HI Market View Commentary 12-21-2020

| Market Recap |

| WEEK OF DEC. 14 THROUGH DEC. 18, 2020 |

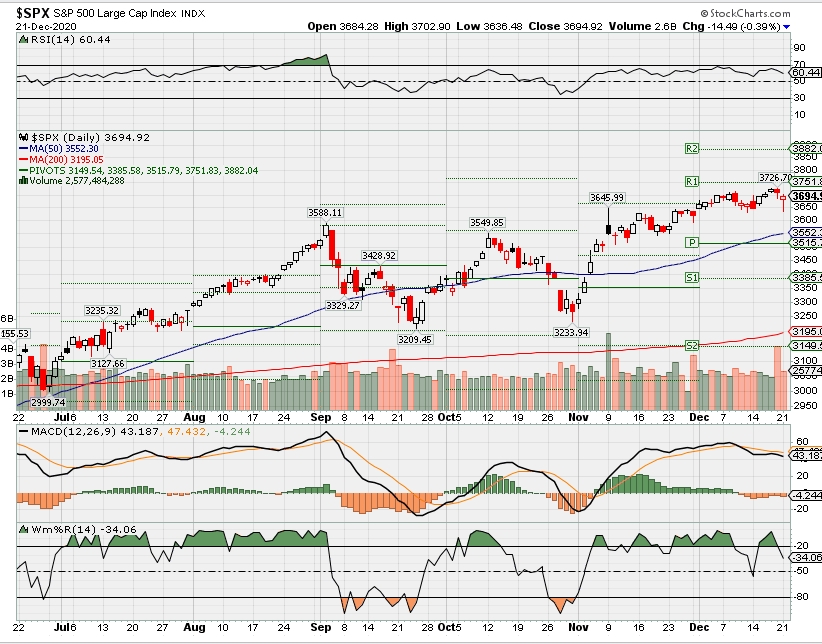

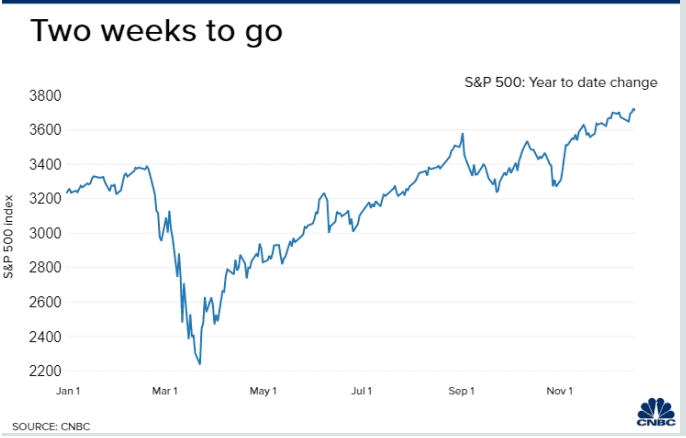

| The S&P 500 index rose 1.7% last week to a fresh closing high as the US moved toward approving a second COVID-19 vaccine and lawmakers neared an agreement on another pandemic stimulus plan. The market benchmark ended the week at 3,709.41, up from last Friday’s closing level of 3,663.46 and marking its highest closing level ever. The index also reached a new intraday high Friday at 3,726.70. It is now up 15% for the year to date. The advance came despite COVID-19 cases and hospitalizations also reaching fresh highs again in the US, as investors are optimistic about the ability of vaccines and more stimulus to help the US economy recover. Distribution of the vaccine produced by Pfizer (PFE) and BioNTech (BNTX) got under way this week and a Food & Drug Administration advisory panel recommended that Moderna’s (MRNA) vaccine also receive emergency use authorization. Meanwhile, Congressional leaders are working on negotiations for some $900 billion in pandemic relief that would include another round of direct payments to households. The week’s advance was led by the technology sector, up 2.8%, followed by consumer discretionary, up 2.2%. Just one sector ended the week in the red: Energy fell 0.7%. The technology sector’s gainers included shares of Synopsys (SNPS), which climbed 7.9% as the software maker said it signed an accelerated share repurchase agreement with Mizuho Markets Americas to buy back $250 million of its shares. Under the agreement, the company will get an initial share delivery of 824,000 shares, with the remainder, if any, to be settled by April 9. Also in the technology sector, PayPal (PYPL) shares rose 10% this week as the payment technology company received a boost to its price target from KeyBanc. KeyBanc’s price target on the stock is now $235, up from $215, while the firm kept its investment rating on the shares at outperform. In consumer discretionary, Chipotle Mexican Grill (CMG) shares also benefited from positive analyst actions. Stifel upgraded its investment rating on the stock to buy from hold while increasing its price target on the shares. JPMorgan also boosted its price target on the shares while keeping its investment rating at neutral. Chipotle shares rose 9.1%. On the downside, the energy sector’s drop came even as crude oil futures rose. Among the sector’s decliners, Kinder Morgan (KMI) shares fell 3.7% this week as Credit Suisse downgraded its investment rating on the stock to neutral from outperform. Next week will be a holiday-shortened week, with the US stock market closing several hours early Thursday for Christmas Eve and closed all day Friday for Christmas Day. The week’s economic data will thus be consolidated into the first four days of the week. Among the data highlights, revised Q3 gross domestic product will be released Tuesday, as well as December consumer confidence and November existing home sales. November new home sales, consumer spending and inflation data will be released Wednesday in addition to December consumer sentiment. Thursday’s data will include November durable goods and capital goods orders along with weekly jobless claims. Provided by MT Newswires. |

S.M.A.R.T. GOALS – A must read

As a Registered Investment Adviser I’ve heard two questions over and over again in the last couple of weeks.

What do you think the market will do in 2021? – What are your goals for 2021?

