HI Market View Commentary 06-01-2021

My Quote of the Day: economies fail to the extent that they don’t protect… Remind you of a certain investment strategy? Yep. Me too.

People in general fail because the fail to protect themselves

- Protection takes hard work

- Protection in the stock market is not a hobby to do

- Verify the education to teach you protection is legit

https://go.ycharts.com/weekly-pulse

Where will our markets end this week?

Lower

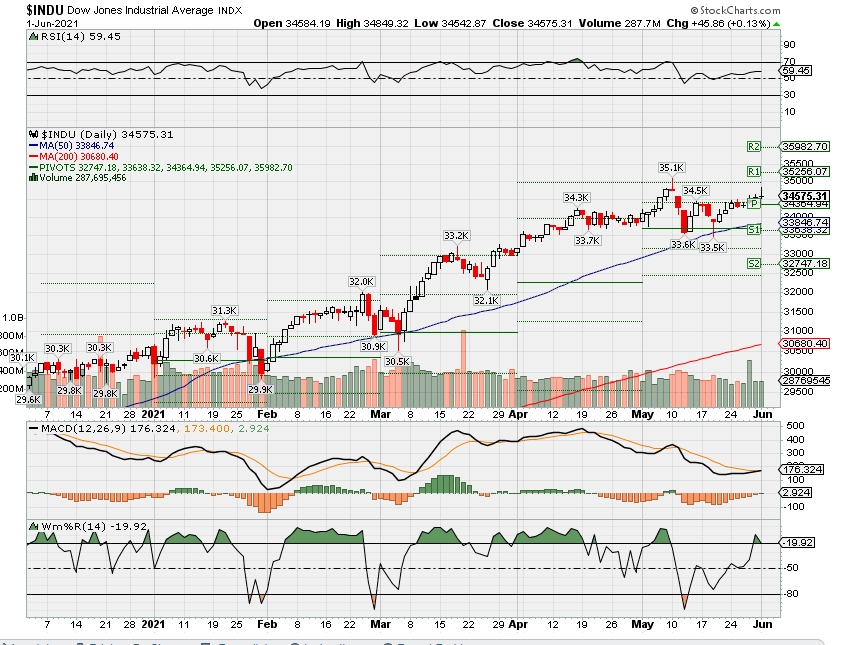

DJIA – Bullish

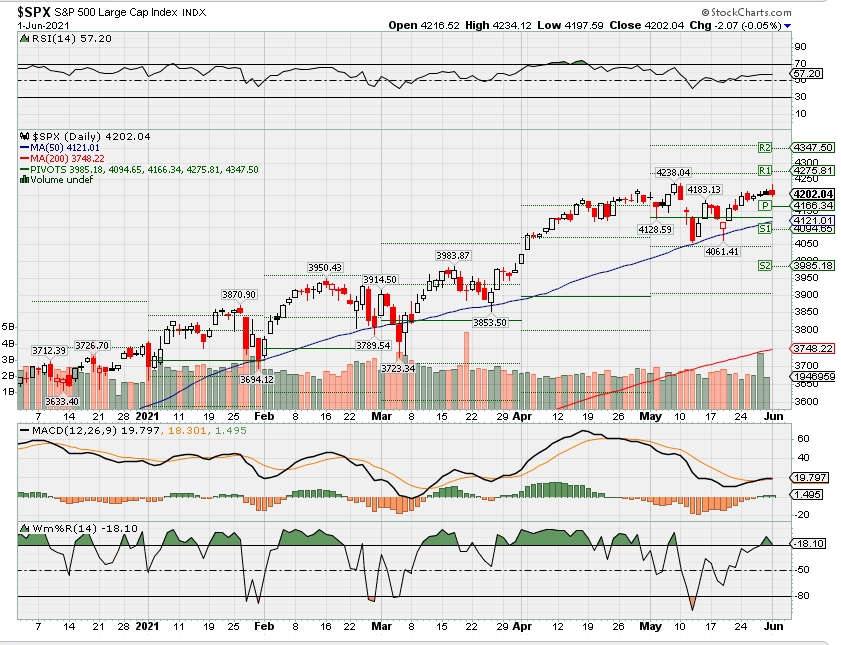

SPX – Bullish

COMP – Bullish

Where Will the SPX end June 2021?

06-01-2021 1.0%

05-24-2021 4.0%

Earnings:

Mon:

Tues: ZM,

Wed: NTAP, PVH, SPWH

Thur: DOCU, FIVE, LULU, AVGO

Fri:

Econ Reports:

Mon:

Tues: Construction Spending, ISM Manufacturing

Wed: MBA, Fed Beige Book

Thur: Initial Claims, Continuing Claims, ADP Employment, Productivity, Unit Labor Costs, ISM Non-Manufacturing,

Fri: Average Workweek, Non-Farm Payrolls,, Private Payrolls, Unemployment rate, Hourly Earnings, Factory Orders,

Int’l:

Mon –

Tues –

Wed –

Thursday –

Friday-

Sunday –

How am I looking to trade?

