Trade Findings and Adjustments 04-09-2020

Federal Reserve unveils details of $2.3 trillion in programs to help support the economy

PUBLISHED THU, APR 9 20208:30 AM EDTUPDATED AN HOUR AGO

Jeff Cox@JEFF.COX.7528@JEFFCOXCNBCCOM

KEY POINTS

- The Fed plan would inject another $2.3 trillion into businesses and revenue-pinched governments.

- Stock futures jumped after the Fed’s announcement.

- Moments earlier, the government reported that 6.6 million new jobless claims were filed last week.

The Federal Reserve on Thursday announced a bevy of new moves aimed at getting another $2.3 trillion of financing into businesses and revenue-pinched governments.

Stock futures jumped after the announcement, which came moments after the government reported that 6.6 million new jobless claims were filed last week.

Among the Fed’s measures were details regarding its Main Street business lending program and several other initiatives it is undertaking to backstop the reeling U.S. economy. The central bank also provided more detail on its market interventions, including plans to buy corporate bonds both at an investment-grade level as well as high-yield, or junk, bonds.

Under provisions outlined for the first time, the loans would be geared toward businesses with up to 10,000 employees and less than $2.5 billion in revenues for 2019. Principal and interest payments will be deferred for a year.

The Fed said the programs would total up to $2.3 trillion and include the Payroll Protection Program and other measures aimed at getting money to small businesses and bolstering municipal finances with a $500 billion lending program.

“Our country’s highest priority must be to address this public health crisis, providing care for the ill and limiting the further spread of the virus,” Fed Chairman Jerome Powell said in a statement. “The Fed’s role is to provide as much relief and stability as we can during this period of constrained economic activity, and our actions today will help ensure that the eventual recovery is as vigorous as possible.”

The measures enhance an already-aggressive move by the Fed to keep markets functioning and support the economy, which has been handcuffed due to public health measures aimed at halting the coronavirus spread.

Money for business and government

The Main Street loans would be a minimum of $1 million and a maximum of either $25 million or an amount that “when added to the Eligible Borrower’s existing outstanding and committed but undrawn debt, does not exceed four times the Eligible Borrower’s 2019 earnings before interest, taxes, depreciation, and amortization,” whatever is less, the Fed said.

The Fed will purchase up to $600 billion in loans.

Terms would see an interest rate equal to the Fed’s Secure Overnight Financing Rate, currently 0.01%, plus 250-400 basis points with a four-year maturity.

A special-purpose vehicle that Fed created jointly with the Treasury Department will purchase 95% of the loan while the financing institution would hold the other 5%.

In addition to the Main Street program aimed at midsize companies, the Fed also announced a move to “bolster the effectiveness” of the Payroll Protection Program by providing term finance to institutions lending through the PPP.

While the Fed already has entered the municipal bond market, the latest steps establish a new Municipal Liquidity Facility that will offer up to $500 billion in lending to states and municipalities. The Treasury will provide a $35 billion backstop to the program to guard against potential losses.

The central bank also said it will expand three existing credit facilities aimed at increasing credit to households and businesses. The new effort will target $850 billion through the three facilities, a move backed by $85 billion in protection from the Treasury.

The Fed also expanded the type of collateral it will accept through one of the programs, known as the Term Asset-backed Loan Facility.

US weekly jobless claims jump by 6.6 million and we’ve now lost 10% of workforce in three weeks

PUBLISHED THU, APR 9 20208:30 AM EDTUPDATED AN HOUR AGO

Jeff Cox@JEFF.COX.7528@JEFFCOXCNBCCOM

KEY POINTS

- More than 16 million Americans have now lost their jobs in three weeks.

- If you compare those claims to the 151 million people on payrolls in the last monthly employment report, that means the U.S. has lost 10% of the workforce in three weeks.

Jobless rolls continued to swell due to the coronavirus shutdown, with 6.6 million Americans filing first-time unemployment claims last week, the Labor Department reported Thursday.

That brings the total claims over the past three weeks to more than 16 million. If you compare those claims to the 151 million people on payrolls in the last monthly employment report, that means the U.S. has lost 10% of the workforce in three weeks.

Moments after the jobless claims report was released, the Federal Reserve announced plans to inject another $2.3 billion into businesses and revenue-pinched governments. Stock futures jumped after the Fed’s announcement.

The most recent jobless number represents a decline of 261,000 from the previous week, which was revised up by 219,000 to nearly 6.9 million.

