HI Market View Commentary 12-13-2021

https://www.briefing.com/the-big-picture

The Big Picture

Last Updated: 10-Dec-21 15:12 ET

2022 stock market return expectations should get dialed down

Our concluding thought from last week’s column was that “the abrupt pivot by Fed Chair Powell is tantamount to issuing the first signal that the ‘party like it’s 1999 vibe’ is coming to an end.”

We recognize that one might construe that as a bearish-minded perspective, especially since long-time market observers know what followed in the year 2000.

It wasn’t intended to sound as apocalyptic as some might have interpreted it to be. Rather, it was more of a warning that, when monetary policy shifts from its most dovish point to something less dovish, the nature of the bull market is going to change.

Specifically, there will be an increased appreciation for profits, positive free cash flow, and dividends, which often get overlooked in an environment when there is no fear of a rate hike from the Federal Reserve, let alone multiple rate hikes.

All In

Recall that the Federal Reserve started 2020 with the target range for the fed funds rate at 1.50-1.75%. It cut that range to 1.00-1.25% on March 3 and lowered it again to 0.00-0.25% on March 15.

The move to the zero bound was accompanied by subsequent announcements of new funding facilities to support the flow of credit to households and businesses, and swap lines with other central banks to lessen the strains in global U.S. dollar funding markets.

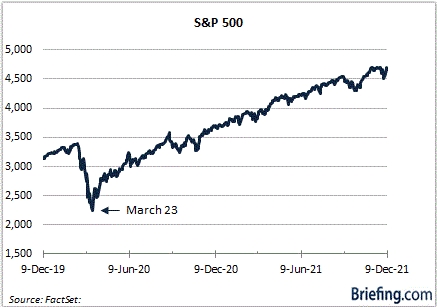

On March 23, though, the Federal Reserve laid down the recovery gauntlet with its announcement that it would purchase Treasury and agency mortgage-backed securities in whatever amounts were needed, establish two facilities to support credit to large employers, which would also entail the Federal Reserve buying investment grade bonds and U.S. listed bond ETFs, establish a Term Asset-Backed Securities Loan Facility, expand its Money Market Mutual Fund Liquidity and Commercial Paper Funding Facilities, and establish a Main Street Business Lending Program.

If there was an all-in moment for the Federal Reserve, that was it.

You know what day the S&P 500 bottomed in its COVID freefall? March 23, 2020. The rest, as it is said, is bull market history.

Multiple Indigestion

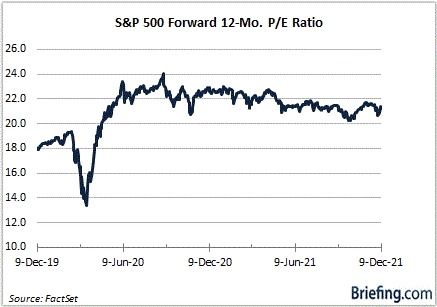

The ultra-accommodative policy, combined with an aggressive fiscal stimulus push, ushered in a period of multiple expansion. Suddenly, the earnings outlook was bright again and market participants were frontrunning the expected earnings growth.

On March 23, 2020, the forward 12-month P/E multiple was 13.4. It would reach 24.1 by September 2 before entering a lower orbit. It currently sits at 21.3, which is a 28% premium to its 10-yr average, according to FactSet.

The S&P 500, then, isn’t as richly valued as it once was, yet it is closing out 2021 at a rich valuation before the Federal Reserve has raised the target range for the fed funds rate even once.

What also jumps out, however, is that multiple expansion has been harder to come by in recent months. Presumably, there is a burgeoning understanding that earnings growth will be slowing in coming quarters, as comparisons get more difficult, and that a monetary policy shift to a less dovish position is going to be part of the equation.

That doesn’t mean stocks can’t go up in price. It means simply that they will be more challenged to increase in price as investors become more discerning about how willing they are to pay for every dollar of earnings in a changing interest rate environment.

