Trade Findings and Adjustments 10-13-2020

https://www.thestreet.com/investing/jpmorgan-beats-q3-earnings-forecast-credit-provisions-tumble

JPMorgan Beats Q3 Earnings Forecast; Credit Provisions Tumble

JPMorgan’s third quarter credit provisions fell to just $611 million, while fixed income and equity revenues surged, helping the biggest U.S. bank smash Wall Street earnings forecasts.

UPDATED:

OCT 13, 2020 11:00 AM EDT

ORIGINAL:

OCT 13, 2020JPMorgan Chase & Co. (JPM) – Get Report posted stronger-than-expected third quarter earnings Tuesday as the bank set aside a much lower amount to cover ad loans amid an improving domestic economy.

JPMorgan CEO Jamie Dimon also said the bank could resume its share buybacks in the first quarter of next year, depending on changes to the Federal Reserve’s cap on shareholder returns, which was extended until the end of 2020 earlier this spring.

JPMorgan said earnings for the three months ending in September were pegged at $9.4 billion, or $2.92 per share, up 9% from the same period last year and well ahead of the Street consensus forecast of $2.22 per share. Group revenues, JPMorgan said, slipped 0.66% to $29.9 billion, again topping analysts’ forecasts of a $28.3 billion tally.

JPMorgan said its credit loss provision for the quarter rose by $611 million, a much lower figure than the front-loaded $10.5 billion booked over the three months ending in June and the market expectation of around $1.8 billion to as high as $6 billion. Group expenses edged higher from last year to $16.9 billion, the bank said.

“JPMorgan Chase earned $9.4 billion of net income on nearly $30 billion of revenue and we maintained our credit reserves at $34 billion given significant economic uncertainty and a broad range of potential outcomes,” Dimon said. “We further strengthened our capital and liquidity position, increasing CET1 capital to $198 billion (13.0% CET1 ratio, up 60 basis points after paying the dividend) and liquidity sources to $1.3 trillion.”“In Consumer & Community Banking, we continue to add deposits, up 28% versus last year – and based on the most recent FDIC data we ranked #1 in U.S. retail deposits for the first time ever as we are investing in the business to better serve our customers’ needs,” he added.

JPMorgan shares were marked 1.33% lower in early trading following the earnings release to change hands at 101.02 each, a move that would put the stock’s six-month gain at around 3%.

Investment banking revenue, JPMorgan said, rose 12% to $2.1 billion, while revenues in the group’s fixed income division surged 29% to $4.6 billion. Equity market revenues, JPMorgan said, rose 32% to $2 billion.

JPM lost $1.66 or 1.62% on fears that they may have to raise another 20 B sometime in the future

Still Holding the $100 level of support

Currently

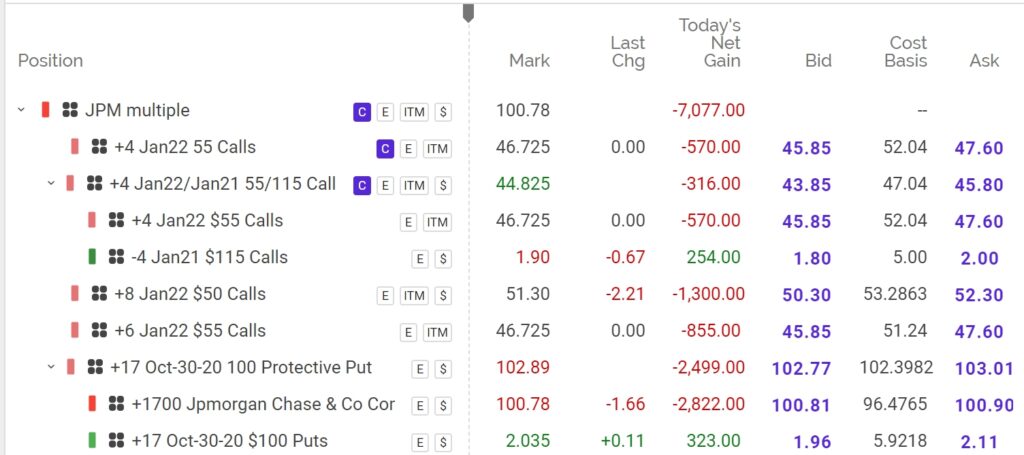

Leap Long Calls Jan 2022 $55 it would cost you $46.73

Break Even = 55 + cost basis 46.73 = $101.73

Delta = 0.99

For half the cost and no dividends you could own JPM for $1.05 of extrinsic Value or $46.73 for the next year and 3 months

Let’s work the half covered call side

Current position = LC purchased for 52.04 short call sold for $5

Net debit = $47.04

BE = 55 + 47.04 = 102.04

AND if JPM trades higher than $115 By Jan 2021 you make $115-102.04 = 12.96 or 12.65% return

