Trade Findings and Adjustments 02-11-2021

Welcome to part two on how HI makes exponential returns in portfolios

It all starts to doing something different. That starts with NOT doing the overall wall street fund system, asset allocation, annuities or bonds.

What’s the key = Collar trade

BTO the long stock position DIS 189.30

BTO the “right to sell my stock for a certain for a certain period of time” Long put Mar 190 for $10.15

New cost basis of 189.30 + 10.15 = $199.43

New risk in the trade Right to sell @ $190 – 199.43 = – 9.43 or 4.72% of the total invested capital is at risk

IF I want to loser my risk even more and cap my upside I sell a call

Selling a call = I am Obligated to sell my stock at a certain price for a certain period of time

Mar $220 Short Call for $2.12 credit

Overall risk in trade? 9.43 – 2.12 = $7.31 = 3.6% risk in total investment

Max Reward until Third Friday in march 220 – 199.43 + 2.12 = 22.69 or 11.4% ROI

I usually want 1000 shares BECAUSE it is easier to dollar cost average OR add shares with the profits of the protection

IF a stock loses 10% I should be able to pick up 10% more shares of stock 100% completely paid for by the protection

Drops could be to $170 , 155 or 135

IF it drops to 170 we still have the right to sell @ 190 = 190K / 170= 1,117 shares we could buy 100

IF it drops to 155 we still have the right to sell @ 190 = 190K / 155= 1,225 shares we could buy 200

IF it drops to 135 we still have the right to sell @ 190 = 190K / 135= 1,407 shares we could buy 400

IF the next three earnings you did this and picked up 700 shares 100% paid for by the protection you have a 70% increase on upward movement.

In INVESTING you need a repeatable process to duplicate over and over to be successful

ANYTHING made up on the way down is profits on the way back up

The neat thing about the collar trade you cheer just as much for stocks moving lower as you would for them to move higher !!!!!

The 2 Types of Growth: Which One of These Growth Curves Are You Following?

written by JAMES CLEAR

We often assume that life works in a linear fashion.

People will say, “You get out of life what you put into it.” The basic idea is that for each unit of effort you put into a given task, you get some unit of return. For example, if you make $25 per hour and you work for two hours, then you’ll make $50. If you work for 4 hours, you’ll make $100. Put more in. Get more out.

There is just one problem. Most of life doesn’t actually follow this linear pattern. Don’t get me wrong, hard work is essential. However, if you expect your life to follow a linear trajectory, then you may find yourself feeling frustrated and confused.

Instead, most areas of life follow two different types of growth. This is something I learned from my friend Scott Young. Let’s talk about these two patterns now.

Which one of these growth curves are you following?

The first type of growth curve is logarithmic.

Logarithmic growth curves increase quickly in the beginning, but the gains decrease and become more difficult as time goes on. Generally speaking, logarithmic growth looks something like this:

There are many examples of logarithmic growth in daily life.

- Fitness and Strength Training: The “beginner gains” come quickly at first, but then it becomes more difficult to get stronger each week.

- Literacy: Children and young students make massive leaps as they learn how to read. Meanwhile, college students and well-educated adults have to put in a focused effort to expand their vocabulary beyond commonly used words.

- Language proficiency: Learning how to speak even a rudimentary level of a new language opens up a whole new world. However, there are only meager gains left for fluent speakers to discover.

- Weight Loss: It may be relatively easy to shed five pounds within a week or two, but then the progress slows. Each successive pound of fat loss is more stubborn than the last.

- Musical skill: Improvements come quickly for a novice guitar player. Improvements come very slowly for a concert pianist.

There are thousands of other examples. In fact, most skills (writing, programming skills, juggling, running, etc.) fall into the logarithmic growth category.

Type 2: Exponential Growth Curve

The second type of growth is exponential.

Exponential growth curves increase slowly in the beginning, but the gains increase rapidly and become easier as time goes on. Generally speaking, exponential growth looks something like this:

You will also find exponential growth opportunities in daily life (although I think they are less prevalent).

- Investments and wealth: Thanks to the power of compound interest, your retirement savings start out as a small treasure in the early years, but balloon in size during the final decade or two of savings.

- Email subscribers and website traffic: New websites receive just a trickle of traffic here and there, but as the weeks and months roll on those trickles can build into a raging river of visitors and subscribers.

- Entrepreneurship and business growth: The assets that you build for your business stack on top of one another and revenue compounds throughout the life of a successful business.

- Social media followers: When you only have 100 followers, getting another 100 followers may take six months. Once you have 1,000 followers, however, getting the next 100 may only take one month. Once you have 100,000 followers, getting another 100 probably takes one day. Your growth rate snowballs.

The Challenges of Each Growth Curve

Neither type of growth is good nor bad. These growth patterns are simply the way certain things work. However, it is important to understand the growth pattern of your task so that you can set your expectations appropriately.