LET’S TALK ABOUT GOALS !!!

Both questions are intertwined and here is my “two cents”. I believe more people will lose money in 2021 as they set their primary goal to make back EVERYTHING they lost in 2020. Ego loses people money just as easily as fear and greed. There are no guarantees in the market and there is no proof the market will bounce back next year. It would be great to make back everything you’ve lost but a profit is still a profit. You don’t go broke by taking profits! You don’t go broke by collar trading! I would hate to see anyone in the market think they know more than the market does and try to outguess the market. It just doesn’t make any sense at all to put on risky trades to make back what you’ve lost in a week, month or last year? Let me introduce you to the idea behind being S.M.A.R.T. in your goal setting.

- S. – Simple, Specific, Schedule – Keep it simple stupid just like old acronym says – KISS. Set a simple return just like you set your primary exits in your trade. Decide on a specific amount (I will talk about this later) and write it down. Schedule it in your planner! Remember your schedule is to make that return over a year’s period not in the month of Jan or in the first half of the year. Make sure you see your goal on a daily basis as you check you schedule on a daily basis.

- M – Measurable – Most people set what is called a “pinpoint” goal. We might decide that we want to make a simple market average return of 7% in a 1 year period. What happens in real life? We hit the goal and then we Quit or Stop trying as hard. Set a range goal. Maybe you always want a minimum return of 7%ish so set your goal to be between 7% to 20%. On the bullish years 7% is easy so I set a goal so If you do make it you still have something to shoot for.

- A – Attainable – Make a plan to how you will attain your goals. Start this step by asking yourself what or who do you want to become? ie… a better trader, a full time trade, a stay at home dad, a millionaire. Too many people at the start of every year write down a wish list not a goal. I wish at the end of the year I can make this amount of money or lose this amount of weight. How will you do it and what will you do to get there? How much of your portfolio will be safe in collar trades? How much will be pure option strategies? How much will you use for vegas trades? Will you use margin to reach your goals? Figure out the details to how you will get to where you want to be at. Start with the end of the year goal on Dec 31st and walk yourself backwards.

- R – Realistic, Relevant – I always want to make a 50% return or more. Some years like this past year I was quite close to being at that goal. What happens in real life? We are nowhere close to our goal and we quit. We give up on the whole thing because we will never hit the goal. Step by step progression in trading is fine and make sure your goals remain relevant throughout the whole year. Don’t forget goals can be adjusted like a trade that may go south. S&P Ave 7.74

- T – Time – Set the time period that you want to accomplish your goals. Set short term, intermediate, long term, and life-long goals you want to reach and hold yourself accountable. Let others know the time period you expect to reach your goals and get the support needed to get there. Whether it is between you and your spouse, your kids, your parents, your education program or maybe the good Lord himself, find support during the tough times. I promise you they will come.

