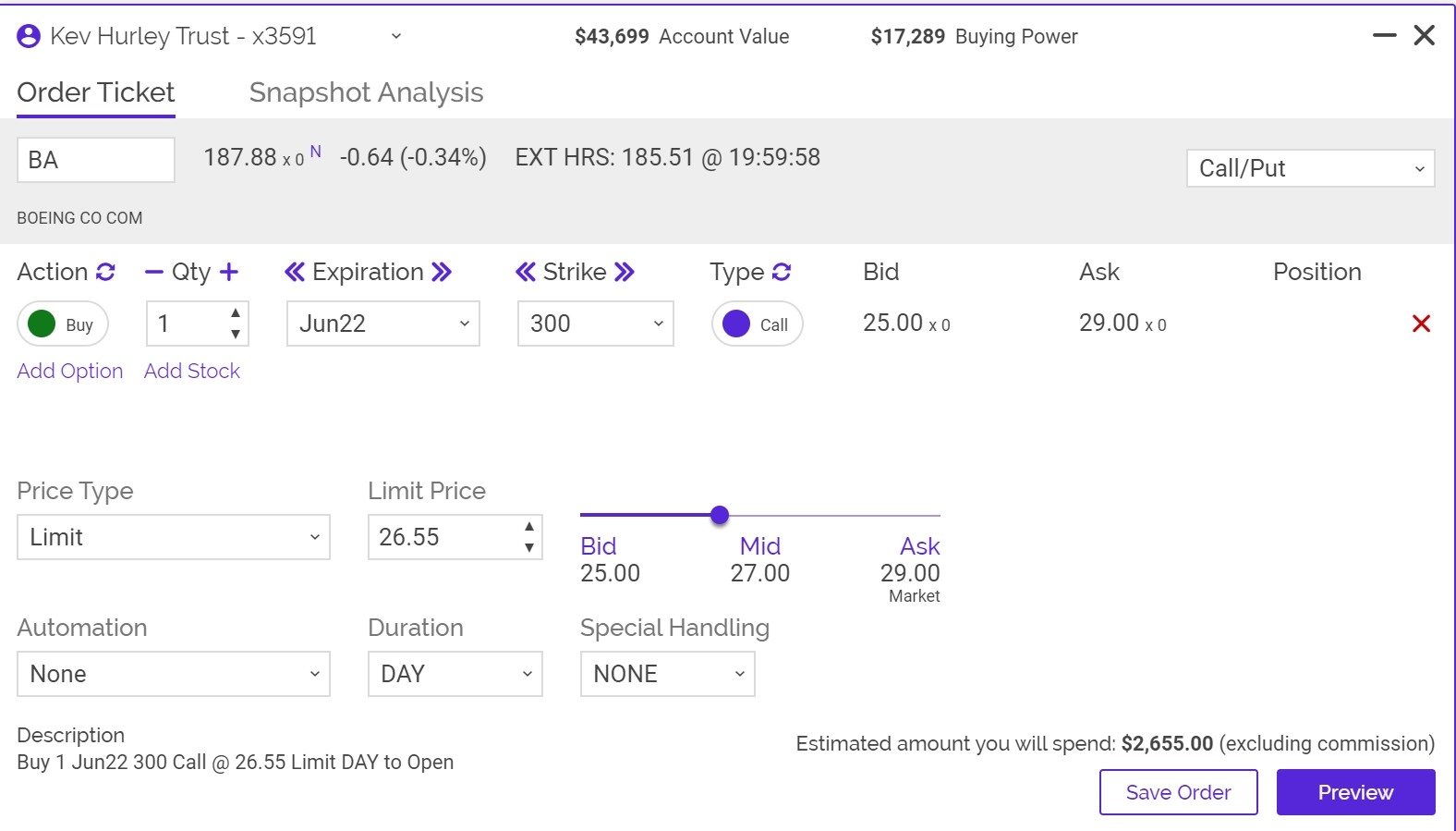

I would use a 300 Jun 22 Long Call for $36

Primary exit when it hits $380-400 exit the trade

Secondary exit dollar cost average

Resistance adjustment add one month short calls when it struggles getting over the 200 SMA

#2 Don’t give all your profits away by continuously rolling long puts

If you lose $8.50 and then add more long puts for $11 = 19.50 to now protect an additional $15 are you making money ?