Earnings and adding protection where needed

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

Biden’s Tax Proposals Spur Anxiety; FAs Tell Clients to Calm Down

By Josh AzarMay 26, 2021

President Joe Biden’s tax proposals have been a frequent topic of conversation among advisors and their clients. The lack of clarity around what a final bill may look like is a major source of anxiety for many clients, according to advisors.

The tax proposals are intended to fund the $1.8 trillion American Families Plan, which was presented last month by Biden to a Joint Session of Congress. High earners are expected to shoulder more of the funding for the plan.

“Right now, tax policy is top of mind for advisors, financial professionals and the clients they serve. They’re clearly concerned about taxes affecting their portfolios — and it’s impacting their approach to investing,” according to Eric Henderson, president of Nationwide Annuity at Nationwide Financial.

Nearly three-fourths, or 74%, of 200 advisors and financial professionals surveyed by the insurance and financial services company from March to May said tax policy is their clients’ top concern.

Too many unknowns

“For me, at least, the level of unknown is the highest I can recall in my 25+ years in the financial advice business,” says Chuck Cooper, advisor and managing partner at StrongBox Wealth.

“We have clients who are wanting to sell their business within the next three to four years, and they’re considering — hopefully not in haste — really accelerating their plans,” he says.

For business owners, the possibility of an increased capital gains tax is particularly alarming since selling can be a significant income event, Cooper says.

As proposed, Biden’s plan would “be designed with protections so that family-owned businesses and farms will not have to pay taxes when given to heirs who continue to run the business,” according to a fact sheet from the White House.

But that does little to calm business owners who may have been considering selling to a private equity shop, for example.

“In most cases, it turns out not to be a circumstance that takes away the momentum or removes the momentum toward a business succession. But it doesn’t leave a lot of smiles,” Cooper says.

Too many worries

Andrew Aiello, partner at Boulevard Family Wealth, has also seen some businesses consider selling early to head off the uncertainty.

“People who are selling businesses right now are being forced to think about taxes changing in the middle of a sale,” Aiello says. “You don’t want someone to make a bad business decision because they’re worried about tax increases that haven’t happened yet.”

Aiello also says the possible reduction of exemptions and increase in wealth transfer taxes have created “a massive amount of confusion, in terms of how do families plan for that.”

Related Content

The best thing clients can do for now is keep calm, review their long-term plans and be prepared to make decisions should the need arise, Aiello says.

“It’s important to start engaging attorneys and financial advisors now,” he adds, while the plan is still in its infancy. “If you come to the table late and unprepared, you might not be able to get the level of service you need.”

Hard pill to swallow

But many clients actually won’t be hurt badly by the tax proposals, according to Mike Gray, principal at Captrust.

“They read the headlines and say ‘Oh, how is this going to affect me?’ Don’t take this personally, but you don’t make enough income to worry about it,” he says. “A lot of this is kind of a non-event for them, and some of the dialogue is just reminding them of that.”

Under the proposals, for individuals with income of $400,000 to $1 million, the rate on ordinary income will rise from 37.0% to 39.6%, according to BlackRock. The federal rate on some portfolio incomes could reach 43.4%, including investment taxes. Long-term capital gains would remain unchanged at 23.8%.

For individuals with more than $1 million in income, the top marginal rate on long-term capital gains and qualified dividends would increase to the same rate as ordinary income, nearly doubling to 43.4% from the current combined rate of 23.8%, BlackRock notes.

Advisors also point to the potential change in the estate tax. Currently, the tax code allows for assets of up to $11 million per person to be exempted from the tax. Biden’s proposal would curtail that exemption to $3.5 million per person.

Taken together, these proposals might prompt some clients to realize their gains sooner than originally planned to reduce the risk of a future tax hike, advisors say.

For example, Captrust’s Gray says one of his clients has stock options that must be exercised by the spring of 2022. With a possible increase in taxes on the horizon, that client is likelier to exercise those options this year.

“I don’t think there’s going to be a lot of interest in selling just for the sake of selling,” Gray says. “But selling things you were planning on selling? This could be a driver for doing some of that.”

Still, he adds, “he idea of paying taxes sooner than you have to is a hard pill to swallow for a lot of people.”

