HI Market View Commentary 08-31-2020

| Market Recap |

| WEEK OF AUG. 24 THROUGH AUG. 28, 2020 |

| The S&P 500 index gained 3.3% last week, reaching fresh highs and rising for a fifth consecutive week as the communication services, technology and financial sectors led a broad climb. The market benchmark ended the week at 3,508.01, marking a new closing high that was up from last week’s closing level of 3,397.16. The S&P 500 also reached a fresh intraday record Friday of 3,509.23, and is now up 8.6% for the year to date. The advance came as investors have been betting on continued strong demand for communication services and technology at a time when the pandemic has many employees and students working remotely. Also boosting sentiment, economic data this week showed orders for durable goods in the US jumped 11% in July, more than double the increase that was expected, while personal consumption spending rose 1.9% in July, surpassing expectations for a 1.5% rise. Federal Reserve Chairman Jerome Powell unveiled a more flexible approach to inflation targeting, saying the central bank will “seek to achieve inflation that averages 2% over time.” This indicates the central bank would allow periods in which inflation is above 2% to balance out periods when it has been below that level. Communication services had the largest percentage gain of the week, up 4.6%, followed by a 4.4% increase in technology and a 4.3% rise in financials. Just one sector was in the red for the week: utilities, which edged down 0.6%. In communication services, gainers included Facebook (FB), Netflix (NFLX) and Alphabet (GOOGL). Facebook’s shares jumped 10% while Netflix shares rose 6.4% and Alphabet shares were up 4.1%. The pandemic has increased demand for the companies’ products and services. In technology, shares of Salesforce.com (CRM) soared 30.6% as the company posted fiscal Q2 results well above analysts’ expectations. The results were seen as an encouraging sign for enterprise spending. In the financial sector, regional banks were strong, with KeyCorp (KEY) climbing 6.9% this week while Regions Financial (RF) added 6.7%. Next week, all eyes will be on the Labor Department’s August jobs report, due Friday. Ahead of that, the market will get readings on manufacturing activity and construction spending Tuesday, followed by factory orders and ADP employment data Wednesday. Provided by MT Newswires. |

Two things:

I was trying to pick up new money from an individual for a super long time. I was asked what was happening in our markets today? I said that I wasn’t sure as obviously we just finished our best August in 30 years. Because I didn’t lie, make something up, or fake an answer he let me know I didn’t have enough “knowledge” to manage his 400K. But do I have enough integrity? Let me tell you why I feel integrity is more important than knowledge

I got to be on a church zoom meeting with Jimmer Fredette on Sunday. A real life NBA player and international basketball star. As I listened to him talk, uplift and encourage youth I heard him mention something that I practice in daily life. When life gets you down, life gets tough, depression or evil gets the best of you, What will you do to find a way to push forward?

I’ve run my business with two separate focuses:

- Make as much money as I can as safely as I can!

- Be a support or life coach with all those I come in contact with, especially my friends who I also get to call my clients

AAPL and YES I’ve told you it “should” fall but its not and it really should have today.

Where will our markets end this week?

Higher

DJIA – Bullish

SPX – Bullish

COMP – Bullish

Where Will the SPX end September 2020?

08-31-2020 -5.0%

Earnings:

Mon: ZM

Tues: HRB,

Wed: GES, M, PVH, SPWA

Thur: CPB, GCO, MIK, AVGO, DOCU,

Fri:

Econ Reports:

Mon:

Tues: ISM Manufacturing , Construction Spending

Wed: MBA, Auto, Truck, ADP Employment Report, Factory Orders, Beige Book

Thur: Initial Claims, Continuing Claims, ISM Services Index, Productivity, Unit Labor Costs, Trade Balance

Fri: Average Workweek, Non-Farm, Private Payrolls, Unemployment Rate, Hourly Earning

Int’l:

Mon –

Tues –

Wed –

Thursday –

Friday-

Sunday –

How am I looking to trade?

Still letting most thing run but preparing for protection to get us through Oct and then new protection for the election. I’m also looking to take profits from those leap call positions and be more cash heavy for an opportunity to buy in lower.

