Trade Findings and Adjustments 07-09-2019

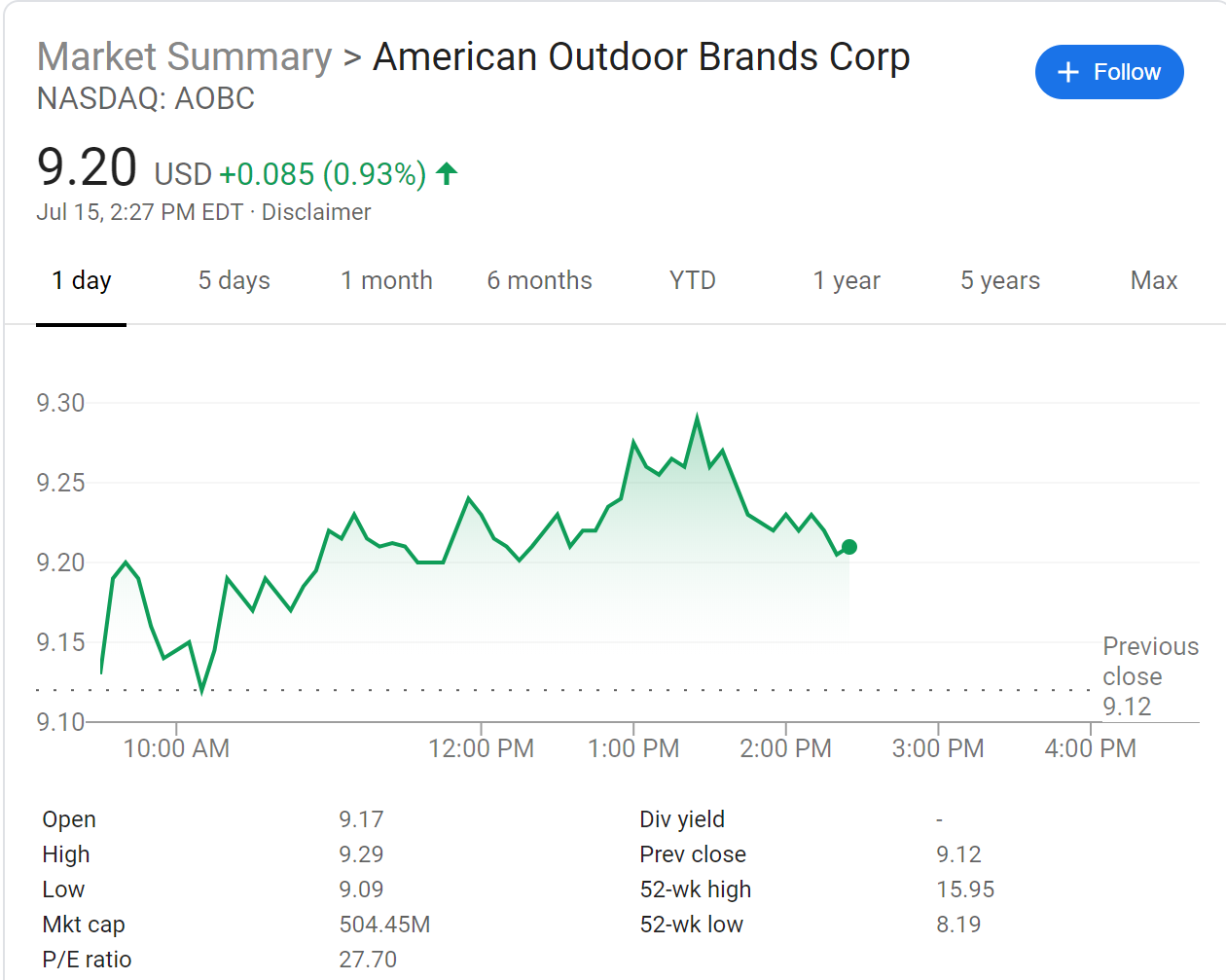

AOBC – Added 3 more contracts to dollar-cost-average the Bull Call position.

Jan 2020 10 strike long call/ 12.50 short call for about .75 cost basis. 3 contracts.

Added 3 more to lower the cost basis down to .68 cent.

AAPL – July 12th for 3 days 197.50/200 bull call. Set a limit order for 1.75 or less.

DIS – holding 140 support level today. I like how DIS has weathered the current market worries.

July 26th Bull Call 135/140 for about $3.90 cost basis.