Do you have a news tip you’d like to share with FA-IQ? Email us at editorial@financialadvisoriq.com.

https://seekingalpha.com/article/4432007-apple-downside-risk

Apple: Downside Risk

May 28, 2021 4:24 PM ET

Summary

- Apple faces iPhone headwinds heading into FY22 after demand was pulled forward this fiscal year.

- New Street Research placed a $90 price target on the stock with a rare Sell rating that used to not be so rare.

- The stock still trades at an expensive 23.5x FY22 EPS estimates despite growth falling to just 3%.

- Looking for a helping hand in the market? Members of Out Fox The Street get exclusive ideas and guidance to navigate any climate.

Apple (AAPL) topped $135 last August and most investors ignored the downside risk inherent in the overpriced tech giant. Despite good results, the stock is actually down over the last nine months while the market is up substantially. My investment thesis is far more Neutral on Apple as the market tries to brush off a rare Sell rating on the stock.

iPhone Demand Snag

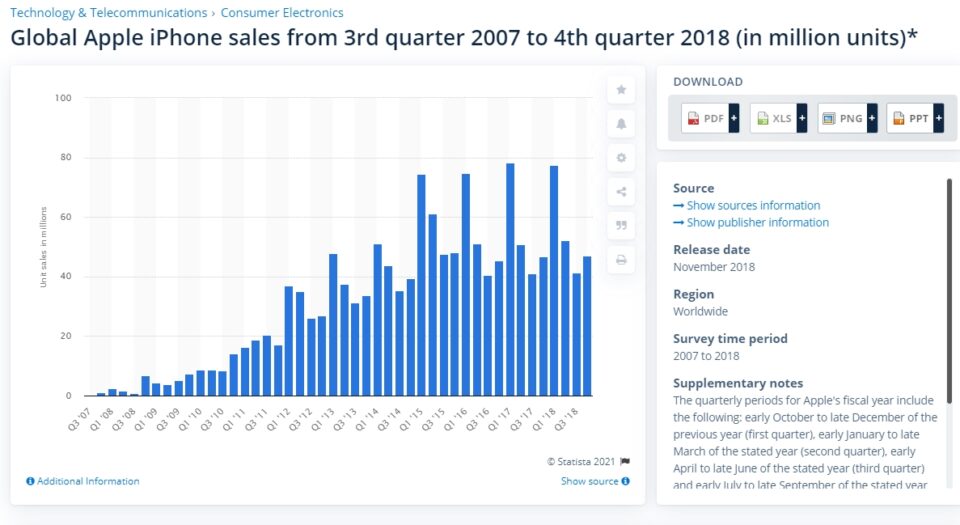

The biggest issue facing Apple in FY22 is pulled forward demand into FY21 due to COVID-19 lockdowns and the 5G iPhone cycle. For this reason, New Street Research predicts iPhone shipments will dip to the 180 million to 200 million range next year while the company is on pace to ship over 220 million this year.

The company faces a couple of issues with the first-hand installed base not growing while replacement cycles are elongating. As consumers rushed to buy new iPhone 12s this fiscal year for the 5G network, the pent-up demand will wane next year.

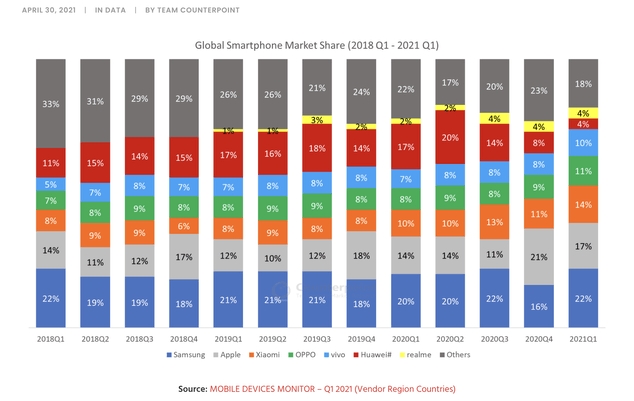

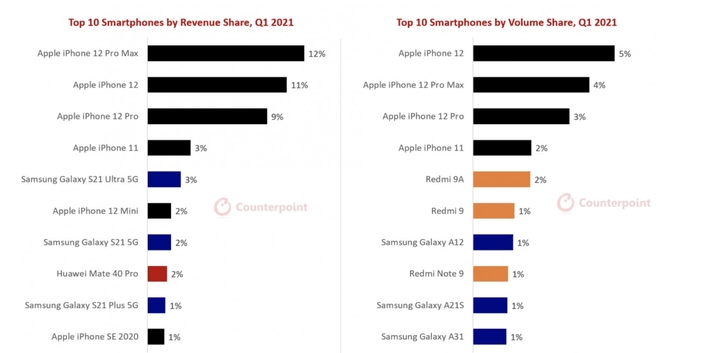

One visual view of how Apple gained temporary market share in the December and March quarters where their spike in global market share during those quarters. For the December quarter, Apple saw their market share jump to 21%, up from only 18% last year. In addition, the September market share (last fiscal quarter of FY20) dipped to only 11% as iPhone sales slipped into the December quarter due to COVID-19 shipping delays.