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

Dow futures rise more than 100 points as Wall Street wraps up its best August in more than 30 years

PUBLISHED SUN, AUG 30 20206:00 PM EDTUPDATED 50 MIN AGO

U.S. stock futures rose on Sunday night as traders were set to end the market’s best August performance since the 1980s.

Dow Jones Industrial Average futures were up 141 points, or 0.5%. S&P 500 and Nasdaq 100 futures gained 0.5% and 0.6%, respectively.

The S&P 500 is up 7.2% month to date, putting the broader-market index on track for its biggest August gain since 1984. The Dow has rallied more than 8% this month and is also headed for its best August in 36 years.

This month’s gains have pushed the S&P 500 to record levels, officially confirming a new bull market has started. The Dow, meanwhile, erased its 2020 losses on Friday, closing the session with a year-to-date gain 0.4%.

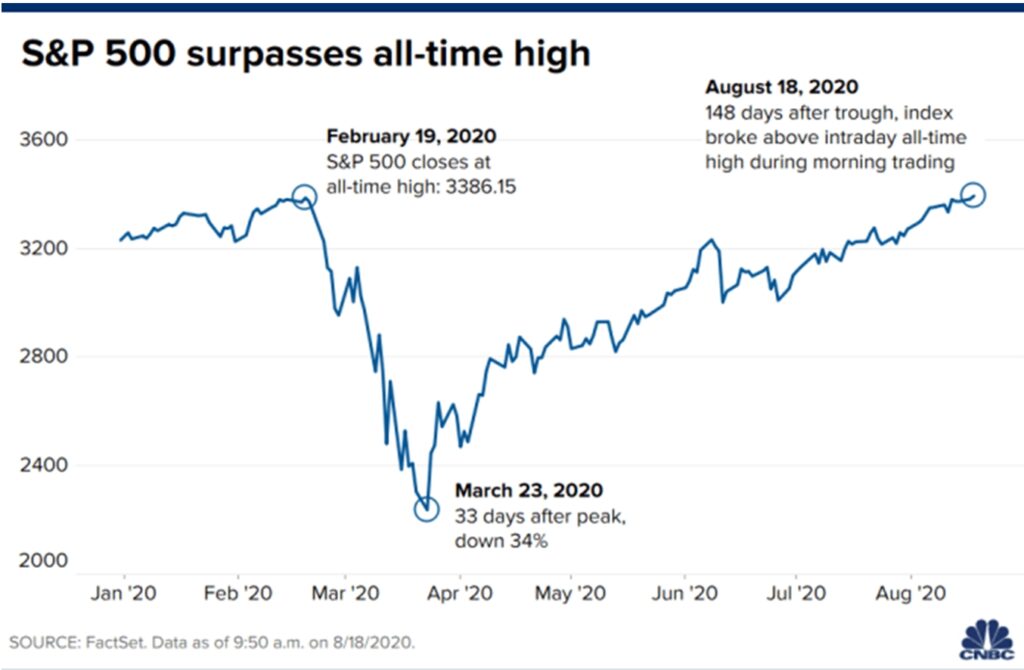

The August rally built on the market’s sharp rebound off the March 23 intraday lows. Since then, the Dow and S&P 500 are up 57% and 60.1%, respectively.

We “had hoped that the market would consolidate its gains since March 23, giving earnings a chance to rebound,” said Ed Yardeni, president and chief investment strategist at Yardeni Research, in a note. “However, Fed officials continue to drive up stock prices by committing to keeping interest rates close to zero for a very long time … Consequently, they are fueling the meltup in stock prices.”

Earlier this year, the Federal Reserve cut rates to zero and launched an open-ended asset-purchasing program to support the economy through the coronavirus pandemic. Last week, the central bank laid out an inflation policy framework that would keep rates lower for longer.

In an apparent long-term bet on the global economy, Warren Buffett announced Sunday that his Berkshire Hathaway conglomerate had acquired stakes of more than 5% in Japan’s five-leading trading companies. Those companies are Itochu Corp., Marubeni Corp., Mitsubishi Corp., Mitsui & Co., and Sumitomo Corp. The five businesses import everything from metals to food into Japan and provide services to manufacturers.

New Dow look

The Dow will kick off the week with three new constituents and with Apple having a much smaller influence on the 30-stock average.