Conservative Trades (Perhaps 70% of your portfolio):

Cash or T-Bills –

Collar Trades –

Protective Puts (also known as Married Puts) –

Covered Calls with Long puts or DITM

Equities –

Medium Risk Trades (Perhaps 20% of your trades):

Bull Put –

Put Calendar –

Call Calendars –

Straddles / Strangles as a volatility play –

Put and / or Call Ratio Backspreads –

Winged Spreads –

Bull Calls (standard application) –

Bear Puts (standard application) –

Straddle / Strangle

Bear Calls –

High Risk Trades (Perhaps 10% or less):

Long Calls or Long Puts (as a non-hedged directional trade) –

Naked Short Put –

Naked Short Call – NEVER DO THIS UNLESS YOU ARE WILLING TO RISK AND LOSE EVERYTHING

Vegas Trades (Outside the box trades) –

New equity positions for 2021 that I am looking at – WMT, ALK, PYPL, SQ, CCL, RCL, MGM, SBUX

I still like my favorites – AAPL, BIDU, BAC, BA, DIS, F, V, & UAA is “still” my wildcard

For smaller accounts following the SPY, QQQ, DIA, F, UAA, Leaps

Where will our markets end this week?

Higher

DJIA – Bullish

SPX – Bullish

COMP – Bullish

Where Will the SPX end December 2020?

12-21-2020 +2.5%

12-14-2020 +2.5%

12-07-2020 +2.5%

11-30-2020 +2.5%

Earnings:

Mon:

Tues: KMAX, CTAS

Wed: PAYX

Thur:

Fri:

Econ Reports:

Mon:

Tues: GDP, GDP Deflator, Existing Home Sales, Consumer Confidence

Wed: MBA, PCE Prices, Core PCE Prices, Personal Income, Personal Spending, FHFA Housing Price Index, New Home Sales, Michigan Sentiment

Thur: Initial Claims, Continuing Claims, Durable Goods, Durable Ex-Trans, HALF DAY IN THE MARKET

Fri: MARKET CLOSED

Int’l:

Mon –

Tues –

Wed –

Thursday –

Friday-

Sunday –

How am I looking to trade?

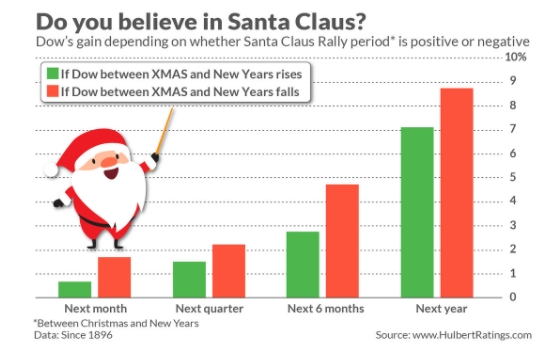

The big decision how far to let stocks run into a Christmas Rally ?!?!?!?!?

EARNINGS

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

https://www.cnbc.com/2020/12/20/stock-market-futures-open-to-close-news.html

Dow falls more than 300 points as new virus strain from the U.K. spooks investors

Stocks fell on Monday to start the holiday week as enthusiasm over a coronavirus stimulus deal was overwhelmed by worries over a viral new Covid strain in the U.K.

The Dow Jones Industrial Average slid 340 points. The S&P 500 shed 1.7% and the Nasdaq Composite fell 1.4%. Tesla dropped as much as 6% as it entered the S&P 500 with a 1.69% weighting in the index, the fifth largest. Dow-component Nike jumped more than 6% to hit a record high on the back of strong earnings.

Now with a stimulus agreed upon, investors may also be seeking to lock in profits after an unexpected banner year. With only two trading weeks left in 2020, the S&P 500 is up 13.6% for the year, while the 30-stock Dow has risen 5.2%. The Nasdaq Composite has rallied 40.7% this year as investors favored high-growth technology companies.