Hence, the S&P 500 in 2022, absent a shock on the interest rate, COVID, and/or geopolitical fronts, might have to settle for increasing in-line with earnings growth as the bull case.

That wouldn’t be a terrible outcome. According to FactSet, calendar 2022 earnings growth is projected to be 9.0%, so the price return for the S&P 500 would be closer to its long-term average. Earnings estimates, though, will be a moving target, and one can expect interest rate moves to contribute to the moving.

Following Fed Funds

According to the CME’s FedWatch Tool, there is a 56.2% probability of the target range for the fed funds rate being raised to 0.25-0.50% at the May meeting and a 76.8% probability of the first move coming at the June meeting. There is a 61.5% probability that a second hike will happen at the September meeting and a 57.7% probability of a third rate hike at the December 2022 meeting.

The market will get a better sense of the Federal Reserve’s own forecasts for the fed funds rate when it releases its updated economic and interest rate projections at the December 15 FOMC meeting.

With the November Consumer Price Index Report showing the highest consumer inflation rate on a year-over-year basis (6.8%) since 1982, it would go down as a dovish surprise if the updated dot plot didn’t show a higher probability of three rate hikes in 2022.

Then again, it’s not impossible that a “dovish surprise” could be seen as a negative development if the market thinks the Federal Reserve is being foolishly complacent with its approach to fighting inflation and will eventually need to take a more aggressive rate-hike path.

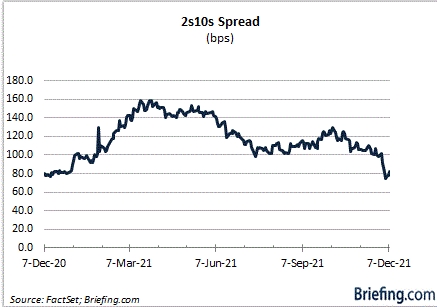

The latter concern has been reflected in a flattening yield curve. The 2s10s spread has narrowed to 82 basis points from 160 basis points in March.

What It All Means

The bull market party doesn’t have to end just because the Federal Reserve is signaling that its policy is going to be less dovish. To be sure, the policy isn’t going to be hawkish.

Even when the Federal Reserve announces that it will be quickening the pace of its tapering, the Federal Reserve will still be buying billions of dollars of Treasury and agency mortgage-backed securities for several more months. Furthermore, moving the target range from 0.00-0.25% to 0.25-0.50% isn’t exactly a death knell for the stock market.

The party, then, can continue, but the music will be turned down a notch or two and the punch bowl will be a little less intoxicating.

Perception matters, too. The perception on March 23, 2020, was that the Federal Reserve was all in, and the stock market has been running with the bulls ever since. The perception now is that that Federal Reserve isn’t going to be the gift horse in 2022 that it was in 2020 and 2021.

Instead, it looks poised to take back some more of its gifts, which means the frivolity in the stock market won’t be the same — or shouldn’t be the same.

Price returns at the index level should moderate, the speculative energy should lose some spark, volatility should be higher, and the back-and-forth rotation between growth and value should persist.

Importantly, though, with the shift to a less dovish policy, party rules dictate that the penchant for buying unprofitable growth at any price should give way to buying profitable growth at a reasonable price.