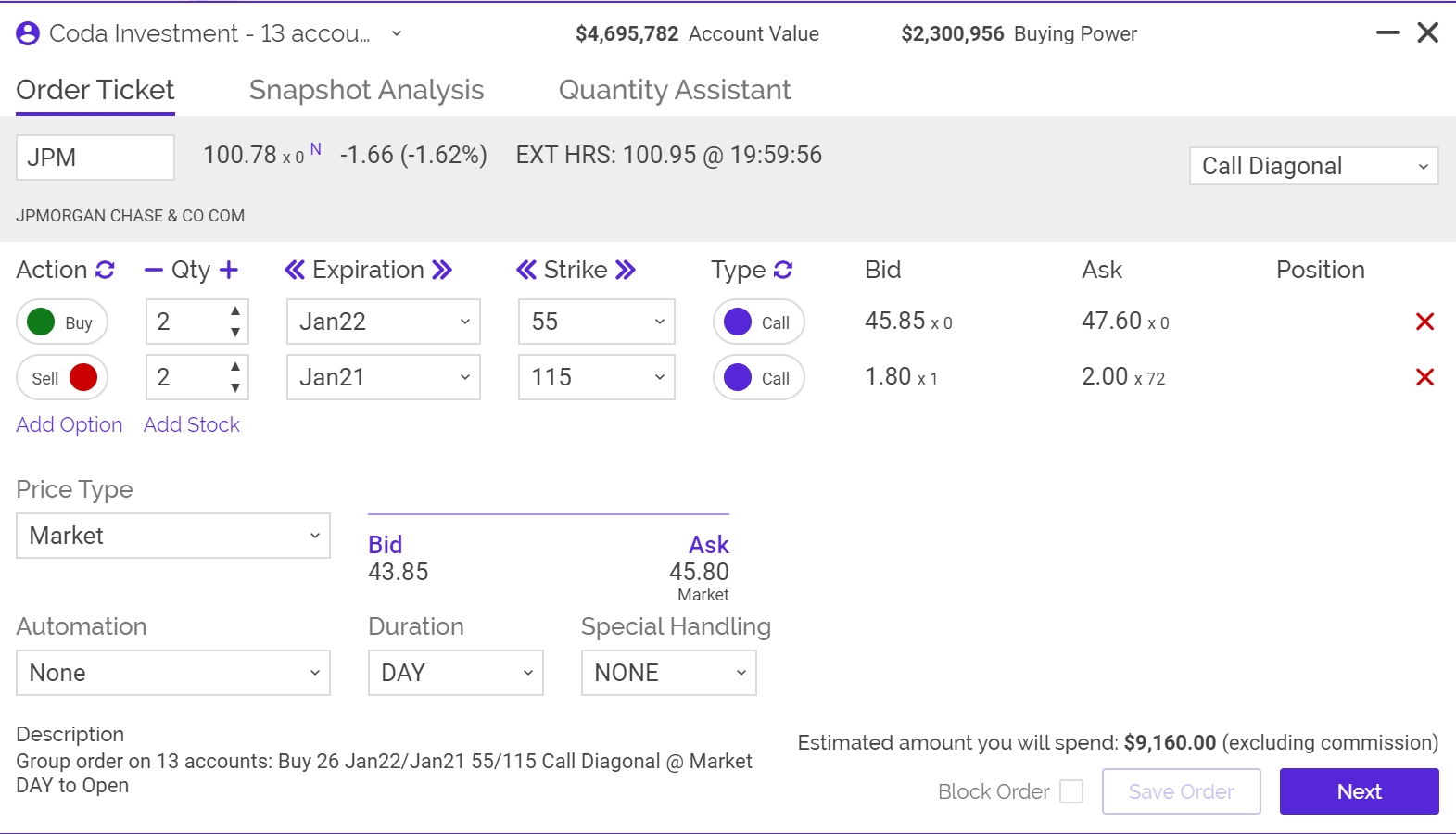

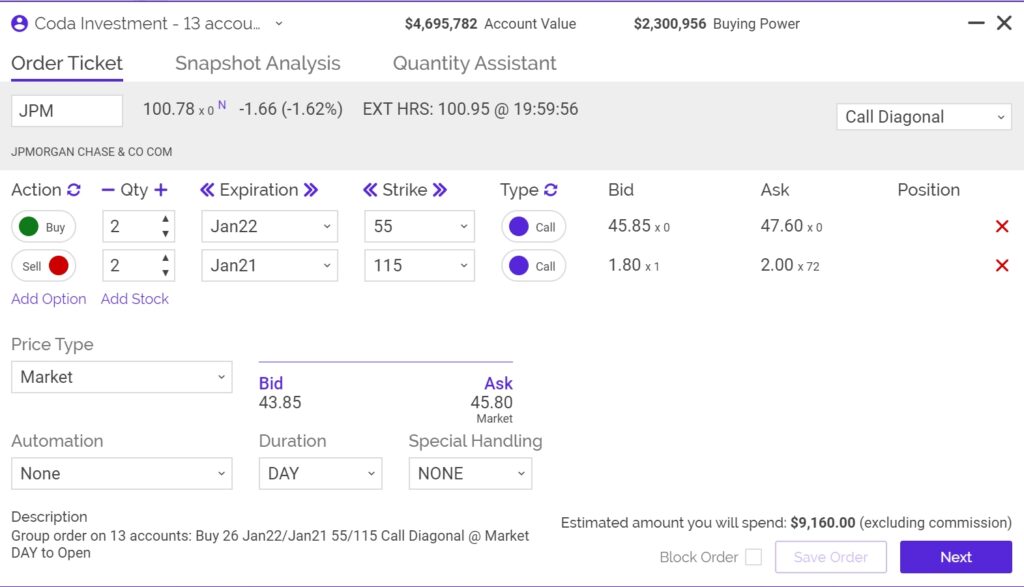

NEW TRADE 55/115 Calendar Bull call

BTO 55 Jan 22 LC for $46.73

STO 115 Jan 21 SC for $1.90

Net Debit = 44.83

BE = 55 + 44.83 = $99.83 AND currently the stock is trading at 100.78

IF you pay 45.78 or less you made an arbitrage time decay benefit.

Negatives = Banks looking for a higher yield curve, stimulus protects the home loan markets, risk is foreclosures,

Employment risk, Wall Street market risk