Oil jumps as much as 12% then cuts gains as traders await OPEC cut details

PUBLISHED THU, APR 9 20208:59 AM EDTUPDATED MOMENTS AGO

Oil prices jumped as much as 12% on Thursday on reports that Saudi Arabia and Russia had reached a deal on a deep output cut, according to Reuters which cited two sources, and that the cuts could reportedly be as high as 20 million barrels per day.

But prices pulled back from their highs as traders awaited key details, such as how the cuts would be divided, as well as how long they might be in place for.

The reported deal comes as a virtual meeting between OPEC and its allies, known as OPEC+, kicked off in which some of the world’s largest producers were set to discuss historic production cuts as the coronavirus pandemic saps demand for crude. The virtual meeting, which was initially planned for last Monday, began around 10:45 a.m. ET.

U.S. West Texas Intermediate jumped 12% to trade at $28.36 per barrel, before paring some of those gains to trade 3.9% higher at $26.07 per barrel, as questions remain over what a potential deal could look like. International benchmark Brent crude rose 2.5% to trade at $33.66 per barrel.

Some are skeptical that a cut as large as 20 million barrels per day could be reached. “I am suspect that is achievable,” said Rebecca Babin, senior energy trader at CIBC Private Wealth Management. “They have set themselves up for an epic fail by floating the 20 million barrel figure,” said Again Capital’s John Kilduff.

Ahead of the meeting, the Street had been watching for cuts in the 10 million to 15 million barrels per day range after President Donald Trump said he had spoken to Russian President Vladimir Putin and Saudi Crown Prince Mohammed bin Salman and expected them to announce a deal of that size.

“We’re optimistic that they’ll reach an agreement between the Saudis and Russians in an effort to stabilize the markets,” U.S. Energy Secretary Dan Brouillette said Thursday on CNBC’s “Squawk Box” ahead of the meeting. “I think they can easily get to 10 million, perhaps even higher, and certainly higher if you include the other nations who produce oil, nations like Canada and Brazil and others. Easily, easily done,” he added.

The meeting comes as relations between some of the world’s largest producers has grown fraught, and Saudi Arabia and Russia had previously signaled that any cut would need to include action from non-OPEC nations such as the U.S., Canada and Norway.

“OPEC+ is trying mightily to cobble together a sizable production cut, and they are in full spin mode to try and rally prices,” Kilduff told CNBC. The “teleconference will be a make-or-break moment for the oil market. The math on a 10 million barrel per day cutback, which is the minimum necessary to stabilize the situation, is almost impossible to compute.”

Energy ministers from the Group of 20 major economies will convene for their own extraordinary meeting on Friday, in which Energy Secretary Dan Brouillette will participate.

The G-20 presidency said Tuesday that the meeting would be held “to foster global dialogue and cooperation to ensure stable energy markets and enable a stronger global economy.”

When it comes to U.S. energy companies, Trump has commented that market forces will prevail, and on Wednesday said that producers have “already cut way back.” Brouillette echoed this on Thursday, telling CNBC that the “demand downturn has led to production cuts in the United States of about 2 million barrels per day thought the reminder of 2020.”

RBC global head of commodities research Helima Croft said she believes the chances “are greater than even” that “a broad framework agreement to curb output by a big headline number” can be achieved, but noted that “the situation remains extremely fluid.”

“There are several land mines lurking right below the surface that could still blow up the negotiations at the 11th hour,” she said in a note to clients Thursday.

But even if a deal is reached, many argue that prices will stay lower for longer due to the unprecedented demand destruction caused by the coronavirus. In other words, the supply side is a secondary story to the demand hit.

“Even if a production-cut agreement is reached, which will surely give prices a short-term boost, we believe the enthusiasm will subside at some point and the reality of the size of the demand’s imbalance will eventually hit the market,” said Bjornar Tonhaugen, head of oil markets at Rystad Energy.

Oil prices crater

At OPEC’s last meeting in early March, de facto leader Saudi Arabia proposed cuts of 1.5 million barrels per day to combat falling demand. But OPEC-ally Russia rejected the proposal, sparking a price war between the two powerhouse producers. Saudi Arabia slashed its oil prices to gain market share, and also ramped up production to record levels above 12 million barrels per day.

Since early March, the outlook for oil has changed drastically as the pandemic spread, with much of the world now staying home. Oil prices sank to their lowest level in nearly two decades. WTI and Brent both fell more than 50% in March for their worst month on record. The first quarter was also the worst in history, with WTI shedding 66%, while Brent fell 65%.