Source: Counterpoint Research

Apple already controls more than 30% of the global smartphone market based on revenues leaving limited upside for next year. The premium smartphone market includes phones priced above $400 only account for 65% of global smartphone revenues. The other revenue comes from value phones where Apple doesn’t even have offerings placing Apple at ~50% of their total addressable market in Q1.

Source: Counterpoint Research

The combined iPhone shipments for the December/March period this fiscal year was 141.4 million units while Apple only sold 112.3 million in the prior fiscal year. Part of the comparable weakness was the March 2020 quarter saw a minor dip in sales due the COVID-19 hit in China and other parts of Asia.

The average Q2/Q3 sales of the last few fiscal years have been around 80 million-plus units. The numbers just don’t add up for Apple topping the sales levels from the holiday period of FY21 in FY22. The newest iPhone 12S/13 unit will likely return to a material level of sales in September capturing those sales in FY21 this year leaving fewer units to sell in FY22.

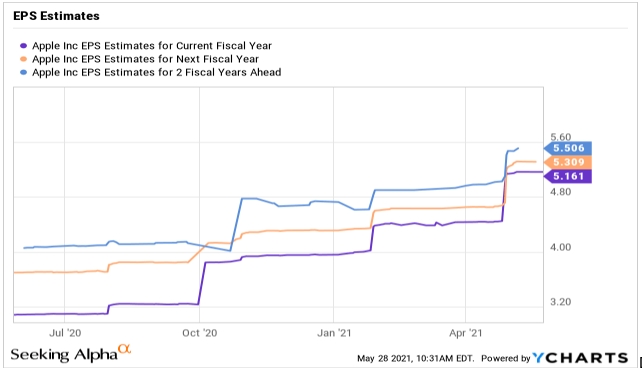

Lack Of Sell Ratings

For these reasons, New Street Research slapped a $90 price target on Apple, down from $135. While most analysts don’t agree with the dire outlook for the tech giant, the consensus estimates are for limited earnings growth next year despite Apple assigning another $90 billion to reduce shares outstanding. The consensus estimates have Apple growing their EPS just 3% per year for FY22 and FY23.

Data by YCharts

Even if Apple doesn’t see a big impact from iPhone sales declines next fiscal year, the stock already trades at 23.5x FY22 EPS targets for a stock only growing earrings annually by 3% going forward. The stock might appear relatively cheap since Apple was trading closer to 27.5x these forward earnings when the stock hit a peak of nearly $145 in January.

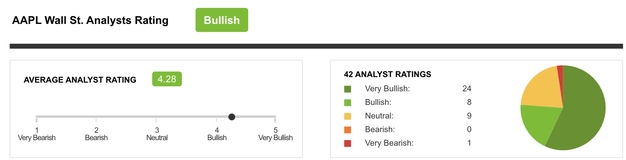

The New Street Research Sell rating is grabbing a bunch of headlines because the market only had one Sell rating on the tech giant. Out of 42 analysts, only two are even bearish on the stock now.

Source: SA Wall St. analyst ratings

The average Wall Street analyst rating is back to the highest levels of the last five years with an average rating of 4.28. Even back in 2019, six analysts were bearish on the stock and the average analyst rating was down below 3.70.

At the time, the stock was in the $50 range and the higher than normal bearish analyst view was a bullish indication. Now, the lack of bears has been a bearish indication going back to last August. Considering Apple has traded at a stretched multiple for the last year, the lack of bears has been a headwind for the stock.

Takeaway

The key investor takeaway is that Apple probably won’t fall to $90, but the tech giant wouldn’t be cheap at 18x current EPS estimates as growth stalls. The biggest risk is for an EPS cut due to lower iPhone sales next fiscal year which would indeed lead the stock down to $90.

The base case isn’t for a 25% dip in the stock, but Apple has far more downside risk than upside potential in the next year.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market, consider joining Out Fox The Street.

The service offers model portfolios, daily updates, trade alerts and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to generate excessive returns in the next few years without taking on the out sized risk of high flying stocks.

This article was written byStone Fox Capital

34.14K Followers

Author of Out Fox The Street

Out Fox the market with misunderstood, high reward opportunities

http://www.outfoxthestreet.com

Stone Fox Capital Advisors, LLC is a registered investment advisor founded in 2010. Mark Holder graduated from the University of Tulsa with a double major in accounting & finance. Mark has his Series 65 and is also a CPA.