Travel-related stocks came under pressure on news of an infectious new coronavirus strain in the U.K., which triggered more severe lockdowns and travel restrictions across Europe.

Norwegian and Royal Caribbean cruise lines shares each dropped more than 3%. American Airlines slid 5.2%, while United Airlines fell more than 4%. Shares of companies that would be hit by stricter lockdown measures fell, including Wynn Resorts and Gap.

“There was actually a lot of encouraging news this morning, although it’s being overshadowed (for now) by the gloomy headlines out of the U.K.,” wrote Vital Knowledge’s Adam Crisafulli in a note to clients. “The market has been in a tug-of-war between the very grim near-term COVID backdrop and the increasingly hopeful medium/long-term outlook (driven by vaccines) – the latter set of forces are more powerful in aggregate, but on occasion the market decides to focus on the former, and stocks suffer as a result.”

The losses came even as lawmakers have reached an agreement on a $900 billion relief package, which would provide direct payments and jobless aid to struggling Americans. The announcement came after negotiators resolved a key sticking point by rolling back the Federal Reserve’s emergency lending powers.

Treasury Secretary Steven Mnuchin told CNBC’s “Squawk Box” that the stimulus money will go out as soon as next week.

Congress passed a one-day spending bill to avoid a government shutdown that would have started at 12:01 a.m. ET Monday. President Donald Trump signed the measure late Sunday evening, according to White House spokesman Judd Deere.

Lawmakers will vote on the relief and funding bill on Monday.

The major averages hit record highs recently amid optimism toward fresh coronavirus stimulus as well as the vaccine rollout. Moderna is shipping its first batch of vaccine doses after receiving approval for emergence use from the U.S. Food and Drug Administration. Meanwhile, the vaccines by Pfizer and BioNTech are being distributed to front-line health-care workers around the country.

The U.K. strain “doesn’t seem to have mutated the surface proteins of the virus in a way that they would slip past our vaccines or prior immunity. In fact, we don’t think that that’s the case,” Dr. Scott Gottlieb told CNBC’s “Squawk Box.” “But what this does suggest is that eventually this vaccine probably will evolve its surface proteins in a way that they won’t be recognized by the antibodies we have right now, and we will have to update our vaccines.”

Gottlieb said the Covid virus did not seem to be mutating its proteins as rapidly as the seasonal flu and estimated that vaccines would need to be updated about every three years.

“Covid mutations are a reality, and there is at least some disappointment around what’s actually in the stimulus deal, which means we may see this translate into volatility as we narrow in on the end of 2020,” said Chris Larkin, managing director of trading and investing product at E-Trade.

On Friday, the Fed announced it will allow the nation’s big banks to resume share buybacks in the first quarter of 2021 subject to certain rules. JPMorgan shares were up almost 3%.

Subscribe to CNBC PRO for exclusive insights and analysis, and live business day programming from around the world.

You can’t sue Pfizer or Moderna if you have severe Covid vaccine side effects. The government likely won’t compensate you for damages either

MacKenzie Sigalos@KENZIESIGALOS

KEY POINTS

- Under the PREP Act, companies like Pfizer and Moderna have total immunity from liability if something unintentionally goes wrong with their vaccines.

- A little-known government program provides benefits to people who can prove they suffered serious injury from a vaccine.

- That program rarely pays, covering just 29 claims over the last decade.

If you experience severe side effects after getting a Covid vaccine, lawyers tell CNBC there is basically no one to blame in a U.S. court of law.

The federal government has granted companies like Pfizer and Moderna immunity from liability if something unintentionally goes wrong with their vaccines.

“It is very rare for a blanket immunity law to be passed,” said Rogge Dunn, a Dallas labor and employment attorney. “Pharmaceutical companies typically aren’t offered much liability protection under the law.“

You also can’t sue the Food and Drug Administration for authorizing a vaccine for emergency use, nor can you hold your employer accountable if they mandate inoculation as a condition of employment.

Congress created a fund specifically to help cover lost wages and out-of-pocket medical expenses for people who have been irreparably harmed by a “covered countermeasure,” such as a vaccine. But it is difficult to use and rarely pays. Attorneys say it has compensated less than 6% of the claims filed in the last decade.