—Patrick J. O’Hare, Briefing.com

| https://go.ycharts.com/weekly-pulse |

| Market Recap |

| WEEK OF DEC. 6 THROUGH DEC. 10, 2021 |

| The S&P 500 index rose 3.8% last week, erasing the last two weeks’ declines and reaching a new closing record as investors grew more hopeful that the omicron variant of COVID-19 may have smaller effects on the US economy than initially feared. The market benchmark ended the week at 4,712.02, up from last week’s closing level of 4,538.43. This marked a new closing high, although the index hasn’t yet topped its intraday high of 4,743.83 reached Nov. 22. It is now up 3.2% for the month to date and is up 25% for the year to date. This marks the S&P 500’s first weekly gain since the week ended Nov. 19. It had fallen for two consecutive weeks on fears of the omicron variant of COVID-19, especially as experts worried its high level of mutations could make the variant more likely to evade existing vaccines. However, data released Wednesday from Pfizer (PFE) and BioNTech (BNTX) showed while a two-dose vaccine regimen wasn’t as effective against omicron as it was against earlier variants of COVID-19, a third dose of their COVID-19 vaccine did neutralize it. Also lifting sentiment were early reports that illness from the variant is milder than previously feared. Meanwhile, November inflation data released Friday showed US consumer price growth had the largest advance last month on an annual basis in nearly four decades. The seasonally adjusted monthly gauge rose 0.8% in November, down slightly from a 0.9% increase in the prior month, but above the Econoday consensus for a gain of 0.7%. Annually, the measure climbed 6.8%, the largest increase since June 1982, although the growth rate was in line with analysts’ consensus. All of the S&P 500’s 11 sectors were in the black for the week, led by a 6% climb in technology and a 3.7% increase in energy. Other sectors that were up by more than 3% each included materials, consumer staples, health care and industrials. The consumer discretionary sector had the smallest increase of the week, up 2.6%. The technology sector’s gainers included shares of consumer technology heavyweight Apple (AAPL), which jumped 11% last week. The stock received a boost to its price target on Tuesday from Morgan Stanley’s Katy Huberty, who said she expects the consumer technology company’s stock to benefit from “a flight to quality” in 2022, “especially as upside from new product categories gets priced in.” Morgan Stanley’s new price target on Apple’s stock is $200 per share, up from $164. The climb in energy shares came as crude oil futures also rose. Data last week showed crude oil inventories fell by 1.9 million barrels in the week ended Dec. 3, but commercial oil inventories declined by only 200,000 barrels, missing expectations for a larger decrease. Gainers in the sector included Halliburton (HAL), up 8.8%, and Schlumberger (SLB), up 6%. Next week, investors will be looking at more readings on the pricing environment, including the November producer price index due Tuesday, leading up to a two-day meeting of the Federal Reserve’s Federal Open Market Committee. November retail sales and import prices will also be released Wednesday, among other reports. Provided by MT Newswires |

Where will our markets end this week?