Invest with Stone Fox Capital’s model Net Payout Yields portfolio on Interactive Advisors as he makes real time trades. The site allows followers to duplicate the model portfolio in their own brokerage accounts. You can find the portfolio and more details here:

Follow Mark on twitter: @stonefoxcapital

Disclosure: I am/we are long AAPL. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Baidu’s Successful Commercialization Of DuerOS And Apollo Will Lead Accelerated Future Growth, And It Is A Bargain Now

May 20, 2021 4:29 PM ET

Summary

- Baidu became a bargain after its price fell from $300 to $189 since March 2021.

- Baidu’s fundamentals remain intact, as reinforced by Q1 results.

- Successful commercialization of DuerOS and Apollo will lead accelerated future growth.

Baidu (NASDAQ:BIDU) is the tech giant of China, poised to become the leader in autonomous driving in China. BIDU reported a strong Q4 (Q4 Results Provide Evidence of Baidu’s Tangible Monetization Opportunities). Since March 2021, Baidu price was pressured along with other US traded Chinese stocks due to tech sell-off and SEC regulations of Holding Foreign Companies Accountable Act passed under the Trump administration. That act stipulates that Chinese companies listed on U.S. stock exchanges are required to be audited by U.S. auditors, as well as provide proof that they are not owned or controlled by the Chinese government. Companies will also have to identify each board member that is currently an official in the Chinese Communist Party. Investors have fear, and the fear put BIDU stock under pressure.

This week BIDU released another strong Q1. Core advertising revenue grew +27% YoY, and +4% QoQ. A particular bright spot is its AI businesses revenue, which reached RMB 4.2B and has accelerated to +70% YoY (vs. 52% in Q4) and accounted for 21% of Core revenue (vs. 18% in 4Q).

As per its Q2 Revenue guidance, BAIDU expects a Revenue growth of 20-33% YoY for Core Revenue. In the long run, BIDU expects non-Advertising revenue mix to exceed Advertising revenue in next three years.

Apollo cumulative L4 test miles reached 6.2M. Robotaxi started to charge for ride-hailing services. Guangzhou Automobile Group will install BIDU’s ASD in new vehicles. DuerOS has been installed in over 1.5M vehicles.

The automotive industry is on the cusp of drastic transformation. 5G connectivity and autonomy will redefine user experience and bring new use cases for passenger vehicles and the transportation industry. I am positive that Baidu’s Apollo business is going to lead the pace of AV commercialization in China. In this early stage (likely some investors will say “speculative”) BIDU stock has not priced in the goodness in this space. But I am encouraged by its solid monetization strategies: 1) smart transportation projects, 2) robotaxi services, 3) AV software sales to auto-OEMs, and 4) joint-venture for AV/EVs with mass-production expected by 2024.

What is BIDU worth?

Based on sum-of-the-parts (SOTP), its fair value will be around $340 to $360. This valuation includes: 1) $68B for advertising (Search+ Feed), on 10x ’22E EBITDA, 2) $20B for Baidu Cloud on 6x ’22E revenue, 3) $18B for Apollo/electric vehicle JV with Geely/DuerOS, 4) $20B for its investments in TCOM, IQ, Kuaishou, and other, and finally 5) a risk adjustment of $18B for conservative purposes. This valuation implies ~30x BIDU total ’22E EPS.

What are the risks?

If we consider the downside scenario, it will most likely come from continued Macro slowdown due to COIVD, trade war, etc. that might have a greater than expected impact on search and consumption for other services. Additionally we need to watch out ByteDance and Tencent’s search products, which might eat shares from BIDU.

This article was written by

1.31K Followers

Kellogg MBA, Master of EE.Over 10 years of equity research experience.

Medium-Term Horizon, Growth

Contributor Since 2015

Kellogg MBA, Master of EE.

Over 10 years of equity research experience.

Disclaimer: Any content on this site is NOT investment, trading, legal, or tax advice, and none of the information available through this website is intended to provide tax, legal, investment or trading advice. Nothing provided through this content whether by the owner or posted by other writers constitutes a solicitation of the purchase or sale of securities/futures. The content on this site is intended for informational purposes only, and should never be used as investment advice. Please do your own research before making any investment decisions.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Cryptocurrencies

Binance Faces Probe by U.S. Money-Laundering and Tax Sleuths

May 13, 2021, 10:43 AM MDT Updated on May 13, 2021, 12:09 PM MDT

Justice Department, IRS seek information about crypto exchange

The federal agencies haven’t accused Binance of wrongdoing

Follow us @crypto for our full coverage.

