What ever happened to the risk of the war in Ukraine ?

Mariupol Seized

President Vladimir Putin said Russia has “liberated” Ukraine’s Mariupol, apart from the massive Azovstal steel plant, which he ordered blockaded. Kyiv has called for urgent talks to save the lives of the fighters and civilians in the city. Russia also said it test fired a new intercontinental ballistic missile in a warning to U.S. allies. Russia’s race to avoid default escalated after a derivatives panel said ruble repayments of interest the country owed on two dollar-denominated bonds were a potential default. Binance Holdings Ltd., the world’s largest cryptocurrency exchange by trading volume, said it is limiting services in Russia.

IT’S SO IMPORTANT to DO YOUR OWN Research

Time to look over what is happening in the portfolio and re-evaluate the portfolio positions

Thoughts from you guys?= Some of these stocks suck right now!!!! Surprised by the stock price fluctuations

What is causing the price fluctuations? = Inflation, War, Fear due to crappy news articles, Supply chain issues, Bad Government policy

DIS lost $7 because NFLX had 2 million less subs and a negative new clientele number for the quarter, HUGE pricing power

F – Investing in EV and has huge backlog

AAPL – Has a huge cash hoard to fight inflation, pricing power

V – Inflation hedge (credit)

BAC, JPM – Banks widen the spread

BA – Huge backlog of orders 9.4 years

FB – Their innovation is very expensive

IF your stocks are losing half their value, why isn’t your portfolio following those stocks? WE USE PROTECTION

I’m sorry some of you are down 30% or more in your portfolios BUT that is the risk in short term trading

THAT’S why I GO SO far out in TIME

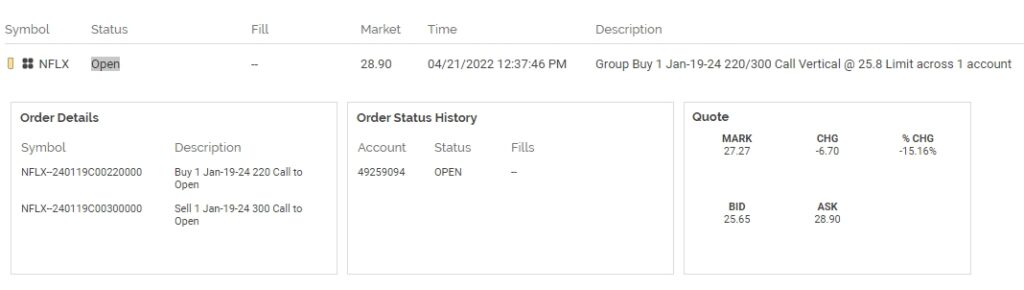

IF you guys think NFLX is being punished unfairly or overly punished then

VERY SPECULATIVE

BTO the Jan 24 $220 Strike long call = $57 Debit

STO the Jan 24 $300 strike short call (hedge) = $30 credit

Net Debit 57-30 = Cost Basis $27

Max Return = 220-300 = 80

80/27 = 2.96 or 296% ROI

https://corporatefinanceinstitute.com/resources/knowledge/valuation/book-value-per-share-bvps/

What is the Book Value Per Share (BVPS)?

The book value per share (BVPS) is calculated by taking the ratio of equity available to common stockholders against the number of shares outstanding. When compared to the current market value per share, the book value per share can provide information on how a company’s stock is valued. If the value of BVPS exceeds the market value per share, the company’s stock is deemed undervalued.

The book value is used as an indicator of the value of a company’s stock, and it can be used to predict the possible market price of a share at a given time in the future.

284K portfolio with using protection IF the stock market loses 50% HI will be breakeven or slightly profitable

We will also double our share counts in these positions SO that when we get a 100% return in the stocks it will be A 200% return for us because we doubled the share count 284×200% return = 852K