Monday was President’s day and the markets were closed.

SO let’s talk Presidents, and Chairman for this year based on last year’s predictions

1st – Energy/OIL – Missing on EPS but beating on revenue = Working harder to make more money but less profits

2nd – Trump his claiming he has ended 7 wars = 7 Wars have ended and he or his cabinet has participated is some way, shape or form,

3rd – GDP = 1.0 % maybe and with tariffs we can’t hit above 1.5% Inflation = 04/04/2025 projections said 5.5-7.5 and worst case scenario 10.1%

4th – FOMC haven’t lowered the US interest rates closer to the world average rate of 2.5%.

5th – The FOMC did NOT follow the data !!!!!

Homebuilders are significantly overpriced and we would expect the pricing to fall for building a home

6th – Non-Farm and Private payrolls were above 100K on a seasonally down month

7th ISM numbers also moving higher = US Manufacturing is starting to take off

What do you think can move the markets going into 2026 ?= AI, Mag 19,

Kevin “The adoption of AI is going to put millions of people out of work!”

Auto, Industrial revolution, computers, cell phones, internet = Lag in employment but eventually more jobs were created in the new industry

APPL – Majestic Siri = First AI that can do Next then commands =

STOP voting for Politicins AND VOTE FOR BUSINESS OWNERS

2.2 million less federal workers, hundreds of billions of dollars of waste cut out of the Fed government, Trade balances are halved

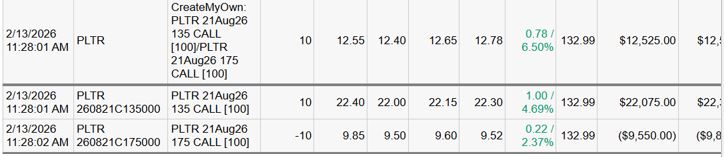

Let’s talk mistakes vs making the best decision you could with the information you had at that time?

Trading Mistake = Day Trading, Actually making a mistake while placing a trade, putting the wrong position on

So we adjusted

Earnings

BIDU 02/18 est

DG 03/12 est

MU 03/18 est

NVDA 02/25 AMC

O 02/24 est

WMT 02/19 BMO

https://www.briefing.com/the-big-picture

The Big Picture

Last Updated: 13-Feb-26 15:03 ET | Archive

Economic data better than expected but not just right

Briefing.com Summary:

*The January jobs and CPI reports beat expectations, but underlying details revealed uneven labor strength and some lingering inflation pressures.

*Payroll gains were concentrated in health care, with downward revisions and sector job losses clouding labor market dynamism.

*Markets may remain volatile as investors scrutinize details beyond headlines for clues on Fed policy direction.

The market received two pieces of key economic data this past week. They were the January Employment Situation Report and the January Consumer Price Index. The former covers the labor market. The latter covers consumer inflation, topics near and dear to just about everyone.

That is partially why they are deemed to be market-moving reports. Other reasons include the fact that they influence monetary policy, consumer sentiment, political views, and growth expectations.

Both reports left an impression this week that could be summed up as better than expected but not just right.

A Tall Order

We’ll begin with the employment report. It was released on Wednesday, February 11, delayed from the original report date of February 6 due to the latest government shutdown.

The report featured positive surprises for payrolls, the unemployment rate, average hourly earnings, and the average workweek. There was nothing not to like in the headline numbers, but with a comprehensive report like this one, it was a tall order for it to be pleasing all around.

| Actual | Briefing.com Consensus | Prior | |

| Nonfarm Payrolls | 130K | 68K | 48K |

| Nonfarm Private Payrolls | 172K | 60K | 64K |

| Unemployment Rate | 4.3% | 4.4% | 4.4% |

| Avg. Hourly Earnings | 0.4% | 0.3% | 0.1% |

| Avg. Workweek | 34.3 | 34.2 | 34.2 |

Some of the main sources of consternation included:

- The recognition that the 130,000 increase in nonfarm payrolls was driven predominately by health care and social assistance jobs (123,500).

- Benchmark revisions showed the total nonfarm employment level for 2025 was revised from +584,000 to just +181,000 (seasonally adjusted).

- Benchmark revisions to not seasonally adjusted data for the total nonfarm employment level from April 2024 to March 2025 were revised down by 862,000.

- Workers unemployed for 27 weeks or more accounted for 25.0% of the unemployed. That was improved from December (26.0%) but well above the same period a year ago (21.1%).

The sum of the parts of this report added up well as talking points, but they didn’t add up fully to convince the market that there is dynamism in the labor market.

That notion rang true as well for workers in industries where employment declined month-over-month: mining and logging (-2K), nondurable goods manufacturing (-4K), wholesale trade (-0.4K), transportation and warehousing (-11.2K), information (-12K), financial activities (-22K), and government (-42K).

In brief, the headlines of the report painted a bright picture that got fuzzier looking the closer you looked at the report.

Beauty in Eye of Beholder

The headlines of the Consumer Price Index also had a brighter hue. Specifically, there was disinflation in total CPI and core CPI, which excludes food and energy, on a year-over-year basis. Total CPI was up 2.4% versus 2.7% in December. Core CPI was up 2.5% versus 2.6% in December.