Amid the decline, which has pressured highly-leveraged U.S. oil companies, President Donald Trump sought to broker a deal between Saudi Arabia and Russia. On April 2 Trump told CNBC that he had spoken to Russian President Vladimir Putin and Saudi Crown Prince Mohammed bin Salman and that he expected them to announce a record production cut.

American drillers are still pumping near record levels as the world is coming to the edge of its ability to store oil. The U.S. oil industry is divided on whether it could or should contribute to production cuts in an effort to stabilize prices.

The American Petroleum Industry opposes cuts, saying such a move would harm the U.S. industry. In Texas, however, Ryan Sitton, one of the three members of the Texas Railroad Commission, has said that the state would consider participating in such a deal.

– CNBC’s Sam Meredith contributed reporting.

https://www.nytimes.com/2020/04/08/business/disney-plus-50-million-subscribers.html

Disney Plus Racks Up 50 Million Subscribers in 5 Months

The Hollywood colossus has been crippled by the pandemic. Its upstart streaming service is one exception.

- Published April 8, 2020Updated April 9, 2020, 12:17 a.m. ET

LOS ANGELES — Disney has taken an especially hard hit from the pandemic, with its theme parks shuttered, movies postponed and ESPN cable channel without live sports to televise.

But the company on Wednesday offered an upbeat update on its newest business — one that may as well have been built for home quarantining: Disney Plus, its Netflix-style streaming service, has 50 million paid subscribers worldwide, an astounding number for a product that is only five months old.

Before its November introduction, analysts expected Disney Plus to take until 2022 to reach 50 million subscribers.

To compare, Hulu, now owned by Disney, has only about 30 million subscribers after 13 years in operation; Hulu has not yet been introduced overseas. The leading streaming service, Netflix, introduced in 2007, has about 167 million subscribers worldwide.

“This bodes well for our continued expansion,” Kevin Mayer, Disney’s streaming chairman, said in a statement.

Last month, Disney introduced the service in eight European countries and India, operating under a rollout schedule set last year. Mr. Mayer said Disney Plus would arrive in Japan and Latin America by the end of the year.

Analysts say the coronavirus pandemic has most likely helped Disney Plus maintain existing subscribers and attract new ones, as parents look for ways to entertain homebound children. Disney Plus, which offers movies and shows from the Disney, Marvel, Pixar, “Star Wars,” National Geographic and “Simpsons” universes, has also benefited from a low monthly cost — $7 for those paying full price — and zealous marketing. An exclusive Disney Plus offering, “The Mandalorian,” a live-action “Star Wars” series, has been a runaway hit.

Disney shares increased about 7 percent in after-hours trading on Wednesday, buoyed by the subscriber count.

The pandemic has battered Disney, which has lost roughly $70 billion in market capitalization since the beginning of February. With its movie, theme park, television production and merchandise businesses at a near standstill, Disney has slashed executive salaries by up to 30 percent; starting on April 19, the company will begin furloughing nonessential employees.

It is unclear how badly the Disney Plus pipeline of original content has been affected. Subscribers have been promised a second season of “The Mandalorian” this year, along with multiple shows featuring Marvel superheroes. Analysts estimate that Disney Plus could lose as much as $1.8 billion annually, with programming a major expense.

In an interview with Barron’s on Tuesday, Robert A. Iger, Disney’s executive chairman, floated the possibility of checking theme park guests for fevers to get that business back on its feet as soon as possible. (Summer at the earliest.)

“People will have to feel comfortable that they’re safe,” Mr. Iger said. Barring a vaccine, “it could come from more scrutiny, more restrictions,” he added. “Just as we now do bag checks for everybody that goes into our parks, it could be that at some point we add a component of that that takes people’s temperatures.”

Brooks Barnes is a media and entertainment reporter, covering all things Hollywood. He joined The Times in 2007 as a business reporter focused primarily on the Walt Disney Company. He previously worked for The Wall Street Journal. @brooksbarnesNYT

https://www.dws.com/en-us/insights/cio-view/charts-of-the-week/cotw-2020/chart-of-the-week-20200403/

Corporate-earnings estimates for 2020 are likely to be revised downwards substantially in the coming weeks. How hard could the S&P 500 be hit?

How bad could things get for corporate earnings, both in the U.S. and worldwide? In the face of a global health emergency, the short answer is that it remains hard to tell. Large parts of the world are under Covid-19 lockdown, delivering tremendous short-term shocks to the supply side and threatening to bring demand destruction on a massive scale. The disruptions will be comparable or worse than after September 11, 2001 and the onset of the financial crisis in 2008.