Immune to lawsuits

In February, Health and Human Services Secretary Alex Azar invoked the Public Readiness and Emergency Preparedness Act. The 2005 law empowers the HHS secretary to provide legal protection to companies making or distributing critical medical supplies, such as vaccines and treatments, unless there’s “willful misconduct” by the company. The protection lasts until 2024.

That means that for the next four years, these companies “cannot be sued for money damages in court” over injuries related to the administration or use of products to treat or protect against Covid.

HHS declined CNBC’s request for an interview.

Dunn thinks a big reason for the unprecedented protection has to do with the expedited timeline.

“When the government said, ‘We want you to develop this four or five times faster than you normally do,’ most likely the manufacturers said to the government, ‘We want you, the government, to protect us from multimillion-dollar lawsuits,’” said Dunn.

It is very rare for a blanket immunity law to be passed. … Pharmaceutical companies typically aren’t offered much liability protection under the law.

Rogge Dunn

DALLAS LABOR AND EMPLOYMENT ATTORNEY

The quickest vaccine ever developed was for mumps. It took four years and was licensed in 1967. Pfizer’s Covid-19 vaccine was developed and cleared for emergency use in eight months — a fact that has fueled public mistrust of the coronavirus inoculation in the U.S.

Roughly 4 in 10 Americans say they would “definitely” or “probably” not get vaccinated, according to a recent survey by the Pew Research Center. While this is lower than it was two months ago, it still points to a huge trust gap.

But drugmakers like Pfizer continue to reassure the public no shortcuts were taken. “This is a vaccine that was developed without cutting corners,” CEO Dr. Albert Bourla said in an interview with CNBC’s “Squawk Box” on Monday. “This is a vaccine that is getting approved by all authorities in the world. That should say something.”

The legal immunity granted to pharmaceutical companies doesn’t just guard them against lawsuits. Dunn said it helps lower the cost of the immunizations.

“The government doesn’t want people suing the companies making the Covid vaccine. Because then, the manufacturers would probably charge the government a higher price per person per dose,” Dunn explained.

Pfizer and Moderna did not return CNBC’s request for comment on their legal protections.

Is anyone liable?

Remember, vaccine manufacturers aren’t the ones approving their product for mass distribution. That is the job of the FDA.

Which begs the question, can you sue the U.S. government if you have an extraordinarily bad reaction to a vaccine?

Again, the answer is no.

“You can’t sue the FDA for approving or disapproving a drug,” said Dorit Reiss, a professor at the University of California Hastings College of Law. “That’s part of its sovereign immunity.”

Sovereign immunity came from the king, explains Dunn, referring to British law before the American Revolution. “You couldn’t sue the king. So, America has sovereign immunity, and even each state has sovereign immunity.”

There are limited exceptions, but Dunn said he doesn’t think they provide a viable legal path to hold the federal government responsible for a Covid vaccine injury.

Bringing workers back to the office in a post-Covid world also carries with it a heightened fear of liability for employers. Lawyers across the country say their corporate clients are reaching out to them to ask whether they can require employees to get immunized.

Dunn’s clients who run businesses serving customers in person or on site are most interested in mandating a Covid vaccine for staff.

“They view it as a selling point,” Dunn said. “It’s particularly important for restaurants, bars, gyms and salons. My clients in that segment of the service industry are looking hard at making it mandatory, as a sales point to their customers.”

While this is in part a public relations tactic, it is legally within an employer’s rights to impose such a requirement.

“Requiring a vaccine is a health and safety work rule, and employers can do that,” said Reiss.

There are a few notable exceptions. If a work force is unionized, the collective bargaining agreement may require negotiating with the union before mandating a vaccine.

Anti-discrimination laws provide some protections as well. Under the Americans with Disabilities Act, workers who don’t want to be vaccinated for medical reasons are eligible to request an exemption. If taking the vaccine is a violation of a “sincerely held” religious belief, Title VII of the Civil Rights Act of 1964 would potentially provide a way to opt out.

Should none of these exemptions apply, employees may have some legal recourse if they suffer debilitating side effects following a work-mandated Covid inoculation.