Binance Holdings Ltd. is under investigation by the Justice Department and Internal Revenue Service, ensnaring the world’s biggest cryptocurrency exchange in U.S. efforts to root out illicit activity that’s thrived in the red-hot but mostly unregulated market.

As part of the inquiry, officials who probe money laundering and tax offenses have sought information from individuals with insight into Binance’s business, according to people with knowledge of the matter who asked not to be named because the probe is confidential. Led by Changpeng Zhao, a charismatic tech executive who relishes promoting tokens on Twitter and in media interviews, Binance has leap-frogged rivals since he co-founded it in 2017.

The firm, like the industry it operates in, has succeeded largely outside the scope of government oversight. Binance is incorporated in the Cayman Islands and has an office in Singapore but says it lacks a single corporate headquarters. Chainalysis Inc., a blockchain forensics firm whose clients include U.S. federal agencies, concluded last year that among transactions that it examined, more funds tied to criminal activity flowed through Binance than any other crypto exchange.

“We take our legal obligations very seriously and engage with regulators and law enforcement in a collaborative fashion,” Binance spokeswoman Jessica Jung said in an emailed statement, while adding that the company doesn’t comment on specific matters or inquiries. “We have worked hard to build a robust compliance program that incorporates anti-money laundering principles and tools used by financial institutions to detect and address suspicious activity.”

Spokespeople for the Justice Department and IRS declined to comment.

U.S. Concerns

U.S. officials have expressed concerns that cryptocurrencies are being used to conceal illegal transactions, including theft and drug deals, and that Americans who’ve made windfalls betting on the market’s meteoric rise are evading taxes. Such worries have been a hindrance to the industry going mainstream, even as Wall Street increasingly embraces Bitcoin and other tokens amid a global investing frenzy.

Read More: How Bitcoin Is Edging Toward Financial Mainstream

This month’s cyber-attack against Colonial Pipeline Co. that’s triggered fuel shortages across the Eastern U.S. is the latest sign of what’s at stake. Colonial paid Eastern European hackers a nearly $5 million ransom in untraceable cryptocurrency within hours of the breach, Bloomberg News reported Thursday, citing two people familiar with the matter.

Bitcoin losses accelerated Thursday after Bloomberg reported the investigation into Binance.

the Justice Department and IRS probe potential criminal violations, the specifics of what the agencies are examining couldn’t be determined, and not all inquiries lead to allegations of wrongdoing.

The officials involved include prosecutors within the Justice Department’s bank integrity unit, which probes complex cases targeting financial firms, and investigators from the U.S. Attorney’s Office in Seattle. The scrutiny by IRS agents goes back months, with their questions signaling that they’re reviewing both the conduct of Binance’s customers and its employees, another person said.

The U.S. Commodity Futures Trading Commission has also been investigating Binance over whether it permitted Americans to make illegal trades, Bloomberg reported in March. In that case, authorities have been examining whether Binance let investors buy derivatives that are linked to digital tokens. U.S. residents are barred from purchasing such products unless the firms offering them are registered with the CFTC.

Analyzing Transactions

Zhao has said Binance closely follows U.S. rules, blocks Americans from its website, and uses advanced technology to analyze transactions for signs of money laundering and other illicit activity. Last year, the firm warned that U.S. residents would have their accounts frozen if they were found to be trading, crypto trade publications have reported.

The inquiries follow a Chainalysis report on criminal transactions involving digital tokens. The firm tracked Bitcoin worth $2.8 billion that it suspects crooks moved on to trading platforms in 2019. Chainalysis determined that roughly 27%, or $756 million, wound up on Binance. Binance responded by saying it adheres to all anti-money laundering regulations in the jurisdictions in which it operates and works with partners like Chainalysis to improve its systems.

In the U.S., authorities have been cracking down on exchanges for flouting laws that are meant to prevent financial crimes, with officials citing the platforms use by terrorists and hackers. Tax violations have also been a priority, with the government recently winning a court order as it seeks to unmask U.S. clients of Kraken, a San Francisco-based exchange.

Read More: Crypto’s Anonymity Has Regulators Circling After Colonial Hack

In October, federal prosecutors in Manhattan announced charges against the founders of Seychelles-based BitMEX, accusing them of violating the Bank Secrecy Act by permitting thousands of U.S. customers to trade while publicly claiming to restrict their access. The claims included failing to register as a futures merchant with the CFTC and not having adequate anti-money laundering controls. Three of the BitMex officials pleaded not guilty and a trial has been scheduled for March 2022. One remains at large.

