Trade Findings and Adjustments 12-08-2020

Let’s see how we did on 12-01-2020 trades?!?!?!!!!!

The key is to letting things run if you want a really big return in your portfolio.

But Kevin if you are doing 20% returns and only risking 5% of your portfolio on 90% winning trades isn’t that the smarter way to go?

52 weeks @ 20 % returns would be 1040% return on the portfolio

1040 *0.05 = Most mathematically you could make on your portfolio is 52% return

Placing a trade every week is stupid IF you believe in Fundamentals, Technical and Sentimental Analysis

THERE ARE TIMES YOU SHOULDN’T BE PLACING A TRADE

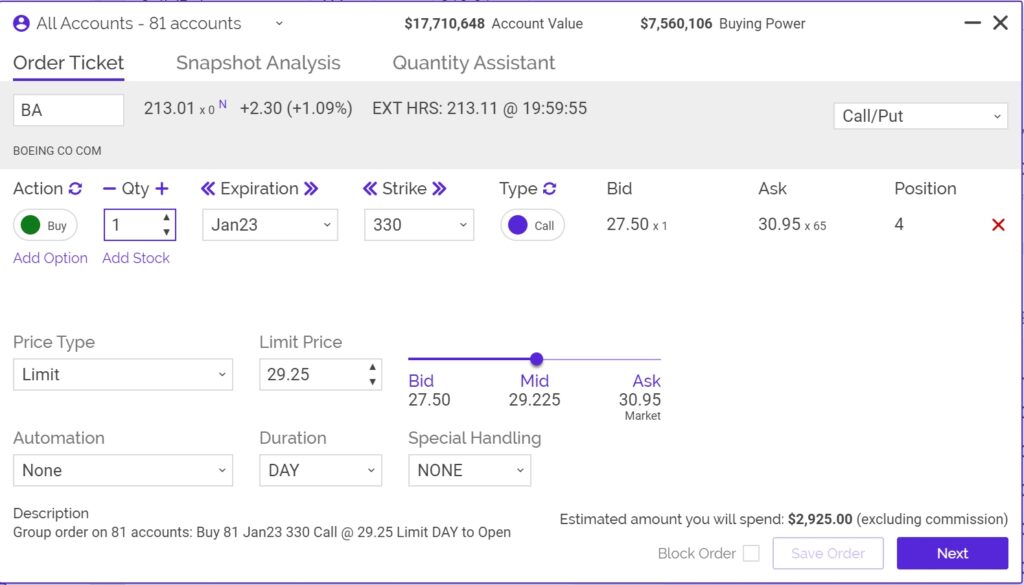

23.50 last traded price for this contract = 22.10 entry price = 1.40 or 6.33% return

BE = 130 + 22.10 = $152.10

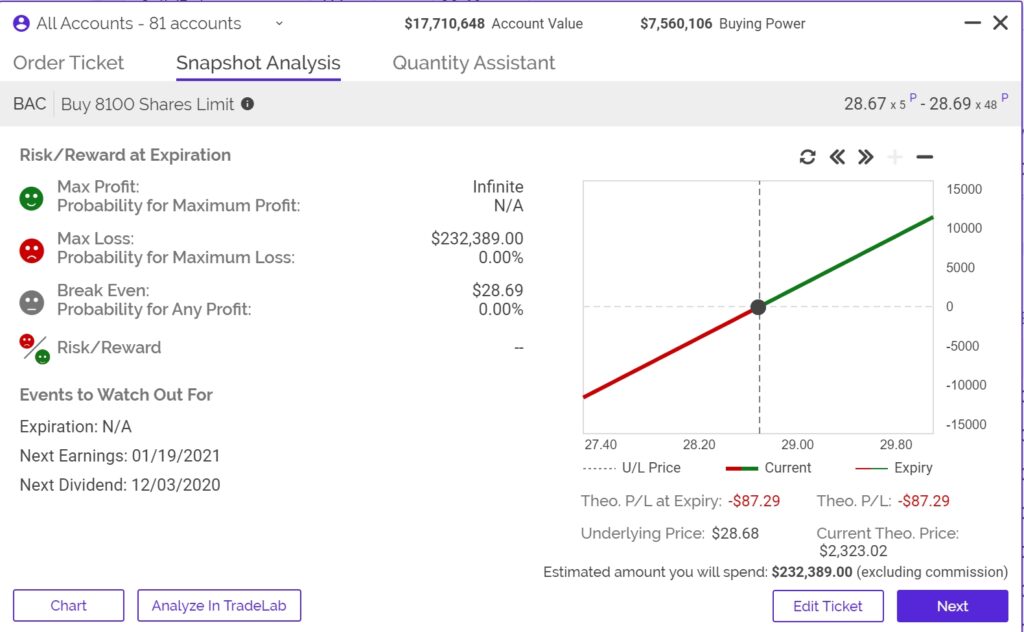

BE = 28.69

Currently at $28.93 = profit of $0.24 or 8.3% return

BE 29.75 Cost Basis = Last traded at 37.80

Profit 37.80 – 29.75 = $8.05 27.05% ROI

I would take off 25% of the position and continue to let it run