Is there a rule of thumb on number contracts to buy?

A: IT DEPENDS!

– What positions you have – diversify a bit.

– The cash you have to be able to dollar cost average. For Collar trading it means our puts allow us to buy more shares if prices fall. But for an account like the one we are trading in, we need to leave room to dollar cost average leap long calls and spread trades.

Apple: The Worst Case Scenario

Jul. 8, 2019 7:31 PM ET|54 comments | About: Apple Inc. (AAPL)

| Bill Maurer Long/short equity, long only, short only, Growth (19,836 followers) |

Summary

Analyst puts sell rating on stock with $150 target.

Reasoning has to do with product cycle disappointment.

Services growth will be key over next 12 months.

Shares of technology giant Apple (NASDAQ:AAPL) dipped more than two percent on Monday, helping to lead US markets lower. The decline came after analyst Jun Zhang at Rosenblatt cut the name to sell, citing fundamental deterioration over the next 12 months. Today, I wanted to examine the pieces of this note, as it would likely represent the worst case scenario for the name.

According to a key Apple watcher, Zhung has the lowest price target of any major analyst at $150, roughly 25% below where shares are currently. What really interests me is the quote that Apple is not a short, because of its cash pile and large buyback. Personally, I think if you think a stock should be at a level this much below where it is, you should be recommending a short position. Investors often get annoyed with some analyst ratings like these, or times when an analyst has a price target below where the stock is yet still has a buy rating (or a sell rating with a higher target).

Perhaps, the most interesting part of the note is that the analyst isn’t citing just one particular item for this negative piece. This could include items like the China trade war that hasn’t been completely solved yet, or increased regulation on big tech names from US or foreign governments. Instead, Zhang came out firing, basically saying Apple will disappoint everywhere, so let’s look at the main points of his argument.

- New iPhone sales will be disappointing.

- iPad sales growth will slow in the second half of 2019.

- Other product sales growth, such as the HomePod, AirPod, and Apple Watch, may not be meaningful to support total revenue growth.

- After strong service revenue growth over the last 4-6 quarters and the launch of Apple Music and news, we believe service revenue growth will also decelerate.

Since the iPhone still represents the majority of revenues, let’s start there. There are some thoughts out there about this cycle being a little soft, primarily as consumers wait for a 5G offering next year. The biggest upgrade focus this year is rumored to be on the camera side, while some nice extras like sharing battery power would be welcomed. In my opinion, the biggest item to watch will be pricing, especially after last year’s effective pricing raise. The good news is that as we move into the holiday quarter and beyond, the year over year comparisons get a lot easier thanks to last year’s big sales miss.

The iPad could be the big wildcard here, just because there are various reports out there talking about either a late 2019 or early 2020 launch for new Pro versions. Apple launched two new iPad Pro models in the fall of 2018, helping sales of the tablet in the holiday period. However, if we look at this device’s history, the iPad Pro doesn’t always get refreshed exactly a year after each version is launched, so there’s the potential that hundreds of millions or even more than a billion worth of revenues could get pushed out of the holiday period into a calendar 2020 quarter.

The “other products” category is perhaps where I disagree most with the analyst note. The Apple Watch continues to sell well as the product continually gets better, and the second generation AirPods will probably be just as popular or more than the original. As for the HomePod, I wouldn’t be surprised to see a price cut to stimulate sales growth, especially if a second generation version is launched this fall. Targeting the home and increasing wearable sales is going to be key for Apple’s next revenue leg up.

The decelerating services growth idea is an interesting one, just because things like Apple Music and others launched in recent years have pushed the base number so much higher, along with the accounting change last year that boosted reported numbers. Over the next year, investors will closely be watching to see how News Plus, the streaming services, and things like Apple Pay are rolled out and expanded. With so many eyeballs focusing on the services segment as Apple’s key future growth pillar, you don’t want to see negative stories like this one on News Plus, suggesting that publishers are not generating the income that was projected.

Could Apple drop to $150 in the next year or so? It seems possible if you consider the levels shares dropped to in the past year when iPhone sales disappointed. However, I don’t think it is as likely unless we get a major negative turn in the US/China trade war. This is because you have much lower expectations this time around, a higher dividend and lower share count, along with the strong possibility that the Fed and other central banks will lower rates to keep economic growth moving along. In the end, I see Monday’s analyst note as the worst-case scenario for Apple.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.www.hurleyinvestments.comwww.myhurleyinvestment.comwww.KevinMhurley.com