Higher

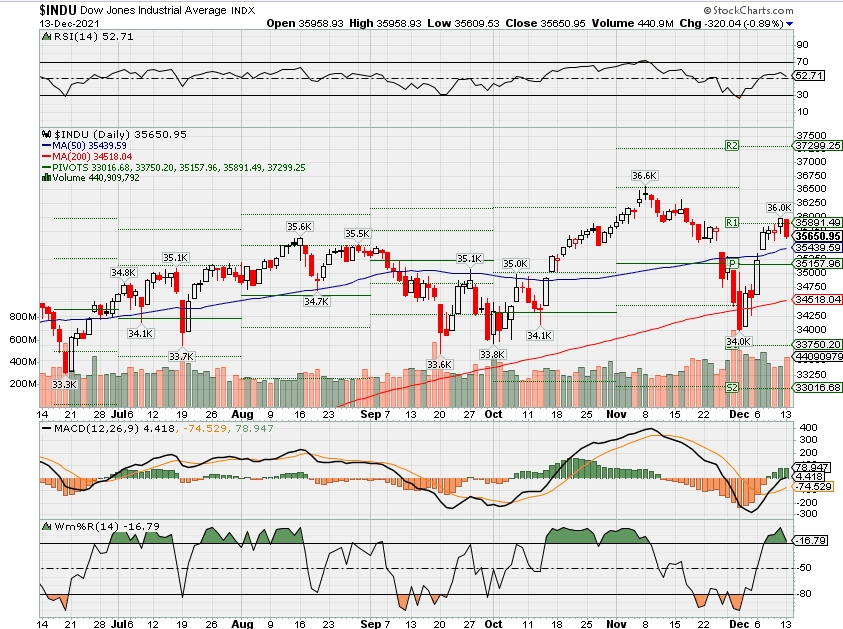

DJIA – Bullish

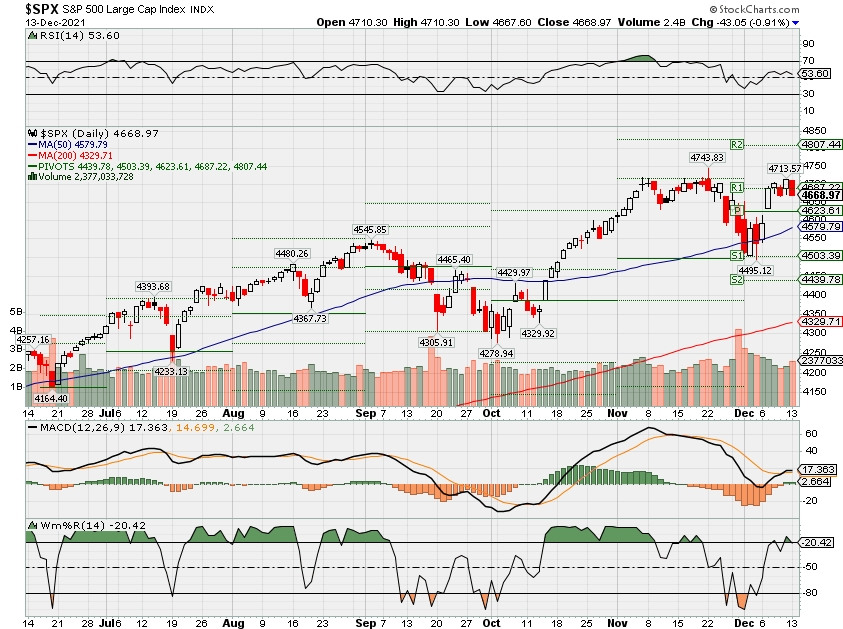

SPX – Bullish

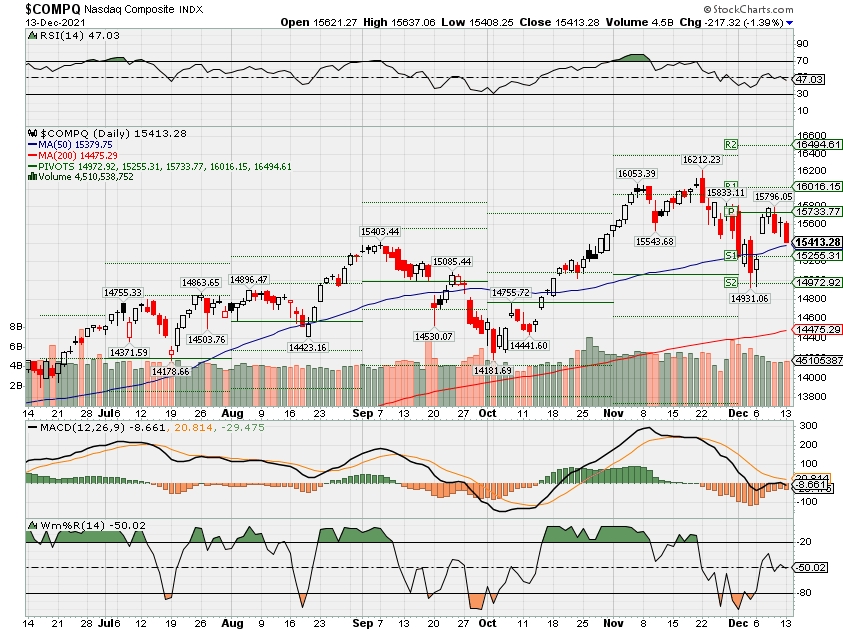

COMP – Bearish

Where Will the SPX end December 2021?