That headline indication was a pleasing sight to the Treasury market, but when it comes to inflation, beauty is in the eye of the beholder.

To that end, you might not care that total CPI was up just 0.2% month-over-month if you were doing a lot of flying. Airfares were up 6.5% month-over-month. A lover of breakfast cereal? Prices were up 2.1% month-over-month. Trying to take a healthier line with fresh fish and seafood? That cost you 3.6% more month-over-month. Enjoy a carbonated drink? Maybe less so with the 1.5% month-over-month increase. Can’t kick the tobacco habit? Perhaps you might, given the 5.1% month-over-month increase in tobacco products other than cigarettes (which were up 1.0%).

Are we cherry-picking the data? Yes, we are. There were deflationary readings for other products and services, but the overarching point is that the positive headline surprises for CPI and core CPI are not monolithic.

Inflation pressures continue to lurk in other corners in such a way that they can be menacing for consumer sentiment and politicians facing re-election even if the headline sounds promising for the market and additional rate cuts.

Briefing.com Analyst Insight

Taken together, the January employment and inflation reports reinforced a familiar theme: progress that comes with asterisks. The labor market is holding up, yet its strength is uneven and heavily concentrated. Inflation is cooling, yet not uniformly enough to erase concerns about lingering price pressures in everyday essentials.

For the Federal Reserve and for investors, that leaves the outlook balanced but delicate. The economy is not flashing warning signs of imminent trouble, but with pockets of softness in the labor market and price pressures persisting beneath the headlines, it is unlikely that the stock market will trade with an all-clear signal.

Accordingly, one can expect the fits and starts, as we have been seeing, to continue as economic data faces increased scrutiny below the headlines.