Attorneys say claims would most likely be routed through worker’s compensation programs and treated as an on-the-job injury.

“But there are significant limits or caps on the damages an employee can recover,” said Dunn. He added that it would likely be difficult to prove.

Mandatory vaccination protocols, however, may not happen until the FDA formally approves the vaccines and grants Pfizer and BioNTech or Moderna a license to sell them, which will take several more months of data to show their safety and effectiveness.

“An emergency use authorization is not a license,” said Reiss. “There’s a legal question as to whether you can mandate an emergency observation. The language in the act is somewhat unclear on that.”

$50,000 a year

The government has created a way for people to recover some damages should something go wrong following immunization.

In addition to the legal immunity, the PREP Act established the Countermeasures Injury Compensation Program (CICP), which provides benefits to eligible individuals who suffer serious injury from one of the protected companies.

The little-known government program has been around for a decade, and it is managed by an agency under HHS. This fund typically only deals with vaccines you probably would never get, like the H1N1 and anthrax vaccines.

If a case for compensation through the CICP is successful, the program provides up to $50,000 per year in unreimbursed lost wages and out-of-pocket medical expenses. It won’t cover legal fees or anything to compensate for pain and suffering.

It is also capped at the death benefit of $370,376, which is the most a surviving family member receives in the event that a Covid vaccine proves to be fatal.

But experts specializing in vaccine law say it is difficult to navigate. “This government compensation program is very hard to use,” said Reiss. “The bar for compensation is very high.”

Also worrisome to some vaccine injury lawyers is the fact that the CICP has rejected a majority of the compensation requests made since the program began 10 years ago. Of the 499 claims filed, the CICP has compensated only 29 claims, totaling more than $6 million.

People who are harmed by a Covid vaccine deserve to be compensated fast and generously. The PREP Act doesn’t do that.

Dorit Reiss

PROFESSOR AT THE UNIVERSITY OF CALIFORNIA HASTINGS COLLEGE OF LAW

David Carney, vice president of the Vaccine Bar Association, said the CICP might deny a claim for a variety of reasons. “One reason might be that the medical records don’t support a claim,” said Carney, who regularly deals with vaccine injury cases. “We have to litigate a lot of really complex issues … and provide a medical basis for why the injury occurred.”

Proving an injury was a direct result of the Covid vaccine could be difficult, according to Carney. “It’s not as simple as saying. ‘Hey, I got a Covid treatment, and now I have an injury.’ There is a lot of burden of proof there.”

There is also a strict one-year statute, meaning that all claims have to be filed within 12 months of receiving the vaccine.

“People who are harmed by a Covid vaccine deserve to be compensated fast and generously,” said Reiss. “The PREP Act doesn’t do that.”

Lawyers tell CNBC that it would make more sense for Covid vaccine injuries to instead be routed through another program under the HHS called the National Vaccine Injury Compensation Program, which handles claims for 16 routine vaccines. Known colloquially as “vaccine court,” the program paid on about 70% of petitions adjudicated by the court from 2006 to 2018.

And since it began considering claims in 1988, the VICP has paid approximately $4.4 billion in total compensation. That dwarfs the CICP’s roughly $6 million in paid benefits over the life of the program.

The VICP also gives you more time to file your claim. You have three years from the date of the first symptom to file for compensation.

“The VICP allows for recovery of pain and suffering, attorney’s fees, along with medical expenses and lost wages, if any,” said Michael Maxwell, a lawyer who practices in the areas of business litigation and personal injury. “Under the CICP, it’s only lost wages and out-of-pocket medical expenses. That’s it, unless there’s a death.”

The Covid-19 vaccines, however, aren’t on the list of eligible vaccines.

Reiss said the best fix would be to change VICP’s rulebook to add Covid vaccines to its list of covered inoculations. “That will require legislative change. I hope that legislative change happens.”

Fed allows banks to resume share buybacks, JPMorgan stock jumps 5%

KEY POINTS

- The Fed announced on Friday that it will allow the nation’s largest banks to resume share buybacks in the first quarter of 2021 subject to certain rules.

- The partial relaxation of its buyback ban came after the Fed’s second round of stress tests in 2020.