However, history can offer at least some guidance. As our “Chart of the Week” shows, consensus earnings estimates for the S&P 500 have occasionally been quite fickle as the calendar year progresses. Currently, they are at minus 10%, or a little more than one standard deviation from the normal trend, taking an average of the past 20 years. A fall by three standard deviations would correspond to a decline in corporate-earnings estimates of about 30%.

The devil is, as always, in the details. Three points are worth noting. First, for a fall in earnings estimates by three standard deviations, the Covid-19 crisis would probably need to be even worse and last longer than the consensus is currently expecting. Second, at least as far as U.S. earnings are concerned, there are are some reasons to expect more resilience than in past downturns. Over the past 20 years, the U.S. technology sector has dramatically grown in size. Strong balance sheets and relatively resilient cash flows among the U.S. companies of the “virtual economy,” such as technology, communications and internet retailing, should help the S&P 500. After all, virtual services, essential goods, health-care services, consumer staples and utilities are accounting now for about half of the S&P 500 profits. By contrast, energy, heavy manufacturing and financial services are smaller than in previous U.S. downturns.

Third and alas, the same is not necessarily true for the rest of the world, where many indices still tilt towards areas of what used to be called the “old economy”. This includes banks, where provisions for non-performing loans will probably have to increase, eroding profits. Energy too features prominently in global indices. “The oil sector alone accounted for around 6% of global profits in 2019. In 2020, that might well fall to zero, given the collapse in oil prices,” points out Thomas Bucher, global equity strategist at DWS. And outside the U.S., it is hard to see other sectors meaningfully make up for such shortfalls.

Sources: Refinitiv, DWS Investment GmbH as of 4/1/20

So how or what do you trade?