—Patrick J. O’Hare, Briefing.com

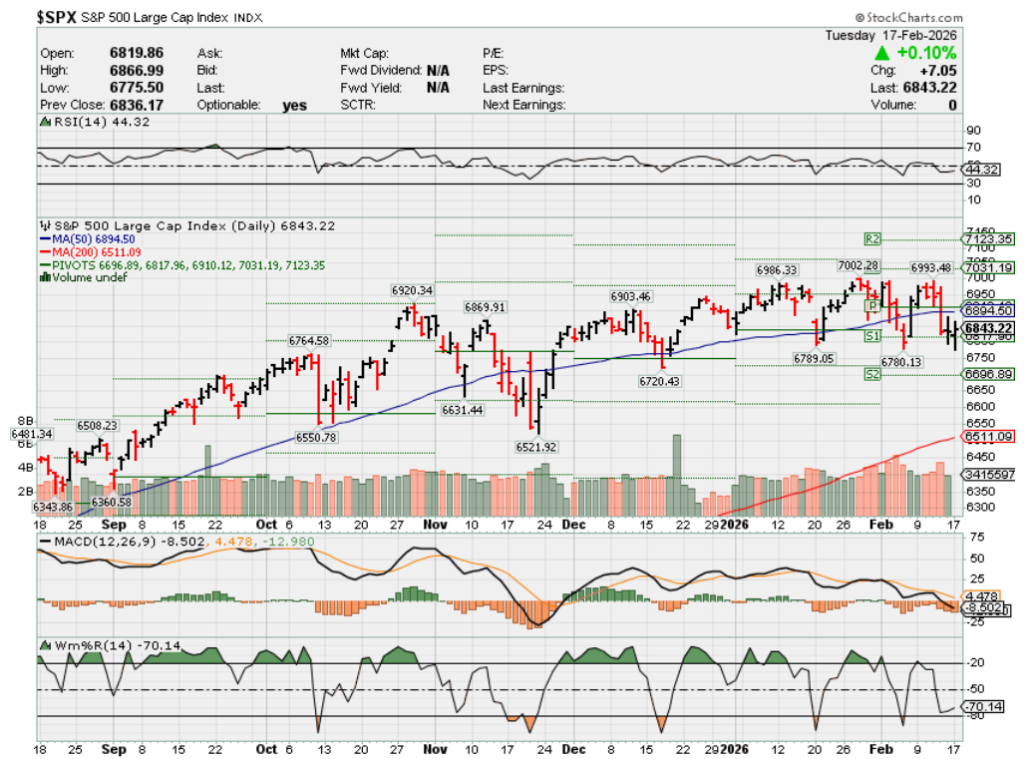

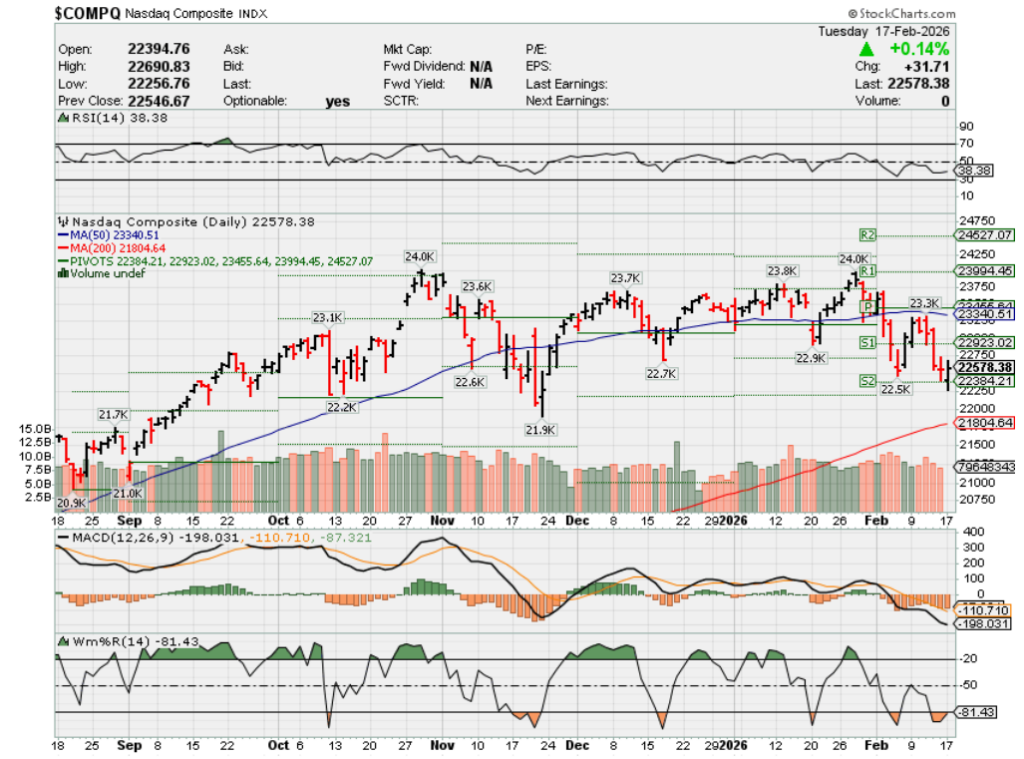

Where will our markets end this week?

Higher

DJIA – Bullish

SPX – Bearish

COMP – Bearish

Where Will the SPX end Feb 2026?

02-17-2026 +1.5%

02-09-2026 +1.5%

02-02-2026 +1.5%

Earnings:

Mon:

Tues: FLR, VMI, DVN, PANW, TOL, ET

Wed: CNK, GRMN, OTF, DASH, HLF, JACK, TAP,

Thur: AKAM, DBX, WMT, RIG

Fri: WU

Econ Reports:

Mon: PRESIDENT’S DAY

Tue Empire, NAHB Housing Market Index

Wed: MBA, Building Permits, Housing Starts, Industrial Production, Capacity Utilization, Net TIC Flows, FOMC Minutes

Thur: Initial Claims, Continuing Claims, Phil Fed, Pending Home Sales

Fri: GDP, GDP Chain Deflator, PDE Prices, PCE Core, Personal Income, Personal Spending, Michigan Sentiment

How am I looking to trade?

Protection and still holding onto cash we raised end of last year/beginning of this year

www.myhurleyinvestment.com = Blogsite

info@hurleyinvestments.com = Email

Questions???

I think we could see almost the same year as last = Correction hits a 20% drop to the decimal point

Top hyperscalers set to boost 2026 AI spending by 70% to $600 billion. How to play the spending boom now

Published Thu, Feb 12 20265:27 PM EST

Artificial intelligence is driving exponential capital expenditure growth, with just the top hyperscalers expecting to spend 70% more this year than they did last year.

Recent earnings reports from Amazon, Alphabet, Meta and Microsoft revealed planned capex of more than $600 billion combined this year. In 2025, these four companies invested just over $350 billion.

The staggering increase was met with mixed reactions from traders, who weighed the level of capex and tried to gauge when the companies would see returns on these investments. Shares of Amazon and Microsoft have respectively plunged 12% and 16% on the year. However, Alphabet stock is down less than 1% in 2026, while Meta has added 1%.

It may take time for the answer to this question to materialize, but in the near-term some companies are already profiting from this spending.

‘Early with the heavy spending’

“Basically, the takeaway is that the most competent companies in the world are telling us that we’re still early,” said Gene Munster, co-founder of Deepwater Asset Management, in an interview. “We’re just taking an approach that we need more exposure.”

Paul Meeks, head of technology research at Freedom Capital Markets, said that while more bearish investors believe that spending will collapse after this year, he sees it plateauing or growing more slowly from here.

“These guys will not make an announcement for their ’26 capital spending and then during the year, change their mind and pull it back,” he told CNBC. “I’ve talked to the management teams of all the hyperscalers, and they see this as a real competitive advantage for them to be early with the heavy spending.”

Meeks also said that while some analysts have cited brewing concerns around certain chipmakers’ profitability given their high spending, it seems unreasonable to expect much evidence of monetization at least at this early stage.

“I’m not disappointed, because I never expected to see the goodies or the return on investment at this stage,” he said.

On the other hand, investor Ken Mahoney took a less bullish take, noting that not all tech titans are putting their money where it matters the most.

“We’re just seeing that there’s no guardrails. Feels like companies are just spending and spending and spending, and hope on the other side they come in first place,” Mahoney, CEO of Mahoney Asset Management, said in an interview.

‘Pick-and-shovel’ stocks

With spending now accelerating, the companies best positioned to capture this next wave of investments might include the “pick-and-shovel” infrastructure stocks that power AI.