12-13-2021 -3.0%

12-06-2021 -3.0%

11-29-2021 +1.0%

Earnings:

Mon:

Tues:

Wed: LEN, TCOM

Thur: ADBE, FDX

Fri: DRI

Econ Reports:

Mon:

Tues: NFIB Small Business Optimism, PPI, Core PPI

Wed: MBA, FED FOMC RATE DECSION, Retail Sales, Retail ex-auto, Empire Manufacturing, Business Inventories, NAHB Housing Market Index

Thur: Initial Claims, Continuing Claims, Housing Starts, Building Permits, Phil Fed, Industrial Production, Capacity Utilization,

Fri: MONTHLY options Expiration

How am I looking to trade?

Long put protection has been added and getting ready for earnings

MU- 12/22 AMC

www.myhurleyinvestment.com = Blogsite

customerservice@hurleyinvestments.com = Email

Questions???

What are next years opportunities? That’s what I will be trying to figure out as I run hundreds of numbers for stocks

Yes Insider buying is always important as is insider Selling

Wedbush’s Dan Ives says Wall Street is underestimating Apple’s iPhone demand

Dan Ives, managing director at Wedbush Securities, joins CNBC’s ‘Squawk Box’ to break down shares of Apple as the company nears a $3 trillion market cap.

Cathie Wood on Tesla, Twitter and Ark Invest’s new Transparency ETF

Maggie Fitzgerald@MKMFITZGERALD

Innovation investor Cathie Wood spoke with CNBC’s “Squawk Box” on Thursday and shared her most recent thoughts on Twitter and Tesla, as well as details on Ark Invest’s newest exchange-traded fund.

Ark Invest’s flagship fund is struggling this year, down about 17%, amid a rotation from growth names into value. However, Ark Innovation’s largest holding, Tesla, is up more than 50% in 2021.

“More people understand now that the electric age is here,” said Wood, founder and CEO of Ark Invest. “Tesla is being awarded accordingly, it has the highest market share out there and it has, even now, more barriers to entry … especially when it comes to battery technology and artificial intelligence, which will lead to autonomous.”

Wood said Tesla’s barriers to entry are where the carmaker is being undervalued by investors. Ark has a $3,000 per share price target on Tesla.

“Even its electric strategy should take the stock much higher than it is now, but we are gratified to see that others are beginning to understand this story, and that Tesla is acting a little more FANG-like than it ever has,” she added.

Not all of Ark’s investments are doing as well as Tesla, however.

Social media giant Twitter, a top 15 holding in Ark Innovation, has not performed well in 2021. The stock is down 15% year to date, but Wood said Twitter should benefit from the influx of “knowledge workers” that utilize the platform. Knowledge workers are laborers, like scientists, programmers, pharmacists, architects and engineers, whose main job is to think, rather than do manual labor.

“This platform, which used to be dominated by tweens and celebrities, in 2012 when we first evolved our research ecosystem, has now evolved to knowledge workers,” she said. “We find it essential at Ark to engage with the communities we are researching and actually to become a part of those communities.”

Wood also said investors are discounting Twitter’s potential role in the verification of nonfungible tokens.

Ark Transparency ETF

Despite the underperformance of Ark’s five main ETFs, the firm launched a new fund Wednesday called Ark Transparency ETF.

The ETF, which trades under the ticker CTRU, is designed to track the stock price movements of the 100 most-transparent companies in the world. Wood believes there is a direct correlation between transparency and stock returns.

“Ark Invest has gone viral as a brand because we’re willing to share and engage with our clients,” Wood said. “The return from transparency has been huge for us.”

Some of Ark Transparency ETF’s top holdings are Nvidia, Enphase Energy, Teradyne, Cloudfare, Tesla, DataDog and Bloom Energy.

Stocks head for a rare third-straight year of double-digit returns. What happens next?

Michael Santoli@MICHAELSANTOLI

The book on the 2022 market is yet to be written, or even started. But it seems right now that the working title could be “Sedate Expectations.”