Don’t expect exponential returns when you’re playing a logarithmic game. Similarly, don’t expect quick wins when you’re building something that has an exponential curve.

When dealing with logarithmic growth, the challenge is to avoid feeling discouraged as your improvements decrease. Improvement will come easily in the beginning and you will become accustomed to enjoying small wins each day. Soon, however, those small wins will become smaller.

Logarithmic growth requires you to have the mental toughness to play a game that will, by definition, become more challenging to win as time goes on. You will feel like you have plateaued. You will question yourself and your abilities. If you want to succeed with logarithmic growth, you have to learn how to fall in love with the boredom of doing the work if you want to maintain consistency as your improvements dwindle.

When dealing with exponential growth, the challenge is to continue working through the early period when you have little or nothing to show for your effort. Exponential growth requires you to be remarkably patient and diligent (often for years or decades) before enjoying a significant payoff. There may be 10 years of silence before you hear the sound of success.

Equally important, you need to give your best effort even when you’re getting average results. Exponential gains only result from sustained effort in the early years.

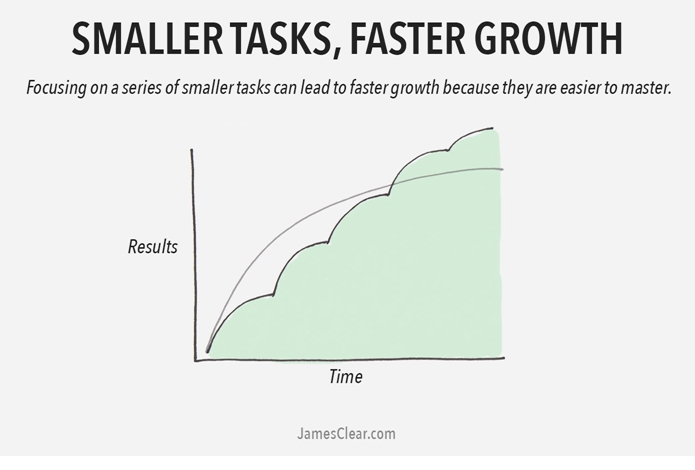

Once you understand the type of growth curve you are dealing with, there are two ways that you can accelerate your progress on a given curve.

OPTION 1

The first option is to break the task down into smaller tasks that can be mastered more quickly. In other words, by getting very specific with the task you are working on, you can increase the rate of growth (i.e. smaller tasks have steeper growth curves because they are easier to master). This strategy works especially well for accelerating your progress on tasks that experience logarithmic growth.

Dave Brailsford’s aggregation of marginal gains is a great example of this. By improving every small task related to cycling by just 1 percent, Brailsford was able to guide his British cyclists to massive success. Mastering these small tasks led to incredibly fast growth.

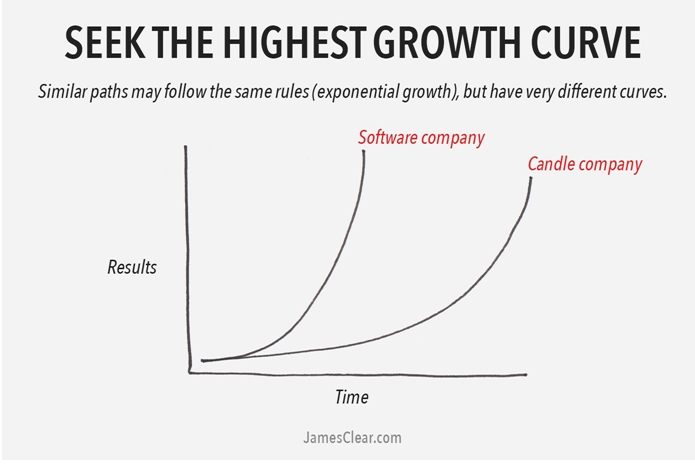

OPTION 2

The second option is to play a different version of the game. More specifically, play the version of the game that has the highest growth curve. This strategy works especially well for tasks that experience exponential growth.

Take entrepreneurship, for example. You could build a candle shop. All of the statements about exponential growth hold true for a candle shop. Given enough time and a good product, you could eventually produce candles at scale, develop new product lines, and otherwise build assets that lead to exponential growth years later.

However, if you played a different version of the entrepreneurship game and started a software company, then you may reach the exponential growth threshold much faster. There are a variety of reasons for this: reduced overhead and manufacturing costs, faster industry growth overall, higher margins, and so on. The end result is that both companies have exponential growth curves, but one has a much steeper slope.

The Bottom Line

Most things in life have some type of growth curve and very rarely is that curve a straight line.

Understand the type of curve you are dealing with so that you can set your expectations appropriately. And if you aren’t happy with the type of growth curve you’re on, then start playing a game with a different curve.

FOOTNOTES

Thanks for reading. You can get more actionable ideas in my popular email newsletter. Each week, I share 3 short ideas from me, 2 quotes from others, and 1 question to think about. Over 1,000,000 people subscribe. Enter your email now and join us.