Come Monday’s open, Salesforce, Amgen and Honeywell will be included in the Dow, replacing longtime component Exxon Mobil, Pfizer and Raytheon Technologies. A 4-for-1 Apple stock split will also take effect on Monday.

Traders will also look ahead to Friday, when the latest U.S. jobs report is set for release. Economists polled by Dow Jones forecast that 1.255 million jobs were created in August.

Subscribe to CNBC PRO for exclusive insights and analysis, and live business day programming from around the world.

Salesforce CEO Marc Benioff speaks during the annual DreamForce conference in San Francisco, California.Justin Sullivan/Getty Images

The Dow Is Making Big Changes. Why You Shouldn’t.

The Dow Jones Industrial Average is making big changes.

Three stocks— Pfizer, Exxon Mobil and Raytheon Technologies—are getting kicked out of the benchmark. Three stocks— Amgen, Salesforce.com and Honeywell are going in.

It is big news for those stocks. The three going in are each up more than 3% in premarket trading, while the three going out are down more than 1%. But perhaps it shouldn’t be. Simply put, there aren’t a lot of investing dollars indexed to the Dow.

In fact, there are roughly $28 billion dollars indexed to the Dow. It might sound like a lot, but the market capitalization of the companies going into the Dow is roughly $440 billion. What’s more, the amount of money indexed and benchmarked to the S&P 500 is more than $11 trillion, according to S&P Global.

The Dow is, for the most part, an index used to reflect the stock market and the state of the U.S. economy. As the economy changes the index changes, but changes don’t have a large, lasting impact on the actual stock prices.

Ultimately, earnings and corporate fundamentals win out.

—Al Root

Wealth gap grows as rising corporate profits boost stock holdings controlled by richest households

PUBLISHED THU, AUG 27 20207:18 AM EDTUPDATED THU, AUG 27 202011:26 AM EDT

Bob Pisani@BOBPISANIThe rich really are getting richer.

Two Federal Reserve economists recently examined the evidence and concluded the gap is getting even wider.

Federal Reserve Board economists Isabel Cairo and Jae Sim found that the inequality gap has risen because owners of assets like real estate and stocks are benefiting from the rise of corporate power and rising profits, along with the decline of labor.

“The before-tax profits share of U.S. corporations has shown a dramatic increase in the last few decades,” the authors wrote. The rise of corporate profits was strongly correlated with the decline of labor. “This correlation suggest that the rise of the profit share and the fall of the labor share may have been driven by a common cause,” they said.

Stagnating wage growth and higher corporate profits have led to a rise in two forms of inequality: in income (the income share of the top households rising steadily), and wealth (the net worth of the top 5% of households increasing 186% from 1983 to 2016), largely because of capital gains.

This is evident when looking at data on stock ownership. While an oft-quoted Gallup Poll indicated that 55% of households own stock in 2020, it is the very wealthy who control almost all of this asset. A separate Federal Reserve report indicates the top 10% of households by net worth control 87.2% of the equities in this country at the end of the first quarter. While the top 1% have always controlled 70% to 80% of stock market value since record-keeping began in 1989, this is the highest level of ownership ever, other than the fourth quarter of 2019, when it was 88.1%.

Who owns stocks: Households by net worth

- Top 1% 51.8%

- Top 90-99% 35.4%

- 50%-99% 12.1%

- Bottom 50% 0.7%

(Q1 2020)

Source: Federal Reserve

For Ivory Johnson, head of Delancey Wealth Management and a member of the CNBC Advisory Council, these statistics are emblematic of the growing perception gap between Wall Street and Main Street.

“The majority of people don’t own stocks and they don’t care the Nasdaq is up 30 percent this year,” he told me.

While the wealth gap has been growing for decades, Johnson lays part of the problem at the feet of the Federal Reserve, who he says has been propping up stock prices for years.

“Twenty percent of U.S. companies are zombie companies — they only survive because the Federal Reserve is propping them up. You have a safety net for stocks provided by the Fed, but only a limited version of that for people who really need help.”

Broader wealth statistics recently published by the Federal Reserve are not much more encouraging. There is an equally wide gap between what the wealthy own and what the bottom 50% own.

It’s largely real estate.

The top 1% have 12.8% of their net worth in real estate. The bottom 50% have 54.4% in real estate.

