Trade Findings and Adjustments 06-15-21

Keve Bybee – keve@hurleyinvestments.com

We are in the summer doldrums… L

What strategy should we look at utilizing?

- Covered Calls

- VIX lower doesn’t help, but that doesn’t mean we can’t find some credit

- Calendar spreads? I would still look at

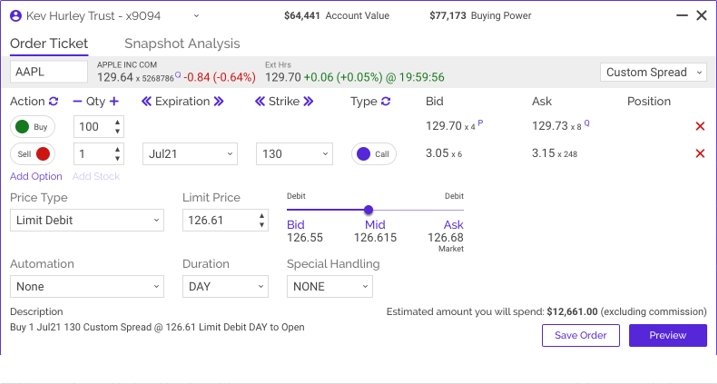

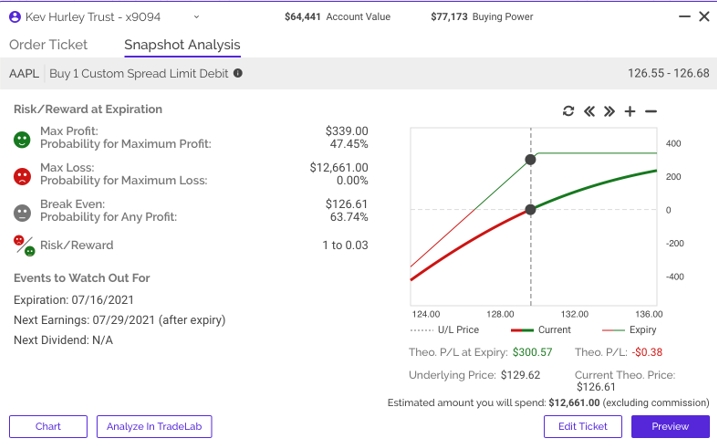

AAPL Covered Call

Stock: 129.70

Short Call: July monthly 130 Strike for $3.10 credit

2.6% return

JPM

- At a support level but needs to confirm.

- My suspicion is that Jamey Dimon talked the stock price down, and may utilize some of the $500 BIILLION in cash to buy back shares.

- Keep an eye out for a covered call at the money for lots of credit.