Washington Presence

With the U.S. circling, Binance has stepped up its presence in Washington and retained a former Treasury Department official and top white-collar defense lawyers to represent it in legal cases and matters being reviewed by regulators. In March, the firm tapped former U.S. Senator Max Baucus, a Montana Democrat, to advise it on policy and government relations.

Read More: Crypto Lobby Forms to Shake Reputation as Criminals’ CurrencyIn September 2019, Binance partnered with a firm called BAM Trading Services Inc., which launched Binance.US to cater to American clients. Brian Brooks, who was a top banking regulator when he led the Office of the Comptroller of the Currency during the Trump administration, became chief executive officer of Binance.US this month.

Amid the hiring blitz, the company has popped up in U.S. cases tied to criminal activity. In February, two Florida men were charged with running an online fentanyl trafficking operation, with one of them accused of depositing the proceeds in a Binance account. That same month, the Justice Department sought the forfeiture of cryptocurrency worth $450,000 traced from ransomware attacks that hit several U.S. companies to a Binance account held by a 20-year-old Ukrainian national. The government didn’t accuse Binance of wrongdoing in either enforcement action.

Disguising Locations

Along with the CFTC, the Justice Department is likely to examine steps that Binance has taken to keep U.S. residents off its exchange. One person familiar with Binance’s operations said that prior to the establishment of Binance.US, Americans were advised to use a virtual proxy network, or VPN, to disguise their locations when seeking to access the exchange.

Jung, the Binance spokeswoman, said the exchange has never encouraged U.S. residents to use VPNs to get around its rules, as doing so would be something “that has always been contrary to our company’s principles.” In January, Zhao tweeted that Binance’s security systems block Americans even if they try to connect through one of the networks.

“We have implemented strong access controls that have been tested via external audit and are under continuous review and evaluation by Binance to ensure that the appropriate restrictions are in place and are effective,” Jung said.

— With assistance by Benjamin Bain, and Alyza Sebenius

(Updates with Bitcoin falling in eighth paragraph.)

https://www.ksl.com/article/50174428/coach-kim-10-people-skills-every-person-needs

Coach Kim: 10 people skills every person needs

By Kim Giles, KSL.com Contributor | Posted – Jun. 1, 2021 at 7:20 a.m.

SALT LAKE CITY — I’ve been working as a people skills expert for 20 years, teaching individuals and organizations to understand human behavior and get along with others. Throughout that time, I’ve discovered 10 basic people skills that I consider to be the skills every human being could work on to help create healthy relationships.

As you read through these 10 people skills, assess yourself and see where you might need some work.

1. Ability to put yourself in another person’s shoes

This is the skill of empathy, which is a skill you can become better at. Recent studies have shown that at least 10% of our capacity for empathy is inherited through our genes; the rest is all about intention and practice. Last week’s LIFEadvice article includes many ways to improve your empathy and teach it to your kids.

2. Ability to accept others who are different from you

We all have a tendency to react in judgment when we meet someone who is different from us. We sometimes assume if two things are different, one must be better and one must be worse. This human tendency encourages us to see others as less than us so we can feel better.

You can change this tendency by choosing to see all humans as having the same, infinite value that never changes. Then when you meet someone who is different, you can practice allowing them to be different and still have the same value.

Understand that the world needs all kinds of people, with different views and different ways of functioning in the world. You can choose tolerance, acceptance, allowing and respecting them instead of judging them. It is a wonderful skill that will improve with practice.

3. Ability to stay open, flexible and change your mind or plans

It can be a real problem in your relationships at home and work if you are too controlling, opinionated, inflexible or sure you are right all the time. Watch for needing to make others wrong for you to feel safe in the world and how this negatively affects your connection with others. It is a good practice to stay open and always assume that you might be wrong about everything you know.

Question what you are told and assume there might be things you don’t know or another perspective you haven’t considered. Be willing to change plans and let go of your expectations, too. Expectations about how things should be can make you too rigid and difficult to work with.

Practice trusting that however things turn out, that must be perfect for some reason and roll with changes in plans without feeling mistreated or taken from. Recognize that you feel loss when things don’t go the way you wanted; but if you trust it’s perfect then, there is no loss.

4. Ability to know your own worth in any situation

Knowing your own worth in any situation means you don’t let situations or other people diminish your value. You can gain this skill by practicing knowing that your intrinsic value can’t change and is the same as every other human being’s, no matter what happens or what anyone thinks.

You can be bulletproof from low self-esteem issues by just choosing to believe your value can’t change. Every time you make a mistake or feel judged or criticized, keep telling yourself “that doesn’t change my value.” As you practice this, you will find you can walk into any situation and feel safe because your sense of safety comes from inside of you.