It’s the other way around for stocks. The top 1% have 34% of their net worth in stocks, the bottom 50% have only 2.2%. The very wealthy also have much more of their wealth tied up in private businesses and “other assets.”

Top 1% of households: Assets

- Equities 34%

- Other assets 22.4%

- Private businesses 21.7%

- Real estate 12.8%

- Pensions 5.9%

- Consumer durables 3.2%

Source: Federal Reserve

Bottom 50% of households: Assets

- Real estate 54.4%

- Consumer durables 20.4%

- Other assets 12%

- Pensions 9.4%

- Equities 2.2%

- Private businesses 1.7%

Source: Federal Reserve

What to do? Cairo and Sim go so far as to suggest higher taxes on the wealthy as a means to redistribute wealth: “Carefully designed redistribution policies can be quite effective macroprudential policy tools and more research is warranted in this area.”

Johnson says taxing the wealthy isn’t going to work, and not just because the rich have lobbyists. “You can tax wealthy people 100 percent and it won’t cover the deficit,” he told me. “The question is, what is fair and what will work?”

The news is not entirely grim. Edward Wolff, an NYU economics professor who has studied wealth distribution trends for many years, said the poor could see higher returns, even on their lesser investments.

“The authors appear to miss the fact that the poor have relatively higher debt and therefore leverage,” he said in an email. “What this means is that the poor actually have a higher rate of return on their portfolio than the rich and see greater growth on their wealth over time from capital gains.”

The S&P 500 finally hit a new record after multiple tries this month. Here’s what could happen next

PUBLISHED TUE, AUG 18 202010:28 AM EDTUPDATED TUE, AUG 18 202011:26 AM EDT

It finally happened, but not without some drama.

The S&P 500 pushed through to an historic intraday high shortly after the open, passing the old February 19th high of 3393.52.

It took several tries. My old friend Sam Stovall at CFRA Research likes to say that new all-time highs are likely rusty doors, they require several attempts before they finally swing open.

The rally to a new historic high on the S&P is one for the record books, on many levels:

- Assuming we also close at a new high, it will have taken less than five months to get back to new highs from the March 23rd low, making it the third-fastest rally to recoup all that it lost, behind the 1982 (which took three months) and 1990 rallies (four months), according to Stovall.

- Friday marked 100 trading days since that March 23rd low. This was the largest 100-day rally ever for the S&P 500 Index, up more than 50%, according to Steve Starker at BTIG.

- Even the bear market records are being broken. Remember that big drop in the S&P from its February 19th high to the March 23rd low, a drop of 34%? It was the shortest bear market since 1929, lasting just 33 calendar days.

Still, the rally has been very uneven. The bulk of the heavy lifting has been done by technology, but in particular by the five big megacap tech names:

Leading the Rally (since Feb. 19)

- Tech: up 12%

- Consumer Discretionary: up 10%

- Comm. Services: up 4%

- Health Care: up 3%

Mega-Cap Momentum (since Feb. 19)

- Amazon: up 46%

- Apple: up 42%

- Netflix: up 25%

- Facebook: up 20%

- Microsoft: up 12%

Despite occasional spurts from cyclical sectors like banks, industrials, and energy, they have remained decided laggards:

Lagging Behind

- Industrials: down 8%

- Banks: down 28%

- Energy: down 31%

For some industries, it is indeed a grim time. Stovall notes that 40% of the 147 sub-industries in the S&P are still down by double-digit percentages.

Nor has the global recovery been even. The U.S. has led and China and South Korea have also regained most of their losses, most of the rest of the world has not. Japan has only recovered roughly 75% of its pre-Covid losses, Brazil a little more than 70%, France and the UK less than 60%.

What’s next?

What’s next for stocks now that we have (improbably) closed at a new record?

Stovall told me that after such a big run, investors should prepare for some modest profit-taking.

“It’s like the messenger from Marathon who crumples from exhaustion after the long run,” he told me by phone.

Of course, that messenger famously died. Stovall doesn’t expect that to happen: “No bull market has ever fallen immediately into a new bear market,” he told me. “They typically fall into a pullback or a correction [a 10% decline]”, noting that the average decline after a new high was 8%.

