Trade Findings and Adjustments 9-1-20

Keve Bybee – keve@hurleyinvestments.com

AAPL – If you had a covered call on some shares you can:

- Let it get called away for a profit! WOOOOO!!!!

- Roll strike price up for more upside but at a bit of cost to roll.

- Leave it alone and add leap calls to convert profit for more return.

SWBI – WHAT IS THE DEAL?!

- How did we sell this stock at $25 if it has never traded higher than $22? Sold it before they split away from American Outdoor Brands.

COST – Leap calls: Sell off for profit and look for a chance to buy a dip

TGT – Not a bad place to take profits. Add new leaps out to Jan 22 160 strike calls if you want to have enough time and money to dollar cost average.

UAA vs NKE? – UAA beat their earnings numbers and NKE did NOT! Why is NKE at all time highs and UAA stinking it up?? Maybe NKE knows better how to deal with negative press than UAA does…

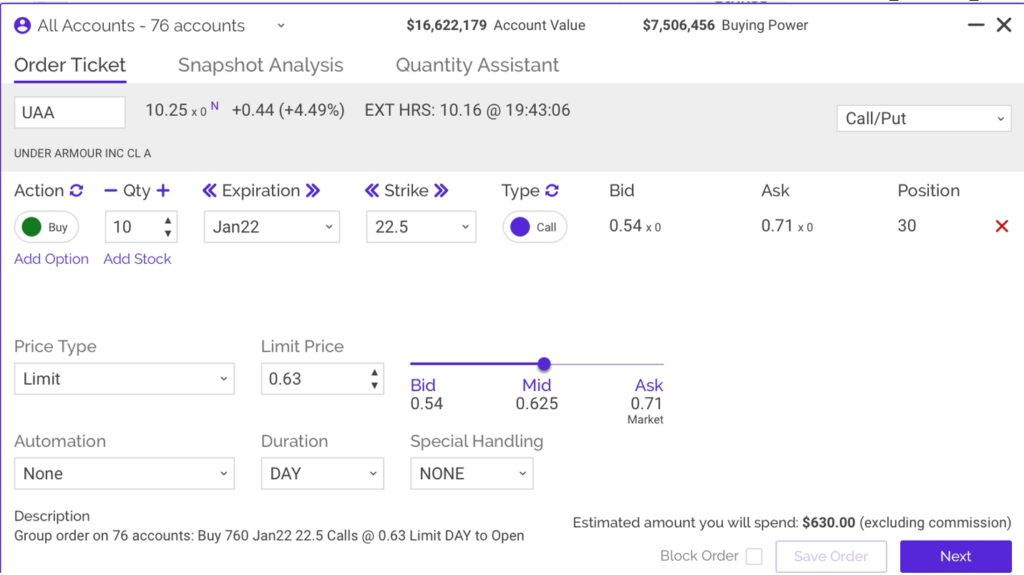

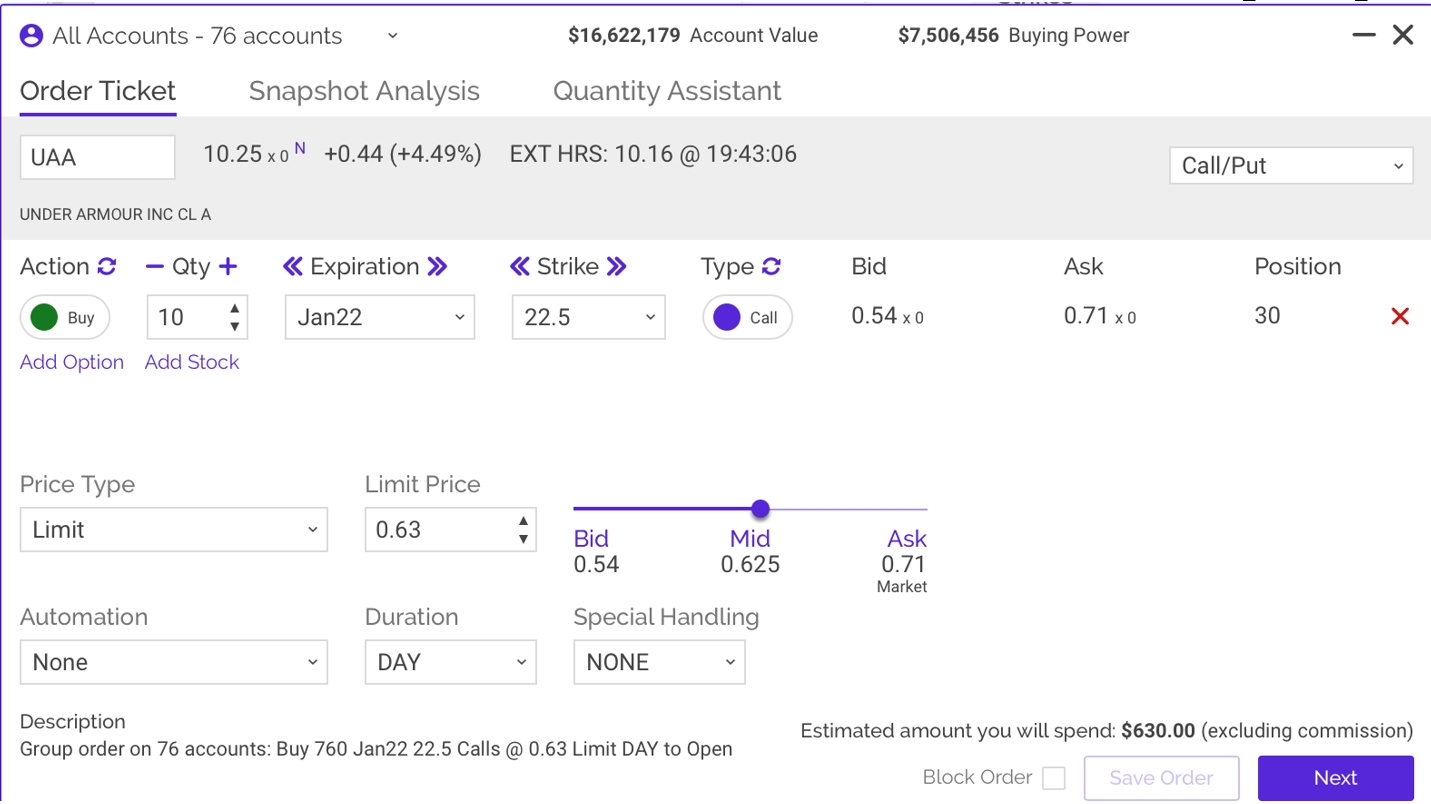

Wait to see if UAA holds and breaks above 50 DMA and 10.25 pivot point.