Among Wall Street strategists, professional investors and retail traders, the consensus outlook now coalescing is for a less-rewarding, possibly more hazardous market next year.

This is probably not a bad thing at a time of year when reflexive optimism is more typically in the air.

Brokerage-house strategists canvassed by CNBC who have released a 2022 outlook see, as an average, the S&P 500 hitting 4925, up less than 5% from Friday’s record close of 4712. Chances are, this average will move a bit higher as the rest of the handicappers weigh in, but quite likely the consensus will settle right around the long-term annual average gain just under 10%.

On one level, this is simply an instinctive reluctance to assume the lavishly generous returns of the past few years will carry forward, with the S&P 500 up 25% in 2021 and having delivered a 23% annualized total return over the past three years despite a 35% crash interrupting the ride.

As sensible and safe as this kind of forecast sounds, a quirk of the market’s stream of returns is that in any given calendar year it has been surprisingly rare for the index performance to come close to that very long-term annual average. In only five years since 1928 was the S&P 500′s total return between 8% and 12%. By contrast, the index has been negative five times as often, and has gained more than 20% in more than 30 separate years, with 2021 on track to join that roster.

It’s understandable that current forecasts assume lower but still positive returns: We are in a maturing economic and corporate-profit cycle, growth rates are likely to settle back, inflation is elevated and could hasten a tighter Federal Reserve. And the forces of mean-reversion always lurk, somewhere.

Jessica Rabe, co-founder of DataTrek Research, noted last week that 2021 will almost certainly be the third straight year of double-digit S&P returns. Such a three-year streak has happened nine times before. In the year following those streaks, the index rose five times and fell four times – a lower win rate than all years.

Yet the average S&P return across all the up and down years was 8.4%, with the five winning fourth years averaging 25% and the four losers averaging a 7% loss.

How the markets react to Fed hikes

How the markets act around a first interest-rate hike in a cycle is also relevant now that the Treasury complex is pretty assertively pricing in two or possibly three rate hikes in 2022, a response to tighter labor markets and more persistent inflation than anticipated.

Ned Davis Research shows that stocks have done well in general in the six months ahead of an initial rate hike. How equities fare after that seems to depend on whether it becomes a “fast” tightening campaign, with a hike at pretty much every Fed meeting, or a slower one that allows for pauses along the way. (On this chart “non-cycles” are those when the Fed cut and then raised rates without a recession in between, such as in parts of the 1990s).

Ned Davis Research

While there’s no way to tell what kind of tightening pace lies ahead – if indeed the market is correct that the Fed will be lifting rates in coming months – the bond market is now pricing in a rather low end point to whatever rate-hike campaign is to come.

This chart from Morgan Stanley shows both certainty in a 2022 start of rate hikes rising and the market’s estimate of how high short-term rates will ultimate get falling in recent months.

Bloomberg

This implies the Fed will be successful in restraining inflation while also perhaps risking an unintended hit to growth, as any rate hikes will be coming as fiscal spending pulls back, pent-up consumer demand is satisfied and the long-term demographic headwinds reassert themselves.

Investor sentiment takes hit

On a more immediate basis, the recent nerve-wracking shakeout in stocks – a 5% drop in the S&P 500 with far more pain felt across the majority of stocks – has left investors wary. Here is a side-by-side look at the equity exposure of the National Association of Active Investment Managers and the bullish percentage from the Investors Intelligence poll of professional investment forecasters – both not far above their 2021 lows in optimism.

NAAIM, Investor Intelligence

Jeff DeGraaf at Renaissance Macro Research on Friday said, “It’s a little surprising to see sentiment turn this bearish this quickly,” with his own composite sentiment gauge falling to a level that has historically shown a 74% chance if positive stock-market returns over the next 13 weeks.

A decent explanation for this apparent overreaction to a pretty modest setback in the broad benchmark is the carnage in the typical stock – and nasty action in the most popular holdings of the fast-money crowd.