“Find those companies that are going to be the backbones and the margins should still be there, based on everything that we can see,” Mahoney said. “Have your shopping list, … but then buy them below the market and be more tactical.”

One such name, Mahoney said, might be CoreWeave, which provides cloud-based infrastructure to AI companies.

“It’ll be really interesting to hear from CoreWeave when they’ve announced that they’ve been able to execute and get more of these data centers online,” he said.

CoreWeave shares year to date

Similarly, Meeks highlighted CoreWeave as a name to watch. The company belongs to the group of neocloud pick-and-shovel stocks that should benefit from the spending, he said. Shares of CoreWeave have surged 33% in 2026.

Munster also listed Arista Networks, ASML and Snowflake as other potential infrastructure beneficiaries. Shares of Arista Networks and ASML have respectively surged 7% and 34% this year, while Snowflake stock has tumbled 18%.

Meanwhile, Mahoney highlighted Oracle as another stock he’s keeping an eye on. While the name is not a buy at its current valuation, he’s watching to see when it might realize returns on its investments. Shares of Oracle have plunged 19% this year and were last trading just under $160.

Mahoney and Munster both pointed to Vertiv as another potential winner. A pick-and-shovel stock, Vertiv provides power infrastructure and cooling systems for data centers. Shares surged 24% on Wednesday as its outlook backed the expectation that demand from data centers is materializing. Over the past year, Vertiv shares have doubled.

GE Verona is another power play that Mahoney is betting on, although he said he wouldn’t necessarily buy the name at its current levels. The stock has jumped 26% this year and was last trading around $790.

Meeks also listed Monolithic Power Systems and Bloom Energy as other derivative power plays to watch. The stocks have gained 32% and 79% this year, respectively.

The investors also said that they weren’t discounting the semiconductor names, including Nvidia.

“The Street has 60%, 70% revenue growth for Nvidia this year, and the S&P is supposed to grow at maybe 10%,” Meeks said. ”[Nvidia’s] at a very, very narrow valuation premium for growth that will swamp the market again this year.”

Nvidia shares are down around 2% over the past three months, and are up around 2% this year.

Besides Nvidia, Meeks listed Broadcom and Taiwan Semiconductor as his three favorite semiconductor plays that “will definitely continue to be beneficiaries.” Mahoney and Munster echoed Meeks’ bullishness for Broadcom, and Munster also sees potential in Taiwan Semiconductor as well. The stocks are respectively trading 1% lower and 23% higher on the year.

Meeks added that Micron was a memory stock he’s also watching now. The stock has ripped 44% higher this year.

— CNBC’s Gabriel Cortes contributed to this report.

Apple’s stock has worst day since April as iPhone maker faces FTC scrutiny, reports of Siri delay

Published Thu, Feb 12 20264:48 PM EST

Updated Thu, Feb 12 20266:52 PM EST

Jennifer Elias@in/jennifer-elias-845b1130/

Key Points

- Apple posted its worst day on the stock market since April 2025.

- FTC Chair Andrew Ferguson sent a letter to Apple CEO Tim Cook to press for a review of Apple News after reports of bias against conservative outlets.

- On Wednesday, Bloomberg reported that the company’s AI update to personal assistant Siri is being delayed.

Why Apple saw its worst trading day since April

Apple just wrapped up its worst day on the stock market since April after reports surfaced about delays with Siri and as the company’s news app faced regulatory scrutiny.

The stock dropped 5% on Thursday, wiping out its gain for the year and leaving it down almost 4% in 2026.

The long-awaited artificial intelligence update to the iPhone maker’s Siri personal assistant has been internally pushed back to May and potentially later, Bloomberg reported Wednesday.

The update was expected to launch within a couple weeks, but the company may roll the features out slowly over several months, the report stated.

Apple told CNBC it is still on track to launch in 2026.

On Wednesday, Federal Trade Commission Chair Andrew Ferguson told Apple CEO Tim Cook to review the terms of service and curation policies on Apple News.

Apple one-year stock chart.

Ferguson cited recent “reports” that Apple News was promoting left-leaning news outlets while suppressing conservative content.

Last month, Apple beat Wall Street expectations when it reported first-quarter earnings. However, the stock has been dragged down in part by Wall Street’s recent concerns that big tech companies are spending too much on AI.

On Tuesday, UBS downgraded the U.S. tech sector to neutral, citing “software uncertainty” and heavy capital expenditure. That followed a sell-off in software stocks over the past week as investors turned cautious toward the sector.

— CNBC’s Steve Kovach contributed to this report.

Bill Ackman reveals stake in Meta, says it has ‘deeply discounted valuation’

Published Wed, Feb 11 20261:25 PM EST

Updated Thu, Feb 12 202610:23 AM EST

Davis Giangiulio@in/davis-giangiulio-4a34a5262/@GiangiulioDavis

Key Points

- Bill Ackman’s Pershing Square Capital Management revealed a new stake in Meta during the fund’s annual investor presentation.

- The stake amounts to 10% of Pershing’s capital as of the end of 2025.

- It’s the third addition to Pershing’s portfolio of 2025, with previously disclosed positions in Amazon and Hertz.

