Trade Findings or Adjustments 02-12-2019

DIS – Common sense of trading an advisory

DON’T just place the trade, follow that days trend, new events and be ready to NOT place a trade if you can’t get the credit/net debit / set up that the trade requires.

IS DIS a better trade today than last week

Possibility for a 3 day trade at 108/110 bull put to exit in one day with half your credit of $0.77

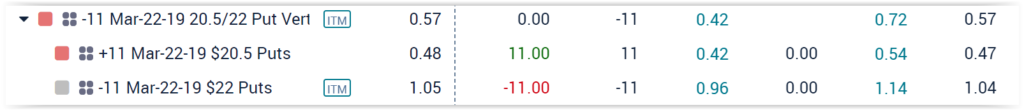

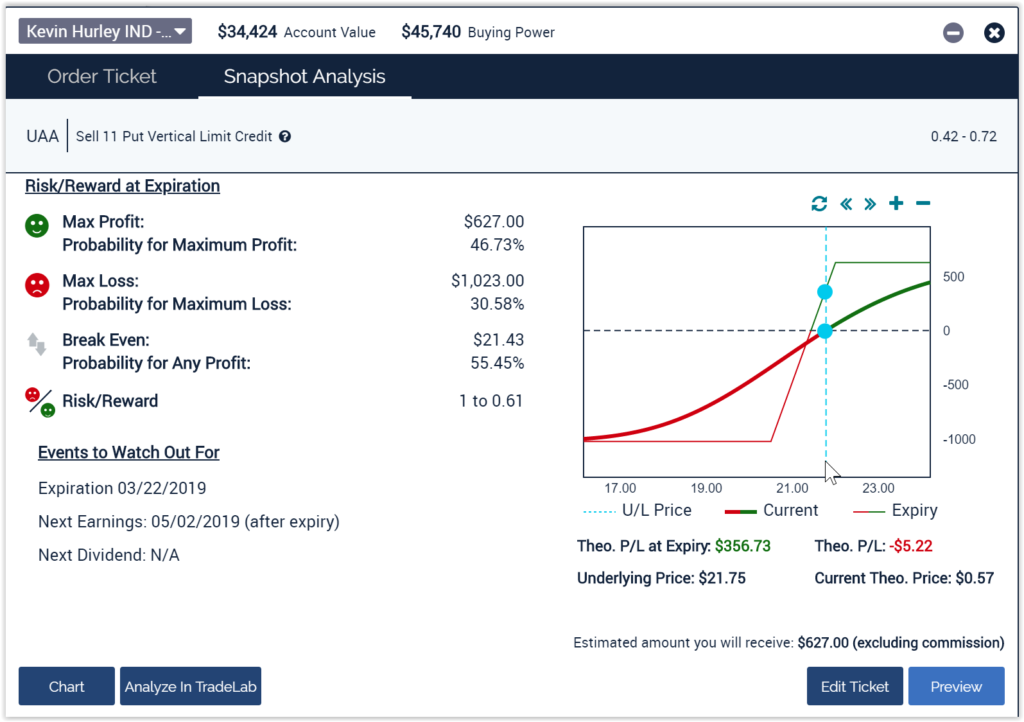

UAA

You could enter a BTO $22.21 looking to exit at 24.20 for a net profit of = $1.99 profit or 8.95%

I don’t have 22K to spend so work on a Bull Call

Mar-22-19 Bull call 22.50/24.50

BTO 22.50 LC for $1.17 – Short Call strike 24.50 credit 0.25 = $0.92 net debit = risk

Max reward diff in strikes=$2 – 0.92 = $1.08

You could do an April 22.50/25 for Net Debit of $0.93

You get and extra 5 weeks for the stock to move and an extra $0.50 of profit

Mine is an adjustment to Long puts against stock ownership

www.hurleyinvestments.com www.myhurleyinvestment.com www.KevinMhurley.com