Just like in spread trading !!!! Follow the trend, technical analysis and STOP rolling your profits away. Let you r stocks run !!!!

#3 Don’t be afraid during bull runs to leverage your money

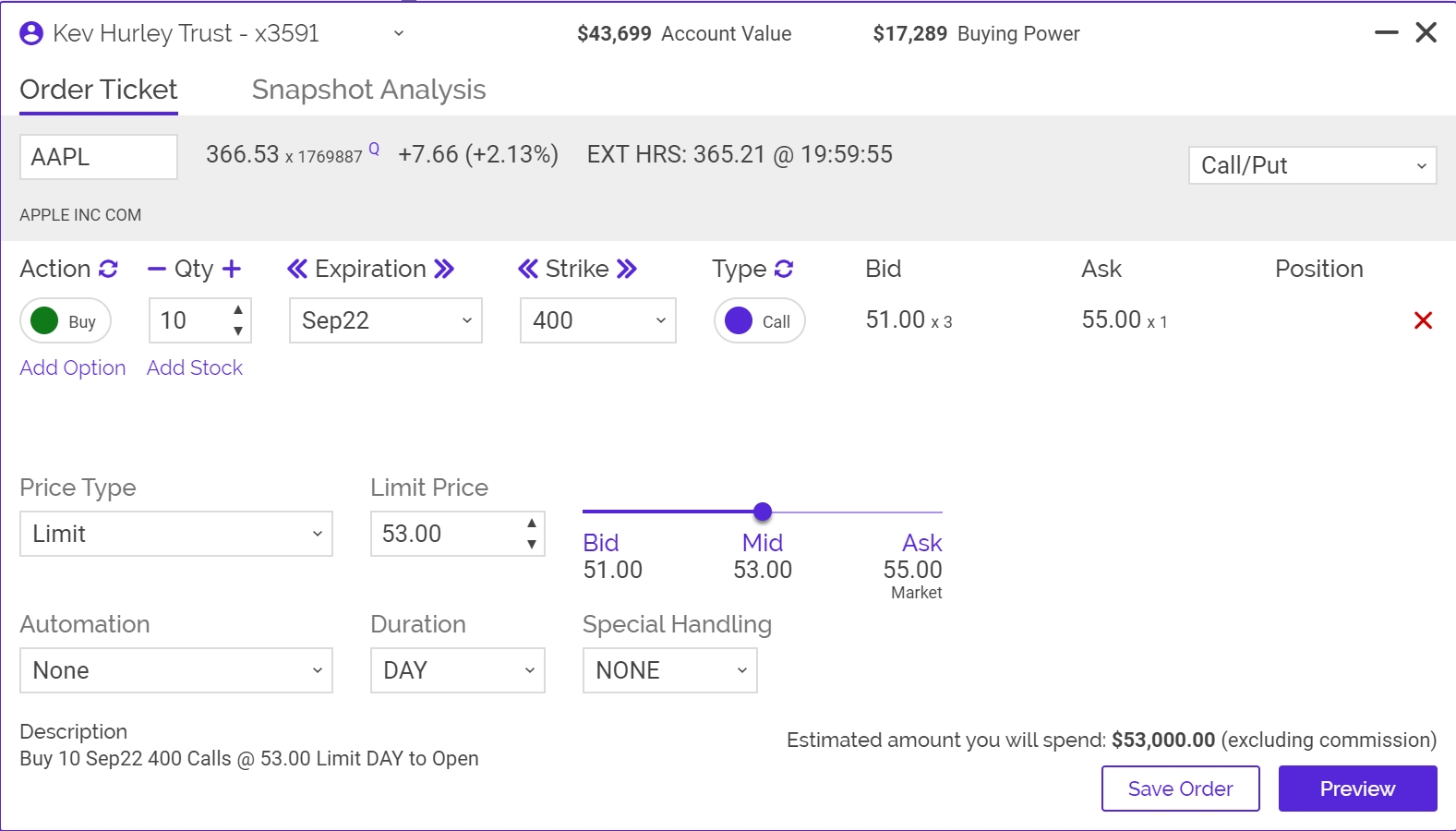

Take the Jan 22 IF you will be planning to exit the position @ $400 ish

For a longer term investor, for worried about over bought, for someone who wants more time at the cost of $1.50 for another 9 months