Bill Ackman’s Pershing Square revealed a sizable stake in Meta on Wednesday.

“We believe Meta’s current share price underappreciates the company’s long-term upside potential from AI and represents a deeply discounted valuation for one of the world’s greatest businesses,” stated the fund’s annual investor presentation.

The position amounts to 10% of Pershing’s capital as of the end of 2025.

Meta shares are off by 16% over the last 12 months on fears it is spending too much on artificial intelligence. The company in its fourth-quarter earnings report in January projected AI-related capital expenditures to total in the range of $115 billion to $135 billion in 2026.

“We believe concerns around META’s AI-related spending initiatives are underestimating the company’s long-term upside potential from AI,” stated the Pershing presentation.

Pershing noted that Meta currently trades at a 22 times its projected earnings over the next 12 months, cheap considering how much AI is set to rev up future earnings growth. Alphabet, Apple and Nvidia all have higher forward P/Es.

Pershing added the stake in the fourth quarter. The fund bought positions in Amazon, Hertz and Meta in 2025, according to the presentation with the Amazon and Hertz stakes previously disclosed.

Last year, Pershing outperformed the S&P 500, with the fund’s net asset value increasing by 20.9% vs. the index’s 17% return.

David Einhorn says the Fed will cut ‘substantially more’ than two times. So he’s betting big on gold

Published Wed, Feb 11 202612:42 PM EST

Updated Wed, Feb 11 20261:09 PM EST

Key Points

- David Einhorn of Greenlight Capital anticipates the Federal Reserve will cut more than twice in 2026, which is what traders have priced in.

- Einhorn owns gold and Secured Overnight Financing Rate, or SOFR, futures.

- Gold has seen massive gains in recent years, though it faced some pressure last month following President Donald Trump’s Fed chair nomination announcement.

Greenlight’s David Einhorn says the Fed will cut ‘substantially more than’ two times this year

Greenlight Capital’s David Einhorn anticipates the Federal Reserve will issue more interest rate cuts this year than what’s being anticipated and that’s giving him greater confidence in his gold bet.

While rate cut expectations diminished a bit Wednesday following the much better-than-expected January jobs report, traders are still currently pricing in a more than 88% chance that the central bank will make two quarter percentage point cuts by the end of the year, according to the CME FedWatch Tool.

But Einhorn said that the market viewing the latest jobs figures as a reason not to cut is “wrong.” In fact, he thinks the rate cuts number could be higher than that, as he expects Kevin Warsh – President Donald Trump’s pick to succeed Jerome Powell as Fed chair – is going to be able to persuade the committee to do so.

“If we have 4% or 5% inflation, sure, then he won’t be able to persuade people, but otherwise he’s going to argue productivity,” Einhorn said on CNBC’s “Money Movers” to Sara Eisen on Wednesday, adding that Warsh, in his view, is going to take the position of cutting “even if the economy is running hot.”

“I think by the time we get to the end of the year, it’s going to be substantially more than two cuts,” he continued.

The hedge fund manager also owns gold, which sold off at the end of last month after Trump announced Warsh as his nominee for Fed chair, as the move eased anxieties on Wall Street surrounding Fed independence.

The yellow metal – typically viewed as an inflation hedge – has since seen some recovery, with gold futures being up more than 17% this year. That’s after it surged more than 60% in 2025 amid threats to central bank independence as well as heightened geopolitical tensions and unstable trade policy. Since 2024, it’s surged more than 120%.

Einhorn — who gained notoriety in 2008, when he bet against Lehman Brothers at the Sohn Investment Conference just months before the investment bank declared bankruptcy — pointed out that gold has actually gone up over the past couple years as a result of “becoming the reserve asset” to own among central banks around the world.

“U.S. trade policy is very unstable, and it’s causing other countries to say we want to settle our trade in something other than U.S. dollars,” he said.

In the long term, he said that a reason to own gold is due to the fact that the current relationship between our fiscal and monetary policies “don’t make any sense.” He also said that other major developed currencies around the world are “as bad or worse” than the U.S.

The U.S. dollar suffered its biggest single-day drop since April 2025 last month after Trump said he wasn’t concerned about the currency’s recent weakness.

“There are some issues that sometime over the next number of years could play out with some of the major currencies,” he said.

Deeming betting on more cuts as “one of the best trades out there right now,” Einhorn said he was also long futures on SOFR (Secured Overnight Financing Rate), which essentially is a bet that short-term rates will continue to go lower.

Is silver a meme trade? How the metal became ‘GameStop in 2026’

Published Mon, Feb 2 20268:42 PM ESTUpdated Mon, Feb 2 202611:36 PM EST

Lee Ying Shan@in/ying-shan-lee@LeeYingshan

Key Points

- The metal’s price action has drawn growing comparisons to meme stocks such as GameStop.

- Michael Antonelli, market strategist at Bull and Baird: “How is Silver different than, say, GameStop?”

- “Silver has just become retail’s new [favorite] toy,” Vanda analyst Ashwin Bhakre.

A vendor shows various models and weights of silver bullion at a gold jewellery manufacturer in “El Sagha”, as gold prices recorded an increase after a devaluation of the local currency, at the gold market area in Cairo, Egypt January 14, 2024.