5. Ability to regulate your own inner state — from unsafe to safe

Every minute of the day, you are in one of two states: feeling safe, where you are capable of showing up for others, or feeling unsafe, where you feel “not good enough” or not secure and aren’t capable of focusing on others. You can and must monitor your inner state and pay attention to where you are. If you start behaving badly or feel un-balanced, you are probably in a fear (unsafe) state.

It is your No. 1 job in life to be responsible for yourself and your behavior. You can choose to make yourself feel safe by choosing to believe your value can’t change and that your journey is the perfect classroom for you. Trust the universe is a wise teacher who knows what it’s doing, and trust that it only brings situations into your life that will bless you and grow you. This means you have the ability to make yourself feel safe in any moment. Your sense of security in the world can come from you, and it will also make you more capable of giving to others.

6. Ability to understand what’s really happening when others are upset

When people are upset, they often channel their anger toward a person — but the angry emotion is not usually about that person. People with good social skills understand this and can see that these people are just scared. It’s fear of failure and loss that upsets people, and their upset is always about their own safety.

Most bad behavior is really a request for love or attention. Humans need some validation or reassurance that they are safe and loved. Bad behavior in another person often doesn’t make us want to validate or love them, but it is what they need. This is, again, a skill that you get better at with practice.

7. Ability to have a difficult conversation the right way

We all need to know the right way to have a touchy conversation so that both parties feel heard, honored and respected at the end. This means seeing the other person as the same as yourself, setting your feelings aside upfront, asking questions and listening to the other person, then asking permission to speak your feelings and share your view. This process is easy, but remembering to practice it in every conversation is hard.

You might need to have a reminder on your phone to remind you to listen before you talk and to validate other people’s right to their opinions. I’ve written numerous articles on this topic in the past.

8. Ability to listen and validate another person

You need to have some conversations with the people in your life in which all you do is ask questions, listen and honor and respect the other person’s right to their feelings. I see this as its own skill because it truly is a specific skill inside of the conversations mentioned above.

Listening is easy for some people who don’t like to talk anyway, but for some of us this is really hard and requires diligent intention and practice. You must consciously decide at the beginning of a conversation that you are committed to making the other person feel heard, understood and valued, and that you will listen more than you talk.

The most powerful way to give this to another person is to simply ask lots of questions and listen with the intent to understand them, rather than trying to figure out what you want to say next. Being a master listener is one of the greatest people skills you can develop.

9. Ability to enforce your own and honor others’ boundaries

This skill is really about seeing your own value as equal to that of other people. This means your needs are equally important as theirs. It also means honoring your right to have boundaries to protect yourself and make sure your needs are met.

Some of us feel selfish if we make our needs important, but it’s not. Putting one’s needs first can actually be wise and healthy.

We must also watch for other people enforcing their boundaries and honor their right to make themselves important too.

10. Ability to make hard decisions from a place of love, not fear

Many of us fear making decisions because we fear mistakes and/or missing out on any options. Your ability to listen to your own intuition and know what choice is right for you is a critical life skill you can, again, practice and get better at.

A technique I teach my coaching clients is to write down all of your options. Then, write down a fear-motivated reason to do each option and a love-motivated reason to do each option. This will double your options. The next step is to cross out all the fear-motivated reasons/options and make a choice from the love-motivated ones.

Sit with that choice and feel what your intuition has to say about it. Does it feel right to you? Does it still bother you and make you feel discontented? You are entitled to know the right path on your perfect classroom journey. You have an inner GPS to guide you. If you haven’t tuned into yours yet, you just need to start practicing listening and feeling your way through some choices. All the answers you need are inside you.

Working on these skills will help you become you someone who is easy to get along with, resolve conflicts, negotiate and make plans with. You will be more likely to make friends easily and feel happier because you will feel safer and more secure and have more to give others.

You can do this.

Editor’s Note: Anything in this article is for informational purposes only. The content is not intended, nor should it be interpreted, to (a) be a substitute for professional medical advice, diagnosis, or treatment. Always seek the advice of your physician or other qualified health provider with any questions you may have regarding a medical condition; (b) create, and receipt of any information does not constitute, a lawyer-client relationship. You should NOT rely upon any legal information or opinions provided herein. You should not act upon this information without seeking professional legal counsel; and (c) create any kind of investment advisor or financial advisor relationship. You should NOT rely upon the financial and investment information or opinions provided herein. Any opinions, statements, services, offers, or other information or content expressed or made available are those of the respective author(s) or distributor(s) and not of KSL. KSL does not endorse nor is it responsible for the accuracy or reliability of any opinion, information, or statement made in this article. KSL expressly disclaims all liability in respect to actions taken or not taken based on the content of this article.