Stovall, like Goldman Sachs’ David Kostin, also believes the S&P will close the year higher, but with a caveat: “We need upward revisions to third and fourth quarter earnings to justify these valuations,” he told me.

These millennials are building businesses for a post-pandemic world

Published Sun, Aug 30 20208:21 PM EDT

The coronavirus pandemic has uprooted most aspects of daily life — and much of the economy built around it.

But out of crisis comes opportunity. And for some young entrepreneurs, the pandemic has unearthed green shoots for a new future.

In Singapore, fast-growing start-ups in the food, retail and technology industries have been working to respond to the changing environment. CNBC Make It spoke to three millennial entrepreneurs to find out how they’re meeting new consumer demands, and what that might mean for a post-pandemic world.

Finding green shoots in crisis

When the novel coronavirus emerged at the start of 2020, agriculture was one of the industries first hit. Supermarket shelves were cleared as people feared food shortages amid border closures and supply chain disruptions.

Even before the pandemic, Ben Swan of Singaporean agriculture technology start-up Sustenir was working to make food supplies more reliable.

“Sustenir’s vision is to actually grow a more resilient future,” the 39-year-old co-founder and CEO said of his vertical urban farm, which enables non-native produce to grow in controlled, indoor environments.

The Australian ex-engineer launched the business in Singapore in 2013 to address land shortages and food scarcity issues. This year, the pandemic has brought more attention to the problem, said Swan.

There’s a big focus now on how do we get our productivity up.

Ben Swan

CO-FOUNDER AND CEO, SUSTENIR

“Singaporeans became a lot more aware about where their produce was coming from,” he said. Meanwhile, border closures made some foods harder to get. “There’s a big focus now on how do we get our productivity up.”

Today, less than 10% of Singapore’s nutritional needs are produced from within the land-scarce country, which is smaller in area than New York City. Singapore’s government hopes to raise that figure to 30% by 2030 through better land use and technology, as well as investments of more than $215 million in start-ups.

The entrepreneur is optimistic that could also help position the company — and the country — as a leading food innovator going forward.

“Because our system can literally retrofit into any building in the world, we do want to be, eventually, in every major city across the world,” said Swan. “Maybe even one day we could consider exporting certain produce into our neighboring countries.”

Making shopping easier

Just as the virus changed agriculture demands, it also shifted shopping habits. Nationwide lockdowns and the subsequent economic blow made consumers and retailers more conscious of their spending.

That’s a space Henry Chan of cashback platform ShopBack has been focusing on for several years.

Since launching in 2014, the Singaporean start-up — which gives users a percentage of cash back on every purchase made through its app — has grown steadily, giving $115 million back to more than 20 million users in Asia Pacific. But when the pandemic hit, the business moved quickly to offer new savings.

In the first half of this year, we have driven slightly under $1 billion in sales for our merchants.

Henry Chan

CO-FOUNDER AND CEO, SHOPBACK

According to Chan, the pandemic has seen consumers’ shopping habits shift to essential needs, such as groceries, at the start of the pandemic, followed more recently by things including fitness products and domestic travel.

Meanwhile, it prompted more retailers to list themselves on the platform in a bid to compensate for lost physical sales. From April to June, ShopBack — which earns a commission from its affiliate merchants every time a sale is made — added 500 new retailers, expanding its list of 4,000 brands including Amazon, Taobao and Expedia.

“Merchants are increasingly mindful of their marketing spend, and that’s where our pay-per-sale model resonates with them,” said 35-year-old Chan. “You can see this from the uplift in merchants joining us. And in the first half of this year, we have driven slightly under $1 billion in sales for our merchants.”

The company’s efforts to move businesses online is to help diversify their sales channels. Even before Covid-19 hit, a 2018 McKinsey study found that 92% of companies believed they would haveto alter their business models as a result of digitization.

Connecting a new digital future

While the pandemic fast-tracked the digitization of many industries, it also unearthed shortcomings in global internet infrastructure.

Over the past four years, laser communications start-up Transcelestial has been working to bridge that gap with a more efficient and less expensive alternative to traditional internet services.

“When you look at the world right now, nearly half of the world is still unconnected, and we’re talking about no internet services, not even basic cellular connectivity,” said Rohit Jha, co-founder and CEO. At the end of 2019, 3.6 billion people — or 46% of the global population — were not connected to the internet, according to the United Nations.