In the past month, the Vanguard Extended Market Index – all stocks not in the S&P 500, from small-caps to huge growth names such as Square and Zoom Video – has lagged the S&P 500 by about ten percentage points in the past three weeks.

And the adrenaline-juiced retail-trader favorites that overtook the market conversation in the early part of this year and had the aggressive amateurs drubbing the prudent professionals have soured. Whether the ARK Innovation basket of high-expectation growth stocks or meme-propelled GameStop and AMC or Robinhood Markets and CoinBase, all have become less fun and more treacherous, all of them down between 40% and 75% from their 2021 peak.

All else held equal, this draining of enthusiasm from the market makes for a less-challenging setup for stocks than would the kind of overconfident momentum chase that the market seemed headed for back in early November.

More muted sentiment and cleaner investor positioning following the purge of risk from portfolios into Dec. 3 allowed for last week’s 3.8% S&P 500 gain.

https://www.advisorhub.com/jpmorgan-set-to-pay-200-million-fine-over-lax-staff-monitoring/

JPMorgan Set to Pay $200 Million Fine Over Lax Staff Monitoring

by Bloomberg News

(Bloomberg) — JPMorgan Chase & Co. is preparing to pay roughly $200 million to resolve U.S. regulatory investigations into lapses over monitoring employee communications.

A settlement with the Securities and Exchange Commission and Commodity Futures Trading Commission could be reached before year-end, according to people familiar with the matter, although the figure is preliminary and could change. SEC commissioners have yet to vote on resolving the matter, one of the people said.

The unusually stiff sanctions for lax surveillance serve as a warning for the financial industry under the new regulatory regime.

Spokespeople for JPMorgan and the CFTC declined to comment, and the SEC didn’t immediately reply to a request for comment.

Wall Street firms are required to scrupulously monitor communications involving their business. That system, already challenged by the proliferation of mobile-messaging apps, was strained all the more as firms sent workers home shortly after the start of the Covid-19 outbreak. Investigators have been looking into JPMorgan’s compliance leading up to and during the pandemic.

Earlier this year, JPMorgan ordered traders, bankers, financial advisers and even some branch employees to dig through years of messages on personal devices and set aside any related to work, Bloomberg reported in June. One of the internal notices directed recipients to root through their messages since the start of 2018 and save those related to work until the company’s legal department instructed them otherwise.

JPMorgan, the biggest U.S. bank, disclosed in an August filing that it had been responding to requests for information “concerning its compliance with records preservation requirements in connection with business communications sent over electronic messaging channels that have not been approved by the firm.”

The bank said at the time that it was engaged in “certain resolution discussions” with regulators. In a subsequent filing last month, it characterized those talks as “advanced resolution discussions.”

In both instances, the New York-based firm said there was no guarantee that a settlement would be reached.

Cathie Wood’s nightmarish 2021: Ark Innovation has plunged 24% as tech has crashed, with 6 out of 8 Ark funds in the red

Dec. 7, 2021, 08:15 AM

Superstar stock-picker Cathie Wood is having a bad 2021.

Photo by PATRICK T. FALLON/AFP via Getty Images

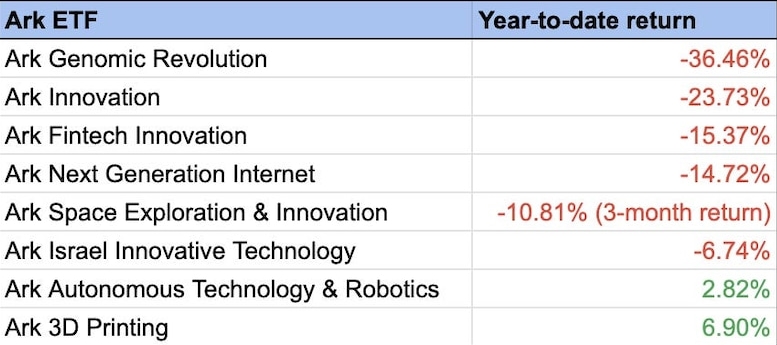

Cathie Wood’s Ark Invest ETFs have taken a hammering in December as investors have avoided tech stocks.With the Fed set to raise interest rates, suddenly, other parts of the market are starting to look more attractive.Ark’s Innovation ETF is now down 23.7% for the year, and six out of eight of Ark’s ETFs are in the red.

