Trade Findings and Adjustments 03-18-20

Keve Bybee – keve@hurleyinvestments.com

Stocks opened a bit lower due to initial claims and 10 yr yield jumping up.

Thoughts on why?

- Businesses may be preparing for a higher minimum wage hike and higher taxes.

- Pipeline businesses shut down.

- Higher regulation coming down the line

- BUT this is just one week and we don’t have a trend

What other economic data to keep an eye on?

- Consumer spending

- Consumer income

- Productivity

- GDP

- New home sales

- Hourly earnings (part of the average work week)

Lets keep our eyes longer term and not get stuck in the weeds.

BA new leap Bull Call to put new money to work. Risking $30.40 to make $125 over the next 2 years sounds like a great idea.

- Jan 23 275 Strike Long Call for $59.85

- Jan 23 400 Strike Short Call for 27.55

New stock to look at?

ALK – Could go higher with travel comping back

CCL – numbers will be easy to beat as travel and vacations come back.

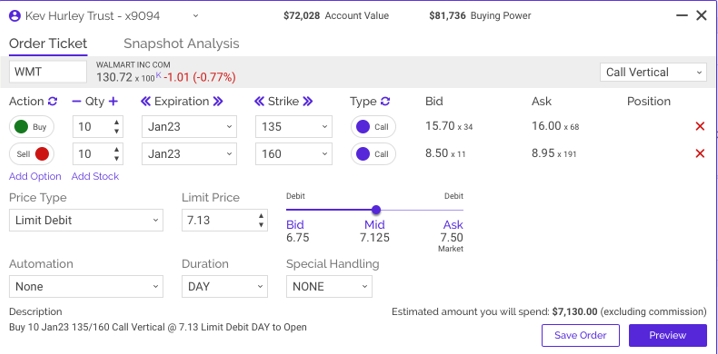

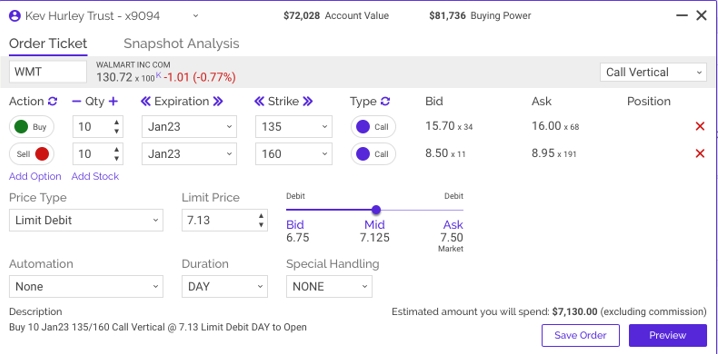

WMT – Stimulus will help consumer spending and Walmart is a likely direction.

GM – take profits? You have the time to let a bullish stock run. BUT It’s at all time highs and not a bad place to take a great profit.

WMT? If I went into it today this is what I might look at. Can’t hurt to wait and see if it has built a support level at 127.50