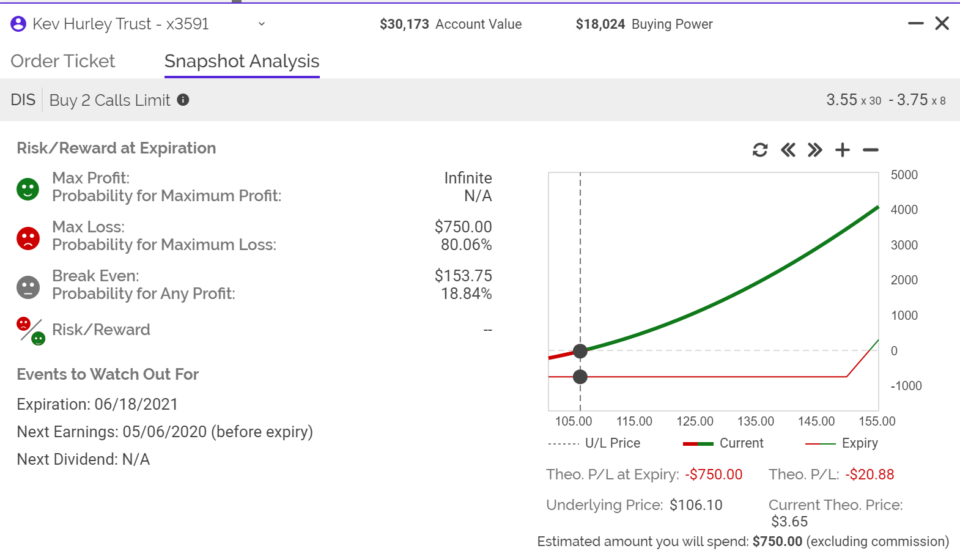

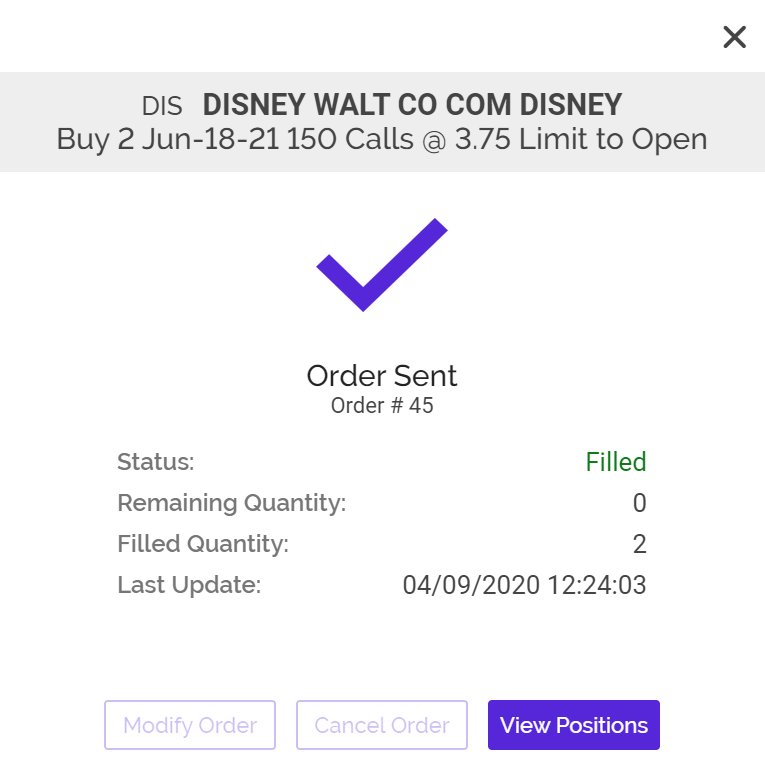

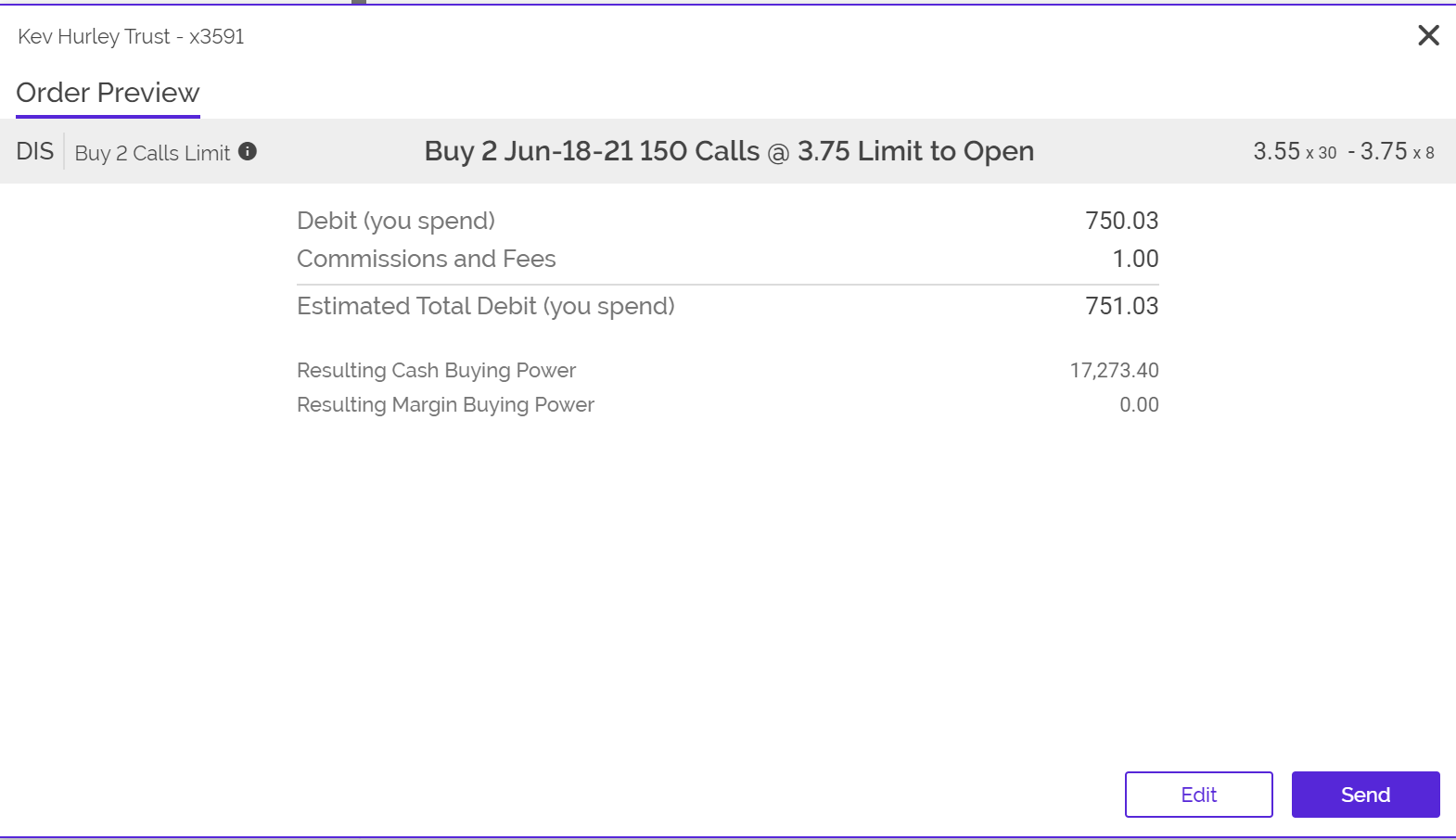