Amr Abdallah Dalsh | Reuters

Silver’s rapid surge and equally dramatic reversal in recent weeks has led market watchers to ask a fundamental question: when does an asset stop trading on fundamentals and start behaving like a meme?

The volatility in silver prices has drawn growing comparisons to meme stocks such as GameStop, the video-game retailer that became a global phenomenon in 2021 after retail traders on Reddit piled in en masse, sending its shares soaring far beyond what traditional valuation models could justify.

Meme stocks are typically characterized by a few core traits: sharp, often parabolic price moves, heavy participation by retail investors and narratives that go viral on social media, sometimes overwhelming fundamentals altogether. Liquidity can rush in quickly, and often exits just as fast.

Michael Antonelli, market strategist at Bull and Baird, laid out the comparison bluntly on X: “How is Silver different than, say, GameStop?” he asked in a post last week. “Is this not a meme now?”

He told CNBC that the metal has reached a kind of “zeitgeist” with retail traders who are starting to move as a herd. While silver does have industrial and consumer uses, prices do not usually move over 100% in three months: “It is totally disconnected and went vertical based on retail flows,” he said.

Individual investors on Jan. 26 poured about $171 million net into the iShares Silver Trust, a popular exchange-traded fund that tracks the metal, according to recent market research firm VandaTrack. That was almost double the previous peak recorded during the “silver squeeze” of 2021.

Spot silver prices advanced almost 5% to $83.37 per ounce on Tuesday, while silver futures in New York rose over 9% to $84 per ounce.

Over the past month, silver has recorded 10 moves of 5% or more in either direction.

“Silver has just become retail’s new [favorite] toy,” Vanda analyst Ashwin Bhakre said.

That enthusiasm is visible across Reddit. The platform played a central role in the original meme-stock phenomenon, with Reddit community WallStreetBets being at the forefront of coordinating retail buying in GameStop in 2021.

On the Reddit Silverbugs forum — a community where users document physical purchases, debate price targets and share memes — posts following the recent sell-off are emblematic of the meme-stock culture.

Silver prices in the past month

“Bought the dip today! DIAMOND HANDS,” wrote Reddit user Jstaakz following the sell-off Friday. “Diamond hands” is a meme-stock term used by retail traders to signal that they plan to keep holding an asset despite sharp losses or extreme volatility, often as a show of conviction or defiance against selling pressure.

Another user asked fellow traders for advice on Monday on whether they should hold or sell their silver, adding that it was bought at $48 per ounce last June.

“Silver is just GameStop in 2026,” Antonelli said.

A self-fulfilling frenzy

For some analysts, silver’s behavior has crossed a familiar and dangerous threshold.

Rhona O’Connell, head of market Intelligence at StoneX, warned that prices had detached from sustainable levels.

“Silver was massively over-valued and in a self-fulfilling frenzy; it is however notoriously fickle and its history is littered with examples of price crashes,” she said. “At present it is behaving like Icarus and to extend the analogy there is a strong risk of other buyers getting burned.”

Tom Sosnoff, chief executive officer at financial technology platform Lossdog, even included gold into the meme fold: “Gold and silver have been absolutely kind of the meme commodity of 2026 … the silver move has been wild … We’re basically seeing a multi-year moves in less than 30 days.”

“Huge volume, huge volatility, not too much rhyme or reason why. I mean, you can make up as many fundamental or technical reasons as you want, but it’s a meme stock trade,” Sosnoff said.

He cautioned that newer participants were drawn in by headlines and social media. “If you’ve never traded silver before in the futures market or in the ETF market, just be careful. These are big contracts, and they fly around, and they’re moving around at levels that, you know, we’ve never seen before.”

Henrietta Treyz, managing partner at Veda Partners, said the dynamic was unmistakable. “The moves in precious metals are really quite something, whether it’s gold or silver. And you can tell as an outside observer that the meme stock component is very much alive and well,” she said. “It reminds me of GameStop.”

However, not everyone agrees silver should be lumped in with narrative-only assets.

Vasu Menon, managing director of investment strategy at OCBC, said silver “sometimes behaves like a meme commodity, but it isn’t one by nature,” pointing to industrial demand from solar panels, electric vehicles and electronics. Menon, however, acknowledged that speculation had amplified recent moves and that sharp corrections were part of silver’s DNA.

Consumer staples are rallying in 2026. Here’s what’s driving the surge in the sector

Published Sun, Feb 15 20268:41 AM EST

Davis Giangiulio@in/davis-giangiulio-4a34a5262/@GiangiulioDavis

As investors have rotated out of tech names to start 2026, consumer staples have been a primary beneficiary.

Consumer staples is the third-best sector in the S&P 500 year to date, behind materials and energy. The sector is up more than 15.5% in 2026, while the broad market index is little changed in the period.

Wolfe Research wrote in a Tuesday note that market-weighted valuations for consumer staples have surged to their highest levels since the 1990s. Bank of America found earlier this month that net inflows into the sector as a percentage of market cap were at an all-time high.

The rally has been so rapid that the sector now has a relative strength index reading of 80, indicating it may be in overbought territory.

