Trade Findings and Adjustments 04-21-2020

Earnings

IF you beat top and bottom lines BUT mention Covid19 or slowdown you are going to tank.

Good words – Withdrawing Yearly Guidance

Perception and funds to weather the storm

Stocks making the biggest moves in the premarket: Coca-Cola, Travelers, Philip Morris, Lockheed & more

Take a look at some of the biggest movers in the premarket:

Coca-Cola (KO) – Coca-Cola reported quarterly earnings of 51 cents per share, 7 cents a share above estimates. Revenue also came in above Wall Street forecasts. The company said a shift in consumer habits due to the Covid-19 pandemic would materially impact results this quarter but it is hopeful for a second-half rebound.

Travelers (TRV) – The insurance company earned $2.62 per share for the first quarter, compared to the consensus estimate of $2.85 a share. Revenue was also short of estimates, hit by higher catastrophe losses. Travelers took $86 million in charges related to the coronavirus outbreak, but it did announce a 4% dividend hike.

Philip Morris (PM) – The tobacco producer beat estimates by 8 cents a share, with quarterly earnings of $1.21 per share. Revenue also beat consensus. The company said the Covid-19 pandemic had limited impact during the quarter, but that it would hurt full-year results.

LabCorp (LH) – The medical lab operator received emergency authorization from the Food and Drug Administration for its at-home Covid-19 test. The test requires consumers to fill out a questionnaire and then get approval from a health-care provider.

Lockheed Martin (LMT) – The defense contractor earned $6.08 per share for its latest quarter, beating the consensus estimate of $5.80 a share. Revenue also came in above analysts’ projections. The company said it is just beginning to experience the impact of Covid-19 in its various businesses and that the ultimate impact on 2020 results is unknown.

Amazon.com (AMZN) – Jeffries raised its price target on the stock to $2,800 a share from $2,300 a share, noting that Amazon continues to benefit from the coronavirus outbreak and that the company is seeing faster growth at its higher-margin businesses.

IBM (IBM) – IBM reported quarterly profit of $1.84 per share, beating consensus estimates by 4 cents a share. Revenue came in below Wall Street forecasts, however, and the company withdrew its annual forecast due to uncertainties surrounding the pandemic. IBM said it was well-positioned financially and would continue to pay dividends.

SAP (SAP) – SAP abandoned its dual CEO structure that had been in place for the past six months, naming Christian Klein as sole CEO of the business software giant. SAP said the move was made to give customers more clarity, and that co-CEO Jennifer Morgan will depart April 30.

General Electric (GE) – GE refinanced a $20 billion revolving credit facility with a new revolving agreement with $15 billion, according to a Securities and Exchange Commission filing.

J.M. Smucker (SJM) – The food producer raised its sales and profit outlook, as consumers continue to stock up on household essentials amid the virus outbreak. The maker of Folgers Coffee and Jif Peanut Butter did say that the magnitude of sales increases has begun to moderate.

Hertz Global (HTZ) – Hertz will lay off 10,000 employees across North America, seeking to cut costs as it deals with the economic fallout of the virus outbreak. The layoffs will cost the car rental company about $30 million, according to an SEC filing.

Darden Restaurants (DRI) – Darden is raising $400 million through a share sale, in order to shore up its liquidity. The parent of Olive Garden and other restaurant chains said same-restaurant sales are down about 45 percent so far this quarter.

Beyond Meat (BYND) – Beyond Meat products will be introduced in Starbucks (SBUX) stores in China this week. Starbucks has reopened most of its stores in China and is hoping the new offerings will help boost customer traffic.

Equifax (EFX) – Equifax reported adjusted quarterly earnings of $1.40 per share, 11 cents above estimates, with the credit reporting agency’s revenue above estimates as well. Equifax said its quarterly revenue was its best in any quarter since the 2017 cyber breach incident, although it did withdraw its full-year forecast due to uncertainties surrounding the coronavirus outbreak.

Help for you

Look to barcharts for $389 package that gives you unusual options activity

Oil and Interactive Brokers for earnings today said “600 million dollar loss, 88 million that they margin called, and 6 million they are responsible for now that for the first time negative values occurred for commodity trading”

Ideas

BIDU Leap 2020 Jun $155 Strike long Call for $2.09

The price really doesn’t matter as we are looking so far out into the future so a $0.25 cent limit order gives you plenty of play in getting oyur order filled. DON’T scalp a nickle to miss making thousands !!!!

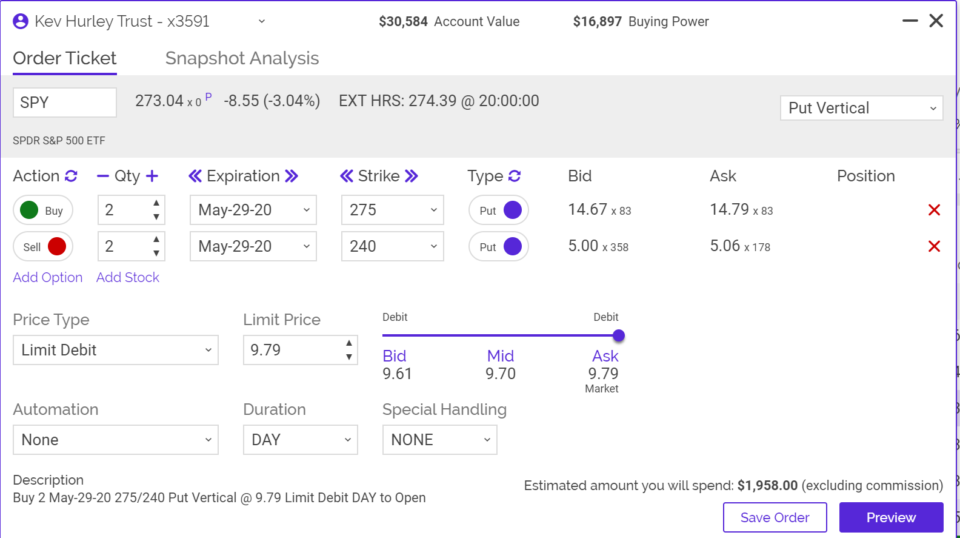

SPY Bear put to be ready for the next down leg. Put it on at the end of day if the market has an up day tomorrow.

www.hurleyinvestments.com www.myhurleyinvestment.com www.KevinMhurley.com