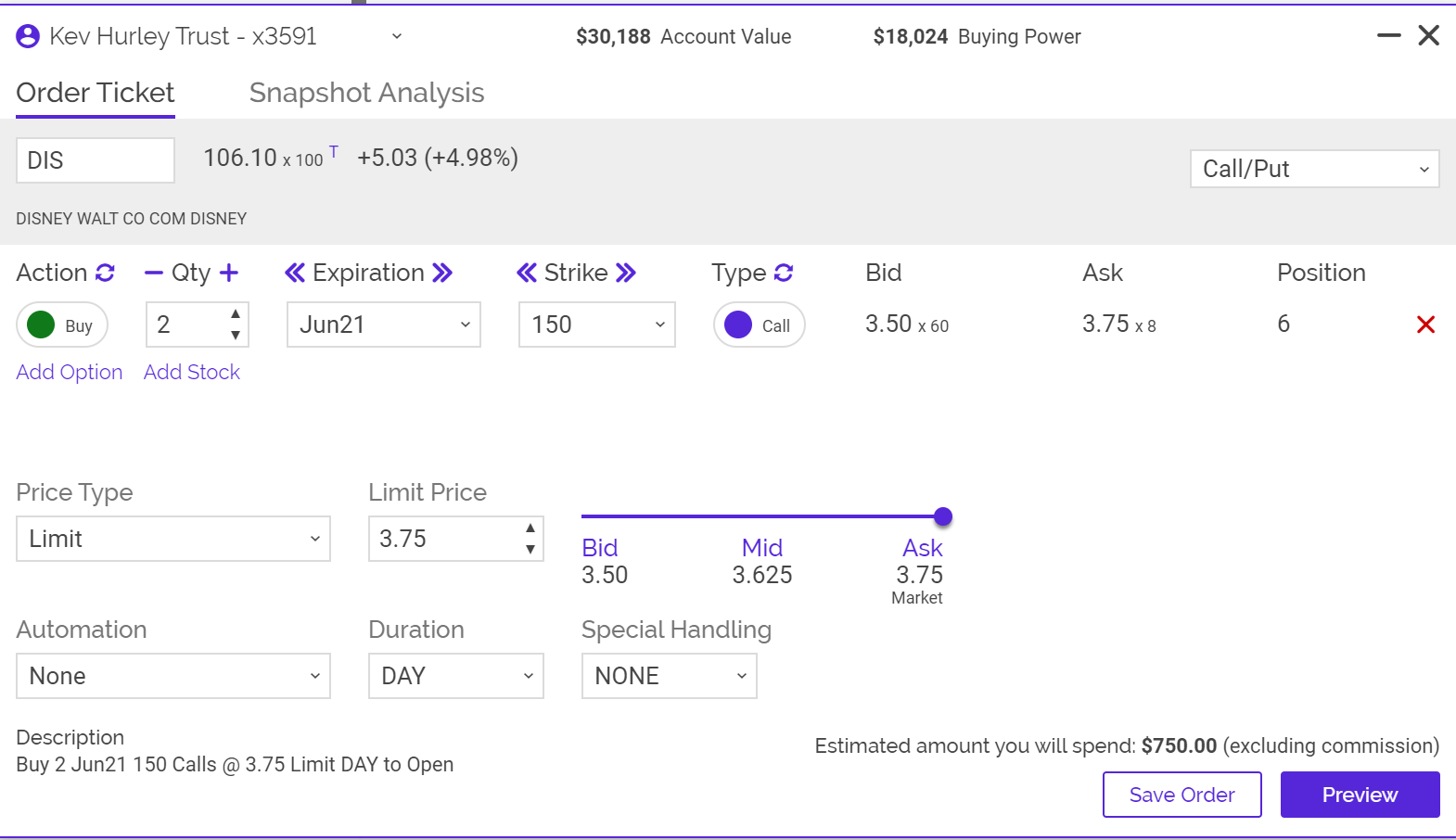

DIS Jun 21-21 Leap Long Calls $150 Strike for $3.50 per contract