Trade Findings and Adjustments 04-29-2021

I was going to redo the last Thursday’s Armstrong PDF but we need to talk about earnings.

I’ve built HI completely around earnings & the collar trade

When stocks go through an earnings event what is the possible movement on average?=1 standard deviation = 16.66% to 18% movement up or down

We entered a full collar trade on FB the last twenty minutes that the market was open yesterday?

Volatility crush or I over paid for the long put protection

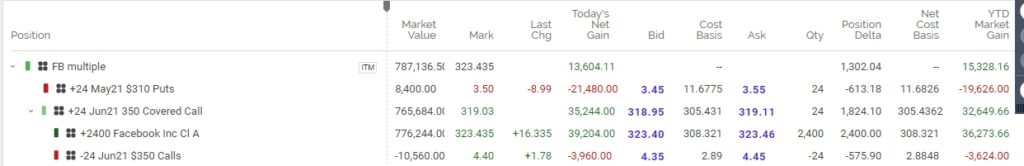

BTO FB @ an average price of $308.32

BTO long puts May monthly $310 strike price for $11.68

STO short calls Jun monthly $350 strike for $2.89

Overall cost basis = 308.32+11.68-2.89 = $317.11

Overall risk in trade is 310 right to sell – 317.11= $7.11 *300 shares $2,133 on a 95K investment or 2.24% Risk on Investment

Maximum Reward 350 – 317.11 = 32.89 * 300 shares $9867 / 95K = 10.38% two month ROI

What is the biggest problem with trading an earnings event?= The market has to figure out what the earnings/guidance means

You NEVER adjust your trade the day after earnings. Sometimes it’s prudent to wait a week or more