Transcelestial’s flagship product — the Centauri wireless device — uses light to transmit data, which Jha said is more “infinitely scalable” than fiber optic cables. Meanwhile its three-kilogram, shoe box-size dimensions mean it can be installed overground by telecom companies in around 10 minutes.

We look 50 years into the future and try to imagine a snapshot of what the world looks like.

Rohit Jha

CO-FOUNDER AND CEO, TRANSCELESTIAL

The 31-year-old said such efficiency reflects the company’s plan to provide internet services fit for a fast-changing world: “We look 50 years into the future and try to imagine a snapshot of what the world looks like.”

As the push toward 5G heats up, that technology will become more important. Though Singapore ranks as a global leader for internet connectivity, much of Southeast Asia is still catching up. By 2025, the region is expected to account for almost a third (29%) of global 5G deployments. Jha said his system could speed up the process by “six to eight months, or even a year.”

To drive that vision, in July Transcelestial received $9.6 million from investors including Singapore’s EDBI and venture capital firm Wavemaker partners — even as global funding dried up due to the pandemic.

“Most of the investors that we got are people who looked at long-term horizons, and that’s the conversation I have with investors when we do initial stuff,” said Jha, “because there’s so much of the journey that’s left.”

Don’t miss: These millennials are transforming the multibillion-dollar health-care industry in the face of coronavirus

Warren Buffett’s Berkshire Hathaway buys stakes in Japan’s five leading trading companies

PUBLISHED SUN, AUG 30 20207:41 PM EDTUPDATED 3 HOURS AGO

KEY POINTS

- Warren Buffett’s Berkshire Hathaway has acquired a slightly more than 5% stake in each of the five leading Japanese trading companies.

- Berkshire acquired the holdings in Itochu Corp., Marubeni Corp., Mitsubishi Corp., Mitsui & Co., and Sumitomo Corp. over a roughly 12-month period through regular purchases on the Tokyo Stock Exchange.

- Based on Friday’s closing prices for the trading houses, a 5% stake in each would be valued at roughly $6.25 billion.

- Berkshire says it intends to hold the investments for the long term, and that it may increase its holdings in any of the companies up to a They say 90 is the new 70, and in Warren Buffett’s case, it may be true.

The chairman and CEO of Berkshire Hathaway announced Sunday — his 90th birthday — that his company has acquired a slightly more than 5% stake in each of the five leading Japanese trading companies. The companies are Itochu Corp., Marubeni Corp., Mitsubishi Corp., Mitsui & Co., and Sumitomo Corp.

Berkshire said it acquired the holdings over a roughly 12-month period through regular purchases on the Tokyo Stock Exchange. Based on Friday’s closing prices for the trading houses, a 5% stake in each would be valued at roughly $6.25 billion.

The Japanese trading companies — known as sogo shosha — are conglomerates that import everything from energy and metals to food and textiles into resource-scarce Japan. They also provide services to manufacturers. The trading houses have helped grow the Japanese economy and contributed to the globalization of its business.

But as they have extended their footprint overseas, they’ve also become more vulnerable to global predicaments, like the financial crisis from a decade ago. The trading houses also face increasing competition from venture capitalists and private equity funds.

For Buffett, the move is no quick trading play. Berkshire says it intends to hold the investments for the long term, and that it may increase its holdings in any of the companies up to a maximum of 9.9%, depending on price. Berkshire also pledged to make no purchases beyond a 9.9% stake in any of the companies unless given approval by the trading companies’ boards of directors.

In describing its intentions for the investment in the trading houses, Berkshire pointed to its history of long-term, passive holdings in companies like Coca-Cola Co., American Express Co., and Moody’s Corp., which each span multiple decades.

“I am delighted to have Berkshire Hathaway participate in the future of Japan and the five companies we have chosen for investment,” said Buffett, adding that the trading houses have many joint ventures around the globe. “I hope that in the future there may be opportunities of mutual benefit.”

Berkshire also said that despite its large, yen-denominated bet, it would have little exposure to currency fluctuations because it holds 625.5 billion of yen-denominated bonds ($5.93 billion) that will mature at various dates from 2023 through 2060.