“Most of what we’ve seen year-to-date has less to do with staples itself, and more to do with the broader market,” Deutsche Bank analyst Steve Powers said in an interview with CNBC. “As there has been a rethink of market positioning, most specifically toward the tech sector… it has opened up rotation into more overlooked, arguably less popular, and defensive sectors.”

Walmart’s enormous footprint

Amid the rally, staples’ largest company Walmart joined the exclusive $1 trillion market cap club, which is largely made up of tech giants. The company has benefited from being viewed as a retailer prepared to adjust for the artificial intelligence economy, Citi analyst Paul Lejuez said in an interview.

“It’s the combination now of both their historical, brick-and-mortar econ business, but also what they’re doing in the world of tech,” he said. “A lot of what they’re building will only, I think, increase the distance between them and the competition.”

Walmart’s sector peers’ shares have lagged behind until the recent rally. In 2025, Walmart gained more than 23%, while consumer staples overall were essentially flat. Walmart’s 20% jump in 2026 is much closer to the sector’s advance.

Sector drivers in 2026

So why are other names in the sector now getting attention? Bank of America analyst Peter Galbo wrote in a recent note that dollar weakness could be aiding shares of companies with multinational presences, like Coca-Cola, Procter & Gamble and Philip Morris. Galbo added those with easier comparison periods for earnings — like Constellation Brands and Conagra Brands — are seeing some of the better performances, too.

There are also signs that fundamentals for these stocks may start improving. Some analysts have named companies within the sector as likely to benefit the most from larger tax refunds tied to President Donald Trump’s “big beautiful bill.”

“If you go back to 2025, a big part of the headwinds to demand was tied to the lower- and lower-middle-income household income cohorts,” Deutsche Bank’s Powers said. “To the extent that they bring some relief… that would be a help to a lot of sectors, but it could help consumer products’ demands as we go into the year.”

Powers added that investors are hopeful that consumption and demand will rise as 2026 goes on, boosting these stocks. That’s something some companies are already projecting, with Procter & Gamble CFO Andre Schulten in the company’s recent earnings call telling investors to “expect stronger results in the second half” of its 2026 fiscal year.

For staples’ outperformance to continue, there will need to be more signs of improving fundamentals and continuing investor interest in rotating out of momentum stocks, Powers said. He added that the rest of the earnings season will be critical to discovering more on the fundamentals angle.

As for the rotational play, Interactive Brokers chief strategist Steve Sosnick forecasted that investors’ behavior to start 2026 won’t change throughout the year.

“We’re going to see the trend of value stocks becoming more popular continuing,” he told CNBC, particularly amid tech’s relative underperformance even before 2026 started. “So it’s sort of like, ‘Let me return to the knitting here. Maybe boring is good in this environment.’”

He worked on Wall Street for nearly 50 years. Here’s what he learned about your finances

By John Towfighi, CNN | Posted – Feb. 16, 2026 at 2:02 p.m.

KEY TAKEAWAYS

- Howard Silverblatt retired from S&P Dow Jones Indices after 49 years.

- He advises investors to understand risks and keep portfolios diversified amid market changes.

- Silverblatt highlights the shift from pensions to 401(k)s increasing personal financial responsibility.

NEW YORK — When Howard Silverblatt first started working on Wall Street, the S&P 500 was at 99.77 points. The week before he retired, the benchmark index was up by 70 times that, to 7,000.

That’s an eye-popping increase — but maybe not surprising, considering Silverblatt started his career on May 17, 1977.

This January, Silverblatt hung up his hat after a nearly 49-year run at Standard & Poor’s — now S&P Dow Jones Indices. He’s a legend on Wall Street as a markets analyst, a trusted source for journalists, and a well-documented data wizard.

It’s all left him uniquely positioned to share the lessons he’s learned from a career stretching across booms, busts, and a transformation in investing. As for the Dow, the blue-chip index traded in the 900s when Silverblatt began his career, and crossed 50,000 points one week after his retirement.

Silverblatt, a native of Brooklyn, New York, spoke with CNN by phone from Florida.

Know how much risk you can stomach

Know what you’re buying — and know the risks.

There are fewer publicly traded companies on the stock market now than when Silverblatt began his career in the ’70s. But there are endless offerings of exchange-traded funds, derivatives and other securities that investors can buy and sell in an instant. That has made it all the more critical for investors to remain vigilant about where they’re putting their money, he said.

Record highs in the stock market — which the Dow and S&P recently hit — are great opportunities to review your portfolio and ensure it is well-diversified.

“Am I still on track with what I want, and all my allocations? Or did the market change it? And do I want to change it back?” he said. “You really need to know your risk tolerance and liquidity.”

Keep an open mind and strive to learn

Silverblatt said he was always good with numbers, stemming from his father’s job as a tax accountant.

“I remember, literally, my first job was at home when I’m 7, 8 years old, putting physical checks in order,” he said.

After graduating from Syracuse University, Silverblatt entered a training program at S&P in downtown Manhattan in the late 1970s.

Silverblatt stayed at the company for the entirety of his career. He said developments in communications, information and technology were the most notable shifts across his career, and it is reflected in the U.S. market: There are 10 American companies worth more than $1 trillion, and eight of those are tech companies.