Cathie Wood’s 2021 has gone from bad to worse in December, with her Ark Invest exchange-traded funds tumbling in highly volatile trading as investors ditch unprofitable tech stocks.

Ark Invest’s flagship Innovation ETF has dropped more than 10% in December and is now down a whopping 23.7% for the year – putting it in bear-market territory.

Six out of eight of Wood’s main ETFs are now in the red in 2021. Ark Genomic Revolution has crashed more than 30% and Ark Fintech Innovation is down around 15%.

Wood, the founder and CEO of Ark invest, shot to investing stardom last year. Ark’s selection of ETFs placed big bets on the technologies of the future – from fintechs to 3D printing – and made huge returns.

https://62a560f82658fb848648189c7c1ef170.safeframe.googlesyndication.com/safeframe/1-0-38/html/container.html Investors were flush with cash from government and central bank stimulus programs and they piled into flashy tech names. Ark’s Innovation ETF returned around 150% in 2020.

Yet many of those tech bets have begun to flop in recent months, as global central banks have started gearing up to turn off the stimulus taps in response to soaring inflation. Concerns about the Omicron variant are also affecting investors.

Many tech companies – especially the ones Wood specializes in – are not expected to become properly profitable for many years. With central banks set to raise interest rates in the next year, the far-off returns these companies offer have started to look a lot less attractive compared to other parts of the market.

Going into 2022, investors will be faced with less fiscal and monetary stimulus supporting the economy and markets, with the Fed removing liquidity by “tapering” bond purchases, Steen Jakobsen, chief investment officer at Saxo Bank, told Insider.

“And that means that high-growth stocks, which is built entirely on low rates and high top-line growth, of course is getting impacted massively,” he said.

https://62a560f82658fb848648189c7c1ef170.safeframe.googlesyndication.com/safeframe/1-0-38/html/container.html Big Ark holdings such as Teladoc, Square and Coinbase have tumbled. Many of Wood’s funds would be doing even worse were it not for her big bets on Tesla, which has jumped more than 40% this year.

A sort of “inverse Ark Innovation ETF” that’s betting against Wood’s stock picks – ticker SARK – has soared more than 20% since launching last month, as many investors have spotted an opportunity.

But despite investors dumping Ark funds, Wood has remained upbeat. She told CNBC last week that it’s the traditional S&P 500 stalwarts that are in a bubble, because they have a less bright future.

“We are not in a bubble. Our strategies would be flying if we were. I think we have not begun rewarding innovation for what’s about to happen and so that’s where our conviction comes from,” she said.

https://62a560f82658fb848648189c7c1ef170.safeframe.googlesyndication.com/safeframe/1-0-38/html/container.html Wood has floated the idea of an “Ark on steroids” fund that would also bet against stocks. And this week Ark is launching its Transparency ETF, designed to track an index of “transparent” companies. Ark Invest did not respond to Insider’s request for comment.

Looked at from a broader angle, things don’t look so bad. The average annualized total return for Ark funds is still around 30% over the last five years.

Saxo’s Jakobsen said he thinks Ark’s funds have a bright future and that investors need to remember their premise.

“The premise of the Ark funds is not to give you an S&P or a Nasdaq performance. It is to buy into the concept that the future has technology embedded into it, and to be part of the future you need to buy a big number of lottery tickets.”

Ark’s ETFs have been hit hard this year, with the majority of returns in the red.

Bloomberg data

HI Financial Services Mid-Week 06-24-2014