- JPMorgan Chase announced in the minutes after the Fed’s test results that its board had approved a new share repurchase program of $30 billion.

The Federal Reserve announced on Friday that it will allow the nation’s big banks to resume share buybacks in the first quarter of 2021 subject to certain rules and that the industry fared well in a second round of stress tests.

Dividends will continue to be capped, the Fed said, and the sum total of a bank’s dividends and repurchases in the first quarter cannot exceed the average quarterly profit from the four most recent quarters.

Share repurchases are important for the industry, typically making up about 70% of the industry’s capital payouts to shareholders.

JPMorgan Chase, the largest U.S. bank by assets, announced in the minutes after the Fed’s test results that its board had approved a new share repurchase program of $30 billion starting in 2021.

“We will continue to maintain a fortress balance sheet that allows us to safely deploy capital by investing in and growing our businesses, supporting consumers and businesses, paying a sustainable dividend, and returning any remaining excess capital to shareholders,” CEO Jamie Dimon said in a release.

Bank stocks rose across the board in after-hours trading with JPMorgan up 5.3%, Goldman Sachs up 4.4% and Wells Fargo up 3.5%.

The announcement, though not a complete unwind of the Fed’s restrictions, signaled that officials are increasingly satisfied with the amount of capital the largest U.S. banks have been able to compile over the course of 2020.

Fed Vice Chair for Supervision, Randal Quarles, offered positive remarks and said the capital restrictions the central bank put in place are working.

“The banking system has been a source of strength during the past year and today’s stress test results confirm that large banks could continue to lend to households and businesses even during a sharply adverse future turn in the economy,” Quarles said in a press release.

Bolstered capital requirements will not be reset in an effort to ensure sufficient safeguards for unexpected losses, according to the Fed’s report. Senior Fed officials said that large banks have managed to build key capital ratios and loss absorption capacity even while setting aside about $100 billion in loan-loss reserves.

The Fed has for more than a decade devised hypothetical doomsday scenarios each year to test whether the nation’s largest banks could withstand various recession simulations.

But banks faced their own real-world test in the first half of 2020, when a spike in U.S. unemployment and widespread business closures wiped out a significant portion of U.S. income. The springtime recession forced banks to build up loan-loss reserves and prepare for widespread credit losses.

The halt to normal business throughout much of the U.S. sent shares of JPMorgan Chase and Bank of America down 16.6% and 15.1%, respectively, between the start of March and the end of April. Wells Fargo equity lost 29% of its value over the same period.

It was in this backdrop that the Fed conducted its first stress tests of the year.

Officials announced in June that banks had done a solid job of building up capital and loan-loss protections, but that they would nonetheless cap dividends and ban buying back stock in the third quarter as a precautionary measure.

The new assessments looked at how banks would perform under three distinct scenarios: A relatively benign “baseline,” and two severe hypothetical futures, according to a report published by the Fed on Thursday.

The Fed said that under both adverse scenarios, large banks would collectively have more than $600 billion in total losses, considerably higher than the first stress test this year. Still, the Fed said every bank’s risk-based capital ratio would remain above the required minimum in either scenario.

The first severe scenario tested bank resilience if the U.S. economy experienced a comparably sharp contraction in growth.

In this scenario, the U.S. unemployment rate peaks briefly at 12.5% in 2021, inflation falls and real GDP declines 3.25% relative to the third quarter of 2020. Equity prices decline more than 30% from the third to the fourth quarter of 2020.

The Fed’s second severe scenario attempted to mimic how the economy would perform if a series of second waves of Covid-19 occurred across different regions of the U.S. over time. Unlike the first scenario, the second severe outcome is marked by a gentler initial drop in activity but a more sluggish recovery.

The unemployment rate peaks at 11% in the fourth quarter of 2020 and remains there until the fourth quarter of 2021. Real GDP falls at an annualized rate of 9% in the fourth quarter of 2020 and equities sink by 50% by the end of 2021 compared to where they were at the end of the third quarter.

Subscribe to CNBC PRO for exclusive insights and analysis, and live business day programming from around the world.

HI Financial Services Mid-Week 06-24-2014