It’s great when stocks go up. Are you prepared for when they go down?

The Dow reaching 50,000 is an amazing milestone, Silverblatt said. But he noted a key fact of the math — a 1,000-point increase from 49,000 to 50,000 is a change of 2%. It’s much less significant than, say, the Dow going from 1,000 to 2,000, which is a 100% increase. It’s a reminder to keep your eye on percent changes in the market instead of points.

Over time, as the Dow hitting 50,000 exemplifies, the market tends to climb higher. As for market exuberance, Silverblatt emphasized the need for investors to be cautious and well-informed.

Silverblatt said Black Monday — the biggest single-day stock market drop in history on October 19, 1987 — still stands out as one of the most eye-opening and memorable moments of his career. The S&P 500 plunged 20.47% in one day.

He remembers it as an analyst — and as a personal investor. He didn’t lose anything that fateful Monday, he joked, because he’d already sold everything by Friday.

After Black Monday, two memorable Wall Street moments for Silverblatt were Lehman Brothers and Bear Sterns going under amid the 2008 financial crisis, and the advent and development of brokerage houses and how they changed access to the stock market.

“It’s not so much about making money in the good times,” he said. “It’s holding on to it in the bad times.”

Retirement savings are more dependent on the market, for better or worse

Just look at retirement assets, Silverblatt said. He is retiring with a pension, or direct benefit plan, in addition to his 401(k). The rise of 401(k)s and individual retirement accounts means most Americans these days only have their invested retirement plan, and not a defined pension.

That’s great for bolstering your retirement savings but brings with it more responsibility to manage their risk.

Direct and indirect stock holdings, including mutual funds or retirement plans, accounted for an all-time high of 45% of households’ financial assets in the second quarter of 2025, according to Federal Reserve data.

“Risk is one of the major items I think people sometimes ignore,” he said. “We all want to go up, but how are we going to do when we go down?”

Hobbies don’t hurt

Silverblatt said he is looking forward to reading more, including the works of William Shakespeare. He also said he is eager to play more chess, read more books, attend talks at his local economics club and perhaps pick up new hobbies like golf.

Math was always his best subject through school, he said. “I was a geek from the beginning,” he said. “And worse than just a number geek. … I was captain of my chess team, so I was a double geek.”

“I do not play golf, but I may take it up,” he said. “I will definitely play more chess. I got a couple of projects to help some friends out as far as the market goes … and then I have to figure out what I’m doing, that’s true, but definitely not 60-hour weeks.”

The Key Takeaways for this article were generated with the assistance of large language models and reviewed by our editorial team. The article, itself, is solely human-written.

| Morgan Stanley just poured through 3,600 stocks and says these are the best opportunities from the AI shakeout Show me the return on equity is the new rule, say analysts. By Barbara Kollmeyer |

| Morgan Stanley sifted through opportunities after the AI shakeout. GETTY IMAGES The jobs report may overshadow the market’s recent preoccupation on just how much artificial intelligence will damage the growth prospects for software and other industries. But the AI concerns are likely to come quickly back to the surface. Morgan Stanley strategists just published a fifth version of what they call global AI stock mapping, sifting through 3,600 names in search of trends and opportunities. One central observation they make: market focus has shifted from pure AI exposure to proof of return on investment (ROI), and they say “the fundamental gap between winners and losers is widening.” The strategists added that companies are starting to flag their proof of ROI, with 30% of North America AI adopters identified by analysts citing “at least one quantifiable AI impact” in the final quarter of 2025, a steady gain over the past year. Investors looking for signs companies are delivering that ROI proof should be looking at whether companies report margin expansion, says a team led by analyst Stephen Byrd. The strategists expect around 80% of AI benefits to come from cost efficiency versus revenue growth. The profit margin for companies they call AI adopters was twice that of global stocks, over the last two years, but the market hasn’t given them that credit in forward estimates. |

| A screen of companies benefiting from AI include Samsung Electronics 005930, SK Hynix 000660, Airbus AIR, Nokia NOK, Visa V, Mastercard MA, Coca-Cola KO and CVS Health CVS, they say. What else should investors be looking out for to spot the winners? Morgan Stanley offers up three more criteria for investors to assess. The first is whether companies that lay off workers clearly explain why the moves are necessary. Secondly, as markets clearly start to punish business models where AI is posing a structural threat, company leaders must demonstrate how the technology is “economically meaningful to the business.” Finally, corporates should be articulating how AI is “embedded in strategy, influencing core financial drivers and delivering measurable ROI.” The analysts see a median 62% upside to their price targets for their list of mispriced stocks after a “broad and largely indiscriminate” sell-off. Morgan Stanley included a screen of companies — mostly software and services — they say were unfairly sold off in a recent move that was “broad and largely indiscriminate, with limited differentiation across business models or fundamentals.” Across those beaten-down stocks, they see a median 62% upside for their price targets, and triple-digit potential for CCC Intelligent Solutions CCC, Vertex VERX, Salesforce CRM and ServiceTitan TTAN. Outside the U.S., Australian-listed Xero XRO and WiseTech WTC offer the most upside, they say. |